Professional Documents

Culture Documents

The Kenyan Boon

The Kenyan Boon

Uploaded by

Daniel Mutisya MutukuCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hotek User Manual 2900 Version 2.8 ENDocument50 pagesHotek User Manual 2900 Version 2.8 ENIT GhazalaNo ratings yet

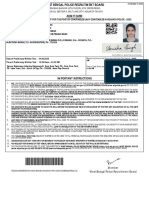

- Admit Card: Araksha Bhavan (5Th Floor), 6Th Cross Road, Block-Dj, Sector-Ii, Salt Lake City, Kolkata-700 091Document1 pageAdmit Card: Araksha Bhavan (5Th Floor), 6Th Cross Road, Block-Dj, Sector-Ii, Salt Lake City, Kolkata-700 091Ayesha HignisNo ratings yet

- Ladaga vs. MapaguDocument5 pagesLadaga vs. MapaguGenerosa GenosaNo ratings yet

- GPOADmin Quick Start Guide 58Document25 pagesGPOADmin Quick Start Guide 58Harikrishnan DhanapalNo ratings yet

- Office of The Sangguniang Barangay: EXECUTIVE ORDER No. 005 of 2021Document2 pagesOffice of The Sangguniang Barangay: EXECUTIVE ORDER No. 005 of 2021michelle100% (2)

- UCM Notes PDFDocument92 pagesUCM Notes PDFTIRUPATHI KARTIKEYANo ratings yet

- 3-Phase Motor Drives W Oscilloscope 48W-73863-0Document31 pages3-Phase Motor Drives W Oscilloscope 48W-73863-0CarloNo ratings yet

- IP Telephony Business CaseDocument7 pagesIP Telephony Business CaseSaeed KhanNo ratings yet

- Jio ReportDocument36 pagesJio ReportHimanshu Singh100% (1)

- Creating Cust Specific POWL Query PDFDocument3 pagesCreating Cust Specific POWL Query PDFvictorSNo ratings yet

- A Research Study of A Three Commercial BuildingDocument12 pagesA Research Study of A Three Commercial BuildingBianca bayangNo ratings yet

- Booth MakersDocument5 pagesBooth Makerslala_omgNo ratings yet

- 757 TowbarDocument20 pages757 TowbarNad RockNo ratings yet

- Mangune v. ErmitaDocument19 pagesMangune v. ErmitaElise Rozel DimaunahanNo ratings yet

- Become An Indicash ATM Franchise Owner: Move Ahead With UsDocument6 pagesBecome An Indicash ATM Franchise Owner: Move Ahead With UsDeepankar GurungNo ratings yet

- GM 1927-16 - PcpaDocument12 pagesGM 1927-16 - PcpaNeumar NeumannNo ratings yet

- PDF Conducting Systematic Reviews in Sport Exercise and Physical Activity David Tod Ebook Full ChapterDocument53 pagesPDF Conducting Systematic Reviews in Sport Exercise and Physical Activity David Tod Ebook Full Chapterrenee.walker170100% (3)

- Insulation Resistance (IR) Values - Electrical Notes & ArticlesDocument31 pagesInsulation Resistance (IR) Values - Electrical Notes & ArticlesKush SharmaNo ratings yet

- Eco 311 Test 1 2020Document9 pagesEco 311 Test 1 2020stanely ndlovuNo ratings yet

- Samier AC 2017 Islamic Public Administration Tradition Historical TheoreticalDocument19 pagesSamier AC 2017 Islamic Public Administration Tradition Historical TheoreticalJunaid AliNo ratings yet

- Cement Types - Portland Cement Association (PCA)Document3 pagesCement Types - Portland Cement Association (PCA)Eddy EffendiNo ratings yet

- Shift SupervisorDocument2 pagesShift SupervisorasphaNo ratings yet

- China Banking Corp. v. Board of Trustees CustodioDocument1 pageChina Banking Corp. v. Board of Trustees CustodioTherese AmorNo ratings yet

- Identify Risk and Apply Risk Management ProcessesDocument14 pagesIdentify Risk and Apply Risk Management ProcessesS Qambar A Shah0% (1)

- Rubrics For A Well Written and Technology Enhanced Lesson PlanDocument5 pagesRubrics For A Well Written and Technology Enhanced Lesson PlanValencia John EmmanuelNo ratings yet

- Dsplab 3Document17 pagesDsplab 3Jacob Popcorns100% (1)

- Service Manual: Serial Number RangeDocument139 pagesService Manual: Serial Number RangeALFARO MORALESNo ratings yet

- Cyber Bullying and The WorkplaceDocument3 pagesCyber Bullying and The WorkplaceIsabel MonicaNo ratings yet

- Bpas 186 Solved AssignmentDocument7 pagesBpas 186 Solved AssignmentDivyansh Bajpai0% (1)

- Performance Analysis Between RunC and Kata Container RuntimeDocument4 pagesPerformance Analysis Between RunC and Kata Container RuntimeClyde MarNo ratings yet

The Kenyan Boon

The Kenyan Boon

Uploaded by

Daniel Mutisya MutukuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Kenyan Boon

The Kenyan Boon

Uploaded by

Daniel Mutisya MutukuCopyright:

Available Formats

The Kenyan Boon

Daniel Mutuku, 15/07/2009

Yes, and this is in reference to the field of Actuarial Science. It was a timely answer to the uncertainties that revolve around us as Kenyans. One major concern, especially for parents, is Will my children study through to college (and have a financially stable future)? Also, if a major illness occurs, the particular household would be cash strained. Well, the traditional areas of function such as life insurance, pensions and healthcare are being addressed currently by local actuarial expertise.

The customary areas do have a high demand for actuarially-trained individuals. This is in tandem with the growth of the financial services sector. More people are taking on insurance, and even more are coming into pension schemes. An individual born in 1954 will be turning 55 this year. This means that numbers born in the immediate pre- and postindependence period are now pensioners, considering most were in pensionable occupations. The growing middle class has made its interest in this sector felt. These instances show a growth of relevance in this field.

Page 1 of 3

News coming from America suggests strongly that the housing crisis could have been well avoided if actuarial minds had come on board in a major way. The ripples (more like waves!) spread round the globe, the story is well known. The Kenyan society has a lot to learn from this. First, actuarial knowledge is relevant and is here to stay! Secondly, the entire financial sector needs some actuarial mind in at least every sub-sector. Not just the usual insurance and pensions. This means any sub-sector in which financial risk is present. I hence read this: Actuarial expertise is required in the entire financial sector.

So what are the other areas in which we can venture into?

Thinking in terms of the local economy yields myriad answers. One is micro insurance, considering that a major part of the Kenyan consumer profile can only afford to pay small chunks of money. The major research organisations can also use our expertise in looking at the financial domain. This does raise the issue of economic problems that Kenya has. Actuaries have the capacity to give expert opinions that will stand the test of time. Every Kenyan needs to live a decent life, with the basic necessities

Page 2 of 3

affordable. Actuaries and budding actuaries must get into this kind of research to directly serve a public purpose.

An article in a UK newspaper reported an MP raising concerns on actuaries failing to inform the public on time with regard to potential financial breakdowns in companies. As we penetrate to wider areas, we will need to be careful in sensitizing the public about the scope of our profession, emphatically. We will also need to have the actuarial society give a green light on the manner in which we venture. The principle of collective responsibility sets in since this is who we are. A blot in the name of this profession is highly undesirable.

In addition, it is imperative that we have confidence in the results that we arrive at. This means that there will be no hesitation on our part to release that information to the public.

Lets forge ahead, carefully, prudently, systematically, with vision, purpose and a strong will to achieve. Our promised land beckons!

Page 3 of 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hotek User Manual 2900 Version 2.8 ENDocument50 pagesHotek User Manual 2900 Version 2.8 ENIT GhazalaNo ratings yet

- Admit Card: Araksha Bhavan (5Th Floor), 6Th Cross Road, Block-Dj, Sector-Ii, Salt Lake City, Kolkata-700 091Document1 pageAdmit Card: Araksha Bhavan (5Th Floor), 6Th Cross Road, Block-Dj, Sector-Ii, Salt Lake City, Kolkata-700 091Ayesha HignisNo ratings yet

- Ladaga vs. MapaguDocument5 pagesLadaga vs. MapaguGenerosa GenosaNo ratings yet

- GPOADmin Quick Start Guide 58Document25 pagesGPOADmin Quick Start Guide 58Harikrishnan DhanapalNo ratings yet

- Office of The Sangguniang Barangay: EXECUTIVE ORDER No. 005 of 2021Document2 pagesOffice of The Sangguniang Barangay: EXECUTIVE ORDER No. 005 of 2021michelle100% (2)

- UCM Notes PDFDocument92 pagesUCM Notes PDFTIRUPATHI KARTIKEYANo ratings yet

- 3-Phase Motor Drives W Oscilloscope 48W-73863-0Document31 pages3-Phase Motor Drives W Oscilloscope 48W-73863-0CarloNo ratings yet

- IP Telephony Business CaseDocument7 pagesIP Telephony Business CaseSaeed KhanNo ratings yet

- Jio ReportDocument36 pagesJio ReportHimanshu Singh100% (1)

- Creating Cust Specific POWL Query PDFDocument3 pagesCreating Cust Specific POWL Query PDFvictorSNo ratings yet

- A Research Study of A Three Commercial BuildingDocument12 pagesA Research Study of A Three Commercial BuildingBianca bayangNo ratings yet

- Booth MakersDocument5 pagesBooth Makerslala_omgNo ratings yet

- 757 TowbarDocument20 pages757 TowbarNad RockNo ratings yet

- Mangune v. ErmitaDocument19 pagesMangune v. ErmitaElise Rozel DimaunahanNo ratings yet

- Become An Indicash ATM Franchise Owner: Move Ahead With UsDocument6 pagesBecome An Indicash ATM Franchise Owner: Move Ahead With UsDeepankar GurungNo ratings yet

- GM 1927-16 - PcpaDocument12 pagesGM 1927-16 - PcpaNeumar NeumannNo ratings yet

- PDF Conducting Systematic Reviews in Sport Exercise and Physical Activity David Tod Ebook Full ChapterDocument53 pagesPDF Conducting Systematic Reviews in Sport Exercise and Physical Activity David Tod Ebook Full Chapterrenee.walker170100% (3)

- Insulation Resistance (IR) Values - Electrical Notes & ArticlesDocument31 pagesInsulation Resistance (IR) Values - Electrical Notes & ArticlesKush SharmaNo ratings yet

- Eco 311 Test 1 2020Document9 pagesEco 311 Test 1 2020stanely ndlovuNo ratings yet

- Samier AC 2017 Islamic Public Administration Tradition Historical TheoreticalDocument19 pagesSamier AC 2017 Islamic Public Administration Tradition Historical TheoreticalJunaid AliNo ratings yet

- Cement Types - Portland Cement Association (PCA)Document3 pagesCement Types - Portland Cement Association (PCA)Eddy EffendiNo ratings yet

- Shift SupervisorDocument2 pagesShift SupervisorasphaNo ratings yet

- China Banking Corp. v. Board of Trustees CustodioDocument1 pageChina Banking Corp. v. Board of Trustees CustodioTherese AmorNo ratings yet

- Identify Risk and Apply Risk Management ProcessesDocument14 pagesIdentify Risk and Apply Risk Management ProcessesS Qambar A Shah0% (1)

- Rubrics For A Well Written and Technology Enhanced Lesson PlanDocument5 pagesRubrics For A Well Written and Technology Enhanced Lesson PlanValencia John EmmanuelNo ratings yet

- Dsplab 3Document17 pagesDsplab 3Jacob Popcorns100% (1)

- Service Manual: Serial Number RangeDocument139 pagesService Manual: Serial Number RangeALFARO MORALESNo ratings yet

- Cyber Bullying and The WorkplaceDocument3 pagesCyber Bullying and The WorkplaceIsabel MonicaNo ratings yet

- Bpas 186 Solved AssignmentDocument7 pagesBpas 186 Solved AssignmentDivyansh Bajpai0% (1)

- Performance Analysis Between RunC and Kata Container RuntimeDocument4 pagesPerformance Analysis Between RunC and Kata Container RuntimeClyde MarNo ratings yet