Professional Documents

Culture Documents

B - Individual Taxation: Philippines

B - Individual Taxation: Philippines

Uploaded by

Jasper Allen B. BarrientosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B - Individual Taxation: Philippines

B - Individual Taxation: Philippines

Uploaded by

Jasper Allen B. BarrientosCopyright:

Available Formats

PHILIPPINES B Individual Taxation

INTRODUCTION The significant national taxes in the Republic of the Philippines are income tax, estate tax, donor's tax, excise tax on certain goods, and documentary stamp tax. Individuals who are self-employed are also subject to a business tax in the form of value added tax or a percentage tax (see Corporate Taxation 8. and 9.6.). Real property tax and real property transfer tax are imposed by local governments. National internal revenue taxes, including income tax, are imposed under the National Internal Revenue Code (NIRC), as amended, and administered by the Bureau of Internal Revenue (BIR). The Bureau of Customs is responsible for the administration of taxes, tariffs and duties from imports, as well as the collection of national internal revenue taxes on imported goods as the agent of the BIR. Local tax laws are embodied in ordinances promulgated by local governments in accordance with the Local Government Code, and are administered by the offices of the treasurer and assessor of each local government. Social security contributions are compulsory for all employees, including selfemployed persons. The currency is the Philippine peso (PHP). 1. INCOME TAX 1.1. Taxable persons Taxable persons are Filipino citizens, alien individuals (both resident and nonresident), estates and certain types of trusts. All citizens are considered resident unless they fulfil the criteria for non-residents (see 6.3.). A citizen who has been previously considered as a non-resident citizen, and who arrives in the Philippines at any time during the taxable year to reside permanently in the Philippines, is a non-resident with respect to his income derived from sources abroad until the date of his arrival in the Philippines. An alien is considered a resident based on his intentions with regard to the length and nature of his stay. While there is no stipulated period within which an alien

may be considered a resident, the BIR has ruled that an alien who has stayed in the Philippines for almost 2 years is still a non-resident for income tax purposes, albeit engaged in trade or business (an NRAETB; see further 6.3.). Married individuals are separately taxable (see 1.10.2.). Partnerships are generally taxed as corporations (see Corporate Taxation 1.). An exception exists in the case of a general professional partnership that is formed by persons for the sole purpose of exercising their common profession and no part of the income of which is derived from engaging in any trade or business. Each partner is required to report as gross income his distributive share actually or constructively received, in the net income of the partnership, the net income of the partnership being computed in the same manner as that of a company. 1.2. Taxable income 1.2.1. General A resident citizen is subject to income tax on worldwide income, while a resident alien is taxed only on income from Philippine sources. Non-resident citizens and non-resident aliens are also taxed only on income from Philippine sources (see 6.2.). Taxable income means the pertinent items of gross income specified in the NIRC, less any deductions and/or personal and additional exemptions authorized for such types of income by the NIRC or other special laws. Gross income means all income derived from whatever source, including (but not limited to) the following items: compensation for services including fees, salaries, wages, commissions and similar items and fringe benefits; gross income from the conduct of trade, business or profession; gains derived from dealings in property; interest; rent; royalties; dividends; annuities; prizes and winnings; pensions; and a partner's distributive share from the net income of a general professional partnership. 1.2.2. Exempt income The following items, among others, are exempt:

the proceeds of life insurance policies; gifts, bequests and devises; amounts received through accident or health Insurance or under Workmen's Compensation Acts, as compensation for personal injuries or sickness, plus the amounts of any damages received whether by suit or agreement, on account of such injuries or sickness; retirement benefits, pensions, gratuities and separation benefits, under certain conditions; and prizes and awards primarily in recognition of religious, charitable, scientific, educational, artistic, literary or civic achievement, under certain conditions.

1.3. Employment income 1.3.1. Salary In general, all salary is taxable. Gross compensation income is subject to a withholding tax (see 1.9.2.). Personal, living or family expenses are not deductible. However, an individual whose family gross income does not exceed PHP 250,000 in a taxable year may claim a maximum deduction of PHP 2,400 for health and/or hospitalization insurance. In the case of married individuals, only one spouse may claim the deduction. Thirteenth month pay and other benefits not exceeding the total amount of PHP 30,000 are exempt. 1.3.2. Benefits in kind Benefits in kind are taxable. However, de minimis benefits, i.e. those of relatively small value and offered or furnished as a means of promoting the health, goodwill, contentment and efficiency of an employee, and those furnished for the convenience of the employer, are exempt. Fringe benefits given to non-rank and file employees are subject to a fringe benefits tax payable by the employer (see Corporate Taxation 4.3.). 1.3.3. Pension income Retirement benefits received under the New Retirement Law (RA 7641) and those paid out of a BIR-qualified retirement plan are exempt, provided the employee has served the same employer for at least 10 years and is not less than 50 years old at the time of his retirement. The exemption may be availed of only once.

An employee's pension contributions and/or insurance premiums are not deductible. However, see 1.3.1. for the deduction for health and/or hospitalization insurance. 1.3.4. Directors' remuneration Fees of non-executive directors are non-compensation income, and are subject to a creditable withholding tax of 10% to 15%, depending on the amount of fees earned in the current year. If the director is also an employee, the director's fees constitute compensation income subject to withholding tax (see 1.9.2.). 1.4. Business and professional income Business and professional income of an individual is generally computed in the same manner as the taxable income of a company, i.e. gross income less allowable deductions (see Corporate Taxation 1.). Allowable deductions include: ordinary and necessary trade, business or professional expenses, such as salaries, wages, travel costs, rental and royalties; interest (however, interest incurred to acquire property used in a trade, business or profession may be treated as a capital expenditure), subject to a reduction; taxes, including foreign taxes not claimed as tax credit (see 6.1.3.); ordinary and capital losses (see 1.8.); bad debts; depreciation (see Corporate Taxation 1.3.5.); charitable contributions to certain domestic companies and donations to the government, its agencies or political subdivisions for public purposes, up to 10% of taxable income (under certain conditions, the donation is fully deductible); research and development expenses (the taxpayer may opt to treat such expenses as a deferred expense over a period of at least 60 months); and contributions to an employees' pension trust. Alternatively, a self-employed person may opt for a standard deduction in an amount not exceeding 10% of his gross income. In either case, the individual is entitled to personal and additional exemptions.

You might also like

- Access Control PolicyDocument8 pagesAccess Control PolicyHesham ElsayedNo ratings yet

- MDI Emissions Reporting Guidelines For The Polyurethane IndustryDocument135 pagesMDI Emissions Reporting Guidelines For The Polyurethane Industrydynaflo100% (1)

- Unilateral Deed of Absolute SaleDocument2 pagesUnilateral Deed of Absolute SaleSarah Nengasca60% (5)

- Three Monks, No WaterDocument2 pagesThree Monks, No WaterMary Pat Smeltzer Thompson0% (1)

- Positions PaperDocument9 pagesPositions Paperapi-238823212100% (1)

- The New Persian Kitchen by Louisa Shafia - RecipesDocument16 pagesThe New Persian Kitchen by Louisa Shafia - RecipesThe Recipe Club83% (12)

- Lesson Income TaxDocument8 pagesLesson Income TaxEfren Lester ReyesNo ratings yet

- Passive Income and Other Sources of Income, Consist of Interest From Foreign and Philippine Currency Bank Deposits (Including Yields andDocument12 pagesPassive Income and Other Sources of Income, Consist of Interest From Foreign and Philippine Currency Bank Deposits (Including Yields andMichelle SilvaNo ratings yet

- NOTES Income TaxDocument6 pagesNOTES Income Taxcanetadexter87No ratings yet

- Acc311 02 2022Document3 pagesAcc311 02 2022Saya PascualNo ratings yet

- TaxationDocument13 pagesTaxationAubrey LegaspiNo ratings yet

- Deductions From Gross IncomeDocument75 pagesDeductions From Gross Incomealdric taclanNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- National TaxDocument6 pagesNational TaxRoi RimasNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeJohnmer AvelinoNo ratings yet

- BIR How To Compute Fringe Benefit Tax REL PARTYDocument69 pagesBIR How To Compute Fringe Benefit Tax REL PARTYRyoNo ratings yet

- MidTerm Lesson Part 1Document34 pagesMidTerm Lesson Part 1ARMAN WAYNE ANGELESNo ratings yet

- Income TaxationDocument32 pagesIncome Taxationblackphoenix303No ratings yet

- Taxation On Individuals - ReviewerDocument2 pagesTaxation On Individuals - ReviewerLouiseNo ratings yet

- Lecture 2 - Income Taxation (Individual)Document8 pagesLecture 2 - Income Taxation (Individual)Lovenia Magpatoc100% (1)

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Gross Income Inc Exc DedDocument9 pagesGross Income Inc Exc DedMelbert BallaraNo ratings yet

- Tax Follosco PDFDocument216 pagesTax Follosco PDFalicorpanaoNo ratings yet

- Inclusion and Exclusion in Taxation NoteDocument13 pagesInclusion and Exclusion in Taxation NoteDenise Rose TrocioNo ratings yet

- Tax 1 ReviewerDocument7 pagesTax 1 ReviewerRaymond SangalangNo ratings yet

- Basic Income Taxation of Corporations in PhilippinesDocument7 pagesBasic Income Taxation of Corporations in PhilippinesMae Katherine Grande Lumbria100% (1)

- National TaxesDocument106 pagesNational TaxesJeeNo ratings yet

- Individual Income TaxDocument27 pagesIndividual Income TaxLean Manuel ParagasNo ratings yet

- Income Tax On Individuals and Tax RatesDocument25 pagesIncome Tax On Individuals and Tax RatesmmhNo ratings yet

- Withholding Tax On Compensation in The PhilippinesDocument3 pagesWithholding Tax On Compensation in The Philippinesrobin pilarNo ratings yet

- Philippines: A.1. Corporate Income TaxDocument6 pagesPhilippines: A.1. Corporate Income TaxIts meh SushiNo ratings yet

- Income Tax On IndividualsDocument25 pagesIncome Tax On IndividualsMohammadNo ratings yet

- Part IV 2 Exclusion and Inclusion Regular Income TaxationDocument11 pagesPart IV 2 Exclusion and Inclusion Regular Income Taxationmary jhoyNo ratings yet

- Summary of Income TaxDocument11 pagesSummary of Income TaxPriyanka KhadkaNo ratings yet

- Lesson 5 - Exclusions and Deductions of Income TaxationDocument34 pagesLesson 5 - Exclusions and Deductions of Income TaxationKhu AbenesNo ratings yet

- Fundamental Concepts of Individual Income TaxationDocument43 pagesFundamental Concepts of Individual Income TaxationLawrence Ting100% (1)

- Income Taxation: Tabian, Jieza Syra A. 2018-017-4883Document30 pagesIncome Taxation: Tabian, Jieza Syra A. 2018-017-4883WAYNENo ratings yet

- Income TaxationDocument3 pagesIncome Taxationm.bagnas.488669No ratings yet

- EC1B1 - Intro TaxationDocument38 pagesEC1B1 - Intro TaxationZen Marcus RodasNo ratings yet

- Tax ReviewerDocument4 pagesTax ReviewerMel Loise DelmoroNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Q and A TaxationDocument22 pagesQ and A TaxationJayson Pajunar ArevaloNo ratings yet

- Acc212 Handout:: Midlands State University Department of AccountingDocument23 pagesAcc212 Handout:: Midlands State University Department of AccountingPhebieon MukwenhaNo ratings yet

- Module 1: Income Tax PrinciplesDocument18 pagesModule 1: Income Tax PrinciplesJun MagallonNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Total IncomeDocument3 pagesTotal IncomeFaisal AhmedNo ratings yet

- Taxation Module 3 5Document57 pagesTaxation Module 3 5Ma VyNo ratings yet

- Taxation Midterm ReviewerDocument5 pagesTaxation Midterm ReviewerMaria RochelleNo ratings yet

- Taxation System in IndiaDocument30 pagesTaxation System in IndiaSwapnil Pisal-DeshmukhNo ratings yet

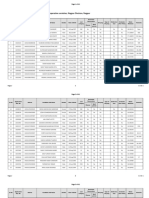

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077No ratings yet

- Exc and Inc of GIDocument6 pagesExc and Inc of GIJermaine Rae Arpia DimayacyacNo ratings yet

- FISC - Income TaxDocument10 pagesFISC - Income TaxDaniela CaraNo ratings yet

- BIR-How To Compute Fringe Benefit Tax, REL PARTYDocument69 pagesBIR-How To Compute Fringe Benefit Tax, REL PARTYLeandrix Billena Remorin Jr75% (4)

- Income and Business TaxationDocument44 pagesIncome and Business TaxationBeverly EroyNo ratings yet

- Preliminaries Tax'Document14 pagesPreliminaries Tax'J A SoriaNo ratings yet

- Classification of TaxpayerDocument5 pagesClassification of Taxpayers2120130No ratings yet

- 1700 Guide June 2011Document2 pages1700 Guide June 2011fatmaaleahNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Taxation ReviewerDocument25 pagesTaxation ReviewerLes EvangeListaNo ratings yet

- Withholding TaxDocument10 pagesWithholding TaxAngelo ChiucoNo ratings yet

- Importance of Withholding Tax SystemDocument7 pagesImportance of Withholding Tax SystemALAJID, KIM EMMANUELNo ratings yet

- Various Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinDocument26 pagesVarious Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinTophe ProvidoNo ratings yet

- Income Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonDocument6 pagesIncome Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonChira Rose Fejedero NeriNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Benefit Availment ProceduresDocument1 pageBenefit Availment ProceduresJasper Allen B. BarrientosNo ratings yet

- Heirs of Sy Bang v. SyDocument6 pagesHeirs of Sy Bang v. SyJasper Allen B. BarrientosNo ratings yet

- 042 - Association of Philippine Coconut Desiccators vs. Philippine Coconut AuthorityDocument13 pages042 - Association of Philippine Coconut Desiccators vs. Philippine Coconut AuthorityJasper Allen B. Barrientos0% (1)

- 041 - GMCR, Inc. vs. Bell TelecommunicationsDocument10 pages041 - GMCR, Inc. vs. Bell TelecommunicationsJasper Allen B. BarrientosNo ratings yet

- Samson vs. RestriveraDocument9 pagesSamson vs. RestriveraJasper Allen B. BarrientosNo ratings yet

- KiampongDocument20 pagesKiampongJasper Allen B. BarrientosNo ratings yet

- 5yr Prog Case Digests PDFDocument346 pages5yr Prog Case Digests PDFMary Neil GalvisoNo ratings yet

- FC CantocoralvocalDocument320 pagesFC Cantocoralvocalfelix miguelNo ratings yet

- Effect of Digitalization and Impact of Employee's PerformanceDocument9 pagesEffect of Digitalization and Impact of Employee's PerformanceAMNA KHAN FITNESSSNo ratings yet

- Literary Theory and Schools of CriticismDocument30 pagesLiterary Theory and Schools of CriticismMaravilla JayNo ratings yet

- ĐỀ KIỂM TRA 12 - 003Document6 pagesĐỀ KIỂM TRA 12 - 003Khánh DiệuNo ratings yet

- For Any Reference Visit: Https://sarathi - Parivahan.gov - In/sarathiserviceDocument1 pageFor Any Reference Visit: Https://sarathi - Parivahan.gov - In/sarathiserviceKavan AminNo ratings yet

- Kelvion Walker Vs Amy WilburnDocument63 pagesKelvion Walker Vs Amy WilburnHorrible CrimeNo ratings yet

- Traceability MatrixDocument3 pagesTraceability MatrixharumiNo ratings yet

- Test Cum Revision PracticeDocument8 pagesTest Cum Revision Practicealiakhtar02No ratings yet

- Teacher Toolbox Assignment Example From ShaneDocument2 pagesTeacher Toolbox Assignment Example From Shaned0% (1)

- Clinic Management System Project For Final Year: Sarfaraj AlamDocument6 pagesClinic Management System Project For Final Year: Sarfaraj AlamUDAY SOLUTIONSNo ratings yet

- Adapting, Transcribing and ArrDocument154 pagesAdapting, Transcribing and ArrAndrewjaye OcampoNo ratings yet

- Chapter 1Document25 pagesChapter 1Naman PalindromeNo ratings yet

- Instructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresDocument3 pagesInstructions: Write TRUE, If The Statement Is Correct, and FALSE, If Otherwise On The Space Provided. No ErasuresRizhelle CunananNo ratings yet

- Human Rights Related To WomenDocument5 pagesHuman Rights Related To WomenAairah ZaidiNo ratings yet

- Case 2 - Relevant InformationDocument3 pagesCase 2 - Relevant Informationhn0743644No ratings yet

- White PaperDocument17 pagesWhite Papernanadmyro Photo6No ratings yet

- Derivative Securities: FINA 3204Document27 pagesDerivative Securities: FINA 3204BillyNo ratings yet

- Saksham. Tort SynopsisDocument4 pagesSaksham. Tort Synopsissaksham tiwariNo ratings yet

- 26-DJR Nagpur - Co-Operative Officer Grade-1Document61 pages26-DJR Nagpur - Co-Operative Officer Grade-1Abdul Raheman ShaikhNo ratings yet

- ISO 9001 Version 2008Document4 pagesISO 9001 Version 2008balotellis721No ratings yet

- Murder in ParadiseDocument5 pagesMurder in ParadiseJamaica BilanoNo ratings yet

- Vda de Barrera V Heirs of Legaspi DigestDocument4 pagesVda de Barrera V Heirs of Legaspi DigestIvan Montealegre ConchasNo ratings yet

- Certificate of Registration Registration No:: Code Subject Unit Class Days Time Room FacultyDocument2 pagesCertificate of Registration Registration No:: Code Subject Unit Class Days Time Room FacultyKael Matt Paul BesmonteNo ratings yet