Professional Documents

Culture Documents

Investment and VC Funds Acting in SEE Region

Investment and VC Funds Acting in SEE Region

Uploaded by

paul_costasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment and VC Funds Acting in SEE Region

Investment and VC Funds Acting in SEE Region

Uploaded by

paul_costasCopyright:

Available Formats

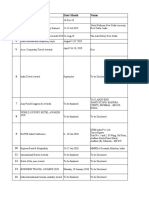

RCI Projects/RCI Investment Funds Research/Croatia

FUND

INVESTMENT STRATEGY 3TS Capital Partners is one of the leading private equity and venture capital firms in Central and Eastern Europe operating in the whole region through offices in Budapest, Bucharest, Prague, Vienna and Warsaw. 3TS is currently the exclusive advisor to three funds totalling approximately 230 million.

Regions of investment

Capitalization amount 3TS is currently the exclusive advisor to three funds totalling approximately 230 million 3TS is currently the exclusive advisor to three funds totalling approximately 200 million

WEB SITE

Adress

Tel

Fax

3TS Capital Partners Ltd.

Central and Eastern Europe

http://www.3tsvp.co m

Vclavsk 12 Praha 2, 120 00 Czech Republic

(+420) 221 460 130

(+420) 221 460 137

3TS Capital Partners

3TS primarily targets expansion capital and buyout investments in high growth sectors including Technology & Telecoms, Media & Marketing, Services and Environment & Energy. The target companies Romania, Hungary, are in growth sectors which are most likely to benefit from the catch Czech Republic, Austria, up to the western EU or the pre-accession run up in the case of the Poland next wave entrants. 3TS can also provide financing to companies expanding into the CEE region.

www.3tscapital.com

61 Buzesti St, BI A6, Et 11. Ap 72 011013 Bucharest, 1 Romania

(+40) 31 102 45 63

N/A

7L Capital Partners Emerging Europe L.P. is a EUR 100 million private 7L Capital Partners equity fund focusing on Branded Goods and Services, Communications, and Technology and Applications.

Made and The Fund is focused on managed fifty-five Emerging Europe, direct http://www.7lcp.com including: Romania, investments, /index.htm Bulgaria, Turkey, Former totaling EUR 242 Yugoslavia and Greece million. Global, including Romania, Poland, Hungary, Czech Republic, Slovakia, Turkey, Bulgaria and Croatia Romania, Bulgaria as well as countries from Western, Central and Eastern Europe, North and South America

N/A

(+30) 210 613 0455

(+30) 210 613 2104

Advent Central & Eastern Europe I&II

Provides finance and management to companies in the private sector. The majority of Advent's investment activity is focused on later-stage investments (buyouts, recapitalizations and growth equity). Advent operates three fund programs with a focus on: business services, retail, technology, media, healthcare and industrial. Typical funding scenarios include: buyouts (including buyouts of noncore divisions of large corporations and buy-outs from private owners) ,financing organic or acquisition-led growth international expansion, recapitalizations, special situations such as restructurings, joint venture investments (partnering with industry players)

330 million

Advent International plc www.adventinternati 111 Buckingham (+44 20) 7333 onal.com Palace Road 5537 London SW1W 0SR England Advent International Romania SRL 7 Maresal Pilsudski Street Sector 1 Trg Ivana Krndelja br.1 88000, Mostar Bosnia and Herzegovina

(+44 20) 7333 0801

Advent International

2.5 Billion EUR

www.adventinternati onal.com

(+40) 21 211 16 02

(+40) 21 211 16 02

Agent d.o.o.

Tourism Real Estate Investment Company

Bosnia

N/A

http://agent.ba/inves t/index.php?option=c om_frontpage&Itemi d=1

(+387) 61 935 537

(+387) 36 551 525

AIG Investment

AIG Investments philosophy dictates investing in companies over the continuum of growth through value.

Bulgaria, Croatia, Czech AIG Investments Republic, Estonia, http://www.aiginvest manages 13 Banul Antonache Hungary, Latvia, ments.com/AIG/Fund approximately US St. Lithuania, Romania, s/Funds+List/Equity/ 27.2 billion USD Bucharest Poland, Romania, Slovak Europe/europe_emer in private equity Romania 011663 Republic, Slovenia and ging_equity.htm assets. Ukraine

N/A

N/A

BC Serdon/RCI Projects/ 29.02.08

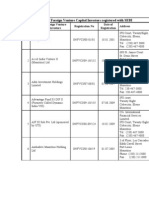

RCI Projects/RCI Investment Funds Research/Croatia

US $754 billion in assets under Romania, throughout management3 AIG Investments Europe, Asia, South and including North America approximately $132 billion in client assets Czech Republic, Hungary, Poland and Romania (the primary Investment size is region) and Bulgaria, AIG New Europe AIGNEF is investing in private companies, typically in excess of 15 per between US$ 10 Croatia, FYR Macedonia, Fund cent of the outstanding shares of a portfolio company million and US$ Moldova, the Slovak 30 million Repubic, Slovenia and Ukraine (the secondary region) Alfa Capital Partners, a leading Moscow-based private equity and real estate investment group, which manages US$701 million in capital Former Soviet Union, Alfa Capital from international institutional and private investors alongside capital South East Europe and $200 million Partners from Alfa Group. The group is created to build an institutional private Turkey equity business. ACP seeks to invest in leading companies and real estate properties. Alfa Developments EAD in the field of finance and for its two-year Alfa Developments history has developed a portfolio of over 500 000 sq.m. in projects Bulgaria N/A EAD encompassing all sectors - tourism, residential, office, commercial, industrial and logistics. The Fund seeks to achieve a superior rate of return by making equity and equity related investments with superior growth potential primarily in the emerging markets of Central and Eastern Europe. AIG Investments philosophy dictates investing in companies over the continuum of growth through value. Newly established Croatian investment fund, focuses on the Croatian companies, where it can exploit best its knowledge of local environment in order to create and add value to the investee Alternative Private companies. They usually combine equity and bank finance to invest Equity between 5 mil EUR and 30 mil EUR per transaction. If the size of the potential transaction would exceed this limit, they might invite other co-investors. To underwrite and formulate investments in opportunistic assets across select emerging markets. Our unique strategy differs from those of other emerging markets managers by our strong focus on analyzing credit, political and legal risk, monitoring our portfolio assets and maintaining sufficient liquidity. To better distinguish emerging markets performing opportunities, we have leveraged our global relationships to promote a network of company management teams, industry experts, investment bankers, and professional advisors that collaborate with us on transactions. We are opportunistic and patient in identifying investments that meet our leveraged risk-adjusted return requirements. Our ultimate goal is to maximize investment returns and to maintain a consistent dividend yield policy.

http://www.aiginvest 13 Banul Antonache ments.com/AIG/Fund St. s/Funds+List/Equity/ Bucharest Europe/europe_emer Romania 011663 ging_equity.htm

N/A

N/A

N/A

Stratos Office Center ul. Skorupki 5 (5th floor) PL-00-546 Warsaw, Mr Pierre F Mellinger, Chief Executive Officer Poland

(+48) 22 583 7000

(+48) 22 583 6969

32/1 Sadovayahttp://www.alfacp.ru Kudrinskaya Street; /eng/ 123001 Moscow, Russian Federation

(+7 495) 775 1828

(+7 495) 775 1827

http://www.alfadevel opments.com/en/

1504 Sofia, Bulgaria (+359) 2 48 93 7 Sheinovo str., 1 660 floor

(+359) 2 94 23 114

Croatia

N/A

Alternative Private (+385) 163 98 http://www.alternati Equity d.o.o., 297 ve-pe.hr/ Republike Austrije 1, 10 000 Zagreb

N/A

Arco Capital

Bulgaria, Batics, Western Balkans

N/A

Emerging Europe, Sofia Central Park http://arcocapital.co Building, 7 Sheinovo m/ Street, floor 3, Sofia 1000, Bulgaria

(359) 2 8952000

(359) 2 8952020

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

ARGUS Capital Group Limited

ARGUS II invests in the following Central and Eastern European countries: Albania, Bosnia & Herzegovina, HU-1126 Budapest, ARGUS was one of the first private equity firms to establish a network Bulgaria, Croatia, the Nagy Jen u. 12 of offices in the countries of Central and Eastern Europe (the The Fund has http://www.arguscap Czech Republic, Estonia, Hungary "Region"). We consider our local presence to be essential to our commitments of italgroup.com/en/ind Hungary, Latvia, strategy of forming close partnerships with investee companies and EUR 263 million. ex.html Lithuania, FYR building them into industry leaders. Macedonia, Montenegro, Poland, Romania, Serbia, Slovakia, Slovenia, and Turkey. Romniceanu Grigore dr. 3A 050574 Bucharest Romania

(+361) 309 00 90

(+361) 309 00 91

Arx Equity Partners Kft. Arx Equity Partners Kft. Representative office

ARX is focused on buy-out and growth capital transactions. Our investment focus is mid-sized companies in Central & Eastern Europe.

Central and Eastern Europe

N/A

www.arxequity.com

(+40) 21 410 0123

(+40) 21 410 5284

ARX is focused on buy-out and growth capital transactions. Our investment focus is mid-sized companies in Central & Eastern Europe.

Central and Eastern Europe

N/A

www.arxequity.com

Kronberg Building Senovn nmest 8 (+ 420 22) 423- (+420 22) 423110 00 Praha 1, The 5399 9424 Czech Rep. (+385) 1 4921 431; +387 33 922 463; Tel/Fax: +381 11 2120 525

Ascendant Capital Advisors

Ascendant offers access for enterprises to private equity and debt capital for the purposes of company expansion, mergers and acquisitions, and other forms of ownership transition. ASCENDANT maintains close relations with a number of international private equity and mezzanine funds. We also have extensive experience negotiating issuances of corporate debt with banks and other lending institutions.

Croatia, Bosnia and Herzegovina, Serbia

N/A

Vukotinovieva 4/2, 10 000 Zagreb, (+385) 1 4921 Croatia; Kulovia 8/2 429/430; Fax: 71000 Sarajevo, +387 33 922 http://www.ascenda BiH; Mihajlo Pupin 463; Tel/Fax: nt.hr Blvd. 10V/ 217, 11 +381 11 2120 070 New Belgrade, 525 Serbia.

Balkan Accession Fund

BAF typically invests, through equity and/or mezzanine finance, in Bulgaria, Romania. The industry leaders active in double digit growth sectors and/or fragmented industries with consolidation protential, and having a clear Fund may also expand its geographic coverage domestic and/or regional expansion strategy through M&A/organic to Western Balkan growth. countries (e.g. Croatia, BAF focuese on investing in: Financial Services, Retail, Logistics & Serbia), Moldova and Distribution, Consumer Produts, Information Technology & Ukraine. Telecommunications, Healthcare, Selected Industrial, Media and other Consumer-Related Services. Baring Communications Equity (Emerging Europe) Limited (BCEE or The Fund) is the oldest and leading media and communications focused fund in the Emerging Europe region. BCEE is uniquely positioned to help bring capital into ventures with gifted entrepreneurs and managers, and/or strategic partners.

110 Million EUR

http://www.bafund.n 36 Oborishte Str. et/ Sofia 1504, Bulgaria

(+359) 2 819 4570

(+359) 2 944 14 75

Baring Communications Equity Emerging Europe

Central and Eastern Europe

$74.25 million

http://www.bcee.net /

BCEE Advisers Kazimierzowska 3 05-510 Konstancin Jeziorna Poland

(+48) 227172500

(+48) 224853011

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

Belgrade Pioneer Fund Invests in Real Estate Property (Argyll Investment Services Limited) BIGINVESTICIONA GRUPA d.d Sarajevo

Serbia

N/A

http://www.belgrade pioneer.gg/

PO Box 354 Suite 4, Weighbridge House Lower Pollet St Peter Port Guernsey GY1 3XF Pruscakova 13, 71 000 Sarajevo

(+44) 1481 740044

(+44) 1481 727356

Investment Fund

Bosnia and Herzegovina

1.2 million

http://www.abds.co m.ba/

(+387 33) 251 440

(+387 33) 251 452

Blue Sea Capital

It favours investments in majority stakes of privately owned companies. It targets companies with a strong national market position and pan-regional expansion plans. The Fund intends to focus on growth by providing capital to successful local entrepreneurs who operate businesses that can easily be expanded regionally, with a clear joint exit path. Blue Sea Capital looks to make investments ranging from EUR 5 million to EUR 20 million.

SEE countries

N/A

Zagreb office Blue Sea Capital, http://blueseacap.co Heinzelova 62A/2, 10 m/ 000 Zagreb

Bulgarian The BIG REIT's strategy is to invest in development of residential and Investments Group office buildings near Sofia and other major metropolitan areas in REIT (Sofia) Bulgaria. Bullend Investments REIT (Sofia) BulVentures Capital Partners Real Estate Investment Trust Bulventures Capital Partners (BVCP) is a fund management company providing private equity financing to high growth potential enterprises.

Bulgaria

N/A

http://www.primepro 14 Antim I Str. pertybg.com 1000 Sofia, Bulgaria Sofia, 36 Vitosha Blvd., fl. 1 51 Evlogy Georgiev Blvd. 1000 Sofia Bulgaria Trg Nikole Subica Zrinskog 6 10000 Zagreb Croatia

( +359 2) 811 9050 (+359) 2 980 1426 (+359) 2 987 9240

( +359 2) 8119051 (+359) 2 980 1426

Bulgaria

N/A

www.bulland.org

Bulgaria

N/A

http://www.bulventu res.com/index.html

N/A

Copernicus invests in a portfolio of companies across a wide range of Copernicus Capital commercial sectors. Specific areas of specialisation include business d.o.o. services, media and telecommunication, tourism related, distribution and logistics, consumer goods and services, health care. Copernicus seeks to identify and invest in a portfolio of companies in its target countries, across a wide range of commercial sectors. The most important criterion for investment is a company that demonstrates exceptional prospects for commercial success.ndustry Sectors: * All business sectors are considered with the exception of certain Copernicus Capital speculative activities and the manufacture of arms and munitions. srl * Specific areas of specialisation include: o business services o media and telecommunication o tourism related o distribution and logistics o consumer goods and services o health care.

Romania, Poland, Croatia, Serbia, UK

$30 million

www.copernicuscapital.com

(+385 1) 487 7900

(+385 1) 487 7901

Croatia and Serbia primarily as well as other SEE countries

30 Million USD

www.copernicuscapital.com

24-26 Polona Street 010503 Bucharest Romania

(+40) 21 312 1622

(+40) 21 312 1644

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

Copernicus seeks to identify and invest in a portfolio of companies in its target countries, across a wide range of commercial sectors. The most important criterion for investment is a company that demonstrates exceptional prospects for commercial success.ndustry Sectors: * All business sectors are considered with the exception of certain Copernicus Capital speculative activities and the manufacture of arms and munitions. srl * Specific areas of specialisation include: o business services o media and telecommunication o tourism related o distribution and logistics o consumer goods and services o health care. DAAC-HERMES S.A., fond de investitii nemutual nespecializat One of two funds at DAAC (second is DAAC Invest - 133K lei) . DAAC unites enterprises related to the leading branches of the Moldavian economy such as processing industry, food industry; procurement, storage and processing of cereals; chemical industry; machinebuilding; repair and service of agricultural equipment;trade and consumer services to population This fund, which is sponsored by the Alpha Group of Greece, makes direct equity investments in private companies, or companies under going privatisation. At least two thirds of the Fund must be allocated to projects in Romania. The rest is considered on an ad-hoc basis for projects in Albania, Bulgaria and FYR Macedonia. DEG promotes private enterprise in developing and transition countries as a contribution to sustainable growth and a lasting improvement in the living conditions of the local population. In Serbia DEG supported the following sectors: * Energy * Water Supply and Sanitation * Private Sector Development Supporting Macedonia on its way to the EU, KfW allocated funds mainly in the areas of water supply, waste water treatment and environmental protection as well as support to micro, small and medium enterprises.

Croatia and Serbia primarily as well as other SEE countries

30 Million USD

www.copernicuscapital.com

Krlewska 16 00-103 Warsaw Poland

(+48) 22 330 6333

(+48) 22 330 6300

Moldova

EUR 400 000*

www.daac.md

MD-2069, mun.Chisinau, Calea (373-22) (373-22) 746397 Iesilor, 10 759845,755932

Danube Fund Ltd

Romania, Albania, Bulgaria and FYR Macedonia

from US$ 0.5 million to US$ 2 million

N/A

Mr D Damianos, Managing Director & General Manager; 8 Merlin Street 10671 Athens, Greece

(+30) 1 362 7710

(+30) 1 361 9532

DEG

All countries

244 million

http://www.deginves Zupana Vlastimira 6 (+381) 11 t.de/EN_Home/DEG/i 11040 Belgrade 3671 273 ndex.jsp

(+381) 11 3671 273

DEG

All countries

105 Million EUR

http://www.kfwentwicklungsbank.de /EN_Home/LocalPres ence/Europe64/Mace donia98/index.jsp http://www.kfwentwicklungsbank.de /EN_Home/LocalPres ence/Europe64/Alban ien/index.jsp http://www.kfwentwicklungsbank.de /EN_Home/LocalPres ence/Europe64/Koso vo/index.jsp

Antonie Grubisik 5 1000 Skopje

(+389) 23 109 241

(+389) 23 212 466

DEG

KfW's financial support in Albania focuses on the water and energy sectors as well as on the promotion of small and medium-sized enterprises. DEG promotes private enterprise in developing and transition countries as a contribution to sustainable growth and a lasting improvement in the living conditions of the local population. In Kosovo DEG supported the following sectors: * Energy * Water Supply and Sanitation * Private Sector Development

All countries

105 Million EUR

Rruga Skenderbej (Rruga e Ambasadave) Nr. 21/1 Kati III Tirana

(+355) 4 22 78 (+355) 4 23 38 69 79

DEG

All countries

105 Million EUR

Zija Shemsiu Nr. 6 10000 Pristina

(+381) 38 544- (+381) 38 544141 141

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

East Capital International AB

Founded in 1997, East Capital is a leading independent asset manager specialising in Eastern European financial markets in assets under management, both in public and private equity.

All countries in SEE

5.7 billion

East Capital International AB

Founded in 1997, East Capital is a leading independent asset manager specialising in Eastern European financial markets in assets under management, both in public and private equity. The EBRD finance will support the expansion of the fast-growing companys business in potato processing under the brand name of Vipa. The financing will support the strengthening of Pestovas market position through the introduction of new products and an increase in exports to neighbouring countries. EIP has been appointed by the investment company EIP III of the USA to find SME investments in the sustainable investment sector in central Europe. These investments can be for up to 1.0 mm and can be projects (such as renewable energy, and fresh and waste water) or companies. Please see the EIP III section (EIP III) of their web site for additional detail

All countries in SEE

5.7 Billion EUR

EBRD

Kosovo

1.9 Million EUR

Headquarters East Capital Box 1364 (+ 46 850) (+ 46 850) www.eastcapital.com SE-111 93 588500 588500 Stockholm Sweden Romanov Dvor http://www.eastcapit Business Centre (+7 495) 380 (+7 495) 380 15 al.com/en/about-east- 4, Romanov Lane 15 00 01 capital/company 125009 Moscow Russia Bojana Todorovska, http://www.ebrd.co EBRD, One Exchange (+44 20) 7338 (+44 20) 7338 m/new/pressrel/200 Square 6940 6100 7/071105b.htm London EC2A 2JN United Kingdom EIP - European Investments & Partners Sp. z o. o., http://www.eip.com. 12C Piaskowa St., 05pl/ 510 KonstancinChylice Poland 33 Aviatorilor Blvd., Bucharest 011853 Romania and/or 9 http://www.axxessca Chamkoria Street, pital.net/eeaf.html Floor 4 Sofia 1527 Bulgaria

European Investments & Partners (EIP)

Central Europe

N/A

(+48) 22 7563232

(+48) 22 756 49 19

Emerging Europe Accession Fund

EEAF invest in companies with strong medium-to-long-term growth potential that can take advantage of the EU convergence plan in the region. The general interest is for Consumer Goods and Consumer Related Services as well as for Professional Services for Companies

South Eastern Europe

+150M fund

(+4) 021-222(+4) 021 2078503 7100 (Buchurest); (Buchurest); +3592 944-1475 +3592 819(Sofia) 4570 (Sofia)

EMP Global

EMP is a world-wide private equity firm with the resources and expertise to source, evaluate, and manage private investments globally in both developed and developing markets and across many industrial and commercial sectors.

EMP Global has played a leading Central and Eastern role as the European countries as Principle Advisor http://www.europe.e well as countries in Asia, to a $550 million mpglobal.com Africa, Latin America and fund targeting the Middle East EU ascension countries of Europe

2020 K Street, NW Suite 400 Washington, DC 20006 United States of America

(+1) 202 331 9051

(+1) 202 331 9250

EnerCap Capital Partners

specialises in private equity investments in renewable energy projects across Central, Eastern and South-Eastern Europe. The EnerCap Power Fund I L.P. was created to capture the exponential growth in renewable energy projects expected in the region. The Fund invests in projects and companies in: Wind energy, Biomass energy, Energy efficiency technologies, Solar energy, Small hydro power Projects generating carbon credits.

emerging (Central, Eastern and SouthEastern) Europe

EnerCap Capital Partners, Burzovn palc, Rybn 14, 110 98 million closed- http://www.enercap. 00 Praha 1, Czech end ten year fund com Republic

( +420) 227 316 222

(+420) 227 316 444

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

Enterprise Investors

Enterprise Investors objective is to invest the money entrusted to us in companies that demonstrate high growth potential, and then to work with the entrepreneurs and the managers to increase the value of those companies. Throughout the years EPIC has developed an effective and consistent approach to investing in CSEE, Turkey and CIS. This approach is founded largely upon EPIC's belief in the need for a strong local presence and active participation in the management of the companies in which it invests. Depending on the project EPIC will act as singular or co-investor. Equest Balkan Properties plc (EBP) looks to invest in commercial property assets, including retail and industrial property, with a view to taking advantage of attractive yields, and potential for capital appreciation in the region. As part of its investment strategy, EBP borrows funds from commercial lenders, as it anticipates that higher returns are achievable through investments than the cost of such debt financing.

Poland and countries in Central and Eastern Europe Bulgaria, Croatia, Serbia Romania, and other countries in South-East Europe, Turkey, Russia and CIS

1.6 Billion EUR

www.ei.com.ro

Domus Center Str. Stirbei Vod Nr. 36, Etaj 5 Bucureti, sector 1, Romania EPIC d.o.o. Dositejeva 26 SRB-11000 Beograd Serbia Grand Offices 4th Floor Room 4.10 13 Septembrie Avenue 90 Bucharest 5 050726 Romania

(+40 21) 314 66 85

(+40 21) 314 81 93

EPIC Investment Partners

N/A

www.epicinvest.com

(+ 381) 11 262 2673

(+ 381) 11 262 8975

Equest

Principal focus is on Bulgaria and Romania, with the rest of the Balkan region a secondary target.

136 Million EUR

http://www.equestba lkan.com/section.asp x?m=61

(+40 21) 403 4495

(+40 21) 403 4490

Equest DOO(Belgrade)

Equest Balkan Properties plc invests in the property market of South East Europe. Its principal focus is on Bulgaria and Romania, with the rest of the Balkan region a secondary target.

Bulgaria, Romania and the Balkan Region

136 Million EUR

http://www.equestba lkan.com/section.asp x?m=61

No 6 Bulevar Mihajla Pupina (+ 381) (11)22 New Belgrade, 00 580 Serbia

(+381) 11 2200583

Equest Balkan Properties plc (EBP) looks to invest in commercial property assets, including retail and industrial property, with a view to taking advantage of attractive yields, and potential for capital Equest EAD (Sofia) appreciation in the region. As part of its investment strategy, EBP borrows funds from commercial lenders, as it anticipates that higher returns are achievable through investments than the cost of such debt financing. ERG Capital 1 ADSIP is operating as a real estate investment trust ERG Capital - 1 (REIT). The company was established in 2004 with the purpose of Special Investment buying, owing and renting two specific built-to suit commercial use Purpose JSC (Sofia properties in Sofia Praktiker and Oriflame, both located on ) Tzarigradsko Shousse Boulevard

Principal focus is on Bulgaria and Romania, with the rest of the Balkan region a secondary target.

136 Million EUR

http://www.equestba lkan.com/section.asp x?m=61

Equest House 8 Khan Asparouh Street Sofia 1463 Bulgaria

(+ 359 2) 851 9120

(+359 2) 851 9102

Bulgaria

N/A

http://www.ergcapita l-1.bg/en/

(+359) (2) 9658 389

(+359) (2) 9445 010

ERSTE - INVEST D.O.O.

Investment fund management company. One of the funds it manages is Erste ADRIATIC EQUITY, a fund investing on the Croatian capital market.

European Privatization and Investment Corporation

Privatization and investment funds established and managed in several CSEE and CIS countries, current focus on tourism portfolios. Manages industrial portfolios for municipalities or industries.

Republic of Croatia, member countries of OECD and EU, United States of America and Serbia, Bosnia and Herzegovina, Montenegro, Albania, Macedonia and Ukraine Bulgaria, Croatia, Serbia Romania, and other countries in South-East Europe, Turkey, Russia and CIS

1 billion

http://www.ersteinvest.hr/defaulteng. aspx

Zagreb, Ilica 10 / II ( +385 62) 372 Croatia 900

(+385 62) 372 901

N/A

www.epicinvest.com

Miramarska 24 HR-10 000 Zagreb Croatia

(+385 1) 600 5615

(+385 1) 600 5616

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

European Privatization and Investment Corporation European Privatization and Investment Corporation European Privatization and Investment Corporation European Privatization and Investment Corporation European Privatization and Investment Corporation

European Privatization and Investment Corporation pioneer in voucher privatization and direct equity investment

European Privatization and Investment Corporation pioneer in voucher privatization and direct equity investment

European Privatization and Investment Corporation pioneer in voucher privatization and direct equity investment

European Privatization and Investment Corporation pioneer in voucher privatization and direct equity investment

Bulgaria, Croatia, Serbia Romania, and other countries in South-East Europe, Turkey, Russia and CIS Bulgaria, Croatia, Serbia Romania, and other countries in South-East Europe, Turkey, Russia and CIS Bulgaria, Croatia, Serbia Romania, and other countries in South-East N/A Europe, Turkey, Russia and CIS Bulgaria, Croatia, Serbia Romania, and other countries in South-East Europe, Turkey, Russia and CIS Bulgaria, Croatia, Serbia Romania, and other countries in South-East Europe, Turkey, Russia and CIS

N/A

www.epicinvest.com

Fadilpasica Mustajbega 19/1 Sarajevo 71000 EPIC d.o.o. Dositejeva 26 SRB-11000 Beograd Serbia EPIC d.o.o. Dositejeva 26 SRB-11000 Beograd Serbia 99 Evlogi Georgiev bul. BG-1142 Sofia Bulgaria EPIC Financial Consulting Strada Paris 54 Sector 1 RO-011817 Bucharest

(+387) 33 223 639

(+387) 33 223 639

N/A

www.epicinvest.com

(+ 381) 11 262 2673

(+ 381) 11 262 8975

www.epicinvest.com

(+ 381) 11 262 2673

(+ 381) 11 262 8975

N/A

www.epicinvest.com

(+ 359) 2 988 7390

(+359) 2 981 6206

European Privatization and Investment Corporation pioneer in voucher privatization and direct equity investment

N/A

www.epicinvest.com

(+40) 1 231 2325

(+40) 1 231 2285

Euroventures Capital

Euroventures is one of the longest-established and leading independent private equity firms in Central Europe. Euroventures comprises four investment programmes, which have invested in 21 companies.

Central Europe

80 Million EUR

www.euroventures.h u

FEH ULAGANJA d.o.o.

Croatia EU, OECD, CEFTA, Croatia, Bosna and Herzegovina, Serbia, Montenegro

N/A

N/A

Hegyalja ut 168 (+36) 1 309 1112 Budapest 7900 Hungary MIRAMARSKA 24 HR 10000 ZAGREB , (+385) 1 6111 Ante Dropulji, 711 director

(+36) 1 319 4762

FIMA GLOBAL INVEST D.O.O*

Investment fund management company. The company manages five investment funds including FIMA Equity and invests in real estates.

http://www.fgi.hr/?L =H

Anina 2, HR 42000 Varazdin

(+385 42) 390 930

(+385 42) 390 980

FMO

GED Capital Development

GED Capital Development

The Netherlands Development Finance Company (FMO) supports the private sector in developing countries and emerging markets. FMO Asia, Africa, Latin provides loans, participations, guarantees and other investment America and Central and 2.7 billion promotion activities. The goal is to contribute to the structural and Eastern Europe sustainable economic growth in these countries and, together with the private sector, obtain healthy returns. Bulgaria, Romania, and GED Group is an independent Private Equity group that operates in the neighbouring the Iberian Peninsula and in Southeastern Europe, with wide-ranging 250 Million EUR countries in SEE as well experience and a proven vocation for enterprise management. as Spain, Portugal GED Group is an independent Private Equity group that operates in Bulgaria, Romania, and the Iberian Peninsula and in Southeastern Europe, with wide-ranging the neighbouring 150 Million EUR experience and a proven vocation for enterprise management. The countries in SEE as well for Bulgaria fund invests in companies at development phase in different sectors as Spain, Portugal of the economy.

http://www.fmo.nl

Anna van Saksenlaan 71; 2593 HW The (+31 70) 314 9 (+31 70) 314 97 Hague; The 6 54 58 Netherlands

www.gedprivateequit y.com

N/A

(+40) 213 175 884

N/A

www.gedprivateequit y.com

N/A

(+359) 2 981 7470

N/A

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

GEMISA SERVICII S.R.L.

Gemisa Investments is the sole private equity fund in Romania focused on financing start-ups and early stage companies. The Fund was set-up at the end of 2004 and has committed investments in 11 companies thereof 10 start-ups and one mature company. At present, Gemisa owns investments in 10 companies, further one exit. Global Finance takes a proactive role in backing exceptional entrepreneurs and managers, providing growth capital to companies with a potential for significant expansion.The main investment activity of Global Finance comprises direct investments in portfolio companies in the manufacturing, information technology, specialty retail, media, telecommunications and services industries. Global Finance takes a proactive role in backing exceptional entrepreneurs and managers, providing growth capital to companies with a potential for significant expansion.The main investment activity of Global Finance comprises direct investments in portfolio companies in the manufacturing, information technology, specialty retail, media, telecommunications and services industries. The main investment activity of Global Finance comprises direct investments in portfolio companies in the manufacturing, information technology, specialty retail, media, telecommunications and services industries. Typical exit methods are IPOs and trade sales to industrial or financial buyers.

Romania

6 Million EUR

http://www.gemisa.r o/investmentstrategy/63/

Calea Rahovei, Nr. 266-268 Bucureti, Sector 5

(+40) 21 404 1400

(+40) 21 404 1401

Global Finance

Bulgaria, Romania, Greece and Eastern Europe

700 million

http://www.globalfin ance.bg/content.asp x?mi=2

14 Filikis Etarias Square, 10673 Athens Greece

(+30 210) 720 8900

(+30 210) 729 2643

Global Finance

Bulgaria, Romania, Greece and Eastern Europe

700 Million EUR through different funds

http://www.globalfin 11 Maria Louisa Blvd. (+359) 2 92 39 (+359) 2 92 39 ance.bg/content.asp 4th floor 561 560 x?mi=2

Global Finance

Bulgaria, Romania, Greece

700 Million EUR http://www.globalfin through different ance.gr/page/default funds .asp?id=10&la=1

Calea Victoriei, Nr. 15, Bucharest Financial Plaza Cod postal 030023, Bucureti, Sector 3

(+40) 21 310 1100 (+40) 21 310 4252

(+40) 21 310 4253

Global Private Equity Holding AG (GPE)

Fund under management Eur 10bn industry sector: Industrial products & services, Consumer retail, Industria Automation, Services others.

Special focus Eastern Europe

www.gutmann.at

Bank Gutmann (+43) 1 502 20 Aktiengesellschaft 0; (+43) Schwarzenbergplatz 1/50.22.03.30; 16 (+43) 1010 Vienna, Austria 1/50.22.02.20 Str. Petru Movila 12, ap.4, 4th Floor MD-2004 Chisinau Moldova Vlaska 99 HR-10000 Zagreb

Horizon Capital

Horizon Capital is a private equity fund manager that originates and manages investments in mid-cap companies with outstanding growth and profit potential in Ukraine and Moldova.

Moldova, Ukraine, USA

300 Million USD

www.horizoncapital.c om.ua

(+373) 22 88 72 00

(+373) 22 88 72 03

Horizonte has been active in Slovenia since 1994 and has since then gradually invested into companies in the whole region of former Horizonte Venture Yugoslavia. Management d.o.o. Currently Horizonte has four funds under management with total committed capital of 63 million. Horizonte has been active in Slovenia since 1994 and has since then gradually invested into companies in the whole region of former Horizonte Venture Yugoslavia. Management d.o.o. Currently Horizonte has four funds under management with total committed capital of 63 million. Horizonte has been active in Slovenia since 1994 and has since then gradually invested into companies in the whole region of former Horizonte Venture Yugoslavia. Management d.o.o. Currently Horizonte has four funds under management with total committed capital of 63 million.

Austria, Slovenia, Croatia, Bosnia and Herzegovina, Serbia

63 million

http://www.horizont e.at/index.php?page =7

(+385) (1) 466 5322

(+385) (1) 466 4850

Austria, Slovenia, Croatia, Bosnia and Herzegovina, Serbia Austria, Slovenia, Croatia, Bosnia and Herzegovina, Serbia, Montenegro and other contries from SEE

63 million

http://www.horizont e.at/index.php?page =7

ul. Ferhadija 11 br BiH-71000 Sarajevo

(+387 33) 207 087

(+387 33) 207 463

63 million

http://www.horizont Teslova 30 e.at/index.php?page SLO-1000 Ljubljana, =7 Slovenia

(+386 1) 241 4780

(+386 1) 241 4788

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

Honestas Private Equity Partners

It currently manages 155 million HRK of capital raised from private domestic and foreign investors participating in the program of the Croatian Government called Economic cooperation funds. Our management team has a proven reference number of successful transactions and projects in Croatia and other countries of Central and Eastern Europe. The intention of the Company is to invest in reputable companies in order to enable additional growth and expansion.

Croatian and Eastern Europe

150 million Croatian kuna

http://www.honestaspe.hr/#!

Ivana Lucica 2A, Eurotower 10000 Zagreb, Hrvatska

(+385) (0)1 555 1994

(+385) (0)1 410 0098

Member of the World Bank Group. IFC fosters sustainable economic growth in developing countries by financing private sector investment, mobilizing capital in the international financial markets, and providing IFC International advisory services to businesses and governments. The products they Finance offer are: Loans for IFC's Account; Syndicated Loans; Equity Finance; Corporations Quasi-Equity Finance; Equity & Debt Funds; Structured Finance; Intermediary Services; Risk Management Products; Local Currency Financing; Municipal Finance; Trade Finance. Member of the World Bank Group. IFC fosters sustainable economic growth in developing countries by financing private sector investment, mobilizing capital in the international financial markets, and providing IFC International advisory services to businesses and governments. The products they Finance offer are: Loans for IFC's Account; Syndicated Loans; Equity Finance; Corporations Quasi-Equity Finance; Equity & Debt Funds; Structured Finance; Intermediary Services; Risk Management Products; Local Currency Financing; Municipal Finance; Trade Finance. Member of the World Bank Group. IFC fosters sustainable economic growth in developing countries by financing private sector investment, mobilizing capital in the international financial markets, and providing IFC International advisory services to businesses and governments. The products they Finance offer are: Loans for IFC's Account; Syndicated Loans; Equity Finance; Corporations Quasi-Equity Finance; Equity & Debt Funds; Structured Finance; Intermediary Services; Risk Management Products; Local Currency Financing; Municipal Finance; Trade Finance. Innova Capital manages funds that aim to invest within the Central, Eastern, or South-Central European Region, primarily in the EU accession countriesFund Innova/3 has only one last deal left in its portfolio. This fund is one of the best performing in European private equity in recent times. Fund Innova/4 is at end of the investment phase with six companies in its portfolio, but no exits yet. In 2010 Innova/5 fund started to invest As of December 2007, IFC has committed more than $170 million of its own funds in the country and has arranged over $8 million in syndications. IFC investments have financed projects in financial markets, information technology, oil and gas, and manufacturing sectors.

Sub-Saharan Africa; East Asia & the Pacific; South Asia; Europe & Central Asia; Latin America & the Caribbean; Middle East & North Africa

$ 6.3 billion

http://www.ifc.org

Trg. J.F. Kennedya 6b/III HR-10000, Zagreb, Croatia

(+385 1) 235 7241

(+385 1) 235 7200

Sub-Saharan Africa; East Asia & the Pacific; South Asia; Europe & Central $6.3 billion Asia; Latin America & the Caribbean; Middle East & North Africa

http://www.ifc.org

Bulevar Kralja Aleksandra 86 1100 Belgrade Serbia

(+381 11) 302 3750

(+381 11) 302 3740

Sub-Saharan Africa; East Asia & the Pacific; South Asia; Europe & Central Asia; Latin America & the Caribbean; Middle East & North Africa

$6.3 billion

http://www.ifc.org/if cext/eca.nsf/content/ 83 Dacia Boulevard, contactus#Turkey_h Sector 2 ub Bucharest, Romania

(40-21) 3182809

(40-21) 3182810

Innova Funds 3,4,5

Poland, Romania, Bulgaria, Hungary, Slovakia, Croatia, Moldova

112 Million USD, 228 M and 388 Million USD

Rondo ONZ 1, 35th floor 00-124 Warsaw Poland. Contacts: Mr www.innovacap.com Robert L Conn, Managing Partner; Mr Steven J Buckley, Managing Partner http://www.ifc.org/if cext/eca.nsf/content/ contactus#ALBANIA Deshmoret e 4 Shkurtit, No. 34 Tirana, Albania

+48 22 583 9400

(+48) 22 583 9420; +48 22 544 94 03

International Finance Corporation

Albania

$170 million

(+355 4) 280 650/1

(+355 4) 240 590

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

iO Adria Limited (until recently: Jupiter Adria)

Jupiter Adria was founded in Croatia by the British fund. After its separation from the Jupiter Fund Management Fund in 2011, the company rebranded and was named iO Adria. iO Adria invests in Croatian resort real estate with a unique idea of creating the finest collection of resort real estates in Croatia that offer authentic Adriatic experience united with the most quality service.

Croatia

http://www.jupiterad ria.hr/

(+)144129227 60

(+1) 441 295 8690 (Garth Lorimer Turner)

JADRAN INVEST D.O.O.

Jadran Kapital d.d is a closed-end investment fund with the principle aim of investing in strategic property assets in Croatia.

Croatia

11 million

http://www.jadranin vest.hr/ji_odrustvu.p hp

SAVSKA 141 10 000 ZAGREB

(+385 1) 6191 647

(+ 385 1) 6191 651

Jupitercurrently manage assets spread across a range of UK and offshore mutual funds, multi-manager products, hedge funds, Jupiter Investment institutional mandates and investment companies. Jupiter has gained Management a reputation for achieving outperformance across a broad variety of Group Limited portfolios specialising in different markets, including UK equities, Europe, global financials and emerging Europe.

emerging Europe

http://www.jupiteron line.co.uk

Jupiter Customer Services Department (+44)8446207 PO Box 10666 600 Chelmsford CM99 2BG

KD Asset Management B.V.

KD Private Equity Fund B.V. is a private greenfield risk capiatl fund Bosnia and Herzegovina, which will make private equity and equtiy related investments in Croatia, Bulgaria, medium-sized companies in selected countries of the SEE region. As a Romania, Serbia, generalist fund, it will invest in export companies with a regional Albania, Macedonia, presence in the consumer goods and durable goods Moldova sectors.Investment period running; no investments yet. Kerten primarily focuses on investment opportunities in Central and Eastern European countries in a broad range of business sectors. Those of most interest are outlined below: *business services *energy and environmental *financial services *food production and processing *health and medical Limestone is a specialist Emerging European equity fund manager based in Tallinn. Its current investment mandates cover several of the most attractive and innovative strategies for the region, including socially responsible investment (SRI) and Pre-IPO opportunities, as Long term investments, combined with small part of short term, diversified of investments in different companies and sectors are the major investment strategic of the MAM investing.

70 Million

www.kd-group.si

Celovka cesta 206 1000 Ljubljana

(+386 1) 582 67 58

(+386 1) 519 28 47

Kerten

Central and Eastern European countries

N/A

www.kerten.com

Kerten Capital SRL Str. Sold. Octavian Moraru nr. 1 Sector 1 011863 Bucharest Romania Vike-Karja 12, Tallinn 10140, Estonia Borka Taleski br.15/2 1000 Skopje; Macedonia

(+40) 21 231 30 16

Limestone Investment Management

emerging (Central and Eastern) Europe Macedonia, Serbia, MonteNegro, Albania, Bosnia and Herzegovina, Croatia.

N/A

http://www.limeston efunds.eu/?id=5351 http://www.mam.co m.mk/Default.aspx?i d=5b7b222d-95d94b2f-bd6dbcff4ccba6ea

(+372) 712 0801

(+372) 628 2370

MAC Assets Management

N/A

(+389) 2 324 55 55

(+389) 2 324 55 55

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

Macquarie Group London

Macquarie Group is a leading provider of banking, financial, advisory, investment and funds management services. Our global operations include offices in the world's major financial centres.

Europe / Middle East / Africa

Ropemaker Place, http://www.macquari 28 Ropemaker 0044 20 3037 e.co.uk/mgl/uk Street, London EC2Y 2000 9HD, UK Marfin Investment Group http://www.marfinin 24 Kifissias Avenue vestmentgroup.com/ Amaroussion, Athens 151 25, Greece http://www.meditera ninvest.hr/templates /mediteranRadnaEng .asp?sifraStranica=1 52 ulica kralja Tomislava 24, 48 260 Krievci, Croatia

Marfin Investment Making private equity-type investments, as well as investments in Group Holdings privatisations and infrastructure projects, in the targeted countries. S.A. Geographical preference : Southern Eastern Europe

Southern Eastern Europe

(+30) 210 81 73 000

MEDITERANINVES T D.O.O.

Company for the formation and management of Real estate investments.

investment funds.

Croatia

140 000

(+385 48) 655 814, 655 809

(+385 48) 655 955

Providing capital to private companies in the new EU member states and the other Balkan countries; While AMC is a generalist fund with no specific sector focus, when looking across all funds of the Mezzanine Management groups, the following industries have Mezzanine generally been particularly attractive Management group Contract services Healthcare Manufacturing/light industry Media and related sectors Mid Europa Partners is a leading independent private equity investment firm focused on Central and Eastern Europe. The compnay typically invests 50 million to 200 million in companies with enterprise values ranging from 100 million to 1,500 million, which are cash-flow generative and have dominant market positions in sectors with high barriers to entry.Target sectors: * Telecoms & Media: * Utilitie * Transportation and logistic * Natural resources * Basic industries * Other sectors: building materials, general manufacturing, healthcare, pharmaceuticals, agri-business, etc...

Romania, Hungary, Poland, Austria and countries throughout Central and Eastern European countries

115 Million USD

www.mezzmanagem ent.com

124 Calea Dorobanti Str. Entrance A, Apt. 3, Ground Floor Bucharest

(0040) 21 231 42 20

(0040) 21 231 42 20

Mid Europa Partners

Central and Eastern Europe

300 Million

Mid Europa Partners Kft Bank Center www.mideuropa.com Platina Tower, 5th floor Szabadsag Ter 7. 1054 Budapest

(+36) 1 411 1270

N/A

Montenegro Investments Ltd. Invests in Real Estate Property (Argyll Investment Services Limited)

Montenegro

N/A

http://www.serbiapr operty.gg/

PO Box 354 Suite 4, Weighbridge House Lower Pollet St Peter Port Guernsey GY1 3XF

(+44) 1481 740044

(+44) 1481 727355

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

NEXUS Private Equity Partners

Nexus Private Equity Partners is a private equity / venture capital fund management company established in Croatia in 2008, with the ambition of developing and positioning Nexus as a key player in both Croatia & SEE Countries the Croatian and regional private equity / venture capital markets withseveral funds under management.

50 Million Euros

http://www.nexuspe.hr/en

I. Lucica 2a, 9th Floor (Eurotower), 10000 Zagreb, Croatia

+385 1 549 9850

38515499859

NCH Advisors

NCH has launched 21 funds since its inception in 1993, and was the first Western investor to raise, invest and successfully liquidate twelve funds in Russia and Eastern Europe. Its two most recent funds dedicated to the region, NCH Agribusiness Partners and NCH New Europe Property Fund II, were launched in the autumn of 2007 and the summer of 2008, respectively. NCH Agribusiness Partners invests in farmland and agribusiness-related activities. NCH New Europe Property Fund II invests in real estate and related assets

Western Balkans

N/A

www.nchadvisors.co m

NCH Advisors Inc., SkyTower, No. 72, Rr. Deshmoret e 4 Shkurtit, Tirana, Albania

(+355) 4 222 1666 ext 162

(+355) 4 222 1666 ext 162

NCH Advisors

NCH has launched 21 funds since its inception in 1993, and was the first Western investor to raise, invest and successfully liquidate twelve funds in Russia and Eastern Europe. Its two most recent funds dedicated to the region, NCH Agribusiness Partners and NCH New Europe Property Fund II, were launched in the autumn of 2007 and the summer of 2008, respectively. NCH Agribusiness Partners invests in farmland and agribusiness-related activities. NCH New Europe Property Fund II invests in real estate and related assets

Russia, Eastern Europe

N/A

NCH Advisors Inc., Krzhizhanovskogo Street, 14, Building 3, 5th Floor, Moscow, Russia 117218 / NCH Direct www.nchadvisors.co Investments Russia, m Capital Tower Business Center, 29, 1st Brestskaya Street, Moscow, Russia 125047 / NCH Advisors Inc., 138 Obvodny Canal

NCH Advisors

NCH has launched 21 funds since its inception in 1993, and was the first Western investor to raise, invest and successfully liquidate twelve funds in Russia and Eastern Europe. Its two most recent funds dedicated to the region, NCH Agribusiness Partners and NCH New Europe Property Fund II, were launched in the autumn of 2007 and the summer of 2008, respectively. NCH Agribusiness Partners invests in farmland and agribusiness-related activities. NCH New Europe Property Fund II invests in real estate and related assets

Russia, Eastern Europe

N/A

NCH Advisors Inc. www.nchadvisors.co 27-T Degtyarevskaya m Street, 2nd Floor, Kyiv, Ukraine 04119

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

NCH Advisors

NCH has launched 21 funds since its inception in 1993, and was the first Western investor to raise, invest and successfully liquidate twelve funds in Russia and Eastern Europe. Its two most recent funds dedicated to the region, NCH Agribusiness Partners and NCH New Europe Property Fund II, were launched in the autumn of 2007 and the summer of 2008, respectively. NCH Agribusiness Partners invests in farmland and agribusiness-related activities. NCH New Europe Property Fund II invests in real estate and related assets

Russia, Eastern Europe

N/A

www.nchadvisors.co m

NCH Advisors Inc., Skytower Office Center, 4th floor, Office E, 63, Vlaicu Pircalab Street, MD2012 Chisinau, Republic of Moldova

New Europe Venture Capital (NEVEQ)

NEVEQ (New Europe Venture Equity) is a venture capital firm launched in May 2006 to invest in exceptional entrepreneurs and rapidly growing and profitable technology companies operating from Southeastern Europe.

Bulgaria, Romania, Serbia, and Macedonia.

22.5 Million EUR

http://www.neveq.co m/

HR-10000 Zagreb, Croatia Strada Ion Cmpineanu, Nr. 11, Union International Center, Etaj 2 Cod postal 010031, Bucureti, Sector 1 Ilica 5 - Oktogon, 10000 Zagreb

(+ 359) 2 850 4000

(+359 2) 858 1999

ORESA VENTURES ROMANIA S.R.L.

ORESA Ventures seeks to invest in those entrepreneurial skills most likely to be found in fast growing small and medium sized enterprises in the private sector.

Poland, Romania and other Estern and Central Europe Countries

N/A

http://www.oresaven tures.com/romania.h tml

(+32) 2 357 5577

N/A

PBZ INVEST D.O.O.

Investment fund management company. The company manages the PZB Equity Fund. Platina is an independent European investment firm focusing on renewable energy infrastructure and special situation buyouts. Their principal focus is on wind, solar and biomass. The projects they invest in use established technologies. Private equity funds consist of the Poteza Adriatic Fund, the venture capital Poteza Innovation and Growth Fund, the Poteza Real Estate Fund, the power supply fund and Poteza Investments Fund. The funds invest assets into private equity of companies in the region of Central and South-Eastern Europe. The principal activities of the Poteza Group are stock broking, asset management, investment banking and pension insurance. Poteza advises closed-end investment funds and manage pension insurance funds, including management of financial instruments for customers, while offering companies expert support when making strategic decision.

Croatia, EU, CEFTA, OECD

332 million

http://www.pbzinves t.hr/

(+385 1) 636 3699

(+385 1) 636 3688 (+44) 20 7042 960

Platina Partners

across Europe

500 million of equity

LONDON (HQ): 20 ( +44) 20 7042 http://www.platinapa Manchester Square, 9600 rtners.com/ W1U 3PZ London

Poteza Group

Central and SouthEastern Europe

N/A

www.poteza.si

elezna cesta 18, SI- (+386 1) 30 70 (+386 1) 30 70 1000 Ljubljana, 800 801

Poteza Partners d.o.o.

Slovenia, Bosnia and Herzegovina

311 million

www.poteza.si/en/in dex.cp2

UNITIC Business Center, Ul. Fra Andela Zvizovica 1 A/9 71000 Sarajevo Bosnia - Herzegovina

(+387 33) 296613

(+387 33) 296559

Prime Property BG REIT is the first public investment vehicle licensed Prime Property BG the Bulgarian Financial Supervisory Board in January 2004.The REIT REIT (Sofia ) strategy is to invest in development of residential and office buildings near Sofia and other major metropolitan areas in Bulgaria.

Bulgaria

N/A

http://primeproperty 14 Antim I Street bg.com/e107/contact Sofia 1303, Bulgaria .php

(+359) 2 8119050

(+359) 2 8119051

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

Prosperus Invest

Quaestus Invest d.o.o. Quaestus Real Estate Quantum Developments REIT (Sofia)

Restriction on investment refers to companies which are based in Croatia and perform the bulk of its operations in Croatia and up to 33% of fund capital in one company and a maximum of 40% in one economic sector. The largest Croatian real estate fund. The portfolio is diversified among telecommunications, food production and medical services sectors. Target investments are great turistic and residential projects on the Adriatic coast and investing in real estate within infrastructural projects. Real Estate Investment Trust

Croatia

340 miliun HRK

Prosperus-invest http://www.prosperu d.o.o., Metaleva 5, (+385) (0)1 61 s-invest.hr/ 89 100 10000 Zagreb, Croatia Ilica 1, 10000 Zagreb, Croatia

(+385) (0)1 61 89 109

Croatia

34 million

www.quaestus.hr

(+385 1) 4880- (+358 1) 4870900 159

Bulgaria

N/A

http://www.quantumSofia, 10 Gladston bg.com/read.php?na Str me=14&lang=bg http://goliath.ecnext. com/coms2/merccompint-0001295531Real-Invest-S-A.html

(+359 2) 921 99 30

(+359 2) 921 99 39

Real Invest S.A.

Financial investment and securities broking

Moldova

EUR 50 000*

Balti, MD-3101 Moldova

373 23 16 14 60

373 23 12 03 28

Renaissance Capital

The leading independent investment bank operating in Russia, the CIS, Central and Eastern Europe, Africa, Asia and other highopportunity emerging and frontier markets. The Firm is an established Central and Eastern and trusted advisor to government, corporate and institutional clients Europe in its core investment banking offerings: M&A, equity, debt, structured solutions and derivatives.

Renaissance Moscow City, Partners Is the Naberezhnaya principal Tower, block C, 10 investment arm of Presnenskaya nab., http://www.renaissa Moscow 123317, Renaissance Group, managing ncegroup.com/ Russia. / Parus an investment Business Center, 2 portfolio of more Mechnikova than $750mn in Street,14th Floor, Russia, the CIS Kiev 01601, Ukraine Resource Partners Sp. z o.o. http://www.resource Focus Building, C partners.eu/en Al. Armii Ludowej 26 00-609 Warszawa

007 (495) 2587777 (Moscow) / 0038 (44) 492-7383 (Kiev) / 381 (11) 302 0000 (Belgrade)

007 (495) 2587778 (Moscow) and/or 0038 (44) 492-7393 (Kiev)

Resource Partners

We seek to invest primarily in growth and expansion with only limited buyout element in profitable medium and small companies. We focus on industries such as: consumer goods and services, retail and distribution, healthcare or manufacturing. We invest a minimum of 5 million via capital increase or purchase of existing shares and are mid-term investors, which means a 3-5 year holding period

Central and Eastern Europe

(+48) 22 579 8200

(+48) 22 579 8201

The Romanian American Enterprise Fund, through its fund manager, Enterprise Capital (EC), works with leading global companies, individuals and institutions pursuing strategic investment ROMANIAN opportunities in Romania and neighboring nations. The Fund invests AMERICAN in financial services, retail, logistics and distribution, consumer ENTERPRISE FUND products, information technology and telecommunications (IT&C), healthcare, selected industrial, media and other consumer related services. Rosslyn Capital Partners is a leading private equity and venture capital firm investing in various industries and sectors including Rosslyn Capital manufacturing, food and beverage, telecommunications, information Partners technologies, renewable energy, agriculture, and real estate development.

Romania

60 Million USD

http://www.raef.ro/e n/

Bulevardul Aviatorilor nr. 33 Cod postal 011853, Bucureti, Sector 1

(+40) 21 207 7100

(+40) 21 222 8503

Bulgaria

N/A

http://www.rosslync 13 Slavyanska Street p.com/index.php?m Sofia 1000 =aboutus&a=overvie Bulgaria w

(+359) 2 915 8010

(+359) 2 981 8512

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

RSG Kapital

By investing in promising early-stage enterprises, RSG Capital provides incentives for business initiatives, thereby making the business environment more dynamic and improving economic growth. However, RSG Capital offers considerably more than financial assistance to the companies it invests in: it uses its experience in company management and its network of partners in Slovenia and abroad to enable the entrepreneur to conduct business efficiently, it assists with optimizing business models and financial structuring, helps to improve marketing routes, and it offers access to research institutions Seedcamp is an early-stage micro seed investment fund and mentoring programme. We make our investment decisions in companies several times throughout the year. Youll often hear these companies referred to as the winners of a Seedcamp event. For the winning companies of any event that we choose to invest in, Seedcamps standard terms are 50000 for 8-10% per cent of the company. As a winner you also get our year-long support in growing your company, countless events, and of course a fast track to all the brilliant mentors and investors we call our friends. Founded in 2001, Salford Capital Partners Inc. (Salford) is a private equity firm investing primarily in developing markets (mainly former Soviet Union and Central & Eastern Europe). Invests in the diary industry in Serbia and Southeast Europe. Founded in 2001, Salford Capital Partners Inc. (Salford) is a private equity firm investing primarily in developing markets (mainly former Soviet Union and Central & Eastern Europe). Invested in the diary industry in Serbia and Southeast Europe.

Slovenia and abroad

N/A

http://www.rsgcapital.si/

RSG Kapital d.o.o., Tehnoloki park 21, 1000 Ljubljana, Slovenija

(+386) 1 620 33 00

(+386) 1 620 33 05

Seedcamp

Europe as well as SEE (e.g. Two project investments in Croatia up to date)

N/A

http://www.seedcam p.com

Salford Capital Partners Inc.

Serbia, Macedonia, Croatia, Bosnia, Slovenia

$ 750 million

http://www.salfordca pital.com/index1.htm

Bulevar Zorana Djindjica 8a Belgrade 11070

(+381) 11 2222 500

(+381) 11 2222 533

Salford Capital Partners Inc.

Serbia, Macedonia, Croatia, Bosnia, Slovenia

750 million US

http://www.salfordca pital.com/index1.htm

Bulevar Zorana Djindjica 8a Belgrade 11070

(+381) 11 2222 500

(+381) 11 2222 533

SEAF Central/Eastern European Growth Fund

SEAF seeks to build businesses with market leadership positions, differentiated products and services, and sustainable cost advantages to achieve attractive risk adjusted returns for the investors. SEAF's focus is to expand and to realize value by accelerating the growth and profitability of local enterprises through capital, operational know-how, and global network. In building the value of local enterprises, SEAF aims to achieve attractive risk-adjusted returns for investors and generate meaningful economic benefits in the local communities. SEAF/Macedonia seeks to invest in companies that have the potential to grow their commercial operations rapidly, and which need capital and assistance to achieve this growth.

Central and Eastern Europe

20.6 Million USD

http://www.seaf.com /fund_ceegf.htm

Parnu mnt 142, 6th Floor Tallinn 11317, Estonia Britanski trg 5/11, 10 000 Zagreb, Croatia Bul. Partizanski Odredi, 62 1000 Skopje, Macedonia

(+372) 651 2690

(+372) 651 2693

SEAF Croatia Fund

Central and Eastern Europe

$ 12.6 million

http://www.seaf.com /fund_south_balkan. htm

(385-1) 481 1912 / 481 1913

(385-1) 482 3558

SEAF Macedonia Fund

Macedonia

13 Million USD

www.seaf.com.mk

(+389) 2 3079 611

(+389) 2 3079 612

SEAF Bulgaria has been active on the Bulgarian financial markets since 1994. The organization is managed by Small Enterprise SEAF Management Assistance Funds (SEAF) which has two venture capital funds in Bulgaria Bulgaria Trans-Balkan Bulgaria Fund (TBBF) and Caresbac Bulgaria. At this time both have fully exhausted their investment capital.

Bulgaria

22 Million USD

www.seaf.bg

6, Bigla Str., Floor 1, 1407 Sofia, Bulgaria

(+359) 2 819 4343

(+359) 2 819 4344

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

SEAF's focus is to expand and to realize value by accelerating the growth and profitability of local enterprises with our capital, operational know-how, and global network. Fund's investment activities typically focus on businesses in emerging markets and those underserved by traditional sources of capital for reasons that relate to the initial size of investment, remote location, cultural differences, or fragmentation within regional markets. SEAF's focus is to expand and to realize value by accelerating the growth and profitability of local enterprises through capital, SEAF South Balkan operational know-how, and global network. In building the value of Fund local enterprises, SEAF aims to achieve attractive risk-adjusted returns for investors and generate meaningful economic benefits in the local communities. SEAF ROMANIA MANAGEMENT S.R.L - TransBalkan Romania Fund Serbia Property Fund Invests in Real Estate Property (Argyll Investment Services Limited)

Romania, Macedonia, Bulgaria, Serbia, Montenegro, Croatia

8.5 Million USD

http://www.seaf.com /fund_south_balkan. htm

Bulevardul Octavian Goga, Nr. 4, M 26 Tronson 1, Etaj Parter, Cod postal 030982, Bucureti, Sector 3

(+40) 21 326 7340

(+40) 21 326 73 37

Montenegro,Serbia, Macedonia

12.6 Million USD

Bulevar AVNOJ-a 67, http://www.seaf.com 1st Floor, Apartment /fund_south_balkan. 2 htm Novi Beograd, Republic of Serbia PO Box 354 Suite 4, Weighbridge House Lower Pollet St Peter Port Guernsey GY1 3XF Sofia 1407 22, Zlaten Rog St., floor 8 office 20

(+381) 11 2129 524

(+381) 11 3016 371

Serbia

N/A

http://www.serbiapr operty.gg/

(+44) 1481 740044

(+44) 1481 727355

SigmaBleyzer

SigmaBleyzer

The Company focuses on consolidation, expansion, restructuring opportunities and on value creation through the active development Ukraine, Romania, of portfolio companies. It invests in private equity opportunities, Bulgaria and Kazakhstan acquire control, and take an active, hands-on role in the management of the funds investments. The Company focuses on consolidation, expansion, restructuring opportunities and on value creation through the active development Ukraine, Romania, of portfolio companies. It invests in private equity opportunities, Bulgaria and Kazakhstan acquire control, and take an active, hands-on role in the management of the funds investments.

SigmaBleyzer currently manages assets valued at over 1 Billion USD. SigmaBleyzer currently manages assets valued at over 1 billion USD

http://www.sigmable yzer.com/

(+359 2) 868 1868

(+359 2) 868 7868

12Bis, Dr. http://www.sigmable Draghiescu St., Sect. yzer.com/ 5, 050579, Bucharest , Romania New York, 277 Park http://www.sitheglob Avenue, 40th Floor, al.com/ New York, NY 10172

(+40 21) 410 1000;

(+40 21) 410 2222

Sithe Global Power, LLC is an international development company Sithe Global Power engaged in the development, construction, acquisition and operation of electric generation facilities in attractive markets around the world Small Investment Fund (SIF) is the first private equity fund established in July 2007 in accordance with the Macedonian Law on Investment Funds. SIF invests in emerging MSMEs (early-stage companies, micro-finance graduates and other small companies, including local start-ups) across a broad range of sectors. Potential companies should have modest to high growth potential, competent managers with high integrity, ambition and successful track record, who are open to learning from SIF. An investment advisory company established in February 2007, whose main business is assisting entrepreneurs in obtaining financing for their investment plans business expansion, market penetration, acquisitions, etc. The financing may take the form of equity, quasiequity, mezzanine loans or project financing, depending on the particular project. The most suitable form of financing is always sought in order to minimize the cost of funds to the Client.

All countries

N/A

Small Investment Fund

Macedonia

6 Million EUR

http://www.spmg.co m.mk/services.php

Mitropolit Teodosij Gologanov 39 1000 Skopje, Macedonia

(+389 2) 3231 037; 3217 026; 3217 027

(+389 2) 3239 703

SORTIS Invest

Bulgaria, SEE

N/A

http://www.sortis.bg /index_en.html

1505, Sofia, Bulgaria, 49 "Madrid" Blvd., floor (+359) 2 943-9070 1

(+359) 2 943-90-71

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

South-Balkan Private-Equity Management Group (SPMG)

SPMG is fund manager and one of the leading Macedonian companies providing management consulting and financial advisory services.

Macedonia and Southeast Europe

N/A

http://www.spmg.co m.mk/services.php

Mitropolit Teodosij Gologanov 39 1000 Skopje, Macedonia

(+389 2) 3231 037; 3217 026; 3217 028

(+389 2) 3239 704

Southeast Europe Equity Fund II (SEEF II); Soros Investment Capital Ltd

The AlbanianAmerican Enterprise Fund ("AAEF")

Established in November 2004 with $65 million in OPIC financing, provides a direct response to the critical need for private capital in southeast Europe by supporting direct private investment in the region,; Managed by Bedminster Capital, an investment advisor to Soros Investment Capital Ltd The Albanian-American Enterprise Fund ("AAEF") is a non-political, not-for-profit U.S. corporation established pursuant to the Support for East European Democracy Act of 1989 (SEED ACT). Its primary purpose is to promote the private sector development of Albania. To accomplish this, the AAEF invests and lends in a wide array of private enterprises, disseminates western business know-how, and, when appropriate, proposes changes to government policies affecting business. The Bulgarian-American Enterprise Fund's (BAEF)mission is to actively participate in the development and expansion of the economy by: * providing equity investments and loans to companies with high growth potential * leveraging its capital through co-financing with local or foreign partners * actively managing its investments * identifying and eliminating obstacles to private sector development through direct advocacy with the Bulgarian government

Albania, BosniaHerzegovina, Bulgaria, Croatia, Macedonia, Romania, SerbiaMontenegro, Slovenia and Turkey

Over 200 Million USD

http://www.opic.gov

1100 New York Avenue, NW Washington, D.C. 20527

(+202) 336 8400

(+202) 336 7949

Albania

over $80 million

http://www.aaef.com /

Rr. "Deshmoret e 4 Shurtit" "Green Park" Complex, Tower 2, 11th Floor, Tirana, Albania

(+355) 4 222 408

(+355) 4 271 952

The BulgarianAmerican Enterprise Fund

Bulgaria

55 Million USD

http://www.baefinve 3 Shipka Street st.com/eng/main.ht Sofia 1504, Bulgaria ml

(+359) 2 948 9200

(+359) 2 946 0118

The Investment Fund for Central and Eastern Europe

A fund established by the Danish Government to support Danish investments in Central and Eastern Europe, is the co-financier of the agency line. IO provides equity, medium- and long-term loans, and guarantees on a commercial basis to promote economic, commercial, and industrial development in Central and Eastern Europe. Technically eligible host countries of IFU investments must be on the OECDs DAC list of development aid recipients, and 2005 GNI per capita income may not exceed USD 2,772 (limit in 2007).

Albania, Bosnia and Herzegovina, Moldova

N/A

Bremerholm 4 (+45) 33 63 75 (+45) 33 32 25 http://www.ifu.dk/dk 1069 Copenhagen K 00 24 Denmark

The Overseas Private Investment Corporation's (OPIC) mission is to The Overseas mobilize and facilitate the participation of United States private capital Private Investment and skills in the economic and social development of less developed Corporation's countries and areas, and countries in transition from nonmarket to (OPIC) market economies. Triland Development is a group of companies which owns, develops, and manages real estate assets including office, residential and retail Triland properties in Bosnia and Herzegovina. Triland Development is Development affiliated with Crow Holdings, one of America's leading real estate development companies.

All countries

N/A

http://www.opic.gov /index.asp

1100 New York Ave., NW Washington DC 20527

(+202) 3368543

(+202) 4085133

Bosnia and Herzegovina

N/A

Ferhadija 21 http://www.triland.n (+387 33) 251 Sarajevo, BiH 71000 et/about.html 800

(+387 33) 251801

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

VCP Zagreb d.o.o. (Vienna Capital Partners)

VCP is focused on both corporate finance advisory and selective direct investments in undervalued companies with high potential for growth. Active in all industries with a special focus on medium-to-large-sized enterprises as well as companies with a high potential for growth and value appreciation. The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies.

Bulgaria, Romania, Hungary, Zagreb, Slovenia, Slowakia, Poland, Czech Republic

N/A

http://www.vcpag.co m/257_EN

Vlaka 40/III 10000 Zagreb Croatia Mr. Mirjana Milic, External Affairs Officer and NGO Liaison Trg. J.F. Kennedya 6b, III Floor 10 000 Zagreb Fra Andjela Zvizdovica 1 71000 Sarajevo Ms. Vesna Kostic, External Affairs Officer Bulevar Kralja Aleksandra 86-90 Belgrade World Bank Office Mr. Denis Boskovski, External Affairs Officer and NGO Liaison 34, Leninova Street 1000 Skopje Ms. Ana Gjokutaj, Communications Officer and NGO Liaison Deshmoret e 4 Shkurtit 34 Tirana Mr. Mirjana Milic, External Affairs Officer and NGO Liaison Trg. J.F. Kennedya 6b, III Floor 10 000 Zagreb Mr. Slavian Gutu, Communications Officer 20/1, Pushkin Street Chisinau MD-2012

( +385 1) 4881 500

(+385 1) 4881 530

World Bank

all countries

http://www.worldban k.org/

(+385 1) 2357 274

(+385 1) 2357 200

World Bank

The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies. The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies.

all countries

N/A

http://www.worldban k.org/

(+387 33) 251 500

(+387 71) 440 108

World Bank

All countries

N/A

http://www.worldban k.org/

(+381 11) 302 3700

(+381 11) 302 3732

World Bank

The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies.

All countries

N/A

http://www.worldban k.org

(+389 2) 3117 159

(+389 2) 311 7627

World Bank

The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies.

all countries

N/A

http://www.worldban k.org/

(+381 11) 302 (381 11) 302 37 37 00 32

World Bank

The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies.

All countries

N/A

http://www.worldban k.org/

(+385 1) 2357 274

(+385 1) 2357 200

World Bank

The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies.

all countries

N/A

http://www.worldban k.org/

(373-22) 200706

(373-22) 237053

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

World Bank

The World Bank carries out projects and provides a wide variety of analytical and advisory services to help meet the development needs of individual countries and the international community. Most commonly projects are based on poverty reduction strategies. The European Private Equity and Venture Capital Association (EVCA) represents the European private equity sector and promotes the asset class both within Europe and throughout the world.

all countries

N/A

http://www.worldban k.org/

EVCA

all countries

N/A

Link to EVCA memebers with preference for investing in Croatia

Ms. Mirlinda Gorcaj, External Affairs (+381 - 38) (+381 - 38) 249 Assistant 249 - 459 780 Str. Mujo Ulqinaku 10000 Prishtina Bastion Tower Place du Champ de (+32 2) 715 00 (+32 2) 725 07 Mars 5 20 04 B-1050 Brussels Belgium

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

info@3tscapital.com, and Jiri Benes jbenes@3tscapital.com

info@3tscapital.com

acfronistas@7LCP.com

jjames@uk.adventinter national.com (Mrs. Joanna James Managing Director)

stcaciuc@adventinterna tional.ro

info@agent.ba

aiginvestmentseurope@aig.com

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

aiginvestmentseurope@aig.com

pmellinger@aigcet.com.pl

info@alfacp.ru

office@alfadevelopment s.com

info@alternative-pe.hr

arcoinfo@arcocapital.co m

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

robert.hejja@arguscapit algroup.com

bucharest@arxequity.co m

praha@arxequity.com

http://www.ascendant. hr/contacts

tom.higgins@bafonline. eu

info@bce.pl

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

N/A

abds@bih.net.ba

info@blueseacap.com

office@primepropertybg .com bulland@mbox.contact. bg nikolay.nikolov@bulvent ures.com

zagreb@copernicuscapital.com

bucharest@copernicuscapital.com

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

warsaw@copernicuscapital.com

N/A

mail@alphavc.gr

elke.hellstern@kfw.de

kfw.Skopje@kfw.de

Kfw.albania@abcomal.com

Elke.Hellstern@kfw.de

BC Serdon/RCI Projects/ 29.02.08

RCI Projects/RCI Investment Funds Research/Croatia

info@eastcapital.com

moscow@eastcapital.co m

todorovb@ebrd.com

asr@eip.com.pl

office@axxesscapital.ne t

inquiries@empw.com