Professional Documents

Culture Documents

Equity Weekly - Rupee, Crude Oil Price and Infosys Results in Focus

Equity Weekly - Rupee, Crude Oil Price and Infosys Results in Focus

Uploaded by

Rahul SaxenaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Weekly - Rupee, Crude Oil Price and Infosys Results in Focus

Equity Weekly - Rupee, Crude Oil Price and Infosys Results in Focus

Uploaded by

Rahul SaxenaCopyright:

Available Formats

Equity Weekly Update Sensex 19410.84 15.03 Nifty 5867.90 25.

70

For the week 8th July to 12th July 2013 Nifty Future 5872.50 39.90

Weekly Outlook: - Rupee, crude oil price and Infosys results in focus On Monday, 8 July 2013, Asian stocks will react to the influential US nonfarm payroll data for June 2013, which will be released during trading hours in the United States. As per market expectations, the data is likely to show an increase of 165,000 jobs in June 2013. The monthly payroll report has been looked at for cues on whether or not the Federal Reserve will begin to roll back its bond-buying program before the end of this year. Federal Reserve Chairman Ben Bernanke on 19 June 2013 said that the central bank may taper the pace of its bond purchases, currently set at $85 billion a month, as early as this year if the economy continues to improve in line with its forecasts. The Central Statistics Office (CSO) will unveil industrial output data for May 2013 on Friday, 12 July 2013. Industrial production rose 2.3% in April 2013, lower than a revised growth of 3.4% in March 2013. Weekly Movement of Market

Key Indices Nifty Sensex Bank Nifty CNX IT NSE Midcap BSE Auto BSE FMCG BSE Metal

BSE Oil & Gas

Level 5867.90 19410.84 11434.30 6604.70 7379.45 10818.24 6845.94 7647.58 8915.96 1620.48 6027.36 1513.22 Level

Change

Change (%)

Weekly Chart Nifty

25.70 15.03 -182.95 -29.45 37.05 102.47 387.85 -106.18 15.55 -2.07 -135.63 2.20

Change

0.44 0.08 -1.57 -0.44 0.50 0.53 6.01 -1.37 0.17 -0.13 -2.20 0.15

Change (%)

BSE Power BSE PSU BSE Reality Top Gainer/ Loser BSE Jaypee Infra United Brew TTK Prestige GlaxoSmithKlin RelianceCom Gitanjali Gems MMTC Ltd. Wockhardt Ltd.

Guj Mineral Dev

Hind. Copper Global Markets Shanghai Nikkei HangSeng FTSE CAC DAX DJIA NASDAQ

25.75 5.20 855.50 172.75 3586.20 573.70 5571.00 886.00 135.60 19.95 183.15 -79.60 79.75 -28.50 914.90 -95.65 113.25 -11.35 65.95 -6.20 Level Change Asian 2007.20 27.99 14309.90 632.58 20854.70 51.41 European 6,375.52 160.05 3,753.85 7,806.00 14.94 -153.22

25.30 25.30 19.04 18.91 17.25 -30.29 -26.33 -9.47 -9.11 -8.59

Change (%)

Technical View On the daily chart of nifty we can see nifty unable to break its resistance level of 5900. Currently nifty is trading above its 8 days, 13 days and 21 days EMA. Investor should wait for make fresh long position in nifty and Aggressive traders can make short position in nifty with strict stop loss of 5920.

Weekly Roundup:Positive global cues following healthy macro data from the US and the assurance from the European Central Bank (ECB) that it would continue its accommodative monetary stance helped the market in India which witnessed aggressive buying by foreign institutional investors (FII) during the week ended 5 th July 2013. The Indian benchmark closed higher in three of the last five trading days but the rally globally was checked ahead of the announcement of the key US non farm payroll data for the month of June. Political unrest in Egypt and Portugal also was a key overhang during the previous week. The US non farm payroll data showed that the Employers added 195,000 jobs in June, a sign of steady improvement in the job market. But this certainly would revive the concerns that the Fed will start rolling back its bond buying programme starting from September. The BSE Sensex gained 15.03 points or 0.08% to settle at 19410.84 on Friday, July 5, 2013 & The CNX Nifty closed with the gain of 25.70 points or 0.44% at 5867.90.

1.41 4.63 0.25 2.58 0.40 -1.93 2.10 2.24

US 15,135.80 311.80 3,479.38 76.13

RR, All Rights Reserved

Page 1 of 4

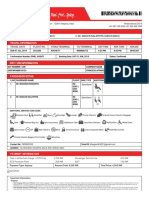

Institutional Activities (Rs Cr)

Calls for the Week

FIIs Monday Tuesday Wednesday Thursday Friday DIIs Monday Tuesday Wednesday Thursday Friday

Buy 2272.67 2301.07 2335.64 2079.02 1545.40 Buy 1196.82 993.01 1207.37 948.57 891.54

Sold 2274.14 2344.27 3040.70 1914.46 1561.11 Sold 983.22 1118.34 954.49 1024.78 786.27

Net -1.47 -43.20 -705.06 164.56 -15.71 Net 213.60 -125.33 252.88 -76.21 105.27

Stock on the Move: - Colgate Palmoliv

Technical View: On the daily chart of Colgate Palmoliv we can see stock had bounced back from its lower levels and broken its resistance level of 1360. Currently stock is trading above its 8 days, 13 days and 21 days EMA. Investor can buy stock near 1370 with stop loss of 1340 for target price of 1425.

Highlights of the Week

Rupee fall gives Unilever $400-mn smile Sebi freezes voting rights, corporate benefits of Gillette India promoters

India-UAE agreement on air services pact may be revoked

Former telecom secy to head Nasscom Is 3G a missed call for telecom operators? Finnish company Metso unfazed by mining hiccups Hero MotoCorp enters Africa UK regulator's import alert on Wockhardt Tax-free bonds for developing airports: AAI Sexual abuse case against IDFC Capital CEO General Motors yet to resume Tavera, Sail production Gujarat Natural Resources Ltd to expand oil production through subsidiary Pune unions threaten mass stir if Bajaj issue not resolved Kinectic-Hyundai JV eyes low cost elevator market Mercedes-Benz to assemble latest SUV at Pune plant Manali Petro to focus on product mix, new markets

Govt plans media blitzkrieg to publicise Food Security ordinance Policy for India-made telecom equipment on hold FIPB clears 7 pharma proposals Twenty-five essential drugs to see 90% decline in prices Central Silk Board gets 21% higher allocation under 12th Plan

RITES to conduct Phase-II feasibility study of Kochi metro

Iron ore export at Paradip rises three-fold IMC gives raw deal to Odisha on coal blocks RBI intervention prevents rupee from hitting a new low Housing finance firms set to tap ECB market YES Bank case hearing deferred to early next week Dollar rises above Rs 61 in Dubai exchange futures India Infradebt to raise Rs 500 cr via debentures

Derivative Trend

4000 3500 3000 2500 2000 1500 1000 500 0 -500 -1000 1 2 3 4 5 6 7 8 9 10

FII'S Activity in F&O Previous Ten Session

9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0

Call Put

-1500

5400

5500

5600

5700

5800

5900

RR, All rights reserved

Page 2 of 4

For Further Details/Clarifications please contact:

RR Information & Investment Research Pvt. Ltd. 47, MM Road Jhandewalan New Delhi-110055 (INDIA) Tel: 011-23636362/63 research@rrfcl.com RR Research Products and Services: IPO / FPO Analysis Mutual Fund Analysis Insurance Analysis Investment Monitor The complete monthly magazine design for Indian investors Join us on face book: https://www.facebook.com/RRFinancialConsultants

Follow us on Twitter: - https://twitter.com/rrfinance1

Follow Us on Google+: - https://plus.google.com/102387639341063312684/about Connect With us: - http://www.linkedin.com/in/rrfinance Find News on Our blog: - http://rrfinancialconsultants.wordpress.com

About RR

RR is first generation business set up in 1986. Shri. Rajat Prasad, a professional qualified Chartered Accountant, is the main founder. He is the architect of its growth and in the last decade has steered the group to be a diverse and respected financial and Insurance Services Organization with nationwide presence with offices in more than 100 cities and a team of 800 Employees. RR has the presence in all metro cities and towns across the length and breadth of the country. RR is headquartered in New Delhi, Capital of India with regional offices in Mumbai, Ahmedabad, Baroda, Jaipur, Chandigarh, Lucknow, Calcutta, Bangalore, Chennai, Noida and Dehradun. It has Associate offices in other cities and Locations totaling 600 locations & 100 cities. It has agent presence in over 500 cities across the country. RR is the only Company in India which provides research based seamless service to its customers through own offices, franchisees and agents.

About RR Research

RR Research provides unbiased and independent research in Equity brokers, Commodity, Currency Market, Fixed Income, Debt Market, Fixed Deposits, Bonds and Debentures, Tax Saving Schemes, Stock market, Mutual Funds, company fixed deposits, Online Share Trading and Life Insurance plans, Insurance Brokers in Delhi. The research team consists of more than 10 analysts, most of which are CAs and MBAs from premier business school with experience ranging from 0 to 10 years. The team is equipped with state of the art analysis tools, software. The research team is engaged in almost every activities of the capital market. In the fundament research front, the team is involved in Economic Analysis, Sectoral Analysis, Company Coverage and Updates. In the trading front, dedicated technical team is employed to provide online technical calls, trading tips, derivative strategies to clients. The team is online during the market hours and anyone through our website can chat live with analysts and can solve any investment related query. The team has extensive network of industry contacts and regularly attending analyst meets/ conference calls to get insight of the company. On regular basis, the team shares its view with leading electronic & print media houses.

For More Information Please Visit: - http://www.rrfinance.com/ or call 9540056975 or dial toll Free 1800110444 RR Financial Consultants 47, M.M. Road, Rani Jhansi Marg Jhandewalan New Delhi-110055 Phone- 01123636362 Fax- 01123636666 Mobile- +919540056975 Toll Free- 1800110444

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GST in India Vol1 PDFDocument233 pagesGST in India Vol1 PDFSrinivas YakkalaNo ratings yet

- Dixon Ticonderoga Case StudyDocument2 pagesDixon Ticonderoga Case StudyShazib Ali100% (1)

- Cities in The Circular Economy The Role of Digital TechnologyDocument10 pagesCities in The Circular Economy The Role of Digital Technologyepraetorian100% (1)

- Review of Related LiteratureDocument7 pagesReview of Related LiteratureRhoxette Pedroza81% (27)

- Role of NGOs in The Promotion of EducationDocument5 pagesRole of NGOs in The Promotion of EducationnrsiddiquipkNo ratings yet

- Technical Analysis AssgDocument9 pagesTechnical Analysis Assgakanksha parabNo ratings yet

- Standardised On-Road Test Cycles - SORT: A Project of The UITP Bus Committee in Collaboration With ManufacturersDocument25 pagesStandardised On-Road Test Cycles - SORT: A Project of The UITP Bus Committee in Collaboration With ManufacturersNadabe PetersenNo ratings yet

- Efjemeekeeheævece Lelee Efmekeàvojeyeeo: NwojeyeeleebDocument1 pageEfjemeekeeheævece Lelee Efmekeàvojeyeeo: NwojeyeeleebNandu BoseNo ratings yet

- Nifty Futures Lot Sizes Information - Dec 2013Document8 pagesNifty Futures Lot Sizes Information - Dec 2013justtrade013926No ratings yet

- 10M EuroDocument2 pages10M EuroAmaliri GeoffreyNo ratings yet

- Invoice 0001 Seven Motorsports Management 2023Document2 pagesInvoice 0001 Seven Motorsports Management 2023ibrahimnorrodinNo ratings yet

- Mr. Bhavesh Ravariya (Adult, Male) 2. Mr. Maulik Kalathiya (Adult, Male)Document2 pagesMr. Bhavesh Ravariya (Adult, Male) 2. Mr. Maulik Kalathiya (Adult, Male)Maulik M. KalathiyaNo ratings yet

- Mendelssohn - O Rest in The LordDocument3 pagesMendelssohn - O Rest in The Lordpedrolopes92No ratings yet

- Abu Dhabi Delhi On Apr 28th 2023Document2 pagesAbu Dhabi Delhi On Apr 28th 2023Abdul Rahman ShaikhNo ratings yet

- Editing Options - Enjoy Transactions: Send FeedbackDocument6 pagesEditing Options - Enjoy Transactions: Send FeedbackTeja SaiNo ratings yet

- Demand TheoryDocument13 pagesDemand TheoryRiTu SinGhNo ratings yet

- Ocean Bill of LadingDocument1 pageOcean Bill of LadingSelina Hakh-Ali100% (1)

- Creative EuropeDocument4 pagesCreative EuropeZahara ApNo ratings yet

- 30 Rules To Master Swing TradingDocument1 page30 Rules To Master Swing TradingPower of Stock MarketNo ratings yet

- Introduction To Agricultural Policy and DevelopmentDocument68 pagesIntroduction To Agricultural Policy and DevelopmentErika Ruth Labis100% (2)

- New Code ListDocument7 pagesNew Code ListHARI KRISHAN PALNo ratings yet

- Swot Analysis of IB in PakistanDocument2 pagesSwot Analysis of IB in PakistanMubeen Zubair100% (2)

- 16 - Guinea Iron OreDocument25 pages16 - Guinea Iron OreBisto MasiloNo ratings yet

- CAMELS Project of Axis BankDocument47 pagesCAMELS Project of Axis Bankjatinmakwana90No ratings yet

- The Furniture Industry in 2016 Competitive Scenarios: Trends and Strategic ImplicationsDocument263 pagesThe Furniture Industry in 2016 Competitive Scenarios: Trends and Strategic ImplicationsJavier Iborra67% (6)

- Istanbul DemographicsDocument11 pagesIstanbul DemographicsBootcamp1No ratings yet

- My Romance Full-PianoDocument4 pagesMy Romance Full-PianoDavi Miranda MirandaNo ratings yet

- Market EconomyDocument84 pagesMarket EconomyRazvan OracelNo ratings yet

- Role of RBI Under Banking Regulation Act, 1949Document11 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- John Rhenz H. Japsay Bit-Computer Technology 4A-G1Document9 pagesJohn Rhenz H. Japsay Bit-Computer Technology 4A-G1Janica Rheanne JapsayNo ratings yet