Professional Documents

Culture Documents

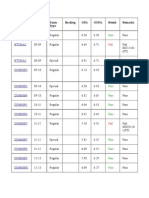

Comparison of Business Entities

Comparison of Business Entities

Uploaded by

Vijay JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison of Business Entities

Comparison of Business Entities

Uploaded by

Vijay JainCopyright:

Available Formats

Comparison of Business Entities: Sole Proprietorship, Partnership, Corporation, LLC

Most companies have a tough time figuring out the right type of business entity for their business. Partnership? Corporation? LLC? Following is a brief overview of the different entity types along with some basic advice. (For those who like to cut to the chase, refer to the Rules of Thumb at the bottom of this post.) Sole Proprietorship A sole proprietorship is the simplest business entity to form. No paperwork needs to be filed- a sole proprietorship generally comes into being when an individual begins conducting a new business (unless you form another legal entity, such as a corporation or LLC). The business may be conducted under an assumed name, which is commonly referred to as a DBA (doing business as). Note: there can be only one owner of a sole proprietorship (any more and youll need to form a partnership, corporation or LLC). General Partnership A partnership is a business with two or more owners that has not formed another type of entity (i.e. corporation or LLC). No paperwork needs to be filed to create a partnership, although drafting a partnership agreement at the outset is recommended. There are two types of partnerships: general partnerships and limited partnerships. Typically speaking, general partnerships are relatively simple to set up and run. Income and expenses pass through to partners and all partners are treated equally. The main drawback of partnerships is that the partners bear personal liability for the debts and obligations of the partnership. As a result, partnerships are not suitable for businesses that engage in inherently risky activities (construction, machinery, food service, environmental risks, etc.). Limited partnership Limited partnerships are more complex to create and maintain than general partnerships. There are two types of partners in a limited partnership: the general partner (who controls day-to-day operations and is liable for business debts) and limited partners (who are not responsible for business debts or claims). The most common example of a limited partnership is a real estate partnership in which one individual (the general partner) solicits investments from other individuals (the limited partners) in order to purchase property. The general partner then manages the business while the limited partners serve as passive investors. Limited partnerships generally involve the preparation of a written partnership agreement, which can be complex because some partners may be treated differently than others. In particular, limited partnerships provide the ability to allocate income/gains/losses/etc. differently among different partners (called special allocations). C Corporation A corporation is a business entity that carries its own legal status, separate and distinct from its owners. As a result, the primary advantage of corporations provide owners with limited liability against business claims (often referred to as the corporate shield). There are two types of corporations: C corporations (often called regular corporations) and S corporations. The primary disadvantage of C corporations is whats known as double taxation: profits are taxed first at corporate tax rates (around 35% for federal and 9% for California) and then again at the individual level (i.e. when owners receive profits from the corporation in the form of dividends, that income is fully taxable on their personal tax return- hence, double taxation). C corporations are formed by filing articles of incorporation with the Secretary of State. S Corporation An S corporation is a regular corporation that has special tax status (under Subchapter S of the IRS code- hence the name). The main advantage of S corporations is that they do not pay federal income tax. Instead, income and/or losses from S corporations pass through to shareholders in the same manner as partnerships (thats why partnerships and S corporations are both referred to as pass-through entities.). In other words, S corporations avoid

double taxation. Note: S corporations have certain restrictions that do not apply to C corporations (i.e. maximum of 100 shareholders, all shareholders must be U.S. citizens, and only one class of stock is allowed). S corporations are formed the same way as C corporations- by filing articles of incorporation with the Secretary of State. Important note: to elect S corporation status, you must file Form 2553 with the IRS within approximately two months of your incorporation date- check with your lawyer or CPA for the details. LLC (Limited Liability Company) Over the past few years, LLCs have replaced S corporations as the most popular form of business organization for new companies. The reason? LLCs combine the best attributes of corporations and partnerships: limited liability, pass-through taxation, and flexibility in allocating profits and losses. Furthermore, LLCs arent subject to many of the same restrictions as S corporations. The biggest drawback of LLCs is that their legal treatment varies by state, making them a questionable choice for businesses that operate (or plan to operate) in multiple states. Much like limited partnerships, LLCs are formed by filing Articles of Organization with the state and governed by an operating agreement that looks a lot like a partnership agreement. LLP (Limited Liability Partnership) LLPs are a special type of partnership designed to provide individual partners with protection against malpractice by other partners in the business. LLPs are primarily designed for professions such as doctors, lawyers and accountants. As a result, theyre not really applicable to anybody else. Rules of Thumb 1) Legal protection. No doubt about it- the need for limited liability is the single most important factor in choosing a business entity for most companies. Rule of thumb: businesses that engage in risky activities should be conducted through a limited liability entity- a corporation, LLC or (to a much lesser extent) limited partnership. 2) Tax issues. When it comes to taxes, sole proprietorships, partnerships and LLCs come out about even (theyre all pass-through entities). As far as corporations are concerned, S corporations have a distinct advantage over C corporations because they avoid double taxation. Rule of thumb: S corporations are the preferred choice for most smaller companies (in particular, start-ups that expect to lose money for the first few years- because the losses can then be passed through to shareholders personal tax returns). 3) Cost and administration. Sole proprietorships and partnerships are the easiest to form and least expensive to maintain. Corporations and LLCs are almost always more expensive to create and difficult to maintain. Rule of thumb: if your business does not need limited liability protection and you want to keep it simple, consider sticking with a sole proprietorship or partnership. 4) If youre considering forming an S corporation: take a look at an LLC instead (for all of the advantages mentioned above). 5) When to choose an S corporation over an LLC: if your company plans to issue stock or stock options, or if your company plans to operate in multiple states. 6) When to choose a C corporation over an S corporation: if the corporation has more than 100 shareholders, has shareholders who are not U.S. citizens, or intends to file a public offering in the future. 7) Be wary of changing from one entity type to another. A lot of people think they can simply convert to a different entity in the future. While it is possible to do so, its never easy and can cause considerable headaches. In particular, trying to convert a C corporation or S corporation to an LLC can trigger some very unpleasant tax consequences. Last but not least: never put appreciating assets (such as real estate or liquid investments) into a C corporation. When you sell them, youll pay double taxes. Go with a partnership instead.

Regulatory Body- Financial Regulatory Bodies In India

Financial sector in India has experienced a better environment to grow with the presence of higher competition. The financial system in India is regulated by independent regulators in the field of banking, insurance, mortgage and capital market. Government of India plays a significant role in controlling the financial market in India. Ministry of Finance, Government of India controls the financial sector in India. Every year the finance ministry presents the annual budget on 28th February. The Reserve Bank of India is an apex institution in controlling banking system in the country. It's monetary policy acts as a major weapon in India's financial market.

Securities and Exchange Board of India (SEBI), Functions of SEBI

Securities and Exchange Board of India (SEBI) was first established in the year 1988 as a non-statutory body for regulating the securities market. It became an autonomous body in 1992 and more powers were given through an ordinance. Since then it regulates the market through its independent powers. Objectives of SEBI: As an important entity in the market it works with following objectives: 1. It tries to develop the securities market. 2. Promotes Investors Interest. 3. Makes rules and regulations for the securities market. Functions of SEBI: Find below SEBI's important functions: 1. Regulates Capital Market 2. Checks Trading of securities. 3. Checks the malpractices in securities market. 4. It enhances investor's knowledge on market by providing education. 5. It regulates the stockbrokers and sub-brokers. 6. To promote Research and Investigation SEBI in India's Capital Market: SEBI from time to time have adopted many rules and regulations for enhancing the Indian capital market. The recent initiatives undertaken are as follows: Sole Control on Brokers: Under this rule every brokers and sub brokers have to get registration with SEBI and any stock exchange in India. For Underwriters: For working as an underwriter an asset limit of 20 lakhs has been fixed. For Share Prices According to this law all Indian companies are free to determine their respective share prices and premiums on the share prices. For Mutual Funds SEBI's introduction of SEBI (Mutual Funds) Regulation in 1993 is to have direct control on all mutual funds of both public and private sector.

NSE India, National Stock Exchange India

In the year 1991 Pherwani Committee recommended to establish National Stock Exchange (NSE) in India. In 1992 the Government of India authorized IDBI for establishing this exchange. In National Stock Exchange there is trading of equity shares, bonds and government securities. India's Stock Exchanges particularly National Stock Exchange has achieved world standards in the recent years. The NSE India ranked its 3rd position since last four years in terms of total number of trading per calendar year. Presently there are 24 stock exchanges in India, out of which 20 have exchanges National Stock Exchange (NSE), over the Counter Exchange of India Ltd, (OTCEI) and Inter-connected Stock Exchange of India limited (ISE) have nationwide trading facilities. New NSE Reference Rates Both MIBOR (Mumbai Inter Bank Offer Rate) and MIBID (Mumbai Inter Bank Bid Rate) are the two new references rates of the National Stock Exchanges. These two new reference rates were launched on June 15, 1998 for the loans of interbank call money market. Both MIBOR and MIBID work simultaneously. The MIBOR indicates lending rate for loans while MIBID is the rate for receipts.

Bombay Stock Exchange, Bombay Stock Exchange India , BSE India

Bombay Stock Exchange is one of the oldest stock exchanges in Asia was established in the year 1875 in the name of "The Native Share & Stock Brokers Association".

Bombay Stock Exchange is located at Dalal Street, Mumbai, India. It got recognition in 1956 from the Government of India under Securities Contracts (Regulation) Act, 1956. Presently BSE SENSEX is recognized over the world. Trading volumes growth in the year 2004-05 have drawn the attention over the globe. As to the statistics, the total turnover from BSE transcation as in June 2006 is calculated at 72013.36 crores. BSE Indices: The well-known BSE SENSEX is a value weighted of 30 scrips. Other stock indices of BSE are BSE 500, BSEPSU, BSEMIDCAP, BSESMLCAP, and BSEBANKEX. BSE 100 Index: The equity share of 100 companies from the list of 5 major stock exchanges such as Mumbai, Calcutta, Delhi, Ahmedabad and Madras are selected for the purpose of compiling the BSE National Index. The year 1983-84 is taken as the base year for this index. The method of compilation here is same as that of the BSE SENSEX. BSE 200 Index: The BSE 200 Index was lunched on 27th May 1994. The companies under BSE 200 have been selected on the basis of their market capitalisation, volumes of turnover and other findamental factors. The financial year 1989-90 has been selected as the base year. BSE 500 Index: BSE 500 Index consisting of 500 scrips is functioning since 1999. Presently BSE 500 Index represents more than 90% of the total market capitalisation on Bombay Stock Exchange Limited. BSE PSU Index: BSE PSU Index has been working since 4th June 2001. This index includes major Public Sector Undertakings listed in the Exchange. The BSE PSU Index tracks the performance of listed PSU stocks in the exchange. Companies In BSE:Companies listed on the Bombay Stock is rising very fast. As to statistics, companies listed to the end of March 1994 reached at 3,200 compared to 992 in 1980.

India Reserve Bank System

Reserve Bank of India is the apex monetary Institution of India. It is also called as the central bank of the country. The bank was established on April1, 1935 according to the Reserve Bank of India act 1934. It acts as the apex monetary authority of the country. The preamble of the reserve bank of India is as follows: "...to regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage."

Foreign Investment Promotion Board

The Foreign Investment Promotion Board is a special agency in India dealing with the matters relating to Foreign Direct Investment. This special board was set up with a view to raise the volume of investment to the country. The sole aim of the board is to create a base in the country by which a larger volume of investment can be drawn to the country. On 18 February 2003, the board was transferred to the Department of Economic Affairs (DEA) Ministry of Finance. mportant functions of the Board are as follows:

Formulating proposals for the promotion of investment. Steps to implement the proposals. Setting friendly guidelines for facilitating more investors. Inviting more companies to make investment. To recommend the Government to have necessary actions for attracting more investment. With regards to the structure of the Foreign Investment Promotion Board, the board comprises the following group of secretaries to the Government: Secretary to Government Department of Economic Affairs, Ministry of Finance- Chairman. Secretary to Government Department of Industrial Policy and Promotion, Ministry of commerce and Industry. Secretary to Government, Department of Commerce, Ministry of Commerce and Industry. Secretary to Government, Economic Relations, Ministry of External Affairs. Secretary to Government, Ministry of Overseas Indian Affairs. In the recent years, particularly after the implementation of the new economic policy, the Government has undertaken many steps to attract more investors for investing in the country. The new proposals for the foreign investment are allowed under the automatic route keeping in view the sectoral practices

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Test Bank Financial Management Ed 11Document20 pagesTest Bank Financial Management Ed 11kabirakhan2007100% (6)

- Surya TutoringDocument34 pagesSurya TutoringVijay Jain0% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sleeping Beauties Bonds - Walt Disney CompanyDocument15 pagesSleeping Beauties Bonds - Walt Disney CompanyThùyDương Nguyễn100% (2)

- CAPE Accounting 2017 U1 P2 PDFDocument11 pagesCAPE Accounting 2017 U1 P2 PDFmama12222No ratings yet

- Btcma1 Btcma2: Semester Code Session Exam Type Backlog GPA Ogpa Result RemarksDocument1 pageBtcma1 Btcma2: Semester Code Session Exam Type Backlog GPA Ogpa Result RemarksVijay JainNo ratings yet

- Class: KN KJ KS KU KH KP KR KE KL KCDocument2 pagesClass: KN KJ KS KU KH KP KR KE KL KCVijay JainNo ratings yet

- WWW - Csa B.in: Central Seat Allocation BOARD - 2013Document1 pageWWW - Csa B.in: Central Seat Allocation BOARD - 2013Vijay JainNo ratings yet

- Inverse Trigonometric FunctionsDocument23 pagesInverse Trigonometric FunctionsVijay JainNo ratings yet

- Comprehensive CasesDocument80 pagesComprehensive CasesAyush PurohitNo ratings yet

- Scheduling of OperationsDocument26 pagesScheduling of OperationsVijay JainNo ratings yet

- Ores and GanguesDocument16 pagesOres and GanguesVijay Jain100% (1)

- Iduction Quarry Se West BokaroDocument37 pagesIduction Quarry Se West BokaroVijay JainNo ratings yet

- Walter and Gordon ModelDocument3 pagesWalter and Gordon ModelVijay JainNo ratings yet

- India Army Doctrine Part2 2004Document38 pagesIndia Army Doctrine Part2 2004Vijay JainNo ratings yet

- Traction VenturesDocument14 pagesTraction VenturesVijay JainNo ratings yet

- Part - I: First Edition: October 2004 Published By: Headquarters Army Training Command Shimla - 171003 IndiaDocument52 pagesPart - I: First Edition: October 2004 Published By: Headquarters Army Training Command Shimla - 171003 Indiakrishnagupta.environNo ratings yet

- What Is Leveraged Buyout and How Does It Works?Document4 pagesWhat Is Leveraged Buyout and How Does It Works?Keval ShahNo ratings yet

- #3 Statement of Comprehensive IncomeDocument7 pages#3 Statement of Comprehensive IncomeMakoy BixenmanNo ratings yet

- Financial Midterm ExaminationDocument3 pagesFinancial Midterm ExaminationHanabusa Kawaii IdouNo ratings yet

- Unit 1 Practice SheetDocument6 pagesUnit 1 Practice SheetDp Brawl StarsNo ratings yet

- Jac Cap Current 1 15Document17 pagesJac Cap Current 1 15api-250385001No ratings yet

- SIMSREE Part Time Brochure 1Document9 pagesSIMSREE Part Time Brochure 1Sweety KumariNo ratings yet

- Class - 4 TransactionDocument8 pagesClass - 4 TransactionAkshay SinghNo ratings yet

- UNIDO&LMADocument55 pagesUNIDO&LMAMilkessa SeyoumNo ratings yet

- Jaiib Caiib Exams LEGAL ASPECTS OF BANKINGDocument16 pagesJaiib Caiib Exams LEGAL ASPECTS OF BANKINGRaghvendra SinghNo ratings yet

- 20 Question To Bes Asked in AgmDocument3 pages20 Question To Bes Asked in AgmRavinder NehraNo ratings yet

- Balance Sheet & Ratio AnalysisDocument102 pagesBalance Sheet & Ratio AnalysisAshokkumar MadhaiyanNo ratings yet

- Chapter 9 - Transparency and Disclosure Company Law: Annual ReportDocument2 pagesChapter 9 - Transparency and Disclosure Company Law: Annual Reportanubhaw sinhaNo ratings yet

- CapitalGainLossSummary EAOP10576 PDFDocument5 pagesCapitalGainLossSummary EAOP10576 PDFYogesh GiriNo ratings yet

- ADIB YAZID - Nota Ringkas CEILLI (Bahasa Inggeris)Document197 pagesADIB YAZID - Nota Ringkas CEILLI (Bahasa Inggeris)Ashlee JingNo ratings yet

- BAO6504 Lecture 3, 2014Document40 pagesBAO6504 Lecture 3, 2014LindaLindyNo ratings yet

- S/N Name Registration No Sex Sign: January 2023Document6 pagesS/N Name Registration No Sex Sign: January 2023Sam DizongaNo ratings yet

- Course Outline MACRDocument3 pagesCourse Outline MACRNeeraj JainNo ratings yet

- Marketbeats Indonesia Jakarta Landed Residential H2 2022Document4 pagesMarketbeats Indonesia Jakarta Landed Residential H2 2022SteveNo ratings yet

- QVARTZ Case Interview Handbook FINAL WebDocument56 pagesQVARTZ Case Interview Handbook FINAL WebEmmaNo ratings yet

- SEM-IV-Fin-403-416 (Till 413)Document8 pagesSEM-IV-Fin-403-416 (Till 413)salafNo ratings yet

- Moyer FINANZAS CUESTIONARIODocument26 pagesMoyer FINANZAS CUESTIONARIOMariana Cordova100% (2)

- Basel Norms I, II and IIIDocument30 pagesBasel Norms I, II and IIIYashwanth PrasadNo ratings yet

- Chapter 2 THE ACCOUNTING CYCLEDocument61 pagesChapter 2 THE ACCOUNTING CYCLEDemelash Agegnhu BeleteNo ratings yet

- Chapter 14 Exercise SolutionsDocument16 pagesChapter 14 Exercise SolutionsCarol Robinson100% (1)

- Titman PPT CH18Document79 pagesTitman PPT CH18IKA RAHMAWATINo ratings yet

- Fin 3320 ProjectDocument13 pagesFin 3320 Projectapi-313630382No ratings yet

- Week 8Document4 pagesWeek 8William LinNo ratings yet