Professional Documents

Culture Documents

Activity Based Costing

Activity Based Costing

Uploaded by

Edi Kristanta PelawiCopyright:

Available Formats

You might also like

- Introduction of Strategic Supply Chain ManagementDocument50 pagesIntroduction of Strategic Supply Chain ManagementMd. Ariful HassanNo ratings yet

- ABCDocument8 pagesABCanggandakonoh33% (3)

- CH 04Document13 pagesCH 04Shaiful Hussain100% (2)

- The Industrial Revolution 1Document6 pagesThe Industrial Revolution 1api-249544695No ratings yet

- Conveyor CalculationsDocument10 pagesConveyor CalculationsCristhian PortocarreroNo ratings yet

- Managerial Accounting - Ch.1Document2 pagesManagerial Accounting - Ch.1Ammar HussainNo ratings yet

- Replacement Models SimpleDocument8 pagesReplacement Models SimplePRITESH DEORENo ratings yet

- 150 199 PDFDocument49 pages150 199 PDFSamuelNo ratings yet

- Acg 4361 Chapter 17 Study Probes SolutionDocument18 pagesAcg 4361 Chapter 17 Study Probes SolutionPatDabzNo ratings yet

- ABC ExerciseDocument3 pagesABC ExerciseRijal DinNo ratings yet

- Chapter 2 - Cost Terminology and Cost BehaviorsDocument24 pagesChapter 2 - Cost Terminology and Cost BehaviorsAbby NavarroNo ratings yet

- Assignment-2 (Cost Accounting)Document24 pagesAssignment-2 (Cost Accounting)Iqra AbbasNo ratings yet

- This Study Resource Was: Econ 315 Connect HW CHP 8Document6 pagesThis Study Resource Was: Econ 315 Connect HW CHP 8Reniella AllejeNo ratings yet

- Unit 7 - Wiley Plus ExamplesDocument14 pagesUnit 7 - Wiley Plus ExamplesMohammed Al DhaheriNo ratings yet

- Time StudyDocument40 pagesTime StudySazid Rahman100% (1)

- Variance Analysis AND Standard CostingDocument37 pagesVariance Analysis AND Standard CostingWaniey HassanNo ratings yet

- Chapter 16Document25 pagesChapter 16assaNo ratings yet

- Lecture6 2018Document73 pagesLecture6 2018ismailNo ratings yet

- Linear ProgrammingDocument8 pagesLinear ProgrammingAngela HencherNo ratings yet

- Introduction To Cost Accounting/CostingDocument36 pagesIntroduction To Cost Accounting/CostingHarisvan To SevenNo ratings yet

- StatementDocument4 pagesStatementAngel Alejo AcobaNo ratings yet

- Absorption and Marginal Costing BasicDocument2 pagesAbsorption and Marginal Costing BasicDavilla CuptaNo ratings yet

- MJNV1W03 - Business Mathematics: Class Branding 1ADocument26 pagesMJNV1W03 - Business Mathematics: Class Branding 1AKatarina KimNo ratings yet

- Borrowing CostsDocument8 pagesBorrowing CostsOwlNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- OPERTIONS RESEARCH Note From CH I V Revised PDFDocument145 pagesOPERTIONS RESEARCH Note From CH I V Revised PDFEzzaddin Sultan100% (1)

- Dexter Company Produces & Sells A Single Product, A Wooden Hand Loom For Weaving SmallDocument1 pageDexter Company Produces & Sells A Single Product, A Wooden Hand Loom For Weaving SmallSabbir ZamanNo ratings yet

- Best Brew CorporationDocument4 pagesBest Brew CorporationIsabella GimaoNo ratings yet

- Waiting Lines PDFDocument51 pagesWaiting Lines PDFAlen Thomas Kattakayam100% (1)

- Acc14 Exercise Capital-BudgetingDocument3 pagesAcc14 Exercise Capital-BudgetingyeezzzzNo ratings yet

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- ABC CostingDocument5 pagesABC CostingMike RobmonNo ratings yet

- ABC Sample ProblemsDocument16 pagesABC Sample ProblemsrsalicsicNo ratings yet

- Group 6 PPT CaseDocument33 pagesGroup 6 PPT CaseRavNeet KaUr100% (1)

- ABCDocument18 pagesABCRohit VarmaNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingArpit SahaiNo ratings yet

- TB ch02 5e MADocument8 pagesTB ch02 5e MAعبدالله ماجد المطارنهNo ratings yet

- SCM Sol 05 14Document14 pagesSCM Sol 05 14bloomshing0% (1)

- Cash Flow Estimation Models: Estimating Relationships and ProblemsDocument30 pagesCash Flow Estimation Models: Estimating Relationships and ProblemsSenthil RNo ratings yet

- Longman F21 (Key)Document18 pagesLongman F21 (Key)Yan Pak KiuNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyArchie Lazaro100% (1)

- Lec4 ABCDocument31 pagesLec4 ABCnathan panNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- Tutorial 4 - Activity-Based CostingDocument3 pagesTutorial 4 - Activity-Based Costingsouayeh wejdenNo ratings yet

- Assignment 5Document6 pagesAssignment 5Ruby TaylorNo ratings yet

- ACCT 346 Final ExamDocument7 pagesACCT 346 Final ExamDeVryHelpNo ratings yet

- Managerial AccountingDocument23 pagesManagerial AccountingErum AnwerNo ratings yet

- ABC SystemDocument11 pagesABC SystemSyarifatuz Zuhriyah UmarNo ratings yet

- Review Problem: Activity-Based Costing: RequiredDocument11 pagesReview Problem: Activity-Based Costing: RequiredTunvir SyncNo ratings yet

- Activity Based Costing ExamplesDocument23 pagesActivity Based Costing ExamplesPinkal PatelNo ratings yet

- Lecture-7 Overhead (Part 4)Document38 pagesLecture-7 Overhead (Part 4)Nazmul-Hassan SumonNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Activity-Based Costing: Mcgraw-Hill/IrwinDocument17 pagesActivity-Based Costing: Mcgraw-Hill/IrwinImran KhanNo ratings yet

- Ch13TB PDFDocument25 pagesCh13TB PDFJinx Cyrus RodilloNo ratings yet

- Activity Based CostingDocument52 pagesActivity Based CostingraviktatiNo ratings yet

- ACCT 434 Midterm Exam (Updated)Document4 pagesACCT 434 Midterm Exam (Updated)DeVryHelpNo ratings yet

- 13 Factory Overhead - DepartmentaliationDocument25 pages13 Factory Overhead - DepartmentaliationGab Gab Malgapo100% (1)

- Activitybased Costing May 20 GMSISUCCESSDocument29 pagesActivitybased Costing May 20 GMSISUCCESSChetan BasraNo ratings yet

- Activity Based Costing Spring 2023 With ThoeryDocument12 pagesActivity Based Costing Spring 2023 With ThoeryHafsah AnwarNo ratings yet

- ABC - Sem-IV - 10 MarksDocument5 pagesABC - Sem-IV - 10 MarksTechboy RahulNo ratings yet

- Cost Assignment I For Royal UDocument6 pagesCost Assignment I For Royal Ufitsum100% (1)

- F5 RM March 2016 AnswersDocument15 pagesF5 RM March 2016 AnswersPrincezPinkyNo ratings yet

- Ar Ar: Er-Softw Er-SoftwDocument1 pageAr Ar: Er-Softw Er-SoftwEdi Kristanta PelawiNo ratings yet

- Action - Accounting Internal Competition 2014 Registration FormDocument1 pageAction - Accounting Internal Competition 2014 Registration FormEdi Kristanta PelawiNo ratings yet

- 97 Kunci Jawaban PDFDocument3 pages97 Kunci Jawaban PDFEdi Kristanta PelawiNo ratings yet

- Ocs November2016 PreseenmaterialDocument22 pagesOcs November2016 PreseenmaterialEdi Kristanta PelawiNo ratings yet

- Academic Calender 2013 2014Document1 pageAcademic Calender 2013 2014Edi Kristanta PelawiNo ratings yet

- Fraud Diamond Four ElementsDocument5 pagesFraud Diamond Four ElementsEdi Kristanta Pelawi100% (1)

- President University Student Enrollment: Name: Academic Year: ID Number: Semester: Advisor: Study ProgramDocument1 pagePresident University Student Enrollment: Name: Academic Year: ID Number: Semester: Advisor: Study ProgramEdi Kristanta PelawiNo ratings yet

- KrsDocument1 pageKrsEdi Kristanta PelawiNo ratings yet

- Overhead AllocationDocument3 pagesOverhead AllocationEdi Kristanta PelawiNo ratings yet

- Management Information System Final Project: Enterprise Resource Planning (Erp) Software For Medium EnterpriseDocument11 pagesManagement Information System Final Project: Enterprise Resource Planning (Erp) Software For Medium EnterpriseEdi Kristanta PelawiNo ratings yet

- 2 200901loeschetadipatri 120803014722 Phpapp01Document4 pages2 200901loeschetadipatri 120803014722 Phpapp01Sai Sricharan ReddyNo ratings yet

- BoosDocument20 pagesBooshollabackcockNo ratings yet

- ArvindDocument83 pagesArvindAkshita SabharwalNo ratings yet

- Jharkhand Orissa West Bengal Bihar Chhattisgarh Madhya PradeshDocument1 pageJharkhand Orissa West Bengal Bihar Chhattisgarh Madhya PradeshRiaNo ratings yet

- Power Mig 255 754Document8 pagesPower Mig 255 754Diego Jaramillo PeñalozaNo ratings yet

- PMR Steam KitsDocument1 pagePMR Steam KitsPeanut d. DestroyerNo ratings yet

- Introduction of Asian PaintsDocument2 pagesIntroduction of Asian PaintsKoh Hui Yi70% (10)

- European Copper Tube BS EN13348Document4 pagesEuropean Copper Tube BS EN13348Andreea Speriatu80% (5)

- Industry Visit ReportDocument19 pagesIndustry Visit ReportMohamad Zaid100% (3)

- 32-Industrial RevolutionDocument2 pages32-Industrial RevolutionGreg KennedyNo ratings yet

- Identification: Non Conformity Report (NCR)Document2 pagesIdentification: Non Conformity Report (NCR)JobJobNo ratings yet

- Screw ConveyorDocument4 pagesScrew ConveyorM.IBRAHEEMNo ratings yet

- U-5 Boring and Jig Boring MachineDocument27 pagesU-5 Boring and Jig Boring Machineapi-271354682No ratings yet

- Mccall'S: Cutting LayoutsDocument4 pagesMccall'S: Cutting LayoutsLinh KurtNo ratings yet

- Tooling Modification of CNC - HBMDocument26 pagesTooling Modification of CNC - HBMpverma02No ratings yet

- Bases StihilDocument2 pagesBases Stihilbrandon100% (1)

- Pressure Equipment - European Standards - Enterprise and IndustryDocument10 pagesPressure Equipment - European Standards - Enterprise and IndustrycastibraNo ratings yet

- Bertuzzi Machinery For PassionFruitDocument4 pagesBertuzzi Machinery For PassionFruitPastillas DesodorantesNo ratings yet

- MCQ ON III & IV UnitDocument3 pagesMCQ ON III & IV UnitRavi Parkhe67% (3)

- Inspection Finding ReportDocument2 pagesInspection Finding ReportnovrendaNo ratings yet

- Slinky Lam StacksDocument22 pagesSlinky Lam StacksL Mahender ReddyNo ratings yet

- Project Report ShampooDocument2 pagesProject Report Shampoovineetaggarwal50% (2)

- Louis VuittonDocument2 pagesLouis VuittonmonamohamadniaNo ratings yet

- Assignment No 1Document2 pagesAssignment No 1Krishna PatelNo ratings yet

- Planos para Gabinete Esquinero de MaderaDocument16 pagesPlanos para Gabinete Esquinero de MaderaIsmael Perez100% (2)

- 8000T LowTemp GlossDocument2 pages8000T LowTemp GlossCarlos Omar Barrera FloresNo ratings yet

- Shapers and PlanersDocument10 pagesShapers and PlanersAlejandro RomainNo ratings yet

- Busted Outseam - The Reinforced StitchDocument6 pagesBusted Outseam - The Reinforced StitchKunal HundiaNo ratings yet

Activity Based Costing

Activity Based Costing

Uploaded by

Edi Kristanta PelawiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity Based Costing

Activity Based Costing

Uploaded by

Edi Kristanta PelawiCopyright:

Available Formats

' ..

r--- L Activity-Based Costing: Demonstration Problems and Practice Quiz _ _____' _ ___ ________

Demonstration Problem 1

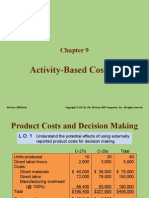

ABC Manufacturing, Inc. produces three gadgets (Ace, Best, and Champ) in two departments, Machining and

Assembly. Each product requires one hour of direct labor for completion. The following table provides production

and cost data for the year.

Ace Best Total

Number of units 25,000 15,000 45,000

Machine hours . 2,500 1,500

@

Mit O.1/o-f1(-

b . f 1'1/1

Direct materials $1,000,000 $450,000

PoHr'L

Direct labor 375,000 225,000

Overhead

Machining

b avo /'A 11 ;.If2,.s;- jMIf

Assembly

(\)L.$

Total overhead

Tot costs

Required:

Use the plantwide allocation method to determin(tk unit cost for each produc})rhe allocation bases to

choose from are

1. Machine hours.

2. Direct labor costs.

1

----------------------

----------------------

Solution:

1. The overhead allocation rate when@achine hou!j)were used as the allocation base was $225 per machine

hour (= $1,350,000 + 6,000 machine hours). The unit cost report would show the following:

Ace Best Champ

Units produced 25,000 15,000 5,000

Machine hours per unit

r

1;

0.4

0.1 0.1

./ ~ - z , " "

)C

Direct materials )C -vv.> $40.0 $30.0

$55.0

Direct labor 15.0 15.0 15.0

C

Applied overhea@ 5 per machine hour}) 22.5 22.5 90.0

Unit cost $77.5 $67.5 $160.0

2. The overhead allocation rate whe direct hour costs ere used as the allocation base was 200% (=

$1,350,000 + $675,000). The unit cos report would show the following:

Ace Best Champ

Units produced 25,000 15,000 5,000

Direct materials $40.0 $30.0 $55.0

Direct labor

x ~ ( 15.0 )(. ~ < ; 15.0 ')(1..-( 15.0

Applied overhea (200% direct labor costs) -? 30.0 30.0 30.0

Unit cost $85.0 $75.0 $100.0

Please note that the same results can be obtained using the number of units produced as the allocation base

because each product requires one hour of direct labor for completion and the direct labor costs are in direct

proportion to the number of units produced. The overhead allocation rate would be $30 per unit (= $1,350,000 +

45,000 units) as shown above.

The department allocation method uses a separate cost pool for each department. Each department has

its own overhead allocation rate or set of rates. This is a variation of the two-stage allocation approach in

which the cost pools happen to be departments.

If the company manufactures products that are quite similar and all use the same set of resources, the

plantwide rate is probably sufficient.

If there are multiple products that require manufacturing facilities in many different ways, departmental

rates provide a better picture of the use of manufacturing resources by the different products.

The choice between a plantwide rate and departmental rates is based on the costs and benefits of the

information inherent in each system. Any incremental costs of additional information must be justified by

an increase in benefits from improved decisions.

2

Demonstration Problem 2

(Continued from Demonstration Problem 1)

Considering the nature of the production processes, the cost accountant of ABC Manufacturing decided to

experiment with the department-specific allocation approach and determined that the Machining Department can

use machine hours as the allocation base for overhead assignment while the Assembly Department can use direct

labor costs instead.

Required:

Use the department allocation method to determine the unit cost for each product.

MH

.:.

Units produced

Machine hours per unit

Direct materials

Direct labor

Applied overhead

Machining ( $,SO per machine hour)

Assembly ( 6{..1"t. of direct labor costs)

nit cost

( Ace

25,000

6' . I

'to

{O

1'g"O

t 5 rn:>

Best

15,000

0.1

10

t S

(

t- 7 D

2- 0'0"0

Champ

5,000

D.".

.be:>

to

2

Solution:

For the Machining Department, the overhead allocation rate would be $150 per machine hour (= $900,000 +

6,000 machine hours).

For the Assembly Department, the overhead allocation rate would be 66.67% (= $450,000 + $675,000).

Ace Best Champ

Units produced 25,000 15,000 5,000

Machine hours per unit 0.1 0.1 0.4

Direct materials $40.0 $30.0 $55.0

Direct labor 15.0 15.0 15.0

Applied overhead

Machining ($150 per machine hour) 15.0 15.0 60.0

Assembly (66.67% of direct labor costs) 10.0 10.0 10.0

Unit cost $80.0 $70.0 $140.0

4

Demonstration Problem 3 (Continued from Demonstration Problems 2 and 3)

The cost accountant of ABC Manufacturing attended aworkshop on activity-based costing and was impressed by the results.

After consulting with the production personnel, he prepared the following information on cost drivers and the estimated

volume for each driver.

Activity Cost driver Cost driver volume

Machining Ace Best Champ

Setup Number of setups 125 75 50 250

Machining Machine hours 2,500 1,500 2,000 6,000

Assembly

Assembly Direct labor hours 25,000 15,000 5,000 45,000

Inspection Number of inspections I 50 25 25 100

U z-< 67JP I .5.1f7fi) '. om:>

The cost accountant also determined how much costs were incurred in eacH of the four activities as follows:

Activity Overhead costs

Machining

Setup

$150,000 -: 'l01:>

Machining ____7---"5---'-0,'-'-00.;:....:0_-:- b,OIS1> M I+s -;. ( J.-S/ M Id-

Total Machining department overhead $900,000

Assembly

$360,000 tK, creo !)/Jk _ =- <t i"/pu-r

Assembly

Inspection

_ __ 1 !r'"'O ::- t1OAspec:t:

Total Assembly department overhead $450,000

Total overhead costs $1,350,000

Required:

1. Determine the cost driver rate for each activity cost pool.

2. Use the activity-based costing method to determine the unit cost for each product.

3. Summarize and comment the results.

5

Solution:

1.

Activity Cost drive rate

Machining

Setup

Machining

Assembly

Assembly

Inspection

2. In the following table, the total costs are divided by the number of units to arrive at the unit cost for each

product.

Ace Best Champ

Direct materials $1,000,000 $450,000 $275,000

Direct labor . 375,000 225,000 75,000

Applied overhead

Setup ($600 per setup) $75,000 $45,000 $30,000

Machining ($125 per machine hour) 312,500 187,500 250,000

Assembly ($8 per direct labor hour) 200,000 120,000 40,000

Inspection ($900 per inspection) 45,000 22,500 22,500

Total overhead costs $632,500 $375,000 $342,500

Total costs $2,007,500 $1,050,000 $692,500

Number of units

Unit cost

Iternativel he following table shows direct calculation of unit cost for each product based on consumption

c Ivities for each unit of the products.

Ace Best Champ

Units produced 25,000 15,000 5,000

Number of setups per unit 0.005 0.005 0.01

Machine hours per unit 0.1 0.1 0.4

Direct labor hours per unit 1 1 1

Number of inspections per unit 0.002 0.00167 0.005

Direct materials $40.0 $30.0 $55.0

Direct labor 15.0 15.0 15.0

Applied overhead

Setup ($600 per setup) 3.0 3.0 6.0

Machining ($125 per machine hour) 12.5 12.5 50.0

Assembly ($8 per direct labor hour) 8.0 8.0 8.0

Inspection ($900 per inspection) 1.8 1.5 4.5

Unit cost $80.3 $70.0 $138.5

6

3. In summary, a comparison of the methods used to calculate unit cost for each product is presented below.

Ace Best

Plantwide rate based on machine hours $77.5 $67.5

Plantwide rate based on direct labor costs ~ 85.0 75.0

Department rates 80.0 __~ 7 0 ~ . 0 ~ __~

Activity-based costing ~ 70.0

In this series of demonstration problem both of the lantwide allocation methods distort product costs Since

Champ uses four times as much machine hours as the ot er two pro ucts, it inevitably receives more cost

assignment from the plantwide method based on machine hours; the opposite is the case when direct labor

costs are used as the allocation base.

The department allocation method and activity-based costing produce comparable numbers that portray

consumption of resources closer to reality. Since it is less costly to implement the department allocation

method than the activity-based costing method, the managers of ABC Manufacturing should probably use the

department allocation method to handle overhead costs in the future.

7

Multiple Choice [c-Ml-sed Py

/"

1. Death spiral /'

Ci)Happens when managers try toyet higher prices to recove(fcreasing reported costV

b. Occurs when capacity is re..duted.

c. May happen when the market share is ga.tnm9.

d. Has to do with costs

2. In atwo-stage cost allocation system,

a. The first stage involves assigning overhead costs to cost pools.

b. The cost pools may be departments.

c. Each cost pool requires an allocation rate.

(12AII of the above.

3. One of the cost pools at Toylands Store is Personnel department that provides recruiting and training for Sales and

Administrative departments and has an estimated overhead of $45,000. Sales department has 12 employees and

Administrative department has 3. How much of the overhead cost of the Personnel department should be allocated to the

Sales department?

a. $9,000.

b. O.

:; 30lf0

c. $36,000.

$38,000.

"-- )l 1;).

The following information is for questions 4- 7.

The accountant of Toylands Manufacturing collected the following information:

Activity Overhead costs Cost driver Product X1 Product X2

Machining Dept.

Setup $200,000 Number of setups 200 50

Machining 700,000 Machine hours 20,000 15,000

Packaging Dept.

Assembly C3"9 irect labor hours 000

Inspection .<:JMOL Number of inspections 120

I

4. If Toylands Manufacturing uses'a plantwide rate based oE t labor hOU!)O allocate overhead costs, how much is

product X1's share of overhead? G )

a. $324,000. To-n.J..

b. $416,000. "t t

c. 638000. I, 3?1=; Ifl"O ru JJLJJ-

d. $552,000. ;: lJUV .,. 6 5Tf) )

(ron.P Pufs)

5. If the department allocation method is used, what is the overhead rate for thE achining hOU!V

as the allocation base? T -(?Q !1 f) opt 0 If ..

a. $39.43 per machine hour. 0

b. $13.71 per machine hour. ( I 00, IAfV -r VV'O, tNO) 7 I

c. $ ne - v ). }f'

$25.71 per machine hour. c-=-== "'\ - iLA M

Z-<J QV9 -r I Sj JYV )

I 4

To-tJ Mils

6. When activity-based costing is used, what i Oduct of the kaging departmenj)verhead costs?

a. 270 000. d

is' "300( dlJ\) -=> t:":3 () L!f X bC? &ro =- (<lO, 67Jn

d. $380,000. ( 'kJ,IJ1iD+ bo, 6W "\ puts +

60 PI

'$ I g'ol.wo _ _) rt{(iTO L )( I;,,'i(" = : 9 61f1l

l)..o+bo

7. When activity-based costing is used, how much of the

:> pu

c. $950,000.

d. $670,000.

z, f /b

O

/ 6lJ))

1

fV07J flO

J-..q6Ut) -- I

J

hHs

+-

Ifo JW _ of I VlJO

3/l>L.-H X J 'DI.JIs - , -r

\ ) --t t -W VlJ

f r 12, 0 :=;. __----.:'-

<'loa tflJD

8. Which of the following is true of activity-based 11. What are the steps required for

costing relative to !?ditional costing? in administration?

a. It requires detailed cost measures. a. Identify activities that consume resources. I

b. Accounting department ajPrf6'can handle.;n1the b. Identify cost drivers associated with

c. C tivity rate per cost driver. J --yo- )..

__

d. All of the above.

9. Activity-based costing can be beneficial to

12. Which of the following statements Wrrect?

a. Nowadays, labor is still a cost in T

a. Banks.

b. Nonprofit organizations.

many companies, especially service

zations.

c. Law firms

c'

b. When the labor is prudent to

All of the above. )

allocate overhead based on direct labor.

c. en tela 0 onen rops, the overhead

rate based on direct labor tends to increase T

substantially.

d. When all resources are used proportionally, __

allocation of overhead based on machine hours is I

acceptable.

d.

5

.

1. a L01

2. d L02

3. c L02

$45 000

, = $3,000 per employees.

12+3

$3,000)( 12 employees at Sales department =

$36,000.

4. d L02

$200,000 +$700,000 + $300,000 + $180,000 =

$1,380,000.

$1 380 000 .

" =$13.8 per direct labor hour.

40,000 + 60, 000

$13.8)( 40,000 direct labor hours =$552,000.

5. d L02

$700,000 +$200,000 =$900,000.

$900 000 .

, =$25.71 per machine hour.

20,000 + 15, 000

6. b L04, L05

$300 000 .

---'- - = $3 per direct labor hour.

40, 000 + 60,000

$180 000 . .

--' - =$1,000 per inspection.

120+60

$3 per direct labor )( 60,000 direct labor hours +

$1,000 per inspection )( 60 inspections =

$240,000.

Answers

7.

8.

9.

10.

11.

12.

b L04, L05

$200 000

--' - = $800 per setup.

200+ 50

$700 000 .

- - ~ ' - - =$20 per machine hour.

20, 000 + 15, 000

$800 per setup )( 200 setups + $20 per machine

hour)( 20,000 machine hours + $3 per direct labor

hour )( 40,000 direct labor hours + $t,OOO per

inspection )( 120 inspections = $800,000.

c L06

d L08

b L07

d L08

b L07

10

You might also like

- Introduction of Strategic Supply Chain ManagementDocument50 pagesIntroduction of Strategic Supply Chain ManagementMd. Ariful HassanNo ratings yet

- ABCDocument8 pagesABCanggandakonoh33% (3)

- CH 04Document13 pagesCH 04Shaiful Hussain100% (2)

- The Industrial Revolution 1Document6 pagesThe Industrial Revolution 1api-249544695No ratings yet

- Conveyor CalculationsDocument10 pagesConveyor CalculationsCristhian PortocarreroNo ratings yet

- Managerial Accounting - Ch.1Document2 pagesManagerial Accounting - Ch.1Ammar HussainNo ratings yet

- Replacement Models SimpleDocument8 pagesReplacement Models SimplePRITESH DEORENo ratings yet

- 150 199 PDFDocument49 pages150 199 PDFSamuelNo ratings yet

- Acg 4361 Chapter 17 Study Probes SolutionDocument18 pagesAcg 4361 Chapter 17 Study Probes SolutionPatDabzNo ratings yet

- ABC ExerciseDocument3 pagesABC ExerciseRijal DinNo ratings yet

- Chapter 2 - Cost Terminology and Cost BehaviorsDocument24 pagesChapter 2 - Cost Terminology and Cost BehaviorsAbby NavarroNo ratings yet

- Assignment-2 (Cost Accounting)Document24 pagesAssignment-2 (Cost Accounting)Iqra AbbasNo ratings yet

- This Study Resource Was: Econ 315 Connect HW CHP 8Document6 pagesThis Study Resource Was: Econ 315 Connect HW CHP 8Reniella AllejeNo ratings yet

- Unit 7 - Wiley Plus ExamplesDocument14 pagesUnit 7 - Wiley Plus ExamplesMohammed Al DhaheriNo ratings yet

- Time StudyDocument40 pagesTime StudySazid Rahman100% (1)

- Variance Analysis AND Standard CostingDocument37 pagesVariance Analysis AND Standard CostingWaniey HassanNo ratings yet

- Chapter 16Document25 pagesChapter 16assaNo ratings yet

- Lecture6 2018Document73 pagesLecture6 2018ismailNo ratings yet

- Linear ProgrammingDocument8 pagesLinear ProgrammingAngela HencherNo ratings yet

- Introduction To Cost Accounting/CostingDocument36 pagesIntroduction To Cost Accounting/CostingHarisvan To SevenNo ratings yet

- StatementDocument4 pagesStatementAngel Alejo AcobaNo ratings yet

- Absorption and Marginal Costing BasicDocument2 pagesAbsorption and Marginal Costing BasicDavilla CuptaNo ratings yet

- MJNV1W03 - Business Mathematics: Class Branding 1ADocument26 pagesMJNV1W03 - Business Mathematics: Class Branding 1AKatarina KimNo ratings yet

- Borrowing CostsDocument8 pagesBorrowing CostsOwlNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- OPERTIONS RESEARCH Note From CH I V Revised PDFDocument145 pagesOPERTIONS RESEARCH Note From CH I V Revised PDFEzzaddin Sultan100% (1)

- Dexter Company Produces & Sells A Single Product, A Wooden Hand Loom For Weaving SmallDocument1 pageDexter Company Produces & Sells A Single Product, A Wooden Hand Loom For Weaving SmallSabbir ZamanNo ratings yet

- Best Brew CorporationDocument4 pagesBest Brew CorporationIsabella GimaoNo ratings yet

- Waiting Lines PDFDocument51 pagesWaiting Lines PDFAlen Thomas Kattakayam100% (1)

- Acc14 Exercise Capital-BudgetingDocument3 pagesAcc14 Exercise Capital-BudgetingyeezzzzNo ratings yet

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- ABC CostingDocument5 pagesABC CostingMike RobmonNo ratings yet

- ABC Sample ProblemsDocument16 pagesABC Sample ProblemsrsalicsicNo ratings yet

- Group 6 PPT CaseDocument33 pagesGroup 6 PPT CaseRavNeet KaUr100% (1)

- ABCDocument18 pagesABCRohit VarmaNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingArpit SahaiNo ratings yet

- TB ch02 5e MADocument8 pagesTB ch02 5e MAعبدالله ماجد المطارنهNo ratings yet

- SCM Sol 05 14Document14 pagesSCM Sol 05 14bloomshing0% (1)

- Cash Flow Estimation Models: Estimating Relationships and ProblemsDocument30 pagesCash Flow Estimation Models: Estimating Relationships and ProblemsSenthil RNo ratings yet

- Longman F21 (Key)Document18 pagesLongman F21 (Key)Yan Pak KiuNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyArchie Lazaro100% (1)

- Lec4 ABCDocument31 pagesLec4 ABCnathan panNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- Tutorial 4 - Activity-Based CostingDocument3 pagesTutorial 4 - Activity-Based Costingsouayeh wejdenNo ratings yet

- Assignment 5Document6 pagesAssignment 5Ruby TaylorNo ratings yet

- ACCT 346 Final ExamDocument7 pagesACCT 346 Final ExamDeVryHelpNo ratings yet

- Managerial AccountingDocument23 pagesManagerial AccountingErum AnwerNo ratings yet

- ABC SystemDocument11 pagesABC SystemSyarifatuz Zuhriyah UmarNo ratings yet

- Review Problem: Activity-Based Costing: RequiredDocument11 pagesReview Problem: Activity-Based Costing: RequiredTunvir SyncNo ratings yet

- Activity Based Costing ExamplesDocument23 pagesActivity Based Costing ExamplesPinkal PatelNo ratings yet

- Lecture-7 Overhead (Part 4)Document38 pagesLecture-7 Overhead (Part 4)Nazmul-Hassan SumonNo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Activity-Based Costing: Mcgraw-Hill/IrwinDocument17 pagesActivity-Based Costing: Mcgraw-Hill/IrwinImran KhanNo ratings yet

- Ch13TB PDFDocument25 pagesCh13TB PDFJinx Cyrus RodilloNo ratings yet

- Activity Based CostingDocument52 pagesActivity Based CostingraviktatiNo ratings yet

- ACCT 434 Midterm Exam (Updated)Document4 pagesACCT 434 Midterm Exam (Updated)DeVryHelpNo ratings yet

- 13 Factory Overhead - DepartmentaliationDocument25 pages13 Factory Overhead - DepartmentaliationGab Gab Malgapo100% (1)

- Activitybased Costing May 20 GMSISUCCESSDocument29 pagesActivitybased Costing May 20 GMSISUCCESSChetan BasraNo ratings yet

- Activity Based Costing Spring 2023 With ThoeryDocument12 pagesActivity Based Costing Spring 2023 With ThoeryHafsah AnwarNo ratings yet

- ABC - Sem-IV - 10 MarksDocument5 pagesABC - Sem-IV - 10 MarksTechboy RahulNo ratings yet

- Cost Assignment I For Royal UDocument6 pagesCost Assignment I For Royal Ufitsum100% (1)

- F5 RM March 2016 AnswersDocument15 pagesF5 RM March 2016 AnswersPrincezPinkyNo ratings yet

- Ar Ar: Er-Softw Er-SoftwDocument1 pageAr Ar: Er-Softw Er-SoftwEdi Kristanta PelawiNo ratings yet

- Action - Accounting Internal Competition 2014 Registration FormDocument1 pageAction - Accounting Internal Competition 2014 Registration FormEdi Kristanta PelawiNo ratings yet

- 97 Kunci Jawaban PDFDocument3 pages97 Kunci Jawaban PDFEdi Kristanta PelawiNo ratings yet

- Ocs November2016 PreseenmaterialDocument22 pagesOcs November2016 PreseenmaterialEdi Kristanta PelawiNo ratings yet

- Academic Calender 2013 2014Document1 pageAcademic Calender 2013 2014Edi Kristanta PelawiNo ratings yet

- Fraud Diamond Four ElementsDocument5 pagesFraud Diamond Four ElementsEdi Kristanta Pelawi100% (1)

- President University Student Enrollment: Name: Academic Year: ID Number: Semester: Advisor: Study ProgramDocument1 pagePresident University Student Enrollment: Name: Academic Year: ID Number: Semester: Advisor: Study ProgramEdi Kristanta PelawiNo ratings yet

- KrsDocument1 pageKrsEdi Kristanta PelawiNo ratings yet

- Overhead AllocationDocument3 pagesOverhead AllocationEdi Kristanta PelawiNo ratings yet

- Management Information System Final Project: Enterprise Resource Planning (Erp) Software For Medium EnterpriseDocument11 pagesManagement Information System Final Project: Enterprise Resource Planning (Erp) Software For Medium EnterpriseEdi Kristanta PelawiNo ratings yet

- 2 200901loeschetadipatri 120803014722 Phpapp01Document4 pages2 200901loeschetadipatri 120803014722 Phpapp01Sai Sricharan ReddyNo ratings yet

- BoosDocument20 pagesBooshollabackcockNo ratings yet

- ArvindDocument83 pagesArvindAkshita SabharwalNo ratings yet

- Jharkhand Orissa West Bengal Bihar Chhattisgarh Madhya PradeshDocument1 pageJharkhand Orissa West Bengal Bihar Chhattisgarh Madhya PradeshRiaNo ratings yet

- Power Mig 255 754Document8 pagesPower Mig 255 754Diego Jaramillo PeñalozaNo ratings yet

- PMR Steam KitsDocument1 pagePMR Steam KitsPeanut d. DestroyerNo ratings yet

- Introduction of Asian PaintsDocument2 pagesIntroduction of Asian PaintsKoh Hui Yi70% (10)

- European Copper Tube BS EN13348Document4 pagesEuropean Copper Tube BS EN13348Andreea Speriatu80% (5)

- Industry Visit ReportDocument19 pagesIndustry Visit ReportMohamad Zaid100% (3)

- 32-Industrial RevolutionDocument2 pages32-Industrial RevolutionGreg KennedyNo ratings yet

- Identification: Non Conformity Report (NCR)Document2 pagesIdentification: Non Conformity Report (NCR)JobJobNo ratings yet

- Screw ConveyorDocument4 pagesScrew ConveyorM.IBRAHEEMNo ratings yet

- U-5 Boring and Jig Boring MachineDocument27 pagesU-5 Boring and Jig Boring Machineapi-271354682No ratings yet

- Mccall'S: Cutting LayoutsDocument4 pagesMccall'S: Cutting LayoutsLinh KurtNo ratings yet

- Tooling Modification of CNC - HBMDocument26 pagesTooling Modification of CNC - HBMpverma02No ratings yet

- Bases StihilDocument2 pagesBases Stihilbrandon100% (1)

- Pressure Equipment - European Standards - Enterprise and IndustryDocument10 pagesPressure Equipment - European Standards - Enterprise and IndustrycastibraNo ratings yet

- Bertuzzi Machinery For PassionFruitDocument4 pagesBertuzzi Machinery For PassionFruitPastillas DesodorantesNo ratings yet

- MCQ ON III & IV UnitDocument3 pagesMCQ ON III & IV UnitRavi Parkhe67% (3)

- Inspection Finding ReportDocument2 pagesInspection Finding ReportnovrendaNo ratings yet

- Slinky Lam StacksDocument22 pagesSlinky Lam StacksL Mahender ReddyNo ratings yet

- Project Report ShampooDocument2 pagesProject Report Shampoovineetaggarwal50% (2)

- Louis VuittonDocument2 pagesLouis VuittonmonamohamadniaNo ratings yet

- Assignment No 1Document2 pagesAssignment No 1Krishna PatelNo ratings yet

- Planos para Gabinete Esquinero de MaderaDocument16 pagesPlanos para Gabinete Esquinero de MaderaIsmael Perez100% (2)

- 8000T LowTemp GlossDocument2 pages8000T LowTemp GlossCarlos Omar Barrera FloresNo ratings yet

- Shapers and PlanersDocument10 pagesShapers and PlanersAlejandro RomainNo ratings yet

- Busted Outseam - The Reinforced StitchDocument6 pagesBusted Outseam - The Reinforced StitchKunal HundiaNo ratings yet