Professional Documents

Culture Documents

Asia Insurance Review - Bermuda Vehicles in Asia - 03.12.12

Asia Insurance Review - Bermuda Vehicles in Asia - 03.12.12

Uploaded by

Appleby123Copyright:

Available Formats

You might also like

- Bowtie Hong Kong Draft 08-29-22Document15 pagesBowtie Hong Kong Draft 08-29-22isabellelyyNo ratings yet

- Globalization and Its Impact of Insurance Industry in IndiaDocument10 pagesGlobalization and Its Impact of Insurance Industry in IndiaRiaz Ahmed100% (1)

- Assaignment On Insurance DevelopmantDocument17 pagesAssaignment On Insurance DevelopmantShuvro RahmanNo ratings yet

- Progressive Final PaperDocument16 pagesProgressive Final PaperJordyn WebreNo ratings yet

- Micro Insurance ProjectDocument56 pagesMicro Insurance Projectßalram SinghNo ratings yet

- Advocis - Foran LLQP Suggested Study Schedule WITH KEY TERMSDocument36 pagesAdvocis - Foran LLQP Suggested Study Schedule WITH KEY TERMSikawoakoNo ratings yet

- Sun Life Financial and Indian Economic Surge: Case Analysis - International BusinessDocument9 pagesSun Life Financial and Indian Economic Surge: Case Analysis - International Businessgurubhai24No ratings yet

- Modern State and Trends of Implementation of Investment Activities of Insurance Companies in Developed CountriesDocument5 pagesModern State and Trends of Implementation of Investment Activities of Insurance Companies in Developed CountriesCentral Asian StudiesNo ratings yet

- Insurance Infographic Nov 2018Document3 pagesInsurance Infographic Nov 2018Šãćhįń ĆhõûdhärÿNo ratings yet

- Islamic Insurance in Bangladesh A Practical Case On Takaful Islami InsuranceDocument43 pagesIslamic Insurance in Bangladesh A Practical Case On Takaful Islami InsurancechoumaNo ratings yet

- Executive Summary: M.S.R.C.A.S.C BangaloreDocument72 pagesExecutive Summary: M.S.R.C.A.S.C BangaloreSubramanya Dg100% (2)

- Brief History of Insurance Company in BangladeshDocument6 pagesBrief History of Insurance Company in BangladeshSarjeel Ahsan Niloy100% (2)

- General Factors of SuccessDocument39 pagesGeneral Factors of SuccessMehulNo ratings yet

- Group 2 - InsuranceDocument14 pagesGroup 2 - InsuranceRehan TyagiNo ratings yet

- 05.19.16 - Shadow InsuranceDocument50 pages05.19.16 - Shadow InsurancePeter BullockNo ratings yet

- Impact of Liberlisation On The Insurance IndustryDocument46 pagesImpact of Liberlisation On The Insurance IndustryParag MoreNo ratings yet

- Group 1Document50 pagesGroup 1agparcoNo ratings yet

- Research Paper On Indian Insurance IndustryDocument7 pagesResearch Paper On Indian Insurance Industryebvjkbaod100% (1)

- Live Project FinalDocument25 pagesLive Project FinalAmanjotNo ratings yet

- Insurance Marketing in Indian EnvironmentDocument6 pagesInsurance Marketing in Indian EnvironmentPurab MehtaNo ratings yet

- CRM Amit PDFDocument93 pagesCRM Amit PDFKIPM College of ManagementNo ratings yet

- SSRN Id1594993Document23 pagesSSRN Id1594993shikha194No ratings yet

- Globalization and Its Impact of Insurance Industry in India: Riaz AhemadDocument10 pagesGlobalization and Its Impact of Insurance Industry in India: Riaz AhemadAlok NayakNo ratings yet

- Takaful Insurance Cover 1Document5 pagesTakaful Insurance Cover 1Derrick SamsonNo ratings yet

- Surety PricingDocument21 pagesSurety PricingMarian GrajdanNo ratings yet

- Max New York Life InsuranceDocument54 pagesMax New York Life InsurancedevveddNo ratings yet

- Financial Derivatives: A Perceived ValueDocument20 pagesFinancial Derivatives: A Perceived ValueIvan MendesNo ratings yet

- East Africa Insurance Industry OverviewDocument7 pagesEast Africa Insurance Industry OverviewsixfeetwonderNo ratings yet

- The Insurance Sector Came Into Being As There Was A Need To Financially Support People in The Time of NeedDocument3 pagesThe Insurance Sector Came Into Being As There Was A Need To Financially Support People in The Time of Needvitthal kendreNo ratings yet

- Financial Institution: S2 AssignmentDocument6 pagesFinancial Institution: S2 AssignmentIftikharUlHassanNo ratings yet

- Discussion Papers: Analysing The Determinants of Credit Risk For General Insurance Firms in The UKDocument43 pagesDiscussion Papers: Analysing The Determinants of Credit Risk For General Insurance Firms in The UKnely coniNo ratings yet

- Insurance CompanyDocument4 pagesInsurance CompanyMd. RobinNo ratings yet

- Changing Scenario of Insurance Industry: Shri Jagendra KumarDocument3 pagesChanging Scenario of Insurance Industry: Shri Jagendra KumarMadhuparna SenNo ratings yet

- Insurance: EFU General Insurance Limited - Analysis of Financial Statements Financial Year 2004 - 1Q 2010Document9 pagesInsurance: EFU General Insurance Limited - Analysis of Financial Statements Financial Year 2004 - 1Q 2010aminafridiNo ratings yet

- Executive SummaryDocument44 pagesExecutive SummaryAvinash LoveNo ratings yet

- Insurance Sector and GlobalizationDocument10 pagesInsurance Sector and GlobalizationJatin Arora50% (2)

- Customer Satisfaction of Life Insurance CompaniesDocument7 pagesCustomer Satisfaction of Life Insurance CompaniesGudiyaNo ratings yet

- The SolutionDocument7 pagesThe SolutionAnonymous y3E7iaNo ratings yet

- External EnvironmentDocument14 pagesExternal Environmentbhumiksab7No ratings yet

- The Growth and Potential of The Indian Insurance Industry: - Sample ArticleDocument12 pagesThe Growth and Potential of The Indian Insurance Industry: - Sample Articleiifra_waqarNo ratings yet

- Insurance and Society: How Regulation Affects The Insurance Industry's Ability To Fulfil Its RoleDocument32 pagesInsurance and Society: How Regulation Affects The Insurance Industry's Ability To Fulfil Its RoleEconomist Intelligence UnitNo ratings yet

- Global TrendsDocument10 pagesGlobal TrendsDivaxNo ratings yet

- Globalization of Insurance MarketDocument15 pagesGlobalization of Insurance MarketLuchian Ana-MariaNo ratings yet

- FM Case Study FinalDocument13 pagesFM Case Study Finalgellie villarinNo ratings yet

- Global Insurance Industry Insights An In-Depth PerspectiveDocument32 pagesGlobal Insurance Industry Insights An In-Depth PerspectiveSzilvia SzabóNo ratings yet

- Go Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Document12 pagesGo Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Mayur SoNo ratings yet

- From (Nikita Nehriya (Nikita - Nehriya@gmail - Com) ) - ID (128) - ProjectDocument17 pagesFrom (Nikita Nehriya (Nikita - Nehriya@gmail - Com) ) - ID (128) - ProjectNikhil AradheNo ratings yet

- Part-I Insurance: Chapter 1 - Introduction To InsuranceDocument66 pagesPart-I Insurance: Chapter 1 - Introduction To Insuranceselvaramesh nadarNo ratings yet

- Conceptual On Between Takaful and ConventionalDocument87 pagesConceptual On Between Takaful and ConventionalAbbas Al-RowaishNo ratings yet

- Lecture 11-The Funeral Assurance Industry & Short Term IndustryDocument5 pagesLecture 11-The Funeral Assurance Industry & Short Term IndustryMoses EagleNo ratings yet

- FRS & J.P. Morgan London Whale CaseDocument10 pagesFRS & J.P. Morgan London Whale CasedecalgosNo ratings yet

- Final Draft Report - 14 SeptDocument50 pagesFinal Draft Report - 14 Septneelove1No ratings yet

- Problems and Prospects of Insurance Buisness in Bangladesh 05Document40 pagesProblems and Prospects of Insurance Buisness in Bangladesh 05Zahirul Islam100% (2)

- Emerging InsuDocument15 pagesEmerging InsuSneha JadhavNo ratings yet

- Conduct of Business Regulation and Covid-19: A Review of The Gulf Insurance IndustryDocument14 pagesConduct of Business Regulation and Covid-19: A Review of The Gulf Insurance IndustryRAVI SONKARNo ratings yet

- Globalisation of Insurance SectorDocument68 pagesGlobalisation of Insurance SectorMonika BishtNo ratings yet

- IntermediariesDocument31 pagesIntermediariesrajesh_natarajan_4No ratings yet

- Re Insurance PaperDocument10 pagesRe Insurance PaperkissishaNo ratings yet

- Malhotra CommitteeDocument5 pagesMalhotra CommitteeBibhash RoyNo ratings yet

- Term Paper On Insurance and Business ConsiderationDocument5 pagesTerm Paper On Insurance and Business ConsiderationafdttatohNo ratings yet

- Notre Dame University Bangladesh Report On Reliance Insurance Limited'Document8 pagesNotre Dame University Bangladesh Report On Reliance Insurance Limited'Cm PunkNo ratings yet

- Development of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketFrom EverandDevelopment of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketNo ratings yet

- Insurance Law NotesDocument51 pagesInsurance Law NotesVina Cagampang100% (1)

- For ApprovalDocument10 pagesFor ApprovalPaulo VillarinNo ratings yet

- Market Risk Management: Eymen Errais, PHD, FRMDocument17 pagesMarket Risk Management: Eymen Errais, PHD, FRMMalek OueriemmiNo ratings yet

- Ic Exam Review: VariableDocument122 pagesIc Exam Review: VariableJL RangelNo ratings yet

- Chapter 1: Basics of Insurance: Let's BeginDocument27 pagesChapter 1: Basics of Insurance: Let's BeginAviNo ratings yet

- Introduction To The Concept of Risk and ReturnDocument31 pagesIntroduction To The Concept of Risk and ReturnSaish ChavanNo ratings yet

- HDFC Life Classic Assure Plus PlanDocument6 pagesHDFC Life Classic Assure Plus PlanPrashant ChaudharyNo ratings yet

- Travel Hassle-Free With... : Ask For HelpDocument3 pagesTravel Hassle-Free With... : Ask For HelpApex BasnetNo ratings yet

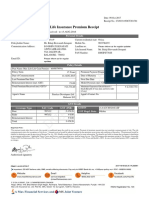

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Ak Iiap Mock-Exam-1Document8 pagesAk Iiap Mock-Exam-1joseph s. butawanNo ratings yet

- AIA PC Insurance BasicsDocument14 pagesAIA PC Insurance BasicsArnabNo ratings yet

- 400+ Stock Market TermsDocument150 pages400+ Stock Market TermsSandeep SharmaNo ratings yet

- TVM Pratice Question-1Document12 pagesTVM Pratice Question-1Neetu Dubey100% (2)

- Class Notes International FinancesDocument9 pagesClass Notes International FinancesMariabelen DoriaNo ratings yet

- The Scope of Marine InsuranceDocument25 pagesThe Scope of Marine InsuranceEbadur RahmanNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedMandar JadhavNo ratings yet

- SBI Life - Poorna Suraksha - Product GuideDocument2 pagesSBI Life - Poorna Suraksha - Product GuideVenkateswarlu BusamNo ratings yet

- Bcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFDocument3 pagesBcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFDeepak KumarNo ratings yet

- Final Exam PrepDocument46 pagesFinal Exam PrepM Fani MalikNo ratings yet

- Max Life Super Term Plan Prospectus PDFDocument12 pagesMax Life Super Term Plan Prospectus PDFFood Supply Headquarter ChandigarhNo ratings yet

- Financial Market PresentationDocument19 pagesFinancial Market PresentationVanshika GoyalNo ratings yet

- 7-Figures Earning EbookDocument8 pages7-Figures Earning EbookMuhammad AslamNo ratings yet

- The Oriental Insurance Company Limited: UIN: OICHLIP445V032021Document4 pagesThe Oriental Insurance Company Limited: UIN: OICHLIP445V032021hitesh315No ratings yet

- Life Insurence SiaDocument116 pagesLife Insurence Siabagi alekhya100% (1)

- Company ProfileDocument5 pagesCompany Profilemhashem_itiNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsDocument4 pagesTata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsRavi PrakashNo ratings yet

- Corporate FinanceDocument16 pagesCorporate FinanceAlgi GenaoNo ratings yet

Asia Insurance Review - Bermuda Vehicles in Asia - 03.12.12

Asia Insurance Review - Bermuda Vehicles in Asia - 03.12.12

Uploaded by

Appleby123Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asia Insurance Review - Bermuda Vehicles in Asia - 03.12.12

Asia Insurance Review - Bermuda Vehicles in Asia - 03.12.12

Uploaded by

Appleby123Copyright:

Available Formats

Bermuda Focus

The use of Bermuda vehicles in Asia

Mr Jeffrey Kirk of Appleby looks at the growing use of Bermuda insurance vehicles in Asia as more companies look for sophisticated services, products and flexible bespoke risk transfer mechanisms.

he global financial crisis continues to bite and, as is the case with other financial services sectors, the (re)insurance industry continues to face challenges emanating from the Eurozone debt crisis, low government yields and slowing growth coupled with increasing inflation. Notwithstanding the challenges, there are encouraging signs on the horizon for Asian (re)insurers. Whilst growth is expected to slow, the emerging Asian (re)insurance market is forecast to grow at a rate that will continue to outperform developed markets. AIAs CEO Mark Tucker has remarked that recent studies have revealed a protection gap of US$40 trillion in the life insurance sector in Asia and that this relates only to mortality cover; if health cover is added, that figure could double.

year. This follows an 11% growth in total gross premium written in 2010. Further, the continuing development of renminbi business is regarded as one of the growth engines for the Hong Kong (re)insurance industry. Growth in the primary insurance markets would also generally support growth in the reinsurance market. Some may question how these China (re)insurance growth views will, in fact, bear out once the final hard 2012 figures are released but the general outlook for 2013 is more optimistic.

The role of Bermuda (re)insurance vehicles

Bermuda is one of the worlds leading (re)insurance jurisdictions. A September 2012, A.M. Best report states that 15 of the worlds top 50 reinsurers are based in Bermuda. This figure does not include a number of Bermuda reinsurers whose holding companies are domiciled elsewhere but whom all make the top 50 and have substantial underwriting operations in Bermuda. In addition, Bermuda remains the worlds number one captive insurance domicile, with a total of 862 captives registered as at the end of 2011. Notwithstanding the global financial crisis, Bermuda has seen a significant increase (three-fold over the first quarter of 2012) in insurer registrations in the second quarter of 2012. This growth was driven predominantly by the increase in special purpose insurers (SPIs), which are popular vehicles employed in the issuance of catastrophe (CAT) bonds. In addition, a number of the new Bermuda reinsurance startups are backed by US hedge funds, which are a growing source of capital to the reinsurance market.

The burgeoning (re)insurance market in China

In 2011, the real growth rate of life insurance in China was weak, estimated by Swiss Re at -6%. However, the expectation is that life insurance premiums will grow in China, possibly at real rates of as high as 11% over 2012. The market view is that this growth in the protection-type products, added to the demand for annuities and health products, bodes well. In the non-life insurance sector, premium growth in China was strong, estimated at 15% in 2011. Increasing demand for car ownership as well as health and personal accident products may continue to drive this growth. In Hong Kong, the Commissioner of Insurance reported growth in both the life and non-life sectors over the past

60

www.asiainsurancereview.com

November 2012

Bermuda Focus

Growth of Bermuda (re)insurers in China

In December 2010 China and Bermuda signed a Tax Information Exchange Agreement (TIEA). The execution of this TIEA is a further step in the development of positive ties between these two jurisdictions and is likely to facilitate (re)insurance operations going forward. These opportunities have been grasped by, amongst others, the Bermuda-based Catlin Group which has offices in Hong Kong and Shanghai and which, in November 2011, entered into a partnership with PRC state-owned China Reinsurance (Group) Corp (China Re). Following this partnership, China Re has established and supplies capital for a special purpose syndicate at Lloyds of London. A Catlin subsidiary manages the syndicate. Further, earlier this year Catlin was granted approval by the China Insurance Regulatory Commission to open and operate a wholly owned representative office in Beijing.

Growth of captives and ILS Bermuda domiciled insurers in Hong Kong

Bermuda (re)insurance vehicles have, for decades, played a prominent role in the (re)insurance sector in Asia. In Hong Kong, of the 160 authorised insurers, 12 are Bermuda domiciled. As such, Bermuda is in joint second position (with the UK also having 12 domiciled Hong Kong authorised insurers) only behind Hong Kong with 85 domiciled insurers. These Bermuda insurers include subsidiaries from eminent (re)insurance groups such as ING, Sun Life, AXA, HSBC and AIA. The vast majority of the Bermuda-domiciled Hong Kong authorised insurers focus on and underwrite long-term business. In light of recent experience, it is also the case that a number of these (re)insurance groups who operate both Bermuda-domiciled Hong Kong authorised life insurers as well as life insurers domiciled elsewhere but also writing business emanating from Hong Kong, are looking to write more of their Hong Kong originating life business through their Bermuda vehicles. The growth and expansion of Bermuda (re)insurers in Asia is not limited to China. Ironshore Insurance recently opened a Singapore office as the next phase of the strategic expansion of its global platform. With the growth of China corporate groups and the resultant increase in insurance premiums necessary to insure such groups from the myriad of commercial risks they face, not surprisingly there has been much greater interest in the possibility of self-insurance and the setting up of stand-alone-captives or rent-a-captives. Bermuda as the worlds leading captive jurisdiction is well-placed to meet this demand. The growth in the insurance-linked securities (ILS) sector also marks an interesting development and one which is likely to appeal to Asian and particularly Chinese investors. The resurgence in the CAT bonds market in Bermuda is a case in point. CAT bonds are risk-linked securities that transfer a specified set of risks from a sponsor to investors. Historically, CAT bonds were used as an alternative risk transfer mechanism (together with the traditional catastrophe reinsurance) to transfer risk faced by (re)insurers from major catastrophes. From an investor perspective, the attraction of CAT bonds and other insurance-linked securities is that these securities are decoupled from the equities, and particularly listed equities, market. Consequently, ILS offers an investment alternative that is not at the mercy of market conditions and macroeconomic fluctuations caused by the global financial crisis, in the same way that is faced by the equities market.

Recent developments

From the perspective of the Bermuda-domiciled Hong Kong authorised life insurers, the 2011 amendments to the Bermuda Insurance Act 1978, so as to introduce five classes of Bermuda long-term insurers as opposed to the previous single class, is to be welcomed. The introduction of the five distinct classes, which range from the Class A wholly-owned or group affiliate captive to the Class E large commercial long-term insurer, reflect the Bermuda Monetary Authoritys (BMA) movement to a risk-based approach to supervision of (re)insurers in accordance with the stated target of being Solvency II equivalent. In addition, the recent 2012 amendments to the Insurance Act 1978, provide the BMA with greater flexibility to allow certain exemptions from its supervisory regime when the (re)insurers in question are being appropriately supervised by other regulatory authorities. This is of particular resonance to Bermuda-domiciled Hong Kong authorised life insurers. The BMAs proactive and collaborative approach to supervision has always been one of the major attractions of Bermuda as a leading (re)insurance jurisdiction.

The future

As Asia and China in particular, continues on its upward trajectory, the need for ever more sophisticated services, products and flexible bespoke risk transfer mechanisms will continue to grow. It is in this context that the Bermuda (re)insurance environment, vehicles and service providers are well placed to offer the greatest value to industry participants and to grow this sector in Asia as a whole.

Mr Jeffrey Kirk is a corporate & commercial partner in the Hong Kong office of offshore law firm Appleby.

www.asiainsurancereview.com

November 2012

61

You might also like

- Bowtie Hong Kong Draft 08-29-22Document15 pagesBowtie Hong Kong Draft 08-29-22isabellelyyNo ratings yet

- Globalization and Its Impact of Insurance Industry in IndiaDocument10 pagesGlobalization and Its Impact of Insurance Industry in IndiaRiaz Ahmed100% (1)

- Assaignment On Insurance DevelopmantDocument17 pagesAssaignment On Insurance DevelopmantShuvro RahmanNo ratings yet

- Progressive Final PaperDocument16 pagesProgressive Final PaperJordyn WebreNo ratings yet

- Micro Insurance ProjectDocument56 pagesMicro Insurance Projectßalram SinghNo ratings yet

- Advocis - Foran LLQP Suggested Study Schedule WITH KEY TERMSDocument36 pagesAdvocis - Foran LLQP Suggested Study Schedule WITH KEY TERMSikawoakoNo ratings yet

- Sun Life Financial and Indian Economic Surge: Case Analysis - International BusinessDocument9 pagesSun Life Financial and Indian Economic Surge: Case Analysis - International Businessgurubhai24No ratings yet

- Modern State and Trends of Implementation of Investment Activities of Insurance Companies in Developed CountriesDocument5 pagesModern State and Trends of Implementation of Investment Activities of Insurance Companies in Developed CountriesCentral Asian StudiesNo ratings yet

- Insurance Infographic Nov 2018Document3 pagesInsurance Infographic Nov 2018Šãćhįń ĆhõûdhärÿNo ratings yet

- Islamic Insurance in Bangladesh A Practical Case On Takaful Islami InsuranceDocument43 pagesIslamic Insurance in Bangladesh A Practical Case On Takaful Islami InsurancechoumaNo ratings yet

- Executive Summary: M.S.R.C.A.S.C BangaloreDocument72 pagesExecutive Summary: M.S.R.C.A.S.C BangaloreSubramanya Dg100% (2)

- Brief History of Insurance Company in BangladeshDocument6 pagesBrief History of Insurance Company in BangladeshSarjeel Ahsan Niloy100% (2)

- General Factors of SuccessDocument39 pagesGeneral Factors of SuccessMehulNo ratings yet

- Group 2 - InsuranceDocument14 pagesGroup 2 - InsuranceRehan TyagiNo ratings yet

- 05.19.16 - Shadow InsuranceDocument50 pages05.19.16 - Shadow InsurancePeter BullockNo ratings yet

- Impact of Liberlisation On The Insurance IndustryDocument46 pagesImpact of Liberlisation On The Insurance IndustryParag MoreNo ratings yet

- Group 1Document50 pagesGroup 1agparcoNo ratings yet

- Research Paper On Indian Insurance IndustryDocument7 pagesResearch Paper On Indian Insurance Industryebvjkbaod100% (1)

- Live Project FinalDocument25 pagesLive Project FinalAmanjotNo ratings yet

- Insurance Marketing in Indian EnvironmentDocument6 pagesInsurance Marketing in Indian EnvironmentPurab MehtaNo ratings yet

- CRM Amit PDFDocument93 pagesCRM Amit PDFKIPM College of ManagementNo ratings yet

- SSRN Id1594993Document23 pagesSSRN Id1594993shikha194No ratings yet

- Globalization and Its Impact of Insurance Industry in India: Riaz AhemadDocument10 pagesGlobalization and Its Impact of Insurance Industry in India: Riaz AhemadAlok NayakNo ratings yet

- Takaful Insurance Cover 1Document5 pagesTakaful Insurance Cover 1Derrick SamsonNo ratings yet

- Surety PricingDocument21 pagesSurety PricingMarian GrajdanNo ratings yet

- Max New York Life InsuranceDocument54 pagesMax New York Life InsurancedevveddNo ratings yet

- Financial Derivatives: A Perceived ValueDocument20 pagesFinancial Derivatives: A Perceived ValueIvan MendesNo ratings yet

- East Africa Insurance Industry OverviewDocument7 pagesEast Africa Insurance Industry OverviewsixfeetwonderNo ratings yet

- The Insurance Sector Came Into Being As There Was A Need To Financially Support People in The Time of NeedDocument3 pagesThe Insurance Sector Came Into Being As There Was A Need To Financially Support People in The Time of Needvitthal kendreNo ratings yet

- Financial Institution: S2 AssignmentDocument6 pagesFinancial Institution: S2 AssignmentIftikharUlHassanNo ratings yet

- Discussion Papers: Analysing The Determinants of Credit Risk For General Insurance Firms in The UKDocument43 pagesDiscussion Papers: Analysing The Determinants of Credit Risk For General Insurance Firms in The UKnely coniNo ratings yet

- Insurance CompanyDocument4 pagesInsurance CompanyMd. RobinNo ratings yet

- Changing Scenario of Insurance Industry: Shri Jagendra KumarDocument3 pagesChanging Scenario of Insurance Industry: Shri Jagendra KumarMadhuparna SenNo ratings yet

- Insurance: EFU General Insurance Limited - Analysis of Financial Statements Financial Year 2004 - 1Q 2010Document9 pagesInsurance: EFU General Insurance Limited - Analysis of Financial Statements Financial Year 2004 - 1Q 2010aminafridiNo ratings yet

- Executive SummaryDocument44 pagesExecutive SummaryAvinash LoveNo ratings yet

- Insurance Sector and GlobalizationDocument10 pagesInsurance Sector and GlobalizationJatin Arora50% (2)

- Customer Satisfaction of Life Insurance CompaniesDocument7 pagesCustomer Satisfaction of Life Insurance CompaniesGudiyaNo ratings yet

- The SolutionDocument7 pagesThe SolutionAnonymous y3E7iaNo ratings yet

- External EnvironmentDocument14 pagesExternal Environmentbhumiksab7No ratings yet

- The Growth and Potential of The Indian Insurance Industry: - Sample ArticleDocument12 pagesThe Growth and Potential of The Indian Insurance Industry: - Sample Articleiifra_waqarNo ratings yet

- Insurance and Society: How Regulation Affects The Insurance Industry's Ability To Fulfil Its RoleDocument32 pagesInsurance and Society: How Regulation Affects The Insurance Industry's Ability To Fulfil Its RoleEconomist Intelligence UnitNo ratings yet

- Global TrendsDocument10 pagesGlobal TrendsDivaxNo ratings yet

- Globalization of Insurance MarketDocument15 pagesGlobalization of Insurance MarketLuchian Ana-MariaNo ratings yet

- FM Case Study FinalDocument13 pagesFM Case Study Finalgellie villarinNo ratings yet

- Global Insurance Industry Insights An In-Depth PerspectiveDocument32 pagesGlobal Insurance Industry Insights An In-Depth PerspectiveSzilvia SzabóNo ratings yet

- Go Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Document12 pagesGo Policy (Insurance Broker) : Student's Name: Student's Id: Date: Word Count: 2000Mayur SoNo ratings yet

- From (Nikita Nehriya (Nikita - Nehriya@gmail - Com) ) - ID (128) - ProjectDocument17 pagesFrom (Nikita Nehriya (Nikita - Nehriya@gmail - Com) ) - ID (128) - ProjectNikhil AradheNo ratings yet

- Part-I Insurance: Chapter 1 - Introduction To InsuranceDocument66 pagesPart-I Insurance: Chapter 1 - Introduction To Insuranceselvaramesh nadarNo ratings yet

- Conceptual On Between Takaful and ConventionalDocument87 pagesConceptual On Between Takaful and ConventionalAbbas Al-RowaishNo ratings yet

- Lecture 11-The Funeral Assurance Industry & Short Term IndustryDocument5 pagesLecture 11-The Funeral Assurance Industry & Short Term IndustryMoses EagleNo ratings yet

- FRS & J.P. Morgan London Whale CaseDocument10 pagesFRS & J.P. Morgan London Whale CasedecalgosNo ratings yet

- Final Draft Report - 14 SeptDocument50 pagesFinal Draft Report - 14 Septneelove1No ratings yet

- Problems and Prospects of Insurance Buisness in Bangladesh 05Document40 pagesProblems and Prospects of Insurance Buisness in Bangladesh 05Zahirul Islam100% (2)

- Emerging InsuDocument15 pagesEmerging InsuSneha JadhavNo ratings yet

- Conduct of Business Regulation and Covid-19: A Review of The Gulf Insurance IndustryDocument14 pagesConduct of Business Regulation and Covid-19: A Review of The Gulf Insurance IndustryRAVI SONKARNo ratings yet

- Globalisation of Insurance SectorDocument68 pagesGlobalisation of Insurance SectorMonika BishtNo ratings yet

- IntermediariesDocument31 pagesIntermediariesrajesh_natarajan_4No ratings yet

- Re Insurance PaperDocument10 pagesRe Insurance PaperkissishaNo ratings yet

- Malhotra CommitteeDocument5 pagesMalhotra CommitteeBibhash RoyNo ratings yet

- Term Paper On Insurance and Business ConsiderationDocument5 pagesTerm Paper On Insurance and Business ConsiderationafdttatohNo ratings yet

- Notre Dame University Bangladesh Report On Reliance Insurance Limited'Document8 pagesNotre Dame University Bangladesh Report On Reliance Insurance Limited'Cm PunkNo ratings yet

- Development of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketFrom EverandDevelopment of Insurance in Angola: Case Study of a Key African Frontier Insurance MarketNo ratings yet

- Insurance Law NotesDocument51 pagesInsurance Law NotesVina Cagampang100% (1)

- For ApprovalDocument10 pagesFor ApprovalPaulo VillarinNo ratings yet

- Market Risk Management: Eymen Errais, PHD, FRMDocument17 pagesMarket Risk Management: Eymen Errais, PHD, FRMMalek OueriemmiNo ratings yet

- Ic Exam Review: VariableDocument122 pagesIc Exam Review: VariableJL RangelNo ratings yet

- Chapter 1: Basics of Insurance: Let's BeginDocument27 pagesChapter 1: Basics of Insurance: Let's BeginAviNo ratings yet

- Introduction To The Concept of Risk and ReturnDocument31 pagesIntroduction To The Concept of Risk and ReturnSaish ChavanNo ratings yet

- HDFC Life Classic Assure Plus PlanDocument6 pagesHDFC Life Classic Assure Plus PlanPrashant ChaudharyNo ratings yet

- Travel Hassle-Free With... : Ask For HelpDocument3 pagesTravel Hassle-Free With... : Ask For HelpApex BasnetNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Ak Iiap Mock-Exam-1Document8 pagesAk Iiap Mock-Exam-1joseph s. butawanNo ratings yet

- AIA PC Insurance BasicsDocument14 pagesAIA PC Insurance BasicsArnabNo ratings yet

- 400+ Stock Market TermsDocument150 pages400+ Stock Market TermsSandeep SharmaNo ratings yet

- TVM Pratice Question-1Document12 pagesTVM Pratice Question-1Neetu Dubey100% (2)

- Class Notes International FinancesDocument9 pagesClass Notes International FinancesMariabelen DoriaNo ratings yet

- The Scope of Marine InsuranceDocument25 pagesThe Scope of Marine InsuranceEbadur RahmanNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedMandar JadhavNo ratings yet

- SBI Life - Poorna Suraksha - Product GuideDocument2 pagesSBI Life - Poorna Suraksha - Product GuideVenkateswarlu BusamNo ratings yet

- Bcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFDocument3 pagesBcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFDeepak KumarNo ratings yet

- Final Exam PrepDocument46 pagesFinal Exam PrepM Fani MalikNo ratings yet

- Max Life Super Term Plan Prospectus PDFDocument12 pagesMax Life Super Term Plan Prospectus PDFFood Supply Headquarter ChandigarhNo ratings yet

- Financial Market PresentationDocument19 pagesFinancial Market PresentationVanshika GoyalNo ratings yet

- 7-Figures Earning EbookDocument8 pages7-Figures Earning EbookMuhammad AslamNo ratings yet

- The Oriental Insurance Company Limited: UIN: OICHLIP445V032021Document4 pagesThe Oriental Insurance Company Limited: UIN: OICHLIP445V032021hitesh315No ratings yet

- Life Insurence SiaDocument116 pagesLife Insurence Siabagi alekhya100% (1)

- Company ProfileDocument5 pagesCompany Profilemhashem_itiNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsDocument4 pagesTata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsRavi PrakashNo ratings yet

- Corporate FinanceDocument16 pagesCorporate FinanceAlgi GenaoNo ratings yet