Professional Documents

Culture Documents

QT Cases

QT Cases

Uploaded by

Himanshu Rajesh PatnekarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QT Cases

QT Cases

Uploaded by

Himanshu Rajesh PatnekarCopyright:

Available Formats

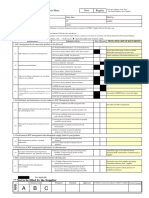

MIT-School of Business Session plan Subject : Quantitative Techniques (C-05)

Session Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

Topic Introduction to Quantitative Techniques Goal Programming Concept and Formulation Goal Programming : Caselets from Ref 1 Goal Programming : Case 1 Goal Programming : Case 2 Goal Programming : Case 3 Part I Goal Programming : Case 3 Part II Replacement Theory: Concepts Replacement Theory: Caselets: Time value of money Replacement Theory: Caselets: Items that fail suddenly Replacement Theory: Caselet: staff replacement Replacement Theory: Case 4 Dynamic programming: Concept and Formulation of deterministic model Dynamic Programming: Caselets: Shortest route problems Dynamic Programming: Caselets Dynamic Programming: Caselets Dynamic Programming: Case 5 Decision Theory: Concept and meaning of terms used Decision Theory: Decisions under risk and decision under uncertainty Decision Theory: Caselets from Ref 1 Decision Theory: Posterior Analysis and Bayes Rule Decision Theory: Case 6 Decision Theory: Caselets from Ref 1 Decision Theory: Case 7 Markov processes: Concept of stochastic processes, Properties, Transition probability matrix

Required Readings Operations Research by N.D. Vohra a)Pages 691 to 739 b)Pages 333 to 348 c)Pages 428 to 431 d)Pages 291 to 316 f) Pages 430 to 470 c)Pages 367 to 383 d)Pages 782 to 825

f)Pages 561 to 570 b)Pages 401 to 428 c)Pages 220 to 235

a) Page 371 to 441 b) Pages 503 to 527 c) Pages 315 to 329 f) Page 608 to 647

b) Pages 641 to 663 f) Pages 659 to 672

26 27 28 29 30 31 32 33 34 35 36

Markov processes: Caselets Markov processes: Caselets Markov processes: Caselets Markov processes: Case 8 Forecasting: Concepts and applications Forecasting: Time series Forecasting: Smoothing methods Forecasting: Exponential smoothing Forecasting: Case 9 Surprise Test 1 Surprise Test 2

e)Page 1014 to 1035

Books Recommended: a) Operations Research & Quantitative Techniques (Using MS Excel): D.P. Apte, Excel Books. b) Operations Research: Hamdy A. Taha: PHI Eighth Edition. c) Operations Research: R. Panneerselvam: PHI d) Operations Research: J.K.Sharma; McMillan e) Introduction to Operations Research: Hillier Liberman; TMH f) Principles of Operations Research for management: Frank S Budnik, Dennis McLeavey & Richard Mojena: AITBS

Subject : Quantitative Techniques (C-05) Case No. 1 Banking on Bank There is always a tradeoff between returns and risks in deciding how to deploy the available funds. The opportunities that promise the high profits are almost always associated with high risks. Banks are required to carefully balance returns and risks because of the legal framework of RBI and their obligations to the share holders to avoid undo hazards, yet strive to meet business goal to maximize profit. This dilemma leads naturally to multi-criteria optimization problem. Here is a case of such problem faced by a bank manager. After working for 15 years as a finance manager in various companies, Mr. Moni got an offer in Pune city co-op bank. The bank was not performing efficiently and also had serious problems recently, which were resolved with lot of efforts. Bank was looking for a dynamic Finance Head to take call on investments to maximize profits. The bank has a modest capital of Rs. 200 crores, with Rs. 1500 crores in demand accounts (current accounts) and Rs. 300 crores in savings accounts and Rs 500 crores as fixed deposit. The Bank also has reserves of Rs 40 crores. Bank pays an interest of 4% on savings account and average of 7% fixed deposits. The table below displays the categories among which the bank must divide its capital and deposited funds as per RBI regulations. RBI also has specified CRR as 4% and SLR 23%. Rates of return are also provided for each category together with other information related to risk. Pune City Co-op Bank Investment Opportunities Investment Category (j) 1. Cash 2. Short Term 3. Gold 3. Reverse REPO 4. Government Bonds below 10 years 5. Government Bonds over 10 years 6. Personal loans 7. Housing loans 8. Commercial loans Return Rate (%) 0.0 4.0 6.0 6.25 7.5 8.25 15.25 10.25 12.5 Liquid Part (%) 100.0 99.5 99.0 96.0 90.0 85.0 0.0 0.0 0.0 Required Capital (%) 0 0.5 8.0 0 5.0 7.5 10.0 10.0 10.0 Risk Asset? (%) No No Yes No No No Yes Yes Yes

Your predecessor finance head rose to the position over thirty years after starting his career as a cashier. He being just commerce graduate did not know OR tools. He has been taking investment decisions based on his subjective judgment using his experience. This at times proved too risky bringing the bank in cash flow problems. Then he suddenly became too conservative resulting in low profits. When you take over the position decide to list constraints and decide to maximize profit. The constraints you list based on management policy and regulators guidelines as: 1. Cash reserve must be at least 14% of the demand deposits based on previous experience of withdrawals by current account holders. 2. In addition you need to keep cash reserve of 4% to cater for withdrawals and maturity of saving account and FDs. 3. Govt. regulation requires certain portion of the total investment must be liquid. Accordingly the portion of investment considered liquid should be at least 47% of demand deposits plus 36% of time deposits. 4. To ensure diversified investments, at least 5% of funds should be invested in each of the eight categories. 5. At least 30% of funds should be invested in commercial loans, to maintain the banks community status. Mr. Moni formulates the problem as LP problem & solves it. Comment on the solutions. Also discuss the difference in profitability issues & cash flow issues. Find out more about CRR, SLR, REPO and reverse REPO. Mr. Moni can set objectives differently as per the higher management perception of the mission and market situation. a) Profit could be one objective. b) Capital-adequacy ratio less than 0.8 could be considered sufficient to ensure smooth working capital management (particularly when many banks are seen to get into trouble). c) With the global financial problems due to toxic debts, Mr. Moni may keep risk asset ratio below 7. Compare the results with various objectives. Are you satisfied with this approach? Now having studied goal programming Mr. Moni decides to use all these goals for investment decisions. He could formulate the problem with equal weight for all goals or un-equal weight as per the bank objectives. He considers 90% profit before tax is excellent to satisfy share holders. They also wont mind little less if they feel that their investment is safe. Also try pre-emptive

goals for formulation. What are your results? How do they help in decision making? Can you modify them over a period? The above goals may be thought of as goal constraints. These are the criteria targets of goal programming and specify requirements that are desirable to achieve but may still be violated in feasible solutions. Once target levels have been specified for goal constraints, we cannot just impose the constraint that each objective must be met. There may not be a feasible solution that simultaneously achieves the desired levels of all goal constraints. Instead we introduce new deviation variables. Deficiency variables are included for both under- and over achievement.

Case developed by Prof (Gp Capt) D.P. Apte

Subject : Quantitative Techniques (C-05) Case No. 2 A Cure for Cuba Fulgencio Batista led Cuba with a cold heart and iron first --- greedily stealing from poor citizens, capriciously ruling the Cuban population that looked to him for guidance, and violently murdering the innocent critics of his politics. In 1958, tired of watching his fellow Cubans suffer from corruption and tyranny, Fidel Castro lead a guerilla attack against the Batista regime and wrested power from Batista in January 1959. Cubans, along with members of the international community, believed that political economic freedom had finally triumphed on the island. The next two years showed, however, that Castro was leading a Communist dictatorship killing his political opponents and nationalizing all privately held assets. The United States responded to Castros leadership in 1961 by invoking a trade embargo against Cuba. The embargo forbade any country from selling Cuban products in the United States and forbade businesses from selling American products to Cuba. Cubans did not feel the true impact of the embargo until 1989 when the Soviet economy collapsed. Prior to the disintegration of the Soviet Union, Cuba had received an average $5 billion in annual economic assistance from the Soviet Union. With the disappearance of the economy that Cuba had almost exclusively depended upon for trade, Cubans had few avenues from which to purchase food, clothes and medicine. The avenues narrowed even further when the United States passed the Torricelli Act in 1992 that forbade American subsidiaries in third countries from doing business with Cuba that had been worth a total of $700 million annually. Since 1989, the Cuban economy has certainly felt the impact from decades of frozen trade. Toady poverty ravages the island of Cuba. Families do not have money to purchase bare necessities, such as milk, and clothing. Children die from malnutrition or exposure. Disease infects the island because medicine is unavailable. Optical neuritis, tuberculosis, pneumonia, and influenza run rampant among the population. Few Americans hold sympathy for Cuba, but Robert Baker, director of Helping Hand, leads a handful of tender souls on Capitol Hill who cannot bear to see politics destroy so many human levies. His organization distributes humanitarian aid annually to needy countries around the world. Mr. Baker recognizes the dire situation in Cuba, and he wants to allocate aid to Cuba for the coming year.

Mr. Baker wants to send numerous aid packages to Cuban citizens. Three different types of packages are available. The basic package contains only food, such as grain and powdered milk. Each basic package costs $300, weighs 120 pounds, and aids 30 people. The advanced package contains food and clothing, such as blankets and fabrics. Each advanced package costs $350, weighs 180 pounds, and aids 35 people. The supreme package contains food, clothing and medicine. Each supreme package costs $720, weighs 220 pounds, and aids 54 people. Mr. Baker has several goals and he wants to achieve when deciding upon the number and types of aid packages to allocate to Cuba. First, he wants to aid at least 20 percent of Cubas 11 million citizens. Second, because disease runs rampant among the Cuban population, he wants at least 3,000 of the aid packages sent to Cuba to be the supreme packages. Third, because he knows many other nations also require humanitarian aid, he wants to keep the cost of aiding Cuba below $20 million. Mr. Baker places different levels of importance on his three goals. He believes the most important goal is keeping costs down since low costs mean that his organization is able to aid a larger number of needy nations. He decides to penalize his plan by 1 point for every $1 million above his $20 million goal. He believes the second most important goal is ensuring that at least 3,000 of the aid packages sent to Cuba are supreme packages, since he does not want to see an epidemic develop and completely destroy the Cuban population. He decides to penalize his plan by 1 point for every 1,000 packages below his goal of 3,000 packages. Finally, he believes the least important goal is reaching at least 20 percent of the population, since he would rather give a smaller number of individuals all they need to thrive instead of a larger number of individuals only some of what they need to thrive. He therefore decides to penalize his plan by 7 points for every 1,00,000 people below his 20 percent goal. Mr. Baker realizes that he has certain limitations on the aid packages that he delivers to Cuba. Each type of package is approximately the same size, and because only a limited number of cargo flights from the United States are allowed into Cuba, he is only able to send a maximum of 40,000 packages. Along with a size limitation, he also encounters a weight restriction. He cannot ship more than 6 million pounds of cargo. Finally, he has a safety restriction. When sending medicine, he needs to ensure that the Cubans know how to use the medicine properly. Therefore, for every 100 supreme packages, Mr. Baker must send one doctor to Cuba at a cost of $33,000 per doctor. 1) How many basic, advanced, and supreme packages should Mr. Baker send to Cuba? 2) Mr. Baker revaluates the levels of importance he places on each of the three goals. To sell his efforts to potential donors, he must show that his program is effective. Donors generally judge the effectiveness of a program on the number of people reached by aid packages. Mr.

Baker therefore decides that he must put more importance on the goal of reaching at least 20 percent of the population. He decides to penalize his plan by 10 points for every half a percentage point below his 20 percent goal. The penalties for his other two goals remain the same. Under this scenario, how many basic, advanced, and supreme packages should Mr. Baker send to Cuba? How sensitive is the plan to changes in the penalty weights? 3) Mr. Baker realizes that sending some more doctors along with the supreme packages will improve the proper use and distribution of the packages contents, which in turn will increase the effectiveness of the program. He therefore decides to send one doctor with every 75 supreme packages. The penalties for the goals remain the same as in part (2). Under this scenario, how many basic, advanced, and supreme packages should Mr. Baker send to Cuba?

The aid budget is cut, and Mr. Baker learns that he definitely cannot allocate more than $20 million in aid to Cuba. Due to the budget cut, Mr. Baker decides to stay with his original policy of sending one doctor with every 100 supreme packages. How many basic, advanced, and supreme packages should Mr. Baker send to Cuba assuming that the penalties for not meeting the other two goals remain the same as in part (1)?

Case taken from Introduction to Operations Research by Hillier Liberman; TMH

Subject : Quantitative Techniques (C-05) Case No. 3 (Part I) One Mission Many Goals! (Part I) I) Vpro Technologies have four centers located in Pune, Bangalore, Chennai and Hyderabad. Considering local conditions, man-hour costs are different at different locations. Vpro got four major projects from US which had to be executed on priority. The US based client wants the projects to be completed in three months as far as possible. The projects are in different areas viz. Cloud computing, telecommunication, banking operations and network security. Each requires different skill sets and domain knowledge. Mr. Boss at Head office of Vpro calls newly joined operations manager Mr. Smart and tells him to work out the project allocation to different centers after discussing with Senior Manager Finance, VP HR and VP Marketing. Mr. Smart thinks this as a simple OR problem. So he thinks why to bother discussing with others? He collects the requirement of man-hours for each project from senior project managers. He also collect from deputy manager finance the center-wise manhour cost data. He prepares the table as follows. Center Wise Cost in Rs. / Man hours Project Cloud Computing Telecommunication Banking Operations Network Security Pune 2500 3000 3800 Bangalore 2800 4000 2800 Chennai 3500 3200 Hyderabad 3000 4200 4200 Man hours required for project 20000 30000 15000 25000

How should the job allotment be done? With 20% mark up, which is standard for the IT industry, what should be the financial quote for the projects by Vpro? Consider the current global situation and discuss. II) Mr. Smart finds it very simple problem and decides the job allocations to different centers. He takes the solution to Mr. Boss. Mr. Boss asks Mr. Smart whether he has consulted VP HR & VP Marketing. Mr. Smart says with a smile No sir, I thought why to disturb them. I could find the optimum solution. The Boss calls for meeting which was attended by VP Technical, VP HR & VP Marketing besides Mr. Smart & Mr. Moni senior manager finance. Mr. Boss explains the situation and asks their views.

VP HR quickly points out, There is a limited capacity to take the projects at the four centers since the capacity of employees On Bench is limited. New recruitment and training in a short time is not feasible. He gives the data on available bench capacity for three months as 16000 man-hours at Pune, 12000 man-hours at Bangalore, 15000 man-hours at Chennai and 18000 man-hours at Hyderabad. VP Technical clarifies that it is possible to split any project between the centers. What would be your recommendation? Comment on the solution. What do you understand by the On Bench capacity? Discuss it in the present global situation. III) VP Marketing does not want to drop any project and wants to complete at least 50% of each project in the stipulated 3 months. He feels that he can negotiate the client for extending the date by couple of months if all projects complete at least 50% by end of three months. He wants to minimize the amount by which the project falls below 50%. Mr. Moni wants that the cost of the project should not exceed Rs. 22 Crores as far as possible in the view of competitive situation. To maintain a good relationship with client VP Marketing wants to complete the banking project to the extent possible. VP Technical is interested in completing cloud computing project as far as possible within three months for future business in this developing field. What solution Mr. Smart provides? Justify your assumptions.

Consider this business proposal in the context of present situation in IT industry on following counts. a) Competitive situation. b) Available trained manpower in the market. c) Manpower planning in recession. d) Companys market reputation to complete jobs in time. e) Cost cutting measures in IT industry. Note: Case No. 3 (Part II) will be given at the end of discussion on Part I.

Case developed by Prof (Gp Capt) D.P. Apte

Subject : Quantitative Techniques (C-05) Case No. 4 Maintenance Dilemma A gas turbine power plant has 200 electro-pneumatic valves. Failure of any valve has a redundancy. However, to avoid any stoppage of plant, the failed valve must be replaced immediately. The past experience showed the failure rate of valves as follows:

Years of operation Probability of failure

1 0.1

2 0.1

3 0.2

4 0.3

5 0.2

6 0.1

Company can follow individual replacement or group replacement policy. Individual replacement has to be done when the plant is running and hence costs Rs.2000/- per valve. Group replacement can be done at the end of the year when the plant is shut down for maintenance. The cost of group replacement is Rs.500/- per valve. The valves also have operating and maintenance costs depending on their life; The O & M costs are given below. All these costs arc incurred during shut down maintenance.

Life in Year

O & M costs per valve in Rs.

10

15

20

30

30

What would be the replacement policy? Mr. Smart, the young production manager argues with boss, on why to discard the old valves during group replacement. He suggests overhauling them and re-using them. Cost of overhaul is just Rs. 1000/-. In that case the group replacement cost reduces to Rs. 300/-per value. However, the experience during trial shows that the overhauled valves failed early. The failure rate of overhauled valves is as follows:

Years of operation Failure rate

1 0.2

2 0.3

3 0.4

4 0.05

5 0.03

6 0.02

Do you think the suggestion of Mr. Smart to use old valves after overhaul is right? O & M costs doubles for overhauled values. What would be your replacement policy? Finance manager points out that we have not considered cost of money which is about 12% per annum. Now what is your decision on replacement policy? You are not very sure that these rates are going to be same. 20% fluctuations over next few years could be expected. Carry out sensitivity analysis within this range of fluctuations. Of course the finance manager assures you that you don't have to bother about the fluctuations of cost of money, which he feels would remain steady over many years. What are your comments? Addition Exercise: Vary the probabilities of failure and observe the effect on the replacement policy.

Case developed by Prof (Gp Capt) D.P. Apte

Subject: Quantitative Techniques (C-05) Case No. 5 Solar Energy Installation Model An experimental solar energy system for residential heating consists of three major components; a solar collector made up of plate glass that is oriented toward the sun; a water tank for storing thermal energy and a piping control system for regulating flows, pressure and temperature. Suppose that three surface areas for the collector are under consideration: 500, 600, and 700 sq ft. Engineering tests show that the area of collector directly affects its ability to increase average ambient (outdoor) temperatures. The 500 sq ft collector increases ambient temperature by a factor of 6; the 600 sq ft collector by a factor of 7; and 700 sq ft collector, by a factor of 8. For example, given an average ambient temperature of 30 0 F, the 600 sq ft collector has the capacity of sending water into the storage tank, which is heated to 2100 F (i.e. 30*7). Over the life of a typical home (estimated at 40 yrs), the amortized cost of the collector is $0.50 per sq ft per yr. Two choices are available for the size of the storage tank: 800 gallons and 1000 gallons. Generally, the tanks have a greater ability to store thermal energy for use during the night time or during cloudy weather. The effective heat retention of the smaller tank is 0.7 , and that of the larger tank is 0.8. For example, the larger tank is capable of effectively maintaining the water at 168 0 F, when the collector delivers water at 2100 F (210*0.8). The amortized cost of the storage facility is $0.15 per gallon per yr. Two choices also are available for the piping and control system. These are amortized at $50 per yr and $100 per yr. The efficiency factor for the cheaper alternative is 0.4 and that for the more expensive alternative is 0.5. For example, if the effective temp of water in a tank is 168 0 F, then an efficiency factor of 0.5 means that the effective temp that can be delivered to the residence is 84 0 F (168*0.5). The effective delivery temp is important because it determines the average cost of supplying conventional heat to supplement the solar system. For a 2000 sq ft residence heated to 70 0 F, the average annual cost of the conventional heating system has been estimated by the following relationship h = 150 + 10 (70 Effective delivery temperature). Note that effective delivery temperatures above 70 0 F reduce h below $150 per year. Moreover, if a calculation yields h<0, then h should be set to zero. Identify the DP structure for this problem. Determine the optimal design by DP. ( to simplify the problem round off the effective temperature to the nearest 10 0 F) Case taken from Principles of Operations Research for Management: Frank S Budnik, Dennis McLeavy & Richard MojenaL AITBS

Subject : Quantitative Techniques (C-05) Case No. 6 Investment Banking

A trust officer for a major banking institution is planning the investment of $1 million family trust for the coming year. The trust officer has identified a portfolio of stocks and another group of bonds that might be selected for investment. The family trust can be invested in stocks or bonds exclusively, or a mix of the two. This trust officer prefers to divide the funds in the increments of 10 percent; that is the family trust may be split as 100% stock& 0% bonds, 90% stocks and 10% bonds, 80% stocks and 20% bonds and so on. The trust officer has evaluated the relationship between the yields on the different investment and general economic conditions. Her judgment is as follows: (1) If the next year is characterized by solid growth in the economy then bonds will yield 12% and stock will yield 20%. (2) If the next year is characterized by inflation, then bonds will yield 18% and stock will yield 10%. (3) If the next year is characterized by stagnation, then bonds will yield 12% and stock will yield 8%.

a. Formulate a payoff table where payoffs represent the annual yield, in dollars, associated with the different investment strategies and the occurrence of various economic conditions. b. Determine the optimal strategy using the maxmax, maxmin, Hurwicz(=0.40), equally likely and regret criteria. c. Suppose that, p (solid growth) =0.4, p (inflation) =0.25 and p (stagnation) =0.35 then use the expected value criterion to select the appropriate strategy. d. What is the expected value of perfect information? e. If the forecasting firm projects following conditional probabilities of the forecast of economy, revise the decision with posterior probabilities

Case taken from Principles of Operations Research for Management: Frank S Budnik, Dennis McLeavy & Richard MojenaL AITBS

States of nature Solid growth Inflation Stagnancy Where

Conditional probabilities X1 X2 X3 0.7 0.2 0.1 0.1 0.05 0.8 0.05 0.1 0.9

X1: Forecast of solid growth. X2: Forecast of inflation. X3: Forecast of stagnancy.

Case taken from Principles of Operations Research for Management: Frank S Budnik, Dennis McLeavy & Richard MojenaL AITBS

Subject : Quantitative Techniques (C-05) Case No. 7 Pipeline Construction Model The installation of an oil pipeline which runs from an oil field to a refinery requires the welding of 1000 seams. Two alternatives have been specified for conducting the welding. 1. Strictly use a team of ordinary and apprentice welders (B-Team) 2. Use a team of master welders (A-Team) who check and rework (as necessary) the works of the B team. If the B team is strictly used, it is estimated from past experience that 5% of the seams will be defective with probability 0.30, or 10% will be defective with probability 0.50, or 20% will be defective with probability 0.20. However if the B team is followed by A team, a defective rate of 1% is almost certain. Material and labour costs are estimated at $400,000 when the B-Team is used strictly, whereas these costs rise to $530,000 when the A-Team is also brought in. Defective seams result in leaks, which must be reworked at a cost of $1,200 per seam, which includes the cost of labour and spilled oil but ignores the cost of environmental damage. a. Determine the optimal decision and its expected cost. How might environmental damage be taken into account? b. A worker on the pipeline with a Baysian inclination (from long years of wagering on sporting events) has proposed that management consider X-ray inspections of five randomly selected seams following the work of the B-Team. Such an inspection would identify defective seams, which would provide the management with more information for the decision on whether or not to bring the A-Team,. It costs $5000 to inspect the five seams. Finally is it worthwhile to carry out the inspection? If so, what decision should be made for each possible result of the inspection?

Case taken from Principles of Operations Research for Management: Frank S Budnik, Dennis McLeavy & Richard MojenaL AITBS

Subject : Quantitative Techniques (C-05) Case No. 8 Vehicle Insurance. 'Profit from Accidents'. In most of Europe and Asia annual automobile insurance premiums are determined by use of a Bonus Malus (Latin for Good-Bad) system. Each policyholder is given a positive integer valued state and the annual premium is the function of this state (along, of course, with the type of car being insured and the level of insurance). A policyholder's state changes from year to year in response to the number of claims made by that policyholder. Because lower numbered states correspond to lower annual premiums, a policyholder's state will usually decrease if he or she had no claims in the preceding year, and will generally increase if he or she had at least one claim. (Thus, no claims is good and typically results in a decreased premium, while claims are bad and typically result in a higher premium.) If we suppose that the number of yearly claims made by a particular policyholder is a Poisson random variable with parameter >-, then the successive states of this policyholder will constitute a Markov chain with transition probabilities Pi,j = e- (k / k! ) j >= 0 k: sj (k) = j State Annual premium In $ 200 250 400 600 Next state if 0 claims 1 1 2 3 1 claim 2 3 4 4 2 claims 3 4 4 4 >=3 claims 4 4 4 4

1 2 3 4

Write a transition matrix for Markov Chain. If average number of accident claims is 1.2 per year, is this rate of premium ok for the company? If not what premium would you propose for your company? Can you suggest any variation in the method to make your policy more attractive?

Subject : Quantitative Techniques (C-05) Case No. 9 The sales manager of Neel Plastics wants to forecast the sales for the coming year so that the company can manage to meet the demands. He studied the monthly sales for past five years. The following table represents monthly sales of Neel Plastics for years 1 through 5. Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 1 742 697 776 898 1030 1107 1165 1216 1208 1131 971 783 2 741 700 774 932 1099 1223 1290 1349 1341 1296 1066 901 3 896 793 885 1055 1204 1326 1303 1436 1473 1453 1170 1023 4 951 861 938 1109 1274 1422 1486 1555 1604 1600 1403 1209 5 1030 1032 1126 1285 1468 1637 1611 1608 1528 1420 1119 1013

Q1: The manager wants to find the trend cycle and seasonal indices 1. Using classical additive model. 2. Using classical multiplicative model. 3. The trend in the data using linear regression smoothing method. 4. Forecast the sales using the trends estimated by regression method and seasonal indices calculated by multiplicative model. Q2: Further he wants to forecast for the year 6 a. Using 4-, 6-, 12- monthly centered moving averages. b. Using exponential smoothing with value of 0.1, 0.3, 0.5, 0.7 and 0.9. c. Assuming that the past pattern will continue for the future, which moving average and which value of should the management select to minimize the error?

You might also like

- Credit Dispute Letters-8814829Document102 pagesCredit Dispute Letters-8814829Mindy Horn100% (2)

- Poem AnalysisDocument4 pagesPoem AnalysisCharles Ting67% (3)

- IIBM Case Study AnswersDocument98 pagesIIBM Case Study AnswersAravind 9901366442 - 990278722422% (9)

- Liquidity Management of Citi BankDocument8 pagesLiquidity Management of Citi BankGanesh AppNo ratings yet

- Prayer Service For The DeadDocument16 pagesPrayer Service For The DeadRodel Ramos DaquioagNo ratings yet

- Bachelor Thesis Investment BankingDocument6 pagesBachelor Thesis Investment Bankingafknoaabc100% (2)

- Basel 3 Literature ReviewDocument7 pagesBasel 3 Literature Reviewaflskkcez100% (1)

- Term Paper International FinanceDocument7 pagesTerm Paper International Financeafdtzfutn100% (1)

- 20230918quiz1 2Document3 pages20230918quiz1 2Bazif AhmedNo ratings yet

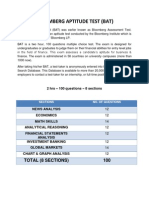

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- B1 Free Solving (May 2019) - Set 1Document5 pagesB1 Free Solving (May 2019) - Set 1paul sagudaNo ratings yet

- Banking Thesis PDFDocument6 pagesBanking Thesis PDFMary Montoya100% (2)

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsJess XueNo ratings yet

- Alok Rustagi Kaushik Sadhu Paresh Nemade Swapnil DeshapndeDocument48 pagesAlok Rustagi Kaushik Sadhu Paresh Nemade Swapnil DeshapndeSwapnil DeshpandeNo ratings yet

- Research Paper Topics in Banking and FinanceDocument7 pagesResearch Paper Topics in Banking and Finances0l1nawymym3100% (1)

- Financial Markets Tutorial and Self Study Questions All TopicsDocument17 pagesFinancial Markets Tutorial and Self Study Questions All TopicsTan Nguyen100% (1)

- UoH FMII Group Assignment, 2022Document4 pagesUoH FMII Group Assignment, 2022Mona A HassanNo ratings yet

- Train Yourself - R K SinghDocument21 pagesTrain Yourself - R K SinghKavithaNo ratings yet

- Report On Banking Industry of BangladeshDocument38 pagesReport On Banking Industry of BangladeshZim-Ud -Daula67% (9)

- Credit Risk Dissertation TopicsDocument5 pagesCredit Risk Dissertation TopicsPaperWritingServiceCollegeTulsa100% (1)

- Financial ManagementDocument8 pagesFinancial Managementoptimistic070% (1)

- Thesis Banking and FinanceDocument6 pagesThesis Banking and Financeamywellsbellevue100% (2)

- Capital Account ConvertibilityDocument9 pagesCapital Account ConvertibilityShihas Muhammed AshrafNo ratings yet

- 2020 Main MemoDocument7 pages2020 Main MemoPusheletso MashiloNo ratings yet

- Binder 1Document155 pagesBinder 1adad9988No ratings yet

- 13 - 1st March 2008 (010308)Document5 pages13 - 1st March 2008 (010308)Chaanakya_cuimNo ratings yet

- Week6SeminarQuestions 6 StudentDocument4 pagesWeek6SeminarQuestions 6 Studentwjfnxdp6xnNo ratings yet

- Investment Banking Thesis IdeasDocument5 pagesInvestment Banking Thesis Ideasveronicahallwashington100% (2)

- Stage 1: Business Development and Marketing Stage 2: Sound Lending Principles/Credit AnalysisDocument2 pagesStage 1: Business Development and Marketing Stage 2: Sound Lending Principles/Credit Analysissaurabh_agraNo ratings yet

- Mba Banking and Finance Thesis TopicsDocument5 pagesMba Banking and Finance Thesis Topicsleanneuhlsterlingheights100% (1)

- Term Paper On One BankDocument4 pagesTerm Paper On One Bankafmzubsbdcfffg100% (1)

- Thesis UbcDocument7 pagesThesis UbcLuisa Polanco100% (2)

- Thesis Topics For Banking and FinanceDocument8 pagesThesis Topics For Banking and Financebsr3rf42100% (2)

- Dissertation On Credit ManagementDocument6 pagesDissertation On Credit ManagementPaperWritingServicesBestUK100% (1)

- Interview PreparationDocument12 pagesInterview PreparationRabeea AsifNo ratings yet

- Interest Rate DissertationDocument6 pagesInterest Rate DissertationCheapCustomWrittenPapersColumbia100% (1)

- 2021 CFA Level II Mock Exam - PM Session Victoria Novak Case ScenarioDocument71 pages2021 CFA Level II Mock Exam - PM Session Victoria Novak Case ScenarioAstanaNo ratings yet

- Research Paper On Central BanksDocument7 pagesResearch Paper On Central Bankst1tos1z0t1d2No ratings yet

- Shadow Banking System ThesisDocument6 pagesShadow Banking System Thesispak0t0dynyj3100% (2)

- ARM SolDocument32 pagesARM SolRizwan AhmadNo ratings yet

- Bank Failure Research PaperDocument8 pagesBank Failure Research Paperwihefik1t0j3100% (1)

- StelaDocument7 pagesStelaMarielle TenorioNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- PHD Thesis in Banking and FinanceDocument8 pagesPHD Thesis in Banking and Financebsqkr4kn100% (2)

- BAIN BRIEF The Return-Of-corporate Strategy in BankingDocument12 pagesBAIN BRIEF The Return-Of-corporate Strategy in BankingMBA MBANo ratings yet

- 2020 Main MemoDocument6 pages2020 Main MemoPusheletso MashiloNo ratings yet

- Bank of Canada Research PapersDocument6 pagesBank of Canada Research Papersgw10yvwgNo ratings yet

- Financial Crisis Dissertation ExamplesDocument7 pagesFinancial Crisis Dissertation ExamplesWriteMyBusinessPaperUK100% (1)

- Main For Details STRAMA - Paper - On - BPI PDFDocument129 pagesMain For Details STRAMA - Paper - On - BPI PDFDesmond Williams100% (3)

- FINM3006 Notes On Past Exams: 2016 Test 1Document77 pagesFINM3006 Notes On Past Exams: 2016 Test 1Navya VinnyNo ratings yet

- Complete Lecture Notes For MAFS 616 Bank PDFDocument33 pagesComplete Lecture Notes For MAFS 616 Bank PDFJohn MilanNo ratings yet

- Dissertation On Commercial BanksDocument4 pagesDissertation On Commercial BanksNeedHelpWithPaperSingapore100% (1)

- Dissertation On Debt ManagementDocument5 pagesDissertation On Debt ManagementHelpWithAPaperNewOrleans100% (1)

- NOTESDocument16 pagesNOTESHUPGUIDAN, GAUDENCIANo ratings yet

- Free Research Papers On Banking and FinanceDocument8 pagesFree Research Papers On Banking and Financeaflbvmogk100% (1)

- Dinheiro FísicoDocument27 pagesDinheiro FísicoWanderson MonteiroNo ratings yet

- Microfinance Dissertation ProposalDocument5 pagesMicrofinance Dissertation ProposalOnlinePaperWritingServiceDesMoines100% (1)

- Master Thesis Topics in Finance and BankingDocument8 pagesMaster Thesis Topics in Finance and Bankingangeladominguezaurora100% (1)

- SYLLABUS Bar Ilan Spring 2022Document4 pagesSYLLABUS Bar Ilan Spring 2022Sreejith BalachandranNo ratings yet

- Investment Banking Research PapersDocument7 pagesInvestment Banking Research Paperstxdpmcbkf100% (1)

- Sample Paper: Aakash National Talent Hunt Exam 2015 (Senior)Document1 pageSample Paper: Aakash National Talent Hunt Exam 2015 (Senior)Himanshu Rajesh PatnekarNo ratings yet

- Himanshu Patnekar - B2B A Case 8Document3 pagesHimanshu Patnekar - B2B A Case 8Himanshu Rajesh PatnekarNo ratings yet

- Is Africa The New Market of The Future?Document5 pagesIs Africa The New Market of The Future?Himanshu Rajesh PatnekarNo ratings yet

- B2B Marketing: Contributers: Prof. Abhay KardeguddiDocument19 pagesB2B Marketing: Contributers: Prof. Abhay KardeguddiHimanshu Rajesh PatnekarNo ratings yet

- Case 10Document3 pagesCase 10Himanshu Rajesh PatnekarNo ratings yet

- PM - Chapter 5 - R1 Systems Development Cycle Middle & Later Stages 200413Document20 pagesPM - Chapter 5 - R1 Systems Development Cycle Middle & Later Stages 200413Himanshu Rajesh PatnekarNo ratings yet

- Digestion Is The Mechanical and Chemical Breakdown ofDocument2 pagesDigestion Is The Mechanical and Chemical Breakdown ofHimanshu Rajesh PatnekarNo ratings yet

- S&RM Session Plan CasesDocument21 pagesS&RM Session Plan CasesHimanshu Rajesh PatnekarNo ratings yet

- LinearDocument3 pagesLinearHimanshu Rajesh PatnekarNo ratings yet

- Li Ka-Shing: at A GlanceDocument2 pagesLi Ka-Shing: at A GlanceHimanshu Rajesh PatnekarNo ratings yet

- S&RM Session Plan CasesDocument21 pagesS&RM Session Plan CasesHimanshu Rajesh PatnekarNo ratings yet

- HRM RJS 0508Document39 pagesHRM RJS 0508Himanshu Rajesh PatnekarNo ratings yet

- ATR451606Document2 pagesATR451606José Alfonso Jiménez CapillaNo ratings yet

- Hardcarb - Corporate ProfileDocument8 pagesHardcarb - Corporate ProfileJimit ShahNo ratings yet

- The 1 Catholic Mass in The PhilippinesDocument16 pagesThe 1 Catholic Mass in The PhilippinesRosalie AlitaoNo ratings yet

- PHD ThesisDocument270 pagesPHD Thesiskamba bryanNo ratings yet

- SS Ind A21 BVX002 - Approval of Permanent Joining Procedure and PersonnelDocument1 pageSS Ind A21 BVX002 - Approval of Permanent Joining Procedure and PersonnelTuTuy AnNo ratings yet

- De Jure MethodDocument2 pagesDe Jure MethodDr. Zulfiqar AliNo ratings yet

- Merton On Structural FunctionalismDocument6 pagesMerton On Structural FunctionalismJahnaviSinghNo ratings yet

- An Assessment of The InternshipDocument1 pageAn Assessment of The InternshipRaj GuruNo ratings yet

- Abella The Tagalog Variety of Nueva EcijaDocument39 pagesAbella The Tagalog Variety of Nueva EcijaFeed Back ParNo ratings yet

- List of SOC Related DocumentsDocument1 pageList of SOC Related DocumentsRavi Yadav0% (1)

- 03 - Information PackagesDocument13 pages03 - Information Packagesyusi cantikNo ratings yet

- Cadence Vol 23Document38 pagesCadence Vol 23api-3709957No ratings yet

- Teaching ScienceDocument55 pagesTeaching ScienceApril ManjaresNo ratings yet

- Case Study AnalysisDocument2 pagesCase Study AnalysisAnand RajNo ratings yet

- Implement A Verilog Model and Display The Output For A Set of Sample Data Together With The Wave Form Obtained For The Problems Given BelowDocument6 pagesImplement A Verilog Model and Display The Output For A Set of Sample Data Together With The Wave Form Obtained For The Problems Given Belowlilly pushparaniNo ratings yet

- Marketing Management Course OutlineDocument6 pagesMarketing Management Course OutlineChandrakant VadluruNo ratings yet

- Project - Portugal An Unlikely Empire - Student GuideDocument5 pagesProject - Portugal An Unlikely Empire - Student GuideBeanieNo ratings yet

- Paper1 OutlineDocument5 pagesPaper1 OutlineKevinNo ratings yet

- Individual Assignment: Retail ManagementDocument11 pagesIndividual Assignment: Retail ManagementTijo ThomasNo ratings yet

- Power-Linker Training Centre: GroupDocument1 pagePower-Linker Training Centre: GroupSunil SinghNo ratings yet

- Current Status, Research Trends, and ChallengesDocument23 pagesCurrent Status, Research Trends, and Challengesqgi-tanyaNo ratings yet

- L&T Aquaseal Butterfly Check Valves PDFDocument24 pagesL&T Aquaseal Butterfly Check Valves PDFnagtummalaNo ratings yet

- Assignment#2 Submitted To: Dr. Aliya Submitted By: Issma Munir Abbasi MS-SP-19-REL-013Document3 pagesAssignment#2 Submitted To: Dr. Aliya Submitted By: Issma Munir Abbasi MS-SP-19-REL-013issma abbasiNo ratings yet

- Osek Os: Session Speaker Deepak VDocument60 pagesOsek Os: Session Speaker Deepak VDaour DiopNo ratings yet

- Pointers, Virtual Functions and PolymorphismDocument9 pagesPointers, Virtual Functions and PolymorphismSANJAY MAKWANANo ratings yet

- Food Grade Anti-Corrosion Grease: Special FeaturesDocument2 pagesFood Grade Anti-Corrosion Grease: Special Featureschem KhanNo ratings yet

- Complete CV JulialeeDocument8 pagesComplete CV JulialeeYus KaiNo ratings yet