Professional Documents

Culture Documents

(Revenue Division) : Description of Goods PCT Heading No

(Revenue Division) : Description of Goods PCT Heading No

Uploaded by

ssasfCopyright:

Available Formats

You might also like

- Explanatory Notes To The HS Fifth Edition PDFDocument2,637 pagesExplanatory Notes To The HS Fifth Edition PDFSam91% (87)

- Dalail Ul Khayrat 5. FridayDocument52 pagesDalail Ul Khayrat 5. Fridaymsadhanani3922100% (1)

- Notification: Description of Goods PCT Heading NoDocument8 pagesNotification: Description of Goods PCT Heading NoMohmmad HarisNo ratings yet

- Notification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadDocument7 pagesNotification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadYasir MasoodNo ratings yet

- Sro 525Document7 pagesSro 525msadhanani3922No ratings yet

- S.No. Chapter, Heading, Sub-Heading or Tariff Item of The First Schedule Description of Goods Abatement Asa Percentage of Retail Sale PriceDocument6 pagesS.No. Chapter, Heading, Sub-Heading or Tariff Item of The First Schedule Description of Goods Abatement Asa Percentage of Retail Sale PriceemeraldenterprisesNo ratings yet

- Cus 1212Document151 pagesCus 1212Sivakumar AmbikapathyNo ratings yet

- Harmonized SystemDocument4 pagesHarmonized SystemAjin lalNo ratings yet

- Tariff 1011 Eng FinalDocument484 pagesTariff 1011 Eng FinalAkshay SthapitNo ratings yet

- Notification No. 477 (E) Dated 25th July, 1991 of The Department of Industrial Policy and Promotion, Ministry of IndustryDocument39 pagesNotification No. 477 (E) Dated 25th July, 1991 of The Department of Industrial Policy and Promotion, Ministry of IndustryHarish100% (3)

- VKGUY ProductsDocument18 pagesVKGUY Productsशीना त्यागीNo ratings yet

- Decree 43Document10 pagesDecree 43PortukNo ratings yet

- Bhutan Trade Classification Tariff Schedule 2022Document493 pagesBhutan Trade Classification Tariff Schedule 2022LoselNo ratings yet

- Tdap Report On New ZealandDocument9 pagesTdap Report On New ZealandUmar AzamNo ratings yet

- Tariff Product ListDocument8 pagesTariff Product ListCNBC.com100% (3)

- China Customs Tariff 2011Document245 pagesChina Customs Tariff 2011bilalz7No ratings yet

- Table 14.2Document4 pagesTable 14.2Sushobhit ChoudharyNo ratings yet

- Central Excise IndiaDocument60 pagesCentral Excise Indiamknatoo1963No ratings yet

- Ed Exemption WTPDocument62 pagesEd Exemption WTPsrinivas69No ratings yet

- European Union, Trade With QatarDocument12 pagesEuropean Union, Trade With QatarnuraladysNo ratings yet

- European Union, Trade With GeorgiaDocument12 pagesEuropean Union, Trade With GeorgiaYuvrajNo ratings yet

- Scoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018Document4 pagesScoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018DRI HQ CINo ratings yet

- Catalogue enDocument38 pagesCatalogue enAndré Luiz Tombini100% (1)

- GTL Guidelines and Processes 08-04-11Document22 pagesGTL Guidelines and Processes 08-04-11Lucky SharmaNo ratings yet

- Analysis of Nigeria, Tanzania, South Africa, Egypt, Cameroon For Leather Products (HS Code 41, 42)Document24 pagesAnalysis of Nigeria, Tanzania, South Africa, Egypt, Cameroon For Leather Products (HS Code 41, 42)Arun MaithaniNo ratings yet

- Depreciation Rates As Per Income Tax Act (For A.Y 2014-15 & 2015-16)Document11 pagesDepreciation Rates As Per Income Tax Act (For A.Y 2014-15 & 2015-16)Shivam SinghNo ratings yet

- Product Code Product Label Viet Nam's Exports To World/total Value in 2011 Value in 2012 Value in 2013 Value in 2014 Value in 2015Document9 pagesProduct Code Product Label Viet Nam's Exports To World/total Value in 2011 Value in 2012 Value in 2013 Value in 2014 Value in 2015FTU.CS2 Trần Uyên ThưNo ratings yet

- Nigerian Customs Import and Export Prohibition List GuideDocument31 pagesNigerian Customs Import and Export Prohibition List GuideOdusanya JosephNo ratings yet

- 2011volume I - Import PDFDocument992 pages2011volume I - Import PDFGellene GarciaNo ratings yet

- Uppcb 2164 03061997 220Document7 pagesUppcb 2164 03061997 220OCI LABSNo ratings yet

- Uzbekistan - EU TradeDocument12 pagesUzbekistan - EU TradeYuvrajNo ratings yet

- ST 5730 2016 Add 7 enDocument270 pagesST 5730 2016 Add 7 enbi2458No ratings yet

- Economía UK-SADocument53 pagesEconomía UK-SAPaoloSantamaríaNo ratings yet

- NAICS Subsector 324-Petroleum and Coal Products ManufacturingDocument8 pagesNAICS Subsector 324-Petroleum and Coal Products ManufacturingGunjan SolankiNo ratings yet

- SIC Codes V2 PDFDocument18 pagesSIC Codes V2 PDFavinashavalaNo ratings yet

- Ifm Catalogue Australia 2010Document237 pagesIfm Catalogue Australia 2010hoekdaNo ratings yet

- Vietnam - WTO CommitmentDocument27 pagesVietnam - WTO CommitmentNhi NguyễnNo ratings yet

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDocument33 pagesTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99No ratings yet

- O.C. Mayors Permit FeesDocument16 pagesO.C. Mayors Permit FeesReymundo Guevara50% (2)

- en Class Flat 1Document23 pagesen Class Flat 1s_navroopNo ratings yet

- Add Cesses 2Document44 pagesAdd Cesses 2api-243542776No ratings yet

- Withholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Document4 pagesWithholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Shahid SiddiqueNo ratings yet

- International Economics: Export Performance of BrazilDocument32 pagesInternational Economics: Export Performance of BrazilPrinceSethia12344444No ratings yet

- VN Exports To World 264610323Document46 pagesVN Exports To World 264610323FTU.CS2 Phu Minh KhangNo ratings yet

- Turkmenistan - EU TradeDocument12 pagesTurkmenistan - EU TradeYuvrajNo ratings yet

- Session 17 DTD 1.2.12 - Module II - FDI PolicyDocument17 pagesSession 17 DTD 1.2.12 - Module II - FDI PolicyKapil SharmaNo ratings yet

- GST Rates Slashed On Over 200 ItemsDocument4 pagesGST Rates Slashed On Over 200 ItemsBABLU ROYNo ratings yet

- Pocket 2011Document40 pagesPocket 2011Gabriel StoicaNo ratings yet

- F - Vendor Products Services List - UNSPSC Ver14 0801 - 01 2013Document17 pagesF - Vendor Products Services List - UNSPSC Ver14 0801 - 01 2013Bryan Peter DionisioNo ratings yet

- Trade Concession To Srilanka From PakistanDocument6 pagesTrade Concession To Srilanka From PakistanBhargav MadhoorNo ratings yet

- S.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HDocument9 pagesS.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HNaveen KhatakNo ratings yet

- No. Product Description Classification Classification RationaleDocument14 pagesNo. Product Description Classification Classification RationalenidzatNo ratings yet

- Directory: Major Chinese Industrial CompaniesDocument221 pagesDirectory: Major Chinese Industrial CompaniesAllChinaReports.com50% (2)

- Nice Classification Class 1Document24 pagesNice Classification Class 1Su Yee Thant ZinNo ratings yet

- ITA Expansion Product List 2015Document8 pagesITA Expansion Product List 2015guerrezNo ratings yet

- Class Presetation ON Globalization and Its Effect in India'S Export SectorDocument22 pagesClass Presetation ON Globalization and Its Effect in India'S Export SectorkomaljeswaniNo ratings yet

- Miscellaneous Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Industrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Soap & Cleaning Compounds World Summary: Market Values & Financials by CountryFrom EverandSoap & Cleaning Compounds World Summary: Market Values & Financials by CountryNo ratings yet

- Soaps & Detergents World Summary: Market Values & Financials by CountryFrom EverandSoaps & Detergents World Summary: Market Values & Financials by CountryNo ratings yet

- Apni Taqat PehchanoDocument124 pagesApni Taqat Pehchanomsadhanani3922No ratings yet

- Shahra e Zindagi Par Kamyabi Ka SafarDocument170 pagesShahra e Zindagi Par Kamyabi Ka Safarmsadhanani3922100% (1)

- Apni Taqat PehchanoDocument124 pagesApni Taqat Pehchanomsadhanani3922100% (2)

- Jam e Karamat e Auliya Vol 2 by Imam NabhaniDocument439 pagesJam e Karamat e Auliya Vol 2 by Imam NabhaniTariq Mehmood Tariq50% (2)

- Ajaib Ul QuranDocument167 pagesAjaib Ul QuranOmair Attari QadriNo ratings yet

- Khazinat Ul Asfia 4 UrDocument181 pagesKhazinat Ul Asfia 4 Urmsadhanani3922No ratings yet

- Gadoon Textile Mills Ltd. PucarsDocument4 pagesGadoon Textile Mills Ltd. Pucarsmsadhanani3922No ratings yet

- Dalail Ul Khayrat 4. ThursdayDocument21 pagesDalail Ul Khayrat 4. Thursdaymsadhanani3922No ratings yet

- Dalail Ul Khayrat 3. WednesdayDocument20 pagesDalail Ul Khayrat 3. Wednesdaymsadhanani3922No ratings yet

- Certificate of Income Tax Deducted: Details of Payer (Person Making The Payment)Document1 pageCertificate of Income Tax Deducted: Details of Payer (Person Making The Payment)msadhanani3922No ratings yet

- Dalail Ul Khayrat 2. TuesdayDocument21 pagesDalail Ul Khayrat 2. Tuesdaymsadhanani3922No ratings yet

- BR 12-9-13-FBR Initiates Talks With SRB PRA and KPRA OfficialsDocument2 pagesBR 12-9-13-FBR Initiates Talks With SRB PRA and KPRA Officialsmsadhanani3922No ratings yet

- Dalail Ul Khayrat 1. MondayDocument36 pagesDalail Ul Khayrat 1. Mondaymsadhanani3922No ratings yet

- Board Meetings: To Review, Consider and Approve To Borrow Long Term Financing and The Issue of Right SharesDocument1 pageBoard Meetings: To Review, Consider and Approve To Borrow Long Term Financing and The Issue of Right Sharesmsadhanani3922No ratings yet

- (Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As FollowsDocument2 pages(Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As Followsmsadhanani3922No ratings yet

- SRO 490 2004-Input InadmissibleDocument1 pageSRO 490 2004-Input Inadmissiblemsadhanani3922No ratings yet

- Cir 1727 - Proposed Tariff RegimeDocument4 pagesCir 1727 - Proposed Tariff Regimemsadhanani3922No ratings yet

- BR 3-10-13 - Input Tax Adjustment Facility RestoredDocument1 pageBR 3-10-13 - Input Tax Adjustment Facility Restoredmsadhanani3922No ratings yet

(Revenue Division) : Description of Goods PCT Heading No

(Revenue Division) : Description of Goods PCT Heading No

Uploaded by

ssasfOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Revenue Division) : Description of Goods PCT Heading No

(Revenue Division) : Description of Goods PCT Heading No

Uploaded by

ssasfCopyright:

Available Formats

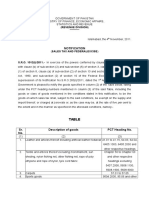

GOVERNMENT OF PAKISTAN MINISTRY OF FINANCE, ECONOMIC AFFAIRS, STATISTICS AND REVENUE (REVENUE DIVISION) ******* Islamabad, the 31st

December, 2011 S.R.O.1125(I)/2011. In exercise of the powers conferred by clause (c) of section 4 read with clause (b) of sub-section (2) and sub-section (6) of section 3, clause (b) of sub-section (1) of section 8 and section 71 of the Sales Tax Act, 1990, and in supersession of its Notification No. S.R.O. 1058(I)/2011, dated the 23 rd November, 2011, the Federal Government is pleased to notify the goods specified in column (2) of the Table below under the PCT heading numbers mentioned in column (3) of the said Table, including the goods or class of goods mentioned in the conditions stated in this notification, to be the goods on which sales tax shall, subject to the said conditions be charged at zero-rate or, as the case may be, at the rate of five per cent, wherever applicable, to the extent and in the manner as specified in the aforesaid conditions, namely:TABLE

S.No. (1) 01. Description of goods (2) Leather and articles thereof including artificial leather Footwear PCT heading No. (3) 41.01 to 41.15, 64.03, 64.04, 6405.1000, 6405.2000 and other respective headings Chapter 50 to Chapter 63 and other respective headings excluding 5407.2000, 5608.1100, 5608.1900, 5608.9000. 57.01 to 57.05 1108.1200 1302.3210, 1302.3290, 1302.3900 9504.2000, 9506 and other respective headings Respective headings 2513.2010 2519.9010 2710.1991 2710.1998 2825.8000 2829.9000

02.

Textile and articles thereof excluding monofilament, sun shading, nylon fishing net, other fishing net, rope of polyethylene and rope of nylon, tyre cord fabric

03. 04. 05. 06. 07. 08. 09. 10. 11. 12. 13.

Carpets Maize (corn) starch Mucilages and thickness, whether or not modified, derived from locust beans locust bean seeds or guar seeds Sports goods Surgical goods Emery powder/grains Magnesium oxide Coning oil Spin finish Oil Antimony oxide Sodium bromate

14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37.

Sodium sulphide and sodium hydrogen sulphide Sodium dithionite Sodium sulphite and sodium hydrosulphide Phosphinates (hypophosphites) and phosphonates (phosphates) Sodium dichromate Hydrogen per oxide p-Xylene Trichloroethylene Ethylene Glycol (MEG) Di-ethylene glycol Ethyl glycol Tri-ethylene Glycol Glutar aldehyde Formic acid Sodium formate Acetic acid Sodium acetate Acrylic acid and its salts Esters of Methacrylic acid Oxalic acid Pure terephthalic acid (PTA) Glycolic acid and their esters Other phosphoric esters and their salts Dyes intermediates

2830.1010, 2830.1090 2831.1010 2832.1010, 2832.1090 2835.1000 2841.3000 2847.0000 2902.4300 2903.2200 2905.3100 2909.4100 2909.4490 2909.4990 2912.1900 2915.1100 2915.1210 2915.2100 2915.2930 2916.1100 2916.1400 2917.1110 2917.3610 2918.1800 2919.9090 2921.0000 2922.0000 2923.0000 2924.0000 2927.0000 2933.0000 2934.0000 2924.1990 2926.1000 2928.0090 3201.1000 3201.2000 3201.9020 3201.9090 3202.1000 3202.9010 3202.9090

38. 39. 40. 41.

DMF (Dimethyl Formamide) Acrylonitrile Other organic derivatives of hydrazine or of hydroxylamine Tanning extracts of vegetable origin; tannins and their salts, ethers, esters and other derivatives

42.

Synthetic organic tanning substances, inorganic tanning substances, tanning perpetrations, whether or not containing natural tanning substances; enzymatic preparations for pre- tanning

43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59.

Disperse dyes and preparations based thereon. Acid dyes and preparations based thereon Basic dyes and preparations based thereon Direct dyes and preparations based thereon Indigo Blue Vat dyes and preparations based thereon Reactive dyes and preparations based thereon Pigments and preparations based thereon Dyes, sulphur Dyes, synthetic Synthetic organic products of a kind used as fluorescent brightening agents. Other synthetic organic colouring matter Pigments and preparations based on titanium dioxide. Other colouring matter and other preparations Granules, flakes, powder of glass (others) Prepared water pigments of a kind used for finishing Leather Cationic surface active agents

3204.1100 3204.1200 3204.1300 3204.1400 3204.1510 3204.1590 3204.1600 3204.1700 3204.1910 3204.1990 3204.2000 3204.9000 3206.1900 3206.4900 3207.4090 3210.0020 3402.1210 3402.1220 3402.1290 3402.1300 3402.9000 3403.1110 3403.1120 3403.1990 3403.9110 3403.9190 3403.9131 3404.9010 3404.9090

60. 61. 62.

Non-ionic surface active agents Surface active preparations and cleaning preparations excluding detergents Preparations for the treatment of textile material, leather, fur skins or other material

63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73.

Spin finish oil Artificial waxes and prepared waxes Other artificial waxes Electro polishing chemicals Other glues (printing gum) Shoe adhesives Hot melt adhesive Enzymes Photographic film, with silver halide emulsion (for textile use) Sensitizing emulsions (for textile use) Fungicides for leather industry

3824.9060 3505.2090

3506.9110 3506.9110 3506.9190 3507.9000 3702.4300 3702.4400 3707.1000 3808.9220

74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101.

Preparation of a kind used in textile or like industry Preparation of a kind used in leather or like industries Compound plasticizers for rubber or plastics Antimony triacetate Palladium catalyst Electrolyte salt Polymers of vinyl acetate (in aqueous dispersion) Vinyl acetate copolymers: in aqueous dispersion Polymers of vinyl alcohol Other vinyl polymers Other acrylic polymers Acrylic polymers in primary forms Polyethylene terephthalate-Yarn grade, and its waste Nylon Chips (PA6) Polyurethanes Silicones in primary form Cellulose nitrates nonplasticised Other cellulose nitrates Carboxymethyl cellulose and its salts Alginic acids, its salts and esters Nylon tubes Artificial leather Synthetic leather grip Natural rubber latex Technical specialized natural rubber Rubber latex Synthetic rubber SBR 1502 latex Butadiene rubber

3809.9110 3809.9190 3809.9300 3812.2000 3815.1910 3815.9000 3824.9060 3905.1200 3905.2100 3905.3000 3905.9990 3906.9030 3906.9090 3907.6010 3908.1000 3909.5000 3910.0000 3912.2010 3912.2090 3912.3100 3913.1000 3917.3910 3921.1300 3926.9099 4001.1000 4001.2200 4002.1100 4002.1900 4002.2000 4002.9900 4007.0010 4007.0090 4302.1910 4303.9000 4304.0000 4404.1000 4501.9000 4504.1010 6804.2100 6815.1000 7019.9010

102. Thermo-plastic rubber (T.P.R.) 103. Vulcanized rubber thread and cord 104. Leather shearing-finish leather with wool 105. Articles of apparel and clothing accessories of fur skin 106. Artificial fur and articles thereof 107. English willow cleft (wood) 108. Cork Granules 109. Cork sheet 110. Satin Finishing Wheels 111. Carbon Fiber 112. Glass fiber sleeves

113. Forging of surgical and dental instruments 114. Nickel rotary printing screens 115. Hooks for footwear 116. Eyes and eyelets for footwear 117. Tubular or bifurcated rivets 118. Strings 119. Bladders and covers of inflatable balls 120. Press-fasteners, snap fasteners and press studs 121. Buttons of plastics not covered with textile material 122. Buttons of base metal not covered with textile materials 123. Studs 124. Buttons 125. Slide fasteners 126. Wood-pulp (dissolving grade)

7326.1920 7508.9010 8308.1010 8308.1020 8308.2000 8308.9090 9506.9919 9606.1000 9606.2100 9606.2200 9606.2910 9606.2920 9607.1100 9607.1900 4702.0000 if imported by manufacturers of viscose staple fibre for use in the manufacturing of viscose staple fibre. 1404.2000 3926.9099

127. Cotton linter 128. Sequins

Conditions

(i) The benefit of this notification shall be available to every such person doing business in textile (including jute), carpets, leather, sports and surgical goods sectors, who is registered as:(a) (b) (c) (d) (ii) manufacturer; importer; exporter; and wholesaler;

on import by registered manufacturers of five zero-rated sectors mentioned in condition (i) above, sales tax shall be charged at the rate of zero per cent on goods useable as industrial inputs;

(iii)

the goods imported by, or supplies made to manufacturers, other than manufacturers mentioned in condition (i) above, shall be charged, sales tax at the rate of five per cent;

iv)

the commercial importers, on import of goods useable as industrial inputs, shall be charged sales tax at the rate of two per cent alongwith one per cent value addition tax at the import stage, which will be accountable against their subsequent liabilities arising against supply of these goods to the zero-rated

sector at the rate of zero per cent or to non zero-rated sectors or unregistered persons at the rate of five per cent as the case may be. The balance amount shall be paid with the monthly sales tax return or in case of excess payment shall be carried forward to the next tax period; (v) the import of finished goods ready for use by the general public, shall be charged to tax at the rate of five per cent and value addition tax at the rate of one per cent; (vi) supplies of finished products of the sectors specified in condition (i) shall, if sold to the retailers (both registered and unregistered) or end consumers shall be charged to sales tax at the rate of five per cent ad val; (vii) supplies of goods, usable as industrial inputs, to registered persons of five zero-rated sectors up to wholesale stage shall be charged to tax at the rate of zero per cent; (viii) the registered persons who are solely or otherwise engaged in the retail business of these goods or products shall pay sales tax at the rate of five per cent ad val on their retail sales and shall be entitled to input tax adjustment. They shall not be required to pay any other sales tax leviable on their such retail transactions, however, such retailers shall be liable to pay turnover tax as prescribed under Chapter III of the Sales Tax Special Procedure Rules, 2007, and the goods supplied at the rate of five per cent shall not constitute part of turnover on which the aforesaid turnover tax is to be paid; (ix) the registered manufacturers who process goods owned by unregistered persons shall charge sales tax at the rate of five per cent on the processing charges received by them, provided that no such tax shall be charged from the registered principals; (x) a registered person who has consumed any other inputs acquired on payment of sales tax, whether covered under this notification or not, shall be entitled to input tax adjustment or, as the case may be, refund in respect of the supplies made by him either at the rate of zero per cent or five per cent or sixteen per cent ad val as the case may be; (xi) the registered manufacturers shall be entitled to adjustment of input tax paid on machinery, parts, spares and lubricants acquired by them for their own use;

(xii)

supply of electricity and gas to the registered manufacturers or exporters of five zero-rated sectors mentioned in condition (i), shall be charged sales tax at the rate of zero per cent in the manner specified by the Board;

(xiii)

the benefit of this notification shall be available to such registered persons who appear on active taxpayers list (ATL) on the website of Federal Board of Revenue; and

(xiv)

this notification shall apply from:

(a) (b) (c) (d) (e) ginning onwards in case of textile sector; production of PTA or MEG for synthetic sector; regular manufacturing in case of carpets and jute products; tannery in case of leather sector; and organized manufacturing in case of surgical and sports goods

2.

This notification shall take effect on and from the 1 st day of January, 2012.

[C.NO.1(140)C(RGST)/2011 (Pt-VI)]

(Shahid Hussain Asad) Additional Secretary

You might also like

- Explanatory Notes To The HS Fifth Edition PDFDocument2,637 pagesExplanatory Notes To The HS Fifth Edition PDFSam91% (87)

- Dalail Ul Khayrat 5. FridayDocument52 pagesDalail Ul Khayrat 5. Fridaymsadhanani3922100% (1)

- Notification: Description of Goods PCT Heading NoDocument8 pagesNotification: Description of Goods PCT Heading NoMohmmad HarisNo ratings yet

- Notification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadDocument7 pagesNotification: S.R.O. 1012 (I) /2011.-In Exercise of The Powers Conferred by Clause (C) of Section 4 ReadYasir MasoodNo ratings yet

- Sro 525Document7 pagesSro 525msadhanani3922No ratings yet

- S.No. Chapter, Heading, Sub-Heading or Tariff Item of The First Schedule Description of Goods Abatement Asa Percentage of Retail Sale PriceDocument6 pagesS.No. Chapter, Heading, Sub-Heading or Tariff Item of The First Schedule Description of Goods Abatement Asa Percentage of Retail Sale PriceemeraldenterprisesNo ratings yet

- Cus 1212Document151 pagesCus 1212Sivakumar AmbikapathyNo ratings yet

- Harmonized SystemDocument4 pagesHarmonized SystemAjin lalNo ratings yet

- Tariff 1011 Eng FinalDocument484 pagesTariff 1011 Eng FinalAkshay SthapitNo ratings yet

- Notification No. 477 (E) Dated 25th July, 1991 of The Department of Industrial Policy and Promotion, Ministry of IndustryDocument39 pagesNotification No. 477 (E) Dated 25th July, 1991 of The Department of Industrial Policy and Promotion, Ministry of IndustryHarish100% (3)

- VKGUY ProductsDocument18 pagesVKGUY Productsशीना त्यागीNo ratings yet

- Decree 43Document10 pagesDecree 43PortukNo ratings yet

- Bhutan Trade Classification Tariff Schedule 2022Document493 pagesBhutan Trade Classification Tariff Schedule 2022LoselNo ratings yet

- Tdap Report On New ZealandDocument9 pagesTdap Report On New ZealandUmar AzamNo ratings yet

- Tariff Product ListDocument8 pagesTariff Product ListCNBC.com100% (3)

- China Customs Tariff 2011Document245 pagesChina Customs Tariff 2011bilalz7No ratings yet

- Table 14.2Document4 pagesTable 14.2Sushobhit ChoudharyNo ratings yet

- Central Excise IndiaDocument60 pagesCentral Excise Indiamknatoo1963No ratings yet

- Ed Exemption WTPDocument62 pagesEd Exemption WTPsrinivas69No ratings yet

- European Union, Trade With QatarDocument12 pagesEuropean Union, Trade With QatarnuraladysNo ratings yet

- European Union, Trade With GeorgiaDocument12 pagesEuropean Union, Trade With GeorgiaYuvrajNo ratings yet

- Scoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018Document4 pagesScoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018DRI HQ CINo ratings yet

- Catalogue enDocument38 pagesCatalogue enAndré Luiz Tombini100% (1)

- GTL Guidelines and Processes 08-04-11Document22 pagesGTL Guidelines and Processes 08-04-11Lucky SharmaNo ratings yet

- Analysis of Nigeria, Tanzania, South Africa, Egypt, Cameroon For Leather Products (HS Code 41, 42)Document24 pagesAnalysis of Nigeria, Tanzania, South Africa, Egypt, Cameroon For Leather Products (HS Code 41, 42)Arun MaithaniNo ratings yet

- Depreciation Rates As Per Income Tax Act (For A.Y 2014-15 & 2015-16)Document11 pagesDepreciation Rates As Per Income Tax Act (For A.Y 2014-15 & 2015-16)Shivam SinghNo ratings yet

- Product Code Product Label Viet Nam's Exports To World/total Value in 2011 Value in 2012 Value in 2013 Value in 2014 Value in 2015Document9 pagesProduct Code Product Label Viet Nam's Exports To World/total Value in 2011 Value in 2012 Value in 2013 Value in 2014 Value in 2015FTU.CS2 Trần Uyên ThưNo ratings yet

- Nigerian Customs Import and Export Prohibition List GuideDocument31 pagesNigerian Customs Import and Export Prohibition List GuideOdusanya JosephNo ratings yet

- 2011volume I - Import PDFDocument992 pages2011volume I - Import PDFGellene GarciaNo ratings yet

- Uppcb 2164 03061997 220Document7 pagesUppcb 2164 03061997 220OCI LABSNo ratings yet

- Uzbekistan - EU TradeDocument12 pagesUzbekistan - EU TradeYuvrajNo ratings yet

- ST 5730 2016 Add 7 enDocument270 pagesST 5730 2016 Add 7 enbi2458No ratings yet

- Economía UK-SADocument53 pagesEconomía UK-SAPaoloSantamaríaNo ratings yet

- NAICS Subsector 324-Petroleum and Coal Products ManufacturingDocument8 pagesNAICS Subsector 324-Petroleum and Coal Products ManufacturingGunjan SolankiNo ratings yet

- SIC Codes V2 PDFDocument18 pagesSIC Codes V2 PDFavinashavalaNo ratings yet

- Ifm Catalogue Australia 2010Document237 pagesIfm Catalogue Australia 2010hoekdaNo ratings yet

- Vietnam - WTO CommitmentDocument27 pagesVietnam - WTO CommitmentNhi NguyễnNo ratings yet

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDocument33 pagesTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99No ratings yet

- O.C. Mayors Permit FeesDocument16 pagesO.C. Mayors Permit FeesReymundo Guevara50% (2)

- en Class Flat 1Document23 pagesen Class Flat 1s_navroopNo ratings yet

- Add Cesses 2Document44 pagesAdd Cesses 2api-243542776No ratings yet

- Withholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Document4 pagesWithholding Tax Rates (Income Tax Ordinance, 2001) For Tax Year 2016Shahid SiddiqueNo ratings yet

- International Economics: Export Performance of BrazilDocument32 pagesInternational Economics: Export Performance of BrazilPrinceSethia12344444No ratings yet

- VN Exports To World 264610323Document46 pagesVN Exports To World 264610323FTU.CS2 Phu Minh KhangNo ratings yet

- Turkmenistan - EU TradeDocument12 pagesTurkmenistan - EU TradeYuvrajNo ratings yet

- Session 17 DTD 1.2.12 - Module II - FDI PolicyDocument17 pagesSession 17 DTD 1.2.12 - Module II - FDI PolicyKapil SharmaNo ratings yet

- GST Rates Slashed On Over 200 ItemsDocument4 pagesGST Rates Slashed On Over 200 ItemsBABLU ROYNo ratings yet

- Pocket 2011Document40 pagesPocket 2011Gabriel StoicaNo ratings yet

- F - Vendor Products Services List - UNSPSC Ver14 0801 - 01 2013Document17 pagesF - Vendor Products Services List - UNSPSC Ver14 0801 - 01 2013Bryan Peter DionisioNo ratings yet

- Trade Concession To Srilanka From PakistanDocument6 pagesTrade Concession To Srilanka From PakistanBhargav MadhoorNo ratings yet

- S.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HDocument9 pagesS.No - Hscod E Commodity 2010-2011 %shar E 2011-2012 (Apr - Jun) %shar E %growt HNaveen KhatakNo ratings yet

- No. Product Description Classification Classification RationaleDocument14 pagesNo. Product Description Classification Classification RationalenidzatNo ratings yet

- Directory: Major Chinese Industrial CompaniesDocument221 pagesDirectory: Major Chinese Industrial CompaniesAllChinaReports.com50% (2)

- Nice Classification Class 1Document24 pagesNice Classification Class 1Su Yee Thant ZinNo ratings yet

- ITA Expansion Product List 2015Document8 pagesITA Expansion Product List 2015guerrezNo ratings yet

- Class Presetation ON Globalization and Its Effect in India'S Export SectorDocument22 pagesClass Presetation ON Globalization and Its Effect in India'S Export SectorkomaljeswaniNo ratings yet

- Miscellaneous Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Industrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Machinery World Summary: Market Values & Financials by CountryFrom EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Soap & Cleaning Compounds World Summary: Market Values & Financials by CountryFrom EverandSoap & Cleaning Compounds World Summary: Market Values & Financials by CountryNo ratings yet

- Soaps & Detergents World Summary: Market Values & Financials by CountryFrom EverandSoaps & Detergents World Summary: Market Values & Financials by CountryNo ratings yet

- Apni Taqat PehchanoDocument124 pagesApni Taqat Pehchanomsadhanani3922No ratings yet

- Shahra e Zindagi Par Kamyabi Ka SafarDocument170 pagesShahra e Zindagi Par Kamyabi Ka Safarmsadhanani3922100% (1)

- Apni Taqat PehchanoDocument124 pagesApni Taqat Pehchanomsadhanani3922100% (2)

- Jam e Karamat e Auliya Vol 2 by Imam NabhaniDocument439 pagesJam e Karamat e Auliya Vol 2 by Imam NabhaniTariq Mehmood Tariq50% (2)

- Ajaib Ul QuranDocument167 pagesAjaib Ul QuranOmair Attari QadriNo ratings yet

- Khazinat Ul Asfia 4 UrDocument181 pagesKhazinat Ul Asfia 4 Urmsadhanani3922No ratings yet

- Gadoon Textile Mills Ltd. PucarsDocument4 pagesGadoon Textile Mills Ltd. Pucarsmsadhanani3922No ratings yet

- Dalail Ul Khayrat 4. ThursdayDocument21 pagesDalail Ul Khayrat 4. Thursdaymsadhanani3922No ratings yet

- Dalail Ul Khayrat 3. WednesdayDocument20 pagesDalail Ul Khayrat 3. Wednesdaymsadhanani3922No ratings yet

- Certificate of Income Tax Deducted: Details of Payer (Person Making The Payment)Document1 pageCertificate of Income Tax Deducted: Details of Payer (Person Making The Payment)msadhanani3922No ratings yet

- Dalail Ul Khayrat 2. TuesdayDocument21 pagesDalail Ul Khayrat 2. Tuesdaymsadhanani3922No ratings yet

- BR 12-9-13-FBR Initiates Talks With SRB PRA and KPRA OfficialsDocument2 pagesBR 12-9-13-FBR Initiates Talks With SRB PRA and KPRA Officialsmsadhanani3922No ratings yet

- Dalail Ul Khayrat 1. MondayDocument36 pagesDalail Ul Khayrat 1. Mondaymsadhanani3922No ratings yet

- Board Meetings: To Review, Consider and Approve To Borrow Long Term Financing and The Issue of Right SharesDocument1 pageBoard Meetings: To Review, Consider and Approve To Borrow Long Term Financing and The Issue of Right Sharesmsadhanani3922No ratings yet

- (Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As FollowsDocument2 pages(Division V Income From Property: Substituted by The Finance Act, 2009. The Substituted "Division V" Read As Followsmsadhanani3922No ratings yet

- SRO 490 2004-Input InadmissibleDocument1 pageSRO 490 2004-Input Inadmissiblemsadhanani3922No ratings yet

- Cir 1727 - Proposed Tariff RegimeDocument4 pagesCir 1727 - Proposed Tariff Regimemsadhanani3922No ratings yet

- BR 3-10-13 - Input Tax Adjustment Facility RestoredDocument1 pageBR 3-10-13 - Input Tax Adjustment Facility Restoredmsadhanani3922No ratings yet