Professional Documents

Culture Documents

O. Maffessanti & Sons Limited Going Concern Report Based On Ratio Analysis DECEMBER 31, 2012

O. Maffessanti & Sons Limited Going Concern Report Based On Ratio Analysis DECEMBER 31, 2012

Uploaded by

Shane ArnoldOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

O. Maffessanti & Sons Limited Going Concern Report Based On Ratio Analysis DECEMBER 31, 2012

O. Maffessanti & Sons Limited Going Concern Report Based On Ratio Analysis DECEMBER 31, 2012

Uploaded by

Shane ArnoldCopyright:

Available Formats

O.

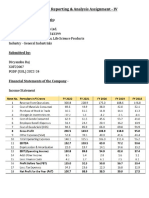

MAFFESSANTI & SONS LIMITED GOING CONCERN REPORT BASED ON RATIO ANALYSIS DECEMBER 31, 2012

PROFITABILITY Ratio analysis reveals that the company profitability has decreased over the period. The return on equity fell by 139% in the current year and by 202% in the previous year. An analysis of other profitability ratio reveal some dramatic fall in percentage points over the same period. Given the retardation in profitability ratios, it is reasonable to assume that there may be some indication that the company is not a going concern and as such, the financial statements should be prepared on a basis that is consistent with the entity not being a going concern.

SHAREHOLDERS RATIOS Where going concern is to be assessed based on shareholders ratios, it is safe to say that shareholders would regard the entity as not being a going concern. Reason being is that there was a decrease in earnings per share by approximately $6,200 over the period ending December 31, 2012. Also the book value of the company fell approximately $756 per stock unit held by shareholders. This is critical indication of going concern deterioration in the eyes of shareholders; as shareholders constantly expect to see an increase on book value and as such market value per share. Therefore these declining shareholders ratios would leave shareholders dubious about the going concern of the company.

LIQUIDITY RATIOS Liquidity and profitability are the fundamental objectives of any profit motive entity. Liquidity is important in that the company needs enough liquid assets in order to be profitable. An analysis of the liquidity ratios shows further indication where doubts can be cast upon the entitys going concern assumption. The acid test ratio has fallen from 0.48 to 0.38 over the period; similarly the current ratio has fallen from 0.57 to 0.44. This reduction in both ratios can lend itself to the fact that company would be able to pay off its short term liabilities as they fall due by its current level of current5 assets. This may lead to disgruntled suppliers who will in turn

withdraw any credit facilities offered, this will have an adverse impact the supply of raw material which is essential for the effective operations of the company. This information casts significant doubt on its going concern assumption. The operating cycle ratios have lengthened which may give further indication that there doubt surrounding its going concern. The debtor collection period has increased from 30 to 51 days. Inventory days have lengthened by 3 days (from 11 to 14 days). While at the same time the company has been taking 56 more days to pay its creditors (from 39 to 95 days). This may be sensible given the fact that debtors are taking a longer time to settle their debts; but at the same time this may damage credit relationship with suppliers; which will inevitably have an adverse impact on its going concern.

You might also like

- Tarmac Case StudyDocument4 pagesTarmac Case StudyNJ77100% (2)

- SAP Activate Methodology For SAP AribaDocument124 pagesSAP Activate Methodology For SAP AribaCleberton Antunes100% (1)

- HBS Finance Basics Course NotesDocument16 pagesHBS Finance Basics Course NotesAlice JeanNo ratings yet

- Gilbert Lumber Case A11Document7 pagesGilbert Lumber Case A11karthik sNo ratings yet

- PR FinanceDocument2 pagesPR FinanceAbdul Rasyid Romadhoni100% (4)

- Maru Batting CenterDocument7 pagesMaru Batting CenterDeepansh Goyal100% (1)

- JMDE 002 FullDocument174 pagesJMDE 002 FullJose Antonio Monje100% (1)

- CalPERS Board Meeting Agendas 2006 Through 2010Document1,001 pagesCalPERS Board Meeting Agendas 2006 Through 2010mflaherman6436No ratings yet

- Branding 101 Course PDFDocument9 pagesBranding 101 Course PDFGrecuMarilu100% (1)

- Ratio AnalysisDocument11 pagesRatio AnalysispalowanNo ratings yet

- Finance Coursework FinalDocument7 pagesFinance Coursework FinalmattNo ratings yet

- P7int 2013 Jun A PDFDocument17 pagesP7int 2013 Jun A PDFhiruspoonNo ratings yet

- Concept Questions:: Net WorthDocument30 pagesConcept Questions:: Net WorthRutuja KhotNo ratings yet

- Lucky Cement AnalysisDocument6 pagesLucky Cement AnalysisKhadija JawedNo ratings yet

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDocument28 pages8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiNo ratings yet

- Financial Management and ControlDocument18 pagesFinancial Management and ControlcrystalNo ratings yet

- Financial ManagementDocument11 pagesFinancial ManagementEngr AtiqNo ratings yet

- Topical Ratio Analysis For PradaDocument4 pagesTopical Ratio Analysis For PradaRadNo ratings yet

- Analysis of Balance SheetDocument5 pagesAnalysis of Balance Sheetprashant pawarNo ratings yet

- Financial Statements Homer SimpsonDocument3 pagesFinancial Statements Homer SimpsonJoe JoyNo ratings yet

- Financial Statements Analysis and Evaluation Veritas PDFDocument16 pagesFinancial Statements Analysis and Evaluation Veritas PDFEuniceNo ratings yet

- QUESTION 1 - Evaluate US Tire's Financial Health. How Well Is The Company Performing?Document3 pagesQUESTION 1 - Evaluate US Tire's Financial Health. How Well Is The Company Performing?Anna KravcukaNo ratings yet

- Below Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsDocument14 pagesBelow Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsQueen ValleNo ratings yet

- TehlilDocument10 pagesTehlilebookreaderNo ratings yet

- Finance: RATIO ANALYSIS TOBERMORAYDocument17 pagesFinance: RATIO ANALYSIS TOBERMORAYFatimah AbdurrahimNo ratings yet

- Homework - 6 13-4) Goals For Sales and Income GrowthDocument3 pagesHomework - 6 13-4) Goals For Sales and Income GrowthARCHIT KUMARNo ratings yet

- Fin & Acc For MGT - Interpretation of Accounts HandoutDocument16 pagesFin & Acc For MGT - Interpretation of Accounts HandoutSvosvetNo ratings yet

- AnalysisDocument10 pagesAnalysiselsiekhateshNo ratings yet

- Theory of Ratio AnalysisDocument14 pagesTheory of Ratio AnalysisReddy BunnyNo ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisDraeselle Desoy-GallegoNo ratings yet

- FINMANDocument16 pagesFINMANSecret SecretNo ratings yet

- Bindura Nickel 2021Document108 pagesBindura Nickel 2021Arnold MoyoNo ratings yet

- Financial Analysis For Sapphire Fibres LimitedDocument6 pagesFinancial Analysis For Sapphire Fibres LimitedRashmeen NaeemNo ratings yet

- Cas Ii Assignment ON Importance of Liquidity Ratios in The IndustryDocument7 pagesCas Ii Assignment ON Importance of Liquidity Ratios in The IndustrySanchali GoraiNo ratings yet

- Liquidity PositionDocument16 pagesLiquidity PositionNuqman AmranNo ratings yet

- Performance of A Company?: How To Deal With Questions On Assessing TheDocument5 pagesPerformance of A Company?: How To Deal With Questions On Assessing TheABUAMMAR60No ratings yet

- INTRODUCTIONDocument2 pagesINTRODUCTIONEllen AgustinNo ratings yet

- Financial Ratio IntrepretationDocument47 pagesFinancial Ratio IntrepretationRavi Singla100% (1)

- Submitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Document18 pagesSubmitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Ramesh BabuNo ratings yet

- Analysis of Infosys LTDDocument18 pagesAnalysis of Infosys LTDshikhachaudhryNo ratings yet

- Interpretation Gma EdDocument6 pagesInterpretation Gma EdVan Errl Nicolai SantosNo ratings yet

- 11 Valuation Issues 2016 ValuationDocument7 pages11 Valuation Issues 2016 ValuationPhuoc DangNo ratings yet

- Amity AssignmentDocument4 pagesAmity Assignmentrakesh92joshiNo ratings yet

- Accounts Case 1Document10 pagesAccounts Case 1kapilg0027No ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Financial Analysis Shell PakistanDocument17 pagesFinancial Analysis Shell PakistanYasir Bhatti100% (1)

- Ratio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisDocument11 pagesRatio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisravikumardavidNo ratings yet

- CDJ Page5Document4 pagesCDJ Page5UyenNo ratings yet

- "Financial Analysis of Kilburn Chemicals": Case Study OnDocument20 pages"Financial Analysis of Kilburn Chemicals": Case Study Onshraddha mehtaNo ratings yet

- Certain Period, or That They Are Not Getting Payments For Invoices in Fast Enough. A SharpDocument6 pagesCertain Period, or That They Are Not Getting Payments For Invoices in Fast Enough. A Sharpmalik waseemNo ratings yet

- Star RiverDocument8 pagesStar Riverjack stauberNo ratings yet

- Financial and Accounting Digital Assignment-2Document22 pagesFinancial and Accounting Digital Assignment-2Vignesh ShanmugamNo ratings yet

- Financial AnalysisDocument8 pagesFinancial AnalysisNor Azliza Abd RazakNo ratings yet

- Finance Report - Bcom B.docx 2Document10 pagesFinance Report - Bcom B.docx 2Krishna SisodiyaNo ratings yet

- Data Analysis and InterpretationDocument15 pagesData Analysis and InterpretationMukesh KarunakaranNo ratings yet

- Financial Ratio Analysis ExplainationDocument5 pagesFinancial Ratio Analysis ExplainationSyaiful RokhmanNo ratings yet

- Financial Analysis - Martin Manufacturing CompanyDocument15 pagesFinancial Analysis - Martin Manufacturing CompanydjmondieNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementMaan CabolesNo ratings yet

- Audit RevisionDocument53 pagesAudit Revisionmalachibroomes1No ratings yet

- Ratio Analysis of TAJGVK Hotels and Resort - Group4Document32 pagesRatio Analysis of TAJGVK Hotels and Resort - Group4Shuvam DotelNo ratings yet

- FRA - IV (Tarsons Products)Document9 pagesFRA - IV (Tarsons Products)RR AnalystNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Payroll Management System Project DocumentationDocument2 pagesPayroll Management System Project DocumentationBhagyashri MendheNo ratings yet

- Step by Step Guide To Sap MM End User TransactionsDocument132 pagesStep by Step Guide To Sap MM End User Transactionssksk1911No ratings yet

- Global Annual Review 2009 PWCDocument62 pagesGlobal Annual Review 2009 PWCDeepesh SinghNo ratings yet

- Acc 112 - Partnership LiquidationDocument19 pagesAcc 112 - Partnership LiquidationJIYAN BERACISNo ratings yet

- Brksec-1021 (2018)Document84 pagesBrksec-1021 (2018)Paul ZetoNo ratings yet

- Module 12Document12 pagesModule 12Heart EuniceNo ratings yet

- HBRDocument2 pagesHBRjyoti.bharadwaj1484No ratings yet

- Notes PartF 2 PDFDocument1 pageNotes PartF 2 PDFMohd Nor UzairNo ratings yet

- Intl Tender Jute Bags 2019 PDFDocument35 pagesIntl Tender Jute Bags 2019 PDFshazuNo ratings yet

- Comprehensive Case Scenario Wilson BrosDocument8 pagesComprehensive Case Scenario Wilson BrosMe MeNo ratings yet

- CourseOutline (SML745)Document4 pagesCourseOutline (SML745)Pratyush GoelNo ratings yet

- Accounting Standards Board (ASB) in 1977Document15 pagesAccounting Standards Board (ASB) in 1977Viswanathan SrkNo ratings yet

- Assignmenment 02 - DB 1111 Report 2023Document152 pagesAssignmenment 02 - DB 1111 Report 2023MuhammedNo ratings yet

- Ethiopian TVET-System: Learning Guide'S #21Document8 pagesEthiopian TVET-System: Learning Guide'S #21mohammed ahmedNo ratings yet

- HR (Job Satisfaction of Employee in Maruti Suzuki)Document36 pagesHR (Job Satisfaction of Employee in Maruti Suzuki)Ayaz Raza100% (2)

- PHUONG Bao Ton Nu ThuDocument7 pagesPHUONG Bao Ton Nu ThuDaisy FreemanNo ratings yet

- APLL Franchise ProposalDocument13 pagesAPLL Franchise ProposalncitindiaNo ratings yet

- UNCEFACT-BRS-Business Requirements Specifications - Cross Industry Invoincing Process-Archivo-BRS - CII - v2.0.6Document49 pagesUNCEFACT-BRS-Business Requirements Specifications - Cross Industry Invoincing Process-Archivo-BRS - CII - v2.0.6RE TPNo ratings yet

- BibliographyDocument2 pagesBibliographyChristian Rebultan50% (2)

- Business English 4 Test SamplesDocument2 pagesBusiness English 4 Test SamplesAlinaArcanaNo ratings yet

- Lean Six Sigma Approach To Improve The Production Process in The Mould Industry: A Case StudyDocument19 pagesLean Six Sigma Approach To Improve The Production Process in The Mould Industry: A Case StudyELVIRA ORENo ratings yet

- ACC106 P2 Quiz 1 Questions Set A KDocument2 pagesACC106 P2 Quiz 1 Questions Set A KShane QuintoNo ratings yet

- Elementos para Marketing DigitalDocument23 pagesElementos para Marketing DigitalAlex MacNo ratings yet

- Financial AssistanceDocument6 pagesFinancial AssistanceNajmi ArifNo ratings yet