Professional Documents

Culture Documents

Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive Sentiment

Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive Sentiment

Uploaded by

Impulsive collectorCopyright:

Available Formats

You might also like

- Indian Ocean Trade Short Answer Question PracticeDocument2 pagesIndian Ocean Trade Short Answer Question Practiceapi-39087829863% (8)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Landbank Board ResolutionDocument8 pagesLandbank Board ResolutionAsisclo CastanedaNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- E-Commerce Adoption and Growth of SMEs in UgandaDocument9 pagesE-Commerce Adoption and Growth of SMEs in UgandaAloysious2014No ratings yet

- A Contribution To The Empirics of Economic GrowthDocument39 pagesA Contribution To The Empirics of Economic GrowthJamesNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownDocument1 pageThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDocument1 pageTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNo ratings yet

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- Thesun 2008-12-18 Page20 Msias rm2Document1 pageThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNo ratings yet

- Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichDocument1 pageThesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDocument1 pageTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDocument1 pageThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNo ratings yet

- TheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekDocument1 pageTheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekImpulsive collectorNo ratings yet

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDocument1 pageThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBDocument1 pageThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBImpulsive collectorNo ratings yet

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDocument1 pageTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNo ratings yet

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDocument1 pageThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNo ratings yet

- TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresDocument1 pageTheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresImpulsive collectorNo ratings yet

- Thesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidDocument1 pageThesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidImpulsive collectorNo ratings yet

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDocument1 pageThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNo ratings yet

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDocument1 pageThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNo ratings yet

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDocument1 pageTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNo ratings yet

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDocument1 pageThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNo ratings yet

- Thesun 2009-04-27 Page15 Imf Says Time To Talk Crisis Exit PlansDocument1 pageThesun 2009-04-27 Page15 Imf Says Time To Talk Crisis Exit PlansImpulsive collectorNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- TheSun 2008-11-03 Page20: Bargain Hunting Likely To Lift MarketDocument1 pageTheSun 2008-11-03 Page20: Bargain Hunting Likely To Lift MarketImpulsive collectorNo ratings yet

- The Sun 2008-10-30 Page22Document1 pageThe Sun 2008-10-30 Page22Impulsive collectorNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- Thesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsDocument1 pageThesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsImpulsive collectorNo ratings yet

- TheSun 2009-01-09 Page18 TNB Open To All Energy OptionsDocument1 pageTheSun 2009-01-09 Page18 TNB Open To All Energy OptionsImpulsive collectorNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- TheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownDocument1 pageTheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensDocument1 pageTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorNo ratings yet

- TheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverDocument1 pageTheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverImpulsive collectorNo ratings yet

- The Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryDocument1 pageThe Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryImpulsive collectorNo ratings yet

- TheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bDocument1 pageTheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bImpulsive collectorNo ratings yet

- Thesun 2009-06-15 Page13 PTP Bucks The TrendDocument1 pageThesun 2009-06-15 Page13 PTP Bucks The TrendImpulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- TheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyDocument1 pageTheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyImpulsive collectorNo ratings yet

- Sub Contractor Interim Payment CertificateDocument1 pageSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDocument1 pageThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNo ratings yet

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDocument4 pagesTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNo ratings yet

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDocument1 pageThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNo ratings yet

- TheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersDocument1 pageTheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersImpulsive collectorNo ratings yet

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDocument1 pageThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNo ratings yet

- TheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileDocument1 pageTheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileImpulsive collectorNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- Top Stories:: FRI 25 SEP 2020Document6 pagesTop Stories:: FRI 25 SEP 2020JNo ratings yet

- Master ScheduleDocument1 pageMaster ScheduleRiezaldi Muhammad IsnanNo ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- August 2009 Chicago Airport StatisticsDocument1 pageAugust 2009 Chicago Airport StatisticsGavin CunninghamNo ratings yet

- Hawaii Auto MarketsDocument1 pageHawaii Auto MarketsHonolulu Star-AdvertiserNo ratings yet

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthDocument1 pageThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorNo ratings yet

- ASBUILD DRAW PAVING008 - Asbuilt Rev - 1-Lamp-01Document1 pageASBUILD DRAW PAVING008 - Asbuilt Rev - 1-Lamp-01fwrconsultantNo ratings yet

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Document1 pageThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- SOP Corporate StoresDocument3 pagesSOP Corporate StoresVikram MishraNo ratings yet

- Bir UpdatesDocument2 pagesBir UpdatesEmma Mariz GarciaNo ratings yet

- Mahanadi Coalfields LimitedDocument6 pagesMahanadi Coalfields LimitedsunilsinghmNo ratings yet

- Social Security System: Mandaue BranchDocument2 pagesSocial Security System: Mandaue Branchjuena purmento lorenNo ratings yet

- Quiz - IntangiblesDocument1 pageQuiz - IntangiblesAna Mae HernandezNo ratings yet

- Business Partner in S4 HANA Customer Vendor IntegrationDocument17 pagesBusiness Partner in S4 HANA Customer Vendor IntegrationpipocaazulNo ratings yet

- Multibagger - Sarda Energy & MineralsDocument2 pagesMultibagger - Sarda Energy & MineralsjitenfuriaNo ratings yet

- I 3 SDocument13 pagesI 3 SSudhanshu PahadiaNo ratings yet

- Product Focus TUKAN K 3000 ENDocument1 pageProduct Focus TUKAN K 3000 ENAndrius MikolaitisNo ratings yet

- Theories of Medical Anthropology2Document14 pagesTheories of Medical Anthropology2Joy PistaNo ratings yet

- Republican Governors Stand Opposed To EPA's Onerous Ozone Regulation ProposalDocument3 pagesRepublican Governors Stand Opposed To EPA's Onerous Ozone Regulation Proposaljthompson8793No ratings yet

- Research Paper Make in IndiaDocument6 pagesResearch Paper Make in IndiaAvik K DuttaNo ratings yet

- Dove Final PresentationDocument20 pagesDove Final PresentationAnshubhi KaroliaNo ratings yet

- 1st Bill - Daily Expenditure: Udc Contruction LTD KustiaDocument22 pages1st Bill - Daily Expenditure: Udc Contruction LTD KustiaShaeree MostafaNo ratings yet

- Kristina Reeves Professional Resume - Administrative Support AssistantDocument3 pagesKristina Reeves Professional Resume - Administrative Support AssistantAnonymous c115e8No ratings yet

- Teak in India: Status, Prospects and Perspectives: R. P. S. KatwalDocument118 pagesTeak in India: Status, Prospects and Perspectives: R. P. S. KatwalRinkoo UppalNo ratings yet

- Econ 11 Problem Set 4Document5 pagesEcon 11 Problem Set 4DadedidoduNo ratings yet

- Lesotho Haeso: Tourism NewsDocument6 pagesLesotho Haeso: Tourism NewsLelimo Dmza Thejane100% (1)

- Salvatore Ch03Document30 pagesSalvatore Ch03tadesse-w100% (1)

- Royal Duty Free STRL AssessmentDocument4 pagesRoyal Duty Free STRL Assessmentefren VidallonNo ratings yet

- Anant Reasiong and Aptitude 187-237Document25 pagesAnant Reasiong and Aptitude 187-237ANANTNo ratings yet

- Free MarketDocument2 pagesFree MarketWan Nur AinNo ratings yet

- F-15 SCDocument12 pagesF-15 SCsailkhanNo ratings yet

- Communist Manifesto PDF FullDocument1 pageCommunist Manifesto PDF FullJeremyNo ratings yet

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Plant LocationDocument19 pagesPlant Locationaditig2286% (7)

Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive Sentiment

Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive Sentiment

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive Sentiment

Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive Sentiment

Uploaded by

Impulsive collectorCopyright:

Available Formats

14 theSun | MONDAY MAY 11 2009

business

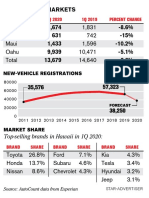

KL market summary

MAY 8, 2009

Australia braces for INDICES CHANGE

unpopular budget

CI expected to stay up

FBMEMAS 6847.64 +27.37

COMPOSITE 1026.78 +3.31

as boom times end INDUSTRIAL

CONSUMER PROD

INDUSTRIAL PROD

2258.76

305.87

79.79

-2.59

+1.92

+1.00

MELBOURNE: Australia is gearing CONSTRUCTION 199.57 +0.52

up for a tough budget on Tuesday, TRADING/SERVICES 137.53 +0.53

on positive sentiment

facing the prospect of the largest FINANCE 8131.59 +47.43

deficit in the country’s history as PROPERTIES 684.14 +23.46

PLANTATION 5038.63 -24.28

the economy struggles with its first MINING 291.81 +16.21

recession in almost two decades. FBMSHA 7112.06 +17.59

The end of the China-driven re- FBM2BRD 4550.63 +72.87

source boom that spurred Australia TECHNOLOGY 14.89 +0.05

to 14 years of virtually uninterrupted

growth has created economic woes SHARE prices on Bursa Malaysia will con- expected to creep in. TURNOVER VALUE

not experienced for a generation in tinue to climb this week on follow through “Whilst investors can hope for gradual 3.254bil RM1.9bil

the so-called “Lucky Country.” buying interest based on the increasing op- upclimb within the next two to three weeks,

Treasurer Wayne Swan has timism of recovery in the global economy, in between there will be intermittent profit

warned that the current situation says an analyst. taking. at 6,847.64, the FBM30 added 220.42 points to

means the centre-left Labor govern- The market breached the 1,000 level “Definitely it can take the market down 6,552.5, the FBM2BRD went up 244.9 points to

ment must make “tough decisions” early last week on the back of improving sharply. Very suddenly and it could be sharp,” 4,550.63 and the FBM-MDQ advanced 719.07

on budget night that will not be health in the global economy. he warned. points to 4,207.14.

popular with the electorate. Jupiter Securities Sdn Bhd head of On a week-to-week basis, the KLCI closed Overall, volume for the week jumped to

“There will be hard choices, Sorry research Pong Teng Siew said there was the week at 1,026.78, up 36.04 points from the 12.764 billion shares valued at RM9.869 bil-

unpopular decisions and no easy Madrid some room for optimism in the local mar- previous week’s closing of 990.74. lion from 6.361 billion shares worth RM5.442

options,” Swan said last week, blam- ket due to improvement in local economic The Industrial Index jumped 2.66 points billion the previous week.

ing the situation on the worst global get a real fundamentals such as the uptrend in com- to 2,258.76, the Finance Index gained 592.56 The Main Board turnover jumped to 10.235

recession in 75 years. hiding modity prices and recovery in manufactur- points to 8,131.59 and the Plantation Index billion shares worth RM9.396 billion from

Economists say the government’s pg 30 ing exports. rose 56.79 points to 5,038.63. 5.426 billion shares valued at RM5.146 billion

attempts to soften the impact of “There is hope that if the economy in the The FBMEmas was 305.78 points higher previously. – Bernama

the downturn with more than A$50 US recovers, the manufacturing export will

billion (RM125 billion) in stimulus also improve.

spending have also weighed on the “We don’t know this for sure yet but

bottom line, creating a mountain of

debt.

The end result, according to

at this point the market has got a little bit

more optimistic about export, resulting in

recovery of stocks prices,” he said.

Experts: Islamic finance must boost

numerous media reports citing

unnamed government sources, will

The support and resistance for the

Kuala Lumpur Composite Index would

regulation, professional staff

be a budget deficit of around A$70 be between 1,018 and 1,060 this week, he

billion (RM175 billion) in 2009-10. added. SINGAPORE: Islamic finance must strength- unscathed by the global financial crisis,

Those sources say the budget is He said the announcement of non-farm en regulation, boost its professional staff and largely because of rules forbidding engage-

likely to remain in deficit for five to six payrolls data in the US and Malaysia’s trade diversify as it takes on a bigger global role ment in the kind of risky business that sank

years as the government attempts to figures will help to define the movement of in the aftermath of the worldwide financial mainstream institutions like Lehman Broth-

recover from a A$200 billion (RM500 the stock market this week. crisis, experts said. ers.

billion) slump in revenues caused by However, he cautioned that there might Financial products compliant with Islamic Syariah law bars the payment and col-

the financial crisis. – AFP be some risks with sudden profit taking syariah law are likely to gain in popularity as lection of interest, which is seen as a form

investors seek safer havens after the ruin of gambling.

caused by toxic derivatives sold globally by Islamic finance also operates on the

mainstream western banks, they said. principle of risk-sharing between the issuing

However, experts warn that Islamic fi- bank and the buyer of a financial product,

nancial institutions must be on their guard making it a less risky alternative to some

against falling into the same unbridled ex- conventional banking instruments.

cesses that jolted Wall Street and snowballed Al-Jasser, the Saudi monetary agency

into a global economic downturn. governor, and other speakers told the Singa-

“Islamic finance is not immune from such pore conference that Islamic finance is likely

pitfalls. Hence we must be careful to avoid to gather momentum in the aftermath of the

this error in the Islamic financial industry,” downturn.

said Muhammad Sulaiman al-Jasser, gover- “It is my belief that Islamic finance has

nor of the Saudi Arabian Monetary Agency. moved on to a new stage in the last few

“Islamic financial institutions are con- years. In the past, it was an individual de-

tinuing to invest time and effort to improve cision based on faith, now it is competing

corporate governance and risk management on its own very strong merits in the global

and I expect that they will continue to avoid marketplace,” he said.

mistakes made in designing over-compli- Islamic finance is now established in 47

cated securities.” countries with more than 600 institutions

He and other experts were speaking at a managing “balance-sheet assets” worth

recent meeting of the Islamic Financial Serv- over US$630 billion (RM2.236 trillion), with

ices Board held in Singapore, which is aim- another US$200 billion (RM710 billion) to

ing to be a key player in Islamic finance. US$300 billion (RM1.065 trillion) managed

Islamic banking has been left relatively as investment funds, he added. – AFP

Nigeria keen to have tie-up with KPJ

KUALA LUMPUR: With its hospitals lacking facili- more because it means running a private hospi-

ties, Nigeria is eager to see partnership between tal, compared to managing a public hospital for

its hospitals and Malaysian medical group KPJ which KPJ has no expertise. But, we are willing

Healthcare Bhd to improve medical facilities in to look at it (Nigerian government’s proposal,”

the African country. he explained.

Nigeria’s Special Assistant for Micro, Small And Aminuddin said the company may take about

Medium Enterprises Development, Muhammad three to six months to study the proposal before

Baba Kachalla, said there is at least one public making a decision.

hospital in each of the 36 states in the country. On the group’s expansion plan, he said it is

“In Nigeria, there are federal and state-level keen to strengthen its presence in Saudi Arabia

hospitals run by the government, but almost all of through a joint venture. Currently, it manages two

these hospitals have poor hospital facilities. hospitals in Jeddah.

“So, I’m asking KPJ if they are interested He disclosed that KPJ will sign a partnership

to come to Nigeria and partner our state gov- deal with another Saudi party in the near term.

ernments to help the hospitals reach world “Our base in Malaysia is already strong, and

standards,” he told Bernama in an interview on now we are looking to creating our base in Saudi

Saturday. Arabia. So, it would be easy for us to expand our

He said if the medical group is interested, services in the Middle East,” he added.

they would facilitate a meeting with various state With a total of 19 hospitals throughout Malay-

governments to discuss the proposal. sia, KPJ Healthcare plans to have at least one new

In response to the request, KPJs group general hospital a year in the country.

manager for business development (international) “We are already talking with some interested

and marketing Aminuddin Dawam said the com- parties. It can be a takeover or a green field

pany may consider the joint-venture proposal. project.”

“They have offered to KPJ to move into the Aminuddin said the company has also re-

country, and we are open about it,” he said. ceived offers from Myanmar and Thailand, but

He said that KPJ also received a proposal from because of the political situation there, KPJ was

a private hospital called Giwa Hospital in Kaduna, still monitoring the countries closely.

Nigeria to serve and manage the hospital. KPJ also has three hospitals in Indonesia and

“And that (Giwa Hospital) may interest us one in Dhaka, Bangladesh. – Bernama

You might also like

- Indian Ocean Trade Short Answer Question PracticeDocument2 pagesIndian Ocean Trade Short Answer Question Practiceapi-39087829863% (8)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Landbank Board ResolutionDocument8 pagesLandbank Board ResolutionAsisclo CastanedaNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- E-Commerce Adoption and Growth of SMEs in UgandaDocument9 pagesE-Commerce Adoption and Growth of SMEs in UgandaAloysious2014No ratings yet

- A Contribution To The Empirics of Economic GrowthDocument39 pagesA Contribution To The Empirics of Economic GrowthJamesNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownDocument1 pageThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDocument1 pageTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNo ratings yet

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDocument1 pageTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- Thesun 2008-12-18 Page20 Msias rm2Document1 pageThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNo ratings yet

- Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichDocument1 pageThesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichImpulsive collectorNo ratings yet

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDocument1 pageTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNo ratings yet

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDocument1 pageTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNo ratings yet

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDocument1 pageTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNo ratings yet

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDocument1 pageThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNo ratings yet

- TheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekDocument1 pageTheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekImpulsive collectorNo ratings yet

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDocument1 pageThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNo ratings yet

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDocument1 pageThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDocument1 pageThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNo ratings yet

- Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBDocument1 pageThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBImpulsive collectorNo ratings yet

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDocument1 pageTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNo ratings yet

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDocument1 pageThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNo ratings yet

- TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresDocument1 pageTheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresImpulsive collectorNo ratings yet

- Thesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidDocument1 pageThesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidImpulsive collectorNo ratings yet

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDocument1 pageThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNo ratings yet

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDocument1 pageThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNo ratings yet

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDocument1 pageTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNo ratings yet

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDocument1 pageThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNo ratings yet

- Thesun 2009-04-27 Page15 Imf Says Time To Talk Crisis Exit PlansDocument1 pageThesun 2009-04-27 Page15 Imf Says Time To Talk Crisis Exit PlansImpulsive collectorNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- TheSun 2008-11-03 Page20: Bargain Hunting Likely To Lift MarketDocument1 pageTheSun 2008-11-03 Page20: Bargain Hunting Likely To Lift MarketImpulsive collectorNo ratings yet

- The Sun 2008-10-30 Page22Document1 pageThe Sun 2008-10-30 Page22Impulsive collectorNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- Thesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsDocument1 pageThesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsImpulsive collectorNo ratings yet

- TheSun 2009-01-09 Page18 TNB Open To All Energy OptionsDocument1 pageTheSun 2009-01-09 Page18 TNB Open To All Energy OptionsImpulsive collectorNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- TheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownDocument1 pageTheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensDocument1 pageTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorNo ratings yet

- TheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverDocument1 pageTheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverImpulsive collectorNo ratings yet

- The Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryDocument1 pageThe Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryImpulsive collectorNo ratings yet

- TheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bDocument1 pageTheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bImpulsive collectorNo ratings yet

- Thesun 2009-06-15 Page13 PTP Bucks The TrendDocument1 pageThesun 2009-06-15 Page13 PTP Bucks The TrendImpulsive collectorNo ratings yet

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDocument1 pageThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNo ratings yet

- TheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyDocument1 pageTheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyImpulsive collectorNo ratings yet

- Sub Contractor Interim Payment CertificateDocument1 pageSub Contractor Interim Payment CertificateUditha AnuruddthaNo ratings yet

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDocument1 pageThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNo ratings yet

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDocument4 pagesTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNo ratings yet

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDocument1 pageThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNo ratings yet

- TheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersDocument1 pageTheSun 2008-12-05 Page27 MAS Pursues Strategic Tie-Ups With Other CarriersImpulsive collectorNo ratings yet

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDocument1 pageThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNo ratings yet

- TheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileDocument1 pageTheSun 2008-11-24 Page16 Share Prices Expected To Stay VolatileImpulsive collectorNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- Top Stories:: FRI 25 SEP 2020Document6 pagesTop Stories:: FRI 25 SEP 2020JNo ratings yet

- Master ScheduleDocument1 pageMaster ScheduleRiezaldi Muhammad IsnanNo ratings yet

- Top Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearDocument4 pagesTop Stories:: JFC: JFC Raises Stake in Tim Ho Wan Holding Firm HOME: HOME Plans To Open 2 More Stores This YearJNo ratings yet

- August 2009 Chicago Airport StatisticsDocument1 pageAugust 2009 Chicago Airport StatisticsGavin CunninghamNo ratings yet

- Hawaii Auto MarketsDocument1 pageHawaii Auto MarketsHonolulu Star-AdvertiserNo ratings yet

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthDocument1 pageThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorNo ratings yet

- ASBUILD DRAW PAVING008 - Asbuilt Rev - 1-Lamp-01Document1 pageASBUILD DRAW PAVING008 - Asbuilt Rev - 1-Lamp-01fwrconsultantNo ratings yet

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Document1 pageThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- SOP Corporate StoresDocument3 pagesSOP Corporate StoresVikram MishraNo ratings yet

- Bir UpdatesDocument2 pagesBir UpdatesEmma Mariz GarciaNo ratings yet

- Mahanadi Coalfields LimitedDocument6 pagesMahanadi Coalfields LimitedsunilsinghmNo ratings yet

- Social Security System: Mandaue BranchDocument2 pagesSocial Security System: Mandaue Branchjuena purmento lorenNo ratings yet

- Quiz - IntangiblesDocument1 pageQuiz - IntangiblesAna Mae HernandezNo ratings yet

- Business Partner in S4 HANA Customer Vendor IntegrationDocument17 pagesBusiness Partner in S4 HANA Customer Vendor IntegrationpipocaazulNo ratings yet

- Multibagger - Sarda Energy & MineralsDocument2 pagesMultibagger - Sarda Energy & MineralsjitenfuriaNo ratings yet

- I 3 SDocument13 pagesI 3 SSudhanshu PahadiaNo ratings yet

- Product Focus TUKAN K 3000 ENDocument1 pageProduct Focus TUKAN K 3000 ENAndrius MikolaitisNo ratings yet

- Theories of Medical Anthropology2Document14 pagesTheories of Medical Anthropology2Joy PistaNo ratings yet

- Republican Governors Stand Opposed To EPA's Onerous Ozone Regulation ProposalDocument3 pagesRepublican Governors Stand Opposed To EPA's Onerous Ozone Regulation Proposaljthompson8793No ratings yet

- Research Paper Make in IndiaDocument6 pagesResearch Paper Make in IndiaAvik K DuttaNo ratings yet

- Dove Final PresentationDocument20 pagesDove Final PresentationAnshubhi KaroliaNo ratings yet

- 1st Bill - Daily Expenditure: Udc Contruction LTD KustiaDocument22 pages1st Bill - Daily Expenditure: Udc Contruction LTD KustiaShaeree MostafaNo ratings yet

- Kristina Reeves Professional Resume - Administrative Support AssistantDocument3 pagesKristina Reeves Professional Resume - Administrative Support AssistantAnonymous c115e8No ratings yet

- Teak in India: Status, Prospects and Perspectives: R. P. S. KatwalDocument118 pagesTeak in India: Status, Prospects and Perspectives: R. P. S. KatwalRinkoo UppalNo ratings yet

- Econ 11 Problem Set 4Document5 pagesEcon 11 Problem Set 4DadedidoduNo ratings yet

- Lesotho Haeso: Tourism NewsDocument6 pagesLesotho Haeso: Tourism NewsLelimo Dmza Thejane100% (1)

- Salvatore Ch03Document30 pagesSalvatore Ch03tadesse-w100% (1)

- Royal Duty Free STRL AssessmentDocument4 pagesRoyal Duty Free STRL Assessmentefren VidallonNo ratings yet

- Anant Reasiong and Aptitude 187-237Document25 pagesAnant Reasiong and Aptitude 187-237ANANTNo ratings yet

- Free MarketDocument2 pagesFree MarketWan Nur AinNo ratings yet

- F-15 SCDocument12 pagesF-15 SCsailkhanNo ratings yet

- Communist Manifesto PDF FullDocument1 pageCommunist Manifesto PDF FullJeremyNo ratings yet

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Plant LocationDocument19 pagesPlant Locationaditig2286% (7)