Professional Documents

Culture Documents

Currency Daily Report, June 13 2013

Currency Daily Report, June 13 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- International Construction Market Survey 2017Document100 pagesInternational Construction Market Survey 2017crainsnewyorkNo ratings yet

- Collection Agency Removal LetterDocument4 pagesCollection Agency Removal LetterKNOWLEDGE SOURCENo ratings yet

- Fixed Income SolutionDocument14 pagesFixed Income SolutionPham Minh DucNo ratings yet

- Exercises On GraphsDocument6 pagesExercises On GraphsDavid Gan50% (2)

- GCE O Level Principles of Accounts GlossaryDocument6 pagesGCE O Level Principles of Accounts Glossaryebookfish0% (1)

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 29Document4 pagesCurrency Daily Report, April 29Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 18Document4 pagesCurrency Daily Report, March 18Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 19Document4 pagesCurrency Daily Report, March 19Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 17 2013Document4 pagesCurrency Daily Report, May 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report May 6Document4 pagesCurrency Daily Report May 6Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, March 20Document4 pagesCurrency Daily Report, March 20Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, March 21Document4 pagesCurrency Daily Report, March 21Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 06 2013Document4 pagesCurrency Daily Report, June 06 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 22Document4 pagesCurrency Daily Report, February 22Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 21Document4 pagesCurrency Daily Report, February 21Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 7 2013Document4 pagesCurrency Daily Report, August 7 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 17 2013Document4 pagesCurrency Daily Report, July 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Calveta Dining ServicesDocument7 pagesCalveta Dining ServicesSmera Eliza Philip100% (2)

- IssuesDocument10 pagesIssuesMujahid AmeenNo ratings yet

- Swarnjayanti Gram Swarojgar Yojna 1999Document29 pagesSwarnjayanti Gram Swarojgar Yojna 1999Muzaffar HussainNo ratings yet

- Poa May 2002 Paper 2Document12 pagesPoa May 2002 Paper 2Jerilee SoCute Watts50% (4)

- Paper 2Document164 pagesPaper 2King Thomas0% (1)

- Valuation of Bonds and SharesDocument39 pagesValuation of Bonds and Shareskunalacharya5No ratings yet

- Final AccountsDocument65 pagesFinal AccountsAmit Mishra100% (1)

- Hba FormDocument3 pagesHba FormAteeqNo ratings yet

- Accounting CH 8Document29 pagesAccounting CH 8Nguyen Dac ThichNo ratings yet

- Capital of The CompanyDocument28 pagesCapital of The CompanyLusajo MwakibingaNo ratings yet

- History of Indian Debt MarketDocument14 pagesHistory of Indian Debt Marketbb2No ratings yet

- Lahore School of Economics. Advance Corporate Finance. MBA II - Winter 2014. Dr. Sohail ZafarDocument6 pagesLahore School of Economics. Advance Corporate Finance. MBA II - Winter 2014. Dr. Sohail Zafarsarakhan0622No ratings yet

- Why Marco Economics Is Important To ManagersDocument2 pagesWhy Marco Economics Is Important To ManagersMichelle Morrison75% (4)

- Managing Economic Exposure PDFDocument24 pagesManaging Economic Exposure PDFNilesh MandlikNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- Elasticity Approach To The Balance of PaymentDocument20 pagesElasticity Approach To The Balance of PaymentMd Najmus SaquibNo ratings yet

- Chapter 15 Suspense Accounts Q1 BastienDocument4 pagesChapter 15 Suspense Accounts Q1 Bastienmelody shayanwakoNo ratings yet

- Asian CrisisDocument2 pagesAsian CrisisTulam2011No ratings yet

- Chapter 04 - AnswerDocument9 pagesChapter 04 - AnswerCrisalie Bocobo0% (1)

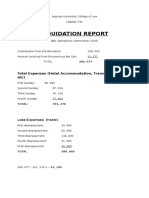

- Liquidation Report: Total Expenses (Hotel Accommodation, Transportation, Etc)Document3 pagesLiquidation Report: Total Expenses (Hotel Accommodation, Transportation, Etc)MaeJoyLoyolaBorlagdatanNo ratings yet

- Macroeconomics Vietnam's GDP and Growth RateDocument24 pagesMacroeconomics Vietnam's GDP and Growth RateHuy Quang NguyenNo ratings yet

- OddFalls Practice SetDocument28 pagesOddFalls Practice SetAntonio Jerome GageNo ratings yet

- Real Estate Mortgage - 2 Title - CorporationDocument2 pagesReal Estate Mortgage - 2 Title - CorporationgeorenceNo ratings yet

- Chapter 11 Money Demand and The Equilibrium Interest RateDocument6 pagesChapter 11 Money Demand and The Equilibrium Interest RatepenelopegerhardNo ratings yet

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaNo ratings yet

Currency Daily Report, June 13 2013

Currency Daily Report, June 13 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, June 13 2013

Currency Daily Report, June 13 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Currencies Daily Report

Thursday| June 13, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Reena Rohit Chief Manager Non-Agri Commodities and Currencies Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated o n currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Thursday| June 13, 2013

Highlights

World Bank cuts global growth forecast to 2.2 percent for 2013. Indias Industrial production declined to 2 percent in April. UKs Claimant Count Change declined by 8,600 in the last month. Fitch credit ratings shift India to stable growth outlook from negative. European Industrial Production gained by 0.4 percent in April. Asian markets are trading lower today on the back of cut in global growth forecast by the World Bank. It is expected that global economy will grow by 2.2 percent in current year from previous estimates of 2.4 percent in January and is below the growth of 2.3 percent in 2012. Indias Consumer Prices Index (CPI) fell to 9.31 percent in May as against a rise of 9.39 percent in April. Industrial production declined to 2 percent in April from rise of 2.5 percent a month ago. Manufacturing output also dropped and was at 2.8 percent in April as compared to increase of 3.2 percent in prior month.

Market Highlights (% change)

Last NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (July13) - $/bbl Comex Gold (Aug13) - $/oz Comex Silver(July13) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% Yield 5760.2 19041.1 14995.23 1612.5 16024.0 1959.2 58497.8 13289.3 95.88 1391.80 21.80 7133.50 102.09 0.0 Prev. day -0.5 -0.5 -0.8 -0.8 -1.6 -1.5 0.2 -0.2 0.5 1.1 0.7 0.9

as on June 12, 2013 WoW -2.8 -2.7 0.2 0.2 -5.6 0.0 10.8 -0.1 2.3 -1.7 -3.0 -4.1 2.4 MoM -3.7 -3.3 -1.8 -1.3 -9.0 -0.5 6.8 -13.6 1.7 0.3 -3.7 -9.1 -1.5 YoY 14.0 4.1 19.3 21.8 24.3 2.0 5.1 54.7 15.1 -13.7 -24.7 -3.3 -0.8

US Dollar Index

The US Dollar Index (DX) declined 0.2 percent in the yesterdays trading session on the back of expectations that Federal Reserve will reduce its bond buying program. However, sharp downside in currency was cushioned as a result of weak global markets which lead to increase in demand for low-yielding currency. The DX touched an intra-day low of 80.75 and closed at 80.95 on Wednesday.

Source: Reuters

US Dollar (% change)

Last Dollar Index US $ / INR (Spot) US $ / INR June13 Futures (NSE) US $ / INR June13 Futures (MCX-SX) 80.95 57.82 57.89 57.95 Prev. day -0.2 0.9 -1.16 -1.04 WoW -2.0 -1.7 1.61 1.72

as on June 12, 2013 MoM -3.6 -5.5 5.29 5.43 YoY 1.9 -3.9 3.58 3.70

Dollar/INR

The Indian Rupee appreciated 0.9 percent in yesterdays trading session. The currency appreciated on account of Fitch credit rating agency changed the economy growth outlook to stable from negative. Further, selling of dollars from exporters also supported an upside in the currency. However, sharp upside in the Rupee was capped as a result of weak global and domestic markets. Additionally, unfavorable industrial production data from the country prevented further positive movement in the Rupee. The currency touched an intra-day high of 57.72 and closed at 57.82 against dollar on Wednesday. For the month of June 2013, FII inflows totaled at Rs.138.90 crores ($29.36 million) as on 12th June 2013. Year to date basis, net capital inflows stood at Rs.83,344.0 crores ($15,382.30 million) till 12th June 2013. Outlook From the intra-day perspective, we expect Indian Rupee to depreciate on account of rise in risk aversion in the global market sentiments. Further, cut in the growth forecast for India by World Bank to 5.7 percent will add downside pressure on currency. However, sharp downside in currency will be cushioned on the back of weakness in DX along with stable economic growth for India by Fitch credit ratings.

Technical Chart USD/INR

Source: Telequote

Technical Outlook

Trend US Dollar/INR June13 (NSE/MCX-SX) Up

valid for June 13, 2013 Support 57.80/57.70 Resistance 58.20/58.35

www.angelbroking.com

Currencies Daily Report

Thursday| June 13, 2013

Euro/INR

The Euro appreciated 0.2 percent in the yesterdays trade on the back of weakness in the DX. Further, favorable industrial production data from the region also supported an upside in the currency. The Euro touched an intra-day high of 1.3359 and closed at 1.3336 against the dollar on Wednesday. However, sharp upside in Euro was capped on account of weak global markets. French Final Non-Farm Payrolls declined by 0.1 percent in Q1 of 2013. German Final Consumer Price Index (CPI) remained unchanged at 0.4 percent in May. French CPI rose by 0.1 percent in May as against a decline of 0.1 percent in April. European Industrial Production gained by 0.4 percent in April from earlier rise of 0.9 percent a month ago. Outlook In todays session, we expect the Euro to weaken on the back of rise in risk aversion in global markets. Additionally, forecast by the World Bank that Gross Domestic Product (GDP) growth in Euro Zone region will contract by 0.6 percent and growth in the region will also decline by 0.1 percent in 2013. This will exert downside pressure on the currency. However, weakness in the DX will cushion sharp fall in the Euro. Technical Outlook

Trend Euro/INR June13 (NSE/MCX-SX) Down 76.70/76.50 77.05/77.20 valid for June 13, 2013 Support Resistance

Euro (% change)

Last Euro /$ (Spot) Euro / INR (Spot) Euro / INR June 13 Futures (NSE) Euro / INR June13 Futures (MCX-SX) 1.3336 77.13 76.8 Prev. day 0.2 0.3 -1.16

as on June 12, 2013 WoW 1.9 -3.6 3.31 MoM 2.8 -8.4 7.62 YoY 6.2 -12.3 10.00

76.9

-1.14

3.36

7.70

10.07

Source: Reuters

Technical Chart Euro

Source: Telequote

GBP (% change)

Last $ / GBP (Spot) GBP / INR (Spot) GBP / INR June13 Futures (NSE) GBP / INR June 13 Futures (MCX-SX) 1.5677 90.721 90.51 Prev. day 0.20 -0.60 -0.54

as on June 12, 2013

GBP/INR

The Sterling Pound appreciated 0.2 percent in yesterdays trade on the back of weakness in the DX. Additionally, favorable Claimant Count Change data from the country acted as a positive factor for the currency. The Sterling Pound touched an intra-day high of 1.5699 and closed at 1.5677 against dollar on Wednesday. Sharp upside in currency was prevented on account of weak global markets. UKs Claimant Count Change declined by 8,600 in May as against a previous fall of 11,800 in April. Average Earnings Index increased by 1.3 percent in April from earlier increase of 0.6 percent a month ago. Unemployment Rate remained unchanged at 7.8 percent in the month of April. Outlook We expect the Sterling Pound to trade on a negative note on the back of weak global markets. Further, cut in global growth forecast by World Bank will add downside pressure on the currency. However, weakness in the DX will restrict sharp fall in the Sterling Pound. Technical Outlook

Trend GBP/INR June 13 (NSE/MCX-SX) Down valid for June 13, 2013 Support 90.40/90.20 Resistance 90.70/91.0

WoW 1.8 3.82 3.60

MoM 2.5 7.71 7.07

YoY 1.1 4.42 4.32

90.61

-0.42

3.70

7.19

4.46

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

www.angelbroking.com

Currencies Daily Report

Thursday| June 13, 2013

JPY/INR

JPY (% change) The Japanese Yen appreciated marginally 0.01 percent in the yesterdays trading session on the back of rise in risk aversion in the global markets which led to increase in demand for the low yielding currency. The Yen touched an intra-day high of 95.13 and closed at 96.0 against dollar on Wednesday. Outlook For intra-day, we expect the Japanese Yen to appreciate, taking cues from rise in risk aversion in the global markets, which will lead to increase in demand for the low-yielding currency. Technical Outlook

Trend JPY/INR June 13 (NSE/MCX-SX) Up valid for June 13, 2013 Support 59.70/59.54 Resistance 60.10/60.25 Last 96 0.6056 59.93 59.93 Prev day 0.0 -0.15 -0.63 -0.61 as on June 12, 2013 WoW -3.1 5.63 4.75 4.75 MoM -5.7 12.25 10.73 10.74 YoY 20.9 -13.70 -14.61 -14.60

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR June13 Futures (NSE) JPY 100 / INR June13 Futures (MCX-SX)

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on June 13, 2013

Indicator ECB Monthly Bulletin MPC Member Tucker Speaks Core Retail Sales m/m Retail Sales m/m Unemployment Claims Import Prices m/m Business Inventories m/m Country Euro UK US US US US US Time (IST) 1:30pm 5:45pm 6:00pm 6:00pm 6:00pm 6:00pm 7:30pm Actual Forecast 0.3% 0.4% 354K 0.1% 0.3% Previous -0.2% 0.1% 346K -0.5% 0.0% Impact Medium Medium High High High Medium Medium

www.angelbroking.com

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- International Construction Market Survey 2017Document100 pagesInternational Construction Market Survey 2017crainsnewyorkNo ratings yet

- Collection Agency Removal LetterDocument4 pagesCollection Agency Removal LetterKNOWLEDGE SOURCENo ratings yet

- Fixed Income SolutionDocument14 pagesFixed Income SolutionPham Minh DucNo ratings yet

- Exercises On GraphsDocument6 pagesExercises On GraphsDavid Gan50% (2)

- GCE O Level Principles of Accounts GlossaryDocument6 pagesGCE O Level Principles of Accounts Glossaryebookfish0% (1)

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 29Document4 pagesCurrency Daily Report, April 29Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 18Document4 pagesCurrency Daily Report, March 18Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 19Document4 pagesCurrency Daily Report, March 19Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 17 2013Document4 pagesCurrency Daily Report, May 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report May 6Document4 pagesCurrency Daily Report May 6Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, March 20Document4 pagesCurrency Daily Report, March 20Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, March 21Document4 pagesCurrency Daily Report, March 21Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 06 2013Document4 pagesCurrency Daily Report, June 06 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 22Document4 pagesCurrency Daily Report, February 22Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 21Document4 pagesCurrency Daily Report, February 21Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 7 2013Document4 pagesCurrency Daily Report, August 7 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 17 2013Document4 pagesCurrency Daily Report, July 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Calveta Dining ServicesDocument7 pagesCalveta Dining ServicesSmera Eliza Philip100% (2)

- IssuesDocument10 pagesIssuesMujahid AmeenNo ratings yet

- Swarnjayanti Gram Swarojgar Yojna 1999Document29 pagesSwarnjayanti Gram Swarojgar Yojna 1999Muzaffar HussainNo ratings yet

- Poa May 2002 Paper 2Document12 pagesPoa May 2002 Paper 2Jerilee SoCute Watts50% (4)

- Paper 2Document164 pagesPaper 2King Thomas0% (1)

- Valuation of Bonds and SharesDocument39 pagesValuation of Bonds and Shareskunalacharya5No ratings yet

- Final AccountsDocument65 pagesFinal AccountsAmit Mishra100% (1)

- Hba FormDocument3 pagesHba FormAteeqNo ratings yet

- Accounting CH 8Document29 pagesAccounting CH 8Nguyen Dac ThichNo ratings yet

- Capital of The CompanyDocument28 pagesCapital of The CompanyLusajo MwakibingaNo ratings yet

- History of Indian Debt MarketDocument14 pagesHistory of Indian Debt Marketbb2No ratings yet

- Lahore School of Economics. Advance Corporate Finance. MBA II - Winter 2014. Dr. Sohail ZafarDocument6 pagesLahore School of Economics. Advance Corporate Finance. MBA II - Winter 2014. Dr. Sohail Zafarsarakhan0622No ratings yet

- Why Marco Economics Is Important To ManagersDocument2 pagesWhy Marco Economics Is Important To ManagersMichelle Morrison75% (4)

- Managing Economic Exposure PDFDocument24 pagesManaging Economic Exposure PDFNilesh MandlikNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- Elasticity Approach To The Balance of PaymentDocument20 pagesElasticity Approach To The Balance of PaymentMd Najmus SaquibNo ratings yet

- Chapter 15 Suspense Accounts Q1 BastienDocument4 pagesChapter 15 Suspense Accounts Q1 Bastienmelody shayanwakoNo ratings yet

- Asian CrisisDocument2 pagesAsian CrisisTulam2011No ratings yet

- Chapter 04 - AnswerDocument9 pagesChapter 04 - AnswerCrisalie Bocobo0% (1)

- Liquidation Report: Total Expenses (Hotel Accommodation, Transportation, Etc)Document3 pagesLiquidation Report: Total Expenses (Hotel Accommodation, Transportation, Etc)MaeJoyLoyolaBorlagdatanNo ratings yet

- Macroeconomics Vietnam's GDP and Growth RateDocument24 pagesMacroeconomics Vietnam's GDP and Growth RateHuy Quang NguyenNo ratings yet

- OddFalls Practice SetDocument28 pagesOddFalls Practice SetAntonio Jerome GageNo ratings yet

- Real Estate Mortgage - 2 Title - CorporationDocument2 pagesReal Estate Mortgage - 2 Title - CorporationgeorenceNo ratings yet

- Chapter 11 Money Demand and The Equilibrium Interest RateDocument6 pagesChapter 11 Money Demand and The Equilibrium Interest RatepenelopegerhardNo ratings yet

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaNo ratings yet