Professional Documents

Culture Documents

Currency Daily Report, July 16 2013

Currency Daily Report, July 16 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, July 16 2013

Currency Daily Report, July 16 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Currencies Daily Report

Tuesday| July 16, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Reena Rohit Chief Manager Non-Agri Commodities and Currencies Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company d does oes not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer er to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Tuesday| July 16, 2013

Highlights

India's Wholesale Price Index (WPI) increased to 4.86 percent in June. US Retail Sales grew at slow pace of 0.4 percent in last month month. US Empire State Manufacturing Index rose to 9.5-mark mark in July July. Asian markets trading on a mixed note today on the back of diverse economic data from US in yesterdays trade coupled with slow economic growth in the Chinese economy adding downside pressure on t the market sentiments. US Retail Sales grew at slow pace of 0.4 percent in June as against a rise of 0.5 percent in May. Empire State Manufacturing Index increased by 1.7 points to 9.5-mark mark in July from earlier rose of 7.8 7.8-level in June. Business Inventories es was at 0.1 percent in May with respect to gain of 0.2 percent a month ago. India's Wholesale Price Index (WPI) increased to 4.86 percent in June from earlier rise of 4.7 percent in May.

Market Highlights (% change)

Last Prev. day

as on July 15, 2013 WoW MoM YoY

NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (Aug13) - $/bbl Comex Gold (Aug13) - $/oz Comex Silver(Sept13) $/oz LME Copper (3 month) -$/tonne CRB Index (Industrial) G-Sec -10 yr @7.8% - Yield

6030.8 20034.5 15484.26 1682.5 1959.2 58497.8 14506.3 106.32 1283.80 19.83

0.4 0.4 0.1 0.1 -1.5 0.2 0.2 0.3 0.5 0.2 -

3.8 3.7 1.7 2.6

5.8 6.4 2.0 3.4 -

15.2 9.5 21.2 24.0 2.0 9.5 66.3 22.1 -19.3 -27.4

7.8 29.4 -0.1 3.1 3.0 3.7

3.1 18.3 11.5 8.7 -6.1 -8.5

US Dollar Index

The US Dollar Index (DX) traded on a flat note in yesterdays trade on the back of rise in risk appetite in the global markets sentiments which led to fall in demand for the currency. Further, retail sales data which came as per expectations along with rise in manufacturing index acted as a negative factor for the currency. The DX touched an intra-day day low of 83.04 and closed at 83.20 on Monday.

6939.25 102.09

-0.2 0.0 -

1.6

-11.6 -

-9.8 1.8

5.1

3.4

Source: Reuters

US Dollar (% change)

as on July 15, 2013 Last Prev. day WoW MoM YoY

Dollar/INR

The Indian Rupee depreciated around 0.1 percent in yesterdays trading session. The currency depreciated on the back of rise in inflation coupled with decline in industrial production and manufacturing data of the country released on Friday. Additionally, expectations tha that Reserve Bank of India (RBI) will keep the key interest rates unchanged in its policy meeting later this month exerted downside pressure on the currency. Further, outflow of foreign funds from equities and debt markets also acted as a negative factor. The e currency touched an intra intra-day low of 60.075 and closed at 59.80 on Monday. For the month of July 2013, FII outflows totaled at Rs.5400.70 crores th ($899.31 million) as on 15 July 2013. Year to date basis, net capital th inflows stood at Rs.66,777.60 crores ($12,601.50 million) till 15 July 2013. Outlook From the intra-day day perspective, we expect the Rupee to depreciate on account of weak economic data from the country in last two trading session. Further, weak global and domestic markets coupled wi with stronger DX will act as a negative factor for the currency.

Dollar Index US $ / INR (Spot) US $ / INR July13 Futures (NSE) US $ / INR July13 Futures (MCX-SX)

83.20 59.80 60.05 60.06

0.0 0.1 -0.08 0.08 -0.06 0.06

-1.4 1.5 -1.45 -1.41

3.1 -3.1 4.19 4.21

4.7 -7.9 8.67 8.68

Technical Chart USD/INR

Source: Telequote

Technical Outlook

Trend US Dollar/INR July13 (NSE/MCX-SX) Up

valid for July 16, 2013 Support 59.60/59.20 Resistance 60.20/60.40

www.angelbroking.com

Currencies Daily Report

Tuesday| July 16, 2013

Euro/INR

The Euro appreciated marginally in yesterdays trade on the back of weakness in the DX. Further, upbeat global markets also supported an upside in the currency. 084 and closed at 1.3062 The Euro touched an intra-day high of 1.3084 against the dollar on Monday. Outlook In todays session, we expect the Euro to trade lower on the back of weak global markets. Further, strength in the DX will exert downside pressure in the currency. However, sharp downside in the currency can be cushioned or reversal can be seen on account of forecast for favorable economic sentiments from the region. Technical Outlook

Trend Euro/INR July13 (NSE/MCX-SX) Down 78.0/77.70 78.40/78.60 valid for July 16, 2013 Support Resistance

Euro (% change)

Last Prev. day

as on July 15, 2013 WoW MoM YoY

Euro /$ (Spot) Euro / INR (Spot) Euro / INR July 13 Futures (NSE) Euro / INR July13 Futures (MCX-SX)

1.3062 78.04 78.2 78.2

0.0 0.1 -0.10 -0.12

1.5 0.1 0.01 0.02

-2.3 -1.0 1.90 1.88

6.4 -12.1 16.11 16.11

Source: Reuters

Technical Chart Euro

GBP/INR

GBP (% change) The Sterling Pound traded on a flat note and depreciated preciated marginally around 0.05 percent. However, weakness in the DX coupled with rise in risk appetite in the global markets cushioned sharp fall in the currency.

$ / GBP (Spot)

Source: Telequote

as on July 15, 2013

Last

Prev. day

WoW

MoM

YoY

1.5098 90.838 90.42

-0.05 0.05 0.40 -0.31 0.31

1.0 0.21 -0.43

-3.9 0.61 0.34

-3.4 5.81 5.97

1.5026 and closed at The Sterling Pound touched an intra-day low of 1.5 1.5098 against dollar on Monday. Outlook We expect the Sterling Pound to trade on a negative note on the back of weak global markets. Further, strength in the he DX will act as a negative factor for the Pound. However, sharp downside in the currency will be prevented or reversal can be seen as result of expectations of favorable economic data from the country. Technical Outlook

Trend GBP/INR July 13 (NSE/MCX-SX) Sideways valid for July 16, 2013 Support 90.10/89.80 Resistance 90.60/90.80

GBP / INR (Spot) GBP / INR July13 Futures (NSE) GBP / INR July 13 Futures (MCX-SX)

90.43

-0.31 0.31

-0.36

0.36

6.00

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

www.angelbroking.com

Currencies Daily Report

Tuesday| July 16, 2013

JPY/INR

JPY (% change) The Japanese Yen depreciated around 0.6 percent in the yesterdays trade on account of rise in risk appetite in the global markets which led to fall in demand for the currency. 99.85 against The Yen touched an intra-day low of 100.48 and closed at 99. dollar on Monday. Outlook For intra-day trade, we expect the Japanese Yen to ap appreciate, taking cues rise in risk aversion in the global markets, which could lead to rise in demand for the currency. Technical Outlook

Trend JPY/INR July 13 (NSE/MCX-SX) Down valid for July 16, 2013 Support 59.75/59.50 Resistance 60.20/60.40 Last Prev day as on July 15, 2013 WoW MoM YoY

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR July13 Futures (NSE) JPY 100 / INR July13 Futures (MCX-SX)

99.85 0.6018 60.01

0.6 -0.33 -0.73

-1.1 0.10 -0.37

4.7 -1.55 -1.14

26.6 -13.58 -13.85

59.97

-0.78

-0.31

-1.24

-13.89

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on July 16, 2013

Indicator Country Time (IST) Actual Forecast Previous Impact

CPI y/y PPI Input m/m RPI y/y German ZEW Economic Sentiment CPI y/y Core CPI y/y ZEW Economic Sentiment BOE Inflation Letter MPC Member Fisher Speaks Core CPI m/m CPI m/m TIC Long-Term Purchases Capacity Utilization Rate Industrial Production m/m FOMC Member George Speaks

UK UK UK Euro Euro Euro Euro UK UK US US US US US US

2:00pm 2:00pm 2:00pm 2:30pm 2:30pm 2:30pm 2:30pm Tentative 4:00pm 6:00pm 6:00pm 6:30pm 6:45pm 6:45pm 11:45pm

3.0% -0.1% 3.4% 39.9 1.6% 1.2% 31.8 0.2% 0.3% 14.3B 77.9% 0.3% -

2.7% -0.3% 3.1% 38.5 1.6% 1.2% 30.6 0.2% 0.1% -37.3B 77.6% 0.0% -

High Medium Medium High Medium Medium Medium High Medium High Medium Medium Medium Medium Medium

www.angelbroking.com

You might also like

- Homework 3 MGMT 41150 KeyDocument9 pagesHomework 3 MGMT 41150 KeyLaxus Dreyer100% (4)

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Level III of CFA Program Mock Exam 1 - Solutions (PM)Document60 pagesLevel III of CFA Program Mock Exam 1 - Solutions (PM)Elizabeth Espinosa ManilagNo ratings yet

- Pricing and Valuation of Forward Commitments: LiteratureDocument6 pagesPricing and Valuation of Forward Commitments: LiteratureAlvianNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 22 2013Document4 pagesCurrency Daily Report, July 22 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 30 2013Document4 pagesCurrency Daily Report, July 30 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 14Document4 pagesCurrency Daily Report, February 14Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 26Document4 pagesCurrency Daily Report, April 26Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 7 2013Document4 pagesCurrency Daily Report, August 7 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 24 2013Document4 pagesCurrency Daily Report, July 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 23 2013Document4 pagesCurrency Daily Report, May 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 12Document4 pagesCurrency Daily Report, February 12Angel BrokingNo ratings yet

- Currency Daily Report, April 15Document4 pagesCurrency Daily Report, April 15Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, April 17Document4 pagesCurrency Daily Report, April 17Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Pankaj Kedia ResumeDocument2 pagesPankaj Kedia Resume8cfyh4zh9qNo ratings yet

- How Do Commodities React To Macro Economic NewsDocument35 pagesHow Do Commodities React To Macro Economic NewsTotie LumanglasNo ratings yet

- Mutual Funds Calculation AspectsDocument27 pagesMutual Funds Calculation AspectsgauravNo ratings yet

- Recession in IndiaDocument17 pagesRecession in Indiakapilkg8100% (5)

- Ps 1Document3 pagesPs 1Jason KristiantoNo ratings yet

- Mutual Fund Advanced - Sample Paper NCFMDocument5 pagesMutual Fund Advanced - Sample Paper NCFMSankitNo ratings yet

- Financial Derivatives: An International PerspectiveDocument131 pagesFinancial Derivatives: An International Perspectiveअंजनी श्रीवास्तव0% (1)

- Valuing Stock Options: The Black-Scholes-Merton ModelDocument22 pagesValuing Stock Options: The Black-Scholes-Merton ModelLeidy ArenasNo ratings yet

- LC Onfeed CBTDocument1 pageLC Onfeed CBTPhương NguyễnNo ratings yet

- Leo Trader ProDocument42 pagesLeo Trader ProDwi Djoko WinarnoNo ratings yet

- Exercises w5Document10 pagesExercises w5Mỹ AnhhNo ratings yet

- Open & High Strategy ManualDocument26 pagesOpen & High Strategy ManualJibin JohnNo ratings yet

- Reference Literature: 1. Financial Accounting and Financial Statement AnalysisDocument3 pagesReference Literature: 1. Financial Accounting and Financial Statement AnalysisDavid OparindeNo ratings yet

- Moonraker - Ian Fleming - 1955Document167 pagesMoonraker - Ian Fleming - 1955HrisikeshBora100% (2)

- IFMP Pakistan's Market Regulations Certification Mock Examination (100 QS) PDFDocument32 pagesIFMP Pakistan's Market Regulations Certification Mock Examination (100 QS) PDFJackey911100% (1)

- Trading TerminologyDocument13 pagesTrading TerminologyAngelllaNo ratings yet

- R42 Derivatives Strategies IFT Notes PDFDocument24 pagesR42 Derivatives Strategies IFT Notes PDFZidane KhanNo ratings yet

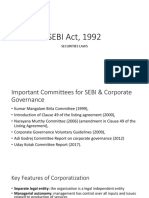

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarNo ratings yet

- Options For BeginnersDocument81 pagesOptions For BeginnersTamás SitkeiNo ratings yet

- IB Australia Pty LTD CFD Product Disclosure StatementDocument35 pagesIB Australia Pty LTD CFD Product Disclosure StatementSim TerannNo ratings yet

- Iiflar2011 12Document106 pagesIiflar2011 12Aisha GuptaNo ratings yet

- Financial Markets in IndiaDocument9 pagesFinancial Markets in IndiatheOnuMonu GamerNo ratings yet

- Bank Management Koch 8th Edition Solutions ManualDocument17 pagesBank Management Koch 8th Edition Solutions ManualKristinGreenewgdmNo ratings yet

- LedgerX Amended Order 09-02-2020 SignedDocument4 pagesLedgerX Amended Order 09-02-2020 SignedMichaelPatrickMcSweeneyNo ratings yet

- GAP Management Managing Interest Rate Risk at Banks and ThriftsDocument18 pagesGAP Management Managing Interest Rate Risk at Banks and ThriftsrunawayyyNo ratings yet

- S R Luthra Institute of Management ErnstDocument5 pagesS R Luthra Institute of Management Ernstnidhi0583No ratings yet

- Practice QuestionsDocument2 pagesPractice QuestionskeshavNo ratings yet