Professional Documents

Culture Documents

S&P Principal Forgiveness, Still The Best Way To Limit U.S

S&P Principal Forgiveness, Still The Best Way To Limit U.S

Uploaded by

bkhollowayCopyright:

Available Formats

You might also like

- Fundamentals of Credit AnalysisDocument5 pagesFundamentals of Credit AnalysisKatherine David de Ramos0% (1)

- Advanced Excel Training Course OutlineDocument4 pagesAdvanced Excel Training Course OutlineAhmad Iqbal100% (1)

- Moody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableDocument4 pagesMoody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableChris SwamNo ratings yet

- Project Report On Credit RatingDocument15 pagesProject Report On Credit RatingShambhu Kumar100% (4)

- Void V Voidable ContractsDocument17 pagesVoid V Voidable ContractsbkhollowayNo ratings yet

- Semiconductor Laser Diode Technology and ApplicationsDocument388 pagesSemiconductor Laser Diode Technology and ApplicationsJosé RamírezNo ratings yet

- With Fed Announcement The Party Resumes, But Only For Investment-GradeDocument8 pagesWith Fed Announcement The Party Resumes, But Only For Investment-Gradeapi-233632612No ratings yet

- Credit Rating System of BangladeshDocument19 pagesCredit Rating System of BangladeshshababNo ratings yet

- A Literature Review of Concepts of Credit Ratings and Corporate ValuationDocument26 pagesA Literature Review of Concepts of Credit Ratings and Corporate ValuationHarsh Vyas100% (1)

- How Standard & Poor's Intends To Finalize Its U.S. Local Governments GO Criteria and Apply Them To RatingsDocument5 pagesHow Standard & Poor's Intends To Finalize Its U.S. Local Governments GO Criteria and Apply Them To Ratingsapi-227433089No ratings yet

- LCEC S&P Rating On GO BondsDocument3 pagesLCEC S&P Rating On GO BondsIrving BlogNo ratings yet

- Auto Loan ABSDocument26 pagesAuto Loan ABSAnonymous 0zdN4FNo ratings yet

- Bank-Loan Loss Given DefaultDocument24 pagesBank-Loan Loss Given Defaultvidovdan9852100% (1)

- LCD's Loan PrimerDocument52 pagesLCD's Loan Primeromardia88No ratings yet

- (Gurgaon) (Mumbai) : US Mortgage Process OriginationDocument9 pages(Gurgaon) (Mumbai) : US Mortgage Process OriginationAshish RupaniNo ratings yet

- U.S. Consumer ABS Performance Remains Relatively Stable Amid Rising RatesDocument5 pagesU.S. Consumer ABS Performance Remains Relatively Stable Amid Rising Ratesapi-227433089No ratings yet

- S&P 2020 Bond RatingDocument3 pagesS&P 2020 Bond RatingLee SanderlinNo ratings yet

- Credit Rating AgenciesDocument11 pagesCredit Rating AgenciesmanyasinghNo ratings yet

- Accolade Wines Downgraded To 'SD' and 301 Millio - S&P Global RatingsDocument7 pagesAccolade Wines Downgraded To 'SD' and 301 Millio - S&P Global Ratingsvitacoco127No ratings yet

- Economic Risk For The U.S. Banking Sector Will Likely Take Time To Improve SubstantiallyDocument4 pagesEconomic Risk For The U.S. Banking Sector Will Likely Take Time To Improve Substantiallyapi-227433089No ratings yet

- The Launch of A Certificate of Deposit Market in China May Benefit Its Midsized Banks The Most, Says S&PDocument3 pagesThe Launch of A Certificate of Deposit Market in China May Benefit Its Midsized Banks The Most, Says S&Papi-239405494No ratings yet

- 2012 08 20 MoodysBaa1GOA BDocument5 pages2012 08 20 MoodysBaa1GOA BEmily RamosNo ratings yet

- EBITDA Used and Abused Nov-20141Document10 pagesEBITDA Used and Abused Nov-20141DealBookNo ratings yet

- Faculty of Business and Management Uitm Cawangan Melaka, Kampus Alor GajahDocument7 pagesFaculty of Business and Management Uitm Cawangan Melaka, Kampus Alor GajahMuhammad FaizNo ratings yet

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Greece Ratings Lowered To SD - Selective DefaultDocument4 pagesGreece Ratings Lowered To SD - Selective DefaultPosto CafeNo ratings yet

- Moody's Assigns Aa2 Bond Rating To Lakewood, OHDocument4 pagesMoody's Assigns Aa2 Bond Rating To Lakewood, OHlkwdcitizenNo ratings yet

- PBADocument30 pagesPBASupriya singhNo ratings yet

- Definition of Credit RiskDocument5 pagesDefinition of Credit RiskraviNo ratings yet

- Credit Rating For Businesses and GovernmentDocument1 pageCredit Rating For Businesses and GovernmentRhea BadanaNo ratings yet

- Q&A: Five Years After The Credit Crisis, U.S. Insurers Tackle Risk and ReformsDocument5 pagesQ&A: Five Years After The Credit Crisis, U.S. Insurers Tackle Risk and Reformsapi-227433089No ratings yet

- CR RatingDocument7 pagesCR RatingCynthia DelaneyNo ratings yet

- General Principal of Credit Rating-1Document35 pagesGeneral Principal of Credit Rating-1Nazir Ahmed ZihadNo ratings yet

- Credit Analyst Q&ADocument6 pagesCredit Analyst Q&ASudhir PowerNo ratings yet

- Ratings On Australian State of New South Wales Affirmed at 'AAA/A-1+' Outlook Remains NegativeDocument3 pagesRatings On Australian State of New South Wales Affirmed at 'AAA/A-1+' Outlook Remains Negativeapi-239404108No ratings yet

- UNIT-5Financial Credit Risk AnalyticsDocument27 pagesUNIT-5Financial Credit Risk Analyticsblack canvasNo ratings yet

- UNIT 5 TR SirDocument25 pagesUNIT 5 TR SirgauthamNo ratings yet

- Running Head: Credit Rating Agencies 1Document7 pagesRunning Head: Credit Rating Agencies 1otieno vilmaNo ratings yet

- S&P Treatmentg of Pensions, Operating Leases ETCDocument107 pagesS&P Treatmentg of Pensions, Operating Leases ETCAndrew RosenbergNo ratings yet

- Credit Rating by Commercial Banks in KenyaDocument29 pagesCredit Rating by Commercial Banks in KenyaSimon MutekeNo ratings yet

- Volcker's Rule: UNION BUDGET 2015 - Banking SectorDocument6 pagesVolcker's Rule: UNION BUDGET 2015 - Banking SectorManu RameshNo ratings yet

- 7 Stages in Loan OriginationDocument4 pages7 Stages in Loan OriginationFirdaus PanthakyNo ratings yet

- Three Thoughts On Economic Impact of The Government ShutdownDocument3 pagesThree Thoughts On Economic Impact of The Government Shutdownapi-227433089No ratings yet

- General Principal of Credit Rating-1 - AaDocument23 pagesGeneral Principal of Credit Rating-1 - AaNazir Ahmed ZihadNo ratings yet

- Federal Reserve Payment Study 2013Document43 pagesFederal Reserve Payment Study 2013armyperryNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- QRM Analysis 08 2013Document32 pagesQRM Analysis 08 2013MarketsWikiNo ratings yet

- Understanding Standard & Poor's Rating Definitions: General CriteriaDocument19 pagesUnderstanding Standard & Poor's Rating Definitions: General CriteriaThanh Nguyen LeNo ratings yet

- CCRA Session 7Document25 pagesCCRA Session 7Amit GuptaNo ratings yet

- Pratik Tiwari Finance ProjectDocument75 pagesPratik Tiwari Finance ProjectPratik TiwariNo ratings yet

- Chapter 4 C CREDIT RATINGDocument8 pagesChapter 4 C CREDIT RATINGCarl AbruquahNo ratings yet

- Pratik Tiwari Project1Document75 pagesPratik Tiwari Project1Pratik TiwariNo ratings yet

- Credit Score Research PapersDocument7 pagesCredit Score Research Papershxmchprhf100% (1)

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- Gramener Case Study Submission: Group Name: 1. 2. 3. 4. Naga Sai Aditya B Najaf Pradeep ShalviDocument19 pagesGramener Case Study Submission: Group Name: 1. 2. 3. 4. Naga Sai Aditya B Najaf Pradeep ShalviShalvi TomarNo ratings yet

- Credit RatingDocument8 pagesCredit RatingchandanchiksNo ratings yet

- Unit 5 Credit Analysis & RatingDocument29 pagesUnit 5 Credit Analysis & Ratingsaurabh thakurNo ratings yet

- S&P Ratings Report 170M PEDFA BondsDocument5 pagesS&P Ratings Report 170M PEDFA BondsEmily PrevitiNo ratings yet

- Credit Rating AgenciesDocument8 pagesCredit Rating AgenciesRnD Team BNo ratings yet

- S&P Study Compares Funding and Liquidity Risks in Several Banking Systems Around The WorldDocument4 pagesS&P Study Compares Funding and Liquidity Risks in Several Banking Systems Around The Worldapi-227433089No ratings yet

- Have Credit Rating Agencies Got A Role in Triggering 2007 Global Financial Crisis?Document5 pagesHave Credit Rating Agencies Got A Role in Triggering 2007 Global Financial Crisis?Emanuela Alexandra SavinNo ratings yet

- Credit Repair Book: The Official Guide to Increase Your Credit ScoreFrom EverandCredit Repair Book: The Official Guide to Increase Your Credit ScoreNo ratings yet

- 4th US DCA Suntrust v. MackyDocument13 pages4th US DCA Suntrust v. MackybkhollowayNo ratings yet

- Horvath V BoNYDocument16 pagesHorvath V BoNYbkhollowayNo ratings yet

- Klem v. Washington Mutual 871051Document43 pagesKlem v. Washington Mutual 871051gs8600mmNo ratings yet

- Niday, Mers Opening Brief Oregon Supreme CourtDocument67 pagesNiday, Mers Opening Brief Oregon Supreme CourtbkhollowayNo ratings yet

- Wva Complaint Against Quicken Loans 10-02-25-Bench-TrialDocument26 pagesWva Complaint Against Quicken Loans 10-02-25-Bench-TrialbkhollowayNo ratings yet

- Commonwealth Virginia V LPS DocX Complaint Consent 1 13Document39 pagesCommonwealth Virginia V LPS DocX Complaint Consent 1 13bkhollowayNo ratings yet

- Carter: GraceDocument2 pagesCarter: Graceapi-318510588No ratings yet

- CoRes PaP-eRs-Gordon PDFDocument10 pagesCoRes PaP-eRs-Gordon PDFSellaaryantyNo ratings yet

- TOYOTA-V5 15217 Body Paint Sales GuideDocument48 pagesTOYOTA-V5 15217 Body Paint Sales GuidesedfrayNo ratings yet

- AT25SF128A 85C Data Sheet RevD 03-19-2019Document56 pagesAT25SF128A 85C Data Sheet RevD 03-19-2019Hans ClarinNo ratings yet

- A Writers Reference 9th Edition Ebook PDFDocument41 pagesA Writers Reference 9th Edition Ebook PDFlinda.malone216No ratings yet

- Alucobond LidlDocument107 pagesAlucobond LidlCatalin BunescuNo ratings yet

- Combined File 013009 GaylordDocument32 pagesCombined File 013009 GaylordjflowersNo ratings yet

- LinksDocument30 pagesLinksIsmal MachacaNo ratings yet

- Sepsis in A SnapDocument1 pageSepsis in A SnapjufnasNo ratings yet

- Azuyama Hotel Massage RoomDocument7 pagesAzuyama Hotel Massage RoomsreymomNo ratings yet

- Neurodiagnostic TechnologyDocument3 pagesNeurodiagnostic TechnologyJeyarajasekar TtrNo ratings yet

- WF 1000XM4Document2 pagesWF 1000XM4Zhu Zhu WangNo ratings yet

- PayPal ESG Materiality AssessmentDocument2 pagesPayPal ESG Materiality AssessmentCandiceNo ratings yet

- Bien-Tan-Siemens Sinamic G120CDocument151 pagesBien-Tan-Siemens Sinamic G120CTài liệu Công ty TNHH Nam TrungNo ratings yet

- Check Sheet 3 Accommodation Recreational Facilities Food and CateringDocument18 pagesCheck Sheet 3 Accommodation Recreational Facilities Food and CateringduthindaraNo ratings yet

- Parks 2018 PDFDocument147 pagesParks 2018 PDFgarabonc100% (2)

- Works!: Creating Realistic Returns With Minimal RiskDocument34 pagesWorks!: Creating Realistic Returns With Minimal RiskWendelmaques Rodrigues PereiraNo ratings yet

- ACCA FA1 Practice Question 1Document5 pagesACCA FA1 Practice Question 1arslan.ahmed8179No ratings yet

- RO7 - RM - S2020 - 0253 - DepEd Region VII Central VisayasDocument2 pagesRO7 - RM - S2020 - 0253 - DepEd Region VII Central VisayasJoe Val CadimasNo ratings yet

- Ey Re-Birth of Ecommerce PDFDocument88 pagesEy Re-Birth of Ecommerce PDFPrateek DubeyNo ratings yet

- Module 4 AwsDocument38 pagesModule 4 Awsnur afrinaNo ratings yet

- COP EER IEER SEER IPLV EXPLAINED - OdtDocument2 pagesCOP EER IEER SEER IPLV EXPLAINED - Odtpsn_kylmNo ratings yet

- InSSIDer Office User GuideDocument13 pagesInSSIDer Office User GuidevilaounipNo ratings yet

- ProspectsDocument217 pagesProspectsKarthikeyan GanesanNo ratings yet

- Degree Attestation CH All An FormDocument1 pageDegree Attestation CH All An FormWajidSyedNo ratings yet

- Middle East Public Health Design Handbook v2Document82 pagesMiddle East Public Health Design Handbook v2TANASEGMIHAINo ratings yet

- Hands-On Project Week 2Document2 pagesHands-On Project Week 2Kojo Osei-MensahNo ratings yet

- TSUV Gyratory CrushersDocument15 pagesTSUV Gyratory CrushersLulu Muñoz RossiNo ratings yet

S&P Principal Forgiveness, Still The Best Way To Limit U.S

S&P Principal Forgiveness, Still The Best Way To Limit U.S

Uploaded by

bkhollowayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S&P Principal Forgiveness, Still The Best Way To Limit U.S

S&P Principal Forgiveness, Still The Best Way To Limit U.S

Uploaded by

bkhollowayCopyright:

Available Formats

[26-Apr-2013] Principal Forgiveness, Still The Best Way To Limit U.S....

https://www.globalcreditportal.com/ratingsdirect/renderArticle.do?articl...

RatingsDirect Research

Principal Forgiveness, Still The Best Way To Limit U.S. Mortgage Redefaults, Is Becoming More Prevalent

26-Apr-2013

In June of last year, Standard & Poor's Ratings Services contended that principal forgiveness was more likely to keep U.S. mortgage borrowers current than more commonly used modification tools (see "The Best Way to Limit U.S. Mortgage Redefaults May Be Principal Forgiveness," June 15, 2012). Data gathered since then not only support this view but also demonstrate servicers' growing adoption of this form of loss mitigation. As of February of this year, more than 1.5 million homeowners have received a permanent modification through the U.S. federal government's Home Affordable Modification Program (HAMP). Since the publication of our June 2012 article, there have been more than 400,000 additional modifications on outstanding mortgages (as of March 2013). This translates to roughly a 22% rate of growth in the number of modifications on an additional $2.4 billion in mortgage debt. Under the HAMP Principal Reduction Alternative (PRA) program, which provides monetary incentives to servicers that reduce principal, borrowers have received approximately $9.6 billion in principal forgiveness as of March 2013. Interestingly, servicers have ramped up their use of principal forgiveness on loans that don't necessarily qualify for PRA assistance. Indeed, among the top five servicers for non-agency loans, we've noted that principal forgiveness, as a percentage of average modifications performed on a monthly basis, has increased by about 200% since the latter half of 2011 (see Chart 1). We attribute part of this to the $25 billion settlement in February 2012 with 49 state attorneys general and these same five servicers: Ally/GMAC, Bank of America, Citi, JPMorgan Chase, and Wells Fargo). In fact, although principal reduction remains the least common type of loan modification among servicers, the percentage of non-agency modified loans that have received principal forgiveness has increased by 3% since June 2012 (see Chart 2). Since 2009, servicers have forgiven principal on approximately $45 billion of outstanding non-agency mortgages.*

Chart 1

1 of 5

5/2/2013 2:49 PM

[26-Apr-2013] Principal Forgiveness, Still The Best Way To Limit U.S....

https://www.globalcreditportal.com/ratingsdirect/renderArticle.do?articl...

Chart 2

2 of 5

5/2/2013 2:49 PM

[26-Apr-2013] Principal Forgiveness, Still The Best Way To Limit U.S....

https://www.globalcreditportal.com/ratingsdirect/renderArticle.do?articl...

Home Equity Is Still Key To Borrower Retention

In our initial research, we compared the average mark-to-market (MTM) loan-to-value (LTV) of modified loans at the time of modification with the value at the end of the first quarter of last year (see Table 1). When we revisited the same population of loans as of March of this year, we noted that LTVs have slightly lowered overall, in part because of an improvement in house prices. However, principal-reduced loans remained the only sub-sector with LTVs staying well below 100%.

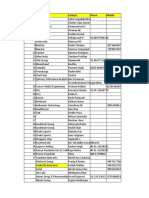

Table 1 Change In Average MTM LTV On Modified Loans Modification type Rate modification Balance capitalization Other debt reduction Principal reduction LTV at origination 80 78 79 78 MTM LTV at time of modification 99 91 106 106 MTM LTV as of April 2012 107 110 113 82 MTM LTV as of March 2013 101 105 104 79 % change between origination and March 2013 26.25 34.62 31.65 1.28

Sources: Core Logic and FHFA March 2013 Index.

Permanence And Redefaults

While our analysis shows average 12-month loss severities for principal-reduced loans to be about 80% compared with 72% for other types of modified loans, our original research had demonstrated that principal reductions displayed a lower rate of re-default than other modification methods. The latest data show that this trend has continued. As of March 2013, loans that received a principal reduction maintained the highest percentage (about 76%) of current-pay borrowers. By contrast, on average less than 50% of loans outstanding that received a modification other than principal forgiveness remained current.

Table 2 Delinquency Profile Of Modified Loans (%) Current 30-day 60-day 90+-day F/C REO Rate reduction 58.57 10.15 4.73 12.85 11.96 1.73 Balance capitalization 54.32 8.42 4.43 15.83 15.03 1.97 Other debt reduction 27.66 4.76 2.51 27.85 31.37 5.85 Principal reduction 76.65 7.81 2.88 7.87 4.25 0.54

Source: Core Logic March 2013 performance.

The rate of repeat modifications on the same loan continues to favor principal forgiveness as a more permanent mitigation tool. Although the percentage of loans with interest rate reductions that have received them more than once increased to 30% from 25% as of June of last year, loans with multiple principal reductions have remained steady at only 5% (see Chart 3).

Chart 3

3 of 5

5/2/2013 2:49 PM

[26-Apr-2013] Principal Forgiveness, Still The Best Way To Limit U.S....

https://www.globalcreditportal.com/ratingsdirect/renderArticle.do?articl...

Improvements In Housing And Servicing As Support

As we acknowledged last June, price depreciation potentially posed the largest drawback to greater utilization of principal forgiveness. Further depreciation in a home's value could erode a borrower's incentive to stay in the home even after a debt reduction. This could lead to a re-default and liquidation at a potentially higher overall loss severity when adding the initial loss that the lender absorbed at the time of the modification. Although our research still demonstrates the likelihood that servicers will recover a greater portion of their receivables through principal forgiveness versus other modification tools, we believe the impact of stable house prices is significant.

Notes

*Due to different reporting mechanisms and information available among the multiple participants that service loans backing the multiple RMBS, we applied a custom methodology in our analysis to determine whether a non-agency loan had been modified and in what form. When we didn't classify a particular loan as being modified, yet supplemental reporting indicated that some form of debt reduction had occurred that resulted in a collateral loss, we then categorized the modification as "other debt reduction." We used the March 2013 Federal Housing Finance Agency home price index to adjust the LTVs. In certain cases, the initial principal amount forgiven may be included in the total loss amount calculated for the loan at liquidation. Primary Credit Analyst: U.S. RMBS: Cesar Romero, New York (1) 212-438-4666; cesar_romero@standardandpoors.com Vandana Sharma, Analytical Manager, New York (1) 212-438-2250; vandana_sharma@standardandpoors.com

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom)

4 of 5

5/2/2013 2:49 PM

[26-Apr-2013] Principal Forgiveness, Still The Best Way To Limit U.S....

https://www.globalcreditportal.com/ratingsdirect/renderArticle.do?articl...

or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees. Any Passwords/user IDs issued by S&P to users are single user-dedicated and may ONLY be used by the individual to whom they have been assigned. No sharing of passwords/user IDs and no simultaneous access via the same password/user ID is permitted. To reprint, translate, or use the data or information other than as provided herein, contact Client Services, 55 Water Street, New York, NY 10041; (1) 212-438-7280 or by e-mail to: research_request@standardandpoors.com. Copyright 2013 Standard & Poors, a division of The McGraw-Hill Companies. All Rights Reserved.

5 of 5

5/2/2013 2:49 PM

You might also like

- Fundamentals of Credit AnalysisDocument5 pagesFundamentals of Credit AnalysisKatherine David de Ramos0% (1)

- Advanced Excel Training Course OutlineDocument4 pagesAdvanced Excel Training Course OutlineAhmad Iqbal100% (1)

- Moody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableDocument4 pagesMoody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableChris SwamNo ratings yet

- Project Report On Credit RatingDocument15 pagesProject Report On Credit RatingShambhu Kumar100% (4)

- Void V Voidable ContractsDocument17 pagesVoid V Voidable ContractsbkhollowayNo ratings yet

- Semiconductor Laser Diode Technology and ApplicationsDocument388 pagesSemiconductor Laser Diode Technology and ApplicationsJosé RamírezNo ratings yet

- With Fed Announcement The Party Resumes, But Only For Investment-GradeDocument8 pagesWith Fed Announcement The Party Resumes, But Only For Investment-Gradeapi-233632612No ratings yet

- Credit Rating System of BangladeshDocument19 pagesCredit Rating System of BangladeshshababNo ratings yet

- A Literature Review of Concepts of Credit Ratings and Corporate ValuationDocument26 pagesA Literature Review of Concepts of Credit Ratings and Corporate ValuationHarsh Vyas100% (1)

- How Standard & Poor's Intends To Finalize Its U.S. Local Governments GO Criteria and Apply Them To RatingsDocument5 pagesHow Standard & Poor's Intends To Finalize Its U.S. Local Governments GO Criteria and Apply Them To Ratingsapi-227433089No ratings yet

- LCEC S&P Rating On GO BondsDocument3 pagesLCEC S&P Rating On GO BondsIrving BlogNo ratings yet

- Auto Loan ABSDocument26 pagesAuto Loan ABSAnonymous 0zdN4FNo ratings yet

- Bank-Loan Loss Given DefaultDocument24 pagesBank-Loan Loss Given Defaultvidovdan9852100% (1)

- LCD's Loan PrimerDocument52 pagesLCD's Loan Primeromardia88No ratings yet

- (Gurgaon) (Mumbai) : US Mortgage Process OriginationDocument9 pages(Gurgaon) (Mumbai) : US Mortgage Process OriginationAshish RupaniNo ratings yet

- U.S. Consumer ABS Performance Remains Relatively Stable Amid Rising RatesDocument5 pagesU.S. Consumer ABS Performance Remains Relatively Stable Amid Rising Ratesapi-227433089No ratings yet

- S&P 2020 Bond RatingDocument3 pagesS&P 2020 Bond RatingLee SanderlinNo ratings yet

- Credit Rating AgenciesDocument11 pagesCredit Rating AgenciesmanyasinghNo ratings yet

- Accolade Wines Downgraded To 'SD' and 301 Millio - S&P Global RatingsDocument7 pagesAccolade Wines Downgraded To 'SD' and 301 Millio - S&P Global Ratingsvitacoco127No ratings yet

- Economic Risk For The U.S. Banking Sector Will Likely Take Time To Improve SubstantiallyDocument4 pagesEconomic Risk For The U.S. Banking Sector Will Likely Take Time To Improve Substantiallyapi-227433089No ratings yet

- The Launch of A Certificate of Deposit Market in China May Benefit Its Midsized Banks The Most, Says S&PDocument3 pagesThe Launch of A Certificate of Deposit Market in China May Benefit Its Midsized Banks The Most, Says S&Papi-239405494No ratings yet

- 2012 08 20 MoodysBaa1GOA BDocument5 pages2012 08 20 MoodysBaa1GOA BEmily RamosNo ratings yet

- EBITDA Used and Abused Nov-20141Document10 pagesEBITDA Used and Abused Nov-20141DealBookNo ratings yet

- Faculty of Business and Management Uitm Cawangan Melaka, Kampus Alor GajahDocument7 pagesFaculty of Business and Management Uitm Cawangan Melaka, Kampus Alor GajahMuhammad FaizNo ratings yet

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Greece Ratings Lowered To SD - Selective DefaultDocument4 pagesGreece Ratings Lowered To SD - Selective DefaultPosto CafeNo ratings yet

- Moody's Assigns Aa2 Bond Rating To Lakewood, OHDocument4 pagesMoody's Assigns Aa2 Bond Rating To Lakewood, OHlkwdcitizenNo ratings yet

- PBADocument30 pagesPBASupriya singhNo ratings yet

- Definition of Credit RiskDocument5 pagesDefinition of Credit RiskraviNo ratings yet

- Credit Rating For Businesses and GovernmentDocument1 pageCredit Rating For Businesses and GovernmentRhea BadanaNo ratings yet

- Q&A: Five Years After The Credit Crisis, U.S. Insurers Tackle Risk and ReformsDocument5 pagesQ&A: Five Years After The Credit Crisis, U.S. Insurers Tackle Risk and Reformsapi-227433089No ratings yet

- CR RatingDocument7 pagesCR RatingCynthia DelaneyNo ratings yet

- General Principal of Credit Rating-1Document35 pagesGeneral Principal of Credit Rating-1Nazir Ahmed ZihadNo ratings yet

- Credit Analyst Q&ADocument6 pagesCredit Analyst Q&ASudhir PowerNo ratings yet

- Ratings On Australian State of New South Wales Affirmed at 'AAA/A-1+' Outlook Remains NegativeDocument3 pagesRatings On Australian State of New South Wales Affirmed at 'AAA/A-1+' Outlook Remains Negativeapi-239404108No ratings yet

- UNIT-5Financial Credit Risk AnalyticsDocument27 pagesUNIT-5Financial Credit Risk Analyticsblack canvasNo ratings yet

- UNIT 5 TR SirDocument25 pagesUNIT 5 TR SirgauthamNo ratings yet

- Running Head: Credit Rating Agencies 1Document7 pagesRunning Head: Credit Rating Agencies 1otieno vilmaNo ratings yet

- S&P Treatmentg of Pensions, Operating Leases ETCDocument107 pagesS&P Treatmentg of Pensions, Operating Leases ETCAndrew RosenbergNo ratings yet

- Credit Rating by Commercial Banks in KenyaDocument29 pagesCredit Rating by Commercial Banks in KenyaSimon MutekeNo ratings yet

- Volcker's Rule: UNION BUDGET 2015 - Banking SectorDocument6 pagesVolcker's Rule: UNION BUDGET 2015 - Banking SectorManu RameshNo ratings yet

- 7 Stages in Loan OriginationDocument4 pages7 Stages in Loan OriginationFirdaus PanthakyNo ratings yet

- Three Thoughts On Economic Impact of The Government ShutdownDocument3 pagesThree Thoughts On Economic Impact of The Government Shutdownapi-227433089No ratings yet

- General Principal of Credit Rating-1 - AaDocument23 pagesGeneral Principal of Credit Rating-1 - AaNazir Ahmed ZihadNo ratings yet

- Federal Reserve Payment Study 2013Document43 pagesFederal Reserve Payment Study 2013armyperryNo ratings yet

- Comparative Analysis Credit RatingDocument103 pagesComparative Analysis Credit RatingRoyal Projects100% (1)

- QRM Analysis 08 2013Document32 pagesQRM Analysis 08 2013MarketsWikiNo ratings yet

- Understanding Standard & Poor's Rating Definitions: General CriteriaDocument19 pagesUnderstanding Standard & Poor's Rating Definitions: General CriteriaThanh Nguyen LeNo ratings yet

- CCRA Session 7Document25 pagesCCRA Session 7Amit GuptaNo ratings yet

- Pratik Tiwari Finance ProjectDocument75 pagesPratik Tiwari Finance ProjectPratik TiwariNo ratings yet

- Chapter 4 C CREDIT RATINGDocument8 pagesChapter 4 C CREDIT RATINGCarl AbruquahNo ratings yet

- Pratik Tiwari Project1Document75 pagesPratik Tiwari Project1Pratik TiwariNo ratings yet

- Credit Score Research PapersDocument7 pagesCredit Score Research Papershxmchprhf100% (1)

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- Gramener Case Study Submission: Group Name: 1. 2. 3. 4. Naga Sai Aditya B Najaf Pradeep ShalviDocument19 pagesGramener Case Study Submission: Group Name: 1. 2. 3. 4. Naga Sai Aditya B Najaf Pradeep ShalviShalvi TomarNo ratings yet

- Credit RatingDocument8 pagesCredit RatingchandanchiksNo ratings yet

- Unit 5 Credit Analysis & RatingDocument29 pagesUnit 5 Credit Analysis & Ratingsaurabh thakurNo ratings yet

- S&P Ratings Report 170M PEDFA BondsDocument5 pagesS&P Ratings Report 170M PEDFA BondsEmily PrevitiNo ratings yet

- Credit Rating AgenciesDocument8 pagesCredit Rating AgenciesRnD Team BNo ratings yet

- S&P Study Compares Funding and Liquidity Risks in Several Banking Systems Around The WorldDocument4 pagesS&P Study Compares Funding and Liquidity Risks in Several Banking Systems Around The Worldapi-227433089No ratings yet

- Have Credit Rating Agencies Got A Role in Triggering 2007 Global Financial Crisis?Document5 pagesHave Credit Rating Agencies Got A Role in Triggering 2007 Global Financial Crisis?Emanuela Alexandra SavinNo ratings yet

- Credit Repair Book: The Official Guide to Increase Your Credit ScoreFrom EverandCredit Repair Book: The Official Guide to Increase Your Credit ScoreNo ratings yet

- 4th US DCA Suntrust v. MackyDocument13 pages4th US DCA Suntrust v. MackybkhollowayNo ratings yet

- Horvath V BoNYDocument16 pagesHorvath V BoNYbkhollowayNo ratings yet

- Klem v. Washington Mutual 871051Document43 pagesKlem v. Washington Mutual 871051gs8600mmNo ratings yet

- Niday, Mers Opening Brief Oregon Supreme CourtDocument67 pagesNiday, Mers Opening Brief Oregon Supreme CourtbkhollowayNo ratings yet

- Wva Complaint Against Quicken Loans 10-02-25-Bench-TrialDocument26 pagesWva Complaint Against Quicken Loans 10-02-25-Bench-TrialbkhollowayNo ratings yet

- Commonwealth Virginia V LPS DocX Complaint Consent 1 13Document39 pagesCommonwealth Virginia V LPS DocX Complaint Consent 1 13bkhollowayNo ratings yet

- Carter: GraceDocument2 pagesCarter: Graceapi-318510588No ratings yet

- CoRes PaP-eRs-Gordon PDFDocument10 pagesCoRes PaP-eRs-Gordon PDFSellaaryantyNo ratings yet

- TOYOTA-V5 15217 Body Paint Sales GuideDocument48 pagesTOYOTA-V5 15217 Body Paint Sales GuidesedfrayNo ratings yet

- AT25SF128A 85C Data Sheet RevD 03-19-2019Document56 pagesAT25SF128A 85C Data Sheet RevD 03-19-2019Hans ClarinNo ratings yet

- A Writers Reference 9th Edition Ebook PDFDocument41 pagesA Writers Reference 9th Edition Ebook PDFlinda.malone216No ratings yet

- Alucobond LidlDocument107 pagesAlucobond LidlCatalin BunescuNo ratings yet

- Combined File 013009 GaylordDocument32 pagesCombined File 013009 GaylordjflowersNo ratings yet

- LinksDocument30 pagesLinksIsmal MachacaNo ratings yet

- Sepsis in A SnapDocument1 pageSepsis in A SnapjufnasNo ratings yet

- Azuyama Hotel Massage RoomDocument7 pagesAzuyama Hotel Massage RoomsreymomNo ratings yet

- Neurodiagnostic TechnologyDocument3 pagesNeurodiagnostic TechnologyJeyarajasekar TtrNo ratings yet

- WF 1000XM4Document2 pagesWF 1000XM4Zhu Zhu WangNo ratings yet

- PayPal ESG Materiality AssessmentDocument2 pagesPayPal ESG Materiality AssessmentCandiceNo ratings yet

- Bien-Tan-Siemens Sinamic G120CDocument151 pagesBien-Tan-Siemens Sinamic G120CTài liệu Công ty TNHH Nam TrungNo ratings yet

- Check Sheet 3 Accommodation Recreational Facilities Food and CateringDocument18 pagesCheck Sheet 3 Accommodation Recreational Facilities Food and CateringduthindaraNo ratings yet

- Parks 2018 PDFDocument147 pagesParks 2018 PDFgarabonc100% (2)

- Works!: Creating Realistic Returns With Minimal RiskDocument34 pagesWorks!: Creating Realistic Returns With Minimal RiskWendelmaques Rodrigues PereiraNo ratings yet

- ACCA FA1 Practice Question 1Document5 pagesACCA FA1 Practice Question 1arslan.ahmed8179No ratings yet

- RO7 - RM - S2020 - 0253 - DepEd Region VII Central VisayasDocument2 pagesRO7 - RM - S2020 - 0253 - DepEd Region VII Central VisayasJoe Val CadimasNo ratings yet

- Ey Re-Birth of Ecommerce PDFDocument88 pagesEy Re-Birth of Ecommerce PDFPrateek DubeyNo ratings yet

- Module 4 AwsDocument38 pagesModule 4 Awsnur afrinaNo ratings yet

- COP EER IEER SEER IPLV EXPLAINED - OdtDocument2 pagesCOP EER IEER SEER IPLV EXPLAINED - Odtpsn_kylmNo ratings yet

- InSSIDer Office User GuideDocument13 pagesInSSIDer Office User GuidevilaounipNo ratings yet

- ProspectsDocument217 pagesProspectsKarthikeyan GanesanNo ratings yet

- Degree Attestation CH All An FormDocument1 pageDegree Attestation CH All An FormWajidSyedNo ratings yet

- Middle East Public Health Design Handbook v2Document82 pagesMiddle East Public Health Design Handbook v2TANASEGMIHAINo ratings yet

- Hands-On Project Week 2Document2 pagesHands-On Project Week 2Kojo Osei-MensahNo ratings yet

- TSUV Gyratory CrushersDocument15 pagesTSUV Gyratory CrushersLulu Muñoz RossiNo ratings yet