Professional Documents

Culture Documents

ElliottWave Diagonal Ending Expanding Report

ElliottWave Diagonal Ending Expanding Report

Uploaded by

pippo6056Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ElliottWave Diagonal Ending Expanding Report

ElliottWave Diagonal Ending Expanding Report

Uploaded by

pippo6056Copyright:

Available Formats

The Elliott Wave Principle

Elliott Wave

1st December 2009 (Charts compiled & edited by Kamil Rajec)

Expanding Diagonal Patterns - Do they really exist? By Peter Goodburn

Table of Contents {click on TOC text!}

Elliotts inclusion of the Contracting Diagonal .................................................... page 1 The Expanding-Diagonal, a mirror image of the Contracting type pattern ..... page 2 Triangle terminology counter-trend Vs trend impulse patterns .................... page 2 First introduction of the Expanding Diagonal ...................................................... page 2 Indoctrination of Belief ............................................................................................ page 3 Can an Expanding Diagonal always be counted another way? ......................... page 3 Examples of Expanding-Diagonal Patterns ........................................................... pages 3- 5 Summary ...................................................................................................................... page 5

Elliotts inclusion of the Contracting Diagonal In R.N.Elliotts original treatise of The Wave Principle (1938), he introduces us to diagonal patterns for the first time on page 21. Under the heading, Triangles, Elliott describes the difference between horizontal triangles that represent hesitation within an ongoing, progressive trend and diagonal triangles that form the concluding 5th wave of a larger five wave sequence {see fig #1}. In both instances, Elliott illustrates five smaller subsequences within each pattern. We are familiar with counter-trend/corrective triangle patterns subdividing into five swings, a-b-c-d-e as these are common events found in price activity. Interestingly, Elliott describes the four different types of counter-trend/corrective triangles, two of which are the contracting (symmetrical) and expanding (reverse-symmetrical) versions. Each is a mirror image of the other, or in other words, is an inversion of the other. We have recognised this phenomenon whilst building the Elliott Wave tutorial patterns for WaveSearch.

Tip print out or hand-draw a contracting-symmetrical triangle, include the narrowing boundary lines then simply turn the page over horizontally then hold up to the light and you will see the expanding-triangle!

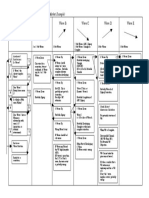

fig. #1 R.N. Elliotts Triangles - First introduction to diagonal patterns

WaveTrack International and its related publications apply R.N.Elliotts The Wave Principle to historical market price activity which categorises and interprets the progress of future price patterns according to this methodology. Whilst it may be reasonable to deduce a course of action regarding investments as a result of such application, at no time or on any occasion will specific securities, futures, options or commodities of any kind be recommended for purchase or sale. Publications containing forecasts are therefore intended for information purposes only. Any opinion contained in these reports is only a statement of our views and are based on information we believe to be reliable but no guarantee is given as to its accuracy or completeness. Markets are volatile and therefore subject to rapid an unexpected price changes. Any person relying on information contained in these reports does so at their own risk entirely and no liability is accepted by WaveTrack in respect thereof. All rights are copyrights to WaveTrack. Reproduction and / or dissemination without WaveTracks prior consent is strictly forbidden. We encourage reviews, quotation and reference but request that full credit is given.

WaveTrack International GmbH Kanalstr. 14

80538 Munich Germany

Phone: +49-89-21020711 Fax: +49-89-92185245 E-Mail: services@wavetrack.com www.wavetrack.com

Triangle terminology counter-trend Vs trend impulse patterns

Before continuing, Id like to make a distinction between the terms Elliott used to describe the horizontal triangle and the diagonal triangle. In todays contemporary use, the term triangle is widely accepted to define a countertrend pattern, and yet we still use the term diagonal triangle to define an impulse (5 wave trending) sequence. During the many years of teaching the Wave Principle, I have found students often confused by this because both are distinctly different types of pattern, yet both incorporate the term triangle. To make it easier, I have dropped the association triangle when referring to the diagonal so that a diagonal is either a generic leadingcontracting/expanding diagonal or an endingcontracting/expanding diagonal, leaving out the term triangle altogether.

fig. #2 The mirror image of diagonal patterns

The Expanding-Diagonal, a mirror image of the Contracting type pattern The diagonal-triangle in current day EW folklore is often referred to as a rare pattern, but this is not true to the keen observer, as they can be found repeatedly across many of the varying asset classes. Elliott drew an illustration of the diagonal-triangle {see fig #2} in the 5th wave location as a contracting type pattern, where the price activity begins from the widest point and ends at the narrowest, almost to an apex. But he did not describe or illustrate its mirror image, or inverted counterpart that we refer to today as an expanding-diagonal, where the starting point is narrowest and the widest at the completion of the pattern. So why did Elliott make this omission when he clearly documented a similar mirror image/inversion for the horizontal triangle pattern? Perhaps it was simply that he had never observed one? Or as we imagine, he was still in the process of formulating all the nuances of his theory we can only speculate on the true answer. Nevertheless, one other consideration that often comes to mind and that is access to data. Back in the 1930s - 40s, all data was complied by hand, most of it on a daily basis, building daily bar or closing line charts. How fast is the learning/observation curve under this restriction? We are now in the computer era with access to an almost unlimited data feed of every market imaginable, covering a far wider historical data base, and most importantly, data that builds into hourly and sub-hourly time-series. With this at our disposal, we can seek and find much easier, and the probability of finding something like an expanding-diagonal is exponentially increased if it exists!

First introduction Diagonal

of

the

Expanding

In Frost & Prechters original book published in 1978 entitled Elliott Wave Principle, there is no mention of the expanding diagonal, although it must be said that this book was by and large, a more ordered re-print of R.N.Elliotts The Wave Principle with the main focus of reproducing the original work. The later re-printed and expanded edition of 1990 did include a chart illustrating a real-life example of the Dow Jones unfolding into an ending-expanding diagonal in the 5th wave position of a larger five wave impulse pattern {see fig #3}, although no explanation of its introduction was attempted. But more importantly, it was recognised and documented as a pattern existing within the doctrines of the Wave Principle.

fig. #3 Frost & Prechters discovery of the expanding diagonal

WaveTrack International GmbH Kanalstr. 14 80538 Munich Germany

Phone: +49-89-21020711 Fax: +49-89-92185245 E-Mail: services@wavetrack.com www.wavetrack.com

The 20th anniversary edition of the same title adds a little more text, albeit brief information on the subject, but curiously seeds doubts to its existence, quote; We have found one case in which the patterns boundary lines diverged, creating an expanding wedgehowever, it is unsatisfying analytically in that its third wave was the shortestand another interpretation was possiblefor these reasons, we do not include it as a valid variation. The chart example referred to was the same hourly chart of the Dow Jones (data-series from 1980) as originally published in 1990. Are there so few examples of this phenomenon that this was the only occasion where it could be studied?

Indoctrination of Belief History is replete with examples of beliefs, no matter what they represent, being avidly protected or guarded so that successive generations never question them anymore, just accept it. It is always easier to go with the consensus. But I have made it a life rule to be openminded about everything and to prove every assumption to my satisfaction, or discard it. Sometimes you just have to assume the role of Copernicus, research and investigate, then be brave enough to publish even though the establishment will offer scorn or worse. Copernicus eventually discovered the heliocentric model of the planets, that the Sun, not the Earth was at the centre of the celestial spheres. But to do this, he had to first break with age-old assumptions, beliefs set them aside and look afresh. Of course, his findings were considered heresy to the ruling members of the Church, and to even utter this was blasphemy. No wonder Copernicus himself did not publish his defining work until after death! But he was brave enough to meet the challenge, go headlong against the accepted view and prove his hypothesis not only to himself but to the benefit of everyone. Returning to the expanding-diagonal, the question remains, does it exist, can it have a place within the Elliott Wave Principle? To my own satisfaction, I have proved that it does, and that it is more commonly found unfolding that generally accepted. But you have to prove this to yourself. Yet, if the expanding diagonal is a recurring pattern that is not so rare, why has it been discarded to the point of inexistence? The answer maybe simple - because the old indoctrination prevented us looking for it. Why search for something that your told does not exist?

I have found that the advocates share a few things in common - they are creative thinkers, have an active imagination and find it quite natural to see things in a hierarchical construct, are comfortable with the idea of fractalisation, self-similarity and cyclicity. When examining the intricacies of counting waves, yes, there is often another way to label price activity from what seems to be an expanding diagonal into something else. Certainly, in Frost & Prechters single example, one might come to the defence of the diagonal but realistically, yes, it could be re-labelled repositioning wave iv. to the right so that it completes as a running flat pattern, with a more simplified advance to end the v.th wave, or alternatively, relabeling the termination of minor wave iii. then describing wave iv. as a triangle ending at what is currently wave b. within wave 5 of the expanding diagonal. This is not proof either way, for what we require is other examples that cannot be easily explained other than what they appear to be - expanding diagonal patterns.

Examples of Expanding-Diagonal Patterns So lets take a look at some collected and stored from the past. These have been selected from the historical archives of WaveSearch, and although many more are documented, will confine this examination to those that display the certainty of identification.

Gold The first example illustrates an ending expandingdiagonal pattern in gold prices during April-May 2004. It is labelled as minuette wave [v] five within a declining five wave impulse pattern beginning from 406.35 and ending at 371.00 {see fig #4}.

Can an Expanding Diagonal always be counted another way? Elliott Wave is a subtle methodology, with only a few hard-and-fast rules, but many guidelines to learn and apply. It certainly has its detractors, but advocates too.

fig. #4 Gold - 60 mins.

WaveTrack International GmbH Kanalstr. 14 80538 Munich Germany

Phone: +49-89-21020711 Fax: +49-89-92185245 E-Mail: services@wavetrack.com www.wavetrack.com

The importance of the entire pattern from 432.60 to 371.00 is that the subwaves of the expanding diagonal cannot be explained or re-labelled any other way they cannot be 4-5, 4-5, 4-5 sequences that end an expanding 13 wave impulse pattern because there did not exist any visible 1-2,1-2,1-2 sequence at the beginning of the decline {see fig #5}.

S&P 500

The second example is of the S&P 500, part of an update released in October 1999 {see fig #6}. The entire decline from 1420.14 to 1233.66 is a great example of a single zig zag pattern, subdividing a-b-c in minute degree. From a fib-price-ratio point of view, this conveys a perfect 100% equality ratio measuring equally waves a & c. Each sequence subdivides into fives waves of smaller, minuette degree, wave a as an expanding five wave impulse, but wave c as an ending-expanding diagonal pattern. There can be no doubt as to its identification there really is no other way to identify this other than the expanding type diagonal. Key aspects to consider Frost & Prechters concern in their example of the Dow Jones was that the third wave was shortest, but in this S&P example, it is clearly larger than the first. Elliott did not illustrate the subdivisions of impulse waves 1-3-5 within the diagonal in The Wave Principle (1938) although reference has been made later that he documented each sequence subdividing into a three wave pattern. This is subject for debate, an issue we shall return to later, although it is appropriate to mention now that it is only apparent in wave (III) three of the diagonal.

fig. #5

Gold - 180 min.

In particular, the reduction of counting waves could be done to fit a more standard 5 wave impulse by incorporating a couple of running flat patterns into the corrective sequences unfolding lower from 406.35, but then this creates another problem because each of the two advances (389.18-399.88 & 377.20-395.88) that act as the end to the running flats are visible overlapping zig zag (or multiple) sequences where they should be a visible five wave sequence (flats subdivide a-b-c, 3-3-5). No, there is no way to bend this into something else this is a true example of an expanding diagonal, a type that occurs at the conclusion of the trend, an endingexpanding diagonal. Almost as an afterthought I realised I have omitted an important point there are Fibonacci ratios imbedded within expanding diagonal patterns that also recur. There are a few but limited ways to measure the finalisation of the pattern. One that I have found repeatedly is where the sum of waves 1-3 equate to the same measurement as found in waves 2-5. This ratio is applied to this Gold chart to good effect prices traded within just half of a dollar of the low signalling the expanding diagonals conclusion at 371.00.

fig. #6 S&P 500 Index - 60 mins.

WaveTrack International GmbH Kanalstr. 14 80538 Munich Germany

Phone: +49-89-21020711 Fax: +49-89-92185245 E-Mail: services@wavetrack.com www.wavetrack.com

Euro vs. sterling (FX cross) The third and final example illustrates an endingexpanding diagonal of a more contemporary period, the currency cross Euro Vs. Sterling of November 2009 {seefig #7}.

One amazing characteristic of the 5th wave within expanding diagonal patterns is the way it covers ground very quickly it accelerates faster and often in shorter time than that of the 3rd wave this is true of this example. Note that we have measured the 5th as unfolding by a fib. 123.6% ratio of the total amplitude of the 1st to 3rd wave high very impressive. Tip print out this ending-expanding diagonal and simply turn the page over horizontally then hold up to the light and you will see its mirror-image the contracting-diagonal pattern!

Summary When I re-read R.N.Elliotts The Wave Principle published in 1938 and of course his later treatise Natures Law of 1948, I often wonder what else he would have discovered had he lived longer and had access to the masses of data that is obtainable today? Perhaps the expanding diagonal would be there amongst all the other patterns, with subdivisions documented for each in his indelible style. One thing for sure, if we can shed new light on the subject, incorporate aspects that remain governed by the true archetypes of the Principles he laid down without contradiction, then we surely have a duty to share them and continue his great work. End Fin Ende

| |

fig. #7 EUR / STLG - 60 mins.

It is labelled as a 5th wave within a larger expanding five wave impulse pattern that began much earlier from 0.8400 in June 09. It represents the final advance before trend reversal. It begins from 0.9077 ending at 0.9414 and shows the expanding characteristics of the diagonal where the narrowest point is at the beginning of the pattern, the widest at the end. It is not always important for the price extreme [in this case, high] of a 5th sequence of the pattern to join the tops of the 1st & 3rd waves often, the 5th high [or low in a downtrend] can often be isolated, hanging mid-air to the right of the upper boundary line, but in this example, it is perfect. Can this pattern be interpreted any other way? Impossible! The first movements higher containing waves [i] through [iv] cannot be bent to fit a triangle for the larger minute wave 4, nor can the advance be labelled as a double/triple zig zag as an expanding b. wave of a progressive flat as the ensuing decline was too large, and eventually overlapped activity during the preceding advancing trend.

Kanalstr. 14 80538 Munich Germany

WaveTrack International GmbH

Phone: +49 (0)89 21 02 07 11 Fax: +49 (0)89 92 18 52 45 E-Mail: services@wavetrack.com

www.wavetrack.com

You might also like

- Patty Brennan Homeopathic GuideDocument54 pagesPatty Brennan Homeopathic Guidepawajee50% (2)

- Astm C 423Document12 pagesAstm C 423Abhinav AcharyaNo ratings yet

- Environmental Impact Assessment ModuleDocument39 pagesEnvironmental Impact Assessment ModuleJoshua Landoy100% (2)

- Elliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveDocument30 pagesElliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveGlobal Evangelical Church Sogakope BuyingLeads100% (1)

- Elliott Wave Crash CourseDocument23 pagesElliott Wave Crash Courservignozzi1No ratings yet

- Elliot WavesDocument6 pagesElliot WavesJorge IvanNo ratings yet

- Harmonic Elliott Wave Article by Ian Copsey PDFDocument12 pagesHarmonic Elliott Wave Article by Ian Copsey PDFMolina CleberNo ratings yet

- Elliott Wave - Basic PDFDocument14 pagesElliott Wave - Basic PDFBasseyMilesAttihNo ratings yet

- Elliott & FibboDocument17 pagesElliott & FibboSATISH100% (2)

- Corrective WaveDocument1 pageCorrective WaveMoses ArgNo ratings yet

- Elliott Wave in The 21st Century: by Matt Blackman With Mike GreenDocument26 pagesElliott Wave in The 21st Century: by Matt Blackman With Mike GreennetcrazymNo ratings yet

- If Ye Know These Things Ross DrysdaleDocument334 pagesIf Ye Know These Things Ross DrysdaleBernardo Rasimo100% (1)

- Elliott Wave International 2 PDFDocument5 pagesElliott Wave International 2 PDFawdasfdsetsdtgfrdfNo ratings yet

- Elliott Wave International 5 PDFDocument4 pagesElliott Wave International 5 PDFawdasfdsetsdtgfrdfNo ratings yet

- 3 Seminario Elliott WaveDocument9 pages3 Seminario Elliott Wavebatraz79100% (2)

- The Elliott WaveDocument11 pagesThe Elliott WaveEduardo LimaNo ratings yet

- Market Mirrors Trend ChangesDocument14 pagesMarket Mirrors Trend ChangesmrsingkingNo ratings yet

- Edition 24 - Chartered 16 February 2011Document11 pagesEdition 24 - Chartered 16 February 2011Joel HewishNo ratings yet

- Elliot Wave CodesDocument1 pageElliot Wave CodesKevin SulaNo ratings yet

- Impulse Rules:: Lliott Waves - Rules and TipsDocument7 pagesImpulse Rules:: Lliott Waves - Rules and TipsNinadTambeNo ratings yet

- Fib Calculations in Elliott Wave Theory AnalysisDocument6 pagesFib Calculations in Elliott Wave Theory Analysishaseeb100% (1)

- Patterns Impulse Patterns Corrective Pat PDFDocument29 pagesPatterns Impulse Patterns Corrective Pat PDFChuks OsagwuNo ratings yet

- ESignal - Manual - ch23 Elliot Wave TriggerDocument2 pagesESignal - Manual - ch23 Elliot Wave Triggerlaxmicc100% (1)

- 1001 Discovering EWPDocument11 pages1001 Discovering EWPJustin Yeo0% (1)

- Elliott Wave Cheat SheetsDocument24 pagesElliott Wave Cheat SheetsDeisy Milena Rodríguez0% (1)

- Neowave Theory by Glenn Neely. Corrections. Rules To Spot A Flat and Zigzag. Variations of Corrections and Formal Logic RulesDocument12 pagesNeowave Theory by Glenn Neely. Corrections. Rules To Spot A Flat and Zigzag. Variations of Corrections and Formal Logic RulesSATISHNo ratings yet

- 3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave TheoryDocument13 pages3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave Theoryomi221No ratings yet

- Elliott Wave and Fibonacci - Learn About Patterns and Core ReferencesDocument33 pagesElliott Wave and Fibonacci - Learn About Patterns and Core ReferencesDuca George100% (1)

- A012 Elliott Wave TheoryDocument81 pagesA012 Elliott Wave TheoryDev ShahNo ratings yet

- Elliot Waves Introduction Akshay Ji BloombergDocument59 pagesElliot Waves Introduction Akshay Ji BloombergAditya Mehta100% (2)

- End of WaveDocument3 pagesEnd of WaveRuben Topaz100% (1)

- The Eleven Elliott WDocument6 pagesThe Eleven Elliott WSATISHNo ratings yet

- Utd 64 S 4 D 8Document14 pagesUtd 64 S 4 D 8davo gNo ratings yet

- Elliot Wave by Jayforexhouse 4.0Document19 pagesElliot Wave by Jayforexhouse 4.0Aivar VilloutaNo ratings yet

- Elliott Wave 2Document29 pagesElliott Wave 2francisblesson100% (2)

- Esignal - Elliott Wave CountsDocument8 pagesEsignal - Elliott Wave CountsMarcianopro1100% (1)

- The Amazing Elliott's Wave3 PDFDocument99 pagesThe Amazing Elliott's Wave3 PDFFlukii Polo100% (1)

- Elliott Wave TheoryDocument13 pagesElliott Wave Theorymark adamNo ratings yet

- NeorulesDocument1 pageNeorulesGurjar rgNo ratings yet

- Ciiltire Guidline Book: Impulsive DiagnolDocument16 pagesCiiltire Guidline Book: Impulsive DiagnolHassan Mohamed0% (1)

- Elliott Wave Lesson 4Document6 pagesElliott Wave Lesson 4Haryanto Haryanto HaryantoNo ratings yet

- Elliott Wave - Intermediate Course Module - Lionheart EWADocument65 pagesElliott Wave - Intermediate Course Module - Lionheart EWASATISHNo ratings yet

- Options On Elliott v1Document22 pagesOptions On Elliott v1hyanandNo ratings yet

- Elliott Wave CourseDocument24 pagesElliott Wave CourseShare Knowledge Nepal100% (1)

- Proficiency Exam Self TestDocument74 pagesProficiency Exam Self TestSujoy SikderrNo ratings yet

- 22.I Continue Covering Progress LabelsDocument20 pages22.I Continue Covering Progress LabelsSATISHNo ratings yet

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocument148 pagesHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerNo ratings yet

- Elliott Wave Theory Is A Collection of Complex TechniquesDocument6 pagesElliott Wave Theory Is A Collection of Complex TechniquessriNo ratings yet

- How To Predict Market's Tops & Bottoms Using Elliott Wave PrincipleDocument20 pagesHow To Predict Market's Tops & Bottoms Using Elliott Wave PrincipleHery100% (1)

- Wavy TunnelDocument15 pagesWavy TunnelRaul Domingues Porto JuniorNo ratings yet

- New Elliottwave Short VersionDocument58 pagesNew Elliottwave Short VersionPeter Nguyen100% (1)

- Guideline 1: How To Draw Elliott Wave On ChartDocument6 pagesGuideline 1: How To Draw Elliott Wave On ChartAtul Mestry100% (2)

- Elliott Wave Rules - GuidelinesDocument9 pagesElliott Wave Rules - GuidelinesaaaaaNo ratings yet

- Elliott Wave Principle - NotesDocument10 pagesElliott Wave Principle - NotesArockia Chinnappa RajNo ratings yet

- Elliot Explisocın To FuckDocument10 pagesElliot Explisocın To FuckAli GBNo ratings yet

- NEoWave S&PDocument1 pageNEoWave S&PshobhaNo ratings yet

- Elliott Wave TheoryDocument2 pagesElliott Wave TheoryredsaluteNo ratings yet

- NEo Wave SensexDocument1 pageNEo Wave SensexJatin SoniNo ratings yet

- Cheatsheets - Elliot WavesDocument3 pagesCheatsheets - Elliot WavesPaul Mears100% (1)

- Elliott Wave Rules GuidelinesDocument15 pagesElliott Wave Rules GuidelinesDaniel PoianiNo ratings yet

- Edmund Burke Maroon 2/4/18Document1 pageEdmund Burke Maroon 2/4/18Chicago MaroonNo ratings yet

- Lawrance Africa Imagined in The Spanish Renaissance - Henry Thomas LectureDocument20 pagesLawrance Africa Imagined in The Spanish Renaissance - Henry Thomas LecturejlawranceNo ratings yet

- Basion Horizontal CobenDocument3 pagesBasion Horizontal CobenJegan KumarNo ratings yet

- Building 7Document1 pageBuilding 7Arshad AlamNo ratings yet

- PAYROLLMANAGEMENTDocument5 pagesPAYROLLMANAGEMENTSai Prabhav (Sai Prabhav)No ratings yet

- ACCA P5 Question 2 June 2013 QaDocument4 pagesACCA P5 Question 2 June 2013 QaFarhan AlchiNo ratings yet

- 3700 S 24 Rev 0 ENDocument3 pages3700 S 24 Rev 0 ENJoão CorrêaNo ratings yet

- Adam Weeks ResumeDocument3 pagesAdam Weeks ResumeAdam WeeksNo ratings yet

- Writing Home, Painting Home: 17th Century Dutch Genre Painting and The "Sailing Letters"Document17 pagesWriting Home, Painting Home: 17th Century Dutch Genre Painting and The "Sailing Letters"María MazzantiNo ratings yet

- Simulation and ModulationDocument89 pagesSimulation and ModulationGuruKPO67% (6)

- VP3401 As04Document2 pagesVP3401 As04shivamtyagi68637No ratings yet

- pdfGenerateNewCustomer SAOAO1030380906Reciept SAOAO1030380906ResidentAccountOpenFormDocument11 pagespdfGenerateNewCustomer SAOAO1030380906Reciept SAOAO1030380906ResidentAccountOpenFormajsingh0702No ratings yet

- 2.20 Optimizing Control: F. G. Shinskey C. G. Laspe B. G. Lipták M. RuelDocument10 pages2.20 Optimizing Control: F. G. Shinskey C. G. Laspe B. G. Lipták M. RueljigjigawNo ratings yet

- Effects of Organic Manure On Okra (AbelmoschusDocument4 pagesEffects of Organic Manure On Okra (AbelmoschusShailendra RajanNo ratings yet

- A Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityDocument22 pagesA Short Version of The Big Five Inventory (BFI-20) : Evidence On Construct ValidityBagas IndiantoNo ratings yet

- Cvp-Analysis AbsvarcostingDocument13 pagesCvp-Analysis AbsvarcostingGwy PagdilaoNo ratings yet

- ESSAYDocument7 pagesESSAYKaren OliveraNo ratings yet

- Domain Model Ppt-1updatedDocument17 pagesDomain Model Ppt-1updatedkhadija akhtarNo ratings yet

- Toward The Efficient Impact Frontier: FeaturesDocument6 pagesToward The Efficient Impact Frontier: Featuresguramios chukhrukidzeNo ratings yet

- Vernacular Terms 2 PDFDocument3 pagesVernacular Terms 2 PDFsmmNo ratings yet

- Board of Technical Education (Student Marksheet)Document2 pagesBoard of Technical Education (Student Marksheet)Manoj SainiNo ratings yet

- Crossing The Bar Critique PaperDocument2 pagesCrossing The Bar Critique PapermaieuniceNo ratings yet

- Halimatus Islamiah Analisis Jurnal Internasional K3Document3 pagesHalimatus Islamiah Analisis Jurnal Internasional K3TussNo ratings yet

- ME-458 Turbomachinery: Muhammad Shaban Lecturer Department of Mechanical EngineeringDocument113 pagesME-458 Turbomachinery: Muhammad Shaban Lecturer Department of Mechanical EngineeringAneeq Raheem50% (2)

- Lec 1 Introduction Slides 1 20 MergedDocument153 pagesLec 1 Introduction Slides 1 20 MergedNeeraj VarmaNo ratings yet

- SBAS35029500001ENED002Document20 pagesSBAS35029500001ENED002unklekoNo ratings yet