Professional Documents

Culture Documents

Currency Daily Report, May 10 2013

Currency Daily Report, May 10 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Assignment 1Document3 pagesAssignment 1sukayna4ameenNo ratings yet

- FSBO Packet For Selling A Home in Johnson County, KansasDocument96 pagesFSBO Packet For Selling A Home in Johnson County, KansasChris DowellNo ratings yet

- Problems On JournalDocument4 pagesProblems On JournalNikhil Luke100% (1)

- Performance Appraisal at KMBDocument66 pagesPerformance Appraisal at KMBKrishna ChodasaniNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 23 2013Document4 pagesCurrency Daily Report, May 23 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, May 24 2013Document4 pagesCurrency Daily Report, May 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 10Document4 pagesCurrency Daily Report, April 10Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 25Document4 pagesCurrency Daily Report, April 25Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report May 6Document4 pagesCurrency Daily Report May 6Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 12Document4 pagesCurrency Daily Report, February 12Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 30 2013Document4 pagesCurrency Daily Report, July 30 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 06 2013Document4 pagesCurrency Daily Report, June 06 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 29Document4 pagesCurrency Daily Report, April 29Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 04 2013Document4 pagesCurrency Daily Report, June 04 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report August 10Document4 pagesCurrency Daily Report August 10Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 26Document4 pagesCurrency Daily Report, March 26Angel BrokingNo ratings yet

- Currency Daily Report, April 17Document4 pagesCurrency Daily Report, April 17Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 26Document4 pagesCurrency Daily Report, February 26Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report, March 25Document4 pagesCurrency Daily Report, March 25Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- The BSP Vision and MissionDocument11 pagesThe BSP Vision and Missioncamille janeNo ratings yet

- Querry TestDocument106 pagesQuerry TestkawaichanNo ratings yet

- Avg. Market Capitalization of Listed Companies During - Jul-Dec 2017Document232 pagesAvg. Market Capitalization of Listed Companies During - Jul-Dec 2017vineetksr1No ratings yet

- Ca 09032011 BookDocument36 pagesCa 09032011 BookCity A.M.No ratings yet

- Bank of BarodaDocument75 pagesBank of BarodaVicky SinghNo ratings yet

- Asset and Liability Management: A Multiple Case Study in Brazilian Financial InstitutionsDocument13 pagesAsset and Liability Management: A Multiple Case Study in Brazilian Financial InstitutionsJohn MichaelNo ratings yet

- 09 Cagungun V PDBDocument2 pages09 Cagungun V PDBYaneeza Macapado33% (3)

- 01 Metrobank V Junnel's Marketing CorporationDocument4 pages01 Metrobank V Junnel's Marketing CorporationAnonymous bOncqbp8yiNo ratings yet

- Thesis On Merchant Banking in IndiaDocument6 pagesThesis On Merchant Banking in Indiaveronicagarciaalbuquerque100% (2)

- Merger Between Centurion Bank of Punjab and HDFCDocument9 pagesMerger Between Centurion Bank of Punjab and HDFCRahul MehrotraNo ratings yet

- 3º Eso Reinforcement Conditional EsoDocument5 pages3º Eso Reinforcement Conditional EsoMarian GonzalezNo ratings yet

- What Are Your Biggest Problems and How Can I Help You Solve Them?Document3 pagesWhat Are Your Biggest Problems and How Can I Help You Solve Them?robert_geller_40% (1)

- Ivrcl LTD (Ivrinf) : Improvement Only If Asset Monetisation MaterialisesDocument7 pagesIvrcl LTD (Ivrinf) : Improvement Only If Asset Monetisation Materialisesdrsivaprasad7No ratings yet

- Project On Various Credit Schemes of SBI Back PDFDocument46 pagesProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNo ratings yet

- Colt 1911 U.S. Army... Shipped Jan. 1918 For a.E.F. in France..Document50 pagesColt 1911 U.S. Army... Shipped Jan. 1918 For a.E.F. in France..anon_835518017No ratings yet

- Banking Laws Villanueva OCRDocument20 pagesBanking Laws Villanueva OCRJohn Rey Bantay RodriguezNo ratings yet

- EFIN 519 Lecture 01Document8 pagesEFIN 519 Lecture 01Irfan Sadique IsmamNo ratings yet

- IonPay PG Guide - PHPDocument12 pagesIonPay PG Guide - PHPAri AnandaprajaNo ratings yet

- Ramesh Kumar Patodia Vs City Bank N.A. and Ors. Calcutta High CourtDocument11 pagesRamesh Kumar Patodia Vs City Bank N.A. and Ors. Calcutta High CourtLekhya ChekkaNo ratings yet

- Exercise 1: Mark The Letter A, B C or D On Your Answer Sheet To Indicate The Underlined Part That Needs Correction in Each of The Following QuestionsDocument7 pagesExercise 1: Mark The Letter A, B C or D On Your Answer Sheet To Indicate The Underlined Part That Needs Correction in Each of The Following QuestionsQuang PhạmNo ratings yet

- GAFLADocument14 pagesGAFLAShashiprakash SainiNo ratings yet

- 919020013783113Document1 page919020013783113Ankur SharmaNo ratings yet

- Certified Credit Research Analyst (CCRA) : Level 1Document2 pagesCertified Credit Research Analyst (CCRA) : Level 1Ashmit RoyNo ratings yet

- Chapter Twelve: Managing and Pricing Deposit ServicesDocument20 pagesChapter Twelve: Managing and Pricing Deposit ServicesNgọc NguyễnNo ratings yet

- ZTBL 6Document15 pagesZTBL 6ali khanNo ratings yet

Currency Daily Report, May 10 2013

Currency Daily Report, May 10 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, May 10 2013

Currency Daily Report, May 10 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Currencies Daily Report

Friday| May 10, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn :6130 Saif Mukadam Research Analyst saif.mukadam@angelbroking.com (022) 2921 2000 Extn :6136 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Ange l Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Friday| May 10, 2013

Highlights

US Unemployment Claims declined to 323,000 for w/e on 3rd May. UKs Manufacturing Production increased by 1.1 percent in March. Japans Current Account at a surplus of 0.34 trillion Yen in March. Asian markets are trading on a higher note today on the back of unexpected decline in US jobless claims data which led to upbeat global market sentiments. US Unemployment Claims declined by 4,000 to 323,000 for the week ending on 3rd May as against a rise of 327,000 in prior week. Mortgage Delinquencies was at 7.25 percent in Q1 of 2013 from earlier rise of 7.09 percent in Q4 of 2012. Wholesale Inventories gained by 0.4 percent in March as compared to decline of 0.3 percent a month ago.

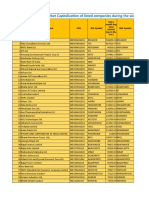

Market Highlights (% change)

Last NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (May13) - $/bbl Comex Gold (June13) - $/oz Comex Silver(May13) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% Yield 6050.2 19939.0 15082.62 1626.7 17090.6 1979.5 58497.8 14191.5 96.39 1468.80 2387.90 7356.50 102.09 Prev. day -0.3 -0.3 -0.1 -0.4 -1.0 1.2 0.2 -0.7 -0.2 -0.3 0.0 -0.9 0.0

as on May 9, 2013 WoW 0.8 1.0 1.7 1.8 2.0 1.1 5.7 -0.1 2.6 0.3 -0.4 7.3 -0.6 MoM 8.2 7.5 1.5 3.6 8.3 1.5 6.4 5.2 5.6 -2.1 2.2 -6.2 #N/A YoY 21.0 9.0 17.5 16.0 24.1 0.3 -2.0 56.9 -0.4 -8.4 -18.0 -8.9 0.5

US Dollar Index

The US Dollar Index (DX) increased by 1.1 percent in the yesterdays trading session on the back of weak global market sentiments which led to rise in demand for the low yielding currency. Further, US equities also traded on a negative note which also supported an upside in the currency. However, sharp upside in the DX was capped on account of favorable US jobless claims data. The currency touched an intra-day high of 82.915 and closed at 82.88 on Thursday.

Source: Reuters

Dollar/INR

The Indian Rupee depreciated by 0.5 percent in yesterdays trading session. The currency depreciated on account of increase in dollar demand from oil and gold importers. Additionally, weak global and domestic market sentiments coupled with strength in the DX exerted downside pressure in the currency. However, sharp downside in the Indian Rupee was cushioned as a result of rise in inflow of foreign funds. The currency touched an intra-day low of 54.35 and closed at 54.35 against dollar on Thursday. For the month of May 2013, FII inflows totaled at Rs.6,731.90 crores ($1,246.09 million) as on 9th May 2013. Year to date basis, net capital inflows stood at Rs.67,768.20 crores ($12,556.40 million) till 9th May 2013. Outlook From the intra-day perspective, we expect Indian Rupee to appreciate on the back of upbeat global market sentiments coupled with weakness in the DX. Further, expectations of positive industrial production and manufacturing output data will also support an upside in the currency. However, sharp upside in the currency will be capped as a result of scams by the major private banks along with dollar demand from the oil and gold importers.

US Dollar (% change)

Last Dollar Index US $ / INR (Spot) US $ / INR May13 Futures (NSE) US $ / INR May13 Futures (MCX-SX) 82.88 54.35 54.35 54.35 Prev. day 1.1 -0.5 0.31 0.32 WoW 0.7 -1.0 0.75 0.76

as on May 9, 2013 MoM 0.7 -0.1 -0.47 -0.47 YoY 4.3 -1.1 2.06 2.07

Technical Chart USD/INR

Source: Telequote

Technical Outlook

valid for May 10, 2013 Trend Support 54.20/54.0 Resistance 54.50/54.65

US Dollar/INR May13 (NSE/MCX-SX)

Sideways

www.angelbroking.com

Currencies Daily Report

Friday| May 10, 2013

Euro/INR

The Euro depreciated by 0.8 percent in yesterdays trade on the back of strength in dollar index coupled with mixed global market sentiments. Further, European Central Bank (ECB) survey showed that Euro zone economy is expected to contract this year by 0.4 percent added downside pressure on the currency. The Euro touched an intra-day low of 1.3009 and closed at 1.3041 against dollar on Thursday. Outlook In todays session, we expect Euro to appreciate on the back of optimistic global market sentiments coupled with weakness in DX. Further, expectation of favorable economic data from Germany may support currency to gain strength. However, ECB survey showed that Euro zone economy is expected to contract this year by 0.4 percent which may cap sharp upside in the Euro. Technical Outlook

Trend Euro/INR May13 (NSE/MCX-SX) Down 71.20/70.90 71.70/72.0 valid for May 10, 2013 Support Resistance

Euro (% change)

Last Euro /$ (Spot) Euro / INR (Spot) Euro / INR May 13 Futures (NSE) Euro / INR May13 Futures (MCX-SX) 1.3041 71.19 71.4 71.4 Prev. day -0.8 0.0 0.39 0.40

as on May 9, 2013 WoW -0.2 -1.3 0.57 0.59 MoM -0.5 0.0 1.81 1.85 YoY 0.8 -5.0 2.04 2.06

Source: Reuters

Technical Chart Euro

GBP/INR

The Sterling Pound depreciated by 0.53 percent in yesterdays trade on the back of strength dollar index coupled with mixed global market sentiments. However, sharp downside in the currency was cushioned as the Bank of England (BOE) kept the interest rates and Asset purchasing Facility unchanged. Further, rise in manufacturing production data prevented sharp depreciation in the sterling pound. UKs Manufacturing Production increased by 1.1 percent in March as against a rise of 0.7 percent a month ago. Industrial Production grew at slow pace of 0.7 percent in March from increase of 0.9 percent in prior month. Asset Purchase Facility remained unchanged at 375 billion Pounds in the month of May. Official Bank Rate also kept unchanged at 0.5 percent in the current month. The Sterling Pound touched an intraday low of 1.5423 and closed at 1.5448 against dollar on Thursday. Outlook We expect Sterling Pound to trade on a positive note as the BOE kept its interest rates and asset purchasing facility unchanged. Further, optimistic global market sentiments coupled with weakness in DX may support sterling pound. Additionally, expectation of favorable economic data from the country may act as a positive factor. Technical Outlook

Trend GBP/INR May 13 (NSE/MCX-SX) Up valid for May 10, 2013 Support 84.30/84.0 Resistance

Source: Telequote

GBP (% change)

Last $ / GBP (Spot) GBP / INR (Spot) GBP / INR May13 Futures (NSE) GBP / INR May 13 Futures (MCX-SX) 1.5448 83.793 84.53 Prev. day -0.53 -0.456 0.63

as on May 9, 2013

WoW -0.5 0.24 0.70

MoM 0.4 1.90 1.98

YoY -4.2 -2.30 -1.83

84.52

0.64

0.70

1.97

-1.87

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

84.80/85.10

www.angelbroking.com

Currencies Daily Report

Friday| May 10, 2013

JPY/INR

The Japanese Yen depreciated by 1.6 percent in yesterdays trade on the back of upbeat global market sentiments in early part of the trade which led to fall in demand for the low yielding currency. Japans Current Account at a surplus of 0.34 trillion Yen in March as against a previous deficit of 0.03 trillion Yen a month ago. Bank Lending rose by 1.7 percent in April from earlier increase of 1.5 percent in March. The Yen touched an intra-day low of 100.79 and closed at 100.59 against dollar on Thursday. Outlook For the intra-day, we expect Japanese Yen to depreciate taking cues from rise in risk appetite in the global market sentiments which will lead to fall in demand for the low yielding currency. Technical Outlook

Trend JPY/INR May 13 (NSE/MCX-SX) Up valid for May 10, 2013 Support 54.80/54.60 Resistance 55.30/55.50

JPY (% change)

Last 100.59 0.5384 55.05 55.07 Prev day 1.6 -1.68 0.45 0.47

as on May 9, 2013 WoW 2.7 -2.02 -0.77 -0.73 MoM 0.9 -7.65 -5.90 -5.88 YoY 26.3 -18.54 -16.96 -16.90

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR May13 Futures (NSE) JPY 100 / INR May13 Futures (MCX-SX)

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on May 10, 2013

Indicator Current Account New Loans Trade Balance G7 Meetings FOMC Member Evans Speaks Fed Chairman Bernanke Speaks FOMC Member George Speaks Federal Budget Balance Country Japan China UK All US US US US Time (IST) 5:20am 10 -15 Day 1 5:55pm 7:00pm 11:30pm 11.30pm

th th

Actual 0.34T -

Forecast 0.48T 770B -8.9B 93.9B

Previous 0.00T 1060B -9.4B -106.5B

Impact High Medium Medium High Medium High Medium Medium

2:00pm

www.angelbroking.com

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Assignment 1Document3 pagesAssignment 1sukayna4ameenNo ratings yet

- FSBO Packet For Selling A Home in Johnson County, KansasDocument96 pagesFSBO Packet For Selling A Home in Johnson County, KansasChris DowellNo ratings yet

- Problems On JournalDocument4 pagesProblems On JournalNikhil Luke100% (1)

- Performance Appraisal at KMBDocument66 pagesPerformance Appraisal at KMBKrishna ChodasaniNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 23 2013Document4 pagesCurrency Daily Report, May 23 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, May 24 2013Document4 pagesCurrency Daily Report, May 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 10Document4 pagesCurrency Daily Report, April 10Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 25Document4 pagesCurrency Daily Report, April 25Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report May 6Document4 pagesCurrency Daily Report May 6Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 12Document4 pagesCurrency Daily Report, February 12Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 30 2013Document4 pagesCurrency Daily Report, July 30 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 06 2013Document4 pagesCurrency Daily Report, June 06 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 29Document4 pagesCurrency Daily Report, April 29Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 04 2013Document4 pagesCurrency Daily Report, June 04 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report August 10Document4 pagesCurrency Daily Report August 10Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 26Document4 pagesCurrency Daily Report, March 26Angel BrokingNo ratings yet

- Currency Daily Report, April 17Document4 pagesCurrency Daily Report, April 17Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 26Document4 pagesCurrency Daily Report, February 26Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report, March 25Document4 pagesCurrency Daily Report, March 25Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- The BSP Vision and MissionDocument11 pagesThe BSP Vision and Missioncamille janeNo ratings yet

- Querry TestDocument106 pagesQuerry TestkawaichanNo ratings yet

- Avg. Market Capitalization of Listed Companies During - Jul-Dec 2017Document232 pagesAvg. Market Capitalization of Listed Companies During - Jul-Dec 2017vineetksr1No ratings yet

- Ca 09032011 BookDocument36 pagesCa 09032011 BookCity A.M.No ratings yet

- Bank of BarodaDocument75 pagesBank of BarodaVicky SinghNo ratings yet

- Asset and Liability Management: A Multiple Case Study in Brazilian Financial InstitutionsDocument13 pagesAsset and Liability Management: A Multiple Case Study in Brazilian Financial InstitutionsJohn MichaelNo ratings yet

- 09 Cagungun V PDBDocument2 pages09 Cagungun V PDBYaneeza Macapado33% (3)

- 01 Metrobank V Junnel's Marketing CorporationDocument4 pages01 Metrobank V Junnel's Marketing CorporationAnonymous bOncqbp8yiNo ratings yet

- Thesis On Merchant Banking in IndiaDocument6 pagesThesis On Merchant Banking in Indiaveronicagarciaalbuquerque100% (2)

- Merger Between Centurion Bank of Punjab and HDFCDocument9 pagesMerger Between Centurion Bank of Punjab and HDFCRahul MehrotraNo ratings yet

- 3º Eso Reinforcement Conditional EsoDocument5 pages3º Eso Reinforcement Conditional EsoMarian GonzalezNo ratings yet

- What Are Your Biggest Problems and How Can I Help You Solve Them?Document3 pagesWhat Are Your Biggest Problems and How Can I Help You Solve Them?robert_geller_40% (1)

- Ivrcl LTD (Ivrinf) : Improvement Only If Asset Monetisation MaterialisesDocument7 pagesIvrcl LTD (Ivrinf) : Improvement Only If Asset Monetisation Materialisesdrsivaprasad7No ratings yet

- Project On Various Credit Schemes of SBI Back PDFDocument46 pagesProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNo ratings yet

- Colt 1911 U.S. Army... Shipped Jan. 1918 For a.E.F. in France..Document50 pagesColt 1911 U.S. Army... Shipped Jan. 1918 For a.E.F. in France..anon_835518017No ratings yet

- Banking Laws Villanueva OCRDocument20 pagesBanking Laws Villanueva OCRJohn Rey Bantay RodriguezNo ratings yet

- EFIN 519 Lecture 01Document8 pagesEFIN 519 Lecture 01Irfan Sadique IsmamNo ratings yet

- IonPay PG Guide - PHPDocument12 pagesIonPay PG Guide - PHPAri AnandaprajaNo ratings yet

- Ramesh Kumar Patodia Vs City Bank N.A. and Ors. Calcutta High CourtDocument11 pagesRamesh Kumar Patodia Vs City Bank N.A. and Ors. Calcutta High CourtLekhya ChekkaNo ratings yet

- Exercise 1: Mark The Letter A, B C or D On Your Answer Sheet To Indicate The Underlined Part That Needs Correction in Each of The Following QuestionsDocument7 pagesExercise 1: Mark The Letter A, B C or D On Your Answer Sheet To Indicate The Underlined Part That Needs Correction in Each of The Following QuestionsQuang PhạmNo ratings yet

- GAFLADocument14 pagesGAFLAShashiprakash SainiNo ratings yet

- 919020013783113Document1 page919020013783113Ankur SharmaNo ratings yet

- Certified Credit Research Analyst (CCRA) : Level 1Document2 pagesCertified Credit Research Analyst (CCRA) : Level 1Ashmit RoyNo ratings yet

- Chapter Twelve: Managing and Pricing Deposit ServicesDocument20 pagesChapter Twelve: Managing and Pricing Deposit ServicesNgọc NguyễnNo ratings yet

- ZTBL 6Document15 pagesZTBL 6ali khanNo ratings yet