Professional Documents

Culture Documents

Iisl Marketupdate - September2012: Market Statistics

Iisl Marketupdate - September2012: Market Statistics

Uploaded by

hitekshaCopyright:

Available Formats

You might also like

- REVOLUTCASEDocument20 pagesREVOLUTCASEFernandoValentinNo ratings yet

- Wrigley CaseDocument15 pagesWrigley CaseDwayne100% (4)

- Fundamental and Technical Analysis at Kotak Mahindra Mba Project ReportDocument108 pagesFundamental and Technical Analysis at Kotak Mahindra Mba Project ReportBabasab Patil (Karrisatte)67% (6)

- Nifty CalculationDocument25 pagesNifty Calculationpratz2706No ratings yet

- Hybrid FinancingDocument1 pageHybrid FinancinghitekshaNo ratings yet

- Research Paper On IPODocument5 pagesResearch Paper On IPOhitekshaNo ratings yet

- Reliance Industries Cost Sheet Ver. 1.0Document2 pagesReliance Industries Cost Sheet Ver. 1.0hiteksha62% (13)

- Valuation ReportDocument42 pagesValuation Reporthiteksha100% (2)

- Strategy EvaluationDocument8 pagesStrategy EvaluationRobert Dacus100% (1)

- Inter Process ProfitsDocument10 pagesInter Process ProfitsKella Pradeep100% (1)

- IISL UpdateDocument11 pagesIISL Updateanalyst_anil14No ratings yet

- Iisl Marketupdate - February 2013: Market StatisticsDocument11 pagesIisl Marketupdate - February 2013: Market StatisticshitekshaNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatednikhilNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatedUrvashi SharmaNo ratings yet

- BSE Index & NSE Index For Last Ten Years (2004-5 To 2014-15)Document8 pagesBSE Index & NSE Index For Last Ten Years (2004-5 To 2014-15)Vinod PawarNo ratings yet

- Base Year Base Index Value Date of Launch Method of Calculation Number of ScripsDocument28 pagesBase Year Base Index Value Date of Launch Method of Calculation Number of Scripsnice_divyaNo ratings yet

- Mini Project On NseDocument19 pagesMini Project On Nsecharan tejaNo ratings yet

- 05aug2014 India DailyDocument73 pages05aug2014 India DailyChaitanya JagarlapudiNo ratings yet

- To: Kiritbhai Ramniklal ShahDocument11 pagesTo: Kiritbhai Ramniklal ShahPratik ShahNo ratings yet

- India Index Services & Products Ltd. (IISL)Document4 pagesIndia Index Services & Products Ltd. (IISL)Trinadh Kumar GuthulaNo ratings yet

- History of BSEDocument5 pagesHistory of BSEapuoctNo ratings yet

- Analysis of Risk Return Relationship inDocument59 pagesAnalysis of Risk Return Relationship inGautam BindlishNo ratings yet

- 10 Ijamtes 2015Document7 pages10 Ijamtes 2015KRISHNAM RAJU JANAMALANo ratings yet

- Nifty 50 Etfs' India Aum Crosses Rs. 1 Trillion: Press ReleaseDocument2 pagesNifty 50 Etfs' India Aum Crosses Rs. 1 Trillion: Press ReleaseShankar Reddy JammuladinneNo ratings yet

- Daily Market OutlookDocument5 pagesDaily Market OutlookshadabvakilNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Nifty: S.No. Company NameDocument5 pagesNifty: S.No. Company NameDurgesh AgnihotriNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Economic Indicators (IFS)Document2 pagesEconomic Indicators (IFS)Sunil NagpalNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Investment Anlysis and Portfolio Management: Project Report of Fundamental Analysis On Consumer Durable IndustryDocument27 pagesInvestment Anlysis and Portfolio Management: Project Report of Fundamental Analysis On Consumer Durable IndustryPatelMayurNo ratings yet

- Stock Market IndicesDocument11 pagesStock Market Indicesoureducation.inNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report Oct 31 2021Document15 pagesPPFCF PPFAS Monthly Portfolio Report Oct 31 2021muraliNo ratings yet

- Ind prs30052024Document2 pagesInd prs30052024mohan ramananNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- MBA Project On Fundamental and Technical Analysis of Kotak BankDocument109 pagesMBA Project On Fundamental and Technical Analysis of Kotak BankSneha MaskaraNo ratings yet

- InnovationsDocument4 pagesInnovationsMousami BanerjeeNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report December 31 2021Document15 pagesPPFCF PPFAS Monthly Portfolio Report December 31 2021Owners EstateNo ratings yet

- A Report OnDocument17 pagesA Report OnsachinktNo ratings yet

- Sun Pharma: Multi Commodity Exchange of India LTDDocument8 pagesSun Pharma: Multi Commodity Exchange of India LTDgargrahulNo ratings yet

- Sensex: Full Form of SENSEX - Stock Exchange Sensitive IndexDocument4 pagesSensex: Full Form of SENSEX - Stock Exchange Sensitive IndexLEKHITHMADANNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument54 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- UniQuest Equity Intelligence 16th NovemberDocument7 pagesUniQuest Equity Intelligence 16th NovemberC A Luve HotchandaniNo ratings yet

- December 2011Document4 pagesDecember 2011utkarshupsNo ratings yet

- Market - Outlook - 09 - 09 - 2015 1Document14 pagesMarket - Outlook - 09 - 09 - 2015 1PrashantKumarNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument52 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- CNX Nifty JRDocument4 pagesCNX Nifty JRsachinhs7No ratings yet

- Factsheet GSDocument18 pagesFactsheet GSbshriNo ratings yet

- EQUITY ANALYSIS WITH REPECT TO Automobile SectorDocument83 pagesEQUITY ANALYSIS WITH REPECT TO Automobile SectorSuraj DubeyNo ratings yet

- A Presentation By: (Group 7)Document10 pagesA Presentation By: (Group 7)Satish PeriNo ratings yet

- Nifty, Sensex A Long Way From Truly Representing The EconomyDocument22 pagesNifty, Sensex A Long Way From Truly Representing The Economyharsh_monsNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Overview NSEDocument26 pagesOverview NSEMinkil BansalNo ratings yet

- DSP BlackRock Focus 25 FundDocument1 pageDSP BlackRock Focus 25 FundRaasik JainNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Stock Market Indices in India: Raghunandan HelwadeDocument38 pagesStock Market Indices in India: Raghunandan HelwadeRaghunandan HelwadeNo ratings yet

- Dynamic Levels Morning Report 26th August 2016 UpDocument5 pagesDynamic Levels Morning Report 26th August 2016 UpSubham MazumdarNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument54 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- NSE NIFTY and Its Correlation With Sectorial Indexes: Nagendra Marisetty and Haritha MDocument11 pagesNSE NIFTY and Its Correlation With Sectorial Indexes: Nagendra Marisetty and Haritha MSAI VAKANo ratings yet

- The Organisation: Associate/Affiliate CompaniesDocument6 pagesThe Organisation: Associate/Affiliate CompaniesnaseerjnNo ratings yet

- CNX Bank IndexDocument3 pagesCNX Bank IndexNidhi AgarwalNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Nifty Stock ExchangeDocument187 pagesNifty Stock Exchangeshrikantmane2753550% (1)

- CNX Nifty JuniorDocument4 pagesCNX Nifty JuniorVenkatesh GoudarNo ratings yet

- Stock Market Income Genesis: Internet Business Genesis Series, #8From EverandStock Market Income Genesis: Internet Business Genesis Series, #8No ratings yet

- Basic of DerivatiovesDocument12 pagesBasic of DerivatioveshitekshaNo ratings yet

- Financial ServicesDocument22 pagesFinancial ServiceshitekshaNo ratings yet

- Quiz 2 Subject: Banking & InsuranceDocument1 pageQuiz 2 Subject: Banking & InsurancehitekshaNo ratings yet

- Account CommonsizeDocument4 pagesAccount CommonsizehitekshaNo ratings yet

- Investing Lessons in Time of CovidDocument1 pageInvesting Lessons in Time of CovidhitekshaNo ratings yet

- Case StudyDocument11 pagesCase StudyhitekshaNo ratings yet

- SubjectsDocument1 pageSubjectshitekshaNo ratings yet

- N. R. Institute of Business Management - NRPGDM Quiz 1 Semester VI Marks-20 Subject: Banking & Insurance (Minor Finance)Document1 pageN. R. Institute of Business Management - NRPGDM Quiz 1 Semester VI Marks-20 Subject: Banking & Insurance (Minor Finance)hitekshaNo ratings yet

- Case Study: Presenta TionDocument8 pagesCase Study: Presenta TionhitekshaNo ratings yet

- Stock LevelsDocument2 pagesStock Levelshiteksha100% (1)

- Pashmina Industry PVT LTD: Balance Sheet For The Year of 2007Document1 pagePashmina Industry PVT LTD: Balance Sheet For The Year of 2007hitekshaNo ratings yet

- PracticalsDocument1 pagePracticalshitekshaNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document4 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)hitekshaNo ratings yet

- Particulars AMT Particular: Profit and Loss Statement For The Year EndedDocument10 pagesParticulars AMT Particular: Profit and Loss Statement For The Year EndedhitekshaNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document5 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)hitekshaNo ratings yet

- Taxmann Publications Pvt. LTD.: Books Available at - .Document6 pagesTaxmann Publications Pvt. LTD.: Books Available at - .hitekshaNo ratings yet

- Kauffman vs. PNB (GR No. 16454)Document1 pageKauffman vs. PNB (GR No. 16454)Katharina Canta100% (1)

- Topic: 1.1 What Is Accounting? 1.2 Who Uses The Accounting Data 1.3 The Basic Accounting EquationDocument6 pagesTopic: 1.1 What Is Accounting? 1.2 Who Uses The Accounting Data 1.3 The Basic Accounting EquationAnn Ameera OraisNo ratings yet

- Questions Asked by Companies in InterviewDocument9 pagesQuestions Asked by Companies in Interviewrathoreabhijeet6No ratings yet

- European Union: Post Crisis Challenges and Prospects For GrowthDocument292 pagesEuropean Union: Post Crisis Challenges and Prospects For GrowtharmandoibanezNo ratings yet

- Consumer Banking ProductsDocument142 pagesConsumer Banking ProductsSami Ullah NisarNo ratings yet

- CV M.Salim Ullah KhanDocument10 pagesCV M.Salim Ullah KhanMuhammad Salim Ullah KhanNo ratings yet

- Travis Kalanick and UberDocument3 pagesTravis Kalanick and UberHarsh GadhiyaNo ratings yet

- ACCT 304 Auditing: Session 1 - Overview of AuditingDocument20 pagesACCT 304 Auditing: Session 1 - Overview of Auditingjeff bansNo ratings yet

- Cash and Cash Equivalents: Problem 1Document4 pagesCash and Cash Equivalents: Problem 1Hannah SalcedoNo ratings yet

- 4 Tangible Fixed Assets: DR CR 000 000Document7 pages4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNo ratings yet

- Teofisto Guingona, Jr. v. City Fiscal of Manila, G.R. No. 60033Document2 pagesTeofisto Guingona, Jr. v. City Fiscal of Manila, G.R. No. 60033xxxaaxxxNo ratings yet

- Business CommunicationsDocument22 pagesBusiness CommunicationsPrince DiuNo ratings yet

- Executive SummaryDocument4 pagesExecutive SummaryalvinsoesiloNo ratings yet

- Sahulat Takaful PlanDocument7 pagesSahulat Takaful PlanMuhammad IrfanNo ratings yet

- LB ph2 Sample Paper 20032019Document20 pagesLB ph2 Sample Paper 20032019Tikendra ChandraNo ratings yet

- Final Work 18-Arid-5983 R Internship ReportDocument34 pagesFinal Work 18-Arid-5983 R Internship ReportRaja Muhammad NomanNo ratings yet

- LIC Housing FinDocument18 pagesLIC Housing FinvishalNo ratings yet

- My Portfolio: For Any Query You Can Contact at Paul-Prasenjit@yahoo - Co.in Blog: Commerceclub - inDocument5 pagesMy Portfolio: For Any Query You Can Contact at Paul-Prasenjit@yahoo - Co.in Blog: Commerceclub - inYaniNo ratings yet

- Encore Real Estate Investment Services Is Pleased To Announce The Sale of A Class "A" Single Tenant Office BuildingDocument3 pagesEncore Real Estate Investment Services Is Pleased To Announce The Sale of A Class "A" Single Tenant Office BuildingPR.comNo ratings yet

- Module 7 - Tax ExercisesDocument3 pagesModule 7 - Tax ExercisesjessafesalazarNo ratings yet

- Bank StatementsDocument4 pagesBank StatementshanhNo ratings yet

- Activity 2-2 Case AnalysisDocument3 pagesActivity 2-2 Case AnalysisJazzie SorianoNo ratings yet

- Impact of Real Estate Sector To The Economic Growth of Nigeria UniprojectmaterDocument10 pagesImpact of Real Estate Sector To The Economic Growth of Nigeria UniprojectmaterdejireNo ratings yet

- 4B Merc 2 Insurance Credit Trans PPSADocument203 pages4B Merc 2 Insurance Credit Trans PPSAMica Joy FajardoNo ratings yet

- Joint - and - Solidarity (1) Bsa 1aDocument47 pagesJoint - and - Solidarity (1) Bsa 1aBernadette Ruiz AlbinoNo ratings yet

- SparcDocument80 pagesSparcPriyanka KumarNo ratings yet

Iisl Marketupdate - September2012: Market Statistics

Iisl Marketupdate - September2012: Market Statistics

Uploaded by

hitekshaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iisl Marketupdate - September2012: Market Statistics

Iisl Marketupdate - September2012: Market Statistics

Uploaded by

hitekshaCopyright:

Available Formats

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

IISL MARKET UPDATE SEPTEMBER 2012

The benchmark index of the Indian capital market S&P CNX Nifty (Nifty 50) closed at 5703.30 points on September 28, 2012

representing a increase of 444.80 points (8.46 %), as compared to the closing value of 5258.50 points on August 31, 2012. During the

month of September 2012, S&P CNX Nifty touched a high of 5735.15 points on September 28, 2012. The free float market

capitalization of S&P CNX Nifty increased from Rs. 16,45,120.44 crores on August 31, 2012 to Rs. 18,01,491.33 crores on September

28, 2012, i.e. a increase of Rs.156370.89 crores (9.51 %).

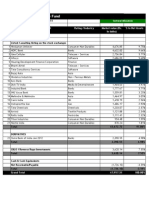

Market Statistics: :

Indices

Index Closing value on

28-Sep-12

S&P CNX Nifty

CNX Nifty Junior

CNX 100

CNX Bank

CNX IT

CNX Midcap

S&P CNX 500

5703.30

11042.75

5583.75

11456.80

6313.80

7840.55

4504.35

31-Aug-12

5258.50

9892.15

5126.30

9990.50

6072.35

7065.85

4129.90

28-Sep-12

Change

(%)

8.46

11.63

8.92

14.68

3.98

10.96

9.07

High

5735.15

11073.75

5611.60

11536.85

6643.80

7875.05

4524.40

Low

5215.70

9851.55

5092.05

9814.05

6031.95

7065.10

4110.80

IISL Index News:

Guidelines for determining Investible Weight Factor (IWF) for all IISL indices using free float market capitalization method.

http://www.nseindia.com/products/content/equities/indices/invest_w_fac.htm

For all other IISL Press Releases please visit below mentioned link.

For more information on IISL Indices, please visit below mentioned link.

http://www.nseindia.com/content/indices/ind_pressreleases.htm

http://www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

Overall Indian Equity Market Performance:

Returns and Volatility of select Indices during September 2012

Indices

Average Daily

Return

Volatility of

Daily Returns

S&P CNX NIFTY

0.42

0.94

CNX NIFTY JUNIOR

0.56

0.65

CNX 100

0.44

0.86

CNX BANK INDEX

0.71

1.54

S&P CNX 500 Equity Index

0.44

0.78

CNX IT INDEX

0.19

1.10

CNX Midcap Index

0.52

0.67

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

Top 10 Turnover Statistics on Cash Market Segment September 2012

Scrips

No. of Trades

2211480

2595551

1847404

885179

2038175

1524770

2153003

870130

1168494

State Bank of India

United Spirits Ltd.

ICICI Bank Ltd.

Cairn India Ltd.

Axis Bank Ltd.

Reliance Industries Ltd.

Tata Motors Ltd.

Infosys Ltd.

Larsen & Toubro Ltd.

Housing Development Finance Corporation Ltd.

Total - Top 10

Total - Universe

Traded Qty

51994103

94485767

78899973

234309503

63866260

75589654

207335990

18675519

30759812

Turnover

(Rs. in Mn.)

106667

99928

78948

76832

66130

62625

54144

47582

45865

Avg. Daily

Turnover

(Rs. Mn.)

5,333

4,996

3,947

3,842

3,307

3,131

2,707

2,379

2,293

% in Total

Turnover

4.48

4.19

3.31

3.22

2.77

2.63

2.27

2.00

1.92

1200989

60069655

45435

2,272

1.91

16495175

915986236

684156

34208

28.70

116278330

14282999139

2383524

119189

100

FII Equity Investment:

FIIs were net buyers during the month of September 2012 with net inflow of Rs. 192.62 billion (USD 3560.57 million) as compared to

net inflow of Rs. 108.04 billion (USD 1945.35 million) during the previous (August 2012) month.

FII Investment

September-12

August-12

Change

Rs. Million

Rs. Million

Gross Purchases

667525

481365

38.67%

Gross Sales

474912

373325

27.21%

Net Investment

Net Investment

(US million $)

192615

108039

78.28%

3560.57

1945.35

83.03%

Source: SEBI website www.sebi.gov.in

Mutual Fund Equity Investment:

Mutual Funds were net sellers during the month of September 2012 with net outflow of Rs. -31.98 billion as compared to net outflow of

Rs-16.31 billion in the previous (August 2012) month.

Mutual Fund

Investment

September-12

August-12

Rs. Million

Rs. Million

Change (%)

Gross Purchases

104272

96707

7.82%

Gross Sales

136259

113018

20.56%

Net Investment

-31987

-16310

96.12%

Source: SEBI website - www.sebi.gov.in

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

Derivatives Index & Stock:

Total turnover in the derivatives segment for the month of Aug 2012 stood at Rs 2,432,168.60 Crores as against 2,591,948.50 Crores in

September 2012. Total F&O Turnover as a percentage of Cash Market turnover stood at 1079.13%.

Turnover in Crores

Derivative Segment

Change

(%)

September ' 2012

August ' 2012

151,127.65

148,456.61

1.80

109.03

52.4

108.07

48,673.41

43,236.07

12.58

349,877.40

315,698.94

10.83

1,809,747.53

1,731,940.36

4.49

59,510.51

39,634.74

50.15

164,569.06

143,841.49

14.41

2,591,948.50

2,432,168.60

6.57

1,079.13

1,187.15

S&P CNX Nifty Index Futures

CNX IT Futures

Bank Nifty futures

Individual Stock Futures

S&P CNX Nifty Index options

Bank Nifty Options

Individual Stock Options

Total F & O Turnover

Total F&O Turnover as % of Cash Market turnover

Exchange Traded Funds (ETFs):

Birla Sun Life Nifty ETF

S&P CNX Nifty

Corpus

Q2

Average

(Rs. Mn.)

30.43

253

15

0.64

57.66

1/100 of underlying

GS Nifty BeES

S&P CNX Nifty

5716.47

30345

20

904.12

578.04

1/10 of underlying

IIFL Nifty ETF

S&P CNX Nifty

198.70

5268

20

108.03

576.47

1/10 of underlying

Kotak Nifty ETF

S&P CNX Nifty

626.38

596

19

58.62

585.39

1/10 of underlying

QNIFTY - Quantum ETF

S&P CNX Nifty

19.29

80

16

1.57

586.46

1/10 of underlying

Religare Nifty ETF

S&P CNX Nifty

25.55

123

17

0.87

575.83

1/10 of underlying

1/10 of underlying

ETF

Underlying Index

Total No.

of Trades

No. of

Days

Traded

Last Price

Turnover

(Rs. Mn.)

28-Sep-12

Valuation of units

S&P CNX Nifty Shariah

8.61

101

18

0.43

125.24

GS PSU Bank BeEs

CNX PSU Bank

87.21

1147

20

7.82

354.58

1/10 of underlying

Kotak PSU

CNX PSU Bank

109.47

809

20

5.28

362.45

1/10 of underlying

GS S&P Shariah BeES

GS Junior BeES

M100

CNX Nifty Junior

839.41

4905

20

77.61

111.48

1/100 of underlying

CNX Midcap

1540.94

2139

20

24.90

8.03

1/1000 of underlying

GS Infra BeES

CNX Infrastructure Index

38.08

426

20

2.92

252.96

1/10 of underlying

GS Bank BeES

CNX Bank

610.36

3951

20

112.13

1165.94

1/10 of underlying

RELBANK

CNX Bank

116.51

289

18

2.43

1201.09

1/10 of underlying

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

International ETF launched on S&P CNX Nifty:

AUM in USD

as on 28 Sep

2012

ETF

Launched

Issuer

USD. Mn.

Exchanges where the ETF is listed

db X-trackers S&P CNX

Nifty ETF

Jul-07

Deutsche Bank AG

291.61

Deutsche Brse

London Stock Exchange

Euronext Paris

Singapore Stock Exchange

Swiss Exchange

Stuttgart Stock Exchange

Hong Kong Stock Exchange

Borsa Italiana

Stockholm Stock Exchange

iShares S&P CNX Nifty

India Swap ETF

Sep-10

Black Rock

Institutional Trust

Company

48.52

London Stock Exchange

Nov-09

Black Rock

Institutional Trust

Company

298.51

NASDAQ

Cross-Listed in Toronto Stock Exchange,

Bolsa de Santiago and Chilean Electronic

Exchange and Bolsa Mexicana de

Valores.

Lyxor ETF India

Sep-07

Lyxor

International Asset

Management (a

wholly owned

subsidiary of

Socit Gnrale)

NEXT FUNDS S&P

CNX Nifty Linked ETF

Nov-09

S&P CNX Nifty Futures

Index fund

XIE Shares India (S&P

CNX Nifty) ETF

iShares S&P India Nifty

50 Index Fund

29.42

Singapore Stock Exchange

London Stock Exchange

Nomura Asset

Management

43.43

Tokyo Stock Exchange

Oct-09

Nikko Asset

Management

12.29

Tokyo Stock Exchange

Feb-12

Enhanced

Investment

Products Ltd.

19.92

Hong Kong Stock Exchange

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

Index Funds:

Average AUM during

Sep 2012

NAV * as on

Rs. Mn.

28-Sep-12

Inception

Date

Underlying Index

Birla Sun Life Index Fund

17-Sep-02

S&P CNX Nifty

253.39

55.98

Canara Robeco Nifty Index

17-Sep-04

S&P CNX Nifty

42.81

30.28

Franklin India Index Fund

13-Jul-00

S&P CNX Nifty

2472.46

45.00

HDFC Index Fund

10-Jul-02

S&P CNX Nifty

815.61

49.30

ICICI Prudential Index Fund

25-Feb-02

S&P CNX Nifty

904.14

53.38

IDBI Nifty Fund

25-Jun-10

S&P CNX Nifty

1522.77

10.78

IDFC Nifty Fund

12-Apr-10

S&P CNX Nifty

120.19

11.16

LIC NOMURA MF Index Fund-Nifty

28-Nov-02

S&P CNX Nifty

312.47

31.84

Principal Index Fund

30-Jun-99

S&P CNX Nifty

168.26

38.88

Reliance Index Fund Nifty Plan

28-Sep-10

S&P CNX Nifty

700.33

9.44

SBI Magnum Index Fund

04-Feb-02

S&P CNX Nifty

363.18

48.80

Tata Index Fund Nifty

24-Feb-03

S&P CNX Nifty

82.32

34.23

Taurus Nifty Index Fund

19-Jun-10

S&P CNX Nifty

10.29

10.72

UTI - Nifty Index Fund

25-Feb-00

S&P CNX Nifty

1687.60

35.61

ICICI Prudential Nifty Junior Index Fund

25-Jun-10

CNX Nifty Junior

68.09

9.76

IDBI CNX Nifty Junior Index Fund

20-Sep-10

CNX Nifty Junior

456.81

8.66

Goldman Sachs S&P CNX 500 Fund

17-Nov-08

S&P CNX 500

733.18

19.12

IIFL Dividend Opportunities Index Fund

06-Jun-12

CNX Dividend Opportunities

215.35

10.95

Name of the Fund

* NAV for Growth option only.

Source: AMFI Website www.amfiindia.com

**Please note that upto September 2010, AUM was uploaded on AMFI Website on monthly basis. The AUM for each

quarter (90 days average) will be computed and uploaded on AMFI Website on the first working day of the following

month of every quarter, effective from quarter ending December 31, 2010.

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

International Indices:

Index Closing Values

Major Indices

28-Sep-12

S&P CNX Nifty

NASDAQ Composite

Dow Jones Indl Average

5703.30

31-Aug-12

Change

(%)

5258.50

8.46

3116.23

3066.96

1.61

13437.13

13090.84

2.65

S&P 500 US

1440.67

1406.58

2.42

FTSE 100

5742.10

5711.50

0.54

DAX

7216.15

6970.79

3.52

Hang Seng

20840.38

19482.57

6.97

Nikkei 225

8870.16

8839.91

0.34

Overall Sectoral Performance:

Best performing S&P CNX Industry sectors (Top 5):

Index Name

CONSTRUCTION

MEDIA & ENTERTAINMENT

PACKAGING

ENGINEERING

TRADING

% Change

22.68

20.78

19.93

18.32

16.92

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

Individual stock performance S&P CNX Nifty:

The benchmark index of the Indian capital market S&P CNX Nifty (Nifty 50) closed at 5703.30 points on September 28, 2012

representing a increase of 444.80 points (8.46 %), as compared to the closing value of 5258.50 points on August 31, 2012. During the

month of September 2012, S&P CNX Nifty touched a high of 5735.15 points on September 28, 2012. The free float market

capitalization of S&P CNX Nifty increased from Rs. 16,45,120.44 crores on August 31, 2012 to Rs. 18,01,491.33 crores on September

28, 2012, i.e. a increase of Rs.156370.89 crores (9.51 %).

During the month of September 2012, Jaiprakash Associates Ltd. was the biggest gainer in S&P CNX Nifty constituent list delivering a

positive return of 27.42 %, Ranbaxy Laboratories Ltd. was the biggest loser, delivering returns of -3.98 %, during the same month.

Sr.

No

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

Security Symbol

ACC

AMBUJACEM

ASIANPAINT

AXISBANK

BAJAJ-AUTO

BANKBARODA

BHARTIARTL

BHEL

BPCL

CAIRN

CIPLA

COALINDIA

DLF

DRREDDY

GAIL

GRASIM

HCLTECH

HDFC

HDFCBANK

HEROMOTOCO

HINDALCO

HINDUNILVR

ICICIBANK

IDFC

INFY

ITC

JINDALSTEL

JPASSOCIAT

KOTAKBANK

LT

LUPIN

M&M

MARUTI

NTPC

ONGC

PNB

POWERGRID

RANBAXY

Equity

Capital (Rs.)

1877452660

3079938872

959197790

4144422760

2893670200

4111233830

18987650480

4895200000

7230842480

19087293440

1605842714

63163644000

3397134518

849039565

12684774000

917406560

1388061768

3076775700

4719419210

399375000

1914579068

2161886533

11527275010

15133197120

2871155755

7846813020

934833818

4252866364

3716050845

1227621266

894035026

3069903780

1444550300

82454644000

42777450600

3391786830

46297253530

2111324745

FF MCAP^

September

28 2012 (Rs.

Crores)

13718

15326

17818

29520

24560

13424

31759

19510

9011

14452

19288

22673

8482

20799

17192

21047

15132

119133

114230

17943

15525

56058

122051

19027

122222

147814

16384

9318

24287

86112

14143

39579

17867

21485

49694

11181

17059

8129

Weightage

(%)

0.76

0.85

0.99

1.64

1.36

0.75

1.76

1.08

0.50

0.80

1.07

1.26

0.47

1.15

0.95

1.17

0.84

6.61

6.34

1.00

0.86

3.11

6.77

1.06

6.78

8.21

0.91

0.52

1.35

4.78

0.79

2.20

0.99

1.19

2.76

0.62

0.95

0.45

Beta

0.80

0.80

0.35

1.56

0.65

1.00

0.85

1.34

0.48

0.86

0.36

0.65

1.67

0.32

0.62

0.70

0.87

0.90

0.95

0.65

1.60

0.34

1.61

1.59

0.89

0.52

1.46

1.96

1.16

1.32

0.92

0.72

0.78

0.68

1.06

0.65

0.56

1.22

0.35

0.24

0.10

0.59

0.17

0.36

0.23

0.42

0.07

0.22

0.09

0.17

0.51

0.06

0.20

0.31

0.24

0.48

0.53

0.19

0.49

0.07

0.72

0.54

0.28

0.14

0.44

0.51

0.47

0.55

0.01

0.35

0.16

0.32

0.28

0.36

0.30

0.11

Volatility

(%)

Monthly

Return

1.35

1.71

1.00

3.02

1.18

2.41

2.05

3.33

1.38

1.97

1.70

1.54

2.63

1.50

1.56

1.26

1.27

1.46

0.98

1.39

2.44

1.43

2.33

2.60

1.44

1.75

3.59

2.66

1.39

2.17

1.78

1.37

1.44

1.33

1.34

2.45

1.41

1.54

12.35

9.01

8.08

14.54

13.16

26.26

7.12

15.80

4.14

-2.65

0.97

2.13

19.58

-1.90

7.80

10.85

6.07

5.32

5.68

6.65

16.23

5.97

17.36

15.22

7.34

1.77

21.30

27.42

13.00

18.91

0.48

13.31

18.13

0.03

1.79

24.20

0.88

-3.98

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

Avg. Impact

Cost

September

2012

0.06

0.06

0.07

0.06

0.07

0.06

0.06

0.06

0.06

0.05

0.05

0.06

0.06

0.05

0.07

0.07

0.06

0.06

0.07

0.05

0.07

0.05

0.07

0.07

0.05

0.05

0.07

0.08

0.08

0.06

0.07

0.07

0.05

0.06

0.08

0.06

0.07

0.06

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

39

40

41

42

43

44

45

46

47

48

49

50

RELIANCE

RELINFRA

SBIN

SESAGOA

SIEMENS

SUNPHARMA

TATAMOTORS

TATAPOWER

TATASTEEL

TCS

ULTRACEMCO

WIPRO

32374182590

2629900000

6710448380

869101423

680590050

1035581955

5415462482

2373072360

9712144500

1957220996

2740952350

4923662606

Total

138350

7277

57761

6677

6032

26136

47297

17321

26728

65998

19234

19729

1801491

7.68

0.40

3.21

0.37

0.33

1.45

2.63

0.96

1.48

3.66

1.07

1.10

1.67

1.48

1.33

1.36

0.95

1.79

0.45

1.61

1.08

1.43

0.74

0.67

0.54

0.46

0.50

0.44

0.38

0.13

0.46

0.34

0.55

0.16

0.18

0.17

1.99

3.02

2.15

2.96

1.47

1.10

2.33

1.45

2.33

1.69

1.41

1.63

9.24

21.05

21.95

-0.15

4.57

4.06

14.19

7.49

10.93

-3.56

16.17

5.09

* Beta & R2 are calculated for the period 01-Oct-2011 to 28-Sep-2012

* Beta measures the degree to which any portfolio of stocks is affected as compared to the effect

on the market as a whole.

* The coefficient of determination (R2) measures the strength of relationship between two variables

the return on a security versus that of the market.

* Volatility is the Std. deviation of the daily returns for the period 01-Sep-2012 to 28-Sep-2012

* Last day of trading was 28-Sep-2012

* Impact Cost for S&P CNX Nifty is for a portfolio of Rs. 50 Lakhs

* Impact Cost for S&P CNX Nifty is the weightage average impact cost

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

0.06

0.07

0.04

0.07

0.07

0.07

0.05

0.07

0.05

0.06

0.07

0.06

0.06

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

Individual stock performance CNX Nifty Junior

The CNX Nifty Junior closed at 11042.75 points on September 28, 2012 representing a decrease of 1150.60 points (11.63%) as

compared to 9892.15 points on August 31, 2012. During the month of September 2012, the CNX Nifty Junior touched a high of

11073.75 points as on September 28, 2012. The free float market capitalization of CNX Nifty Junior increased from Rs. 2,85,739.70

Crores on August 31, 2012, to Rs. 3,03,452.46 Crores on September 28, 2012 i.e. a increase of Rs. 17712.76 Crores (-1.38%).

During the month of September 2012 GMR Infrastructure Ltd. was the biggest gainer in CNX Nifty Junior constituent list delivering

positive returns of 36.26%, Glaxosmithkline Pharmaceuticals Ltd. was the biggest loser, delivering negative returns of -5.66%, during

the same month.

Sr.

No

Security Symbol

Equity

Capital (Rs.)

FF MCAP^

September

28 2012 (Rs.

Crores)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

ABIRLANUVO

ADANIENT

ADANIPORTS

APOLLOHOSP

ASHOKLEY

BAJAJHLDNG

BANKINDIA

BHARATFORG

BIOCON

BOSCHLTD

CANBK

COLPAL

CONCOR

CROMPGREAV

CUMMINSIND

DABUR

DIVISLAB

EXIDEIND

FEDERALBNK

GLAXO

GLENMARK

GMRINFRA

GODREJCP

GSKCONS

HINDPETRO

IDBI

IDEA

INDHOTEL

INDUSINDBK

JSWSTEEL

LICHSGFIN

MCDOWELL-N

MPHASIS

OFSS

PETRONET

PFC

RCOM

RECLTD

1135254410

1099810083

4006788200

695625795

2660676634

1112935100

5737803700

465588632

1000000000

313989000

4430000000

135992817

1299827940

1282983072

554400000

1742921211

265468580

850000000

1712115340

847030170

270692303

3892434782

340326031

420555380

3386272500

12783681060

33104691560

807472787

4694003330

2231172000

1009326000

1307949680

2101042170

419970645

7500000440

13200068830

10320134405

9874590000

4862

4434

5748

5710

3143

4876

5807

4122

1945

7901

6170

8043

4586

4717

6863

6990

6876

7037

7652

8278

5896

2758

7085

7175

5097

3435

6816

3395

12415

7930

8488

11066

2954

4965

4739

6554

4298

7155

Weightage

(%)

1.60

1.46

1.89

1.88

1.04

1.61

1.91

1.36

0.64

2.60

2.03

2.65

1.51

1.55

2.26

2.30

2.27

2.32

2.52

2.73

1.94

0.91

2.33

2.36

1.68

1.13

2.25

1.12

4.09

2.61

2.80

3.65

0.97

1.64

1.56

2.16

1.42

2.36

Beta

0.96

1.83

0.97

0.42

1.13

0.42

1.63

1.08

0.83

0.37

1.61

0.20

0.36

1.49

0.74

0.33

0.41

0.66

1.15

0.19

0.25

1.99

0.16

0.13

0.53

1.57

0.72

1.08

1.29

1.96

1.09

1.46

0.66

0.62

0.53

1.79

1.78

1.91

R2

0.33

0.37

0.19

0.04

0.32

0.11

0.55

0.39

0.24

0.13

0.56

0.03

0.07

0.37

0.20

0.08

0.11

0.15

0.50

0.04

0.02

0.42

0.01

0.01

0.09

0.62

0.15

0.38

0.52

0.55

0.41

0.20

0.14

0.13

0.11

0.48

0.51

0.55

Volatility

(%)

Monthly

Return

2.44

2.88

1.81

1.45

1.92

1.47

2.42

2.00

1.62

0.89

2.95

1.03

0.96

2.64

2.11

1.27

1.50

1.79

1.87

1.59

1.69

4.08

1.10

1.52

1.91

1.72

1.32

1.59

1.43

1.98

1.97

4.09

1.59

1.17

1.48

3.34

3.05

3.08

20.59

29.11

12.09

16.35

16.99

3.76

21.90

9.54

4.63

2.59

35.63

-0.02

2.06

16.87

9.84

4.45

-5.03

14.49

9.96

-5.66

-4.54

36.26

-3.37

1.53

3.37

19.18

14.27

14.07

12.24

9.12

17.37

25.48

4.63

1.14

3.78

17.87

34.44

15.66

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

Avg.

Impact

Cost

September

2012

0.08

0.09

0.10

0.13

0.13

0.15

0.09

0.08

0.08

0.10

0.07

0.08

0.18

0.10

0.11

0.07

0.10

0.10

0.09

0.11

0.08

0.14

0.12

0.12

0.08

0.08

0.08

0.10

0.10

0.07

0.08

0.07

0.12

0.09

0.08

0.08

0.11

0.09

India Index Services and Products Limited (IISL)

A Joint Venture of NSE and CRISIL

39

40

41

42

43

44

45

46

47

48

49

50

RELCAPITAL

RPOWER

SAIL

SRTRANSFIN

TATACHEM

TECHM

TITAN

TORNTPOWER

UNIONBANK

UNIPHOS

YESBANK

ZEEL

2456328000

28051264660

41305252890

2263540680

2547562780

1276149210

887786160

4724483080

5505490350

915122164

3553626990

955116027

Total

4860

5393

5006

7547

5635

3624

10884

2973

4679

4357

10039

10473

303452

1.60

1.78

1.65

2.49

1.86

1.19

3.59

0.98

1.54

1.44

3.31

3.45

1.93

1.59

1.36

0.96

0.65

0.71

1.08

0.67

1.53

0.80

1.58

0.70

0.52

0.42

0.40

0.26

0.28

0.17

0.28

0.15

0.45

0.17

0.56

0.17

2.78

2.19

2.69

1.26

1.03

1.29

1.30

3.67

2.70

1.57

2.14

2.36

34.91

28.87

9.27

-2.41

5.23

21.72

18.52

18.58

32.60

10.08

16.21

19.52

* Beta & R2 are calculated for the period 01-Oct-2011 to 28-Sep-2012

* Beta measures the degree to which any portfolio of stocks is affected as compared to the effect

on the market as a whole.

* The coefficient of determination (R2) measures the strength of relationship between two variables

the return on a security versus that of the market.

* Volatility is the Std. deviation of the daily returns for the period 01-Sep-2012 to 28-Sep-2012

* Last day of trading was 28-Sep-2012

* Impact Cost for CNX Nifty Junior is for a portfolio of Rs. 25 Lakhs

* Impact Cost for CNX Nifty Junior is the weightage average impact cost

India Index Services and Products Ltd. (IISL) Exchange Plaza, Plot No C/1, G Block, Bandra-Kurla Complex, Bandra (E),

Mumbai 400 051.

Tel: +91 22 26598385 / 86. Fax: +91 22 26598384. Email: iisl@nse.co.in, URL: www.nseindia.com/content/indices/ind_introduction.htm

0.06

0.09

0.08

0.09

0.08

0.05

0.09

0.14

0.10

0.10

0.06

0.10

0.09

You might also like

- REVOLUTCASEDocument20 pagesREVOLUTCASEFernandoValentinNo ratings yet

- Wrigley CaseDocument15 pagesWrigley CaseDwayne100% (4)

- Fundamental and Technical Analysis at Kotak Mahindra Mba Project ReportDocument108 pagesFundamental and Technical Analysis at Kotak Mahindra Mba Project ReportBabasab Patil (Karrisatte)67% (6)

- Nifty CalculationDocument25 pagesNifty Calculationpratz2706No ratings yet

- Hybrid FinancingDocument1 pageHybrid FinancinghitekshaNo ratings yet

- Research Paper On IPODocument5 pagesResearch Paper On IPOhitekshaNo ratings yet

- Reliance Industries Cost Sheet Ver. 1.0Document2 pagesReliance Industries Cost Sheet Ver. 1.0hiteksha62% (13)

- Valuation ReportDocument42 pagesValuation Reporthiteksha100% (2)

- Strategy EvaluationDocument8 pagesStrategy EvaluationRobert Dacus100% (1)

- Inter Process ProfitsDocument10 pagesInter Process ProfitsKella Pradeep100% (1)

- IISL UpdateDocument11 pagesIISL Updateanalyst_anil14No ratings yet

- Iisl Marketupdate - February 2013: Market StatisticsDocument11 pagesIisl Marketupdate - February 2013: Market StatisticshitekshaNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatednikhilNo ratings yet

- Indian Stock Exchange NSE and How Their Indices Are CalculatedDocument46 pagesIndian Stock Exchange NSE and How Their Indices Are CalculatedUrvashi SharmaNo ratings yet

- BSE Index & NSE Index For Last Ten Years (2004-5 To 2014-15)Document8 pagesBSE Index & NSE Index For Last Ten Years (2004-5 To 2014-15)Vinod PawarNo ratings yet

- Base Year Base Index Value Date of Launch Method of Calculation Number of ScripsDocument28 pagesBase Year Base Index Value Date of Launch Method of Calculation Number of Scripsnice_divyaNo ratings yet

- Mini Project On NseDocument19 pagesMini Project On Nsecharan tejaNo ratings yet

- 05aug2014 India DailyDocument73 pages05aug2014 India DailyChaitanya JagarlapudiNo ratings yet

- To: Kiritbhai Ramniklal ShahDocument11 pagesTo: Kiritbhai Ramniklal ShahPratik ShahNo ratings yet

- India Index Services & Products Ltd. (IISL)Document4 pagesIndia Index Services & Products Ltd. (IISL)Trinadh Kumar GuthulaNo ratings yet

- History of BSEDocument5 pagesHistory of BSEapuoctNo ratings yet

- Analysis of Risk Return Relationship inDocument59 pagesAnalysis of Risk Return Relationship inGautam BindlishNo ratings yet

- 10 Ijamtes 2015Document7 pages10 Ijamtes 2015KRISHNAM RAJU JANAMALANo ratings yet

- Nifty 50 Etfs' India Aum Crosses Rs. 1 Trillion: Press ReleaseDocument2 pagesNifty 50 Etfs' India Aum Crosses Rs. 1 Trillion: Press ReleaseShankar Reddy JammuladinneNo ratings yet

- Daily Market OutlookDocument5 pagesDaily Market OutlookshadabvakilNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Nifty: S.No. Company NameDocument5 pagesNifty: S.No. Company NameDurgesh AgnihotriNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Economic Indicators (IFS)Document2 pagesEconomic Indicators (IFS)Sunil NagpalNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Investment Anlysis and Portfolio Management: Project Report of Fundamental Analysis On Consumer Durable IndustryDocument27 pagesInvestment Anlysis and Portfolio Management: Project Report of Fundamental Analysis On Consumer Durable IndustryPatelMayurNo ratings yet

- Stock Market IndicesDocument11 pagesStock Market Indicesoureducation.inNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report Oct 31 2021Document15 pagesPPFCF PPFAS Monthly Portfolio Report Oct 31 2021muraliNo ratings yet

- Ind prs30052024Document2 pagesInd prs30052024mohan ramananNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- MBA Project On Fundamental and Technical Analysis of Kotak BankDocument109 pagesMBA Project On Fundamental and Technical Analysis of Kotak BankSneha MaskaraNo ratings yet

- InnovationsDocument4 pagesInnovationsMousami BanerjeeNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report December 31 2021Document15 pagesPPFCF PPFAS Monthly Portfolio Report December 31 2021Owners EstateNo ratings yet

- A Report OnDocument17 pagesA Report OnsachinktNo ratings yet

- Sun Pharma: Multi Commodity Exchange of India LTDDocument8 pagesSun Pharma: Multi Commodity Exchange of India LTDgargrahulNo ratings yet

- Sensex: Full Form of SENSEX - Stock Exchange Sensitive IndexDocument4 pagesSensex: Full Form of SENSEX - Stock Exchange Sensitive IndexLEKHITHMADANNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument54 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- UniQuest Equity Intelligence 16th NovemberDocument7 pagesUniQuest Equity Intelligence 16th NovemberC A Luve HotchandaniNo ratings yet

- December 2011Document4 pagesDecember 2011utkarshupsNo ratings yet

- Market - Outlook - 09 - 09 - 2015 1Document14 pagesMarket - Outlook - 09 - 09 - 2015 1PrashantKumarNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument52 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- CNX Nifty JRDocument4 pagesCNX Nifty JRsachinhs7No ratings yet

- Factsheet GSDocument18 pagesFactsheet GSbshriNo ratings yet

- EQUITY ANALYSIS WITH REPECT TO Automobile SectorDocument83 pagesEQUITY ANALYSIS WITH REPECT TO Automobile SectorSuraj DubeyNo ratings yet

- A Presentation By: (Group 7)Document10 pagesA Presentation By: (Group 7)Satish PeriNo ratings yet

- Nifty, Sensex A Long Way From Truly Representing The EconomyDocument22 pagesNifty, Sensex A Long Way From Truly Representing The Economyharsh_monsNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Overview NSEDocument26 pagesOverview NSEMinkil BansalNo ratings yet

- DSP BlackRock Focus 25 FundDocument1 pageDSP BlackRock Focus 25 FundRaasik JainNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Stock Market Indices in India: Raghunandan HelwadeDocument38 pagesStock Market Indices in India: Raghunandan HelwadeRaghunandan HelwadeNo ratings yet

- Dynamic Levels Morning Report 26th August 2016 UpDocument5 pagesDynamic Levels Morning Report 26th August 2016 UpSubham MazumdarNo ratings yet

- Index: PPLTVF PPLF PPTSF PPCHFDocument54 pagesIndex: PPLTVF PPLF PPTSF PPCHFTunirNo ratings yet

- NSE NIFTY and Its Correlation With Sectorial Indexes: Nagendra Marisetty and Haritha MDocument11 pagesNSE NIFTY and Its Correlation With Sectorial Indexes: Nagendra Marisetty and Haritha MSAI VAKANo ratings yet

- The Organisation: Associate/Affiliate CompaniesDocument6 pagesThe Organisation: Associate/Affiliate CompaniesnaseerjnNo ratings yet

- CNX Bank IndexDocument3 pagesCNX Bank IndexNidhi AgarwalNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Nifty Stock ExchangeDocument187 pagesNifty Stock Exchangeshrikantmane2753550% (1)

- CNX Nifty JuniorDocument4 pagesCNX Nifty JuniorVenkatesh GoudarNo ratings yet

- Stock Market Income Genesis: Internet Business Genesis Series, #8From EverandStock Market Income Genesis: Internet Business Genesis Series, #8No ratings yet

- Basic of DerivatiovesDocument12 pagesBasic of DerivatioveshitekshaNo ratings yet

- Financial ServicesDocument22 pagesFinancial ServiceshitekshaNo ratings yet

- Quiz 2 Subject: Banking & InsuranceDocument1 pageQuiz 2 Subject: Banking & InsurancehitekshaNo ratings yet

- Account CommonsizeDocument4 pagesAccount CommonsizehitekshaNo ratings yet

- Investing Lessons in Time of CovidDocument1 pageInvesting Lessons in Time of CovidhitekshaNo ratings yet

- Case StudyDocument11 pagesCase StudyhitekshaNo ratings yet

- SubjectsDocument1 pageSubjectshitekshaNo ratings yet

- N. R. Institute of Business Management - NRPGDM Quiz 1 Semester VI Marks-20 Subject: Banking & Insurance (Minor Finance)Document1 pageN. R. Institute of Business Management - NRPGDM Quiz 1 Semester VI Marks-20 Subject: Banking & Insurance (Minor Finance)hitekshaNo ratings yet

- Case Study: Presenta TionDocument8 pagesCase Study: Presenta TionhitekshaNo ratings yet

- Stock LevelsDocument2 pagesStock Levelshiteksha100% (1)

- Pashmina Industry PVT LTD: Balance Sheet For The Year of 2007Document1 pagePashmina Industry PVT LTD: Balance Sheet For The Year of 2007hitekshaNo ratings yet

- PracticalsDocument1 pagePracticalshitekshaNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document4 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)hitekshaNo ratings yet

- Particulars AMT Particular: Profit and Loss Statement For The Year EndedDocument10 pagesParticulars AMT Particular: Profit and Loss Statement For The Year EndedhitekshaNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document5 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)hitekshaNo ratings yet

- Taxmann Publications Pvt. LTD.: Books Available at - .Document6 pagesTaxmann Publications Pvt. LTD.: Books Available at - .hitekshaNo ratings yet

- Kauffman vs. PNB (GR No. 16454)Document1 pageKauffman vs. PNB (GR No. 16454)Katharina Canta100% (1)

- Topic: 1.1 What Is Accounting? 1.2 Who Uses The Accounting Data 1.3 The Basic Accounting EquationDocument6 pagesTopic: 1.1 What Is Accounting? 1.2 Who Uses The Accounting Data 1.3 The Basic Accounting EquationAnn Ameera OraisNo ratings yet

- Questions Asked by Companies in InterviewDocument9 pagesQuestions Asked by Companies in Interviewrathoreabhijeet6No ratings yet

- European Union: Post Crisis Challenges and Prospects For GrowthDocument292 pagesEuropean Union: Post Crisis Challenges and Prospects For GrowtharmandoibanezNo ratings yet

- Consumer Banking ProductsDocument142 pagesConsumer Banking ProductsSami Ullah NisarNo ratings yet

- CV M.Salim Ullah KhanDocument10 pagesCV M.Salim Ullah KhanMuhammad Salim Ullah KhanNo ratings yet

- Travis Kalanick and UberDocument3 pagesTravis Kalanick and UberHarsh GadhiyaNo ratings yet

- ACCT 304 Auditing: Session 1 - Overview of AuditingDocument20 pagesACCT 304 Auditing: Session 1 - Overview of Auditingjeff bansNo ratings yet

- Cash and Cash Equivalents: Problem 1Document4 pagesCash and Cash Equivalents: Problem 1Hannah SalcedoNo ratings yet

- 4 Tangible Fixed Assets: DR CR 000 000Document7 pages4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNo ratings yet

- Teofisto Guingona, Jr. v. City Fiscal of Manila, G.R. No. 60033Document2 pagesTeofisto Guingona, Jr. v. City Fiscal of Manila, G.R. No. 60033xxxaaxxxNo ratings yet

- Business CommunicationsDocument22 pagesBusiness CommunicationsPrince DiuNo ratings yet

- Executive SummaryDocument4 pagesExecutive SummaryalvinsoesiloNo ratings yet

- Sahulat Takaful PlanDocument7 pagesSahulat Takaful PlanMuhammad IrfanNo ratings yet

- LB ph2 Sample Paper 20032019Document20 pagesLB ph2 Sample Paper 20032019Tikendra ChandraNo ratings yet

- Final Work 18-Arid-5983 R Internship ReportDocument34 pagesFinal Work 18-Arid-5983 R Internship ReportRaja Muhammad NomanNo ratings yet

- LIC Housing FinDocument18 pagesLIC Housing FinvishalNo ratings yet

- My Portfolio: For Any Query You Can Contact at Paul-Prasenjit@yahoo - Co.in Blog: Commerceclub - inDocument5 pagesMy Portfolio: For Any Query You Can Contact at Paul-Prasenjit@yahoo - Co.in Blog: Commerceclub - inYaniNo ratings yet

- Encore Real Estate Investment Services Is Pleased To Announce The Sale of A Class "A" Single Tenant Office BuildingDocument3 pagesEncore Real Estate Investment Services Is Pleased To Announce The Sale of A Class "A" Single Tenant Office BuildingPR.comNo ratings yet

- Module 7 - Tax ExercisesDocument3 pagesModule 7 - Tax ExercisesjessafesalazarNo ratings yet

- Bank StatementsDocument4 pagesBank StatementshanhNo ratings yet

- Activity 2-2 Case AnalysisDocument3 pagesActivity 2-2 Case AnalysisJazzie SorianoNo ratings yet

- Impact of Real Estate Sector To The Economic Growth of Nigeria UniprojectmaterDocument10 pagesImpact of Real Estate Sector To The Economic Growth of Nigeria UniprojectmaterdejireNo ratings yet

- 4B Merc 2 Insurance Credit Trans PPSADocument203 pages4B Merc 2 Insurance Credit Trans PPSAMica Joy FajardoNo ratings yet

- Joint - and - Solidarity (1) Bsa 1aDocument47 pagesJoint - and - Solidarity (1) Bsa 1aBernadette Ruiz AlbinoNo ratings yet

- SparcDocument80 pagesSparcPriyanka KumarNo ratings yet