Professional Documents

Culture Documents

Daily Metals and Energy Report, June 14 2013

Daily Metals and Energy Report, June 14 2013

Uploaded by

Angel BrokingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Metals and Energy Report, June 14 2013

Daily Metals and Energy Report, June 14 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Friday| June 14, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Reena Rohit Chief Manager Non-Agri Currencies and Commodities Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. Thi s document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedbac k is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Friday| June 14, 2013

International Commodities

Overview

US Core Retail Sales increased by 0.3 percent in the last month. German Wholesale Price Index (WPI) declined by 0.4 percent in May. US Unemployment Claims declined to 334,000 for w/e on 7th June. Asian markets are trading higher today on the back of favorable economic data from US which beat the estimates. Further, expectations that Federal Reserve will make plans to keep the interest rates lower also supported an upside in global markets. US Core Retail Sales increased by 0.3 percent in May. Retail Sales rose by 0.6 percent in May as against a previous rise of 0.1 percent in April. Unemployment Claims declined by 12,000 to 334,000 for week ending on 7th June from earlier rise of 346,000 in prior week. Import Prices fell by 0.6 percent in last month as compared to drop of 0.7 percent in April. Business Inventories rose 0.3 percent in April with respect to decline of 0.1 percent a month ago. The US Dollar Index (DX) declined 0.3 percent in the yesterdays trading session on the back of better than forecast economic data from US. Further, rise in risk appetite in global markets in later part of the trade added downside pressure on the currency. Additionally, expectations of the Fed keeping interest rates low acted as a negative factor for the currency. The DX touched an intra-day low of 80.51 and closed at 80.74 on Thursday. The Indian Rupee depreciated 0.3 percent in yesterdays trading session. The currency depreciated on account of cut in the growth outlook of the economy to 5.7 percent by World Bank. Further, weak domestic markets coupled with disappointing statement from Finance Minister as no concrete steps were taken added downside pressure on the currency. However, sharp downside in the Rupee was cushioned as a result of weakness in the DX. Additionally, selling of dollars from exporters prevented sharp downside in the Rupee. The currency touched an intraday low of 58.56 and closed at 57.99 against dollar on Thursday. For the month of June 2013, FII outflows totaled at Rs.905.30 crores ($149.83 million) as on 13th June 2013. Year to date basis, net capital inflows stood at Rs.82,299.80 crores ($15,203.10 million) till 13th June 2013.

Market Highlights (% change)

Last INR/$ (Spot) 57.99 Prev day -0.3

as on 13 June, 2013 w-o-w -1.9 m-o-m -5.8 y-o-y -3.9

$/Euro (Spot)

1.3374

0.3

1.0

3.5

5.9

Dollar Index NIFTY

80.74

-0.3

-1.0

-3.6

1.6

5699.1

-1.1

-3.8

-4.9

11.3

SENSEX

18827.2

-1.1

-3.5

-4.5

2.9

DJIA

15176.1

1.2

0.9

-0.4

21.4

S&P

1636.4

1.5

0.9

0.2

24.4

Source: Reuters

The Euro appreciated 0.3 percent in the yesterdays trade on the back of weakness in the DX. Further, upbeat global markets in the later part of the trade also supported an upside in the currency. The Euro touched an intra-day high of 1.339 and closed at 1.3374 against the dollar on Thursday. However, sharp upside in Euro was capped on account of unfavourable economic data from Germany. German Wholesale Price Index (WPI) declined by 0.4 percent in May from earlier fall of 0.2 percent a month ago.

www.angelcommodities.com

Commodities Daily Report

Friday| June 14, 2013

International Commodities

Bullion Gold

Spot gold prices declined by around 0.2 percent in yesterdays trading session on the back of rise in risk appetite in the global markets in later part of the trade which led to fall in safe haven demand. Further, expectations that Fed will keep the interest rates lower also added downside pressure on prices. The yellow metal touched an intra-day low of $1374.09/oz and closed at $1385.40/oz in yesterdays trade. However, sharp downside in the prices was cushioned as a result of weakness in the DX. In the Indian markets, prices ended on a negative note, declining 0.7 percent and closed at Rs.27766/10 gms after touching an intra-day low of Rs. 27711/10 gms on Thursday. Depreciation in the Rupee prevented sharp fall in prices on the MCX. Market Highlights - Gold (% change)

Gold Gold (Spot) Unit $/oz Last 1385.4 Prev. day -0.2 as on 13 June, 2013 WoW -2.0 MoM -2.8 YoY -14.6

Gold (Spot Mumbai) Gold (LBMA-PM Fix) Comex Gold (August13) MCX Gold (August13)

Rs/10 gms $/oz

27890.0

1.0

1.1

4.5

-7.6

1385.0

0.2

-1.1

-3.4

-14.2

$/oz

1377.6

0.0

-2.7

-0.7

-14.6

Rs /10 gms

27766.0

-0.7

-0.5

4.0

-7.8

Source: Reuters

Silver

Taking cues from fall in gold prices along with downside in base metals group, Spot silver prices fell 0.3 percent in yesterdays trade. The white metal touched an intra-day low of $21.55/oz and closed at $21.80/oz in yesterdays trading session. However, sharp downside in prices was cushioned as a result of weakness in the DX. On the domestic front, prices dropped 0.7 percent and closed at Rs.43,235/kg after touching an intra-day low of Rs.43,180/kg on Thursday.

Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (July13) MCX Silver (July13) Unit $/oz Rs/1 kg Last 21.8 44800.0 Prev day -0.3 0.7

as on 13 June, 2013 WoW -3.5 -1.2 MoM -6.7 -1.1 YoY -23.8 -19.3

$/oz $/ oz

2183.0 21.6

0.2 -1.0

-3.5 -4.9

-6.9 -4.7

-24.4 -25.4

Rs / kg

43235.0

-0.7

-2.9

-2.9

-20.6

Outlook

In todays session, we expect precious metals to trade lower on the back of rise in risk appetite in global markets thereby leading to fall in safe haven demand. Further, expectations that Fed will maintain its interest rates will exert downside pressure on prices. However, weakness in the DX will cushion sharp fall in prices. In the Indian markets, appreciation in the Rupee will add downside pressure on prices. Technical Outlook

Unit Spot Gold MCX Gold Aug13 Spot Silver MCX Silver July13 $/oz Rs/10 gms $/oz Rs/kg valid for June 14, 2013 Support 1378/1373 27650/27550 21.55/21.40 42900/42600 Resistance 1389/1396 27870/28000 21.95/22.30 43700/44300

Source: Reuters

Technical Chart Spot Gold

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Friday| June 14, 2013

International Commodities

Energy Crude Oil

Nymex crude oil prices increased around 0.8 percent in yesterdays trading session, taking cues from weakness in the DX. Additionally, favorable economic data from US led to expectations of increase in demand for the fuel. Crude oil prices touched an intra-day high of $96.92/bbl and closed at $96.70/bbl on Thursday. Additionally, decline in US jobless claims data shows that economy is growing and acted as a positive factor for prices. On the domestic bourses, prices gained 0.2 percent and the commodity closed at Rs.5,571/bbl, after touching an intra-day high of Rs.5,583/bbl in yesterdays trade. Depreciation in the Rupee supported an upside in prices on the MCX. Market Highlights - Crude Oil (% change)

Crude Oil Brent (Spot) Nymex Crude (July 13) ICE Brent Crude (July13) MCX Crude (June 13) Unit $/bbl $/bbl Last 104.1 96.7 Prev. day -0.2 0.8 WoW 0.5 2.0 as on 13 June, 2013 MoM 1.2 1.6 YoY 7.1 17.0

$/bbl

104.3

0.7

0.6

1.6

7.4

Rs/bbl

5571.0

0.2

3.1

7.3

19.5

Source: Reuters

Market Highlights - Natural Gas

Natural Gas (NG) Nymex NG MCX NG (June 13) Unit $/mmbtu Rs/ mmbtu Last 3.822 221.1

(% change)

as on 13 June, 2013

Natural Gas

Nymex natural gas prices gained by more than 1 percent yesterday on the back of less than expected rise in US natural gas inventories. Further, weakness in the DX supported an upside in prices. However, sharp upside in prices was capped as a result of expectations warm weather conditions. Gas prices touched an intra-day high of $3.85/mmbtu and closed at $3.822/mmbtu in yesterdays trade. On the domestic front, prices rose 1.2 percent on account of depreciation in the Rupee and closed at Rs.221.10/mmbtu after touching an intra-day high of Rs.223.70/mmbtu on Thursday. EIA Inventories Data US Energy Information Administration (EIA) released its weekly inventories yesterday and US natural gas inventory increased less than expectations by 95 billion cubic feet (bcf) which stood at 2.347 trillion cubic feet for the week ending on 7th June 2013. Outlook For todays trade, crude oil prices in the international markets are expected to trade on a higher note on the back of upbeat global markets coupled with weakness in the DX. Further, favorable economic data from US in yesterdays trade and Fed keeping the interest rates lower will support an upside in prices. Additionally, expectations of positive economic data from US and Euro Zone will be more optimistic for crude prices. Appreciation in the Indian Rupee will prevent sharp gained in prices on the MCX. Technical Outlook

Unit NYMEX Crude Oil MCX Crude June13 $/bbl Rs/bbl valid for June 14, 2013 Support 95.95/95.10 5530/5480 Resistance 97.35/98.05 5610/5650

Prev. day 1.1 1.2

WoW -0.70 1.14

MoM -2.92 2.74

YoY 74.44 79.46

Source: Reuters

Technical Chart NYMEX Crude Oil

Source: Telequote

Technical Chart NYMEX Natural Gas

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Friday| June 14, 2013

International Commodities

Base Metals

The base metals pack traded lower yesterday on the back of weak global markets in the early part of the trade and remained weak in the whole trading session. However, sharp downside in prices was cushioned on account of weakness in the DX along with favourable economic data from US. Further, decline in LME inventories also prevented sharp fall in prices. In the Indian markets, depreciation in the Rupee restricted further fall in prices on the MCX. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (June13) LME Aluminum (3 month) MCX Aluminum Rs /kg 106.2 -0.3 -3.7 5.1 -1.4 $/tonne 1860.0 -0.6 -5.2 0.2 -4.8 Rs/kg 408.4 -0.8 -2.1 2.1 -1.1 $/tonne Last 7062.0 Prev. day -1.0 as on 13 June, 2013 WoW -3.7 MoM -10.0 YoY -4.9

Copper

Copper prices fell 1 percent in yesterdays trade on the back of weak global markets in the prior part of the trade and continued to trade lower till the end. The red metal touched an intra-day low of $7011.25/tonne and closed at $7062.0/tonne in yesterdays trading session. However, sharp downside in prices was cushioned as a result of weakness in the DX coupled with favourable economic data from US. Further, decline in LME copper inventories by 0.2 percent which stood at 608,300 tonnes restricted sharp fall in prices. On the domestic front, prices fell 0.8 percent and closed at Rs. 408.40/kg, after touching an intra-day low of Rs 406.20/kg on Thursday. Depreciation in the Rupee prevented sharp fall in prices on the MCX. Outlook In todays session, we expect base metal prices to trade with a positive note on the back of upbeat global markets coupled with weakness in the DX. Additionally, favourable economic data from US in yesterdays trade along with forecast for optimistic data from US and Euro Zone in todays trade will act as a positive factor for prices. On the domestic bourses, appreciation in the Rupee will prevent sharp upside in prices. Technical Outlook

Unit MCX Copper June13 MCX Zinc June 13 MCX Lead June 13 MCX Aluminum June13 MCX Nickel June 13 Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for June 14, 2013 Support 406/403 105.0/104.20 120.0/119.20 105.50/104.80 812/807 Resistance 411/414 106.50/107.40 121.80/122.50 107.0/107.60 824/832

(June13) LME Nickel (3 month) MCX Nickel (June13) LME Lead (3 month) MCX Lead (June13) LME Zinc (3 month) MCX Zinc (June13)

Source: Reuters

$/tonne

14110.0

-1.1

-6.2

-6.7

-15.7

Rs /kg

818.5

-1.0

-4.4

-1.1

-12.3

$/tonne

2091.5

-1.4

-4.8

5.8

9.0

Rs /kg

121.0

-1.2

-3.2

11.8

13.5

$/tonne

1847.0

-1.2

-4.5

0.2

-1.9

Rs /kg

105.8

-1.0

-2.9

5.6

0.9

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 13 June 608,300 5,206,350 183,672 1,091,625 199,975

th

12 June 609,550 5,214,150 183,720 1,096,250 200,325

th

Actual Change -1,250 -7,800 -48 -4,625 -350

(%) Change -0.2 -0.1 0.0 -0.4 -0.2

Source: Reuters

Technical Chart LME Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Friday| June 14, 2013

International Commodities

Important Events for Today

Indicator Monetary Policy Meeting Minutes CPI y/y Core CPI y/y MPC Member McCafferty Speaks PPI m/m Core PPI m/m Current Account Capacity Utilization Rate Industrial Production m/m Prelim UoM Consumer Sentiment Country Japan Euro Euro UK US US US US US US Time (IST) 5:20am 2:30pm 2:30pm 3:20pm 6:00pm 6:00pm 6:00pm 6:45pm 6:45pm 7:25pm Actual Forecast 1.4% 1.2% 0.1% 0.1% -110B 77.9% 0.3% 84.9 Previous 1.4% 1.0% -0.7% 0.1% -110B 77.8% -0.5% 84.5 Impact Medium Medium Medium Medium High Medium Medium Medium Medium High

www.angelcommodities.com

You might also like

- Indian Rupee Crisis of 2013Document15 pagesIndian Rupee Crisis of 2013Harshal Phuse0% (2)

- Daily Metals and Energy Report, June 7 2013Document6 pagesDaily Metals and Energy Report, June 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 12 2013Document6 pagesDaily Metals and Energy Report, July 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 17 2013Document6 pagesDaily Metals and Energy Report, June 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 31 2013Document6 pagesDaily Metals and Energy Report, May 31 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 15Document6 pagesDaily Metals and Energy Report, March 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 13 2013Document6 pagesDaily Metals and Energy Report, June 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 11 2013Document6 pagesDaily Metals and Energy Report, July 11 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 18Document6 pagesDaily Metals and Energy Report, April 18Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 10 2013Document6 pagesDaily Metals and Energy Report, June 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 12 2013Document6 pagesDaily Metals and Energy Report, June 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 15 2013Document6 pagesDaily Metals and Energy Report, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 22 2013Document6 pagesDaily Metals and Energy Report, May 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 16 2013Document6 pagesDaily Metals and Energy Report, May 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 30 2013Document6 pagesDaily Metals and Energy Report, July 30 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 23 2013Document6 pagesDaily Metals and Energy Report, July 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 24 2013Document6 pagesDaily Metals and Energy Report, June 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 22 2013Document6 pagesDaily Metals and Energy Report, July 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 14 2013Document6 pagesDaily Metals and Energy Report, May 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 21Document6 pagesDaily Metals and Energy Report, February 21Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 16 2013Document6 pagesDaily Metals and Energy Report, July 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 27 2013Document6 pagesDaily Metals and Energy Report, June 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 20 2013Document6 pagesDaily Metals and Energy Report, June 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 5 2013Document6 pagesDaily Metals and Energy Report, June 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 18Document6 pagesDaily Metals and Energy Report, March 18Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 3 2013Document6 pagesDaily Metals and Energy Report, July 3 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 9 2013Document6 pagesDaily Metals and Energy Report, July 9 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 5 2013Document6 pagesDaily Metals and Energy Report, July 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 20 2013Document6 pagesDaily Metals and Energy Report, May 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 18 2013Document6 pagesDaily Metals and Energy Report, July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report January 16Document6 pagesDaily Metals and Energy Report January 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 19 2013Document6 pagesDaily Metals and Energy Report, June 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 6 2013Document6 pagesDaily Metals and Energy Report, August 6 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report 07 March 2013Document6 pagesDaily Metals and Energy Report 07 March 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 5 2013Document6 pagesDaily Metals and Energy Report, August 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 21 2013Document6 pagesDaily Metals and Energy Report, May 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 13 2013Document6 pagesDaily Metals and Energy Report, May 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 23 2013Document6 pagesDaily Metals and Energy Report, May 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 02Document6 pagesDaily Metals and Energy Report, April 02Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 12Document6 pagesDaily Metals and Energy Report, February 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 27 2013Document6 pagesDaily Metals and Energy Report August 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 13Document6 pagesDaily Metals and Energy Report, March 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 20Document6 pagesDaily Metals and Energy Report, February 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 19Document6 pagesDaily Metals and Energy Report, March 19Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 26Document6 pagesDaily Metals and Energy Report, April 26Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 26 2013Document6 pagesDaily Metals and Energy Report, July 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report Jan 04Document6 pagesDaily Metals and Energy Report Jan 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 10 2013Document6 pagesDaily Metals and Energy Report, May 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 23Document6 pagesDaily Metals and Energy Report, April 23Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 13Document6 pagesDaily Metals and Energy Report, February 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28 2013Document6 pagesDaily Metals and Energy Report August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 10Document6 pagesDaily Metals and Energy Report, April 10Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 25Document6 pagesDaily Metals and Energy Report, March 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 13 2013Document6 pagesDaily Metals and Energy Report, August 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 22 2013Document6 pagesDaily Metals and Energy Report, August 22 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- International Financial Management-1Document180 pagesInternational Financial Management-1Ramu LaxmanNo ratings yet

- Asian CurrencyDocument62 pagesAsian CurrencyDemar DalisayNo ratings yet

- SL Paper1Document65 pagesSL Paper1Mariana BritoNo ratings yet

- WWW - Edutap.co - In: Forex Markets - Video 1Document51 pagesWWW - Edutap.co - In: Forex Markets - Video 1SaumyaNo ratings yet

- SU1. Open Economy Free Trade and Protectionism Bop Exchange Rate Currency ConvertibilityDocument69 pagesSU1. Open Economy Free Trade and Protectionism Bop Exchange Rate Currency ConvertibilityHarvinder SinghNo ratings yet

- One Rupee SchemeDocument6 pagesOne Rupee SchemeSaravananNo ratings yet

- Demonitization and Its Impact On Indian EconomyDocument59 pagesDemonitization and Its Impact On Indian EconomyMohit Agarwal100% (1)

- Exim BankDocument43 pagesExim Banksamier shoaib100% (2)

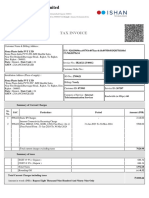

- IshaanDocument2 pagesIshaanNikunjNanduNo ratings yet

- August InvoiceDocument1 pageAugust Invoicecindyshweta95No ratings yet

- Losd00935400 In37230002813 B 16062023 0613071Document1 pageLosd00935400 In37230002813 B 16062023 0613071Rajesh MaddiNo ratings yet

- Cad To Inr - Google SearchDocument1 pageCad To Inr - Google Searchkrishnakul1512No ratings yet

- 2.3.2 Base Currency Information: Fundamentals of Tally - ERP 9Document1 page2.3.2 Base Currency Information: Fundamentals of Tally - ERP 9isaacNo ratings yet

- Project On Everything You WantDocument2 pagesProject On Everything You Wantravi prakash srivastavNo ratings yet

- Tax Invoice - LBS 2022-23 116 - 10 - 11 - 22Document1 pageTax Invoice - LBS 2022-23 116 - 10 - 11 - 22Atul KhadkeNo ratings yet

- Currency Converter in Python Project WebDocument6 pagesCurrency Converter in Python Project WebYouNo ratings yet

- RBI Master Circular On Risk Management and Inter-Bank DealingsDocument85 pagesRBI Master Circular On Risk Management and Inter-Bank DealingsRushabh DagliNo ratings yet

- Kitgum Business Institute: 2.0 How To Create Company in Tally Erp9Document10 pagesKitgum Business Institute: 2.0 How To Create Company in Tally Erp9oloka GeorgeNo ratings yet

- Socio Economic Classes of IndiaDocument14 pagesSocio Economic Classes of Indiaakka-47100% (4)

- Test - Admission of Partner - SolutionDocument8 pagesTest - Admission of Partner - SolutionPooja KukrejaNo ratings yet

- 24022200120711SBIN ChallanReceiptDocument1 page24022200120711SBIN ChallanReceiptRem ZemeyNo ratings yet

- Current Affairs 2023 Questions and Answers November 17Document27 pagesCurrent Affairs 2023 Questions and Answers November 17ShabbirNo ratings yet

- Border Road Organisation Chief Engineer Project Sampark: (Ministry of Defence) Government of IndiaDocument130 pagesBorder Road Organisation Chief Engineer Project Sampark: (Ministry of Defence) Government of IndiaER Rajesh MauryaNo ratings yet

- Brij Narain Indian Economic Life Prices WagesDocument293 pagesBrij Narain Indian Economic Life Prices WagesNajaf Haider0% (1)

- Demonetisation and Its Impact On Indian EconomyDocument57 pagesDemonetisation and Its Impact On Indian Economysargun kaurNo ratings yet

- Creating and Administering Analytics and Reports For SCMDocument146 pagesCreating and Administering Analytics and Reports For SCMRaghavendra KuthadiNo ratings yet

- To Be Provided On The Letterhead of The Certifying Chartered Accountant/ Company SecretaryDocument2 pagesTo Be Provided On The Letterhead of The Certifying Chartered Accountant/ Company Secretaryharinder singhNo ratings yet

- 3 - Arbitrage Through Forward RateDocument13 pages3 - Arbitrage Through Forward RateNishtha GuptaNo ratings yet

- Tokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To ADocument9 pagesTokyo, Japan (April 11, 2014) - As Announced in A Release Dated April 7, 2014, Pursuant To AnarayanasamNo ratings yet