Professional Documents

Culture Documents

BetterInvesting Weekly Stock Screen 5-27-13

BetterInvesting Weekly Stock Screen 5-27-13

Uploaded by

BetterInvestingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BetterInvesting Weekly Stock Screen 5-27-13

BetterInvesting Weekly Stock Screen 5-27-13

Uploaded by

BetterInvestingCopyright:

Available Formats

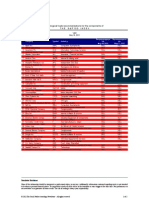

WEEK OF MAY 27, 2013

Company Name

Alimentation Couche-Tard

Apple

CH Robinson Worldwide

Coca-Cola Femsa, S.A.B. de C.V.

Cognizant Technology Solutions Corp.

Danaher Corp.

Dollar Tree Stores

EMC Corp.

Oracle Corp.

O'Reilly Automotive

Priceline.com

Ross Stores

Synnex Corp.

UnitedHealth Group

Symbol

ATD.B.TO

AAPL

CHRW

KOF

CTSH

DHR

DLTR

EMC

ORCL

ORLY

PCLN

ROST

SNX

UNH

Industry

Grocery Stores

Consumer Electronics

Integrated Shipping & Logistics

Beverages - Soft Drinks

Information Tech. Svcs.

Diversified Industrials

Discount Stores

Data Storage

Software - Infrastructure

Auto Parts

Leisure

Apparel Stores

Business Services

Health Care Plans

Screen Notes

MyStockProspector screen on May 24

Sales above $5 billion.

Ten-year sales, EPS growth of 10% or more.

Analysts consensus estimate five-year EPS growth of at least 10%.

Ten-year sales, EPS R2 of 0.80 and higher.

Trend of at least even for pre-tax income, return on equity.

P/E to both historical and projected EPS growth rates of less than 1.5.

Sales

Hist 10 Yr

(million $) Rev Gr (%)

22,997.5

24.4

156,508.0

41.7

11,359.1

12.5

11,207.6

13.8

7,346.5

39.0

18,260.4

13.0

7,394.5

11.3

21,713.9

13.6

37,121.0

17.7

6,182.2

19.0

5,261.0

24.0

9,721.1

10.4

10,285.5

10.0

110,618.0

15.3

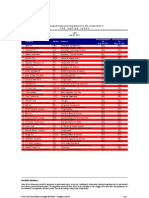

Hist 10 Yr

EPS Gr (%)

25.7

85.1

18.7

13.1

35.2

13.9

21.2

17.2

18.4

18.6

57.3

22.9

15.6

12.9

Proj 5 Yr

Rev R2 10 Yr EPS R2 10 Yr EPS Gr (%)

0.85

0.91

16.9

0.99

0.95

15.1

0.93

0.94

13.1

0.98

0.83

17.2

0.98

0.97

18.7

0.94

0.92

13.8

1.00

0.93

16.8

0.96

0.85

13.3

0.99

0.99

12.4

0.97

0.93

17.0

0.96

0.89

20.8

0.99

0.93

12.5

0.96

0.95

10.0

0.89

0.86

10.5

PE/Hist

EPS Gr

0.82

0.13

0.85

1.33

0.52

1.30

0.87

1.15

0.89

1.20

0.49

0.81

0.62

0.95

PE/Proj

EPS Gr

1.25

0.72

1.22

1.02

0.98

1.32

1.11

1.49

1.32

1.31

1.35

1.49

0.96

1.17

Trend PTI

++

++

-+

++

Even

+

++

++

Even

++

++

++

++

++

Trend ROE

++

++

+

Even

Even

Even

++

++

Even

++

++

++

+

+

You might also like

- Competing on Analytics: Updated, with a New Introduction: The New Science of WinningFrom EverandCompeting on Analytics: Updated, with a New Introduction: The New Science of WinningRating: 5 out of 5 stars5/5 (2)

- US SAP Users ListDocument9 pagesUS SAP Users ListmanishmotsNo ratings yet

- BetterInvesting Weekly Stock Screen 4-29-13Document1 pageBetterInvesting Weekly Stock Screen 4-29-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-29-13Document1 pageBetterInvesting Weekly Stock Screen 7-29-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-13Document1 pageBetterInvesting Weekly Stock Screen 10-14-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-20-14Document1 pageBetterInvesting Weekly Stock Screen 1-20-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-24-14Document1 pageBetterInvesting Weekly Stock Screen 2-24-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-7-14Document1 pageBetterInvesting Weekly Stock Screen 4-7-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-22-13Document1 pageBetterInvesting Weekly Stock Screen 7-22-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-2-12Document1 pageBetterInvesting Weekly Stock Screen 7-2-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-14-16Document1 pageBetterInvesting Weekly Stock Screen 3-14-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-17-13Document1 pageBetterInvesting Weekly Stock Screen 6-17-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 12-16-13Document1 pageBetterInvesting Weekly Stock Screen 12-16-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-16-12Document1 pageBetterInvesting Weekly Stock Screen 4-16-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock-Screen 9-22-14Document1 pageBetterInvesting Weekly Stock-Screen 9-22-14BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 7-15-13Document1 pageBetterInvesting Weekly Stock Screen 7-15-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-3-14Document1 pageBetterInvesting Weekly Stock Screen 2-3-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-21-14Document1 pageBetterInvesting Weekly Stock Screen 7-21-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-15-14Document1 pageBetterInvesting Weekly Stock Screen 9-15-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-1-13Document1 pageBetterInvesting Weekly Stock Screen 4-1-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-26-12Document3 pagesBetterInvesting Weekly Stock Screen 3-26-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-29-14Document1 pageBetterInvesting Weekly Stock Screen 9-29-14BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 1-26-15Document1 pageBetterInvesting Weekly Stock Screen 1-26-15BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- MGMT 565 Assignment 3 TeamDocument3 pagesMGMT 565 Assignment 3 TeamPierce CassidyNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 4-6-15Document1 pageBetterInvesting Weekly Stock Screen 4-6-15BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- DT Reports Symbol Guide: Through Aug. 5, 2015: Index EtfsDocument6 pagesDT Reports Symbol Guide: Through Aug. 5, 2015: Index Etfschr_maxmannNo ratings yet

- BetterInvesting Weekly Stock Screen 7-28-14Document1 pageBetterInvesting Weekly Stock Screen 7-28-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-13Document1 pageBetterInvesting Weekly Stock Screen 9-9-13BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 12-9-13Document1 pageBetterInvesting Weekly Stock Screen 12-9-13BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Ascendere Associates LLC Innovative Long/Short Equity ResearchDocument10 pagesAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 9-24-12Document1 pageBetterInvesting Weekly Stock Screen 9-24-12BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Top 25 N A S D A Q CompaniesDocument1 pageAstrological Trade Recommendations For The Top 25 N A S D A Q Companiesapi-139665491No ratings yet

- Astrological Trade Recommendations For Thetop Nasdaq CompaniesDocument1 pageAstrological Trade Recommendations For Thetop Nasdaq Companiesapi-139665491No ratings yet

- Midsize2012booklet 1865031Document250 pagesMidsize2012booklet 1865031maleemNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Apple PlanDocument42 pagesApple PlanValdécy Cardoso da CostaNo ratings yet

- Astrological Trade Recommendations For Thetop Nasdaq CompaniesDocument1 pageAstrological Trade Recommendations For Thetop Nasdaq Companiesapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 11-26-12Document1 pageBetterInvesting Weekly Stock Screen 11-26-12BetterInvestingNo ratings yet

- Astrological Trade Recommendations For Thetop Nasdaq CompaniesDocument1 pageAstrological Trade Recommendations For Thetop Nasdaq Companiesapi-139665491No ratings yet

- Astrological Trade Recommendations For The Top 25 N A S D A Q CompaniesDocument1 pageAstrological Trade Recommendations For The Top 25 N A S D A Q Companiesapi-139665491No ratings yet

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryFrom EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Mastering Operational Performance : The Ultimate KPI HandbookFrom EverandMastering Operational Performance : The Ultimate KPI HandbookNo ratings yet

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryFrom EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- BetterInvesting Weekly Stock Screen 1-27-2020Document3 pagesBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-7-19Document1 pageBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-28-19Document1 pageBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-5-19Document1 pageBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-16-18Document1 pageBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-2-19Document1 pageBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-11-19Document1 pageBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-2-19Document1 pageBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-1-19Document1 pageBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-19Document1 pageBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-19Document1 pageBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-22-19Document1 pageBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingNo ratings yet

- Financial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrDocument2 pagesFinancial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrBetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-10-19Document1 pageBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-25-19Document1 pageBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-9-19Document1 pageBetterInvesting Weekly Stock Screen 4-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-19Document1 pageBetterInvesting Weekly Stock Screen 1-23-19BetterInvesting100% (1)

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 11-19-18Document1 pageBetterInvesting Weekly Stock Screen 11-19-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-5-18Document1 pageBetterInvesting Weekly Stock Screen 11-5-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet