Professional Documents

Culture Documents

Thesun 2009-04-15 Page15 Singapore Recession Likely Deeper Than Expected

Thesun 2009-04-15 Page15 Singapore Recession Likely Deeper Than Expected

Uploaded by

Impulsive collector0 ratings0% found this document useful (0 votes)

32 views1 page- World stock markets rallied after Goldman Sachs reported higher-than-expected first quarter profits, fueling hopes that the banking sector had turned a corner in the global financial crisis.

- Singapore's economy is predicted to contract even more severely than previously estimated, with GDP now forecast to shrink 6-9% in 2009 compared to an earlier estimate of a 2-5% decline.

- Data showed Singapore's GDP dropped 11.5% in the first quarter from a year ago, much worse than the 4.2% decline in the previous quarter, as the manufacturing sector was hit hard by falling exports.

Original Description:

Original Title

thesun 2009-04-15 page15 singapore recession likely deeper than expected

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- World stock markets rallied after Goldman Sachs reported higher-than-expected first quarter profits, fueling hopes that the banking sector had turned a corner in the global financial crisis.

- Singapore's economy is predicted to contract even more severely than previously estimated, with GDP now forecast to shrink 6-9% in 2009 compared to an earlier estimate of a 2-5% decline.

- Data showed Singapore's GDP dropped 11.5% in the first quarter from a year ago, much worse than the 4.2% decline in the previous quarter, as the manufacturing sector was hit hard by falling exports.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

32 views1 pageThesun 2009-04-15 Page15 Singapore Recession Likely Deeper Than Expected

Thesun 2009-04-15 Page15 Singapore Recession Likely Deeper Than Expected

Uploaded by

Impulsive collector- World stock markets rallied after Goldman Sachs reported higher-than-expected first quarter profits, fueling hopes that the banking sector had turned a corner in the global financial crisis.

- Singapore's economy is predicted to contract even more severely than previously estimated, with GDP now forecast to shrink 6-9% in 2009 compared to an earlier estimate of a 2-5% decline.

- Data showed Singapore's GDP dropped 11.5% in the first quarter from a year ago, much worse than the 4.2% decline in the previous quarter, as the manufacturing sector was hit hard by falling exports.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

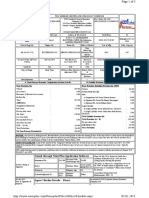

theSun | WEDNESDAY APRIL 15 2009 15

business

World stocks rally on hopes for global banking sector

LONDON: World stock markets Equities also won ground yes- “The figures, (which) follow to consider that he worst really

mostly rallied yesterday after up- terday after Goldman launched similarly upbeat soundings from might be over for the banking sec-

beat results from Goldman Sachs plans to repay its US govern- Wells Fargo that it expects to tor.”

sparked hope the banking sector ment rescue aid of US$10 billion make a profit in the first quarter, In European markets yesterday,

had turned the corner in the global (RM36.2 billion) with a US$5 billion have bolstered sentiment for Frankfurt fizzed 1.28% higher,

financial crisis, dealers said. (RM1.81 billion) share issue plus financial stocks,” said Calyon London rose 0.34% and Paris won

Goldman had posted on cash from additional resources. analyst Stuart Bennett. 0.83%. All three markets were

Monday a first-quarter net profit The Goldman news was ap- “Citigroup and JP Morgan are shut on Friday and Monday for

of US$1.81 billion (RM6.55 bil- plauded by investors who are slated to release their earnings the Easter holiday weekend.

lion), with earnings per share of awaiting the latest results from figures later in the week and a In Asia, Hongkong share prices

US$3.39. That was sharply higher banking firms reeling from the positive print from them is likely leapt 4.55%, driven also by gains in

than US$1.33 per share forecast ongoing global financial and eco- to allow a further falling off of banking giant HSBC and Chinese

by most analysts. nomic crisis that erupted in 2007. risk aversion as the market starts stocks, dealers said. – AFP

briefs

Singapore recession likely Qantas says ‘no choice’

as it cuts jobs

SYDNEY: Australia’s Qantas announced more job

cuts, slashed its profit forecast by more than half and

deferred new plane orders yesterday, saying it had no

choice if it hoped to weather the global downturn.

deeper than expected

The flag carrier said it would get rid of up to 1,750

jobs and now expected full-year profits of A$100-200

million (RM240-480 million) – sharply down from the

A$500 million (RM1.2 billion) it predicted in November.

“The size of the cuts really surprised the market,

although the fact that there was a profit downgrade

SINGAPORE: Singapore’s worst in external demand which we don’t compared with 16.4% in the previous

Chelsea did not,” said Julia Lee, an analyst with Bell Direct, as

chairman shares in the airline plunged more than 8%.

economic crisis since independence believe is the case,” said Leong, who quarter, the ministry said. “People did not expect the cuts to be so deep,” she

is predicted to be even worse than is still maintaining a forecast of a 4% The estimate is based on preliminary Bucks told Sky Business. It was Qantas’ third round of job cuts

expected, with output now forecast to contraction for this year. data computed mainly from the first trend by in less than a year. – AFP

shrink by up to 9% this year, official If Singapore’s GDP shrinks by 9% two months of 2009 and a fuller picture

data showed yesterday. this year, it will become the worst- is likely to emerge next month. ruling out

The Ministry of Trade and Indus- performing Asian economy this year, Almost every sector of Singapore’s Mourinho Michelin to shut US tyre factory,

try (MTI) said gross domestic product economists said. economy was hit in the first quarter

pg 31 cut 1,000 jobs

(GDP) would fall by 6-9% this year, a But Standard Chartered bank said with manufacturing especially af- NEW YORK: The US subsidiary of French tyre

stunning downgrade from the previ- forecasts of a worse than 10% contrac- fected by the fall-off in exports, the maker Michelin said Monday it will shut a US plant

ous official estimate of a decline of tion this year “seem overly pessimistic ministry said. in Alabama, where it employs 1,000 people, due to

2-5%. to us”. Manufacturing shrank 29% year an “unprecedented” slump in demand.

“MTI’s earlier forecast had fac- The country’s influential found- on year, pulled down sharply by de- Michelin North America said the closure of the

tored in the likelihood of a weak first ing father Lee Kuan Yew last month clines in crucial exports of electronics, plant in Opelika, Alabama, by Oct 31 was part of

quarter, but the advance estimates warned that the economy may shrink chemicals and biomedical products. a restructuring plan for its manufacturing opera-

indicate that actual GDP growth will by 10% if exports continue to fall “With most of Singapore’s key tions “in response to the unprecedented drop in

undershoot earlier expectations by a sharply. trading partners still in recession, the market demand”. – AFP

significant margin,” it said. Despite the latest official projec- manufacturing sector will continue to

Previously, Singapore’s worst per- tion, the Straits Times Index of share remain weak for the rest of the year,”

formance since it became a republic in prices closed 1.08% higher at 1,897.02 the ministry said. China seeks to ease

1965 was in 2001, when the economy points yesterday The revised GDP forecast was South Korean concerns

contracted 2.4%. The revised outlook came as fresh made after key exports, known as BEIJING: China yesterday sought to ease concern in

The revised 2009 outlook was the data showed GDP shrank 11.5% in non-oil domestic exports (NODX), South Korea about China’s rise as a global economic

fourth downgrade since November, a the first quarter from a year ago, far fell by an estimated 17% in March to power, saying its development was an opportunity

reflection of the severity of the reces- worse than the 4.2% decline recorded S$11.88 billion (RM28.51 billion) from rather than a threat.

sion confronting the trade-dependent in the preceding three months. a year ago. South Korea said on Monday the ascent of its

city state as electronics and other The fall is the worst ever for a The Monetary Authority of Sin- powerful neighbour could harm its own economic

manufactured exports continue to single quarter since records began gapore, the de facto central bank, growth and intensify competition, especially in export

plunge. in 1976. Singapore’s previous record announced yesterday in a separate markets and energy diplomacy.

“It’s quite shocking,” Leong Wai quarterly contraction was in 2001 statement it was adopting an easier But Chinese Foreign Ministry spokeswoman Jiang

Ho, an economist with Barclays Capi- when GDP shrank 6.4% in the third policy stance, which essentially allows Yu deflected those worries. “China and South Korea

tal, said of the government’s revised quarter. the local currency to depreciate. are friendly neighbours, bilateral cooperation is mutu-

outlook. On a seasonally adjusted annual- The Singapore dollar is currently ally beneficial. We seek to have practical cooperation

“It’s a reflection of their assump- ised basis, GDP declined 19.7% in the hovering at around 1.50 to the US in every field with South Korea on the basis of equality

tion that things could get a lot worse first quarter this year, also a record, dollar. – AFP and to develop together,” she said. – Reuters

Berjaya Hotel & Resorts opts

for flexi-pricing strategy

DUBAI: Berjaya Hotel and Resorts has opted for terms of publicity in this market. We have to

flexibility in rates and pricing structure to ride out increase our presence, be more aggressive in

the current economic downturn, said its regional working with key players in this region, including

sales and marketing director Peggy Tan. agents and airlines,” she said.

She said the hotel group is also focusing more Meanwhile, HolidayCity.com, a leading online

on domestic as well as regional markets, such as hotel reservation service provider specialising

the Middle East, India, China and Southeast Asia, in discounted room rates, announced yesterday

to boost business. it has entered into a partnership with the hotel

“Flexibility is the keyword for us. You can hold group to provide its customers access to com-

your rates but if people are not occupying your petitive rates and a variety of accommodation

rooms, then there’s no point,” she told Bernama. options in 15 Berjaya Properties in Malaysia, Asia

Tan said recent travel fairs held in Southeast Pacific and Europe.

Asia showed that Malaysians still travelled and Lee Lai Huat, CEO of HolidayCity.com, re-

that people would prefer to go to nearer destina- marked, “It’s an amazing opportunity indeed to

tions, opting for more affordable packages. be able to work together with Berjaya Hotels

According to her, travellers who chose to stay & Resorts (www.berjayahotels-resorts.com) in

in four-or five-star hotels would receive better offering our guests competitive rates and special

value for money because most of the hotels and promotions at their properties”.

agents are currently offering “very good deals” “Through this partnership, they can look

in the market. forward to extending their brand presence and

She predicted that soft bookings would remain inventory to more target audiences online.”

perhaps for the next six to eight months, with a Berjaya Hotels & Resorts’ director of e-Busi-

tendency for last-minute bookings. “People don’t ness and Yield Management Chris Cheong said,

book so early now because in the current situa- “HolidayCity.com has a wide distribution reach

tion they’re adopting the wait-and-see attitude, and would fit well into Berjaya Hotels & Resorts’

what with low-cost carriers offering cheaper current online marketing strategies”.

tickets and hotels giving good deals. There’s a “Recognising this potential, we decided to

lot of value-adding in the market,” she said. work together with HolidayCity.com to attract

Tan said as far as the Middle East is concerned, more high-yield customers to our properties.

the hotel group still considered it an important “Based on our current online marketing strate-

market, especially countries like Saudi Arabia, gies to create a higher net presence, HolidayCity.

United Arab Emirates and Iran. com will be part of a larger internet marketing

“We did a roadshow last year with Tourism strategy plan to reach an even wider selection

Malaysia which had actually benefited us in of customers worldwide.”

You might also like

- Bike InsuranceDocument2 pagesBike InsuranceAnil Kumar56% (41)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- JAL Case Analyst ReportDocument24 pagesJAL Case Analyst Reportuygh gNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Mastercard Transaction Dispute Form PDFDocument2 pagesMastercard Transaction Dispute Form PDFAshillinNo ratings yet

- Thesun 2009-03-18 Page15 China Cements Place As Top Creditor To UsDocument1 pageThesun 2009-03-18 Page15 China Cements Place As Top Creditor To UsImpulsive collectorNo ratings yet

- Thesun 2008-12-31 Page22 Us Expands Auto Bailout Japan Mulls Fresh AidDocument1 pageThesun 2008-12-31 Page22 Us Expands Auto Bailout Japan Mulls Fresh AidImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page19 Japan Says Economic Crisis Worst Since WWIIDocument1 pageThesun 2009-02-17 Page19 Japan Says Economic Crisis Worst Since WWIIImpulsive collectorNo ratings yet

- Thesun 2009-03-12 Page18 China Japan Figures Overshadow Market RallyDocument1 pageThesun 2009-03-12 Page18 China Japan Figures Overshadow Market RallyImpulsive collector100% (1)

- Bus JetDocument36 pagesBus Jetdarpan12011981No ratings yet

- Thesun 2009-04-29 Page15 Stocks Fall Yen Gains On Us Bank and Flu WorriesDocument1 pageThesun 2009-04-29 Page15 Stocks Fall Yen Gains On Us Bank and Flu WorriesImpulsive collectorNo ratings yet

- TheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bDocument1 pageTheSun 2009-09-04 Page11 Epf q2 Investment Income Is Rm4.8bImpulsive collectorNo ratings yet

- Section 3 - Group 12 - Report WritingDocument11 pagesSection 3 - Group 12 - Report WritingRavi KumarNo ratings yet

- AfmDocument26 pagesAfmcf34No ratings yet

- Afm PDFDocument26 pagesAfm PDFcf34No ratings yet

- Thesun 2009-05-28 Page16 Economy Contracts by 6Document1 pageThesun 2009-05-28 Page16 Economy Contracts by 6Impulsive collectorNo ratings yet

- TheSun 2009-02-05 Page18 Big Aussie Stimulus Package Hits HurdleDocument1 pageTheSun 2009-02-05 Page18 Big Aussie Stimulus Package Hits HurdleImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page17 Australia Unveils A$42billion Second StimulusDocument1 pageTheSun 2009-02-04 Page17 Australia Unveils A$42billion Second StimulusImpulsive collectorNo ratings yet

- TheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxDocument1 pageTheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxImpulsive collectorNo ratings yet

- APT Morgans 11 Apr 2018 PDFDocument4 pagesAPT Morgans 11 Apr 2018 PDFNikhil JoyNo ratings yet

- Power To The People: City Blasts Euro Boss Over Growth ClaimsDocument35 pagesPower To The People: City Blasts Euro Boss Over Growth ClaimsCity A.M.No ratings yet

- TheSun 2008-11-05 Page22 A Cuts Rates As Glbal Recession Gloom BuildsDocument1 pageTheSun 2008-11-05 Page22 A Cuts Rates As Glbal Recession Gloom BuildsImpulsive collectorNo ratings yet

- EC N E Ess AN IN AN ST ES S Esses: O Omi R ION D DI Indu RI & Bu INDocument7 pagesEC N E Ess AN IN AN ST ES S Esses: O Omi R ION D DI Indu RI & Bu INbharat_wayalNo ratings yet

- PBB Hartalega NGC Land 13 June 2013Document5 pagesPBB Hartalega NGC Land 13 June 2013Piyu MahatmaNo ratings yet

- 03the Economic Times WealthDocument5 pages03the Economic Times WealthvivoposNo ratings yet

- Australian CAPEX: Investment Plans Scaled BackDocument3 pagesAustralian CAPEX: Investment Plans Scaled BackAdam JonesNo ratings yet

- Punj Lloyd: Performance HighlightsDocument12 pagesPunj Lloyd: Performance HighlightsAngel BrokingNo ratings yet

- Strategy Radar - 2012 - 1109 XX High Level Snapshot On ReinsuranceDocument2 pagesStrategy Radar - 2012 - 1109 XX High Level Snapshot On ReinsuranceStrategicInnovationNo ratings yet

- TheSun 2008-12-11 Page22 World Bank Forecasts Deeper GloomDocument1 pageTheSun 2008-12-11 Page22 World Bank Forecasts Deeper GloomImpulsive collectorNo ratings yet

- China Property Sector: Stress Test For Major DevelopersDocument7 pagesChina Property Sector: Stress Test For Major Developersdohad78No ratings yet

- Thesun 2009-03-11 Page02 Najib Paints Grim Economic PictureDocument1 pageThesun 2009-03-11 Page02 Najib Paints Grim Economic PictureImpulsive collectorNo ratings yet

- Surprisingly, Property Was The Best-Performing Asset Class in SA Last YearDocument16 pagesSurprisingly, Property Was The Best-Performing Asset Class in SA Last YearaddyNo ratings yet

- Third Point Q3 2020 Investor Letter TPOIDocument12 pagesThird Point Q3 2020 Investor Letter TPOIMichael LoNo ratings yet

- Media & Entertainment-May09Document3 pagesMedia & Entertainment-May09Kaushik SarkarNo ratings yet

- Red Ink FlowsDocument2 pagesRed Ink FlowsRafi DevianaNo ratings yet

- Attitude and Performance AppraisalsDocument1 pageAttitude and Performance Appraisalspt.rakeshNo ratings yet

- TheSun 2008-12-09 Page22 Aussies Asked To Spend A$8bil Before ChristmasDocument1 pageTheSun 2008-12-09 Page22 Aussies Asked To Spend A$8bil Before ChristmasImpulsive collectorNo ratings yet

- Sectoral Snippets: India Industry InformationDocument19 pagesSectoral Snippets: India Industry InformationdatppNo ratings yet

- ENR Top 600 US Specialty Contractors 2010Document27 pagesENR Top 600 US Specialty Contractors 2010ApaxATONo ratings yet

- Earnings and GDP Drive PCOMP Higher: Week in ReviewDocument2 pagesEarnings and GDP Drive PCOMP Higher: Week in ReviewAhwen 'ahwenism'No ratings yet

- TheSun 2009-02-10 Page19 Nissan Sees Big Loss To Cut 20000 JobsDocument1 pageTheSun 2009-02-10 Page19 Nissan Sees Big Loss To Cut 20000 JobsImpulsive collectorNo ratings yet

- Thesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownDocument1 pageThesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownImpulsive collectorNo ratings yet

- SpiceJet Q2 Results Net Loss Narrows To Rs 449 CDocument1 pageSpiceJet Q2 Results Net Loss Narrows To Rs 449 Cmuhammedrafick98No ratings yet

- AAPL Equity Research - JPM (2019.01.30)Document12 pagesAAPL Equity Research - JPM (2019.01.30)Joe SantoroNo ratings yet

- Airline Industry Economic Performance Jun19 Report PDFDocument6 pagesAirline Industry Economic Performance Jun19 Report PDFFahad MohamedNo ratings yet

- Project in Designing Work Organizations On British Ariways: Indian Institute of Management, LucknowDocument17 pagesProject in Designing Work Organizations On British Ariways: Indian Institute of Management, LucknowRajan sharmaNo ratings yet

- Accord Capital Equities Corporation: DISCLOSURES UPDATE November 19, 2010 - FridayDocument4 pagesAccord Capital Equities Corporation: DISCLOSURES UPDATE November 19, 2010 - FridayJC CalaycayNo ratings yet

- New Illumina CEO Warns of Challenging 2024 As Firm Again Lowers 2023 Guidance On Flat Q3 Revenues - GenomeWebDocument3 pagesNew Illumina CEO Warns of Challenging 2024 As Firm Again Lowers 2023 Guidance On Flat Q3 Revenues - GenomeWebDivya PanchalNo ratings yet

- Air Canada - BSMM-8000B-06 Part 2 Business Communications - Group 7 - Crisis Management ProjectDocument18 pagesAir Canada - BSMM-8000B-06 Part 2 Business Communications - Group 7 - Crisis Management Projectnuzhat nowreenNo ratings yet

- SpiceJet StoryDocument3 pagesSpiceJet StoryArjun VikasNo ratings yet

- The Economics & Finance Club: News UpdateDocument4 pagesThe Economics & Finance Club: News UpdateVikas BarbhayaNo ratings yet

- RHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Document3 pagesRHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Rhb InvestNo ratings yet

- Jyoti Structures 2QFY2013Document11 pagesJyoti Structures 2QFY2013Angel BrokingNo ratings yet

- Pcomp Up On Gov't Stimulus Programs: Week in ReviewDocument2 pagesPcomp Up On Gov't Stimulus Programs: Week in ReviewJervie GacutanNo ratings yet

- Thesun 2009-08-27 Page14 GDP Contracts at Slower Pace of 3Document1 pageThesun 2009-08-27 Page14 GDP Contracts at Slower Pace of 3Impulsive collectorNo ratings yet

- 2011-Top 225 International ContractorsDocument63 pages2011-Top 225 International ContractorsKaan EralpNo ratings yet

- Genting Swot AnalysisDocument9 pagesGenting Swot AnalysisAlexander Chow Yee Min0% (1)

- RHB Equity 360° - 04/03/2010Document3 pagesRHB Equity 360° - 04/03/2010Rhb InvestNo ratings yet

- SN 112105Document8 pagesSN 112105wduslnNo ratings yet

- January 30, 2009Document1 pageJanuary 30, 2009fad_jav100% (2)

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityFrom EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityNo ratings yet

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- 12 - Sharuff and Co.v. Baloise Fire Insurance G.R. No. 44119 March 30, 1937Document2 pages12 - Sharuff and Co.v. Baloise Fire Insurance G.R. No. 44119 March 30, 1937Emrico CabahugNo ratings yet

- AccountingDocument8 pagesAccountingBasil Babym50% (2)

- What Is Journal, How Many Types of Journal?Document8 pagesWhat Is Journal, How Many Types of Journal?devender143No ratings yet

- 320 (April 2013) PDFDocument19 pages320 (April 2013) PDFChanzey ɢғxNo ratings yet

- AccountingDocument30 pagesAccountingFahad NasirNo ratings yet

- How The SWIFT System WorksDocument4 pagesHow The SWIFT System WorksyadavrajeNo ratings yet

- Trump's June 3, 2016 Tax BillDocument2 pagesTrump's June 3, 2016 Tax Billcrainsnewyork67% (3)

- Issued Through Nsureplus Application SoftwareDocument1 pageIssued Through Nsureplus Application SoftwaresureshNo ratings yet

- State Bank of India Designing Training Program at SBI: Final ReportDocument30 pagesState Bank of India Designing Training Program at SBI: Final ReportRhea SharmaNo ratings yet

- 14x19 CM E-Auction Sale Notice - CBI-2 Acc-LudhianaDocument1 page14x19 CM E-Auction Sale Notice - CBI-2 Acc-Ludhianaarjun SinghNo ratings yet

- ISM Group Presentation Template SXI - ArchieDocument23 pagesISM Group Presentation Template SXI - ArchieArchie LazaroNo ratings yet

- MBP 2Document13 pagesMBP 2SATISH -IBMNo ratings yet

- CatalogDocument19 pagesCatalogbtahara2No ratings yet

- Bahan Uas English Definisi WadiahDocument3 pagesBahan Uas English Definisi WadiahVarul EfandiNo ratings yet

- A Study On Ratio Analysis of Laxmi BankDocument7 pagesA Study On Ratio Analysis of Laxmi BankAyesha james75% (4)

- IAS 37 Provisions, Contingent Liabilities and Contingent AssetsDocument6 pagesIAS 37 Provisions, Contingent Liabilities and Contingent AssetsMonjurul HassanNo ratings yet

- Curriculum Vitae: Month/YearDocument4 pagesCurriculum Vitae: Month/Yearajaykr22021988No ratings yet

- All Bank PL PolicyDocument23 pagesAll Bank PL PolicyVishal BawaneNo ratings yet

- DTT Effectively Stopping Continuation SetupsDocument9 pagesDTT Effectively Stopping Continuation Setupsmangelbel6749100% (1)

- Daftar Riwayat Hidup Calon Anggota Dewan Komisaris PT Bank Jago TBKDocument5 pagesDaftar Riwayat Hidup Calon Anggota Dewan Komisaris PT Bank Jago TBKbimobimoprabowoNo ratings yet

- Instructions:: Name: Score: Bank Statement ReconciliationDocument3 pagesInstructions:: Name: Score: Bank Statement ReconciliationAlpha JNo ratings yet

- Limit Transaksi Rekening UOB - ENDocument1 pageLimit Transaksi Rekening UOB - ENGandhung WicaksonoNo ratings yet

- Mock 03 001 PDFDocument30 pagesMock 03 001 PDFmasud khanNo ratings yet

- September TD Bank - BulgariaDocument1 pageSeptember TD Bank - Bulgariamy24websiteNo ratings yet

- Electronic Banking QuestionnaireDocument5 pagesElectronic Banking QuestionnaireSenche100% (2)

- Incoterms: Eneral NformationDocument4 pagesIncoterms: Eneral NformationrooswahyoeNo ratings yet

- National Income Accounting and The Balance of PaymentsDocument29 pagesNational Income Accounting and The Balance of Paymentsanji 1230% (1)

- Online Banking System Asp .Net C SourceDocument4 pagesOnline Banking System Asp .Net C Sourcemanjunath rmNo ratings yet