Professional Documents

Culture Documents

DBLM Solutions Carbon Newsletter 06 June

DBLM Solutions Carbon Newsletter 06 June

Uploaded by

David BolesCopyright:

Available Formats

You might also like

- LNG Industry May 2013Document92 pagesLNG Industry May 2013Edgar Rojas ZAcarias100% (1)

- Design of A 4-Way Passive Cross-Over Network - 0 PDFDocument100 pagesDesign of A 4-Way Passive Cross-Over Network - 0 PDFBrandy ThomasNo ratings yet

- Behaviour Modification TechniquesDocument42 pagesBehaviour Modification Techniquesdr parveen bathla100% (1)

- DBLM Solutions Carbon Newsletter 15 AugDocument1 pageDBLM Solutions Carbon Newsletter 15 AugDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 JulyDocument1 pageDBLM Solutions Carbon Newsletter 18 JulyDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 March 2014Document1 pageDBLM Solutions Carbon Newsletter 13 March 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 OctDocument1 pageDBLM Solutions Carbon Newsletter 02 OctDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 JulyDocument1 pageDBLM Solutions Carbon Newsletter 25 JulyDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 Jan 2014Document1 pageDBLM Solutions Carbon Newsletter 23 Jan 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 OctDocument1 pageDBLM Solutions Carbon Newsletter 30 OctDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 AugDocument1 pageDBLM Solutions Carbon Newsletter 08 AugDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Mar 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Mar 2015David BolesNo ratings yet

- Coal Capital Briefing Jan 12Document3 pagesCoal Capital Briefing Jan 12James LeatonNo ratings yet

- DBLM Solutions Carbon Newsletter 25 SepDocument1 pageDBLM Solutions Carbon Newsletter 25 SepDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 JulyDocument1 pageDBLM Solutions Carbon Newsletter 25 JulyDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 SepDocument1 pageDBLM Solutions Carbon Newsletter 12 SepDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 AugDocument1 pageDBLM Solutions Carbon Newsletter 29 AugDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- Shale Gas: Four Myths and A Truth: BRIEFING PAPER, March 2014Document7 pagesShale Gas: Four Myths and A Truth: BRIEFING PAPER, March 2014downbuliaoNo ratings yet

- DBLM Solutions Carbon Newsletter 16 Jan 2014Document1 pageDBLM Solutions Carbon Newsletter 16 Jan 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- What Is CarbonDocument52 pagesWhat Is CarbonSandipNo ratings yet

- Carbon TradingDocument28 pagesCarbon TradingrahatnazgulNo ratings yet

- Carbon Footprint AnalysisDocument17 pagesCarbon Footprint AnalysisAbhishek LalNo ratings yet

- United Kingdom 2012Document19 pagesUnited Kingdom 2012rodrigo_andsNo ratings yet

- Kevin Colcomb, Matthew Rymell and Alun Lewis: Very Heavy Fuel Oils: Risk Analysis of Their Transport in Uk WatersDocument12 pagesKevin Colcomb, Matthew Rymell and Alun Lewis: Very Heavy Fuel Oils: Risk Analysis of Their Transport in Uk WatersSidney Pereira JuniorNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Feb 2014Document1 pageDBLM Solutions Carbon Newsletter 13 Feb 2014David BolesNo ratings yet

- Thel Top Ten Chemical Companies 2014Document6 pagesThel Top Ten Chemical Companies 2014haiqalNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- Piotr Drozdzyk Article Energy MarketDocument10 pagesPiotr Drozdzyk Article Energy MarketPiotr DrozdzykNo ratings yet

- Industrial-Pellets-Report PellCert 2012 SecuredDocument30 pagesIndustrial-Pellets-Report PellCert 2012 SecuredmilosgojicNo ratings yet

- Ukpia UK Refining SectorDocument8 pagesUkpia UK Refining Sectorduncanmac200777No ratings yet

- Natural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightDocument10 pagesNatural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightchoiceenergyNo ratings yet

- DBLM Solutions Carbon Newsletter 06 NovDocument1 pageDBLM Solutions Carbon Newsletter 06 NovDavid BolesNo ratings yet

- Natural Gas Specification Challenges in The LNG IndustryDocument13 pagesNatural Gas Specification Challenges in The LNG IndustrySanjay KumarNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)Document1 pageDBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)David BolesNo ratings yet

- Coyle KBR Durr PS4 - 7 - NaturalGasSpecificationChallenges PDFDocument21 pagesCoyle KBR Durr PS4 - 7 - NaturalGasSpecificationChallenges PDFGeoffreyHunterNo ratings yet

- Natural Gas Specification Challenges in The LNG IndustryDocument22 pagesNatural Gas Specification Challenges in The LNG IndustryKailash GuptaNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- EU ETS Report WebDocument18 pagesEU ETS Report WebTerry Townsend, EditorNo ratings yet

- Carbon Trading-The Future Money Venture For IndiaDocument11 pagesCarbon Trading-The Future Money Venture For IndiaijsretNo ratings yet

- PHP W5 Ih MVDocument6 pagesPHP W5 Ih MVfred607No ratings yet

- Mechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaDocument20 pagesMechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaTilo ObashNo ratings yet

- Energy Markets Jdelgado 0408Document7 pagesEnergy Markets Jdelgado 0408BruegelNo ratings yet

- Pet CokeDocument12 pagesPet Cokezementhead100% (1)

- Carbon Credits MarketDocument14 pagesCarbon Credits MarketAndrei SlipchenkoNo ratings yet

- Carbon DerbyDocument12 pagesCarbon DerbyyukiyurikiNo ratings yet

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDocument9 pagesNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNo ratings yet

- Nomura Carbon CreditDocument13 pagesNomura Carbon CreditMonil DharodNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- Energy and Markets Newsletter January 18-2012Document11 pagesEnergy and Markets Newsletter January 18-2012choiceenergyNo ratings yet

- Marlo Lewis - Cap-And-Trade Schemes Are Not MarketsDocument4 pagesMarlo Lewis - Cap-And-Trade Schemes Are Not MarketsCompetitive Enterprise InstituteNo ratings yet

- Forecasting European Carbon MarketDocument20 pagesForecasting European Carbon MarketRaquel CadenasNo ratings yet

- DBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDavid BolesNo ratings yet

- Transformations in Gas Shipping: Market Structure and EfficiencyDocument31 pagesTransformations in Gas Shipping: Market Structure and EfficiencyDipto Pratomo NugrohoNo ratings yet

- Fossil Fuel Hydrogen: Technical, Economic and Environmental PotentialFrom EverandFossil Fuel Hydrogen: Technical, Economic and Environmental PotentialNo ratings yet

- The Sins of Big Oil: How Multinationals Destroy our Planet, Climate and Economy while Making Insane Profits and use Greenwashing to Fool Society!From EverandThe Sins of Big Oil: How Multinationals Destroy our Planet, Climate and Economy while Making Insane Profits and use Greenwashing to Fool Society!No ratings yet

- Carbon Finance: The Financial Implications of Climate ChangeFrom EverandCarbon Finance: The Financial Implications of Climate ChangeRating: 5 out of 5 stars5/5 (1)

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 June 2015Document1 pageDBLM Solutions Carbon Newsletter 18 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 June 2015Document1 pageDBLM Solutions Carbon Newsletter 04 June 2015David BolesNo ratings yet

- Country Partnership Strategy: Georgia 2014 - 2018Document19 pagesCountry Partnership Strategy: Georgia 2014 - 2018David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 June 2015Document1 pageDBLM Solutions Carbon Newsletter 10 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 30 Apr 2015David BolesNo ratings yet

- Crochet BraceletsDocument1 pageCrochet Braceletsminervana1100% (1)

- CFAP-01 CA PakistanDocument630 pagesCFAP-01 CA PakistanMuhammad ShehzadNo ratings yet

- American Airlines VS Ca 327 Scra 482 PDFDocument4 pagesAmerican Airlines VS Ca 327 Scra 482 PDFGwen Alistaer CanaleNo ratings yet

- Agriculture MatterDocument27 pagesAgriculture MatterksbbsNo ratings yet

- RA 10168 Related LitsDocument7 pagesRA 10168 Related LitsJade Belen ZaragozaNo ratings yet

- Kelt RonDocument98 pagesKelt RonGeorge KurishummoottilNo ratings yet

- Hustler Magazine Inc V FalwellDocument6 pagesHustler Magazine Inc V FalwellJon Bandoma100% (1)

- Consolidated QuestionsDocument77 pagesConsolidated QuestionsvenkatNo ratings yet

- The Magnacarta For Public School Teachers v.1Document70 pagesThe Magnacarta For Public School Teachers v.1France BejosaNo ratings yet

- n340 - Day Care Management n6 Memo June 2019 EditedDocument11 pagesn340 - Day Care Management n6 Memo June 2019 Editednokwandamasango57No ratings yet

- Labor Standards (Azucena, JR., 2013) 165Document1 pageLabor Standards (Azucena, JR., 2013) 165Marlo Caluya ManuelNo ratings yet

- Installatie en Onderhouds Manual CPAN XHE 3Document52 pagesInstallatie en Onderhouds Manual CPAN XHE 3valerivelikovNo ratings yet

- Dowry Laws in IndiaDocument20 pagesDowry Laws in Indiasanket jamuarNo ratings yet

- Definition of StatisticsDocument2 pagesDefinition of StatisticsBilli ManoNo ratings yet

- ME Module 1Document104 pagesME Module 1vinod kumarNo ratings yet

- Refugees and AssylumDocument18 pagesRefugees and AssylumCherry Ann Bawagan Astudillo-BalonggayNo ratings yet

- 'A Comparative Analysis For Customer Satisfaction Level of Levi's & Wrangler JeansDocument50 pages'A Comparative Analysis For Customer Satisfaction Level of Levi's & Wrangler JeansDigvijay Singh Chauhan80% (10)

- Entity Relationship Modeling: ObjectivesDocument13 pagesEntity Relationship Modeling: Objectivesniravthegreate999No ratings yet

- PROSPECTORDocument1 pagePROSPECTORsplendidhccNo ratings yet

- Index 2019Document79 pagesIndex 2019YuGenNo ratings yet

- TCS HR Interview QuestionsDocument10 pagesTCS HR Interview Questionsmanchiraju raj kumar100% (1)

- DX DiagDocument31 pagesDX DiagAntonio MarrazzoNo ratings yet

- What Date Should I Put On My Cover LetterDocument6 pagesWhat Date Should I Put On My Cover Letteroabmfmdkg100% (1)

- Hongkong and Shanghai Banking Corporation (HSBC) : International Money TransfersDocument3 pagesHongkong and Shanghai Banking Corporation (HSBC) : International Money TransfersThenmozhi ThambiduraiNo ratings yet

- Writing Task 1 Explanation AcademicDocument12 pagesWriting Task 1 Explanation AcademicMuza StewartNo ratings yet

- Lim Tanhu v. Ramolete, 66 SCRA 425 (1975)Document40 pagesLim Tanhu v. Ramolete, 66 SCRA 425 (1975)Clauds Gadzz100% (1)

- Project 1 2 3 Extra TestsDocument100 pagesProject 1 2 3 Extra TestsAnitaNo ratings yet

- Application Form / Checklist : Department of Fire & Rescue Services, Government of KeralaDocument37 pagesApplication Form / Checklist : Department of Fire & Rescue Services, Government of KeralaStew884No ratings yet

DBLM Solutions Carbon Newsletter 06 June

DBLM Solutions Carbon Newsletter 06 June

Uploaded by

David BolesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DBLM Solutions Carbon Newsletter 06 June

DBLM Solutions Carbon Newsletter 06 June

Uploaded by

David BolesCopyright:

Available Formats

Issue LXXXIII

Carbon Newsletter

DBLM Solutions

06 June 2013

The EUA Dec13 contract is currently at 3.95. Carbon gained until lunchtime yesterday on the back of healthy auction demand, but regressed thereafter to current levels as participants took profit. Recently EUETS data was published. The largest emitters in the EUETS in 2012 were energy producers RWE, E.ON and Vattenfall. They emiitted 157 MtCO2, 92 MtCO2, and 90 MtCO2. These values were calculated at group level., including stakeholdings in other companies included in the EUETS. For example,RWE experienced a shortfall of 45 million allowances. At current prices, RWEs allowance shortage represents a cost of 174,150,000.

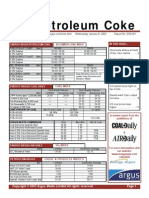

Weekly Recap ICE EUA Spot 3.77 3.90 3.87 3.91 3.88 811 2.91% ICE CER Spot 0.39 0.40 0.40 0.40 0.38 0 -2.56% ICE EUA Dec13 3.82 3.95 3.92 3.96 3.91 80,818 2.35% ICE CER Dec13 0.40 0.41 0.41 0.40 0.40 930 -

we witnessed the week before and 2.98 the previous week.

Auctions

EEX held auctions last Thursday, Friday, Monday and Tuesday,auction prices were 3.65, 3.96, 3.80 and 3.90 respectively. The cover ratios for the above auctions were 2.12,2.43,2.48 & 4.07 respectively.(Cover ratio Amount of bids/actual volume). The ICE exchange also held the fortnightly UK auction. They sold 4,134,000 EUAs at 3.96 each. In total an extra 18,539,000 EUAs were brought to the market place.

Global Carbon Markets

It is interesting to note even though the EUETS is bombarded with negative press, it is very evident that carbon markets are proliferating through the global stage as illustrated below.

30/05/2013 31/05/2013 03/06/2013 04/06/2013 05/06/2013 Volumes lots Week %

In 2012, the three companies with the highest surplus of EU carbon allowances (EUAs) were two steel makers and one cement manufacturer : ArcelorMittal (37 million EUAs surplus), Tata Steel (17 million EUAs surplus) and Lafarge (12 million EUAs surplus). The EUA/CER spread widened this week to 3.50 at close of business last night versus the 3.31 spread

Today, over 40 national and 20 subnational government jurisdictions have implemented or signalled an intent to initiate a carbon cap and trade system in the near future.

The contents of the Newsletter is not a recommendation, either implicit or explicit, to buy or sell emission permits. Contact: David Boles, Compliance Markets -Direct: +3531 4433 584; Mob:00353 831744707 DBLM Solutions is partly funded by the Wicklow Enterprise Board.

You might also like

- LNG Industry May 2013Document92 pagesLNG Industry May 2013Edgar Rojas ZAcarias100% (1)

- Design of A 4-Way Passive Cross-Over Network - 0 PDFDocument100 pagesDesign of A 4-Way Passive Cross-Over Network - 0 PDFBrandy ThomasNo ratings yet

- Behaviour Modification TechniquesDocument42 pagesBehaviour Modification Techniquesdr parveen bathla100% (1)

- DBLM Solutions Carbon Newsletter 15 AugDocument1 pageDBLM Solutions Carbon Newsletter 15 AugDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 JulyDocument1 pageDBLM Solutions Carbon Newsletter 18 JulyDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 March 2014Document1 pageDBLM Solutions Carbon Newsletter 13 March 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 OctDocument1 pageDBLM Solutions Carbon Newsletter 02 OctDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 JulyDocument1 pageDBLM Solutions Carbon Newsletter 25 JulyDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 Jan 2014Document1 pageDBLM Solutions Carbon Newsletter 23 Jan 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 OctDocument1 pageDBLM Solutions Carbon Newsletter 30 OctDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 AugDocument1 pageDBLM Solutions Carbon Newsletter 08 AugDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Mar 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Mar 2015David BolesNo ratings yet

- Coal Capital Briefing Jan 12Document3 pagesCoal Capital Briefing Jan 12James LeatonNo ratings yet

- DBLM Solutions Carbon Newsletter 25 SepDocument1 pageDBLM Solutions Carbon Newsletter 25 SepDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 JulyDocument1 pageDBLM Solutions Carbon Newsletter 25 JulyDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 SepDocument1 pageDBLM Solutions Carbon Newsletter 12 SepDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 AugDocument1 pageDBLM Solutions Carbon Newsletter 29 AugDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- Shale Gas: Four Myths and A Truth: BRIEFING PAPER, March 2014Document7 pagesShale Gas: Four Myths and A Truth: BRIEFING PAPER, March 2014downbuliaoNo ratings yet

- DBLM Solutions Carbon Newsletter 16 Jan 2014Document1 pageDBLM Solutions Carbon Newsletter 16 Jan 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- What Is CarbonDocument52 pagesWhat Is CarbonSandipNo ratings yet

- Carbon TradingDocument28 pagesCarbon TradingrahatnazgulNo ratings yet

- Carbon Footprint AnalysisDocument17 pagesCarbon Footprint AnalysisAbhishek LalNo ratings yet

- United Kingdom 2012Document19 pagesUnited Kingdom 2012rodrigo_andsNo ratings yet

- Kevin Colcomb, Matthew Rymell and Alun Lewis: Very Heavy Fuel Oils: Risk Analysis of Their Transport in Uk WatersDocument12 pagesKevin Colcomb, Matthew Rymell and Alun Lewis: Very Heavy Fuel Oils: Risk Analysis of Their Transport in Uk WatersSidney Pereira JuniorNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Feb 2014Document1 pageDBLM Solutions Carbon Newsletter 13 Feb 2014David BolesNo ratings yet

- Thel Top Ten Chemical Companies 2014Document6 pagesThel Top Ten Chemical Companies 2014haiqalNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- Piotr Drozdzyk Article Energy MarketDocument10 pagesPiotr Drozdzyk Article Energy MarketPiotr DrozdzykNo ratings yet

- Industrial-Pellets-Report PellCert 2012 SecuredDocument30 pagesIndustrial-Pellets-Report PellCert 2012 SecuredmilosgojicNo ratings yet

- Ukpia UK Refining SectorDocument8 pagesUkpia UK Refining Sectorduncanmac200777No ratings yet

- Natural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightDocument10 pagesNatural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightchoiceenergyNo ratings yet

- DBLM Solutions Carbon Newsletter 06 NovDocument1 pageDBLM Solutions Carbon Newsletter 06 NovDavid BolesNo ratings yet

- Natural Gas Specification Challenges in The LNG IndustryDocument13 pagesNatural Gas Specification Challenges in The LNG IndustrySanjay KumarNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)Document1 pageDBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)David BolesNo ratings yet

- Coyle KBR Durr PS4 - 7 - NaturalGasSpecificationChallenges PDFDocument21 pagesCoyle KBR Durr PS4 - 7 - NaturalGasSpecificationChallenges PDFGeoffreyHunterNo ratings yet

- Natural Gas Specification Challenges in The LNG IndustryDocument22 pagesNatural Gas Specification Challenges in The LNG IndustryKailash GuptaNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- EU ETS Report WebDocument18 pagesEU ETS Report WebTerry Townsend, EditorNo ratings yet

- Carbon Trading-The Future Money Venture For IndiaDocument11 pagesCarbon Trading-The Future Money Venture For IndiaijsretNo ratings yet

- PHP W5 Ih MVDocument6 pagesPHP W5 Ih MVfred607No ratings yet

- Mechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaDocument20 pagesMechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaTilo ObashNo ratings yet

- Energy Markets Jdelgado 0408Document7 pagesEnergy Markets Jdelgado 0408BruegelNo ratings yet

- Pet CokeDocument12 pagesPet Cokezementhead100% (1)

- Carbon Credits MarketDocument14 pagesCarbon Credits MarketAndrei SlipchenkoNo ratings yet

- Carbon DerbyDocument12 pagesCarbon DerbyyukiyurikiNo ratings yet

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDocument9 pagesNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNo ratings yet

- Nomura Carbon CreditDocument13 pagesNomura Carbon CreditMonil DharodNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- Energy and Markets Newsletter January 18-2012Document11 pagesEnergy and Markets Newsletter January 18-2012choiceenergyNo ratings yet

- Marlo Lewis - Cap-And-Trade Schemes Are Not MarketsDocument4 pagesMarlo Lewis - Cap-And-Trade Schemes Are Not MarketsCompetitive Enterprise InstituteNo ratings yet

- Forecasting European Carbon MarketDocument20 pagesForecasting European Carbon MarketRaquel CadenasNo ratings yet

- DBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDavid BolesNo ratings yet

- Transformations in Gas Shipping: Market Structure and EfficiencyDocument31 pagesTransformations in Gas Shipping: Market Structure and EfficiencyDipto Pratomo NugrohoNo ratings yet

- Fossil Fuel Hydrogen: Technical, Economic and Environmental PotentialFrom EverandFossil Fuel Hydrogen: Technical, Economic and Environmental PotentialNo ratings yet

- The Sins of Big Oil: How Multinationals Destroy our Planet, Climate and Economy while Making Insane Profits and use Greenwashing to Fool Society!From EverandThe Sins of Big Oil: How Multinationals Destroy our Planet, Climate and Economy while Making Insane Profits and use Greenwashing to Fool Society!No ratings yet

- Carbon Finance: The Financial Implications of Climate ChangeFrom EverandCarbon Finance: The Financial Implications of Climate ChangeRating: 5 out of 5 stars5/5 (1)

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 June 2015Document1 pageDBLM Solutions Carbon Newsletter 18 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 June 2015Document1 pageDBLM Solutions Carbon Newsletter 04 June 2015David BolesNo ratings yet

- Country Partnership Strategy: Georgia 2014 - 2018Document19 pagesCountry Partnership Strategy: Georgia 2014 - 2018David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 June 2015Document1 pageDBLM Solutions Carbon Newsletter 10 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 30 Apr 2015David BolesNo ratings yet

- Crochet BraceletsDocument1 pageCrochet Braceletsminervana1100% (1)

- CFAP-01 CA PakistanDocument630 pagesCFAP-01 CA PakistanMuhammad ShehzadNo ratings yet

- American Airlines VS Ca 327 Scra 482 PDFDocument4 pagesAmerican Airlines VS Ca 327 Scra 482 PDFGwen Alistaer CanaleNo ratings yet

- Agriculture MatterDocument27 pagesAgriculture MatterksbbsNo ratings yet

- RA 10168 Related LitsDocument7 pagesRA 10168 Related LitsJade Belen ZaragozaNo ratings yet

- Kelt RonDocument98 pagesKelt RonGeorge KurishummoottilNo ratings yet

- Hustler Magazine Inc V FalwellDocument6 pagesHustler Magazine Inc V FalwellJon Bandoma100% (1)

- Consolidated QuestionsDocument77 pagesConsolidated QuestionsvenkatNo ratings yet

- The Magnacarta For Public School Teachers v.1Document70 pagesThe Magnacarta For Public School Teachers v.1France BejosaNo ratings yet

- n340 - Day Care Management n6 Memo June 2019 EditedDocument11 pagesn340 - Day Care Management n6 Memo June 2019 Editednokwandamasango57No ratings yet

- Labor Standards (Azucena, JR., 2013) 165Document1 pageLabor Standards (Azucena, JR., 2013) 165Marlo Caluya ManuelNo ratings yet

- Installatie en Onderhouds Manual CPAN XHE 3Document52 pagesInstallatie en Onderhouds Manual CPAN XHE 3valerivelikovNo ratings yet

- Dowry Laws in IndiaDocument20 pagesDowry Laws in Indiasanket jamuarNo ratings yet

- Definition of StatisticsDocument2 pagesDefinition of StatisticsBilli ManoNo ratings yet

- ME Module 1Document104 pagesME Module 1vinod kumarNo ratings yet

- Refugees and AssylumDocument18 pagesRefugees and AssylumCherry Ann Bawagan Astudillo-BalonggayNo ratings yet

- 'A Comparative Analysis For Customer Satisfaction Level of Levi's & Wrangler JeansDocument50 pages'A Comparative Analysis For Customer Satisfaction Level of Levi's & Wrangler JeansDigvijay Singh Chauhan80% (10)

- Entity Relationship Modeling: ObjectivesDocument13 pagesEntity Relationship Modeling: Objectivesniravthegreate999No ratings yet

- PROSPECTORDocument1 pagePROSPECTORsplendidhccNo ratings yet

- Index 2019Document79 pagesIndex 2019YuGenNo ratings yet

- TCS HR Interview QuestionsDocument10 pagesTCS HR Interview Questionsmanchiraju raj kumar100% (1)

- DX DiagDocument31 pagesDX DiagAntonio MarrazzoNo ratings yet

- What Date Should I Put On My Cover LetterDocument6 pagesWhat Date Should I Put On My Cover Letteroabmfmdkg100% (1)

- Hongkong and Shanghai Banking Corporation (HSBC) : International Money TransfersDocument3 pagesHongkong and Shanghai Banking Corporation (HSBC) : International Money TransfersThenmozhi ThambiduraiNo ratings yet

- Writing Task 1 Explanation AcademicDocument12 pagesWriting Task 1 Explanation AcademicMuza StewartNo ratings yet

- Lim Tanhu v. Ramolete, 66 SCRA 425 (1975)Document40 pagesLim Tanhu v. Ramolete, 66 SCRA 425 (1975)Clauds Gadzz100% (1)

- Project 1 2 3 Extra TestsDocument100 pagesProject 1 2 3 Extra TestsAnitaNo ratings yet

- Application Form / Checklist : Department of Fire & Rescue Services, Government of KeralaDocument37 pagesApplication Form / Checklist : Department of Fire & Rescue Services, Government of KeralaStew884No ratings yet