Professional Documents

Culture Documents

Currency Daily Report, May 17 2013

Currency Daily Report, May 17 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, May 17 2013

Currency Daily Report, May 17 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Currencies Daily Report

Friday| May 17, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn :6130 Saif Mukadam Research Analyst saif.mukadam@angelbroking.com (022) 2921 2000 Extn :6136 Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Ange l Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Friday| May 17, 2013

Highlights

US Building Permits increased by 1.02 million in the last month. European CPI remained unchanged at 1.2 percent in month of April. US Unemployment Claims increased to 360,000 for w/e on 10th May. Japans Core Machinery Orders increased by 14.2 percent in March. Asian markets are trading lower today on the back of unfavorable economic data from the US in yesterdays trading session which led to rise in risk aversion in the global market sentiments. US Building Permits increased by 1.02 million in April as against a rise of 0.89 million in March. Core Consumer Price Index (CPI) remained unchanged at 0.1 percent in the month of April. Unemployment Claims increased by 32,000 to 360,000 for the week ending on 10th May from earlier rise of 328,000 in prior week. CPI declined by 0.4 percent in last month as compared to earlier fall of 0.2 percent in March. Housing Starts fell to 0.85 million in April with respect to rise of 1.02 million in March. Philly Fed Manufacturing Index was at -5.2-mark in May from rise of 1.3-level in April, Chinas Conference Board (CB) Leading Index rose to 1.5 percent in April from earlier decline of 0.6 percent in March.

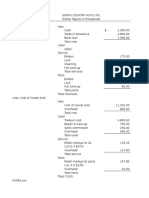

Market Highlights (% change)

Last NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (May13) - $/bbl Comex Gold (June13) - $/oz Comex Silver(May13) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% Yield 6169.9 20247.3 15233.22 1650.5 17544.0 1986.8 58497.8 15037.2 95.16 1387.10 2264.30 7263.75 102.09 Prev. day 0.4 0.2 -0.3 -0.5 0.3 0.9 0.2 -0.4 0.9 -0.7 0.0 0.9 0.0

as on May 16, 2013 WoW 2.0 1.5 1.0 1.5 2.7 0.4 5.5 -0.1 -1.3 -3.5 -4.2 -1.3 -1.4 MoM 6.7 6.5 4.7 4.8 11.3 3.3 8.5 12.9 8.1 -0.6 -2.9 -7.4 -0.3 YoY 24.8 10.7 20.9 24.6 32.1 1.0 8.3 70.9 2.5 -10.9 -19.1 -5.0 0.2

US Dollar Index

The US Dollar Index (DX) declined by 0.3 percent in the yesterdays trading session on the back of rise in risk appetite in the global market sentiments in the early part of the trade which led to fall in demand for the low yielding currency. However, sharp downside in the currency was cushioned on account of unfavorable economic data from the US. Further, US equities traded lower which also prevented sharp fall in the DX. The currency touched an intra-day low of 83.57 and closed at 83.72 on Thursday.

Source: Reuters

US Dollar (% change)

Last Dollar Index US $ / INR (Spot) US $ / INR May13 Futures (NSE) US $ / INR May13 Futures (MCX-SX) 83.72 54.77 54.90 54.90 Prev. day -0.3 0.0 -0.06 -0.07 WoW 1.0 -0.8 1.01 1.00

as on May 16, 2013 MoM 1.3 -1.4 1.19 1.20 YoY 5.4 -0.8 0.48 0.48

Dollar/INR

The Indian Rupee depreciated marginally by 0.01 percent in yesterdays trading session. The currency depreciated on account of increase in dollar demand from importers. However, sharp downside in the Indian Rupee was cushioned as a result of upbeat domestic market sentiments coupled with weakness in the DX. The currency touched an intra-day low of 54.895 and closed at 54.77 against dollar on Thursday. For the month of May 2013, FII inflows totaled at Rs.10,752.10 crores th ($1,981.89 million) as on 16 May 2013. Year to date basis, net capital th inflows stood at Rs.71,788.50 crores ($13,292.20 million) till 16 May 2013. Outlook From the intra-day perspective, we expect Indian Rupee to depreciate on the back of weak global market sentiments coupled with strength in the DX. Further, dollar demand from importers will exert downside pressure on the currency.

Technical Chart USD/INR

Source: Telequote

Technical Outlook

valid for May 17, 2013 Trend Support 54.7/54.5 Resistance 55.05/55.3

US Dollar/INR May13 (NSE/MCX-SX)

Sideways

www.angelbroking.com

Currencies Daily Report

Friday| May 17, 2013

Euro/INR

The Euro depreciated marginally by 0.04 percent in yesterdays trade on the back of weak global market sentiments. However, favorable economic data from Euro zone coupled with weakness in DX cushioned sharp fall in the currency. French Prelim Non-Farm Payrolls declined by 0.1 percent in Q1 of 2013 as against a fall of 0.3 percent in Q4 of 2012. Italian Trade Balance was at a surplus of 3.24 billion Euros in March from earlier surplus of 1.09 billion Euros a month ago. European Consumer Price Index (CPI) remained unchanged at 1.2 percent in the month of April. Core CPI declined to 1 percent in April as compared to rise of 1.5 percent in prior month. European Trade Balance was at a surplus of 18.7 billion Euros in March with respect to earlier surplus of 12.7 billion Euros a month ago. The Euro touched an intra-day low of 1.2845 and closed at 1.2881 against dollar on Thursday. Outlook In todays session, we expect Euro to depreciate on the back of strength in DX coupled with weak global market sentiments. Further, rise in worries over Europe economic growth as the GDP data showed that the economy contracted for six consecutive quarters may add downside pressure. Technical Outlook

Trend Euro/INR May13 (NSE/MCX-SX) Down 70.4/70.15 70.9/71.1 valid for May 17, 2013 Support Resistance

Euro (% change)

Last Euro /$ (Spot) Euro / INR (Spot) Euro / INR May 13 Futures (NSE) Euro / INR May13 Futures (MCX-SX) 1.2881 70.50 70.7 70.7 Prev. day -0.04 0.0 0.07 0.07

as on May 16, 2013 WoW -1.2 1.0 -0.95 -0.95 MoM -1.3 0.3 -0.57 -0.56 YoY 1.3 -4.1 1.80 1.84

Source: Reuters

Technical Chart Euro

Source: Telequote

GBP (% change)

Last $ / GBP (Spot) GBP / INR (Spot) 1.5268 83.684 83.62 Prev. day 0.23 0.247 0.04

as on May 16, 2013

WoW -1.2 -0.13 -1.08

MoM -0.1 0.61 0.71

YoY -4.0 -3.54 -3.84

GBP/INR

The Sterling Pound appreciated by 0.23 percent in yesterdays trade on the back of weak dollar index coupled with favorable economic data from the country. However, rise in risk aversion in the global market sentiments capped sharp gains in the sterling pound. The Sterling Pound touched an intra-day high of 1.5322 and closed at 1.5268 against dollar on Thursday. Outlook We expect Sterling Pound to trade on a negative note on the back of strength in DX coupled with rise in risk aversion in the global market sentiments. However, favorable economic data from the country may cushion sharp fall in the currency. Technical Outlook

Trend GBP/INR May 13 (NSE/MCX-SX) Sideways valid for May 17, 2013 Support 83.3/83.1 Resistance 83.8/84.1

GBP / INR May13 Futures (NSE) GBP / INR May 13 Futures (MCX-SX)

83.58

0.01

-1.11

0.66

-3.88

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

www.angelbroking.com

Currencies Daily Report

Friday| May 17, 2013

JPY/INR

The Japanese Yen depreciated by 0.01 percent in the yesterdays trade on the back of upbeat global market sentiments in the early part of the trade which led to fall in demand for the low yielding currency. However, sharp downside in the currency was cushioned as a result of favorable economic data from the country. Japans Core Machinery Orders increased by 14.2 percent in March as against a rise of 4.2 percent a month ago. The Yen touched an intra-day low of 102.68 and closed at 102.24 against dollar on Thursday. Outlook For the intra-day, we expect Japanese Yen to appreciate taking cues from rise in risk aversion in the global market sentiments which will lead to increase in demand for the low yielding currency. Technical Outlook

Trend JPY/INR May 13 (NSE/MCX-SX) Down valid for May 17, 2013 Support 53.3/53.1 Resistance 53.8/54.1

JPY (% change)

Last 102.24 0.5363 53.61 53.60 Prev day 0.0 0.09 0.11 0.10

as on May 16, 2013 WoW 1.6 -0.39 -2.62 -2.66 MoM 4.2 -3.30 -3.41 -3.42 YoY 27.3 -20.91 -20.97 -20.98

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR May13 Futures (NSE) JPY 100 / INR May13 Futures (MCX-SX)

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on May 17, 2013

Indicator Core Machinery Orders m/m MPC Member Weale Speaks Prelim UoM Consumer Sentiment Country Japan UK US Time (IST) 5:20am 2:45pm 7:25pm Actual 14.2% Forecast 3.1% 77.9 Previous 7.5% 76.4 Impact Medium Medium High

www.angelbroking.com

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- The Way of The Superior Trader by Forexia PDFDocument53 pagesThe Way of The Superior Trader by Forexia PDFHengki Suwondo100% (8)

- LSCC Final Bill CC FormDocument2 pagesLSCC Final Bill CC FormV Venkata Narayana77% (13)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sheshu KNo ratings yet

- F KG HSE RA Steel Doors Installation 2Document3 pagesF KG HSE RA Steel Doors Installation 2Alvin Badz50% (2)

- Currency Daily Report, March 19Document4 pagesCurrency Daily Report, March 19Angel BrokingNo ratings yet

- Currency Daily Report, March 18Document4 pagesCurrency Daily Report, March 18Angel BrokingNo ratings yet

- Currency Daily Report, April 10Document4 pagesCurrency Daily Report, April 10Angel BrokingNo ratings yet

- Currency Daily Report, April 17Document4 pagesCurrency Daily Report, April 17Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report, March 22Document4 pagesCurrency Daily Report, March 22Angel BrokingNo ratings yet

- Currency Daily Report May 6Document4 pagesCurrency Daily Report May 6Angel BrokingNo ratings yet

- Currency Daily Report, March 20Document4 pagesCurrency Daily Report, March 20Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 24 2013Document4 pagesCurrency Daily Report, May 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 29Document4 pagesCurrency Daily Report, April 29Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Currency Daily Report, April 25Document4 pagesCurrency Daily Report, April 25Angel BrokingNo ratings yet

- Currency Daily Report, May 23 2013Document4 pagesCurrency Daily Report, May 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 22Document4 pagesCurrency Daily Report, April 22Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 21Document4 pagesCurrency Daily Report, March 21Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, March 28Document4 pagesCurrency Daily Report, March 28Angel BrokingNo ratings yet

- Currency Daily Report, May 28 2013Document4 pagesCurrency Daily Report, May 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Currency Daily Report, February 22Document4 pagesCurrency Daily Report, February 22Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 06 2013Document4 pagesCurrency Daily Report, June 06 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 28Document4 pagesCurrency Daily Report, February 28Angel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, March 26Document4 pagesCurrency Daily Report, March 26Angel BrokingNo ratings yet

- Currency Daily Report, June 04 2013Document4 pagesCurrency Daily Report, June 04 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 21Document4 pagesCurrency Daily Report, February 21Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 18Document4 pagesCurrency Daily Report, February 18Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 25Document4 pagesCurrency Daily Report, March 25Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report November 5Document4 pagesCurrency Daily Report November 5Angel BrokingNo ratings yet

- Currency Daily Report, February 26Document4 pagesCurrency Daily Report, February 26Angel BrokingNo ratings yet

- Currency Daily Report, May 21 2013Document4 pagesCurrency Daily Report, May 21 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Turtle Map CMDocument6 pagesTurtle Map CMmtechewitNo ratings yet

- DissolutionDocument38 pagesDissolutionBrian Daniel BayotNo ratings yet

- IBM Maximo Asset Management Release 7.1: Product Description GuideDocument12 pagesIBM Maximo Asset Management Release 7.1: Product Description GuideKumar AjitNo ratings yet

- Item Invoice DownloadDocument2 pagesItem Invoice DownloadgoodmorningviewersNo ratings yet

- Iso 22000 Checklist Fsms f6.4-22 (FSMS)Document14 pagesIso 22000 Checklist Fsms f6.4-22 (FSMS)BRIGHT DZAH100% (1)

- CV Karntimon - YDocument4 pagesCV Karntimon - Yichigosonix66No ratings yet

- DHL Parcel Uk: International Label AdviceDocument7 pagesDHL Parcel Uk: International Label AdviceCarol ManirakizaNo ratings yet

- Search For An Answer To Any Question... : Have More Answers For FreeDocument10 pagesSearch For An Answer To Any Question... : Have More Answers For FreeMarium Raza100% (1)

- Jorge Lopez Resume 1 PDFDocument2 pagesJorge Lopez Resume 1 PDFapi-361851126No ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- COst Accounting SystamDocument4 pagesCOst Accounting SystamAishwary SakalleNo ratings yet

- TaxDocument26 pagesTaxParticia CorveraNo ratings yet

- Atul's ResumeDocument3 pagesAtul's Resumejapulin9No ratings yet

- CAT 2007 Question Paper With SolutionsDocument59 pagesCAT 2007 Question Paper With SolutionsdheerajajwaniNo ratings yet

- Contract To SellDocument1 pageContract To Selljamaica deangNo ratings yet

- Process ModelDocument4 pagesProcess ModelParvathi GoudNo ratings yet

- Bank and Secrecy Law in The PhilippinesDocument18 pagesBank and Secrecy Law in The PhilippinesBlogWatchNo ratings yet

- Invitation To Bid For The Procurement of Stone Masonry of Brgy. Igburi - Bagumbayan RoadDocument2 pagesInvitation To Bid For The Procurement of Stone Masonry of Brgy. Igburi - Bagumbayan RoadSanJoaquinIloiloNo ratings yet

- Mastech Digital Press Release 7.13.2017Document2 pagesMastech Digital Press Release 7.13.2017MastechDigitalNo ratings yet

- Unit-01-Introduction To ERP StructureDocument17 pagesUnit-01-Introduction To ERP Structurefz11No ratings yet

- NMIMS - Retail Operations - Abhishek SharmaDocument13 pagesNMIMS - Retail Operations - Abhishek SharmaMAITRI JOSHINo ratings yet

- Q1 Infor On NA CountyDocument2 pagesQ1 Infor On NA Countysheiji_roNo ratings yet

- Transmittal Letter Blank 2022Document3 pagesTransmittal Letter Blank 2022Likey PromiseNo ratings yet

- FCR Fiata PDFDocument2 pagesFCR Fiata PDFBenNo ratings yet

- Bourse Stock ExchangeDocument20 pagesBourse Stock ExchangeSiva IddipilliNo ratings yet

- Parol Evidence Seaoil Petroleum Corp Vs Autocorp Group G.R. No. 164326 October 17, 2008Document1 pageParol Evidence Seaoil Petroleum Corp Vs Autocorp Group G.R. No. 164326 October 17, 2008vestiahNo ratings yet