Professional Documents

Culture Documents

US - Richmond Manufacturing PMI

US - Richmond Manufacturing PMI

Uploaded by

Eduardo PetazzeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US - Richmond Manufacturing PMI

US - Richmond Manufacturing PMI

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

US - Richmond Manufacturing PMI

by Eduardo Petazze

Last updated: April 28, 2015

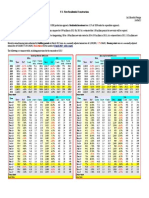

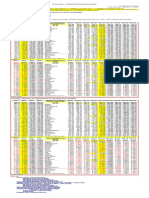

Richmond manufacturing activity remained soft in April 2014, with shipments, and orders declined, although at a slower pace compared to last month.

However, by 2015 the outlook for manufacturing activity in the Richmond district is projected to expand, but at a slower pace than in 2014.

The purpose of this is to restate the monthly survey compiled by the Federal Reserve Bank of Richmond on manufacturing activity, like a PMI, facilitating

comparison with other indicators.

Last press release: April 2015 - pdf, 3 pages

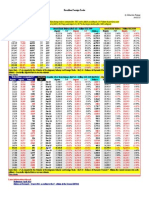

Current Activity - Seasonally Adjusted

Inventories

Composite Shipments New order

Order Capacity

Vendor Employees Average

Wages

Activiy, SA

(33%)

(40%) backlogs utilization lead time

(27%) workweek

Finished

Raw

38.16

Jan-13

42.94

42.80

40.05

39.45

39.87

48.67

47.37

46.67

55.19

62.01

61.37

51.19

Feb-13

51.58

53.96

49.51

42.44

54.97

49.42

51.74

48.46

54.79

56.30

58.15

51.33

Mar-13

50.50

52.80

45.92

42.07

47.78

47.81

54.48

54.64

52.64

56.36

61.69

50.66

Apr-13

46.74

45.76

45.47

40.45

41.81

48.61

49.83

48.66

54.89

55.40

59.91

53.85

May-13

49.58

53.42

47.65

42.55

47.89

50.69

47.74

48.98

53.62

54.34

53.69

57.28

Jun-13

53.69

55.33

54.38

49.29

49.65

51.22

50.65

54.94

55.72

54.36

54.97

47.09

Jul-13

48.45

47.53

48.09

41.45

47.39

51.62

50.12

51.56

53.92

56.22

56.05

53.30

Aug-13

54.55

55.93

55.18

46.47

50.28

50.39

51.94

53.30

56.22

55.82

56.77

51.70

Sep-13

50.11

49.54

51.67

45.56

49.47

50.46

48.50

48.00

56.14

55.82

57.08

48.25

Oct-13

51.16

50.72

50.92

43.16

47.73

54.85

52.06

49.45

54.40

56.10

57.38

54.42

Nov-13

54.46

56.03

54.58

47.20

49.87

52.36

52.35

54.09

56.46

56.36

55.92

51.71

Dec-13

55.52

55.57

54.49

46.29

52.65

49.00

56.98

53.05

55.31

55.81

55.86

49.07

Jan-14

53.62

54.67

53.68

47.62

55.24

50.76

52.24

53.74

55.72

55.43

51.83

48.73

Feb-14

49.17

48.89

48.78

46.54

47.02

50.96

50.08

47.99

56.77

56.38

57.81

48.44

Mar-14

47.64

47.35

45.98

44.14

44.42

52.69

50.47

51.14

55.99

56.32

55.37

56.98

Apr-14

53.07

52.11

54.87

46.34

49.74

51.75

51.59

51.89

53.49

57.54

54.44

57.97

May-14

53.70

53.64

53.30

49.50

50.33

52.11

54.35

52.67

61.10

57.44

55.17

55.20

Jun-14

51.83

50.87

52.38

48.10

53.42

50.92

52.17

52.69

56.08

54.04

56.98

51.96

Jul-14

53.25

51.50

52.50

50.00

52.00

56.00

56.50

51.50

58.00

56.00

60.50

54.52

Aug-14

55.74

55.00

56.50

57.50

58.50

58.00

55.50

54.00

55.50

58.00

58.50

58.58

Sep-14

56.91

55.50

57.00

53.00

56.50

55.00

58.50

55.00

54.50

61.50

60.00

57.07

Oct-14

60.09

61.50

61.00

54.50

56.50

56.00

57.00

54.50

55.50

57.50

59.50

51.82

Nov-14

51.72

50.50

50.50

49.00

56.50

53.50

55.00

52.50

57.50

60.00

61.50

49.59

Dec-14

53.38

52.50

52.00

47.50

47.50

51.00

56.50

52.00

54.00

61.00

60.00

48.43

Jan-15

53.13

55.00

52.00

45.50

54.50

52.50

52.50

54.00

51.50

62.50

59.50

49.44

Feb-15

49.98

49.50

49.00

45.00

48.00

51.00

52.00

47.00

54.00

60.00

58.00

46.79

Mar-15

46.07

43.50

43.50

44.00

46.50

45.50

53.00

48.00

54.00

62.50

62.50

52.54

Apr-15

48.76

47.00

47.00

46.00

48.00

47.00

53.50

52.00

54.50

59.00

59.50

54.97

May-15

50.79

49.50

49.00

55.00

54.19

Jun-15

50.81

49.30

49.50

54.60

50.27

Jul-15

51.39

49.30

49.60

56.60

51.69

Aug-15

52.87

50.90

51.70

57.00

55.72

Sep-15

54.07

51.90

52.80

58.60

53.31

Oct-15

56.26

55.30

55.40

58.70

53.11

Nov-15

53.22

51.60

51.40

57.90

48.68

Dec-15

52.41

50.60

50.00

58.20

-4.44

Change

2.69

3.50

3.50

2.00

1.50

1.50

0.50

4.00

0.50

-3.50

-3.00

Latest data Reformulated as an indicator of PMI (The 100% of the firms reporting increase minus the 50% of reporting unchange)

Own estimate

Composite

Activiy, NSA

Note: Composite Activity Indicator, original and seasonally adjusted data, from the preceding table has minor rounding differences with the officially

published.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- QMS Audit ChecklistDocument8 pagesQMS Audit ChecklistAmb Patrick OghateNo ratings yet

- Tricks of The Trade - PM Role With ContractsDocument2 pagesTricks of The Trade - PM Role With ContractsxavimNo ratings yet

- EPC Dubai Summit - SimonaDocument15 pagesEPC Dubai Summit - SimonaBen Rejab HichemNo ratings yet

- CASE STUDY Boeing Commercial Airplane Group Wichita DivisionDocument12 pagesCASE STUDY Boeing Commercial Airplane Group Wichita DivisionHarsha ShivannaNo ratings yet

- Fall 2016 Material List ONLINE UndergraduateDocument5 pagesFall 2016 Material List ONLINE UndergraduateSri HarshaNo ratings yet

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- U.S. New Residential ConstructionDocument1 pageU.S. New Residential ConstructionEduardo PetazzeNo ratings yet

- Retail Sales in The UKDocument1 pageRetail Sales in The UKEduardo PetazzeNo ratings yet

- Euro Area - Industrial Production IndexDocument1 pageEuro Area - Industrial Production IndexEduardo PetazzeNo ratings yet

- Wacc ProjectDocument8 pagesWacc ProjectSubhash PandeyNo ratings yet

- QU EHSMS Training - Contractor Management Training PresenstationDocument44 pagesQU EHSMS Training - Contractor Management Training PresenstationAlizamin SyedNo ratings yet

- Contractor Method Statement (RL)Document8 pagesContractor Method Statement (RL)Shaikh Muhammad AteeqNo ratings yet

- IG1 - IGC1-0023-ENG-OBE-V1 Answer SheetDocument9 pagesIG1 - IGC1-0023-ENG-OBE-V1 Answer SheetCE DepartmentNo ratings yet

- Managing Projects Chapter 14Document33 pagesManaging Projects Chapter 14nadegepierremNo ratings yet

- Feedback - MOCKP1B1Document24 pagesFeedback - MOCKP1B1Raman ANo ratings yet

- The ISO Survey of Management System Standard CertificationsDocument85 pagesThe ISO Survey of Management System Standard CertificationscarlosNo ratings yet

- Brand Building and Brand Management Syllabus PDFDocument2 pagesBrand Building and Brand Management Syllabus PDFDimple PanchalNo ratings yet

- Facilitating Organisational Learning Activities: Types of Organisational Culture and Their Influence On Organisational Learning and PerformanceDocument16 pagesFacilitating Organisational Learning Activities: Types of Organisational Culture and Their Influence On Organisational Learning and PerformancePeggyNo ratings yet

- DPMT6Industrial Management and EntrepreneurshipSDocument2 pagesDPMT6Industrial Management and EntrepreneurshipSBHUSHAN PATILNo ratings yet

- Filipino Leadership StylesDocument2 pagesFilipino Leadership Stylescasemarchie07No ratings yet

- A Project of Market Plan On "Unilever Pakistan": Operations ManagementDocument24 pagesA Project of Market Plan On "Unilever Pakistan": Operations ManagementJawadNo ratings yet

- GL Account Interview Questions SapDocument4 pagesGL Account Interview Questions Sapsatyalakshman sudhaNo ratings yet

- Preble Company Manufactures One Product. Its Variable ManufacturiDocument7 pagesPreble Company Manufactures One Product. Its Variable ManufacturiJaspal SinghNo ratings yet

- Amrita Soni ResumeDocument3 pagesAmrita Soni Resumesoni.amrita03No ratings yet

- Agreement For The Sales And Purchase Of Palm Acid Oil: Seller 甲方(卖方): Long Hua Opgt (M) Sdn BhdDocument9 pagesAgreement For The Sales And Purchase Of Palm Acid Oil: Seller 甲方(卖方): Long Hua Opgt (M) Sdn Bhdbudi irawanNo ratings yet

- Chapter 8 Designing Service ProcessesDocument4 pagesChapter 8 Designing Service ProcessesDeema FNo ratings yet

- Project Veegrip BeltsDocument58 pagesProject Veegrip BeltsHema Ramasamy100% (2)

- Bureau Veritas Sustainability Service Application FormDocument7 pagesBureau Veritas Sustainability Service Application FormNadilafitri AriyaniNo ratings yet

- Process Design and Analysis: Chapter ElevenDocument34 pagesProcess Design and Analysis: Chapter ElevenAndhitiawarman NugrahaNo ratings yet

- Problem 1:: Bianca Regina Lizardo Mr. Tadiwan BS AccountancyDocument3 pagesProblem 1:: Bianca Regina Lizardo Mr. Tadiwan BS AccountancyBianca LizardoNo ratings yet

- Rhelec Ingeniería Cia., Ltd. RFQ No. Request For Quotation/Solicitud de CotizacionDocument2 pagesRhelec Ingeniería Cia., Ltd. RFQ No. Request For Quotation/Solicitud de CotizacionJose Luis A.No ratings yet

- Annamalai M B A Human Resource Management 347 Solved Assignment 2020 Call 9025810064Document8 pagesAnnamalai M B A Human Resource Management 347 Solved Assignment 2020 Call 9025810064Palaniappan NNo ratings yet

- FR SD22 Examiner ReportDocument26 pagesFR SD22 Examiner Reportfeysal shurieNo ratings yet

- Finch Excel ReportDocument15 pagesFinch Excel ReportshuvorajbhattaNo ratings yet