Professional Documents

Culture Documents

1Q12 Earnings Release

1Q12 Earnings Release

Uploaded by

JBS RIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1Q12 Earnings Release

1Q12 Earnings Release

Uploaded by

JBS RICopyright:

Available Formats

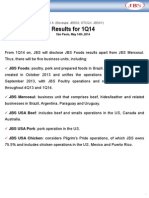

Result for 1Q12 Results

JBS S.A. (Bovespa: JBSS3)* So Paulo, May 15th, 2012

JBS reported adjusted net income of R$240 million m Net et revenue increased 9.1% compared with 1Q11

1Q12 HIGHLIGHTS

JBS posted consolidated ted net revenue of R$16.0 billion, illion, 9.1% higher than 1Q11. 1Q11 Consolidated EBITDA was R$696.5 million. EBITDA margin was 4.4%. JBS Mercosul was the highlight during the quarter reporting net revenue of R$3,827.4 R$3,827 million, an increase of 6.2% over 1Q11. EBITDA increased 64.9% over the same period and was R$508.6 million, EBITDA margin was 13.3%. JBS USA Pork net revenue totaled US$855.4 million, 2.2% % higher than 1Q11. EBITDA was US$55.8 million. JBS USA Chicken (PPC) posted net revenue of US$1.9 billion and EBITDA of US$104.0 million in the period, reversing the negative negative result presented in 1Q11. 1Q11 Adjusted net Income in the period was R$240.3 million excluding deferred income tax liabilities generated by goodwill (this only generates effective income tax payment if the company sells the investment that generated goodwill). Without this adjustment net income was R$116.1 million. The Company ended the quarter with R$5.15 billion in cash or cash equivalent, corresponding to 100% % of short-term short debt. 2012 Events JBS initiated operations in the poultry industry in Brazil through the lease of Frangosul assets, with capacity to process 1.1 million birds/day. JBS adds 12 beef slaughter units in Brazil with a combined capacity to process around 8,000 8 head/day. This expansion xpansion in Brazil, in poultry and beef, will add an estimated additional annualized revenue of R$4.5 billion. The approval of the Voluntary Public Offering to Exchange JBS shares for shares issued by Vigor.

*JBS S.A. (JBS) (Bovespa: JBSS3), the global leading producer of animal protein announces today its results for the first f quarter of 2012 (1Q12). . For the purpose of analysis, this report considers the results for the quarter ended December 31, 2011 (4Q11) and March 31, 2011 (1Q11). The consolidated results of JBS are presented in Brazilian Real (R$) and when separately analyzed, each business unit uni reports its results in the currency of the country in which it operates. The operations of JBS Australia are an integral part of the subsidiary sub JBS USA and both results refer to the period of 13 weeks ended May 25, 2012 (1Q12). ). The quantitative data, such su as volumes and heads slaughtered, are not audited.

Result for 1Q12 Results

ANALYSIS OF RESULTS BY BUSINESS UNIT

Analysis of the principal financial indicators of JBS by Business Unit (in local currency)

1Q12 Net Revenue JBS USA Beef JBS USA Pork JBS USA Chicken JBS Mercosul EBITDA JBS USA Beef JBS USA Pork JBS USA Chicken JBS Mercosul EBITDA Margin JBS USA Beef JBS USA Pork JBS USA Chicken JBS Mercosul % % % % -1.1% 6.5% 5.5% 13.3% 5.0% 8.3% 1.2% 10.7% 7.1% 12.2% -2.8% 8.6% US$ US$ US$ R$ -45.4 55.8 104.0 508.6 223.6 77.0 22.6 407.7 -27.5% 360.1% 24.7% 269.7 101.7 -53.5 308.3 -45.1% 64.9% US$ US$ US$ R$ 4,078.8 855.4 1,888.8 3,827.4 4,491.6 923.1 1,829.3 3,800.5 -9.2% -7.3% 3.3% 0.7% 3,793.3 836.6 1,892.5 3,604.2 7.5% 2.2% -0.2% 6.2% 4Q11 % 1Q11 %

Performance by Business Unit

JBS Mercosul

JBS USA (Including Australia)

Net sales (US$ billion)

4.5

JBS USA

JBS USA (PPC)

Net sales (R$ billion)

Net sales (US$ million)

1 3 0 0 0 . 1 2 2 0 0 . 1 1 4 0 0 .

Net sales (US$ billion)

1 0 6 0 0 .

3.9 3.6 3.6

3.8

3.8 3.8

4.2 4.0

9 80 0 .

4.1

9 00 0 .

836,6 846.0 867.1

923.1 855.4 1.9 2.0 1.9 1.8 1.9

8 20 0 .

7 40 0 .

6 60 0 .

5 80 0 .

5 00 0 .

4 20 0 .

3 40 0 .

2 60 0 .

1 80 0 .

1 00 0 .

1Q11

2Q11

3Q11

4Q11

1Q12

1Q11

2Q11

3Q11

4Q11

1Q12

1Q11

2Q11

3Q11

4Q11

1Q12

1Q11

2Q11

3Q11

4Q11

1Q12

EBITDA (R$ million)

5 0 0 8 00

EBITDA (US$ million)

1 6 0 . % 1 4 0 . % 16 0 . %

EBITDA (US$ million)

1 2 0 . % 19 9 9 . 7 7

EBITDA (US$ million)

7 00

6 00

5 00

4 00

13.3% 11.6% 10.7% 8.6% 508.6 427.9 453.8 407.7 308,3

8 0 . % 6 0 . % 4 0 . % 2 0 . % 0 0 . % - 2 0 . % - 4 0 . %

11.8%

7.1%

4 0 0

12.2%

14 0 . %

4.4% 5.0% 1.1% 184.1 223.6

1 0 0 . %

9.9%

8 0 . %

6 0 . %

12 0 . %

8.8% 8.3% 6.5%

5 0 0 1 3 0 . % 9 0 . %

9 0 . %

5.5%

4 0 0

7 0 . %

4 0 . %

10 0 . %

3 0 0

269.7

-1.1%

5 0 . %

5 0 . %

2 0 . %

0 0 . %

- 2 0 . %

101.7

9 99 . 7 7

1 0 . %

1.2%

3 0 0

3 0 . %

- 4 0 . %

- 6 0 . %

83.6

2 0 0 - 8 0 . %

75.9

77.0 55.8

- 3 0 . %

-2.8%

-2.4% -1.7% 104,0

1 0 . %

- 10 . %

- 30 . %

- 7 0 . %

2 0 0

- 50 . %

3 00

- 1 00 . %

- 1 10 . % - 1 20 . %

- 70 . %

2 00 1 0 0

- 6 0 . % 1 00

44.7 1Q11 2Q11 3Q11 4Q11

-45,4 1Q12

- 1 40 . %

- 90 . % - 1 50 . % - 1 60 . % 1 0 0

- 1 80 . % - 1 90 . % - 8 0 . %

-53,5 -47,6 -31,4 1Q11 2Q11 3Q11

22,6 4Q11 1Q12

- 1 1 0 . %

- 2 00 . %

- 1 3 0 . %

- 2 20 . % 0 - 1 0 0 . % 0 - 0 0 . 2 3 - 2 30 . % 0 - 1 5 0 . %

- 2 40 . %

1Q11

2Q11

3Q11

4Q11

1Q12

- 1 0 0

- 2 60 . %

- 2 80 . %

1Q11

2Q11

3Q11

4Q11

1Q12

- 1 0 0 - 2 0 0

- 1 7 0 . %

- 1 9 0 . %

- 3 00 . % - 2 1 0 . %

- 2 3 0 . %

- 2 5 0 . %

EBITDA Margin (%)

Result for 1Q12 Results

Consolidated analysis of the principal operational indicators of JBS

R$ million Net Revenue Cost of Goods Sold Gross Income Gross Margin Selling Expenses General and Adm. Expenses Net Financial Income (expense) Other Income (expense) Operating Income Income and social contribution taxes Participation of non-controlling shareholders Net Income (Loss) EBITDA EBITDA Margin Net Income (Loss) per share

(1) Participation of Controlling Shareholders.

(1)

1Q12 16,011.1 (14,357.2) 1,653.9 10.3% (816.4) (427.9) (155.8) (12.2) 241.6 (112.1) (13.4) 116.1 696.5 4.4% 0.04

4Q11 16,934.5 (15,040.0) 1,894.5 11.2% (839.3) (491.4) (549.2) (22.4) (7.9) (15.3) 48.7 25.6 940.6 5.6% 0.01

% -5.5% -4.5% -12.7% -2.7% -12.9% -71.6% -45.6% 632.6% 354.0% -26.0% -

1Q11 14,672.7 (12,984.3) 1,688.4 11.5% (737.5) (418.9) (351.1) (8.8) 172.2 (82.2) 57.0 147.0 835.9 5.7% 0.06

% 9.1% 10.6% -2.0% 10.7% 2.1% -55.6% 39.0% 40.3% 36.3% -21.0% -16.7% -

Number of Heads Processed and Sales Volume*

1Q12 Heads Processed (thousand) Cattle Hogs Smalls Volume Sold (thousand tons)* Domestic Market* Fresh and Chilled Beef Processed Beef Others Exports Fresh and Chilled Beef Processed Beef Others TOTAL

* Not including chicken

4Q11 3,625.7 3,651.9 894.7 1,667.9 1,423.2 35.9 208.9 502.9 472.4 14.4 16.1 2,170.9

% 2.5% -9.4% 4.5% 2.3% 1.8% -3.1% 6.3% -10.7% -11.5% 1.8% -0.3% -0.7%

1Q11 3,750.2 3,303.6 574.0 1,738.4 1,467.4 32.9 238.0 499.0 466.7 17.8 14.5 2,237.4

% -0.9% 0.1% 62.9% -1.9% -1.2% 5.6% -6.8% -10.0% -10.4% -17.5% 10.9% -3.7%

3,717.9 3,307.0 934.8 1,706.1 1,449.3 34.8 222.0 448.9 418.2 14.7 16.1 2,155.0

Result for 1Q12 Results

CONSOLIDATED RESULTS

Net Revenue JBS consolidated net revenue in 1Q12 was R$16,011.1 million, an increase of 9.1% compared to 1Q11 when the Company posted R$14,672.7 million. million This expansion was caused primarily by the performance in the USA Beef, , due to higher prices during the quarter, and by the Mercosul Unit, which presented an increase of 16.0% in volume sold of fresh beef in the domestic market combined with export price increase. increase In 1Q12, approximately 78% of global sales were generated domestically in the markets that the Company is present and 22% % came from exports.

EBITDA 1Q12 EBITDA was R$696.5 696.5 million, a decline of 16.7% compared to 1Q11. 1Q11. This result was due to a negative result coming from JBS USA Beef business unit, , which posted negative EBITDA of US$45.4 million, compared to positive EBITDA of US$ 269.7 million in 1Q11. This result was partially offset by the reversal of PPC negative EBITDA of US$53.5 million in 1Q11, to US$ 104.0 million positive in 1Q12. JBS Mercosul osul expanded its EBITDA by approximately R$200 R* million in the period, which more than offset the lower results in the JBS USA Pork business. The consolidated EBITDA margin was 4.4% This result reinforces the importance of the Companys protein and geographical diversification, as can be seen on the consolidated results, made possible by the good performance of some business units at times when other business units face difficulties. difficulties Financial Result 1Q12 financial result was R$155.8 $155.8 million, an improvement of 55.6% over 1Q11, reflecting the exchange rate variation in the period of R$230.0 $230.0 million, driven mainly by 2.9% decrease in the exchange rate of U.S. Dollar against the Real in the period. On the other hand, derivatives result was negative R$109.9 $109.9 million, due to long positions position in U.S. currency which were maintained since the previous period and increased during 1Q12 at favorable rates.

Net Income Adjusted net Income in the period was R$240.3 million excluding deferred income tax liabilities liabiliti generated by goodwill (this only generates effective income tax payment if the company sells the investment that generated goodwill). Without this adjustment net income was R$116.1 million. Capital Expenditure In 1Q12, , total capital expenditure (CAPEX) of JBS in property, plant, ant, and equipment was R$292 million, 7.4% lower than 1Q11 and in line with depreciation depreciation and amortization which was R$285 million. The main focus of investments were for the improvement rovement of productivity and the increase in storage age capacity and distribution globally.

Result for 1Q12 Results

Indebtedness JBS net debt to EBITDA, , excluding Pilgrims Pride (PPC), a US Listed Company controlled by JBS, was 3.6x at the end of 1Q12. The leverage indicator increased due to JBS USA Beef negative margin during the 1Q12, which negatively impacted EBITDA LTM in US$332.1 million.

JBS (excluding PPC)

R$ million Gross debt (+) Short Term Debt (+) Long Term Debt (-) Cash and Equivalents Net debt Net debt/EBITDA

3/31/12 16,380.9 4,990.3 11,390.6 5,055.6 11,325.3 3.6x 12/31/11 16,201.8 5,310.1 10,891.7 5,195.7 11,006.1 3.0x Var.% 1.1% -6.0% 4.6% -2.7% 2.9%

(1) EBITDA LTM. U.S. dollar exchange rate of the last day of the period. Pilgrims Pride was excluded from the debt calculation of JBS due to the fact that PPC is a non-recourse recourse subsidiary controlled by JBS.

Including Pilgrims Pride, leverage increased from 4.0x in 4Q11 to 4.3x in 1Q12, due to JBS USA beef weak performance, as mentioned previously, despite PPC good result, as expected, which added US$157,5 million to LTM EBITDA.

JBS including Pilgrims Pride

R$ million Gross debt (+) Short Term Debt (+) Long Term Debt (-) Cash and Equivalents Net debt Net debt/EBITDA

(1) EBITDA LTM. U.S. dollar exchange rate of the last day of the period.

3/31/12 18,686.1 5,018.7 13,667.3 5,150.8 13,535.3 4.3x

12/31/11 18,872.2 5,339.4 13,532.8 5,288.2 13,584.0 4.0x

Var.% -1.0% -6.0% 1.0% -2.6% -0.4%

Result for 1Q12 Results

Cash Position

The Company ended the quarter with R$5.15 R$5. billion in cash or cash equivalent, corresponding to 100% of short-term debt.

Leverage

1500 1300 1100 900 700 500 300 100 -100

4.3x 4.0 3.6 3.1 3.1 3.2 3.0 3.0 4.0 3.6x

4 4 3 3 2 2 1 1

1Q11

2Q11

3Q11

4Q11

1Q12

0 0

. .

Leverage

LeverageEx LeverageEx-PPC

EBITDA EBITDA Ex-PPC

ST / LT Debt Profile

1Q11

30%

70%

2Q11

27%

73%

3Q11

28%

72%

4Q11

28%

72%

1Q12

27%

73%

Short Term

Long Term

Source: JBS

Result for 1Q12 Results

ANALYSIS OF RESULTS BY BUSINESS UNIT

JBS USA Beef (including Australia), 45% of JBS S.A. Net Revenue

1Q12 net revenue for this business unit was US$4,078.8 million, outperforming 4Q11 4 by 7.5%. This result reflects an increase in average sales prices in the domestic and export markets since 2011. Compared to 4Q11, Q11, revenue decreased 9.2%, , as a consequence of lower export volumes and reduced prices in the domestic market. EBITDA was negative US$45.4 million, impacted by an historical high price of livestock, which increased 17.6% in the period, and by a 4.8% appreciation of Australian Dollar against U.S. Dollar in the quarter which impacted cost of goods sold in that country. This increase in price of cattle in the U.S. was combined with low sales prices both domestically and in exports. The Company believes in the recovery of margins in this sector through better sales prices and a balance between supply and demand during 2012, besides the increase in demand and higher cattle le availability seasonally. The management remains committed to operate with low cost, focused on increased profitability per animal processed and an improved sales mix.

Highlights (US GAAP)

US$ million Heads slaughtered (thousand) Net Revenue EBITDA EBITDA margin % 1Q12 1,960.3 4,078.8 (45.4) -1.1% 4Q11 2,108.7 4,491.6 223.6 5.0% % -7.0% -9.2% 1Q11 2,003.1 3,793.3 269.7 7.1% % -2.1% 7.5% -

Breakdown of Net Revenues

Domestic Market Net Revenue (US$ million) Volume (tons) Average Price (US$/Kg) Exports Net Revenue (US$ million) Volume (tons) Average Price (US$/Kg)

1Q12 3,105.4 881.3 3.52 1Q12 973.3 249.4 3.90

4Q11 3,261.8 872.9 3.74 4Q11 1,229.9 304.7 4.04

% -4.8% 1.0% -5.7% % -20.9% -18.1% -3.3%

1Q11 2,774.1 908.7 3.05 1Q11 1,019.2 280.8 3.63

% 11.9% -3.0% 15.4% % -4.5% -11.2% 7.5%

Result for 1Q12 Results

JBS USA Pork, 10% % of JBS S.A. Net Revenue

US$ million, 2.2% above 1Q11, , reflecting primarily an Net revenue for the quarter was US$855.4 increase in domestic average age sales prices. Compared to 4Q11, 4 there re was a decrease of 7.3% as a result of seasonally lower number of heads processed and sales volume. EBITDA was US$55.8 million during 1Q12 and margin was 6.5%. 1Q12 results were impacted by 3.5% increase in raw material combined with a reduction in export volume, due to some weaker markets.

Highlights (US GAAP)

US$ million Animals slaughtered (thousand) Net Revenue EBITDA EBITDA margin %

1Q12 3,307.0 855.4 55.8 6.5%

4Q11 3,651.9 923.1 77.0 8.3%

% -9.4% -7.3% -27.5%

1Q11 3,303.6 836.6 101.7 12.2%

% 0.1% 2.2% -45.1%

Breakdown of Net Revenues

Domestic Market Net Revenue (US$ million) Volume (thousand tons) Average Price (US$/Kg) Exports Net Revenue (US$ million) Volume (thousand tons) Average Price (US$/Kg)

1Q12 697.5 292.3 2.39 1Q12 157.9 68.5 2.30

4Q11 763.9 310.5 2.46 4Q11 159.2 65.8 2.42

% -8.7% -5.9% -3.0% % -0.8% 4.1% -4.7%

1Q11 683.2 321.0 2.13 1Q11 153.4 71.5 2.15

% 2.1% -8.9% 12.1% % 2.9% -4.2% 7.4%

Result for 1Q12 Results

JBS USA Chicken (Pilgrims Pride Corporation, a US listed Company controlled by JBS USA), 21% of JBS S.A. Net Revenue 1Q12 net revenue was US$1,888.8 million, stable compared to 1Q11. Adjusted EBITDA was US$104.0 million, reversing the negative result of US$53.5 million in 1Q11. The resumption of margins in the chicken industry can be proven by first quarter results. PPC obtained positive operating cash flow of US$29.4 $29.4 million and net income of US$39.6 million in the period. There was also a reduction of US$221.5 21.5 million in net debt through the conclusion of the offering made in 1Q12 and cash generation in the period. These results reinforce the Company's strategy strategy to operate with low cost, operational efficiency and "spirit of ownership" at all levels of the organization. The focus of the administration is to value all cuts of the bird and not be dependent only on the high price of white meat to raise margins and maintain profitability in the long run. In addition, the Company believes that the industry can be profitable even with volatility in grain prices, by focusing on reducing costs and balancing supply ly and demand.

Highlights (US GAAP)

US$ million Net Revenue EBITDA EBITDA margin %

1Q12 1,888.8 104.0 5.5%

4Q11 1,829.3 22.6 1.2%

% 3.3% 360.1%

1Q11 1,892.5 (53.5) -2.8%

% -0.2% -

Result for 1Q12 Results

JBS Mercosul, 24% % of JBS S.A. Net Revenue 6.2 in Net revenue of JBS Mercosul came in at R$3,827.4 million in 1Q12, an increase of 6.2% comparison with 1Q11, , as a result of an increase in domestic sales prices and volumes. Compared to 4Q11, revenue was flat. flat EBITDA for the quarter was R$508.6 million, an increase of 64.9% in comparison with 1Q11. EBITDA margin was the highlight and came in at 13.3%. JBS Mercosul exceptional result was driven by the beef operation in Brazil, as shown by the numbers of JBS Controller (Company) in the income statement (page 16 of this release). Gross margin increased from 21.4% in 1Q11 to 26.8% in 1Q12, reflecting the increased availability of livestock for slaughter r and improved price base of raw materials. EBITDA at JBS Controller was R$514.4 million with EBITDA margin of 15.4% which demonstrates the synergy gains during 2011 and reduction in operating costs. Highlights

R$ million Heads slaughtered (thousand) Net Revenue EBITDA EBITDA margin % 1Q12 1,757.6 3,827.4 508.6 13.3% 4Q11 1,517.0 3,800.5 407.7 10.7% % 15.9% 0.7% 24.7% 1Q11 1,747.1 3,604.2 308.3 8.6% % 0.6% 6.2% 64.9%

Breakdown of Net Revenues

Domestic Market Net Revenue (million R$) Fresh and Chilled Product Processed Items Others TOTAL Volume (thousand tons) Fresh and Chilled Product Processed Items Others TOTAL Average Price (R$/Kg) Fresh and Chilled Product Processed Items Others 6.63 5.48 2.52 7.30 5.46 2.65 -9.2% 0.4% -4.9% 6.84 5.56 1.88 -3.1% -1.4% 34.0% 275.8 34.8 222.0 532.5 239.7 35.9 208.9 484.5 15.1% -3.1% 6.3% 9.9% 237.7 32.9 238.0 508.7 16.0% 5.6% -6.8% 4.7% 1,828.8 190.6 559.1 2,578.5 1,748.9 195.9 553.3 2,498.0 4.6% -2.7% 1.0% 3.2% 1,625.6 183.0 448.5 2,257.1 12.5% 4.1% 24.6% 14.2% 1Q12 4Q11 % 1Q11 %

10

Result for 1Q12 Results

JBS Mercosul, 24% % of JBS S.A. Net Revenues

Breakdown of Net Revenues

Exports Net Revenue (million R$) Fresh and Chilled Beef Processed Beef Others TOTAL Volume (thousand tons) Fresh and Chilled Beef Processed Beef Others TOTAL Average Price (R$/Kg) Fresh and Chilled Beef Processed Beef Others

1Q12 817.9 173.7 257.3 1,248.9

4Q11 892.4 159.5 250.5 1,302.4

% -8.3% 8.9% 2.7% -4.1%

1Q11 872.7 166.3 308.1 1,347.0

% -6.3% 4.5% -16.5% -7.3%

100.3 14.7 16.1 131.0

101.9 14.4 16.1 132.5

-1.7% 1.8% -0.3% -1.1%

114.4 17.8 14.5 146.7

-12.4% -17.5% 10.9% -10.7%

8.16 11.84 16.03

8.75 11.07 15.56

-6.8% 7.0% 3.0%

7.63 9.35 21.29

6.9% 26.7% -24.7%

11

Result for 1Q12 Results

TABLES AND CHARTS

Graph I - JBS Consolidated Exports Distribution 1Q12

Mexico 14.7% Others 20.7%

China, Hong Kong and Vietnam 14.4% Taiwan 2.5% Chile 3.8%

US$ 2,039.7 million

Japan 10.2%

Canada 4.7% Africa and Middle East 7.9%

E.U 5.9% Russia 9.1%

South Korea 6.1%

Source: JBS

Table I - Breakdown of Production Costs by Business Unit (%)

1Q12 (%) Raw material (livestock) Processing (including ingredients and packaging) Labor Cost

Consolidated 80.3% 10.6% 9.2%

JBS Mercosul 86.2% 7.7% 6.2%

USA Beef 87.4% 5.5% 7.1%

USA Pork 83.0% 7.3% 9.7%

USA Chicken 55.6% 27.3% 17.1%

Source: JBS

12

Result for 1Q12 Results

To Contact JBS:

Head Office Avenida Marginal Direita do Tiet, 500 CEP: 05118-100 05118 So Paulo SP Brazil Phone: (55 11) 3144-4000 Fax: (55 11) 3144-4171

www.jbs.com.br

Investor Relations Phone: (55 11) 3144-4447 E-mail: ir@jbs.com.br www.jbs.com.br/ir

13

Result for 1Q12 Results

CONSOLIDATED FINANCIAL STATEMENTS STATEMENT JBS S.A.

JBS S.A. Balance sheets (In thousands of Reais)

Company

March 31, 2012 December 31, 2011

Consolidated

March 31, 2012 December 31, 2011

ASSETS CURRENT ASSETS Cash and cash equivalents Trade accounts receivable, net Inventories Biological assets Recoverable taxes Prepaid expenses Other current assets 3,177,231 1,840,663 1,691,558 1,421,441 13,099 219,142 3,612,867 1,883,093 1,544,261 1,330,609 8,148 256,225 5,150,828 4,431,010 5,594,857 171,295 1,916,537 138,013 467,021 5,288,194 4,679,846 5,405,705 209,543 1,690,311 131,033 526,649

TOTAL CURRENT ASSETS

8,363,134

8,635,203

17,869,561

17,931,281

NON-CURRENT ASSETS Long-term assets Credits with related parties Judicial deposits and others Recoverable taxes Total long-term assets

611,629 167,347 560,558 1,339,534

88,505 104,207 562,027 754,739

498,069 411,653 622,664 1,532,386

552,197 389,947 626,126 1,568,270

Investments in subsidiaries Property, plant and equipment, net Intangible assets, net

6,254,220 8,057,574 9,531,393 23,843,187

7,561,574 7,803,582 9,531,506 24,896,662

15,364,157 12,478,965 27,843,122

15,378,714 12,532,619 27,911,333

TOTAL NON-CURRENT ASSETS

25,182,721

25,651,401

29,375,508

29,479,603

TOTAL ASSETS

33,545,855

34,286,604

47,245,069

47,410,884

The accompanying notes are an integral part of the financial statements

14

Result for 1Q12 Results

JBS S.A. Balance sheets (In thousands of Reais)

Company

March 31, 2012 Decem ber 31, 2011

Consolidated

March 31, 2012 Decem ber 31, 2011

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES Trade accounts payable Loans and financings Income taxes Payroll, social charges and tax obligation Payables related to facilities acquisitions Other current liabilities 838,313 4,226,873 429,565 136,040 443,724 666,375 4,574,702 347,863 10,589 466,402 3,193,850 5,018,748 10,193 1,182,422 136,040 423,232 3,323,886 5,339,433 211,528 1,167,163 10,589 343,100

TOTAL CURRENT LIABILITIES

6,074,515

6,065,931

9,964,485

10,395,699

NON-CURRENT LIABILITIES Loans and financings Convertible debentures Payroll, social charges and tax obligation Payables related to facilities acquisitions Deferred income taxes Provision for lawsuits risk Other non-current liabilities 6,210,233 1,283 48,881 413,298 142,325 26,412 7,095,193 1,283 2,048 289,798 140,975 27,554 13,667,344 1,283 673,041 48,881 797,598 197,295 243,696 13,532,761 1,283 683,812 2,048 678,372 251,560 266,161

TOTAL NON-CURRENT LIABILITIES

6,842,432

7,556,851

15,629,138

15,415,997

SHAREHOLDERS' EQUITY Capital stock Capital transaction Capital reserve Revaluation reserve Profit reserves Treasury shares Valuation adjustments to shareholders' equity in subsidiaries Accumulated translation adjustments in subsidiaries Retained earnings Attributable to controlling interest Attributable to noncontrolling interest TOTAL SHAREHOLDERS' EQUITY 21,506,247 (10,127) 373,366 100,100 1,440,799 126,972 (3,025,984) 117,535 20,628,908 20,628,908 21,506,247 (10,212) 985,944 101,556 1,440,799 (610,550) 127,071 (2,877,033) 20,663,822 20,663,822 21,506,247 (10,127) 373,366 100,100 1,440,799 126,972 (3,025,984) 117,535 20,628,908 1,022,538 21,651,446 21,506,247 (10,212) 985,944 101,556 1,440,799 (610,550) 127,071 (2,877,033) 20,663,822 935,366 21,599,188

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

33,545,855

34,286,604

47,245,069

47,410,884

The accompanying notes are an integral part of the financial statements

15

Result for 1Q12 Results

JBS S.A. Statements of income for the three months period ended March 31, 2012 and 2011 (In thousands of Reais)

Company

2012 2011 2012

Consolidated

2011

NET SALE REVENUE Cost of goods sold GROSS INCOME OPERATING INCOME (EXPENSE) General and administrative expenses Selling expenses Financial expense, net Equity in earnings of subsidiaries Other income (expenses), net

3,350,379 (2,451,641) 898,738

3,172,007 (2,493,902) 678,105

16,011,080 (14,357,175) 1,653,905

14,672,740 (12,984,313) 1,688,427

(162,472) (327,025) (38,775) (130,962) 75

(145,423) (298,505) (303,081) 195,505 2,894

(427,891) (816,404) (155,821) (12,185)

(418,917) (737,451) (351,130) (8,769)

(659,159)

(548,610)

(1,412,301)

(1,516,267)

NET INCOME BEFORE TAXES Current income taxes Deferred income taxes

239,579 750 (124,250) (123,500) 116,079

129,495 748 16,725 17,473 146,968

241,604 16,643 (128,728) (112,085) 129,519

172,160 (194,595) 112,360 (82,235) 89,925

NET INCOME OF THE PERIOD

ATTRIBUTABLE TO: Controlling interest Noncontrolling interest

116,079 13,440 129,519

146,968 (57,043) 89,925

Net income basic per thousand shares - in reais

39.16

59.17

39.16

59.17

The accompanying notes are an integral part of the financial statements

16

Result for 1Q12 Results

JBS S.A. Statements of cash flows for the three months period ended March 31, 2012 and 2011 (In thousands of Reais)

Company 2012 Cash flow from operating activities Net income of the period attributable to controlling interest Adjustments to reconcile loss to cash provided on operating activities . Depreciation and amortization . Allowance for doubtful accounts . Equity in earnings of subsidiaries . Loss (gain) on assets sales . Deferred income taxes . Current and non-current financial charges . Provision for lawsuits risk . Impairment 116,079 2011 146,968

Consolidated 2012 2011 116,079 146,968

105,084 130,962 (75) 124,251 (297,993) 1,350 179,658

97,270 1,128 (195,505) (1,525) (16,725) 86,527 2,108 120,246 33,627 44,596 (76,027) (46,039) (87,495) (33,372) (217,471) (261,935)

285,043 (2,086) 6,114 128,728 (219,501) (15) 4,144 318,506 210,061 (273,759) (225,116) 2,440 44,691 33,374 (104,951) 21,961 13,440 (77,156) (36,509)

311,161 7,851 (1,863) (112,360) 164,524 2,692 518,973 31,632 (105,371) (84,412) (90,819) 68,268 (10,642) (430,175) (264,225) (57,043) (72,655) (496,469)

Decrease (increase) in operating assets Trade accounts receivable Inventories Recoverable taxes Other current and non-current assets Related party receivable Biological assets Increase (decrease) operating liabilities Trade accounts payable Other current and non-current liabilities Noncontrolling interest Valuation adjustments to shareholders' equity in subsidiaries Net cash provided by (used in) operating activities Cash flow from investing activities Additions to property, plant and equipment and intangible assets Increase in investments in subsidiaries Decrease in investments in subsidiaries Proceeds received from termination agreement of Inalca JBS Net effect of working capital of acquired (merged) company Net cash provided by (used in) investing activities Cash flow from financing activities Proceeds from loans and financings Payments of loans and financings Capital transactions Shares acquisition of own emission Net cash provided by (used in) financing activities

43,934 (147,297) (44,593) (31,007) (347,365) 167,155 100,559 (78,956)

(226,991) 871,887 644,896

(104,355) (552,356) 504,002 (152,709)

(291,965) 151 (291,814)

(315,305) 504,002 188,697

453,764 (1,453,397) 85 (2,028) (1,001,576)

1,381,281 (1,739,270) (55,398) (413,387)

4,421,162 (4,211,525) (263) (1,680) 207,694

2,727,498 (2,860,053) (55,398) (187,953)

Effect of exchange variation on cash and cash equivalents Variance in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the period

(435,636) 3,612,867 3,177,231

(828,031) 3,000,649 2,172,618

(16,737) (137,366) 5,288,194 5,150,828

(21,573) (517,298) 4,074,574 3,557,276

The accompanying notes are an integral part of the financial statements

17

Result for 1Q12 Results

DISCLAIMER

This release contains forward-looking looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of JBS. These are merely projections and, as such, are based exclusively on the expectations of JBS management concerning the future of the business and its continued access to capital to fund the Companys business plan. Such forward-looking looking statements depend, substantially, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy and the industry, among other factors and risks disclosed in JBS filed disclosure documents and are, therefore, subject to change without prior notice.

18

You might also like

- Bata IMC StrategyDocument3 pagesBata IMC StrategyMeghna Shah100% (6)

- Sales Organization Structure and Salesforce DeploymentDocument36 pagesSales Organization Structure and Salesforce DeploymentE Kay MutemiNo ratings yet

- DemonstraDocument88 pagesDemonstraJBS RINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument89 pagesDemonstra??es Financeiras em Padr?es InternacionaisJBS RINo ratings yet

- Earnings Release 1Q14Document22 pagesEarnings Release 1Q14JBS RINo ratings yet

- 1Q13 ReleaseDocument19 pages1Q13 ReleaseJBS RINo ratings yet

- Press Release 4Q12Document21 pagesPress Release 4Q12JBS RINo ratings yet

- 1Q14 PresentationDocument21 pages1Q14 PresentationJBS RINo ratings yet

- 1Q13 PresentationDocument22 pages1Q13 PresentationJBS RINo ratings yet

- 3Q14 PresentationDocument31 pages3Q14 PresentationJBS RINo ratings yet

- 1Q15 PresentationDocument22 pages1Q15 PresentationJBS RINo ratings yet

- 2T15 Conference Call PresentationDocument22 pages2T15 Conference Call PresentationJBS RINo ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- 4Q11 Earnings ReleaseDocument20 pages4Q11 Earnings ReleaseJBS RINo ratings yet

- 1Q09 Conference Call PresentationDocument15 pages1Q09 Conference Call PresentationJBS RINo ratings yet

- 1Q16 Earnings PresentationDocument18 pages1Q16 Earnings PresentationJBS RINo ratings yet

- 2Q14 PresentationDocument28 pages2Q14 PresentationJBS RINo ratings yet

- 2Q12 Conference Call PresentationDocument20 pages2Q12 Conference Call PresentationJBS RINo ratings yet

- BM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsDocument10 pagesBM&FBOVESPA S.A. Announces Second Quarter 2011 EarningsBVMF_RINo ratings yet

- 2Q16 Financial StatementsDocument82 pages2Q16 Financial StatementsJBS RINo ratings yet

- PepsiCo Segments CaseDocument4 pagesPepsiCo Segments CaseAntonio J AguilarNo ratings yet

- 4Q11 Earnings: February 15, 2012Document22 pages4Q11 Earnings: February 15, 2012BVMF_RINo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- OFIX News 2017-2-27 EarningsDocument9 pagesOFIX News 2017-2-27 EarningsmedtechyNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010Document12 pagesBM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010BVMF_RINo ratings yet

- Performance Highlights: NeutralDocument12 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- 1Q10 Conference Call PresentationDocument36 pages1Q10 Conference Call PresentationJBS RINo ratings yet

- BM&FBOVESPA S.A. Posts Robust Results For The Third Quarter 2011Document9 pagesBM&FBOVESPA S.A. Posts Robust Results For The Third Quarter 2011BVMF_RINo ratings yet

- 4Q08 Conference Call PresentationDocument17 pages4Q08 Conference Call PresentationJBS RINo ratings yet

- Market Outlook 29th July 2011Document11 pagesMarket Outlook 29th July 2011Angel BrokingNo ratings yet

- 4Q 2006Document2 pages4Q 2006doansiscusNo ratings yet

- HUL Result UpdatedDocument11 pagesHUL Result UpdatedAngel BrokingNo ratings yet

- 3Q16 ResultsDocument83 pages3Q16 ResultsJBS RINo ratings yet

- DemonstraDocument104 pagesDemonstraJBS RINo ratings yet

- Q2 Year 2011: SET / Reuters / Bloomberg Tuf / Tuf - BK / Tuf TBDocument6 pagesQ2 Year 2011: SET / Reuters / Bloomberg Tuf / Tuf - BK / Tuf TBGymmy YeoNo ratings yet

- 4Q12 Conference Call PresentationDocument31 pages4Q12 Conference Call PresentationJBS RINo ratings yet

- Olam International Significantly Improves PATMI To S$351.3 Million For 2016Document6 pagesOlam International Significantly Improves PATMI To S$351.3 Million For 2016ashokdb2kNo ratings yet

- JBS Institutional Presentation Including 2015 ResultsDocument26 pagesJBS Institutional Presentation Including 2015 ResultsJBS RINo ratings yet

- 4Q07 Conference Call PresentationDocument15 pages4Q07 Conference Call PresentationJBS RINo ratings yet

- Burger King Worldwide Reports Second Quarter 2014 ResultsDocument21 pagesBurger King Worldwide Reports Second Quarter 2014 ResultsRiven MainNo ratings yet

- BM&FBOVESPA S.A. Announces Results For The First Quarter 2012Document9 pagesBM&FBOVESPA S.A. Announces Results For The First Quarter 2012BVMF_RINo ratings yet

- Hello WorldDocument11 pagesHello WorldCharlie LimNo ratings yet

- 2Q12 Earnings Presentation: August 8, 2012Document21 pages2Q12 Earnings Presentation: August 8, 2012BVMF_RINo ratings yet

- Alok Industries LTD: Q1FY12 Result UpdateDocument9 pagesAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNo ratings yet

- 3Q07 Conference Call PresentationDocument15 pages3Q07 Conference Call PresentationJBS RINo ratings yet

- Earnings ReleaseDocument9 pagesEarnings ReleaseBVMF_RINo ratings yet

- 2Q10 Conference Call PresentationDocument27 pages2Q10 Conference Call PresentationJBS RINo ratings yet

- BAC Q4 2013 PresentationDocument25 pagesBAC Q4 2013 PresentationZerohedgeNo ratings yet

- Message To Shareholders Consolidated Statement of Income Consolidated Balance Sheet Consolidated Statement of Cash Flows Notes To Consolidated Financial StatementsDocument1 pageMessage To Shareholders Consolidated Statement of Income Consolidated Balance Sheet Consolidated Statement of Cash Flows Notes To Consolidated Financial Statementssalehin1969No ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- Volcan Compañía Minera S A A BVL VOLCABC1 FinancialsDocument37 pagesVolcan Compañía Minera S A A BVL VOLCABC1 FinancialsAlex ShuanNo ratings yet

- 4Q11 Earnings Presentation Final 1.13.12Document23 pages4Q11 Earnings Presentation Final 1.13.12sushil2005No ratings yet

- Relevant FactDocument14 pagesRelevant FactJBS RINo ratings yet

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloNo ratings yet

- Management Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)Document25 pagesManagement Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)monjito1976No ratings yet

- Market Outlook 11th November 2011Document13 pagesMarket Outlook 11th November 2011Angel BrokingNo ratings yet

- OFIX News 2017-8-7 General ReleasesDocument8 pagesOFIX News 2017-8-7 General ReleasesmedtechyNo ratings yet

- Nestle India: Performance HighlightsDocument9 pagesNestle India: Performance HighlightsAngel BrokingNo ratings yet

- 4Q16 Earnings PresentationDocument20 pages4Q16 Earnings PresentationZerohedgeNo ratings yet

- Fish & Seafood Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandFish & Seafood Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Minutes of The Board of Directors' Meeting Held On May 08, 2017Document2 pagesMinutes of The Board of Directors' Meeting Held On May 08, 2017JBS RINo ratings yet

- 1Q17 Earnings PresentationDocument15 pages1Q17 Earnings PresentationJBS RINo ratings yet

- Minutes of The Board of Directors' Meeting Held On May 05, 2017Document2 pagesMinutes of The Board of Directors' Meeting Held On May 05, 2017JBS RINo ratings yet

- MgmtReport FSDocument96 pagesMgmtReport FSJBS RINo ratings yet

- JBS - Annual and Sustainability Report 2016Document144 pagesJBS - Annual and Sustainability Report 2016JBS RINo ratings yet

- 4Q16 and 2016 Earnings PresentationDocument21 pages4Q16 and 2016 Earnings PresentationJBS RINo ratings yet

- Minutes of The Board of Directors' Meeting Held On March 13, 2017Document4 pagesMinutes of The Board of Directors' Meeting Held On March 13, 2017JBS RINo ratings yet

- Minutes of The Supervisory Board's Meeting Held On November 10, 2016Document3 pagesMinutes of The Supervisory Board's Meeting Held On November 10, 2016JBS RINo ratings yet

- JBS Announces Cancellation of Shares Held in Treasury and Approval of A New Share Buyback ProgramDocument2 pagesJBS Announces Cancellation of Shares Held in Treasury and Approval of A New Share Buyback ProgramJBS RINo ratings yet

- JBS Institutional Presentation Including 3Q16 ResultsDocument24 pagesJBS Institutional Presentation Including 3Q16 ResultsJBS RINo ratings yet

- KIA India Dealer Application FormDocument13 pagesKIA India Dealer Application FormSalim MiyaNo ratings yet

- Flowchart AccountingDocument4 pagesFlowchart Accountingtomasangel1830No ratings yet

- Walmart Case Analysis - Kelompok 2 - B5CDocument29 pagesWalmart Case Analysis - Kelompok 2 - B5CPatricia gNo ratings yet

- Chapter 18 - Creating Competitive AdvantageDocument23 pagesChapter 18 - Creating Competitive Advantagenquochuy10a6No ratings yet

- Job Order CostingDocument25 pagesJob Order CostingNors PataytayNo ratings yet

- Tugas Chapter 2Document2 pagesTugas Chapter 2ALIA TUNGGA DEWINo ratings yet

- Bol EntrepreneurshipDocument2 pagesBol EntrepreneurshipEaea OjorpNo ratings yet

- Netscape Valuation For IPO... PV of FCFsDocument1 pageNetscape Valuation For IPO... PV of FCFsJunaid EliasNo ratings yet

- CHAPTER 1 Group 5Document9 pagesCHAPTER 1 Group 5Yoejjiro CalcetasNo ratings yet

- A+ Debre T Economics Mid Exam PDFDocument4 pagesA+ Debre T Economics Mid Exam PDFFekadu BachaNo ratings yet

- Market AreasiDocument31 pagesMarket AreasiAnitha AndarriniNo ratings yet

- Impact of Human Resource Management On Organizational Performance in Construction CompaniesDocument12 pagesImpact of Human Resource Management On Organizational Performance in Construction CompaniesMark GeorgeNo ratings yet

- Compro 2022 - PT OBSESI MASA DEPAN SUKSES - CompressedDocument44 pagesCompro 2022 - PT OBSESI MASA DEPAN SUKSES - CompressedOtak Kanan TattooNo ratings yet

- Ebook PDF Strategic Integrated Marketing Communications 3rd Edition PDFDocument41 pagesEbook PDF Strategic Integrated Marketing Communications 3rd Edition PDFashley.forbes710100% (35)

- Kotak Nifty ETF PDFDocument4 pagesKotak Nifty ETF PDFkayNo ratings yet

- Wa0025.Document8 pagesWa0025.Pieck AckermannNo ratings yet

- Chapter 2 ProblemsDocument3 pagesChapter 2 ProblemsNguyên BùiNo ratings yet

- Reviewer Acc5115 Q2Document11 pagesReviewer Acc5115 Q2Rachel LuberiaNo ratings yet

- Strategic Management A Competitive Advantage Approach Concepts And Cases 17Th 17Th Edition Fred R David full chapter pdf docxDocument69 pagesStrategic Management A Competitive Advantage Approach Concepts And Cases 17Th 17Th Edition Fred R David full chapter pdf docxazaldemuxnee100% (2)

- 99 High Wood W Sue MarksDocument4 pages99 High Wood W Sue Marksmichael_antisdaleNo ratings yet

- Order Execution Policy PDFDocument20 pagesOrder Execution Policy PDFJennifer TimtimNo ratings yet

- Advertising & Brand Management - MCQDocument7 pagesAdvertising & Brand Management - MCQPARTH NAIKNo ratings yet

- 3RD Exam Reviewer IgDocument5 pages3RD Exam Reviewer IgFebemay LindaNo ratings yet

- Solution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark BradshawDocument42 pagesSolution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark Bradshawbrandonfowler12031998mgj100% (47)

- Week 3 - Profit and LossDocument22 pagesWeek 3 - Profit and LossRishabh SinghNo ratings yet

- Jahangirnagar University: AssignmentDocument7 pagesJahangirnagar University: AssignmentMesbaul RatulNo ratings yet

- Lesson From The Strategy ManforceDocument10 pagesLesson From The Strategy Manforceaminat abiolaNo ratings yet

- Module 4 Absorption Variable Throughput CostingDocument3 pagesModule 4 Absorption Variable Throughput CostingSky Soronoi100% (1)