Professional Documents

Culture Documents

American Mortgage Crisis

American Mortgage Crisis

Uploaded by

Neha BhayaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

American Mortgage Crisis

American Mortgage Crisis

Uploaded by

Neha BhayaniCopyright:

Available Formats

Assignment on American mortgage crisis

Subject : Financial management Prepared by: Neha bhayani (Roll no.03) Submitted to: pro. utkarsh trivedi Shree sahajanand institute of management

AMERICAN MORTGAGE CRISIS

Mortgage: In simple terms, it is a conditional conveyance of property as security for the repayment of a loan. Sub-prime Mortgage: It means offering loans to borrowers who do not qualify for them at market interest rates due to their deficient or poor credit history. Since this involves risk of non-payment by the client, it is usually offered at a higher interest rate. Sub-prime lending may be utilized for sub-prime mortgages (few home loans), sub-prime car loans, subprime credit cards etc. Subprime mortgages totaled $600 billion in 2006, accounting for about one-fifth of the US home loan market. Some of the subprime mortgages include: Interest-only mortgages, which allow borrowers to pay only interest for a period of time pick a payment loans, for which borrowers choose their monthly payment initial fixed rate mortgages that can be converted to variable rates Potential sub-prime borrowers may comprise of financially troubled people i.e. those who lost jobs, those with a history of previous debts, those who have had marital problems or those who had unexpected medical conditions. Sub-prime lenders take a higher degree of risk; by increasing the interest rates they manage to offset the risk to an extent.

SUB-PRIME MORTGAGE CRISIS IN US:

The US real estate industry had a boom between 2001 and 2005 as property prices reached historic highs on account of low interest rates, price-to-rent ratios and other factors. When property prices began to fall due to saturation or lack of demand, the owners had to face mortgage loan which was higher compared to property value. The collapse of the US market had a direct impact on housing values, mortgage industry, real estate companies, hedge funds etc. (A hedge fund is an investment fund charging a performance fee and typically open to only a limited range of investors; unlike mutual funds and pension funds, hedge funds are not usually regulated by Securities Exchange Commission.) In late 2006, several US sub-prime mortgage companies had to close down due to losses. New Century Financial Corporation had to file for bankruptcy. Some companies were accused for actively encouraging fraudulent income inflation on loan applications. This led to collapse of stock prices for many companies in subprime mortgage industry, notably for some large lenders like Countrywide Financial and Washington Mutual.

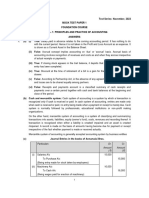

Sensex Chart of year 2006

16,000.00 14,000.00 12,000.00 10,000.00 8,000.00 6,000.00 4,000.00 2,000.00 0.00 2/1/2006 23/01/06 14/02/06 6/3/2006 27/03/06 19/04/06 9/5/2006 29/05/06 16/06/06 5/7/2006 25/07/06 14/08/06 4/9/2006 22/09/06 13/10/06 3/11/2006 23/11/06 13/12/06 Series1 Series2 Series3 Series4

Sub-prime mortgage crisis in US in 2006(June)

Sensex Chart of June 2006

12,000.00 10,000.00 8,000.00 6,000.00 4,000.00 2,000.00 0.00 Series1 Series2 Series3 Series4

Sub-prime mortgage crisis in US in 2006(June)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Financial Management Chapters 1 4 CabreraDocument22 pagesFinancial Management Chapters 1 4 CabreraElaine Joyce GarciaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Texas Real Estate Sales Exam 4e PDFDocument287 pagesTexas Real Estate Sales Exam 4e PDFفهد محمد سليمان النمر100% (2)

- Swot AnalysisDocument21 pagesSwot AnalysisEvan SenNo ratings yet

- Vault Guide To Actuarial Careers (2007)Document232 pagesVault Guide To Actuarial Careers (2007)Christopher KingNo ratings yet

- Investment Notes (Lecture 2)Document35 pagesInvestment Notes (Lecture 2)JoelNo ratings yet

- F IndemnityGuaranteeDocument11 pagesF IndemnityGuaranteeNeha BhayaniNo ratings yet

- Detox Plan For One DayDocument1 pageDetox Plan For One DayNeha BhayaniNo ratings yet

- International Human Resource Management: Rhimy C RajanDocument22 pagesInternational Human Resource Management: Rhimy C RajanNeha BhayaniNo ratings yet

- Product/Service Costing: Prof. Shailesh Gandhi IIM, AhmedabadDocument27 pagesProduct/Service Costing: Prof. Shailesh Gandhi IIM, AhmedabadNeha BhayaniNo ratings yet

- Green HRM IN India: Arundhathi B - 14mba0023 Rijo James - 14mba0027Document25 pagesGreen HRM IN India: Arundhathi B - 14mba0023 Rijo James - 14mba0027Neha BhayaniNo ratings yet

- Job and Batch CostingDocument19 pagesJob and Batch CostingNeha BhayaniNo ratings yet

- Employee EngagementDocument25 pagesEmployee EngagementNeha Bhayani100% (1)

- Financial Statement & Ratio AnalysisDocument37 pagesFinancial Statement & Ratio AnalysisNeha BhayaniNo ratings yet

- Ch. 4 - The Time Value of MoneyDocument46 pagesCh. 4 - The Time Value of MoneyNeha BhayaniNo ratings yet

- CSR N SibsDocument17 pagesCSR N SibsNeha BhayaniNo ratings yet

- Automobile Industry IndiaDocument32 pagesAutomobile Industry IndiaNeha BhayaniNo ratings yet

- Blocks - HTML Co-Op Banks Feel New RBI Norm Blocks Progress: Wednesday, January 27, 2010Document3 pagesBlocks - HTML Co-Op Banks Feel New RBI Norm Blocks Progress: Wednesday, January 27, 2010Neha BhayaniNo ratings yet

- This Is The Season of Scams and The Biggest Ever Corruption Cases in India Have Been Unearthed More RecentlyDocument4 pagesThis Is The Season of Scams and The Biggest Ever Corruption Cases in India Have Been Unearthed More RecentlyNeha BhayaniNo ratings yet

- Matthew Brown Unit 4: Pre-Production PortfolioDocument12 pagesMatthew Brown Unit 4: Pre-Production PortfolioMatthew BrownNo ratings yet

- Introduction To SAP: Venkat Emani FICO Certified Consultant / TrainerDocument22 pagesIntroduction To SAP: Venkat Emani FICO Certified Consultant / TrainerVenkat EmaniNo ratings yet

- CFAS - Chapter 6: IdentificationDocument1 pageCFAS - Chapter 6: Identificationagm25100% (1)

- Foreign Exchange Manual (March 2020)Document561 pagesForeign Exchange Manual (March 2020)Mehmood Ul HassanNo ratings yet

- Cindy Lota - Activity No. 3 - Statement of Financial PositionDocument6 pagesCindy Lota - Activity No. 3 - Statement of Financial PositionCindy LotaNo ratings yet

- Account Statement - 2024 01 01 - 2024 01 31 - en GB - 058232Document2 pagesAccount Statement - 2024 01 01 - 2024 01 31 - en GB - 058232stefanutcornel.davidNo ratings yet

- Deed of Absolute Sale of Real Property: TAX DECLARATION NO. 01017-00093Document3 pagesDeed of Absolute Sale of Real Property: TAX DECLARATION NO. 01017-00093Elaiza LaudeNo ratings yet

- PDFDocument21 pagesPDFkaushikNo ratings yet

- FINMAN-107 Quiz Assignment 4Document5 pagesFINMAN-107 Quiz Assignment 4CHARRYSAH TABAOSARESNo ratings yet

- Summer Project: Presented By: Priyancy Goyal A3906411222 BBA (G) 2011-2014Document11 pagesSummer Project: Presented By: Priyancy Goyal A3906411222 BBA (G) 2011-2014Vartika BaranwalNo ratings yet

- Case Study On Property Agency FraudDocument2 pagesCase Study On Property Agency Fraudmuqm5001No ratings yet

- FAFSA Checklist FY23Document2 pagesFAFSA Checklist FY23Lyon HuynhNo ratings yet

- Republic Act 7722Document16 pagesRepublic Act 7722empeechoiNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Ansori2021 The Role of Revenues in Reducing Local Government Fiscal Distress An Empirical Study in IndonesiaDocument11 pagesAnsori2021 The Role of Revenues in Reducing Local Government Fiscal Distress An Empirical Study in IndonesiaDR. SYUKRIY ABDULLAH , S.E, M.SINo ratings yet

- Invoice Puma Jacket FlipcartDocument5 pagesInvoice Puma Jacket FlipcartPrashant AdhikariNo ratings yet

- Failure of YahooDocument12 pagesFailure of YahooVaishali Yadav100% (1)

- Setup Steps For OPM ModuleDocument3 pagesSetup Steps For OPM ModulekjganeshNo ratings yet

- M7 - P2 Corporate Income Taxation (15B) - Students'Document46 pagesM7 - P2 Corporate Income Taxation (15B) - Students'micaella pasionNo ratings yet

- Child Care Business PlanDocument14 pagesChild Care Business PlanVidya VNo ratings yet

- Big Bank TheoryDocument2 pagesBig Bank TheoryTaariniNo ratings yet

- FINAL 421-A Hearing PowerpointDocument22 pagesFINAL 421-A Hearing PowerpointJanet BabinNo ratings yet

- Filinvest Land Vs CA - EdDocument2 pagesFilinvest Land Vs CA - Edida_chua8023No ratings yet

- Article Reveiw Done by Endeshaw YibeltalDocument4 pagesArticle Reveiw Done by Endeshaw Yibeltalendeshaw yibetal100% (2)

- Pelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di TangerangDocument7 pagesPelatihan Penyusunan Laporan Keuangan Bagi Usaha Industri Kreatif Di Tangerangfaesal fazlurahmanNo ratings yet