Professional Documents

Culture Documents

The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011

The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011

Uploaded by

pissiqtzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011

The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011

Uploaded by

pissiqtzaCopyright:

Available Formats

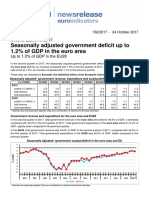

68/2013 - 29 April 2013

Taxation trends in the European Union

The overall tax-to-GDP ratio in the EU27 up to 38.8% of GDP in 2011

Labour taxes remain major source of tax revenue

This News Release, published on 29 April 2013, has been revised, following the correction of an error in the calculation of the average top personal income tax rate for France and Slovakia for 2013. This correction also slightly affects the data for the EU27 and the euro area. The overall tax-to-GDP ratio , meaning the sum of taxes and social contributions in % of GDP, in the EU27 stood 2 at 38.8% in 2011, from 38.3% in 2010 and 38.4% in 2009. The overall tax ratio in the euro area (EA17) increased to 39.5% in 2011, up from 39.0% in 2010 and 39.1% in 2009. The tax burden varies significantly between Member States, ranging in 2011 from less than 30% in Lithuania (26.0%), Bulgaria (27.2%), Latvia (27.6%), Romania (28.2%), Slovakia (28.5%) and Ireland (28.9%), to more than 40% in Denmark (47.7%), Sweden (44.3%), Belgium (44.1%), France (43.9%), Finland (43.4%), Italy (42.5%) and Austria (42.0%). Between 2010 and 2011, the largest increases in tax-to-GDP ratios were recorded in Portugal (from 31.5% to 33.2%), Romania (from 26.7% to 28.2%) and France (from 42.5% to 43.9%), and the highest falls in Estonia (from 34.1% to 32.8%), Sweden (from 45.4% to 44.3%) and Lithuania (from 27.0% to 26.0%). This information comes from the 2013 edition of the publication Taxation trends in the European Union issued by Eurostat, the statistical office of the European Union and the Commissions Directorate-General for Taxation and Customs Union. This publication compiles tax indicators in a harmonised framework based on the European System of Accounts (ESA 95), allowing accurate comparison of the tax systems and tax policies between EU Member States.

3 1 2

Lowest implicit tax rates on labour in Malta, on consumption in Spain and on capital in Lithuania

The largest source of tax revenue in the EU27 is labour taxes, representing nearly half of total tax receipts, followed by consumption taxes at roughly one third and taxes on capital at around one fifth. The GDP-weighted average implicit tax rate on labour in the EU27 was up from 35.4% in 2010 to 35.8% in 2011. Among the Member States, the implicit tax rate on labour ranged in 2011 from 22.7% in Malta, 24.6% in Bulgaria, 25.5% in Portugal and 26.0% in the United Kingdom, to 42.8% in Belgium, 42.3% in Italy and 40.8% in Austria. The average implicit tax rate on consumption in the EU27 was up from 19.7% in 2010 to 20.1% in 2011. Implicit tax rates on consumption were lowest in 2011 in Spain (14.0%), Greece (16.3%), Latvia (17.2%) and Italy (17.4%), and highest in Denmark (31.4%), Sweden (27.3%), Luxembourg (27.2%), Hungary (26.8%) and Finland (26.4%). In the EU27 in 2011, the average implicit tax rate on capital for the Member States for which data are available was down compared with 2010 in ten Member States and up in nine. Implicit tax rates on capital ranged from 5.5% in Lithuania to 44.4% in France.

4

Tax revenue and implicit tax rates by type of economic activity

Tax revenue, % of GDP 2000 EU27** EA17** Belgium Bulgaria Czech Republic Denmark Germany Estonia Ireland Greece*** Spain France Italy Cyprus Latvia Lithuania Luxembourg Hungary Malta Netherlands Austria Poland Portugal Romania Slovenia Slovakia Finland Sweden United Kingdom Norway Iceland 40.4 40.9 45.1 31.5 33.8 49.4 41.3 31.0 31.3 34.6 34.1 44.2 41.5 30.0 29.7 30.0 39.2 39.8 27.3 39.9 43.0 32.6 31.1 30.2 37.3 34.1 47.2 51.5 36.8 42.6 37.1 2010 38.3 39.0 43.8 27.5 33.5 47.4 37.9 34.1 28.3 31.7 32.1 42.5 42.5 35.6 27.2 27.0 37.5 37.9 32.6 38.8 41.9 31.8 31.5 26.7 37.8 28.1 42.5 45.4 35.4 42.6 35.0 2011 38.8 39.5 44.1 27.2 34.4 47.7 38.7 32.8 28.9 32.4 31.4 43.9 42.5 35.2 27.6 26.0 37.2 37.0 33.5 38.4 42.0 32.4 33.2 28.2 37.2 28.5 43.4 44.3 36.1 42.5 35.9 2000 36.4 38.3 43.6 38.1 41.2 41.0 39.1 37.8 28.7 33.8 30.5 39.4 42.0 21.6 36.7 41.1 29.9 41.4 20.5 35.0 40.1 33.6 22.3 : 37.6 36.3 44.0 46.8 25.9 37.1 : Implicit tax rate* on: Labour 2010 35.4 37.4 42.7 23.5 38.5 34.6 36.8 36.8 26.2 31.5 32.7 38.1 42.7 26.9 33.1 31.7 31.5 38.4 21.7 37.0 40.5 30.3 24.0 30.0 35.0 32.2 39.0 39.1 25.8 36.3 : 2011 35.8 37.7 42.8 24.6 39.0 34.6 37.1 36.2 28.0 30.9 33.2 38.6 42.3 26.7 32.0 32.0 32.8 38.4 22.7 37.5 40.8 32.2 25.5 31.4 35.2 31.9 39.6 39.4 26.0 36.2 : Consumption 2000 20.1 19.8 21.8 18.5 18.8 33.4 19.2 19.5 25.5 16.5 15.8 21.2 18.3 12.6 18.4 18.0 23.0 27.2 15.6 23.8 22.2 17.8 18.3 17.0 23.3 21.7 28.5 26.3 19.0 31.2 25.6 2010 19.7 19.3 21.2 21.4 20.8 31.3 19.7 25.4 22.3 16.4 14.7 19.4 17.4 19.0 16.9 17.6 27.1 27.5 18.7 26.9 21.3 20.5 17.6 18.1 23.6 17.7 25.1 27.9 18.3 29.1 22.8 2011 20.1 19.4 21.0 22.4 21.4 31.4 20.1 26.1 22.1 16.3 14.0 19.9 17.4 17.7 17.2 17.5 27.2 26.8 19.0 26.3 21.2 20.8 18.0 21.6 23.0 18.7 26.4 27.3 19.5 : 22.8 2000 : 29.9 29.5 : 18.7 36.0 27.0 6.4 : : 29.3 40.1 28.1 24.8 12.3 6.8 : 18.5 : 20.0 27.2 20.5 31.1 : 17.3 21.5 38.1 42.7 44.0 42.2 : Capital 2010 : 27.2 28.7 : 16.6 : 19.7 9.8 : : : 39.7 33.0 30.6 7.9 7.1 : 19.9 : 13.0 23.3 18.6 28.4 : 21.9 14.3 28.7 29.2 35.7 41.9 : 2011 : 28.9 30.3 : 17.6 : 22.0 7.9 : : : 44.4 33.6 24.7 9.9 5.5 : 17.3 : 12.9 23.6 18.3 31.6 : 20.5 14.8 27.4 27.0 34.9 41.9 :

* Implicit tax rates (ITR) express aggregate tax revenues as a percentage of the potential tax base for each field (see footnote 4). ** EU27 and EA17 overall tax ratios are calculated as GDP-weighted averages of the Member States. The EA17 ITR on capital is calculated using estimated data for missing Member States. *** Provisional : Data not available

Highest top personal income tax rates in Sweden and highest corporate tax rate in France

The average top personal income tax rate in the EU27 is 38.7% in 2013, up from 38.1% in 2012, but well below the level of 2000 at 44.8%. The highest top rates on 2013 personal income are observed in Sweden (56.6%), Denmark (55.6%), Belgium (53.7%), Portugal (53.0%), Spain and the Netherlands (both 52.0%), and the lowest in Bulgaria (10.0%), Lithuania (15.0%), Hungary and Romania (both 16.0%). The average top corporate tax rate in the EU27 is 23.0% in 2013, stable compared with 2012, but well below its 6 level in 2000. The highest statutory tax rates on 2013 corporate income are recorded in France (36.1%), Malta (35.0%) and Belgium (34.0%), and the lowest in Bulgaria and Cyprus (both 10.0%) and Ireland (12.5%). The average standard VAT rate in the EU27 is 21.3% in 2013, slightly up compared with 2012. In 2013 compared with 2012, six Member States increased their VAT rate, and only Latvia reduced it. In 2013, the standard VAT rate varies from 15.0% in Luxembourg and 18.0% in Cyprus and Malta to 27.0% in Hungary and 25.0% in Denmark and Sweden.

7 5

Top statutory income tax rates and standard VAT rates, %

Tax on personal income 2000 EU27* EA17* Belgium Bulgaria Czech Republic Denmark Germany Estonia Ireland Greece Spain France Italy Cyprus Latvia Lithuania Luxembourg Hungary Malta Netherlands Austria Poland Portugal Romania Slovenia Slovakia Finland Sweden United Kingdom Norway Iceland

* ** *** :

Tax on corporate income 2000 31.9 34.4 40.2 32.5 31.0 32.0 51.6 26.0 24.0 40.0 35.0 37.8 41.3 29.0 25.0 24.0 37.5 19.6 35.0 35.0 34.0 30.0 35.2 25.0 25.0 29.0 29.0 28.0 30.0 28.0 30.0 2012 23.0 25.4 34.0 10.0 19.0 25.0 29.8 21.0 12.5 20.0 30.0 36.1 31.4 10.0 15.0 15.0 28.8 20.6 35.0 25.0 25.0 19.0 31.5 16.0 18.0 19.0 24.5 26.3 24.0 28.0 20.0 2013*** 23.0 25.7 34.0 10.0 19.0 25.0 29.8 21.0 12.5 26.0 30.0 36.1 27.5 10.0 15.0 15.0 29.2 20.6 35.0 25.0 25.0 19.0 31.5 16.0 17.0 23.0 24.5 22.0 23.0 28.0 20.0 2000 19.2 18.1 21.0 20.0 22.0 25.0 16.0 18.0 21.0 18.0 16.0 19.6 20.0 10.0 18.0 18.0 15.0 25.0 15.0 17.5 20.0 22.0 17.0 19.0 19.0 23.0 22.0 25.0 17.5 : :

VAT** 2012 21.0 20.0 21.0 20.0 20.0 25.0 19.0 20.0 23.0 23.0 18.0 19.6 21.0 17.0 22.0 21.0 15.0 27.0 18.0 19.0 20.0 23.0 23.0 24.0 20.0 20.0 23.0 25.0 20.0 : : 2013*** 21.3 20.4 21.0 20.0 21.0 25.0 19.0 20.0 23.0 23.0 21.0 19.6 22.0 18.0 21.0 21.0 15.0 27.0 18.0 21.0 20.0 23.0 23.0 24.0 20.0 20.0 24.0 25.0 20.0 : :

2012 38.1 43.1 53.7 10.0 15.0 55.4 47.5 21.0 41.0 49.0 52.0 46.8 47.3 38.5 25.0 15.0 41.3 20.3 35.0 52.0 50.0 32.0 49.0 16.0 41.0 19.0 49.0 56.6 50.0 40.0 31.8

2013*** 38.7 44.3 53.7 10.0 22.0 55.6 47.5 21.0 41.0 46.0 52.0 50.2 43.0 38.5 24.0 15.0 43.6 16.0 35.0 52.0 50.0 32.0 53.0 16.0 50.0 25.0 51.1 56.6 45.0 40.0 31.8

44.8 47.1 60.6 40.0 32.0 62.9 53.8 26.0 44.0 45.0 48.0 59.0 45.9 40.0 25.0 33.0 47.2 44.0 35.0 60.0 50.0 40.0 40.0 40.0 50.0 42.0 54.0 51.5 40.0 47.5 :

Arithmetic average If two VAT rates were applicable during a year the one being in force for more than six months or introduced on 1 July is indicated in the table. The cut-off date for taking into account changes in tax rates was 11 March 2013. Data not available

1. The overall tax-to-GDP ratio measures the tax burden as the total amount of taxes and compulsory actual social contributions as a percentage of GDP. This definition differs slightly from the one used in the common Eurostat / DirectorateGeneral for Taxation and Customs Union Statistics in Focus 55/2012, "In 2011 tax revenues increased to 40.0% of GDP in the EU-27 and 40.8% of GDP in the EA-17", which includes voluntary and imputed social contributions. GDP-weighted averages are used for the calculation of EU and euro area aggregates. 2. EU27: Belgium, Bulgaria, the Czech Republic, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom. Euro area (EA17): Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland. 3. "Taxation trends in the European Union", only available in English. This publication and News Release are based on data available on 11 March 2013. The publication can be purchased from authorised sales agents or downloaded free of charge in PDF format from the Eurostat or Directorate-General for Taxation and Customs Union websites: http://epp.eurostat.ec.europa.eu/portal/page/portal/government_finance_statistics/publications/other_publications http://ec.europa.eu/taxtrends 4. Implicit tax rates (ITR) measure the average tax burden on different types of economic income or activities, i.e. on labour, consumption and capital. ITR express aggregate tax revenues as a percentage of the potential tax base for each field. The ITR on labour is the ratio between taxes and social contributions paid on earned income and the cost of labour. The numerator includes all direct and indirect taxes and social contributions levied on employed labour income, while the denominator amounts to the total compensation of employees working in the economic territory increased by taxes on wage bills and the payroll. It is calculated for employed labour only (and therefore excludes the tax burden on social transfers, including pensions). The average may conceal important variations in the tax burden across the income distribution. The ITR on consumption is the ratio between the revenue from consumption taxes and the final consumption expenditure of households on the economic territory. The ITR on capital includes, in the numerator, the taxes levied on the income earned from savings and investments by households and corporations and taxes related to stocks of capital stemming from savings and investment in previous periods. The denominator of the capital ITR is a proxy of the world-wide capital and business income of Member States' residents for domestic tax purposes. Trends in the capital ITR reflect a wide range of factors and should be interpreted with caution. All ITRs for the EU and the euro area are calculated as GDP-weighted averages. 5. The top personal income tax rate refers to the tax rate for the highest income bracket adding surcharges of general application. 6. The adjusted statutory tax rate on corporate income takes into account corporate income tax (CIT) and, if they exist, surcharges, local taxes, or even additional taxes levied on tax bases that are similar but often not identical to the CIT. 7. Value Added Tax, or VAT, is a general, broadly based consumption tax assessed on the value added to goods and services. The standard VAT rate is the rate to which a majority of goods and services are subject, while the Member States may apply reduced VAT rates to goods and services enumerated in a restricted list.

Issued by: Eurostat Press Office

For further information: Laura WAHRIG Tel: +352-4301-37 687 estat-esa95-gov@ec.europa.eu Thomas HEMMELGARN Tel: +32-2-295-66 56 taxud-structures@ec.europa.eu

Tim ALLEN Louise CORSELLI-NORDBLAD Tel: +352-4301-33 444 eurostat-pressoffice@ec.europa.eu

Eurostat news releases on the internet: http://ec.europa.eu/eurostat Taxation news releases on the internet: http://ec.europa.eu/taxation_customs/taxation/index_en.htm

You might also like

- Teacher CertificationDocument2 pagesTeacher Certificationapi-418741017100% (1)

- Taxation Trends in The EU - 2016 PDFDocument340 pagesTaxation Trends in The EU - 2016 PDFDiana IrimescuNo ratings yet

- Eurostat Taxation Trend 201 enDocument5 pagesEurostat Taxation Trend 201 enWISDOM your outside perspective pillarNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Ireland: Developments in The Member StatesDocument4 pagesIreland: Developments in The Member StatesBogdan PetreNo ratings yet

- GE 3 May 2012 - Andrea ManzittiDocument23 pagesGE 3 May 2012 - Andrea ManzittiMeadsieNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- Hourly Labour Costs Ranged From 5.4 To 43.5 Across The EU Member States in 2018Document4 pagesHourly Labour Costs Ranged From 5.4 To 43.5 Across The EU Member States in 2018vengadeshNo ratings yet

- 2012-03-19 Greece Is Changing Updated Mar 2012Document64 pages2012-03-19 Greece Is Changing Updated Mar 2012guiguichardNo ratings yet

- Labour Costs Highest in The Financial and Insurance SectorDocument7 pagesLabour Costs Highest in The Financial and Insurance SectorTurcan Ciprian SebastianNo ratings yet

- Fiscal PolicycesifoDocument38 pagesFiscal PolicycesifoHotIce05No ratings yet

- Taxation Trends in EU in 2010Document42 pagesTaxation Trends in EU in 2010Tatiana TurcanNo ratings yet

- 2 24102017 BP en PDFDocument3 pages2 24102017 BP en PDFDan BNo ratings yet

- Deficitul Romaniei A Ajuns La 3,2% Din PIB Pe Primul Trimestru Din 2017Document3 pagesDeficitul Romaniei A Ajuns La 3,2% Din PIB Pe Primul Trimestru Din 2017Daniel IonascuNo ratings yet

- Hourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Document4 pagesHourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Turcan Ciprian SebastianNo ratings yet

- Taxation Trends in The European Union - 2012 74Document1 pageTaxation Trends in The European Union - 2012 74d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 20Document1 pageTaxation Trends in The European Union - 2012 20d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- EU Goverment Debt Q1 2013Document4 pagesEU Goverment Debt Q1 2013Yannis KoutsomitisNo ratings yet

- GDP Up by 0.2% in Both Euro Area and EU28Document2 pagesGDP Up by 0.2% in Both Euro Area and EU28Valter SilveiraNo ratings yet

- ARI39 2018 Toygur Guide To Understanding Italy 2018 Elections and BeyondDocument11 pagesARI39 2018 Toygur Guide To Understanding Italy 2018 Elections and BeyondBelle CabalNo ratings yet

- Euro-Zone Government Deficit at 2.7% of GDP and Public Debt at 70.7% of GDPDocument7 pagesEuro-Zone Government Deficit at 2.7% of GDP and Public Debt at 70.7% of GDPbxlmichael8837No ratings yet

- What Is Portugal's Rank in The OECD?Document6 pagesWhat Is Portugal's Rank in The OECD?aimaportugal97No ratings yet

- 8 07052020 Ap enDocument6 pages8 07052020 Ap enJanNo ratings yet

- The Tax Burden of Typical Workers in The EU 28-2018: James Rogers - Cécile PhilippeDocument15 pagesThe Tax Burden of Typical Workers in The EU 28-2018: James Rogers - Cécile PhilippeBogdan BotaşNo ratings yet

- Taxation Trends in The European Union - 2012 61Document1 pageTaxation Trends in The European Union - 2012 61d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 70Document1 pageTaxation Trends in The European Union - 2012 70d05registerNo ratings yet

- GDP Down by 3.8% in The Euro Area and by 3.5% in The EU: Preliminary Flash Estimate For The First Quarter of 2020Document2 pagesGDP Down by 3.8% in The Euro Area and by 3.5% in The EU: Preliminary Flash Estimate For The First Quarter of 2020Orestis VelmachosNo ratings yet

- Taxe Și Impozite (% PIB)Document6 pagesTaxe Și Impozite (% PIB)dlavinutzzaNo ratings yet

- Tax Revenues Per GDPDocument8 pagesTax Revenues Per GDPizforever1287557No ratings yet

- Taxation Trends in The European Union - 2012 159Document1 pageTaxation Trends in The European Union - 2012 159d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 21Document1 pageTaxation Trends in The European Union - 2012 21d05registerNo ratings yet

- USt Saetze EU MitgliedstaatenDocument2 pagesUSt Saetze EU MitgliedstaatenBernhard KeimNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends Report 2020.enDocument308 pagesTaxation Trends Report 2020.enviktor's VibesNo ratings yet

- Economia Subterana in Europa PDFDocument112 pagesEconomia Subterana in Europa PDFFlorin Marius PopaNo ratings yet

- 95-2010 - en - JournDocument5 pages95-2010 - en - Journjohn_miller3043No ratings yet

- Cr2015 Belgium enDocument89 pagesCr2015 Belgium enIlias MansouriNo ratings yet

- Flash Estimate Euro GDP Q4 2011Document3 pagesFlash Estimate Euro GDP Q4 2011economicdelusionNo ratings yet

- Taxation Trends in The European Union - 2012 107Document1 pageTaxation Trends in The European Union - 2012 107d05registerNo ratings yet

- Europe 2020 Targets: (Public Sector Only)Document3 pagesEurope 2020 Targets: (Public Sector Only)Lenna ZabaNo ratings yet

- GDP Down by 12.1% in The Euro Area and by 11.9% in The EUDocument3 pagesGDP Down by 12.1% in The Euro Area and by 11.9% in The EULjubinko JosipovicNo ratings yet

- Taxation Trends in The European Union - 2012 90Document1 pageTaxation Trends in The European Union - 2012 90d05registerNo ratings yet

- France's Economic Background: InflationDocument5 pagesFrance's Economic Background: InflationMis Alina DenisaNo ratings yet

- Klabin Webcast 20101 Q10Document10 pagesKlabin Webcast 20101 Q10Klabin_RINo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Roubini1989 Goverment SpendingDocument35 pagesRoubini1989 Goverment SpendingE. C. ReynaldoNo ratings yet

- 01 IMF - Taxing Immovable Property - 2013 21Document1 page01 IMF - Taxing Immovable Property - 2013 21Dimitris ArgyriouNo ratings yet

- Euro Area Government Deficit at 0.5% and EU28 at 0.6% of GDPDocument9 pagesEuro Area Government Deficit at 0.5% and EU28 at 0.6% of GDPEconomy 365No ratings yet

- 2 08062023 Ap enDocument10 pages2 08062023 Ap enrehanpinjara32No ratings yet

- Second Estimate For The Q2 2013 Euro GDPDocument6 pagesSecond Estimate For The Q2 2013 Euro GDPeconomicdelusionNo ratings yet

- Paying Taxes 2014Document175 pagesPaying Taxes 2014Jose Cespedes100% (1)

- Taxation Trends in The European Union - 2012 66Document1 pageTaxation Trends in The European Union - 2012 66d05registerNo ratings yet

- Taxes and Economic GrowthDocument24 pagesTaxes and Economic GrowthSadamNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 86Document1 pageTaxation Trends in The European Union - 2012 86d05registerNo ratings yet

- VAT Romania 1aprilDocument2 pagesVAT Romania 1aprilMaria Gabriela PopaNo ratings yet

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDocument44 pagesTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNo ratings yet

- Euro Area Unemployment Rate at 10.5%Document6 pagesEuro Area Unemployment Rate at 10.5%Joeljar Enciso SaraviaNo ratings yet

- EIB Investment Survey 2023 - European Union overviewFrom EverandEIB Investment Survey 2023 - European Union overviewNo ratings yet

- GovernanceDocument33 pagesGovernanceAli HasanieNo ratings yet

- Position PaperDocument16 pagesPosition PaperSheralyne Daz PequinaNo ratings yet

- Metropolitan Bank & Trust Company vs. Court of AppealsDocument2 pagesMetropolitan Bank & Trust Company vs. Court of AppealsMir SolaimanNo ratings yet

- Republic vs. CA, G.R. No. 163604, May 6, 2005Document2 pagesRepublic vs. CA, G.R. No. 163604, May 6, 2005Dara CompuestoNo ratings yet

- MSEDCL - Bill Info June-2020Document4 pagesMSEDCL - Bill Info June-2020pavan rautNo ratings yet

- FGGGFD 971Document280 pagesFGGGFD 971Bijelo DugmeNo ratings yet

- Chapter1 HistoryDocument2 pagesChapter1 HistoryMadhukar PvsnNo ratings yet

- Testing of All Equipment Components and Parts Imported For Use in TheDocument2 pagesTesting of All Equipment Components and Parts Imported For Use in Thesarita kumariNo ratings yet

- G.R. No. 180651Document9 pagesG.R. No. 180651Ran NgiNo ratings yet

- LIBERI V TAITZ (E.D. PA) - 1 - COMPLAINT - Gov - Uscourts.paed.302150.1.0Document45 pagesLIBERI V TAITZ (E.D. PA) - 1 - COMPLAINT - Gov - Uscourts.paed.302150.1.0Jack RyanNo ratings yet

- List of Teaching and Non-Teaching Personnel (Form 1A) As of JUNE 2017Document7 pagesList of Teaching and Non-Teaching Personnel (Form 1A) As of JUNE 2017Goldine Barcelona EteNo ratings yet

- Salonga vs. Warner Barnes and Co.Document4 pagesSalonga vs. Warner Barnes and Co.Teoti Navarro ReyesNo ratings yet

- DSP - PartnershipDocument28 pagesDSP - PartnershipdemNo ratings yet

- Weekly Tax TableDocument12 pagesWeekly Tax TableLianna HendyNo ratings yet

- Robc Committee Listing 05-22-23Document5 pagesRobc Committee Listing 05-22-23api-61882337No ratings yet

- Simny G. Guy, Et Al., v. Gilbert GuyDocument4 pagesSimny G. Guy, Et Al., v. Gilbert GuyYuri NishimiyaNo ratings yet

- Jeremy Persons DeterminationDocument21 pagesJeremy Persons DeterminationCasey SeilerNo ratings yet

- G.R. No. L-51806 November 8, 1988 Civil Aeronautics Administration, Petitioner, COURT OF APPEALS and ERNEST E. SIMKE, RespondentsDocument22 pagesG.R. No. L-51806 November 8, 1988 Civil Aeronautics Administration, Petitioner, COURT OF APPEALS and ERNEST E. SIMKE, RespondentsPrincess Rosshien HortalNo ratings yet

- Adjudications of Cyber Disutes InindiaDocument22 pagesAdjudications of Cyber Disutes InindiaProf. Amit kashyapNo ratings yet

- Aninon Vs Atty. Sabitsana (A.C. No. 5098, April 11, 2012)Document2 pagesAninon Vs Atty. Sabitsana (A.C. No. 5098, April 11, 2012)Eric RecomendableNo ratings yet

- Investment Advisers Act of 1940Document30 pagesInvestment Advisers Act of 1940Edward WinfreySNo ratings yet

- Aaa Special Recognition GreenDocument8 pagesAaa Special Recognition GreendinaNo ratings yet

- English 3sci18 1trim3Document2 pagesEnglish 3sci18 1trim3SAFONo ratings yet

- 82 - Republic Vs Marcopper DigestDocument1 page82 - Republic Vs Marcopper DigestcharmssatellNo ratings yet

- Family Code 271 Sanctions Abuse: Kleytman v. Pechonkina First District Court of Appeals California - Family Law - Family Court - DivorceDocument3 pagesFamily Code 271 Sanctions Abuse: Kleytman v. Pechonkina First District Court of Appeals California - Family Law - Family Court - DivorceCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument12 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Whether or Not The Will Executed in China Should Be Allowed Here in The Philippines (NO)Document2 pagesWhether or Not The Will Executed in China Should Be Allowed Here in The Philippines (NO)Basil MaguigadNo ratings yet

- Assignment 2Document68 pagesAssignment 2Mitz FranciscoNo ratings yet

- Alonso vs. Villamor 16 Phil. 315Document8 pagesAlonso vs. Villamor 16 Phil. 315albemartNo ratings yet