Professional Documents

Culture Documents

PHP 9 HC CNE

PHP 9 HC CNE

Uploaded by

NATSOIncOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PHP 9 HC CNE

PHP 9 HC CNE

Uploaded by

NATSOIncCopyright:

Available Formats

Congress

Must

Prioritize

Highway

Funding

Fuel

Tax

Remains

Most

Effective,

Efficient

Way

to

Fund

Infrastructure

America's

infrastructure

is

showing

signs

of

age,

and

unfortunately,

the

current

18.4

cents-per-gallon

fuel

tax

rate

is

insufficient

to

fund

both

the

repair

and

expansion

of

our

highway

infrastructure.

To

keep

the

U.S.

competitive

and

facilitate

efficient

interstate

commerce,

it

is

imperative

that

the

federal

government

address

the

fuel

tax

issue

and

maintain

its

strong

national

role

in

infrastructure

development

in

the

next

transportation

reauthorization.

Trust

Fund

Out

of

Money:

By

2015,

the

Highway

Trust

Fund

won't

be

able

to

meet

its

obligations,

according

to

a

recent

statement

by

the

Congressional

Budget

Office

(CBO)

to

the

House

Budget

Committee.

Without

addressing

the

issue,

the

report

says

Federal

lawmakers

would

have

to

cut

transportation

spending

by

92

percent

in

order

to

bring

revenue

and

spending

in

line.

The

federal

motor

fuels

tax,

which

is

currently

18.4

cents

per

gallon

for

gasoline

and

24.4

cents

for

diesel,

hasnt

been

increased

since

1993.

In

addition,

Americans

are

driving

more

fuel-efficient

vehicles

and

driving

less.

Congress

should

no

longer

delay

action

on

this

pressing

issue.

The

cost

of

doing

nothing

will

cause

further

decline

in

our

infrastructure,

drastically

increasing

costs,

imperiling

safety,

and

ultimately,

stifling

economic

growth.

Now

is

the

time

to

act.

Fuel

Tax

Still

the

Most

Effective,

Efficient

Solution:

In

recent

years

with

the

prolonged

recession,

Congress

has

been

hesitant

to

consider

an

increase

in

the

fuel

tax.

However,

fuel

taxes

remain

the

most

efficient

and

equitable

method

to

raise

dedicated

highway

funds.

Fuel

taxes

are

the

ultimate

user

fee

or

pay-as-you-go

approach,

which

is

why

they

have

been

used

for

so

many

decades

to

build

and

maintain

our

existing

infrastructure.

Other

funding

solutions,

such

as

tolling,

encounter

significant

public

opposition

and

are

an

extremely

inefficient

means

of

funding

infrastructure.

Nearly

one-third

of

all

tolling

revenue

collected

is

spent

on

toll

collection,

even

with

electronic

collections

systems.

Administering

the

federal

motor

fuels

tax,

by

comparison,

costs

just

0.2

percent

of

the

fees

collected.

Ignoring

the

Issue

Leads

to

Unfavorable

Solutions:

Failing

to

address

the

need

for

increased

highway

funding

at

the

federal

level

encourages

states

to

seek

alternative

funding

solutions

that

are

unfavorable

to

citizens

and

businesses,

such

as

tolling.

Most

notably,

Virginia,

North

Carolina

and

Missouri

have

sought

to

toll

interstates

under

a

Federal

Highway

Administration

pilot

program.

None

of

these

efforts

has

moved

forward,

however,

amid

strong

public

opposition.

Tolls

result

in

double

taxation

on

motorists,

while

threatening

residents

and

businesses

with

economic

hardships,

diversion

of

traffic

to

less-safe

roads,

and

increased

costs

for

shipped

goods.

Desire

to

Adjust

Fuel

Tax

Gaining

Momentum:

The

number

of

states

seeking

to

generate

transportation

revenues

by

increasing

their

state

motor

fuel

taxes

is

growing,

which

could

help

to

generate

the

political

will

to

make

a

change

at

the

federal

level.

Wyoming

was

the

first

state

this

year

to

raise

its

fuel

tax,

raising

its

tax

to

24

cents

per

gallon

from

14

cents.

Proposals

in

Washington,

New

Hampshire,

Michigan,

Pennsylvania,

Nevada

and

Vermont

are

also

under

consideration.

Alternatively,

at

least

18

states

are

considering

proposals

that

move

away

from

a

cents-per-gallon

excise

tax

and

toward

a

percentage-based

sales

tax

collected

at

the

wholesale

level

that

would

keep

up

with

inflation.

Virginias

newly

passed

tax

replaces

the

states

17.5-cents-per-gallon

tax

on

gasoline

with

a

3.5

percent

wholesale

tax

on

motor

fuels

that

will

keep

pace

with

economic

growth

and

inflation.

Maryland

also

recently

reduced

the

states

23.5-cents-per

gallon

gas

tax

by

5

cents

per

gallon

and

replaced

it

with

a

new

3

percent

sales

tax

at

the

wholesale

level,

phased

in

over

two

years.

Action Requested: Leadership will undoubtedly consider major changes to the current system as it begins to negotiate the next highway transportation bill. As the collectors of the nations fuel taxes, fuel retailers are in the best position to provide valuable input into how the system works and whether potential changes to it are viable. We ask to be at the table for these discussions to provide feedback on any changes to the current system that may be considered. NATSO staff contacts: Holly Alfano, halfano@natso.com, (703) 739-8501; Brad Stotler, bstotler@natso.com, (703) 739-8566

You might also like

- Page 1 Kite RunnerDocument2 pagesPage 1 Kite RunnerKeenan Riley Ennis60% (5)

- No No Boy OKADA Classroom - GuideDocument65 pagesNo No Boy OKADA Classroom - Guidesilv_er100% (1)

- Road Reform JaDocument4 pagesRoad Reform Jaapi-287830785No ratings yet

- Need For UN Audit Shown by This China Energy Fund Committee Doc Listing Jeff Sachs, Achim Steiner and Warran Sach As Advisers - But SG Guterres Won't Audit, Bans PressDocument20 pagesNeed For UN Audit Shown by This China Energy Fund Committee Doc Listing Jeff Sachs, Achim Steiner and Warran Sach As Advisers - But SG Guterres Won't Audit, Bans PressMatthew Russell LeeNo ratings yet

- Mayoral Transition Committee Report and RecommendationsDocument22 pagesMayoral Transition Committee Report and RecommendationsUSA TODAY NetworkNo ratings yet

- Declining Transportation Funds FactSheetDocument2 pagesDeclining Transportation Funds FactSheetKeith DunnNo ratings yet

- 2023 PSC Infrastructure Investment NeedsDocument44 pages2023 PSC Infrastructure Investment NeedsWXYZ-TV Channel 7 DetroitNo ratings yet

- VMT Taxation: A Modest Proposal: Alex Pazuchanics Katie Ross Randy Caruso Lauren PessoaDocument18 pagesVMT Taxation: A Modest Proposal: Alex Pazuchanics Katie Ross Randy Caruso Lauren PessoarcarusoNo ratings yet

- Fischer's Record On Raising TaxesDocument62 pagesFischer's Record On Raising TaxesBob KerreyNo ratings yet

- Maryland Energy Administration Revenue ReportDocument11 pagesMaryland Energy Administration Revenue ReportAnonymous sKgTCo2No ratings yet

- Road RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportDocument20 pagesRoad RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportCityNewsTorontoNo ratings yet

- Tolls: Road Testing Free Market Ideas To Drive Better Roads With Less TrafficDocument14 pagesTolls: Road Testing Free Market Ideas To Drive Better Roads With Less TrafficHeath W. FahleNo ratings yet

- America-Transportation and Infrastructure FinanceDocument44 pagesAmerica-Transportation and Infrastructure FinanceDeo AvanteNo ratings yet

- TFA Message SummaryDocument3 pagesTFA Message SummaryErick EricksonNo ratings yet

- CBO - Reducing Gasoline Consumption - Three Policy OptionsDocument51 pagesCBO - Reducing Gasoline Consumption - Three Policy OptionsConor KennyNo ratings yet

- Views Visions - Transportatoin - Clowser Article-CDocument3 pagesViews Visions - Transportatoin - Clowser Article-CMichael A. SecrettNo ratings yet

- Cornyn TaxDocument2 pagesCornyn TaxATA MediaNo ratings yet

- Fact Sheet On The Georgia Transportation PlanDocument2 pagesFact Sheet On The Georgia Transportation PlanErick Erickson0% (1)

- Where The Rubber Meets The Road: Reforming California's Roadway SystemDocument30 pagesWhere The Rubber Meets The Road: Reforming California's Roadway SystemreasonorgNo ratings yet

- 1 The Taxation of Fuel Economy: B 2011 by National Bureau of Economic Research. All Rights ReservedDocument38 pages1 The Taxation of Fuel Economy: B 2011 by National Bureau of Economic Research. All Rights ReservedcssdfdcNo ratings yet

- EV Registration Fees and HB1392 - NRDCDocument13 pagesEV Registration Fees and HB1392 - NRDCVikram rajputNo ratings yet

- Governor O'Malley, Senate President Miller, House Speaker Busch Propose Transportation Investment PlanDocument3 pagesGovernor O'Malley, Senate President Miller, House Speaker Busch Propose Transportation Investment PlanlrbrennanNo ratings yet

- This Year: What Must Be DoneDocument4 pagesThis Year: What Must Be Doneapi-231827968No ratings yet

- 2015 Transportation Comparative Data ReportDocument94 pages2015 Transportation Comparative Data ReportThe Council of State GovernmentsNo ratings yet

- Transportation Funding Brochure July 2015Document7 pagesTransportation Funding Brochure July 2015KOLD News 13No ratings yet

- 2013 4 23 Week in ReviewDocument2 pages2013 4 23 Week in Reviewapi-215003736No ratings yet

- HCR 14 2009 MIDocument1 pageHCR 14 2009 MIJim NeubacherNo ratings yet

- Iff Analysis h0260 2015 PDFDocument2 pagesIff Analysis h0260 2015 PDFDustinHurstNo ratings yet

- Pages 1513-1947: Submissions To Darrell Issa Regarding Federal Regulation: February 7, 2011Document435 pagesPages 1513-1947: Submissions To Darrell Issa Regarding Federal Regulation: February 7, 2011CREWNo ratings yet

- NorquistDocument1 pageNorquistThe Virginian-PilotNo ratings yet

- Fuel Price IncreasesDocument4 pagesFuel Price IncreaseswithcareNo ratings yet

- Finalbill 2Document2 pagesFinalbill 2api-336183509No ratings yet

- House Fiscal Agency: Legislative Analysis On Roads PackageDocument4 pagesHouse Fiscal Agency: Legislative Analysis On Roads PackageClickon DetroitNo ratings yet

- Metro Reform - A Maryland ApproachDocument30 pagesMetro Reform - A Maryland ApproachAnonymous sKgTCo2100% (1)

- Multistate Tax Commission ArticleDocument7 pagesMultistate Tax Commission Articleyfeng1018No ratings yet

- Questions About Clunkers 30 July 2009Document2 pagesQuestions About Clunkers 30 July 2009Mazana ÁngelNo ratings yet

- July 2009 - North Suburban Republican Forum NewsletterDocument12 pagesJuly 2009 - North Suburban Republican Forum NewsletterThe ForumNo ratings yet

- 12mem530 F BaltimoreDocument3 pages12mem530 F BaltimoreAnonymous Feglbx5No ratings yet

- Washington Co. Roads 2008 3Document9 pagesWashington Co. Roads 2008 3The GazetteNo ratings yet

- Will Repair or Replace 15,500 Lane Miles and 330 Bridges Without A Tax IncreaseDocument3 pagesWill Repair or Replace 15,500 Lane Miles and 330 Bridges Without A Tax IncreasePatrick CondonNo ratings yet

- CLT TO Legislature: "NO TAX INCREASES!"Document2 pagesCLT TO Legislature: "NO TAX INCREASES!"Danielle Wrobel FishNo ratings yet

- Round 8 ReportDocument14 pagesRound 8 Reportjohn_spadyNo ratings yet

- Who Pays For ParkingDocument86 pagesWho Pays For ParkingcrainsnewyorkNo ratings yet

- 01-30-12 Coalition Letter NAT GASDocument2 pages01-30-12 Coalition Letter NAT GASjames_valvoNo ratings yet

- Paving Report2016finalDocument14 pagesPaving Report2016finalAntuanet SaldañaNo ratings yet

- Evaluating Options For Funding Tennessee'S Infrastructure NeedsDocument5 pagesEvaluating Options For Funding Tennessee'S Infrastructure NeedsAnonymous GF8PPILW5No ratings yet

- 2015 Hornstein Dibble Post Regular Pre Special Session Legislative UpdateDocument3 pages2015 Hornstein Dibble Post Regular Pre Special Session Legislative UpdateScott DibbleNo ratings yet

- Clearhighwaysactof 2016Document2 pagesClearhighwaysactof 2016api-336980744No ratings yet

- Community Bulletin - April 2013Document9 pagesCommunity Bulletin - April 2013State Senator Liz KruegerNo ratings yet

- Tax Reform Coaltion LetterDocument3 pagesTax Reform Coaltion LetterAmericansForProsperityNo ratings yet

- The Surprising Incidence of Tax Credits For The Toyota PriusDocument32 pagesThe Surprising Incidence of Tax Credits For The Toyota PriusAkandNo ratings yet

- Want To Cut Gasoline Use? Raise TaxesDocument2 pagesWant To Cut Gasoline Use? Raise TaxesGlen YNo ratings yet

- H.196 Veto-3Document3 pagesH.196 Veto-3Ashley MooreNo ratings yet

- BillpaperfinalDocument6 pagesBillpaperfinalapi-336183509No ratings yet

- AP StyleDocument3 pagesAP StyleJoemar FurigayNo ratings yet

- 2021.03.03 - Gas and Electric Franchise Priorities - SERDocument4 pages2021.03.03 - Gas and Electric Franchise Priorities - SERRob NikolewskiNo ratings yet

- Policy Memo #1 - Heather Ah SanDocument3 pagesPolicy Memo #1 - Heather Ah SanHeather Ah SanNo ratings yet

- Iff Analysis h0311 2015 PDFDocument3 pagesIff Analysis h0311 2015 PDFDustinHurstNo ratings yet

- Top 10 Reasons Michigan Needs To Raise The Cap On Electric Competition - FinalDocument2 pagesTop 10 Reasons Michigan Needs To Raise The Cap On Electric Competition - Finalapackof2No ratings yet

- Automakers TestimonyDocument24 pagesAutomakers TestimonyhiltzikNo ratings yet

- Final Sales Tax Inform ADocument16 pagesFinal Sales Tax Inform Avladimirkulf2142No ratings yet

- Lawmakers' Letter To Assembly On Devolution, March 2012Document2 pagesLawmakers' Letter To Assembly On Devolution, March 2012WAMU885newsNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Opt-Out Letter: (Merchant Name)Document1 pageOpt-Out Letter: (Merchant Name)NATSOIncNo ratings yet

- PhpvczupvDocument1 pagePhpvczupvNATSOIncNo ratings yet

- PHP FLYAstDocument2 pagesPHP FLYAstNATSOIncNo ratings yet

- PHPT Sed 1 HDocument1 pagePHPT Sed 1 HNATSOIncNo ratings yet

- PHP WPURb YDocument2 pagesPHP WPURb YNATSOIncNo ratings yet

- PHP Hkot TADocument6 pagesPHP Hkot TANATSOIncNo ratings yet

- PHP JYO5 XuDocument14 pagesPHP JYO5 XuNATSOIncNo ratings yet

- Phpu 52 RVoDocument3 pagesPhpu 52 RVoNATSOIncNo ratings yet

- PHP T2 P VZDDocument1 pagePHP T2 P VZDNATSOIncNo ratings yet

- PHP 0 LG 6 PRDocument1 pagePHP 0 LG 6 PRNATSOIncNo ratings yet

- PHP 6 VI 1 X 6Document28 pagesPHP 6 VI 1 X 6NATSOIncNo ratings yet

- PHP VTZ AQdDocument2 pagesPHP VTZ AQdNATSOIncNo ratings yet

- PHP 716 TuwDocument2 pagesPHP 716 TuwNATSOIncNo ratings yet

- PHPF 5 JavrDocument9 pagesPHPF 5 JavrNATSOIncNo ratings yet

- PHP X9 KN PCDocument6 pagesPHP X9 KN PCNATSOIncNo ratings yet

- PHPB ZSFV CDocument4 pagesPHPB ZSFV CNATSOIncNo ratings yet

- PHPQF YFf YDocument1 pagePHPQF YFf YNATSOIncNo ratings yet

- Plan For Tomorrow's Trucking Economy: FeaturingDocument19 pagesPlan For Tomorrow's Trucking Economy: FeaturingNATSOIncNo ratings yet

- PHPMZ T7 B 2Document1 pagePHPMZ T7 B 2NATSOIncNo ratings yet

- PHP UG71 W 1Document4 pagesPHP UG71 W 1NATSOIncNo ratings yet

- PHP V5 V MARDocument33 pagesPHP V5 V MARNATSOIncNo ratings yet

- PHPNN 8 NwyDocument11 pagesPHPNN 8 NwyNATSOIncNo ratings yet

- Phps JB D9 GDocument13 pagesPhps JB D9 GNATSOIncNo ratings yet

- PHP Haf 2 SuDocument21 pagesPHP Haf 2 SuNATSOIncNo ratings yet

- PHP X9 GniiDocument10 pagesPHP X9 GniiNATSOIncNo ratings yet

- India and Pakistan MCQsDocument12 pagesIndia and Pakistan MCQsF219208 Muhammad Ahmad ShakeelNo ratings yet

- 3.a Barbara Levick - Morals, Politic, and The Fall of The Roman RepublicDocument11 pages3.a Barbara Levick - Morals, Politic, and The Fall of The Roman RepublicPram BayuNo ratings yet

- Partial Jason Miller TranscriptDocument7 pagesPartial Jason Miller TranscriptDaily KosNo ratings yet

- Crespo Vs Mogul G.R. No. L-53373Document4 pagesCrespo Vs Mogul G.R. No. L-53373cm mayorNo ratings yet

- 4TH Quarter Accomplishment 2021Document43 pages4TH Quarter Accomplishment 2021bacoor cps opnNo ratings yet

- IlluminatiDocument2 pagesIlluminatiSanjana AhujaNo ratings yet

- BB Judicial EthicsDocument52 pagesBB Judicial EthicsisraeljamoraNo ratings yet

- Toluna Sweeptakes RulesDocument4 pagesToluna Sweeptakes RulesAntwan HaynesNo ratings yet

- What Is CaricomDocument9 pagesWhat Is CaricomNatasha GrahamNo ratings yet

- CS Form No. 212 Revised Personal Data Sheet NewDocument16 pagesCS Form No. 212 Revised Personal Data Sheet Newrickymalubag014No ratings yet

- The American Mosaic The American Indian ExperienceDocument3 pagesThe American Mosaic The American Indian Experienceapi-285563917No ratings yet

- Guy Debord To Michel Prigent PDFDocument2 pagesGuy Debord To Michel Prigent PDFAngelNo ratings yet

- Three Basic Principles Underlying The British ConstitutionDocument3 pagesThree Basic Principles Underlying The British ConstitutionM. JosephNo ratings yet

- Kosovo Partneri IrenaDocument6 pagesKosovo Partneri IrenaIrena PavlovićNo ratings yet

- 2018 Essay Competition Poster EnglishDocument1 page2018 Essay Competition Poster EnglishMutahhir IshtiaqNo ratings yet

- Golden Age Guided NotesDocument3 pagesGolden Age Guided Notesapi-347934096No ratings yet

- 37-BIR (1945) Certificate of Tax Exemption For CooperativeDocument2 pages37-BIR (1945) Certificate of Tax Exemption For CooperativeEditha Valenzuela67% (3)

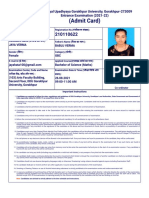

- (Admit Card) : Deen Dayal Upadhyaya Gorakhpur University, Gorakhpur-273009 Entrance Examination (2021-22)Document1 page(Admit Card) : Deen Dayal Upadhyaya Gorakhpur University, Gorakhpur-273009 Entrance Examination (2021-22)ShubbjlNo ratings yet

- The Karnataka Certain Inams Abolition Act, 1977Document18 pagesThe Karnataka Certain Inams Abolition Act, 1977Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- AFFIDAVIT - Dev Hurnam - SP JUDGE MATADEENDocument6 pagesAFFIDAVIT - Dev Hurnam - SP JUDGE MATADEENForce Vive Triolet MauritiusNo ratings yet

- Medi-Caps Institute of Management & Technology Medi-Caps Institute of Management & TechnologyDocument12 pagesMedi-Caps Institute of Management & Technology Medi-Caps Institute of Management & TechnologyprinceNo ratings yet

- Unit 3. Different Economic Systems: Text ADocument4 pagesUnit 3. Different Economic Systems: Text Amahda lena100% (1)

- Resume ObjectiveDocument2 pagesResume Objectiveapi-12705072No ratings yet

- Akshay Pramod DhanveDocument1 pageAkshay Pramod DhanveManoj GaikwadNo ratings yet

- Nation and State Lesson 4Document44 pagesNation and State Lesson 4Lord Byron FerrerNo ratings yet

- Torts Final Draft 13 Anoop Kumar 17Document18 pagesTorts Final Draft 13 Anoop Kumar 17anoopNo ratings yet