Professional Documents

Culture Documents

Week 3 Individual Assignment 373

Week 3 Individual Assignment 373

Uploaded by

Kathi ChamblissOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 3 Individual Assignment 373

Week 3 Individual Assignment 373

Uploaded by

Kathi ChamblissCopyright:

Available Formats

Accounting Short-Answer Questions

Accounting Short-Answer Questions Kathi Chambliss May 14, 2013 BSHS/373 Frieda Flowers

Accounting Short-Answer Questions

First we need to define nonprofit and for-profit organizations. For-profit organizations capitalize on profit. Nonprofit organizations capitalize, through grants, fundraising, and government programs, the mission. Since nonprofits serve the public a clear understanding of how income is spent. There are audits, regulations, abide by rules and regulations. Nonprofits and for-profits are governed by a different set of rules. One way nonprofit and for-profit are different is through tax exemptions. Forprofits report on a number of things for example income, deductions, and salary payments, to name a few. Reports have to be created to enable the IRS to know how much taxes the organization will have to pay. Nonprofits are still responsible for reporting to the IRS however is allowed to file tax exempt. Even though the rules are different a nonprofit organization still has to pay taxes on payroll, real estate and sales tax on operations that produce revenue. Another difference that separates nonprofit from for-profit is balance sheets and statements of financial position. For-profit organizations use a balance sheet to help owners determine profit because it shows assets and liabilities. Because there is no profit to be determined in a nonprofit organization, this type of organization only needs a statement of financial position. The financial position shows cash on hand, money owed, and value of the agency. For-profit organizations use income statements every quarter to show how much money is being made, losses, expenses, and any warning signs that things might be going wrong. Nonprofits prepare a report known as financial activities because there is no profit to show. It does show revenue, expenses, and assets however it also shows if the "assets

Accounting Short-Answer Questions are unrestricted, temporarily restricted, or permanently, restricted for or from projects, functions, or capital expenditures." (Nonprofit Accounting Software, 2011) Nonprofits are constantly proving where their money came from, where it is going, and is the targeted population being served properly. Because of this, all nonprofits require an audit to be prepared at the end of every year. An audit is a report, prepared by a CPA, providing lucidity to nonprofits donations and how they are spent. Each nonprofit has a treasurer and secretary who maintain the books and manage the

deposits. Nonprofits require several other board members to co-sign on checks. Also two people are required to handle the income, make deposits, and categorize funds. Using the organization's minutes, an auditor will verify justifiable expenses. All purchases made by people of nonprofits are required a strict paper trail for verification. Last the auditor closes the books for the fiscal year, prepares a balance sheet, reconciles bank statements, and determines what funds have not been put on the books. Even though nonprofits are tax-exempt the IRS can do an audit. "When the IRS audits, it looks for specific items, such as a 3:1 ratio of charitable work to fundraising efforts. What this means is for every fundraiser, an organization must do at least three giving campaigns in accordance to its bylaw mission." (Mason, 1999-2013) Nonprofit and for-profit have similarities in accounting practices for example credit, cash, payroll, property, and assets. However when it comes to nonprofits accountants with nonprofit experience is preferred. "There are regulatory issues, compliance issues, audits, and reporting demands that the differences in total demand accuracy and a prove track record." (Nonprofit Accounting Software, 2011) Weaknesses in an organization can cause irreversible damages and an auditor can uncover these

Accounting Short-Answer Questions

weaknesses and make suggestions on how to fix and improve these procedures. "Internal controls are policies and procedures that safeguard operational efficiency and ensure that funds are used appropriately. They also guard against the deliberate misuse of money." (Rees)

Accounting Short-Answer Questions References Mason, L. (1999-2013). Non-Profit Audit Requirements. Retrieved from http://www.ehow.com/aobut_5065599_nonprofit-audit-requirements.html Nonprofit Accounting Software. (October, 2011). Accounting Differences Between Nonprofits and For-Profits. Retrieved from http://www.nonprofitaccountingsoftware.org/2013/10/accounting-differencesbetween-nonprofits-and-for-profits/ Rees, S. (n.d.). What an Audit is and Why Your Nonprofit Should Have One. Retrieved From http://ezinearticles.com/?What-an-Audit-Is-and-Why-Your-NonprofitShould Have-One&id=2172659

You might also like

- Summary 2Document5 pagesSummary 2Karin NafilaNo ratings yet

- Non Profit AccountingDocument36 pagesNon Profit Accountingapi-3837252100% (2)

- Article Theme Non Profit OrganizationsDocument6 pagesArticle Theme Non Profit OrganizationsJoemari MislangNo ratings yet

- Basic Financial Statements: The Accounting Process Financial Statements The Accounting Equation Chart of AccountsDocument7 pagesBasic Financial Statements: The Accounting Process Financial Statements The Accounting Equation Chart of Accountspri_dulkar4679No ratings yet

- General AccountingDocument70 pagesGeneral AccountingPenn CollinsNo ratings yet

- Unit 1: Accounting and The Business Environment What Is Accounting?Document6 pagesUnit 1: Accounting and The Business Environment What Is Accounting?shereseNo ratings yet

- Why Do We Need AccountingDocument4 pagesWhy Do We Need Accountinglaxmi300No ratings yet

- Chapter 1Document15 pagesChapter 1Kibrom EmbzaNo ratings yet

- BASIACCDocument3 pagesBASIACCEdjon AndalNo ratings yet

- Accounting Chap 1 DiscussionDocument7 pagesAccounting Chap 1 DiscussionVicky Le100% (2)

- Why Do We Need Accounting?: Managerial Accounting. Financial Accounting Is Comprised of Information That CompaniesDocument31 pagesWhy Do We Need Accounting?: Managerial Accounting. Financial Accounting Is Comprised of Information That CompaniesPutti Vishal RajNo ratings yet

- How Is A Nonprofit Different From A For-Profit Business? Answer: Here Are Some of The Differences Between A Business and ADocument7 pagesHow Is A Nonprofit Different From A For-Profit Business? Answer: Here Are Some of The Differences Between A Business and Argayathri16No ratings yet

- Lecture Notes - 1: Chapter 1: Accounting in BusinessDocument8 pagesLecture Notes - 1: Chapter 1: Accounting in BusinessThomas SamungoleNo ratings yet

- Chapter 1: Accounting and The Business Environment: Objective 1Document23 pagesChapter 1: Accounting and The Business Environment: Objective 1jennyNo ratings yet

- Chapter - 04 Financial Statement For Non Profit Making OrganizationDocument71 pagesChapter - 04 Financial Statement For Non Profit Making OrganizationAuthor Jyoti Prakash rathNo ratings yet

- Activity Module 4 Part 1 SolisDocument2 pagesActivity Module 4 Part 1 SolisCPAREVIEWNo ratings yet

- Non-Profit Distinction: Organization Charitable Organizations Trade Unions ArtsDocument16 pagesNon-Profit Distinction: Organization Charitable Organizations Trade Unions ArtszdnacarioNo ratings yet

- Management Information System in Ed Admin Course RequirementDocument3 pagesManagement Information System in Ed Admin Course RequirementCo LydeNo ratings yet

- Introduction To AccountingDocument5 pagesIntroduction To AccountingMardy DahuyagNo ratings yet

- What Is The Difference Between Accounting and FinanceDocument4 pagesWhat Is The Difference Between Accounting and FinanceAmulya HgNo ratings yet

- Managing Profits and Losses On NonDocument2 pagesManaging Profits and Losses On NonAmar narayanNo ratings yet

- Nonprofit AccountingDocument10 pagesNonprofit AccountingRoschelle MiguelNo ratings yet

- Principles of Basic BookkeepingDocument8 pagesPrinciples of Basic Bookkeepingtunde adeniranNo ratings yet

- Branches of Acctg. AutosavedDocument33 pagesBranches of Acctg. AutosavedtoqueroaltheamistoyNo ratings yet

- Accounting Tutorial: Chapter 1: Introduction To AccountingDocument71 pagesAccounting Tutorial: Chapter 1: Introduction To AccountingNansie MarianoNo ratings yet

- Government Accountant: Federal Accounting Standards Advisory Board (FASB) - Government Accounting Standards Board (GASB)Document5 pagesGovernment Accountant: Federal Accounting Standards Advisory Board (FASB) - Government Accounting Standards Board (GASB)Glaiza GiganteNo ratings yet

- Jaibb AccountingDocument13 pagesJaibb AccountingAriful Haque SajibNo ratings yet

- Corporate Managers Must Issue Many Reports To The PublicDocument3 pagesCorporate Managers Must Issue Many Reports To The PublicKiran patilNo ratings yet

- Chapter1 5importance JRJDocument45 pagesChapter1 5importance JRJJames R JunioNo ratings yet

- Accounting Basics: Financial Statements 7Document13 pagesAccounting Basics: Financial Statements 7Rashid HussainNo ratings yet

- Lesson 6aaDocument6 pagesLesson 6aakabaso jaroNo ratings yet

- C213 Study Guide - SolutionDocument23 pagesC213 Study Guide - Solutiondesouzas.ldsNo ratings yet

- Subject: TopicDocument21 pagesSubject: TopicDharmikNo ratings yet

- Chapter 1 PAIDocument18 pagesChapter 1 PAIabdihalimNo ratings yet

- UHY Not-For-Profit Newsletter - March 2012Document2 pagesUHY Not-For-Profit Newsletter - March 2012UHYColumbiaMDNo ratings yet

- Untitled Document - Edited - 2024-05-31T005310.927Document4 pagesUntitled Document - Edited - 2024-05-31T005310.927OdeteNo ratings yet

- Activity No. 2 Cases: Objectives of Financial ReportingDocument11 pagesActivity No. 2 Cases: Objectives of Financial ReportingShiela MorenoNo ratings yet

- Workbook AccountsDocument38 pagesWorkbook AccountsSummyyaNo ratings yet

- Comment How Does Financial Statements and Reporting Differs in Case of Public Entity, Specialized and Non-Profit Organisation?Document1 pageComment How Does Financial Statements and Reporting Differs in Case of Public Entity, Specialized and Non-Profit Organisation?Hashir AslamNo ratings yet

- Financial Accounting and AnalysisDocument32 pagesFinancial Accounting and AnalysisSafwan HossainNo ratings yet

- Chapter 1 AccountingDocument13 pagesChapter 1 AccountingChan Man SeongNo ratings yet

- Principles of Accounts 1.0Document6 pagesPrinciples of Accounts 1.0miraaloabiNo ratings yet

- AccountingDocument4 pagesAccountingErma AlferezNo ratings yet

- Nonprofit HandbookDocument32 pagesNonprofit HandbookMike DeWine100% (5)

- Five Generally Accepted Accounting PrinciplesDocument7 pagesFive Generally Accepted Accounting PrinciplesAaliya SayyadNo ratings yet

- 5013c Filing ProcedureDocument8 pages5013c Filing ProcedureOretha Brown-JohnsonNo ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingRiza CabellezaNo ratings yet

- Writing Unit 1Document8 pagesWriting Unit 1Yulinda SaledaNo ratings yet

- Cash Flow White Paper Summer 2014Document14 pagesCash Flow White Paper Summer 2014Jona CiroNo ratings yet

- Lecture Week 1Document11 pagesLecture Week 1abdul rehmanNo ratings yet

- Lecture 1Document31 pagesLecture 1api-275959008No ratings yet

- CH 1Document10 pagesCH 1psureshkumar316No ratings yet

- Module For AccountingDocument46 pagesModule For AccountingJhefz KhurtzNo ratings yet

- AssignmentDocument3 pagesAssignmentAayan HossainNo ratings yet

- Accounting Thesis LolDocument240 pagesAccounting Thesis LolSteeeeeeeephNo ratings yet

- Differences Between Sole ProprietorshipDocument5 pagesDifferences Between Sole ProprietorshipUsman KhalidNo ratings yet

- ANGLAIS - Séquence 2Document7 pagesANGLAIS - Séquence 2laity ndiayeNo ratings yet

- Principles of Accounting SummaryDocument9 pagesPrinciples of Accounting SummaryMichael BrandonNo ratings yet

- Nonprofit AccountingDocument19 pagesNonprofit AccountingMayari de AmanteNo ratings yet

- Prediksi Financial Distress Kasus Industri Manufaktur Pendekatan Model Regresi LogistikDocument13 pagesPrediksi Financial Distress Kasus Industri Manufaktur Pendekatan Model Regresi LogistikHaidar EEka HenryNo ratings yet

- Diversification StrategyDocument13 pagesDiversification StrategyitsmrcoolpbNo ratings yet

- Derivatives: Swap Markets and ContractsDocument19 pagesDerivatives: Swap Markets and ContractsDEVINo ratings yet

- ACCOUNTING PRINCIPLES L. 1Document16 pagesACCOUNTING PRINCIPLES L. 1Dalia SamirNo ratings yet

- A Thesis On Customer Satisfaction OF Nepal Investment Bank LimitedDocument80 pagesA Thesis On Customer Satisfaction OF Nepal Investment Bank LimitedBijay PradhanNo ratings yet

- AB BankDocument134 pagesAB BankENAMUL HAQUENo ratings yet

- Just Dial - 20220703 - 0001Document2 pagesJust Dial - 20220703 - 0001Ratnadeep kambleNo ratings yet

- Business Studies Financial StatementsDocument3 pagesBusiness Studies Financial StatementsSusanna NgNo ratings yet

- XXXXXXX 500005 UnlockedDocument6 pagesXXXXXXX 500005 Unlockedk kNo ratings yet

- Form A2Document3 pagesForm A2jibran sakharkarNo ratings yet

- Tugas 1 Product-LineDocument3 pagesTugas 1 Product-LinejuniarNo ratings yet

- Proforma InvoiceDocument1 pageProforma Invoicecharananwar100% (1)

- Corporate Finance (Psbv026Nabb)Document34 pagesCorporate Finance (Psbv026Nabb)Krisi ManNo ratings yet

- Several Financial Institutions in CameroonDocument6 pagesSeveral Financial Institutions in CameroonGuy MoroNo ratings yet

- PvtdiscrateDocument4 pagesPvtdiscrateapi-3763138No ratings yet

- Ratio AnalysisDocument15 pagesRatio AnalysisShubham patilNo ratings yet

- Bankers Confidential ReportDocument1 pageBankers Confidential ReportBappa ChakrabortyNo ratings yet

- SEBI Grade A 2020 Live Quiz Ratio Analysis Part 1Document15 pagesSEBI Grade A 2020 Live Quiz Ratio Analysis Part 1anjaliNo ratings yet

- Wholsale Energy MarketDocument105 pagesWholsale Energy Marketpodgorica56No ratings yet

- A Level, Partnership Accounts BasicsDocument16 pagesA Level, Partnership Accounts BasicsMohsen Shafiq80% (5)

- CA Unit 1Document24 pagesCA Unit 1Vivek AyreNo ratings yet

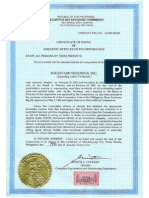

- BHI SEC Cert & Amended Articles of Incorporation PDFDocument9 pagesBHI SEC Cert & Amended Articles of Incorporation PDFkimberly_uymatiaoNo ratings yet

- SMRP Metric - Guideline RAVDocument2 pagesSMRP Metric - Guideline RAVjimeneajNo ratings yet

- Chapter 14 Meetings of Shareholders: AGM EGMDocument31 pagesChapter 14 Meetings of Shareholders: AGM EGMRashmin SolankiNo ratings yet

- Account - 47600500000823 Shivam Gupta So Late Ram Naresh GuptaDocument1 pageAccount - 47600500000823 Shivam Gupta So Late Ram Naresh GuptaAbhay SinghNo ratings yet

- د. إبراهيم العباديDocument26 pagesد. إبراهيم العباديabdosmartoNo ratings yet

- Rogers 2021 Annual ReportDocument148 pagesRogers 2021 Annual ReportGiacomo ARANA MORINo ratings yet

- Introduction To Entrepreneurship What Is Entrepreneurship?Document7 pagesIntroduction To Entrepreneurship What Is Entrepreneurship?Pogi PauleNo ratings yet

- Income Expenses Ingresos y GastosDocument1 pageIncome Expenses Ingresos y GastosCHELEX 1 HNNo ratings yet

- Maths Project On Home BudgetDocument10 pagesMaths Project On Home BudgetKatyayni KohliNo ratings yet