Professional Documents

Culture Documents

Coal

Coal

Uploaded by

Kishore Kumar KamisettiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coal

Coal

Uploaded by

Kishore Kumar KamisettiCopyright:

Available Formats

COAL

Coal Scenario in IndiaAn Overview: Rajesh Nath, Managing Director & Dipanjan Paul, Business Analyst, VDMA India

Posted on February 20, 2013

Geology and Reserves of Indian coal

Coal is the most abundant fossil fuel resource in the country. India, currently, stands eighth in terms of total World Coal Resources, whereas it is fourth from the point of view of identified reserves.

The coal occurrences in India are mainly distributed along the present day river valleys i.e. DamodarValley, Sone-MahanadiValley, Pench-KanhanValley, Wardha-Godavari Valley etc. There are 69 major coalfields located in the peninsular India besides, 17 located in the north-eastern region. The bulk of the coal reserves are confined to the south-eastern quadrant of the country in West Bengal, Jharkand, Orissa, Chattisgarh & Madhya Pradesh.

The coal reserves of India have been estimated by the Geological Survey of India at 285.8 billion tonnesup to the depth of 1200m, as on 31.03.2011.

Out of 285.8 billion tonnes (Bt) of coal reservesPrime coking coal are 5.3 Bt, Medium & Semicoking coals are 28 Bt and Non-coking coals 250.8 Bt. Most of these resources occur in Gondwanas and the balance in the Tertiary formations.

Currently, lignite reserves in the country have been estimated at around 39.7 billion tonnes, most of which, occur in Tamilnadu. Other states where lignite deposits have been located are Rajasthan, Gujarat, Kerala, Jammu and Kashmir and Union Territory of Pondicherry.

Basically, Indian coals have high mineral matter (ash) content unlike Pennsylvanian and Carboniferous coals of America and Europe respectively.

COAL RESERVES IN INDIA AS ON 31.03.2011 (IN MT)

Type of Coal Prime Coking

Proved Indicated 4614 699 0

Inferred 5313 26454 1707

Total

Medium Coking 12573 12001 1880 Semi Coking Non Coking Tertiary Coal Total Lignite 173.22.9423.14 482 1003 222

95739 123668 31488 250895 594 99 799 1493

114002 137471 34390 285862

Coal Resources:

India ranks third amongst the coal producing countries of the world in terms of annual coal production. However, in respect of coal resources, it is endowed with less than one percent of world coal resources. Of the 285.8 billion tonnes of Indian coal resources up to a depth of 1200 metres, about 105.7 billion tonnes fall under proved or confirmed category. This constitutes about five percent of the world proved coal resources.

production had come up to a level of nearly 72 million tonnes per year only. The entire coal industry in India was nationalised during 1972-73 and then on massive investments were made by the

Government of India in this basic infrastructure sector. India now ranks as the third largest coal producer of the World next only to China and USA.

Mining depths in Indian coalfields are quite shallow, barring a few mines in Jharia and Raniganj coalfields. Major share of coal resources lies at a depth of less than 300 metres. About 87 percent of coal resources lie within the depth range of 600 metres. However, in most of the coalfields, exploration work beyond 600 metres depth is yet to be taken up. It is expected that the resource figures will improve considerably, with increased depth of exploration.

Deposit characteristics vary widely from coalfield to coalfield. In some areas like Jharia and Raniganj coalfields, high concentration of super imposed seams (as much as 40 in number) pose great challenge to mining operations. Presence of a large number of thick seams, though a blessing for open cast mining, is again a major underground mining problem. Reserves in steeply inclined seams are, however, only marginal.

Geological inconsistencies like faults, folds, washouts etc, common in most of the coalfields, tend to reduce the mining potential of deposits. Intrusions such as dykes and sills often lead to operational problems and quality deterioration.

Nearly all Indian Coal seams are prone to spontaneous heating. The incubation period varies widely from 2 to 12 months. However, compared to gas emission in other parts of the world, the coal seams in India are less gassy.

Due to the very nature of deposition, Indian coals, in general, are of inferior quality owing to high ash percentage, when compared with coal available in the international trade arena. Despite this, Indian coals in general merit better environment friendly use because of:

>

Low sulphur content

>

Low chlorine content and

>

Low toxic trace elements

Additional advantages for industrial use

>

High ash fusion temperature

>

Low iron content and

>

Refractory nature of ash

The exploration database, created so far, is adequate for preparation of a long-term perspective plan for mining of coal in the country.

Coal deposits in India are confined to eastern, southern and central parts of the country, consisting of 27 major coalfields. The shares of overall coal resources of different States are:

Andhra Pradesh

9.59%

Bihar

14.58%

Chhattisgarh

20.81%

Jharkhand

19.44%

Madhya Pradesh

14.30%

Maharashtra

7.93%

Orissa

19.58%

Uttar Pradesh

2.64

West Bengal

4.33%

Balance share of coal reserves is distributed over Arunachal Pradesh, Assam, Meghalaya and Nagaland.

Quality wise resource is 8.27 % Coking Coal and 91.73% Non Coking Coal.

Out of Total Non Coking Coal the

superior grades A, B and C with Ash content 24% or less inferior grades with ash content between 24-45% Jharia Coalfield is the main source of prime coking coal. Superior grade non coking coals are generally available in Raniganj Coalfield of West Bengal, Central India Coalfield of Madhya Pradesh and Talcher Coalfields of Orissa.

The ash of Indian coal is of inherent nature and has high presence of near gravity material

(NGM). This makes washing of Indian coal rather difficult. Some of the positive features of Indian Coal are low sulphur, low toxic elements and high ash fusion temperature.

Coal Industry in India

Coal India is the largest public sector company, about 80.86% of the total coal production in the country comes from the collieries of Coal India Ltd (CIL). It has eight subsidiaries: Bharat Coking Coal Ltd., Central Coalfields Ltd., Eastern Coalfields Ltd., Western Coalfields Ltd., South Eastern Coalfields Ltd., Northern Coalfields Ltd., Mahanadi Coalfields Ltd., Central Mine Planning & Design Institute Ltd.

The Singareni Collieries Company Limited (SCCL) is a coal-mining company jointly owned by the Government of Andhra Pradesh and Government of India. The Singareni coal reserves stretch across

350 Kms of the Pranahita, Godavari Valley of Andhra Pradesh with a proven geological reserves aggregating to 8791 million tonnes. SCCL is currently operating 13 opencast and 37 underground mines in Andhra Pradesh.

The Coal Mines (Nationalisation) Act, 1973 was amended w.e.f. 9th June 1993 to allow coal mining by both private and public sector for captive consumption for production of iron and steel, generation of power, washing of coal obtained from a mine and other end use, which would be notified by the Government from time to time. Under the last provision, cement production was further allowed as an end use w.e.f 5th March 1996 for captive mining of coal. The restriction of captive mining does not apply to state-owned coal/mineral development undertakings like CIL, SCCL, Neyveli Lignite Corporation (NLC) etc. and Mineral Development Corporation of the State Governments.

Coal Production

Coal production achieved in the country during the year 2010-11 has been 533.07 million tonnes as compared to the production of 523.16 million tonnes achieved during the

previous year i.e. 2009-10 showing a compounded annual growth rate of 1.91%.

About 80.86% of the total coal production in the country comes from the collieries of Coal India Ltd (CIL). CIL is also the biggest supplier of coal in the country.

Anticipated Coal Production2012-13 (In million tonnes) Name of the Co. CIL SCCL58 570 Coal Production

Others125Total753

Coal production over the years

Raw Coal

2009-10

2010-11

1. Growth of Production (India)

4.42%

0.20%

Growth of Production (CIL)

2.97%

0.10%

2. Growth of Off-take (India)

4.89%

1.84%

Growth of Off-take (CIL)

3.49%

2.0%

3. Closing Stock/ (average monthly take off)

0.80%

4. Colliery Consumption/ Off-take

0.17%

0.17%

5. Stripping Ratio (OBR/RC)

2.13

2.13

6. Import growth (overall-Coal)

17%

25.58%

Coking Coal

-4.31%

13.41%

Non-Coking Coal

36.58%

31.77%

7. Avg.pit head value/ Ton Coal (Non Captive Public)

14.19

Coal Production based on Technology

In India opencast and underground mining is prevalent. Opencast mine production grew by 5.54 % to 457 mt in the year 2009-10

In the case of Underground (UG) mines, the production in 2009-10 is 58.60 mt

Production of Coal and its share by type of Mining. Type of mining OC 2008-09 Share (%) UG Total Production 433.7 58.97 492.75

Production

88.03% 11.89% 100%

2009-10 Share (%) Growth (%)

Production

457

58.60 515.6

88.63% 11.37% 100% 5.54% -0.5% 4.67%

Demand, Production & Supply

The demand of coal assessed by the Planning Commission during the year 2010-11 was 572MT

The target of coal production was 97.2% achieved by Coal India Ltd (CIL) in 2010-11 and 104% achieved by Singareni Collieries Co. Ltd (SCCL).

Demand of Power, Steel and Cement in a developing country is closely related to its economic growth. It is difficult to imagine a country slated for growth without using power, steel and cement. Global as well as Indian steel and cement production are dependent on coal. That is why distribution of coal of adequate quantity and quality to power sector followed by steel and cement manufacturing sector is considered a priority in Indian Coal Industry.

Sectoral Off-Take of raw Coal (Million Tonnes) Cos. Achieved (2010-11) Cement Others Total 7.03 (1.7) 7.3 102.9 411.3 (25.03) (100) 8.3 49.4

Power Steel CIL % SCCL %

290.7 10.7 (70.6) (2.6) 33.83 0.05 (68.4) (0.1) 8.7

(14.7) (16.8) (100) 0.7 17.3 52.3

Others 25.7 % Total

(49.1) (16.6) (1.91) (33.07) (100) 350.2 19.45 14.3 (2.79) (25) 128.5 512.4 (100)

(68.3) (3.7)

Project under Formulation

Name of Project million) PURNADIH OC CCL TAPIN OC DINESH OC CCL WCL

Company

Latest Capital (in million Rs.)

Latest Capital( In Euro

2100 2640 4960 3770 2030 4470 SECL 4470

35 44 82.66 62.83 33.83 74.5 4620 74.5 77

PENGANGA OC WCL BATURA OC PELMA OC SECL SECL

CHURCHA RO UG TALABIRA OC MCL

The expansion programme undertaken by SCCL in brownfield underground projects are in the final stage and plans are afoot to implement a few Greenfield projects as well.

Private Coal mining in India

The governments strategy to allow coal mining by standalone companies that have tie-ups with steel, cement and power companies for coal supplies will become operational within the coming

month. Coal ministry & law ministry officials confirmed that those mining companies who have supply contracts with authorized users namely steel, cement and power companies can have mining rights to those coal blocks that is reserved for confined users, even without emending the Coal Mines (Nationalization) Act, 1973. The move is likely to give further push to coal production and will play a pivotal role in meeting the countrys future demand to a large extent.

Investment opportunities in Coal Industries Public sector undertakings have been in the total command of the coal production since 1973-74 to present day, but with the liberalisation of economy since June 1991 the scenario has changed. Huge investments are required to meet the increasing demand of coal for power and other industries and at the same time Government is looking for private player to invest.

Under the present policy of free market economy, Government is removing controls on industry and trade, reducing the tariff on import and allowing private investment in companies even up to majority share holding by private / foreign sources. The Coal Mines (Nationalisation) Act, 1973 has been amended to allow private participation in coal mining as captive mines for companies engaged in opening new units for power generation, coal preparation (washing) and production of Iron & Steel and Cement. Government has already appointed a Screening Committee under the Ministry of Coal to allocate identified Coal Blocks for captive mining to above categories. Already 100 Blocks have been identified and several companies given permission to operate such blocks.

Investment opportunity in Transfer of New Technology Investment opportunity in Manufacture of Equipment / Spares Investment opportunity in Construction of Road (Both Approach and Arterial) in Coalfields Investment opportunity in Building Rail-lines Investment Opportunity in Major Repair Workshops / Spares depots Investment Opportunities in Environmental Protection Investment Opportunities in Joint Venture for Opening New Mines Investment Opportunities for Leasing of Equipment Investment Opportunities in Ancillary and Infrastructure Developments Investment Opportunities in Auxiliary Industries

Investment Opportunities in Development of Ports and for Handling Imported Coal Areas of interest for the Indian Coal Mining Companies are follows: Powered support Longwall / Shortwall Continuous miners in Room and Pillar system Roof bolting systems application of light bolting machines in Bord and Pillar development galleries Mechanised depillaring of coal seams developed on Bord and Pillar system Prediction of Strata behavior in extraction of developed pillars by caving method. Design of roof support to permit mechanised depillaring. Use of Road Haul Dumper, Continuous miner Application of mobile powered supports (Crawler mounted) in depillaring by caving method Road Headers Coal Conveyor systems Simple and cost effective men and material transport system in inclined roadways Ventilation system in mines Coal Handling arrangements high speed loading equipment Advanced geological exploration techniques to prove faults with small throw (less than 5 metres); in depth range of 20 to 300 m. Communication system in underground mines Application of Information Technology in mining activities Simple method of beneficiation of coal upgradation of coal needed for Power PlantsImproved hydraulic stowing techniques using river sand, crushed overburden, fly ash and other locally available materials FDI in Mining sector Year (April to March) 2008-09 2009-10 2010-11 2011-12 Grand total FDI in Rs. Crore FDI in Euro million

161.09 24.78 829.92 127.68 357.42 54.98 436.61 67.17 1,785.04 274.62

New coal projects in India

Lanco Infratech Ltd. setting up 1320 MW coal based power unit PNC Infratech Ltd 660 MW coal based Power unit Bharat Coking Coal Ltd setting up a 2.5 million tpa coal washery at Dugda. MaharastraState power generation Co. Ltd. set up a 1,320 MW coal based power unit on PPP basis. Era Infra Engineering Ltd plans to set up a 2640 MW coal based power unit at Rajauli. CIL offers 447 million tonnes of coal to power utilities. Regulatory Framework of Coal Industry in India Coal Industry in India is regulated largely by the provisions of: The Coal Mines (Nationalisation) Act, 1973 To nationalise the coal sector Mines & Minerals (Development & Regulation) Act, 1957 To regulate exploration and exploitation of minerals The Coal Bearing Area (Acquisition & Development) Act To facilitate acquisition of coal bearing land Environmental Protection Act, 1986 To conduct mining operations in an environmental friendly manner Liberalisation of Policy Regime: The main thrust of the policy is to liberalise the statutory and regulatory regime in order to promote investment in the coal sector.The recent policy initiatives have been in the following direction: Captive mining by Power, Steel and Cement industry allowed. Foreign Direct Investment allowed upto 100% in Power and coal mining Creating a competitive market for sale of coal Progressive reduction of custom duty on Coal and HEMM imports Introduction of Contract Mining

Bibliography

Coal Directory of India Government of India-Ministry of Coal Annual Report Report on Overview of Coal Mining sector in IndiaVDMA Information from SCCL & CIL website www.vdmaindia.org

(Reuters) - Rising Indian coal imports are the knight in shining armour for producers from the Americas through Africa to Asia -- at least that's the impression the industry is keen to give.

That India's coal imports have no option but to rise and the only matter in dispute is by how much, was the consensus of producers and consumers at the Coaltrans India conference this week in Goa.

But is the consensus based more in hope than reality?

The thing that is always striking about India's coal sector, for both domestic production and imports, is that forecasts are rarely correct.

India's coal demand was around 730 million tonnes in the 2011/12 fiscal year, with about 100 million tonnes of that met through imports.

The consensus of forecasts at the Coaltrans event is for demand to rise to about 1.1 billion tonnes by the end of the current five-year plan in 2016/17.

Some of this 370 million tonnes increase in annual demand is expected to be met by state-controlled Coal India, the world's biggest miner of the fuel.

However, there is likely to be a shortfall in the region of 200 million to 250 million tonnes, which global producers are hoping to fill.

Certainly imports have been increasing dramatically in India, with arriving cargoes jumping 29 percent to 112.8 million tonnes in the April to January period, the first nine months of the 2012-13 financial year.

Looking at the split between thermal and coking coal it's clear that imports of the lower-grade fuel for power stations are increasing at a faster rate, mainly as a result of the lower prevailing international prices and Coal India's ongoing inability to increase production sufficiently.

Demand for coking coal for steel-making is also expected to surge as India plans to nearly double steel capacity from the current 70 million tonnes to about 130 million tonnes by 2014/15.

With increasing uncertainty over the trajectory of Chinese coal imports, it would seem that India may well be the nirvana coal miners seek, offering a lifeline to U.S. producers who have been pummelled by the shale gas revolution as well as underpinning expansions and new projects in places such as Mozambique and Australia.

But while the demand for coal is likely to be fairly close to the consensus forecast, there remain serious question marks over whether this demand can actually be fulfilled, even if global supplies are plentiful.

STRUCTURAL CHALLENGES

India's coal, power and steel sectors face enormous structural challenges and most issues can be traced to the regulatory regimes that delay and stifle businesses.

In mining, India has plentiful reserves but Coal India consistently fails to meet targets.

Even when coal is produced, the rail system struggles to get it from where it was mined to where it's needed.

And when the fuel finally reaches the plant, the utility struggles to produce power it can sell profitably because controls at the state electricity boards keep prices below the cost of generation.

Poor domestic coal supply is the driver of imports, but the higher cost makes the economics even worse for power producers, with several executives of independent operators complaining that they are incurring losses and are considering shutting down plants, which would exacerbate India's power shortages.

In the steel industry, state-owned Steel Authority of India Ltd, the country's largest producer, acts as a price-setter, meaning that margins for private producers are also often negative, which inhibits the ability to boost production and hence the need for coking coal.

There is broad awareness of these issues among coal industry participants, and even a fair degree of consensus on how to solve them.

Coal India should be broken up, foreign and local mining companies should be allowed to compete for blocks and start production, and mine approvals should be streamlined from the more than 20 state and federal agencies that currently have to give the green light to projects.

Private companies should be allowed to build and operate railroads, perhaps in conjunction with the state operator.

And most importantly, electricity and steel prices must be freed up to accurately reflect the costs of production.

All of these reforms are the purview of the federal and state governments, and there's not much optimism that there is the necessary political will, or ability, to make changes.

The most likely outcome is that India continues on what I call the "bumbling along" path, whereby no major changes are made but enough is done to ensure that the deficits of coal, power and steel don't reach crisis levels.

This is likely to result in rising imports of coal, but perhaps not to the levels of 250 million tonnes a year by 2016/17 that many in the industry are hoping for.

It also means that new coal projects will only go ahead where there are strong offtake agreements in place, in other words where the buyer is a major partner in the mine.

Other producers will have to hope that Indian demand does indeed rise as forecast, but they will also have to be aware that the South Asian nation will only purchase when prices are low.

(Clyde Russell is a Reuters market analyst. The views expressed are his own)

You might also like

- FCO Pasir Silika (English)Document1 pageFCO Pasir Silika (English)Yohannes ChriestavoartoNo ratings yet

- Jayakhisma ComProDocument94 pagesJayakhisma ComProAchmad DjunaidiNo ratings yet

- Harmonized National Research and Development Agenda (HNRDA) 2017-2022Document16 pagesHarmonized National Research and Development Agenda (HNRDA) 2017-2022Jomer GonzalesNo ratings yet

- QPReport PDFDocument193 pagesQPReport PDFRud SiNo ratings yet

- Star Fleet Battles RulesDocument31 pagesStar Fleet Battles RulesPaoloViarengo100% (2)

- APAC ProspectusDocument84 pagesAPAC Prospectusshare818No ratings yet

- Dissertation - International Trade of CoalDocument15 pagesDissertation - International Trade of CoalRano Joy100% (1)

- Coking Coal IndexDocument12 pagesCoking Coal IndexZaidan EffendieNo ratings yet

- Pt. Harta Bumi Internasional: Full Corporate OfferDocument1 pagePt. Harta Bumi Internasional: Full Corporate OfferWawan TomallakaniNo ratings yet

- RSM Sum Info Memo Doc Aug 15-1 (Revised)Document50 pagesRSM Sum Info Memo Doc Aug 15-1 (Revised)Tegar PribiantoNo ratings yet

- Geo Energy JORC 2017Document134 pagesGeo Energy JORC 2017Farah SafrinaNo ratings yet

- Presentasi Katingan Ria 2018Document19 pagesPresentasi Katingan Ria 2018bagas prakosoNo ratings yet

- CTI PresentationDocument19 pagesCTI PresentationSantosh BeheraNo ratings yet

- Company Profile PT Tohoma MandiriDocument16 pagesCompany Profile PT Tohoma MandiriEcyNo ratings yet

- KDW Coaltrans Singapore 2011.SMGC - Webs - 2Document41 pagesKDW Coaltrans Singapore 2011.SMGC - Webs - 2Gardo PrasetyoNo ratings yet

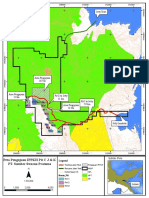

- Summary Pengajuan IPKKH Pit C J & KDocument3 pagesSummary Pengajuan IPKKH Pit C J & KAfriani FRNo ratings yet

- Coa TB Rimau 1607 BG Rimau 3005 - 4000Document1 pageCoa TB Rimau 1607 BG Rimau 3005 - 4000achwan febriantoNo ratings yet

- Kci Kendilo ProfileDocument1 pageKci Kendilo Profileapi-167631790No ratings yet

- Corprate Presentation GEO GroupDocument43 pagesCorprate Presentation GEO GroupFulkan HadiyanNo ratings yet

- Coal Sourcing Handling and Transportation Report - Volume - VDocument497 pagesCoal Sourcing Handling and Transportation Report - Volume - Vদেওয়ানসাহেবNo ratings yet

- Company Profile 090410r1Document27 pagesCompany Profile 090410r1Nipindo PrimatamaNo ratings yet

- SI SMA MV. Jetty EX TANITODocument2 pagesSI SMA MV. Jetty EX TANITOYohanes RotinsuluNo ratings yet

- Hasil Bor DasDocument74 pagesHasil Bor Dasvorda buaymadangNo ratings yet

- UntitledadsDocument20 pagesUntitledadsRAHMAT WIDYANTO100% (1)

- Tus GEMSDocument389 pagesTus GEMSRud SiNo ratings yet

- PT Bhumi Rantau EnergiDocument2 pagesPT Bhumi Rantau EnergihindradiNo ratings yet

- 45 Gar KaltimDocument1 page45 Gar Kaltimapi-174139371No ratings yet

- Gen Rev PT Akar Mas International Pomala SultraDocument10 pagesGen Rev PT Akar Mas International Pomala SultraSETIONo ratings yet

- Alur Trading Batubara-Lc Non PB Versi EnglishDocument3 pagesAlur Trading Batubara-Lc Non PB Versi Englishagus salimNo ratings yet

- 2 - Minepract - Presentasi Pertambangan Mineral Batubara (UU 4-2009)Document51 pages2 - Minepract - Presentasi Pertambangan Mineral Batubara (UU 4-2009)Erie Haryanto100% (1)

- GMT Coal Presentation 2010Document22 pagesGMT Coal Presentation 2010Leris Efronda ManafeNo ratings yet

- Pt. Jayeon SejahteraDocument52 pagesPt. Jayeon SejahteraTrends Property100% (1)

- Daw-Compro Oct 2023Document27 pagesDaw-Compro Oct 2023oktafianrinaldyNo ratings yet

- Draft Ucg ImmDocument24 pagesDraft Ucg Immzoel tekmiraNo ratings yet

- Indonesia Up Date:: Progress of The NPI Ramp-Up, Barriers To Market Growth and Outlook For Future ProductionDocument26 pagesIndonesia Up Date:: Progress of The NPI Ramp-Up, Barriers To Market Growth and Outlook For Future ProductionDavid Budi SaputraNo ratings yet

- Draft - C0419120154-Tdlsv-Ift Pt. Mandiangin Batubara Mv. Apex PDFDocument10 pagesDraft - C0419120154-Tdlsv-Ift Pt. Mandiangin Batubara Mv. Apex PDFRIO THRIVENI JAMBINo ratings yet

- Product List For Coal - WEN 2016 Rev.0Document1 pageProduct List For Coal - WEN 2016 Rev.0Lidef SellenrofNo ratings yet

- NTPC Coal Supply Bid DocumentDocument0 pagesNTPC Coal Supply Bid DocumentmdphilipNo ratings yet

- Perbandingan Harga Kontrak Kerja Pt. Laman Mining & Pt. PBPNDocument1 pagePerbandingan Harga Kontrak Kerja Pt. Laman Mining & Pt. PBPNBlack CavannaNo ratings yet

- Executive Summary Takara Site ZefinaDocument13 pagesExecutive Summary Takara Site Zefinavorda buaymadangNo ratings yet

- Final Coal ReportDocument101 pagesFinal Coal Reportvikasgupta2750% (2)

- Coal Sales - PSBDocument24 pagesCoal Sales - PSBGigih Marda PradanaNo ratings yet

- Contract Sales Purchase Agreement - TJU, RRU - ChinaDocument7 pagesContract Sales Purchase Agreement - TJU, RRU - Chinagarut beraksiNo ratings yet

- Pt. WTM Present MSDocument35 pagesPt. WTM Present MSUSAHA KAWAN BERSAMANo ratings yet

- Coal Stratigraphy of SepariDocument14 pagesCoal Stratigraphy of SepariGhandy 'Grancos' AdutaeNo ratings yet

- Fco PTMMC Gar 42-40Document5 pagesFco PTMMC Gar 42-40mahendrarakasiwi631No ratings yet

- TABEL Bor LAPANGAN Abs LENGKAPDocument2 pagesTABEL Bor LAPANGAN Abs LENGKAPyusak billanNo ratings yet

- Britmindogroupcompanyprofile PDFDocument20 pagesBritmindogroupcompanyprofile PDFSatia Aji PamungkasNo ratings yet

- Ar Bayan 09Document198 pagesAr Bayan 09lpj gsvcNo ratings yet

- MAS SARI - Legal, Permit, Coal Mine Summary1Document4 pagesMAS SARI - Legal, Permit, Coal Mine Summary1donwload bunkNo ratings yet

- Corporate Profile TanwinDocument17 pagesCorporate Profile TanwinSamsudin Puluhulawa100% (1)

- Banpu - Annual Report - 2011Document162 pagesBanpu - Annual Report - 2011juli_0942080No ratings yet

- Company Profile PT Bintang Agro Sentosa English Standard Version PDFDocument24 pagesCompany Profile PT Bintang Agro Sentosa English Standard Version PDFSkandinavia ApartmentNo ratings yet

- Mine SummaryDocument1 pageMine SummaryMuhamad AkbarNo ratings yet

- Report of Survey and Coal MappingDocument8 pagesReport of Survey and Coal Mappingyusak billanNo ratings yet

- Coal Resources and Reserves SummaryDocument1 pageCoal Resources and Reserves Summaryalbab onyonNo ratings yet

- Batubara Long LeesDocument10 pagesBatubara Long LeesMartyson Yudha PrawiraNo ratings yet

- KCI Kendilo Coal Indonesia ProfileDocument1 pageKCI Kendilo Coal Indonesia Profilegbh_suryoNo ratings yet

- KLG Presentation Oct08Document26 pagesKLG Presentation Oct08Rizky RizNo ratings yet

- PT. Harindo Prima Kreasi: Formal Corporate OfferDocument1 pagePT. Harindo Prima Kreasi: Formal Corporate OfferSatish Babu NutakkiNo ratings yet

- Underground Coal Gasification: A New Clean Coal Utilization Technique For IndiaDocument11 pagesUnderground Coal Gasification: A New Clean Coal Utilization Technique For IndiavitriniteNo ratings yet

- Icc Coal Report PDFDocument28 pagesIcc Coal Report PDFravi196No ratings yet

- Cut Off Grade Based Stope Optimisation To Maximise Value at The Garpenberg Mine 5Document90 pagesCut Off Grade Based Stope Optimisation To Maximise Value at The Garpenberg Mine 5Ramadhani NdondeNo ratings yet

- Political Ecologies of The SubsoilDocument27 pagesPolitical Ecologies of The SubsoilklderaNo ratings yet

- What Is The Difference Between FerriticDocument4 pagesWhat Is The Difference Between FerriticScott TrainorNo ratings yet

- MEJ October 2019 IssueDocument40 pagesMEJ October 2019 IssueprasashivNo ratings yet

- Symons Cone Crusher PatentDocument11 pagesSymons Cone Crusher PatentKeshav Chhawchharia100% (1)

- AMT4SAP - Junio26 - Red - v3 PDFDocument30 pagesAMT4SAP - Junio26 - Red - v3 PDFCarlos Eugenio Lovera VelasquezNo ratings yet

- World Gold Analyst - Zimbabwe Special Report September 2010Document100 pagesWorld Gold Analyst - Zimbabwe Special Report September 2010dshornikovNo ratings yet

- 4239 Indian Stock DetailsDocument1,484 pages4239 Indian Stock DetailsSoori GanipineniNo ratings yet

- Analisis Jarak Heading Terhadap Muck RaiseDocument11 pagesAnalisis Jarak Heading Terhadap Muck RaiseomingNo ratings yet

- Mining Investment ColombiaDocument43 pagesMining Investment Colombiapatchman17No ratings yet

- KTMDocument2 pagesKTMKevin TarlaNo ratings yet

- The Illegal Gold Mining Activities in The Sleepy Town of Bayog in The Southern Philippine Province of Zamboanga Del Sur Have Been Going On For The Past 15 YearsDocument3 pagesThe Illegal Gold Mining Activities in The Sleepy Town of Bayog in The Southern Philippine Province of Zamboanga Del Sur Have Been Going On For The Past 15 YearsJezzalex RigzNo ratings yet

- PT Bumi Resources TBKDocument18 pagesPT Bumi Resources TBKkeberosuNo ratings yet

- Cable BoltingDocument12 pagesCable BoltingMohnit Ghosh100% (1)

- Informe Tecnico Candelaria - 2018 - TR en Ingles PDFDocument202 pagesInforme Tecnico Candelaria - 2018 - TR en Ingles PDFcristian casanova diazNo ratings yet

- Congo Report Carter Center Nov 2017Document108 pagesCongo Report Carter Center Nov 2017jeuneafriqueNo ratings yet

- Brochure Iron OreDocument8 pagesBrochure Iron Orelavu_chowdaryNo ratings yet

- Drill and Blast Performance Evaluation ADocument8 pagesDrill and Blast Performance Evaluation AAUGEN AMBROSENo ratings yet

- Dokumen - Tips - Colliery Training Reportsarpi Project EclDocument41 pagesDokumen - Tips - Colliery Training Reportsarpi Project EclRahul GhoshNo ratings yet

- 01 Autoslicer Application and Intergration MSAP OP Short-Term Planning REDocument26 pages01 Autoslicer Application and Intergration MSAP OP Short-Term Planning REJuan Gabriel Pari ChipanaNo ratings yet

- IndustriesDocument5 pagesIndustriesmuheet bhatNo ratings yet

- Conveyor Transfer Stations 2Document2 pagesConveyor Transfer Stations 2tubagus syariefNo ratings yet

- Chemistry PPT1234567890Document9 pagesChemistry PPT1234567890purunjay joshiNo ratings yet

- PB Filter Press Sidebar Me1500 Me2500 en Web DataDocument4 pagesPB Filter Press Sidebar Me1500 Me2500 en Web DataTiago J C MachadoNo ratings yet

- Unit 1Document10 pagesUnit 1Elena Galac DudusNo ratings yet

- Bangalore DataDocument300 pagesBangalore DataamandeepNo ratings yet

- The Mines Regulations, 2018: Chapter S-15.1 Reg 8Document188 pagesThe Mines Regulations, 2018: Chapter S-15.1 Reg 8SuvamosmeNo ratings yet

- Beaeka General Business PLC Exploration Work Programme For CoalDocument38 pagesBeaeka General Business PLC Exploration Work Programme For CoalGeta EjiguNo ratings yet