Professional Documents

Culture Documents

Ecb - Faq

Ecb - Faq

Uploaded by

Sanchit AroraCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Treasury Management PDFDocument78 pagesTreasury Management PDFGUNJAN BHATIA100% (1)

- Dealing Room, ERM, FX Risk, DerivativesDocument37 pagesDealing Room, ERM, FX Risk, DerivativesSanchit AroraNo ratings yet

- Becoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Document13 pagesBecoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Sanchit AroraNo ratings yet

- Reasons For Foreign Direct Investment by Alan S. GuttermanDocument6 pagesReasons For Foreign Direct Investment by Alan S. GuttermanSanchit AroraNo ratings yet

- What Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Document2 pagesWhat Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Sanchit AroraNo ratings yet

- Benefits To TataDocument4 pagesBenefits To TataSanchit AroraNo ratings yet

- 632 OmDocument16 pages632 OmSanchit AroraNo ratings yet

- Exchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesDocument27 pagesExchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesSanchit AroraNo ratings yet

- Ercury Effects: Mercury Can Cause Harmful Effects Before Symptoms DevelopDocument15 pagesErcury Effects: Mercury Can Cause Harmful Effects Before Symptoms DevelopSanchit AroraNo ratings yet

- Bail Application Prabhat KumarDocument17 pagesBail Application Prabhat KumarVivek TanwarNo ratings yet

- E PassbookDocument18 pagesE PassbookNilanjan KarmakarNo ratings yet

- MI 400 Questions IB GuideDocument6 pagesMI 400 Questions IB GuideMulugeta AshangoNo ratings yet

- Banking Awareness MCQs For RBI Assistant MainsDocument22 pagesBanking Awareness MCQs For RBI Assistant MainskavinkumareceNo ratings yet

- Prevention of NPAs A Comparative Study On Indian BanksDocument6 pagesPrevention of NPAs A Comparative Study On Indian BanksPurandhara ReddyNo ratings yet

- TADocument41 pagesTAAnita SharmaNo ratings yet

- Payments Bank: FM Group AssingmentDocument24 pagesPayments Bank: FM Group AssingmentHardik RastogiNo ratings yet

- Analysis of Product and Services of Bank of BarodaDocument71 pagesAnalysis of Product and Services of Bank of BarodaShivam Yadav0% (1)

- Company History of SBI, ICICIDocument461 pagesCompany History of SBI, ICICImuruganvg100% (1)

- Mixture and Alligation Shortcuts - Gr8AmbitionZDocument11 pagesMixture and Alligation Shortcuts - Gr8AmbitionZDeepak ReghunandanNo ratings yet

- Economics Prelims Notes GenDocument93 pagesEconomics Prelims Notes Gensrk08072003No ratings yet

- SSC Bolt Jan 2024Document54 pagesSSC Bolt Jan 2024whoamiaug1997No ratings yet

- QP repeatPrescreeningJSODocument46 pagesQP repeatPrescreeningJSORuchiNo ratings yet

- Analysis of Npa in Banking Industry - A Comparative Study Between Public Sector Banks and Private Sector BanksDocument16 pagesAnalysis of Npa in Banking Industry - A Comparative Study Between Public Sector Banks and Private Sector BanksAngelNo ratings yet

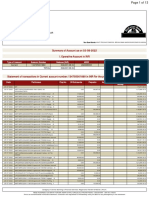

- Summary of Account As On 03-08-2022 I. Operative Account in INRDocument13 pagesSummary of Account As On 03-08-2022 I. Operative Account in INRMonu DewanganNo ratings yet

- Circularand Syllabus BCom Bankingand Insurance CBCSPatternwef 202122Document27 pagesCircularand Syllabus BCom Bankingand Insurance CBCSPatternwef 202122sumedh249900No ratings yet

- Xii - Economics - Money and Banking (Notes)Document5 pagesXii - Economics - Money and Banking (Notes)Janvi AhluwaliaNo ratings yet

- Rbi CircularDocument8 pagesRbi CircularadswerNo ratings yet

- Insight 09 Placement Guide IIT KanpurDocument120 pagesInsight 09 Placement Guide IIT Kanpurparasdeshpande100% (2)

- Regulatory Framework of Mutual FundsDocument24 pagesRegulatory Framework of Mutual FundsLovepreet NegiNo ratings yet

- Who Is An NRI?: NRI Can Invest in The Following ProductsDocument7 pagesWho Is An NRI?: NRI Can Invest in The Following ProductsnikmanojNo ratings yet

- Banking Law MCQDocument33 pagesBanking Law MCQShivansh Bansal100% (7)

- BFM Module C Chapter 18 Part IiDocument10 pagesBFM Module C Chapter 18 Part IifolinesNo ratings yet

- Scan 0001Document16 pagesScan 0001Alfaz AnsariNo ratings yet

- 74769bos60492 cp10Document62 pages74769bos60492 cp10harshrathore17579No ratings yet

- Roles of RBI As Banker To GovernmentDocument6 pagesRoles of RBI As Banker To GovernmentRishav KumarNo ratings yet

- Current Affairs Capsule August 2016.compressedDocument93 pagesCurrent Affairs Capsule August 2016.compressedmanoj maniNo ratings yet

- Anecdotes Comprising Common Banking FraudsDocument2 pagesAnecdotes Comprising Common Banking Fraudssid guptaNo ratings yet

- LPD 2022 Adv 278Document184 pagesLPD 2022 Adv 278P N rajuNo ratings yet

Ecb - Faq

Ecb - Faq

Uploaded by

Sanchit AroraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ecb - Faq

Ecb - Faq

Uploaded by

Sanchit AroraCopyright:

Available Formats

External Commercial Borrowing (ECB)

Q. 1. What is an ECB? Ans. ECB is an abbreviation for External Commercial Borrowings which are governed by a set of guidelines issued by the Government of India/Reserve Bank of India. ECB refers to commercial loans , in the form of bank loans, buyers credit, suppliers credit, securitised instruments (e.g. floating rate notes and fixed rate bonds) availed from non- resident lenders with minimum average maturity of 3 years. ECBs are a key component of Indias overall external debt which includes, inter alia, external assistance, buyers credit, NRI deposits, short- term credit and Rupee debt. Q2. What are the steps involved in availing an ECB? Ans. ECBs can be accessed under two routes: i. Automatic Route where there is no prior approval of RBI/Government is required ii. Approval Route where prior approval of RBI/ Government is required

Automatic Route

Q3. Who is eligible to raise funds through ECB- Automatic route? Ans: ECB for investment in real sector -industrial sector, especially infrastructure sector-in India, will be under Automatic Route, i.e.. it will not require RBI/ Government approval. However, in case of doubt as regards eligibility to access Automatic Route, applicants may take recourse to the Approval Route. Corporates registered under the Companies Act except financial intermediaries (such as banks, financial institutions (FIs), housing finance companies and NBFCs) are eligible. Individuals, Trusts and Non- Profit making organizations are not eligible to raise ECB. Q4. From whom such funds are to be raised under ECB- Automatic route? Borrowers can raise ECB from internationally recognised sources such as (i) international banks, international capital markets, multilateral financial institutions (such as IFC, ADB, CDC etc.,), (ii) export credit agencies and (iii) suppliers of equipment, foreign collaborators and foreign equity holders. Q5. What are other terms and conditions for raising funds through ECB- Automatic route? Ans : i) . Amount and Maturity a) ECB up to USD 20 million or equivalent with minimum average maturity of three years b) ECB above USD 20 million and up to USD 500 million or equivalent with minimum average maturity of five years

Ans : From Recognised Lenders .

c) ECB up to USD 20 million can have call/put option provided the minimum average maturity of 3 years is complied before exercising call/put option. d) The maximum amount of ECB which can be raised by an eligible borrower under this route is USD 500 million during a financial year. ii) All-in-cost ceilings All-in-cost includes rate of interest, other fees and expenses in foreign currency except commitment fee, pre-payment fee, and fees payable in Indian Rupees. Moreover, the payment of withholding tax in Indian Rupees is excluded for calculating the all-in-cost. The all-in-cost ceilings for ECB will be indicated from time to time. The following ceilings will have immediate effect and will be valid till reviewed. Minimum Average Maturity Period Three years and up to five years More than five years All-in-cost Ceilings over six month LIBOR* 200 basis points 350 basis points

* for the respective currency of borrowing or applicable benchmark. iii) End-use a) ECB can be raised only for investment (such as import of capital goods, new projects, modernization/expansion of existing production units) in real sector industrial sector including small and medium enterprises (SME) and infrastructure sector - in India. Infrastructure sector is defined as (i) power, (ii) telecommunication, (iii) railways, (iv) road including bridges, (v) ports, (vi) industrial parks and (vii) urban infrastructure (water supply, sanitation and sewage projects); b) Utilisation of ECB proceeds is permitted in the first stage acquisition of shares in the disinvestment process and also in the mandatory second stage offer to the public under the Governments disinvestment programme of PSU shares. c) Utilisation of ECB proceeds is not permitted for on-lending or investment in capital market by corporates d) Utilisation of ECB proceeds is not permitted in real estate. The term real estate excludes development of integrated township as defined by Ministry of Commerce and Industry, Department of Industrial Policy and Promotion, SIA (FC Division), Press Note 3 (2002 Series, dated 04.01.2002). e) ECB proceeds can be utilized for overseas direct investment in Joint Venture (JV)/ Wholly Owned Subsidy (WOS) subject tom the guidelines issued (time to time) on Indian Direct Investment in JV/ WOS abroad. f) End- uses of ECB for working capital, general corporate purpose and repayment of existing loans are not permitted.

iv)

Security The choice of security to be provided to the lender/supplier is left to the borrower. However, creation of charge over immovable assets and financial securities, such as shares, in favour of overseas lender is subject to Regulation 8 of Notification No. FEMA 21/RB-2000 dated May 3, 2000 and Regulation 3 of Notification No. FEMA 20/RB-2000, dated May 3, 2000, respectively.

APPROVAL ROUTE

Q.6. Who is eligible to raise funds through ECB- Approval route? Ans : Following organizations/ institutions are authorized to raise funds through ECB- Approval route: a) Financial institutions dealing exclusively with infrastructure or export finance such as IDFC, IL&FS, Power Finance Corporation, Power Trading Corporation, IRCON and EXIM Bank are considered on a case by case basis. b) Banks and financial institutions which had participated in the textile or steel sector restructuring package as approved by the Government are also being permitted to the extent of their investment in the package and assessment by RBI based on prudential norms. Any ECB availed for this purpose so far is to be deducted from their entitlement. c) Cases falling outside the purview of the automatic route limits and maturity period mentioned above. Q.7. From whom such funds can be raised under ECB- Approval route? banks, international capital markets, multilateral financial institutions (such as IFC, ADB, CDC etc.,), (ii) export credit agencies and (iii) suppliers of equipment, foreign collaborators and foreign equity holders. Q.8. What are other terms and conditions for raising funds through ECB- Approval route? Ans : i) All-in-cost ceilings All-in-cost includes rate of interest, other fees and expenses in foreign currency except commitment fee, pre-payment fee, and fees payable in Indian Rupees. Moreover, the payment of withholding tax in Indian Rupees is excluded for calculating the all-in-cost. The all-in-cost ceilings for ECB will be indicated from time to time. The following ceilings will have immediate effect and will be valid till reviewed.

Ans : Borrowers can raise ECB from internationally recognised sources such as (i) international

Minimum Average Maturity Period Three years and up to five years More than five years

All-in-cost Ceilings over six month LIBOR* 150 basis points 250 basis points

* for the respective currency of borrowing or applicable benchmark. ii) End-use a) ECB can be raised only for investment (such as import of capital goods, new projects, modernization/expansion of existing production units) in real sectorindustrial sector including small and medium enterprises (SME) and infrastructure sector-in India. Infrastructure sector is defined as (i) power, (ii) telecommunication, (iii) railways, (iv) road including bridges, (v) ports, (vi) industrial parks and (vii) urban infrastructure (water supply, sanitation and sewage projects); b) Utilisation of ECB proceeds is permitted in the first stage acquisition of shares in the disinvestment process and also in the mandatory second stage offer to the public under the Governments disinvestment programme of PSU shares. c) Utilisation of ECB proceeds is not permitted for on-lending or investment in capital market by corporates except for banks and financial institutions eligible under paragraph 2(B)(i)(a) and 2(B)(i) (b); d) Utilisation of ECB proceeds is not permitted in real estate. The term real estate excludes development of integrated township as defined by Ministry of Commerce and Industry, Department of Industrial Policy and Promotion, SIA (FC Division), Press Note 3 (2002 Series, dated 04.01.2002). e). ECB proceeds can be utilized for overseas direct investment in Joint Venture (JV)/ Wholly Owned Subsidy (WOS) subject tom the guidelines issued (time to time) on Indian Direct Investment in JV/ WOS abroad. f). End- uses of ECB for working capital, general corporate purpose and repayment of existing loans are not permitted. iii) Security The choice of security to be provided to the lender/supplier is left to the borrower. However, creation of charge over immovable assets and financial securities, such as shares, in favour of overseas lender is subject to Regulation 8 of Notification No. FEMA 21/RB-2000 dated May 3, 2000 and Regulation 3 of Notification No. FEMA 20/RB-2000, dated May 3, 2000, respectively. Q.9. What is the procedure for raising such funds? Ans : Applicants are required to submit an application in form ECB through designated AD to the Chief General Manager-in-Charge, Foreign Exchange Department, Reserve Bank of India, Central Office, External Commercial Borrowings Division, Mumbai 400 001 along with necessary documents.

Q.10.: Whether ADs are authorized to issue guarantees for such loans? Ans : ADs may issue Guarantee/LoU/ LoC in favour of overseas supplier, bank and financial institutions, upto USD 20 million per transaction for a period up to one year for import of all non- capital goods permissible under Foreign Trade Policy (except Gold) and up to three years for import of capital goods. However, the period of such guarantees/ LoU/ LoCs has to be co- terminus with the period of credit, reckoned from the date of shipment. Q.11. Where the proceeds received under ECB are to be parked? Ans. ECB proceeds should be parked overseas until actual requirement in India.

Q.12. Whether prepayment of such loans are permitted? Ans : Prepayment of ECB up to USD 100 million is permitted without prior approval of RBI, subject to compliance with the stipulated minimum average maturity period as applicable for the loan. Q.13. Whether refinancing of existing ECB by raising fresh ECB is permitted? Ans : Refinancing of existing ECB by raising fresh loans at lower cost is permitted subject to the condition that the outstanding maturity of the original loan is maintained. Q. 14. Whether ADs are permitted to remit funds abroad towards debt servicing? Ans : The designated Authorised Dealer (AD) has the general permission to make remittances of instalments of principal, interest and other charges in conformity with ECB guidelines issued by Government / RBI from time to time. Q.15. What are the procedures for raising such funds? Ans : Borrower may enter into loan agreement with recognised overseas lender for raising ECB under Automatic Route without prior approval of RBI. The borrower may note to comply with the reporting arrangement under paragraph 2(C)(i). The primary responsibility to ensure that ECB raised / utilised are in conformity with the ECB guidelines and the Reserve Bank regulations/directions/circulars is that of the concerned borrower. Q.16. What are the reporting requirements for ECB? Ans : a) Borrowers are required to submit Form 83, in duplicate, certified by the Company Secretary (CS) or Chartered Accountant (CA) to the designated AD. One copy is to be forwarded by the designated AD to the Director, Balance of Payments Statistics Division, Department of Statistical Analysis and Computer Services (DESACS), Reserve Bank of India, Bandra-Kurla Complex, Mumbai 400 051 for allotment of loan registration number. b) The borrower can draw-down the loan only after obtaining the loan registration number from DESACS, RBI. c) Borrowers are required to submit ECB-2 Return (format in Annex III) on monthly basis certified by the designated AD so as to reach DESACS, RBI within seven working days from the close of month to which it relates.

Q.17. Who is responsible to ensure that the ECB raised/ utilized are in conformity with the RBI instructions? Ans: The primary responsibility to ensure that ECB guidelines are in conformity with RBI instructions is that of the concerned borrower. However, the designated AD is also required to ensure that raising/ utilisation is as per the ECB guidelines at the time of certification.

Q.18. Are ADs permitted to crystalise the ECB liability arising out of guarantee provided for ECB raised by corporates? Ans: Yes, but after seeking an approval from RBI. ADs desiring to crystallize their foreign currency liability into Rupees arising out of Bank guarantee issued against ECBs are to make an application to the CGM, Foreign Exchange Department, External Commercial Borrowings Division, RBI, Central Office, Mumbai, giving full details viz. the borrowers name, amount raised, maturity, circumstances leading to invocation of BG/ LoC, date of default, its impact on the liabilities of the overseas branch of the AD concerned and other relevant factors.

Q.19. Whether units located in SEZ are permitted to raise ECB? Ans. Yes, subject to following conditions: a. ECB is raised for their own requirement, and b. They shall not transfer or on- lend any borrowed funds to their sister concern or any other unit in Domestic Tariff Area (DTA). Q.20. What is Trade Credits? Ans: Trade Credits (TC) refer to credits extended for imports directly by the overseas supplier, bank and financial institution for original maturity of less than three years. Depending on the source of finance, such trade credits include suppliers credit or buyers credit. Suppliers credit relates to credit for imports in to India extended by the overseas supplier, while buyers credit refers to loans for payment of imports in to India arranged by the importer from a bank or financial institution outside India for maturity of less than three years. However, buyers credit and suppliers credit for three years and above come under the category of External Commercial Borrowings (ECB) which are governed by ECB guidelines. Q.21. What are the specific features of Trade Credits? Ans : Amount and Maturity ADs are permitted to approve trade credits for imports into India up to USD 20 million per import transaction for import of all items (permissible under the EXIM Policy) with a maturity period (from the date of shipment) up to one year. For import of capital goods, ADs may approve trade credits up to USD 20 million per import transaction with a maturity period of more than one year and less than three years. No roll-over/extension will be permitted by the AD beyond the permissible period.

All-in-cost Ceilings The all-in-cost ceilings are as under: Maturity period All-in-cost ceilings over 6 months LIBOR* 50 basis points 125 basis points

Up to one year More than one year but less than three years * for the respective currency of credit or applicable benchmark.

The all-in-cost ceilings include arranger fee, upfront fee, management fee, handling / processing charges, out of pocket and legal expenses, if any. The all-in-cost ceilings will be reviewed from time to time. Guarantee ADs may issue Guarantee/LoU/ LoC in favour of overseas supplier, bank and financial institutions, upto USD 20 million per transaction for a period up to one year for import of all non- capital goods permissible under Foreign Trade Policy (except Gold) and up to three years for import of capital goods. However, the period of such guarantees/ LoU/ LoCs has to be co- terminus with the period of credit, reckoned from the date of shipment. Reporting Arrangements ADs are required to furnish details of approvals, drawal, utilisation, and repayment of trade credit granted by all its branches, in a consolidated statement, during the month, in form TC to the Director, Division of International Finance, Department of Economic Analysis and Policy, Reserve Bank of India, Central Office Building, 8th floor, Fort, Mumbai 400 001 so as to reach not later than 10 th of the following month. Each trade credit may be given a unique identification number by the AD.

Prepared by Reena Ray, Faculty

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Treasury Management PDFDocument78 pagesTreasury Management PDFGUNJAN BHATIA100% (1)

- Dealing Room, ERM, FX Risk, DerivativesDocument37 pagesDealing Room, ERM, FX Risk, DerivativesSanchit AroraNo ratings yet

- Becoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Document13 pagesBecoming The Go-To' Bank: Barclays Strategic Review Executive Summary 12 February 2013Sanchit AroraNo ratings yet

- Reasons For Foreign Direct Investment by Alan S. GuttermanDocument6 pagesReasons For Foreign Direct Investment by Alan S. GuttermanSanchit AroraNo ratings yet

- What Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Document2 pagesWhat Is Required:: MPF753/953: Assignment 2, T2 2011 Due Date: Monday 5 September 2011Sanchit AroraNo ratings yet

- Benefits To TataDocument4 pagesBenefits To TataSanchit AroraNo ratings yet

- 632 OmDocument16 pages632 OmSanchit AroraNo ratings yet

- Exchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesDocument27 pagesExchange Rate Regimes and Monetary Autonomy: Empirical Evidence From Selected Caribbean CountriesSanchit AroraNo ratings yet

- Ercury Effects: Mercury Can Cause Harmful Effects Before Symptoms DevelopDocument15 pagesErcury Effects: Mercury Can Cause Harmful Effects Before Symptoms DevelopSanchit AroraNo ratings yet

- Bail Application Prabhat KumarDocument17 pagesBail Application Prabhat KumarVivek TanwarNo ratings yet

- E PassbookDocument18 pagesE PassbookNilanjan KarmakarNo ratings yet

- MI 400 Questions IB GuideDocument6 pagesMI 400 Questions IB GuideMulugeta AshangoNo ratings yet

- Banking Awareness MCQs For RBI Assistant MainsDocument22 pagesBanking Awareness MCQs For RBI Assistant MainskavinkumareceNo ratings yet

- Prevention of NPAs A Comparative Study On Indian BanksDocument6 pagesPrevention of NPAs A Comparative Study On Indian BanksPurandhara ReddyNo ratings yet

- TADocument41 pagesTAAnita SharmaNo ratings yet

- Payments Bank: FM Group AssingmentDocument24 pagesPayments Bank: FM Group AssingmentHardik RastogiNo ratings yet

- Analysis of Product and Services of Bank of BarodaDocument71 pagesAnalysis of Product and Services of Bank of BarodaShivam Yadav0% (1)

- Company History of SBI, ICICIDocument461 pagesCompany History of SBI, ICICImuruganvg100% (1)

- Mixture and Alligation Shortcuts - Gr8AmbitionZDocument11 pagesMixture and Alligation Shortcuts - Gr8AmbitionZDeepak ReghunandanNo ratings yet

- Economics Prelims Notes GenDocument93 pagesEconomics Prelims Notes Gensrk08072003No ratings yet

- SSC Bolt Jan 2024Document54 pagesSSC Bolt Jan 2024whoamiaug1997No ratings yet

- QP repeatPrescreeningJSODocument46 pagesQP repeatPrescreeningJSORuchiNo ratings yet

- Analysis of Npa in Banking Industry - A Comparative Study Between Public Sector Banks and Private Sector BanksDocument16 pagesAnalysis of Npa in Banking Industry - A Comparative Study Between Public Sector Banks and Private Sector BanksAngelNo ratings yet

- Summary of Account As On 03-08-2022 I. Operative Account in INRDocument13 pagesSummary of Account As On 03-08-2022 I. Operative Account in INRMonu DewanganNo ratings yet

- Circularand Syllabus BCom Bankingand Insurance CBCSPatternwef 202122Document27 pagesCircularand Syllabus BCom Bankingand Insurance CBCSPatternwef 202122sumedh249900No ratings yet

- Xii - Economics - Money and Banking (Notes)Document5 pagesXii - Economics - Money and Banking (Notes)Janvi AhluwaliaNo ratings yet

- Rbi CircularDocument8 pagesRbi CircularadswerNo ratings yet

- Insight 09 Placement Guide IIT KanpurDocument120 pagesInsight 09 Placement Guide IIT Kanpurparasdeshpande100% (2)

- Regulatory Framework of Mutual FundsDocument24 pagesRegulatory Framework of Mutual FundsLovepreet NegiNo ratings yet

- Who Is An NRI?: NRI Can Invest in The Following ProductsDocument7 pagesWho Is An NRI?: NRI Can Invest in The Following ProductsnikmanojNo ratings yet

- Banking Law MCQDocument33 pagesBanking Law MCQShivansh Bansal100% (7)

- BFM Module C Chapter 18 Part IiDocument10 pagesBFM Module C Chapter 18 Part IifolinesNo ratings yet

- Scan 0001Document16 pagesScan 0001Alfaz AnsariNo ratings yet

- 74769bos60492 cp10Document62 pages74769bos60492 cp10harshrathore17579No ratings yet

- Roles of RBI As Banker To GovernmentDocument6 pagesRoles of RBI As Banker To GovernmentRishav KumarNo ratings yet

- Current Affairs Capsule August 2016.compressedDocument93 pagesCurrent Affairs Capsule August 2016.compressedmanoj maniNo ratings yet

- Anecdotes Comprising Common Banking FraudsDocument2 pagesAnecdotes Comprising Common Banking Fraudssid guptaNo ratings yet

- LPD 2022 Adv 278Document184 pagesLPD 2022 Adv 278P N rajuNo ratings yet