Professional Documents

Culture Documents

02 - John Shelford June 22 2005

02 - John Shelford June 22 2005

Uploaded by

Juan M Garcia CondeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 - John Shelford June 22 2005

02 - John Shelford June 22 2005

Uploaded by

Juan M Garcia CondeCopyright:

Available Formats

Analysis and General Vision of the Raspberry in North America

2005 Chile Export Association Berries Seminar Santiago, Chile June 21-22, 2005 Presented by John Shelford President Global Berry Farms

Outline

Fresh Raspberries Recent Production History Changing Production Origins Growth

Outline

PERISHABLES GROUP

NA Processed Raspberries

North American Red Raspberries Production

120 100 Pounds (Millions 80 60 40 20 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Year Processed Fresh

PERISHABLES GROUP

NA Processed Raspberries

North American Processed Red Raspberries Production

120 100 Pounds (Milliions 80 60 40 20 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Years

PERISHABLES GROUP

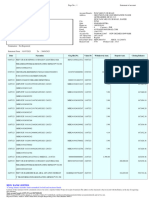

California Raspberry Production

Acres 2004 2003 2002 2001 2000 1999

Source: USDA

Yield 20,800 20,500 12,200 10,900 10,800 11,6000

Total 66,560,000 61,500,000 29,280,000 25,070,000 21,600,000 20,880,000

3,200 3,000 2,400 2,300 2,000 1,800

PERISHABLES GROUP

Fresh Raspberries Weekly Shipments

Raspberry US Industry Supply in Cases Source: USDA National Berry Report

Thousands

Cases 600

500

400

300

200

100

44 45 46 47 48 49 50 51 52

PERISHABLES GROUP

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43

Weeks 2002-2003 Industry 2003-2004 Total Industry 2004-2005 Industry

Weekly FOB Price

Raspberry US Industry Average Price Per Case Source: USDA National Berry Report

$35

$30

$25 Price per Case

$20

$15

$10

$5

$50 52 26 44 16 18 20 22 12 14 30 32 34 36 40 46 48 24 10 28 38 42 2 4 6 8

Weeks 2003 2004 2005

PERISHABLES GROUP

Market Share

Raspberry Weeks 44-52,1-20 Analysis Past 3 Seasons -- Source: USDA WITH SUPPLY SHARE by ORIGIN %

Millions 7

Growth: 18% Growth: 15%

35% 40% 48% 24% 19% 33% 37%

2004 California Mexico Chile

Cases

23%

42%

2005

0 2003

PERISHABLES GROUP

Berry Category in Supermarkets

National Berry Dollar Sales - Conventional & Organic Combined by Berry Type (average per week per store)

$1,327 $1,297 $1,120 $914 $846

$343 $310 $242 $175

$395

$89

$165 $123 $147 $165 $28 $39 $47

$64

$84

Strawberries

Blueberries 2000 2001 2002

Raspberries 2003 2004

Blackberries

PERISHABLES GROUP

10

Berry Category in Supermarkets

National Berry Category Dollar Share Conventional & Organic Combined by Berry Type (average per week per store)

73.3%69.0% 69.7% 68.8% 66.7%

19.0% 18.0% 18.3% 15.2%

20.3%

7.7%

9.3% 9.0% 8.7% 8.5% 3.4% 2.4% 2.9% 2.9%

4.3%

Strawberries

Blueberries 2000 2001 2002

Raspberries 2003 2004

Blackberries

PERISHABLES GROUP

11

Berry Category in Supermarkets

National Berry Category Contribution to Total Produce Dollars Conventional & Organic Combined by Berry Type (average per week per store)

6.0% 5.7% 5.2% 4.4% 3.2% 4.5% 4.0% 3.6% 3.1% 4.0%

0.7% 0.3% 0.1% 0.1%

0.8% 0.4% 0.1% 0.0%

1.0% 0.5% 0.2% 0.0%

1.0% 0.5% 0.2% 0.0%

1.2% 0.5% 0.3% 0.0%

2000 Total Berry Category

2001 Strawberries Blueberries

2002 Raspberries

2003 Blackberries

2004 Specialty & Other Berries

PERISHABLES GROUP

12

Raspberry Demand

Good and increasing Retail excellent! Great for special occasions,

every day demand increasing

PERISHABLES GROUP

13

Raspberry Demand

Demand drivers

Improved quality Flavor Consistency in appearance Availability

PERISHABLES GROUP

14

Food Service

Demand is second to strawberries Raspberries add value to menus Restaurant luxury perception

PERISHABLES GROUP

15

Challenges

Fresh Market Growers

Variety development for appearance, taste, size, and productivity Development of competitive varieties that are economically viable

PERISHABLES GROUP

16

Challenges

Chilean Growers

Transportation cost Mexico and California supplies growth will continue Climate modification technology advancing in Mexico and California

PERISHABLES GROUP

17

Summary

All raspberries growers for North American markets must aggressively develop varieties delivering superior fruit and competitive yields to meet the challenge of the market leader. There is great opportunity for the successful achievement of this challenge.

PERISHABLES GROUP

18

When Are Raspberries Not Just Raspberries?

When they dont disappoint When they are consistent When they increase consumption When consumers ask for them by name When consumers switch stores to get those berries When they build store loyalty When price does not matter When competitor retail ads dont drive the business When shrink is in single digits When they come with no rejections and 99.9% service levels!

PERISHABLES GROUP

You might also like

- BackspaceDocument22 pagesBackspaceApoorv arora0% (1)

- Kellogg's Marketing Strategy and Marketing PlansPPT at BECDOMSDocument45 pagesKellogg's Marketing Strategy and Marketing PlansPPT at BECDOMSBabasab Patil (Karrisatte)No ratings yet

- Dos Equis Brand Fact BookDocument21 pagesDos Equis Brand Fact BookEmily TausNo ratings yet

- Case Study GatoradeDocument16 pagesCase Study Gatoradenithinraj661100% (1)

- Mini Farming: Self-Sufficiency on 1/4 AcreFrom EverandMini Farming: Self-Sufficiency on 1/4 AcreRating: 4.5 out of 5 stars4.5/5 (6)

- 02 - SR (1) - John Shelford June 21 20053Document32 pages02 - SR (1) - John Shelford June 21 20053Juan M Garcia CondeNo ratings yet

- Business PlanDocument15 pagesBusiness PlanronskierelenteNo ratings yet

- A Market Evaluation of Salad DressingsDocument4 pagesA Market Evaluation of Salad DressingsChuck AchbergerNo ratings yet

- 2009berry PricingsurveyDocument6 pages2009berry PricingsurveyMauricio LarrainNo ratings yet

- Body of The ResearchDocument54 pagesBody of The ResearchDino DizonNo ratings yet

- A Niche For Sustainability Fair Labor and Environmentally Sound Practices in The Specialty Coffee IndustryDocument16 pagesA Niche For Sustainability Fair Labor and Environmentally Sound Practices in The Specialty Coffee Industryaldemar reyes alvisNo ratings yet

- Avocados: From The Farm To Your TableDocument18 pagesAvocados: From The Farm To Your Tablegstewart05No ratings yet

- WriteupDocument2 pagesWriteupUttamNo ratings yet

- Whole Foods Market Case AnalysisDocument39 pagesWhole Foods Market Case AnalysisSadman Shariar BiswasNo ratings yet

- Business Plan From InternetDocument8 pagesBusiness Plan From InternetKiro AkramNo ratings yet

- Cola Wars Continue Coke and Pepsi in 2006 by Group C 120426105113 Phpapp02Document27 pagesCola Wars Continue Coke and Pepsi in 2006 by Group C 120426105113 Phpapp02RazMittalNo ratings yet

- Presentation 4th Global Tea Forum Dubai (World Tea News)Document10 pagesPresentation 4th Global Tea Forum Dubai (World Tea News)Dan BoltonNo ratings yet

- Business Plan FancyDocument6 pagesBusiness Plan FancyLaraib ButtNo ratings yet

- Organic Advantage: Field Crop ProductionDocument16 pagesOrganic Advantage: Field Crop ProductionOrganicAlbertaNo ratings yet

- Organic Advantage: Vegetable ProductionDocument17 pagesOrganic Advantage: Vegetable ProductionOrganicAlbertaNo ratings yet

- 2012.04 Almonds and Chocolate BrochureDocument12 pages2012.04 Almonds and Chocolate BrochureJaideep Singh SidhuNo ratings yet

- How The CAFB OperatesDocument1 pageHow The CAFB OperatesChris von SpiegelfeldNo ratings yet

- Auntie Carla FeasibilityDocument59 pagesAuntie Carla FeasibilityIqraFatimaNo ratings yet

- California Case PresentationDocument58 pagesCalifornia Case Presentationrefaie1No ratings yet

- Terra Chips Case StudyDocument30 pagesTerra Chips Case StudyHomework PingNo ratings yet

- Welcome to the Agrihood: Housing, Shopping, and Gardening for a Farm-to-Table LifestyleFrom EverandWelcome to the Agrihood: Housing, Shopping, and Gardening for a Farm-to-Table LifestyleNo ratings yet

- Agr 20269Document16 pagesAgr 20269lanh tranNo ratings yet

- Hortsci Article p1662 1Document8 pagesHortsci Article p1662 1guada_moliNo ratings yet

- Case Study On Natureview Farm: Group 10 Section B Submitted To: Prof. Vibhava SrivastavaDocument19 pagesCase Study On Natureview Farm: Group 10 Section B Submitted To: Prof. Vibhava SrivastavaSwaraj DharNo ratings yet

- Business Plan: Fancy's Foods, LLC. 2409 Oak Hollow Drive Antlers, OK 74523 (580) 298-223Document21 pagesBusiness Plan: Fancy's Foods, LLC. 2409 Oak Hollow Drive Antlers, OK 74523 (580) 298-223Elijah T DhNo ratings yet

- Adopt An Apple Handout Appalachia - revised06.30.10-MZDocument10 pagesAdopt An Apple Handout Appalachia - revised06.30.10-MZDori ChandlerNo ratings yet

- Neera ECManohar PCADocument44 pagesNeera ECManohar PCAJoseph FloresNo ratings yet

- Cost of Food MonopoliesDocument55 pagesCost of Food MonopoliesFood and Water Watch100% (2)

- Save The Food Fact SheetDocument1 pageSave The Food Fact SheettrangNo ratings yet

- Northern VA LFS Assessment Final ReportDocument26 pagesNorthern VA LFS Assessment Final Reportihatefacebook4everNo ratings yet

- Equal Exchange Annual ReportDocument16 pagesEqual Exchange Annual ReportPhuocNo ratings yet

- 9-12 May Rice News, 2022Document110 pages9-12 May Rice News, 2022Mujahid AliNo ratings yet

- SM Cola Wars Continue 2006Document18 pagesSM Cola Wars Continue 2006Srishti ManchandaNo ratings yet

- 2013 Pitahaya Production Seminar & Field Day: August 23, 2013 San Marcos, CADocument46 pages2013 Pitahaya Production Seminar & Field Day: August 23, 2013 San Marcos, CAHuyen NguyenNo ratings yet

- Edited Presentation FINAL COPY - Whole FoodsDocument46 pagesEdited Presentation FINAL COPY - Whole FoodsShahriar AlamNo ratings yet

- A Commodity Profile of ApricotsDocument6 pagesA Commodity Profile of ApricotsChristopherwalkerNo ratings yet

- Challenges and Opportunities in The U.S. Fresh Produce IndustryDocument8 pagesChallenges and Opportunities in The U.S. Fresh Produce IndustryBonnie Maguathi MwauraNo ratings yet

- Natureview Farm Report (GROUP 1B)Document7 pagesNatureview Farm Report (GROUP 1B)CHANDAN SHARMANo ratings yet

- Case Analysis 1 Tagatac GroupDocument11 pagesCase Analysis 1 Tagatac GroupSALEM, JUSTINE WINSTON DS.100% (1)

- Beverage IndustryDocument59 pagesBeverage IndustryDustin HaiNo ratings yet

- PepsiCo 2005Document14 pagesPepsiCo 2005smjafri1No ratings yet

- Research FileDocument50 pagesResearch FileMohd HarishNo ratings yet

- Competitive Analysis For Maple WaterDocument5 pagesCompetitive Analysis For Maple Waterapi-299081956No ratings yet

- Rebalancing Act: Updating U.S. Food and Farm PoliciesDocument203 pagesRebalancing Act: Updating U.S. Food and Farm PoliciesthousanddaysNo ratings yet

- Kelloggs PowerpointDocument45 pagesKelloggs Powerpointravi235No ratings yet

- Acai Case Revised-2Document7 pagesAcai Case Revised-2Ayman FergeionNo ratings yet

- Herbs: Organic Greenhouse Production: AttraDocument16 pagesHerbs: Organic Greenhouse Production: AttraRebecca SheaNo ratings yet

- Natureview FarmsDocument4 pagesNatureview FarmsAnkita TanejaNo ratings yet

- Market Supply: Economics Case StudiesDocument1 pageMarket Supply: Economics Case StudiesLeilani FNo ratings yet

- Final Paper MyjuizDocument31 pagesFinal Paper MyjuizFrancis Bhrill NuezNo ratings yet

- Growing People News - Rowing People News: Project ReportDocument8 pagesGrowing People News - Rowing People News: Project ReportGarden Therapy NewslettersNo ratings yet

- Nature View FarmDocument3 pagesNature View FarmUttamNo ratings yet

- The Waste Not, Want Not Cookbook: Save Food, Save Money, and Save the PlanetFrom EverandThe Waste Not, Want Not Cookbook: Save Food, Save Money, and Save the PlanetRating: 3.5 out of 5 stars3.5/5 (3)

- Farm-to-Table Desserts: 80 Seasonal, Organic Recipes Made from Your Local Farmers? MarketFrom EverandFarm-to-Table Desserts: 80 Seasonal, Organic Recipes Made from Your Local Farmers? MarketNo ratings yet

- The Fresh Girl's Guide to Easy Canning and PreservingFrom EverandThe Fresh Girl's Guide to Easy Canning and PreservingRating: 4 out of 5 stars4/5 (2)

- The Locavore’s Kitchen: A Cook’s Guide to Seasonal Eating and PreservingFrom EverandThe Locavore’s Kitchen: A Cook’s Guide to Seasonal Eating and PreservingNo ratings yet

- Profit From Wood Fuel: So You Want To..Document2 pagesProfit From Wood Fuel: So You Want To..Juan M Garcia CondeNo ratings yet

- Effects of Fruiting Spur Thinning On Fruit Quality and Vegetative Growth of Sweet Cherry (Prunus Avium)Document8 pagesEffects of Fruiting Spur Thinning On Fruit Quality and Vegetative Growth of Sweet Cherry (Prunus Avium)Juan M Garcia CondeNo ratings yet

- Stewart Postharvest ReviewDocument11 pagesStewart Postharvest ReviewJuan M Garcia CondeNo ratings yet

- 03 - SR (1) - Adam Olins2Document12 pages03 - SR (1) - Adam Olins2Juan M Garcia CondeNo ratings yet

- PMP Exam Preparation Study Guide - Project Cost ManagementDocument33 pagesPMP Exam Preparation Study Guide - Project Cost ManagementNarendra Reddy EluruNo ratings yet

- Estimation of Leaf Area in Sweet Cherry Using A Non-Destructive MethodDocument8 pagesEstimation of Leaf Area in Sweet Cherry Using A Non-Destructive MethodJuan M Garcia CondeNo ratings yet

- 02 - SR (1) - John Shelford June 21 20053Document32 pages02 - SR (1) - John Shelford June 21 20053Juan M Garcia CondeNo ratings yet

- Organic StrawberryDocument41 pagesOrganic StrawberryJuan M Garcia CondeNo ratings yet

- Organic Insect and Disease Control FOR: Sweet CornDocument10 pagesOrganic Insect and Disease Control FOR: Sweet CornJuan M Garcia CondeNo ratings yet

- Effects of Fire On Properties of Forest Soils A Review CertiniDocument10 pagesEffects of Fire On Properties of Forest Soils A Review CertiniJuan M Garcia CondeNo ratings yet

- Organic Carrots: Production Guide For For ProcessingDocument31 pagesOrganic Carrots: Production Guide For For ProcessingJuan M Garcia Conde100% (1)

- Soil Color As An Indicator of Slash-And-Burn Fire SeverityDocument8 pagesSoil Color As An Indicator of Slash-And-Burn Fire SeverityJuan M Garcia CondeNo ratings yet

- Alien Invasive Species Impacts On Forests and ForestryDocument66 pagesAlien Invasive Species Impacts On Forests and ForestryJuan M Garcia CondeNo ratings yet

- Effects of Forest Harvesting On C and N Soil Storage Johnson-CurtisDocument12 pagesEffects of Forest Harvesting On C and N Soil Storage Johnson-CurtisJuan M Garcia CondeNo ratings yet

- Changes in Soil Mineralogy and Texture Caused by Slash-And-Burn FiresDocument10 pagesChanges in Soil Mineralogy and Texture Caused by Slash-And-Burn FiresJuan M Garcia CondeNo ratings yet

- Gab Preliminar 822 Petrobras 23 CB1 01 PDFDocument1 pageGab Preliminar 822 Petrobras 23 CB1 01 PDFNailson BritoNo ratings yet

- Dalit Capitalism - Anand TDocument2 pagesDalit Capitalism - Anand TreaderswordsNo ratings yet

- Programme Report Light The SparkDocument17 pagesProgramme Report Light The SparkAbhishek Mishra100% (1)

- Title Facts Issue/S Ruling Doctrine GR No. 79777: PD 27, Eos 228Document26 pagesTitle Facts Issue/S Ruling Doctrine GR No. 79777: PD 27, Eos 228Carla VirtucioNo ratings yet

- Significance of Public Enterprise in Developing Countries: By: Eda J. PajeDocument17 pagesSignificance of Public Enterprise in Developing Countries: By: Eda J. PajeEda Paje AdornadoNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument46 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaGayathri NathanNo ratings yet

- Application AccountingDocument39 pagesApplication Accountingramatarak100% (4)

- 405 488 1 PB PDFDocument6 pages405 488 1 PB PDFhadisetiawanNo ratings yet

- Adress ListDocument3 pagesAdress ListJoseph Hines100% (1)

- Security Bank Products and ServicesDocument4 pagesSecurity Bank Products and ServicesMary Grace CastilloNo ratings yet

- In 1953, It Became A Protectorate Within The Semi-Independent Federation of Rhodesia and Nyasaland. The Federation Was Dissolved in 1963Document4 pagesIn 1953, It Became A Protectorate Within The Semi-Independent Federation of Rhodesia and Nyasaland. The Federation Was Dissolved in 1963Eloisa MansanoNo ratings yet

- Article Global SupplyDocument3 pagesArticle Global SupplyKathryn StacyNo ratings yet

- Coupons and Oligopolistic Price DiscriminationDocument16 pagesCoupons and Oligopolistic Price DiscriminationkutukankutuNo ratings yet

- Flipkart Labels 23 Feb 2024 08 17Document50 pagesFlipkart Labels 23 Feb 2024 08 17royalskhatriNo ratings yet

- Car Lease CalculationsDocument90 pagesCar Lease CalculationsNiraj KumarNo ratings yet

- Country Specific EffectsDocument46 pagesCountry Specific EffectsNur AlamNo ratings yet

- Bank of KathmanduDocument8 pagesBank of KathmanduKAMAL POKHRELNo ratings yet

- Invoice-WH Owner-Dec-18Document8 pagesInvoice-WH Owner-Dec-18Vipul 77No ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceavinashvmNo ratings yet

- LIC's JEEVAN ANKUR 807 PDFDocument3 pagesLIC's JEEVAN ANKUR 807 PDFgvspavan0% (2)

- Project For Std-Xi (2024-25)Document4 pagesProject For Std-Xi (2024-25)manashsamal6372No ratings yet

- Haiti: Earthquake: Organization Type Organization Last Name First Name Title Email Mobile Phone Sat PhoneDocument7 pagesHaiti: Earthquake: Organization Type Organization Last Name First Name Title Email Mobile Phone Sat Phoneapi-22074666No ratings yet

- Bank Finance For Working Capital - E&MDocument5 pagesBank Finance For Working Capital - E&MPrakash PatelNo ratings yet

- Assignment# 3 CompleteDocument13 pagesAssignment# 3 CompleteASAD ULLAHNo ratings yet

- ProdDocument2 pagesProdmohit sharmaNo ratings yet

- Comparative Analysis of Bank of BarodaDocument5 pagesComparative Analysis of Bank of BarodaArpita ChristianNo ratings yet

- West Lancashire Local PlanDocument262 pagesWest Lancashire Local PlanMatthew WrightNo ratings yet

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Mohammed RiyanNo ratings yet

- Advantages and Disadvantages of GlobalizationDocument19 pagesAdvantages and Disadvantages of GlobalizationSiddharth Senapati100% (1)