Professional Documents

Culture Documents

Formulario Certificado de Origen

Formulario Certificado de Origen

Uploaded by

Carolina AparicioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formulario Certificado de Origen

Formulario Certificado de Origen

Uploaded by

Carolina AparicioCopyright:

Available Formats

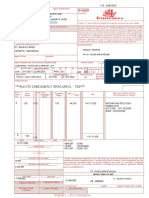

Certificate of Origin

1. Exporters name, address, country:

Certificate No.:

CERTIFICATE OF ORIGIN

2. Producers name and address, if known:

Form F for China-Chile FTA

Issued in

3. Consignees name, address, country: 5. For Official Use Only

CHILE

(see Instruction overleaf)

Preferential Tariff Treatment Given Under _______ Preferential Treatment Not Given (Please state reasons)

4. Means of transport and route (as far as known) Departure Date Signature of Authorized Signatory of the Importing Country Vessel /Flight/Train/Vehicle No. Port of loading Port of discharge 6. Remarks

7. Item number (Max. 20)

8. Marks and numbers on packages

9. Number and kind of packages; description of goods

10. HS code (Six digit code)

11. Origin criterion

12. Gross weight,

13. Number,

quantity (Quantity date of Unit) or other measures (liters, m3, etc) invoice and invoiced value

14. Declaration by the exporter statement are correct, that all the goods were produced in

15. Certification exporter is correct.

The undersigned hereby declares that the above details and It is hereby certified, on the basis of control carried out, that the declaration of the

CHILE

(Country) and that they comply with the origin requirements specified in the FTA for the goods exported to

CHINA

Importing country)

Place and date1, signature and stamp of certifying authority Certifying authority Tel: Address: Fax:

A Certificate of Origin under China-Chile Free Trade Agreement shall be valid for one year from the date of issue in the exporting country.

Place and date, signature of authorized signatory

Overleaf Instruction

Box 1: Box 2:

State the full legal name, address (including country) of the exporter. State the full legal name, address (including country) of the producer. If more than one producers good is included in the certificate, list the additional producers, including name, address (including country). If the exporter or the producer wishes the information to be confidential, it is acceptable to state Available to the competent governmental authority upon request. If the producer and the exporter are the same, please complete field with SAME. If the producer is unknown, it is acceptable to state "UNKNOWN".

Box 3: Box 4: Box 5:

State the full legal name, address (including country) of the consignee. Complete the means of transport and route and specify the departure date, transport vehicle No., port of loading and discharge. The customs authorities of the importing country must indicate ( ) in the relevant boxes whether or not preferential tariff treatment is accorded.

Box 6:

Customers Order Number, Letter of Credit Number, and etc. may be included if required. If the invoice is issued by a non-Party operator, the name, address of the producer in the originating Party shall be stated herein.

Box 7: Box 8: Box 9:

State the item number, and item number should not exceed 20. State the shipping marks and numbers on the packages. Number and kind of package shall be specified. Provide a full description of each good. The description should be sufficiently detailed to enable the products to be identified by the Customs Officers examining them and relate it to the invoice description and to the HS description of the good. If goods are not packed, state in bulk. When the description of the goods is finished, add *** (three stars) or \ (finishing slash).

Box 10: Box 11:

For each good described in Box 9, identify the HS tariff classification to six digits. If the goods qualify under the Rules of Origin, the exporter must indicate in Box 11 of this form the origin criteria on the basis of which he claims that his goods qualify for preferential tariff treatment, in the manner shown in the following table: The origin criteria on the basis of which the exporter claims that his goods qualify for preferential tariff treatment Goods wholly obtained General rule as 40% regional value content Products specific rules P RVC PSR Insert in Box 11

Box 12:

Gross weight in Kilos should be shown here. Other units of measurement e.g. volume or number of items which would indicate exact quantities may be used when customary.

Box 13: Box 14: Box 15:

Invoice number, date of invoices and invoiced value should be shown here. The field must be completed, signed and dated by the exporter. Insert the place, date of signature. The field must be completed, signed, dated and stamped by the authorized person of the certifying authority. The telephone number, fax and address of the certifying authority shall be given.

You might also like

- MAERKSDocument1 pageMAERKSmboutsalafloreNo ratings yet

- Plantilla BLDocument1 pagePlantilla BLFrancisco Miguel Garcia RamonNo ratings yet

- BL Hamburg SudDocument1 pageBL Hamburg SudTomás TorresNo ratings yet

- MovingandRelocationServices - Proof of Publication - RedactedDocument275 pagesMovingandRelocationServices - Proof of Publication - RedactedJAGUAR GAMINGNo ratings yet

- Hapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentDocument2 pagesHapag-Lloyd Aktiengesellschaft, Hamburg: Multimodal Transport or Port To Port ShipmentMapi Suyo Reyes100% (1)

- Sample Copy GENCON 76Document6 pagesSample Copy GENCON 76Chang Phạn100% (1)

- Formato de BookingDocument1 pageFormato de BookingFinitus InfinitusNo ratings yet

- Modelo de Conocimiento de Embarque Bill of LadingDocument2 pagesModelo de Conocimiento de Embarque Bill of LadingCarlos Peréz100% (1)

- Invoice - Packing List TemplateDocument3 pagesInvoice - Packing List TemplateMetzger Tamba KendemaNo ratings yet

- Online Services: Reading File 2Document2 pagesOnline Services: Reading File 2Luciano Augusto Silveira FernandesNo ratings yet

- Modelo de Conocimiento de Embarque Bill of Lading Abril 2012Document1 pageModelo de Conocimiento de Embarque Bill of Lading Abril 2012Anunnaki Ocampo0% (1)

- China Formulario Certificado Origen InglesDocument2 pagesChina Formulario Certificado Origen InglesLissette Fernanda Moraga VergaraNo ratings yet

- Masonic Lodge Strategic PlanDocument42 pagesMasonic Lodge Strategic PlanKimmy2010100% (2)

- Certificado de Origen Peru ChinaDocument2 pagesCertificado de Origen Peru ChinaChristianGutierrezSulcaNo ratings yet

- Packing List ModeloDocument1 pagePacking List ModeloAlan CassanoNo ratings yet

- Bill of Lading Original: Nombre: Beltsasar Paco Ramirez Paralelo:AlfaDocument1 pageBill of Lading Original: Nombre: Beltsasar Paco Ramirez Paralelo:AlfaCesar RamírezNo ratings yet

- Bill of LadingDocument1 pageBill of LadingLuis BirminghanNo ratings yet

- Practica de Llenado de BLDocument2 pagesPractica de Llenado de BLCesar RamírezNo ratings yet

- Air Way Bill SampleDocument1 pageAir Way Bill SampleHariNo ratings yet

- Bill of Lading: Bar Code SpaceDocument3 pagesBill of Lading: Bar Code Spacealexandra reyesNo ratings yet

- TirCarnet TemplateDocument13 pagesTirCarnet TemplategavgabiNo ratings yet

- Bill of Lading Andina ChileDocument1 pageBill of Lading Andina ChileH'a Ram0% (1)

- Documentos ImportacionDocument73 pagesDocumentos ImportacionStefany GomezNo ratings yet

- Formato de Guia Comerci ExteriorDocument2 pagesFormato de Guia Comerci ExteriorGuga Jara VelizNo ratings yet

- Ejemplo MBL CoscoDocument6 pagesEjemplo MBL CoscoVanessa AnguloNo ratings yet

- U.S. Customs Form: CBP Form 7501 - InstructionsDocument5 pagesU.S. Customs Form: CBP Form 7501 - InstructionsCustoms FormsNo ratings yet

- Formato Modelo de Conocimiento de Embarque - Bill of Lading Clase Mayo 10Document1 pageFormato Modelo de Conocimiento de Embarque - Bill of Lading Clase Mayo 10Andres Fernando Millan PereaNo ratings yet

- Commercial Invoice: Reset FormDocument3 pagesCommercial Invoice: Reset FormBen AliNo ratings yet

- 1BLB000293 BLDocument1 page1BLB000293 BLritaNo ratings yet

- Actividad de Aprendizaje 11 Evidencia 3 Ensayo "Free Trade Agreement (Fta) Advantages and 9531174Document4 pagesActividad de Aprendizaje 11 Evidencia 3 Ensayo "Free Trade Agreement (Fta) Advantages and 9531174MARIANo ratings yet

- Bill of Lading No.: Mediterranean Shipping Company S.ADocument2 pagesBill of Lading No.: Mediterranean Shipping Company S.AFUMISERVI CANo ratings yet

- Modelo de Conocimiento de Embarque Bill of LadingDocument1 pageModelo de Conocimiento de Embarque Bill of LadingCarlos EstévezNo ratings yet

- Modelo de Conocimiento de Embarque Bill of Lading Abril 2012Document1 pageModelo de Conocimiento de Embarque Bill of Lading Abril 2012ELYNo ratings yet

- Awb David Keklak To PRGDocument1 pageAwb David Keklak To PRGSuloutan IslandNo ratings yet

- Bill of Lading: Bar Code SpaceDocument1 pageBill of Lading: Bar Code SpacedownloadnovaNo ratings yet

- Modelo Air-Way BillDocument1 pageModelo Air-Way BillAndreaNo ratings yet

- Commercial InvoiceDocument4 pagesCommercial InvoiceHenry SilvaNo ratings yet

- BL + CO + Inv + Pack 113915295Document10 pagesBL + CO + Inv + Pack 113915295Đàn NguyễnNo ratings yet

- Certified True Copy: Bill of Lading For Ocean Transport or Multimodal TransportDocument4 pagesCertified True Copy: Bill of Lading For Ocean Transport or Multimodal TransportAndrea MuñozNo ratings yet

- Bill of LadingDocument1 pageBill of LadingJaviera GarateNo ratings yet

- Carta Porte Multimodal ComercioDocument2 pagesCarta Porte Multimodal ComercioMariela FernandezNo ratings yet

- Natal Pepper Co - MSC Sariska - 05rDocument6 pagesNatal Pepper Co - MSC Sariska - 05rEugene NaickerNo ratings yet

- SS2202036 - House BLDocument1 pageSS2202036 - House BLSon KimNo ratings yet

- U.S. Customs Form: CBP Form I-92 - Sample Form For ReferenceDocument3 pagesU.S. Customs Form: CBP Form I-92 - Sample Form For ReferenceCustoms FormsNo ratings yet

- Zzsmedc8bkey PDFDocument2 pagesZzsmedc8bkey PDFAlejandro L GonzalezNo ratings yet

- Proforma Invoice For Roma ServicesDocument1 pageProforma Invoice For Roma ServicesAhimbisibwe BakerNo ratings yet

- Fob, F, Elf: Green Coffee C ContractDocument6 pagesFob, F, Elf: Green Coffee C ContractcoffeepathNo ratings yet

- BL MasterDocument1 pageBL MasterLidia Meylin Rivero LoayzaNo ratings yet

- Modelo de Documento de Transporte Bill of LadingDocument9 pagesModelo de Documento de Transporte Bill of LadingCarreño JossyNo ratings yet

- Konsimento OmegaDocument1 pageKonsimento OmegaMahendra Tyre Works RaigarhNo ratings yet

- Conocimiento de Embarque BLDocument8 pagesConocimiento de Embarque BLLizi100% (1)

- S H I P P e R I N Formation - Not Part of This B/L ContractDocument4 pagesS H I P P e R I N Formation - Not Part of This B/L ContractRenato Mendoza BerecheNo ratings yet

- International Purchase Order: Goods Will Not Be Accepted Unless This Order Number Appears On All Invoices and PackagesDocument3 pagesInternational Purchase Order: Goods Will Not Be Accepted Unless This Order Number Appears On All Invoices and PackagesSonjoy Das ChowdhuryNo ratings yet

- Total: 850 Bags GW: 16,030.000 - KGS: 1 /40' HC Containers Said To Contain ARKU 8349200 SEAL NO:0912838 TARE:3890Document1 pageTotal: 850 Bags GW: 16,030.000 - KGS: 1 /40' HC Containers Said To Contain ARKU 8349200 SEAL NO:0912838 TARE:3890وردة الشتاء السوداءNo ratings yet

- Biography of GianmarcoDocument2 pagesBiography of GianmarcocontretrasNo ratings yet

- (Doe-001) BL OriginalDocument2 pages(Doe-001) BL OriginalVictor Manuel Sanchez Reyes100% (1)

- Shipper's Declaration - Model PDFDocument2 pagesShipper's Declaration - Model PDFmarceloestimulo100% (2)

- Origen ChinaDocument3 pagesOrigen ChinaRodrigoMoralesMuñozNo ratings yet

- Annex 4-C: Form of Certificate of OriginDocument3 pagesAnnex 4-C: Form of Certificate of OriginWei YeeNo ratings yet

- Original: Certificate of Origin Form For China-Peru FTADocument2 pagesOriginal: Certificate of Origin Form For China-Peru FTAMuñoz Sanchez EsthefanyNo ratings yet

- Certificate of Origining Feb WR PDFDocument3 pagesCertificate of Origining Feb WR PDFLucero GonzalesNo ratings yet

- Documentary Treatment - SheinDocument11 pagesDocumentary Treatment - Sheinapi-690484399No ratings yet

- List of ME SecDocument7 pagesList of ME SecWaqas TayyabNo ratings yet

- 3 Step Administrative ProcedureDocument14 pages3 Step Administrative Procedurejoe100% (6)

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- 5.2 Manajemen OrganisasiDocument12 pages5.2 Manajemen OrganisasiMochammad HafizhNo ratings yet

- SOP For Sweden MGKDocument3 pagesSOP For Sweden MGKMahim100% (1)

- Redemption FormDocument1 pageRedemption FormHema LatthaNo ratings yet

- Module 3 - Relative ValuationDocument11 pagesModule 3 - Relative ValuationLara Camille CelestialNo ratings yet

- Explaining Growth and Consolidation in RP Microfinance InstitutionsDocument70 pagesExplaining Growth and Consolidation in RP Microfinance InstitutionsJovi DacanayNo ratings yet

- Production - Inventory - Location - Transportation - InformationDocument7 pagesProduction - Inventory - Location - Transportation - InformationKushal BagadiyaNo ratings yet

- Director Marketing Advertising Media in Detroit MI Resume Charles WatkinsDocument2 pagesDirector Marketing Advertising Media in Detroit MI Resume Charles WatkinsCharlesWatkinsNo ratings yet

- Housing Loan ApplicationformDocument2 pagesHousing Loan Applicationformเอเรียล ชาเวซNo ratings yet

- Tugas Bahasa Inggris Hukum: Nama: Herdini Juliyani NPM: 1900874201314 Dosen Pengampu: Yanti Ismiyati,,S.Pd.,M.PdDocument4 pagesTugas Bahasa Inggris Hukum: Nama: Herdini Juliyani NPM: 1900874201314 Dosen Pengampu: Yanti Ismiyati,,S.Pd.,M.PdCakra ChandrascaNo ratings yet

- BIMBSec - Guan Chong Berhad - 20120727 - Initiate Coverage - Grinding A Regional PathDocument11 pagesBIMBSec - Guan Chong Berhad - 20120727 - Initiate Coverage - Grinding A Regional PathBimb SecNo ratings yet

- Importing, Exporting, and Sourcing: Global MarketingDocument28 pagesImporting, Exporting, and Sourcing: Global MarketingÖmer DoganNo ratings yet

- Capability CertificateDocument90 pagesCapability CertificateCharul Arora100% (1)

- 67-4-3 AccountancyDocument23 pages67-4-3 AccountancyLokanathan KrishnamacharyNo ratings yet

- Task 1 Stakeholders of Well-Known Large Businesses: Unit 5 Understanding External InfluencesDocument5 pagesTask 1 Stakeholders of Well-Known Large Businesses: Unit 5 Understanding External Influencespsvg8cq97tNo ratings yet

- Form GSTR 9cDocument24 pagesForm GSTR 9ckumar45caNo ratings yet

- Marketing Communication Paper 01 PDFDocument7 pagesMarketing Communication Paper 01 PDFraghunathaneceNo ratings yet

- Transportation in LogesticDocument78 pagesTransportation in LogesticNekkash Muhammed100% (1)

- AusAid Visibility and RecognitionDocument12 pagesAusAid Visibility and RecognitionmarcheinNo ratings yet

- Bantam Episodes - 011 - Little GirlsDocument127 pagesBantam Episodes - 011 - Little Girlskrstas774No ratings yet

- Swift InfrastructureDocument67 pagesSwift InfrastructureArvind Chaudhary100% (3)

- PT CIP - Financial Report 2014-2015 PDFDocument56 pagesPT CIP - Financial Report 2014-2015 PDFYanthi AsharyNo ratings yet

- Product Information Sheet LIRDocument2 pagesProduct Information Sheet LIRrajesh_rbpNo ratings yet

- 10-Emirates Greetings From EmiratesDocument13 pages10-Emirates Greetings From EmiratesLevirolfDeJesusNo ratings yet

- Test Your KnowledgeDocument8 pagesTest Your KnowledgeElle WongNo ratings yet