Professional Documents

Culture Documents

Paladin Code Ethics

Paladin Code Ethics

Uploaded by

Sachin BansalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paladin Code Ethics

Paladin Code Ethics

Uploaded by

Sachin BansalCopyright:

Available Formats

Code of Ethics for Financial Professionals

The primary purpose of this Code of Ethics is to provide consumers with the information they need to determine the integrity of financial professionals. In addition, this Code of Ethics differentiates advisors who provide consumers with written documentation for their ethical practices from advisors who do not.

Consumers should view this Code of Ethics and print a copy so they have a permanent record of the content. It is Paladin Registrys opinion that consumers should have a written record of all important information that they rely on when they select advisors to help them achieve their financial goals.

Code of Ethics

As a member of the Paladin Registry I know consumers need objective information when they select financial advisors. I also know the critical importance of ethics in my relationships with clients and the critical role I play in the achievement of their financial goals. By providing a copy of the Paladin Registrys Code of Ethics, I agree to adhere to the following ethical principles:

I acknowledge I am a Registered Investment Advisor or Investment Advisor Representative with a current registration that permits me to provide financial advice for fees.

I acknowledge I am a fiduciary when I provide financial advice and services.

I will serve my clients with integrity, competence, independence, objectivity, and professionalism.

I will not misrepresent or omit any information, when marketing my services, which would cause consumers to select me for the wrong reasons.

I will provide full written disclosure for my credentials, ethics, business practices, and services (See my Paladin Registry Profile).

I will only provide advice and services when I possess the necessary knowledge to provide expert advice and quality services.

I will maintain my levels of knowledge and professionalism by participating in the continuing education programs of recognized associations and other third party service providers.

I will achieve a thorough understanding of my clients current situations, concerns, needs, and goals before I provide any financial advice or services.

I will provide investment advice that is suitable in regard to my clients return objectives and tolerances for risk.

I will establish realistic expectations of the benefits and results that clients can expect from my advice and services.

I will maintain the confidential nature of all client information and take reasonable steps to prevent access to the information by unauthorized people.

I will provide open-architected financial strategies that give my clients a broad range of investment choices not limited to any particular company or group of products.

I will avoid potential conflicts of interest that impact the risk exposure, performance, or expenses of my clients assets.

I will avoid products that represent potential conflicts of interest or excessive expenses or risk to my clients.

I will be in compliance with all regulatory and statutory requirements that impact the delivery of my planning or investment services.

I will provide reports and communications that can be easily understood by clients who are not investment experts.

I will answer all client requests for information or resolution of problems in a timely, complete, and truthful manner.

I will extend extra time and consideration to clients who have recently become responsible for significant asset amounts or are facing substantial emotional trauma - for example, pending or recent retirees, widows and widowers, divorcees, and the terminally ill.

I will have an agreement in place with clients in regard to the basis and amount of my compensation before any advice or services are rendered.

I will provide full disclosure for all sources of compensation that result from my advice and services.

I will not accept additional amounts of compensation or other benefits from third parties for my advice or services to clients without my clients knowledge in advance.

I will provide a written service agreement that is counter-signed by clients and does not contain provisions that are in conflict with any applicable regulations or fiduciary standards of care.

I will maintain appropriate records that document my analysis, advice, and client communications.

Certification

I certify the information in this Code of Ethics accurately reflects the ethical standards that govern my relationships with clients.

Name of Financial Professional: Heidi Clute Date of Agreement: October 24, 2007

You might also like

- Amoeba Sisters Video Recap: Nature of ScienceDocument2 pagesAmoeba Sisters Video Recap: Nature of ScienceAlejandro Roblox63% (24)

- Lufthansa - Your Booking InformationDocument3 pagesLufthansa - Your Booking InformationMedia PilleNo ratings yet

- Similarities Between ACA & APADocument20 pagesSimilarities Between ACA & APAPrincessDharaNo ratings yet

- SAP R3 OverviewDocument42 pagesSAP R3 OverviewSachin BansalNo ratings yet

- Mas Practice Standards and Ethical ConsiderationsACDocument3 pagesMas Practice Standards and Ethical ConsiderationsACLorenz BaguioNo ratings yet

- Independence and YouDocument2 pagesIndependence and Youhi2joeyNo ratings yet

- Ethical Issues in RetailingDocument14 pagesEthical Issues in RetailingAlok Tripathi50% (2)

- LBP Form No. 4Document8 pagesLBP Form No. 4Shie La Ma RieNo ratings yet

- Unit v. Ethical and Professional Considerations in Financial PlanningDocument24 pagesUnit v. Ethical and Professional Considerations in Financial PlanningShreya NairNo ratings yet

- 3 Ethics and Acceptance of AppointmentDocument20 pages3 Ethics and Acceptance of Appointmentsouravdhali421No ratings yet

- IMA CodeofconductDocument3 pagesIMA CodeofconductAkai Senshi No TenshiNo ratings yet

- 2.0 Ethical Concerns For Accountants Mike MbayaDocument38 pages2.0 Ethical Concerns For Accountants Mike MbayaREJAY89No ratings yet

- B. Professional and Ethical ConsiderationDocument18 pagesB. Professional and Ethical ConsiderationDavid JohnNo ratings yet

- Mas Practice Standards and Ethical Considerations MAS Practice Standards Personal CharacteristicsDocument4 pagesMas Practice Standards and Ethical Considerations MAS Practice Standards Personal CharacteristicsRoderick RonidelNo ratings yet

- Cu Website Market CodeDocument8 pagesCu Website Market CodemikeNo ratings yet

- Assurance Engagements Acceptance of AppointmentDocument17 pagesAssurance Engagements Acceptance of AppointmentSayraj Siddiki AnikNo ratings yet

- The IMA Code of Conduct For Management Accountants: Appendix BDocument3 pagesThe IMA Code of Conduct For Management Accountants: Appendix BOnickul HaqueNo ratings yet

- Client Service OutlineDocument2 pagesClient Service OutlineAndrewNo ratings yet

- The Importance of Independence.: Q:-Who Is Subject To Independence Restrictions?Document5 pagesThe Importance of Independence.: Q:-Who Is Subject To Independence Restrictions?anon-583391No ratings yet

- 15 Ethics in CounsellingDocument23 pages15 Ethics in CounsellingPhilip TosinNo ratings yet

- A$a L2 EditedDocument6 pagesA$a L2 EditedKimosop Isaac KipngetichNo ratings yet

- Ethical Principles of CounselorsDocument3 pagesEthical Principles of CounselorsMary Grace AbustanNo ratings yet

- BACT308 - LECTURE 3 & 4 - Audt Planning and Risk AssessementDocument79 pagesBACT308 - LECTURE 3 & 4 - Audt Planning and Risk AssessementLord OkaiNo ratings yet

- Code of ConductDocument6 pagesCode of ConductPrabu PappuNo ratings yet

- Code of EthicsDocument11 pagesCode of EthicsM-AngeleNo ratings yet

- Annex I Code of Ethics Business Conduct Conflict of InterestDocument13 pagesAnnex I Code of Ethics Business Conduct Conflict of InterestAslesh ChoudharyNo ratings yet

- Audit Notes Midsems FinDocument14 pagesAudit Notes Midsems FinAaditya ManojNo ratings yet

- Assurance Principle ReportDocument4 pagesAssurance Principle ReportVictoria Lovely May MediloNo ratings yet

- ICWIM - 005 Fiduciary RelationshipsDocument49 pagesICWIM - 005 Fiduciary RelationshipsMaher G. BazakliNo ratings yet

- Ethic 3.2 (自動儲存)Document5 pagesEthic 3.2 (自動儲存)winningpiggodNo ratings yet

- Ifmp Code of EthicsDocument3 pagesIfmp Code of EthicschqaiserNo ratings yet

- PRSA Code of Ethics: AdvocacyDocument6 pagesPRSA Code of Ethics: AdvocacyShiffa Salsabila AzizaNo ratings yet

- AFP Code of EthicsDocument1 pageAFP Code of EthicsRyan DixonNo ratings yet

- Expanded Services of Accountants-FABM Chapter 2Document8 pagesExpanded Services of Accountants-FABM Chapter 2Jeannie Lyn Dela CruzNo ratings yet

- Ethical Issues in CounsellingDocument23 pagesEthical Issues in Counsellingemily0% (3)

- Basic Principles of Accounting Code of EthicsDocument7 pagesBasic Principles of Accounting Code of EthicsBeby AnggytaNo ratings yet

- DisciplineDocument9 pagesDisciplinejonathanampongcNo ratings yet

- Diass: Module - 6Document25 pagesDiass: Module - 6ArseniaNo ratings yet

- Couns Mod 6 - EthicsDocument7 pagesCouns Mod 6 - EthicsHarshita KapoorNo ratings yet

- Standards and EthicsDocument3 pagesStandards and Ethicsatik103No ratings yet

- Topic 8-Ethical Dimensions in ConsultancyDocument7 pagesTopic 8-Ethical Dimensions in ConsultancyWeru CharlesNo ratings yet

- Transitioning Clients and the Retirement Exit Decision: Includes strategies and tools for seeking and implementing group referralsFrom EverandTransitioning Clients and the Retirement Exit Decision: Includes strategies and tools for seeking and implementing group referralsNo ratings yet

- ABS-LECTURE 3 (Professional Ethics)Document32 pagesABS-LECTURE 3 (Professional Ethics)Lordwin ArcherNo ratings yet

- Unit 1 - Standards of Professional ConductDocument116 pagesUnit 1 - Standards of Professional ConductLuis PaulinoNo ratings yet

- Career Counselling EthicsDocument2 pagesCareer Counselling EthicsAishwariya BanerjeeNo ratings yet

- Quality Control PolicyDocument11 pagesQuality Control PolicyReah Bello SominoNo ratings yet

- Code of Ethics: FOR Professional AccountantsDocument42 pagesCode of Ethics: FOR Professional AccountantsTracy Marsh RapanutNo ratings yet

- Counselling Code of Ethics Presenting in New EraDocument113 pagesCounselling Code of Ethics Presenting in New EraThavasri ChandiranNo ratings yet

- Chapter ThreeDocument36 pagesChapter ThreeVida SalehiNo ratings yet

- Code of Ethics - PRSADocument6 pagesCode of Ethics - PRSASebas FuertesNo ratings yet

- Choosing the Right Investment Advisor: An Essential Step on the Road to Financial FreedomFrom EverandChoosing the Right Investment Advisor: An Essential Step on the Road to Financial FreedomNo ratings yet

- Code of Ethics at Habib Bank Limited PakistanDocument13 pagesCode of Ethics at Habib Bank Limited PakistanPinkAlert100% (4)

- Week 2 Professional ConductDocument31 pagesWeek 2 Professional Conductptnyagortey91No ratings yet

- UNIT 5 Audit1-InsuranceDocument28 pagesUNIT 5 Audit1-InsuranceJawahar KumarNo ratings yet

- Chapter 2 CODEDocument22 pagesChapter 2 CODESarah Yatco100% (1)

- Ethics in Accounting For PrintingDocument10 pagesEthics in Accounting For PrintingJing SagittariusNo ratings yet

- Code of Ethics - Board of Counsellors MalaysiaDocument63 pagesCode of Ethics - Board of Counsellors Malaysiaartisroleplay123No ratings yet

- Day 1 S. I& IIDocument20 pagesDay 1 S. I& IIhisab bNo ratings yet

- Topic 2 The Role of Professional AccountantDocument27 pagesTopic 2 The Role of Professional AccountantYanPing AngNo ratings yet

- BKAA 3023 Â " Topic 1 - Code of Ethics For AuditorsDocument20 pagesBKAA 3023 Â " Topic 1 - Code of Ethics For AuditorsDarren 雷丰威No ratings yet

- ETHICSDocument45 pagesETHICSAhmedNo ratings yet

- Audit Lecture #6 - Ethical ThreatsDocument9 pagesAudit Lecture #6 - Ethical ThreatsAkira CambridgeNo ratings yet

- Ethical and Legal Issues in CounsellingDocument11 pagesEthical and Legal Issues in Counsellingchirchirelly100% (1)

- UNIT III Merchant Banking & LeasingDocument35 pagesUNIT III Merchant Banking & Leasingsuseelasenthilkumar10No ratings yet

- 2012 Sales and Operations PlanningDocument14 pages2012 Sales and Operations PlanningSachin BansalNo ratings yet

- Australia Template New 2015Document3 pagesAustralia Template New 2015Sachin BansalNo ratings yet

- CSCP ExamContentManual 2012Document25 pagesCSCP ExamContentManual 2012Thabo Kholoane100% (2)

- Greater Bhiwadi Master Plan 2031Document227 pagesGreater Bhiwadi Master Plan 2031direct2umeshNo ratings yet

- Sukanya Samriddhi Account Opening FormDocument2 pagesSukanya Samriddhi Account Opening FormSachin BansalNo ratings yet

- XLRI GMP Class of 2013 BrochureDocument84 pagesXLRI GMP Class of 2013 BrochurehartsidNo ratings yet

- List of Placement ConsultantsDocument17 pagesList of Placement Consultantsshivankj0% (1)

- Number Range Problem While Creating A VendorDocument4 pagesNumber Range Problem While Creating A VendorSachin BansalNo ratings yet

- Discover Sap SCMDocument36 pagesDiscover Sap SCMNizar MuhammadNo ratings yet

- Measurement ChartDocument4 pagesMeasurement ChartSachin BansalNo ratings yet

- Objective: Ethics in Finance andDocument1 pageObjective: Ethics in Finance andSachin BansalNo ratings yet

- CV GMP FormatDocument1 pageCV GMP FormatSachin BansalNo ratings yet

- Bhopal Gas Tragedy. Ethical Frame Work Analysis. Sachin Bansal G11041Document11 pagesBhopal Gas Tragedy. Ethical Frame Work Analysis. Sachin Bansal G11041Sachin Bansal100% (1)

- 10 DunningDocument66 pages10 DunningSachin BansalNo ratings yet

- 13.vendor CreationDocument22 pages13.vendor CreationSachin BansalNo ratings yet

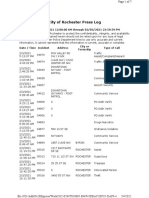

- RPD Daily Incident Report 2/3/21Document7 pagesRPD Daily Incident Report 2/3/21inforumdocsNo ratings yet

- Demonstrating The Social Construction of RaceDocument7 pagesDemonstrating The Social Construction of RaceThomas CockcroftNo ratings yet

- Selection of A Premier in Nunavut and Related IssuesDocument93 pagesSelection of A Premier in Nunavut and Related IssuesNunatsiaqNewsNo ratings yet

- Implementing The Weil, Tate and Ate Pairings Using Sage SoftwareDocument19 pagesImplementing The Weil, Tate and Ate Pairings Using Sage SoftwareMuhammad SadnoNo ratings yet

- Universiti Tunku Abdul Rahman: UEME1323 StaticsDocument26 pagesUniversiti Tunku Abdul Rahman: UEME1323 StaticsshintanNo ratings yet

- Root Cause Valid For Reason CodeDocument2 pagesRoot Cause Valid For Reason CodenagasapNo ratings yet

- 10.de Thi Lai.23Document3 pages10.de Thi Lai.23Bye RainyNo ratings yet

- DANCE PPT For RizalDocument40 pagesDANCE PPT For RizalAngelica perezNo ratings yet

- Accessibility of Urban Green Infrastructure in Addis-Ababa City, Ethiopia: Current Status and Future ChallengeDocument20 pagesAccessibility of Urban Green Infrastructure in Addis-Ababa City, Ethiopia: Current Status and Future ChallengeShemeles MitkieNo ratings yet

- MicroChannel HeatExchangersDocument16 pagesMicroChannel HeatExchangerskhushal bhanderiNo ratings yet

- Advanced Presentation Skills WorkshopDocument34 pagesAdvanced Presentation Skills WorkshopJade Cemre ErciyesNo ratings yet

- Death and The AfterlifeDocument2 pagesDeath and The AfterlifeAdityaNandanNo ratings yet

- English Work - Maria Isabel GrajalesDocument5 pagesEnglish Work - Maria Isabel GrajalesDavid RodriguezNo ratings yet

- Simulation AssignmentDocument10 pagesSimulation Assignmentsyeda maryemNo ratings yet

- Tesla Manufacturing Plant in Canada AnnouncementDocument1 pageTesla Manufacturing Plant in Canada AnnouncementMaria MeranoNo ratings yet

- Ob-Gyn Quiz 4Document11 pagesOb-Gyn Quiz 4Ndor BariboloNo ratings yet

- Gpsmap 8500 Installation Instructions: Registering Your DeviceDocument12 pagesGpsmap 8500 Installation Instructions: Registering Your DeviceGary GouveiaNo ratings yet

- ICGSE Y8 Maths Progression Test Mid-Year (Chapter1-11)Document10 pagesICGSE Y8 Maths Progression Test Mid-Year (Chapter1-11)YAP LEE KHIMNo ratings yet

- Assignment of Kesavananda Bharti V State of KeralaDocument17 pagesAssignment of Kesavananda Bharti V State of KeralaFarjana Akter67% (3)

- Accounting May-June 2019 EngDocument18 pagesAccounting May-June 2019 Englindort00No ratings yet

- Philosophical Elements in Thomas Kuhn's Historiography of ScienceDocument12 pagesPhilosophical Elements in Thomas Kuhn's Historiography of ScienceMartín IraniNo ratings yet

- Vocabulary and Picture Prompts For Language Teaching Book 2 PDFDocument72 pagesVocabulary and Picture Prompts For Language Teaching Book 2 PDFmartinan100% (1)

- Combustion & Fuels: Cement Process Engineering Vade-MecumDocument15 pagesCombustion & Fuels: Cement Process Engineering Vade-MecumJesus RodriguezNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentPeter Jun ParkNo ratings yet

- Superagent: A Customer Service Chatbot For E-Commerce WebsitesDocument12 pagesSuperagent: A Customer Service Chatbot For E-Commerce WebsitesAisha AnwarNo ratings yet

- Albanian Armenian CelticDocument25 pagesAlbanian Armenian CelticdavayNo ratings yet