Professional Documents

Culture Documents

Master Toy

Master Toy

Uploaded by

underwood@eject.co.zaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Master Toy

Master Toy

Uploaded by

underwood@eject.co.zaCopyright:

Available Formats

Master Data Entry

Income Statement

For posting over 4 periods - Click Here

Year

Year

Year

2003

2004

2005

Sales & Cost of Sales

Gross Sales

$2,010,000

Discounts/Allowances

($50,000)

Net Sales

$2,560,000

($60,000)

$2,721,800

($70,000)

Year

2006

$3,285,454

($80,000)

$1,960,000

$2,500,000

$2,651,800

$3,205,454

Direct Material Cost

$320,000

$427,600

$431,238

$432,513

Direct Labor Cost

$300,000

$315,000

$330,450

$346,364

Other Direct Costs

Total Cost of Sales

$125,000

$745,000

$128,750

$871,350

$132,613

$894,301

$136,591

$915,467

$1,215,000

$1,628,650

$1,757,500

$2,289,987

Fixed Expenses

Executive Salaries

Advertising

Auto & Truck Expenses

Depreciation

Employee Benefits

Home Office Business Expenses

Insurance

Bank Charges

Legal & Professional Services

Meals & Entertainment

Office Expense

Retirement Plans

Rent - Equipment

Rent - Office & Business Property

Repairs

Supplies

Taxes - Business & Payroll

Travel

Utilities

Other Expenses

Total Fixed Expenses

2003

$190,000

$50,000

$30,000

$5,000

$3,000

$1,000

$3,906

$2,133

$1,000

$4,000

$6,000

$1,000

$3,000

$8,750

$1,000

$1,000

$1,000

$6,230

$11,974

$0

$329,993

2004

$191,000

$51,500

$30,900

$5,150

$3,090

$1,030

$3,754

$2,197

$1,330

$4,120

$6,180

$1,030

$3,090

$9,110

$1,030

$1,030

$1,030

$6,120

$12,374

$0

$335,065

2005

$195,000

$53,045

$31,827

$45,305

$3,183

$1,061

$4,010

$2,263

$1,670

$4,244

$6,365

$1,061

$3,183

$9,544

$1,061

$1,061

$1,061

$6,010

$14,186

$0

$385,138

2006

$195,000

$54,636

$32,782

$50,464

$3,278

$1,093

$3,994

$2,331

$2,020

$4,371

$6,556

$1,093

$3,278

$9,929

$1,093

$1,093

$1,093

$5,900

$16,974

$0

$396,977

Variable Expenses

Office salaries

Employee benefits

Payroll taxes

Sales and Marketing

Telephone and telegraph

Stationary and office supplies

Bad debts

Postage

Contributions

Add Item

Add Item

Add Item

Add Item

Add Item

Miscellaneous

Total Variable Expenses

2003

$90,000

$43,000

$18,000

$14,000

$6,000

$2,110

$100

$5,557

$0

$0

$0

$0

$0

$0

$0

$178,767

2004

$102,700

$46,875

$18,540

$14,420

$6,180

$2,680

$103

$5,724

$0

$0

$0

$0

$0

$0

$0

$197,222

2005

$112,368

$47,970

$19,096

$14,853

$6,365

$3,005

$106

$5,895

$0

$0

$0

$0

$0

$0

$0

$209,659

2006

$118,647

$51,249

$19,669

$15,298

$6,556

$3,493

$109

$6,072

$0

$0

$0

$0

$0

$0

$0

$221,095

Operating expenses

Interest

Depreciation

Amortization

Other

2003

$508,760

$16,250

$32,500

$1,250

$0

$558,760

2004

$532,287

$16,738

$33,475

$1,288

$0

$583,787

2005

$594,797

$17,240

$34,479

$1,326

$0

$647,842

2006

$618,071

$17,757

$35,514

$1,366

$0

$672,707

Gross Profit

Expenses

Total expenses

Copyright, 2006, JaxWorks, All Rights Reserved.

Master Data Entry

Operating income

$656,240

$1,044,863

$1,109,658

$1,617,279

Subtotal

2003

$10,000

$20,000

$30,000

2004

$10,300

$20,600

$30,900

2005

$10,609

$21,218

$31,827

2006

$10,927

$31,855

$42,782

Income before tax

$686,240

$1,075,763

$1,141,485

$1,660,061

Income taxes

$205,872

$322,729

$342,445

$498,018

Net income

$480,368

$753,034

$799,039

$1,162,043

$670,368

$944,034

$994,039

$1,357,043

Other income and expenses

Gain (loss) on sale of assets

Other (net)

Return On Ownership

Copyright, 2006, JaxWorks, All Rights Reserved.

Master Data Entry

Balance Sheet

ASSETS

Current Assets

Cash and cash equivalents

Accounts receivable

Notes receivable

Inventory

Other current assets

Total Current Assets

Year

2003

$451,000

$350,000

$1,200

$400,000

$10,000

$1,212,200

Year

2004

$464,530

$460,500

$3,200

$612,000

$10,300

$1,550,530

Year

2005

$478,466

$871,315

$3,000

$824,360

$10,609

$2,187,750

Year

2006

$492,820 ####

$1,382,454

$3,400

$937,091

$10,927

$2,826,692

Fixed Assets

Land

Buildings

Equipment

Subtotal

Less-accumulated depreciation

Total Fixed Assets

2003

$1,000,000

$1,500,000

$800,000

$3,300,000

$400,000

$2,900,000

2004

$1,030,000

$1,045,000

$824,000

$2,899,000

$412,000

$2,487,000

2005

$1,106,090

$1,591,350

$948,720

$3,646,160

$424,360

$3,221,800

2006

$1,109,273

$1,739,091

$874,182

$3,722,545

$437,091

$3,285,454

Intangible Assets

Cost

Less-accumulated amortization

Total Intangible Assets

2003

$50,000

$20,000

$30,000

2004

$51,500

$20,600

$30,900

2005

$53,045

$21,218

$31,827

2006

$54,636

$21,855

$32,782

$25,000

$4,167,200

$25,750

$4,094,180

$26,523

$5,467,899

$27,318

$6,172,246

Other assets

Total Assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities

Accounts payable

Notes payable

Current portion of long-term debt

Income taxes

Accrued expenses

Other current liabilities

Total Current Liabilities

2003

$600,000

$100,000

$100,000

$30,000

$90,000

$16,000

$936,000

2004

$618,000

$103,000

$103,000

$30,900

$92,700

$16,480

$964,080

2005

$636,540

$106,090

$106,090

$31,827

$95,481

$16,974

$993,002

2006

$640,563

$109,273

$109,273

$32,782

$98,345

$17,484

$1,007,719

Non-Current Liabilities

Long-term debt

Deferred income

Deferred income taxes

Other long-term liabilities

2003

$601,200

$100,000

$30,000

$50,000

2004

$624,200

$103,000

$30,900

$51,500

2005

$645,630

$106,090

$31,827

$53,045

2006

$668,308

$109,273

$32,782

$54,636

$1,717,200

$1,773,680

$1,829,594

$1,872,718

2003

$100,000

100,000

$950,000

$1,400,000

$2,450,000

2004

$100,000

100,000

$678,500

$1,542,000

$2,320,500

2005

$100,000

100,000

$1,853,045

$1,685,260

$3,638,305

2006

$100,000

100,000

$2,469,710

$1,729,818

$4,299,528

$4,167,200

$4,094,180

$5,467,899

$6,172,246

$0

$0

$0

$0

Total Liabilities

Stockholders' Equity

Capital stock issued

Number of shares issued

Additional paid in capital

Retained earnings

Total Stockholders' Equity

Total Liabilities and Equity

Amount sheet is out-of-balance

Copyright, 2006, JaxWorks, All Rights Reserved.

Forecast Analysis- 12 Fiscal Periods

There are instances where 4 financial periods are not enough. This worksheet allows you to post additional periods up

to 12. You will be overwriting forecast formulas, so, be sure you save a backup copy for recovery.

Income Statement

Use this worksheet with the Financial Summary sheet that flags problem areas that are magified over time.

Gross Sales

Discounts/Allowances

Net Sales

Direct Material Cost

Direct Labor Cost

Other Direct Costs

Total Cost of Sales

Gross Profit

Year

2003

$2,010,000

($50,000)

$1,960,000

$320,000

$300,000

$125,000

$745,000

Year

2004

$2,560,000

($60,000)

$2,500,000

$427,600

$315,000

$128,750

$871,350

Year

2005

$2,721,800

($70,000)

$2,651,800

$431,238

$330,450

$132,613

$894,301

Year

2006

$3,285,454

($80,000)

$3,205,454

$432,513

$346,364

$136,591

$915,467

Year

2007

$3,641,354

($90,000)

$3,551,354

$488,132

$361,589

$140,397

$990,118

Year

2008

$4,040,170

($100,000)

$3,940,170

$522,250

$377,043

$144,261

$1,043,553

Year

2009

$4,438,986

($110,000)

$4,328,986

$556,367

$392,497

$148,124

$1,096,988

Year

2010

$4,837,803

($120,000)

$4,717,803

$590,485

$407,951

$151,988

$1,150,423

Year

2011

$5,236,619

($130,000)

$5,106,619

$624,603

$423,405

$155,851

$1,203,859

Year

2012

$5,635,435

($140,000)

$5,495,435

$658,720

$438,859

$159,715

$1,257,294

Year

2013

$6,034,251

($150,000)

$5,884,251

$692,838

$454,313

$163,578

$1,310,729

Year

2014

$6,433,067

($160,000)

$6,273,067

$726,956

$469,767

$167,442

$1,364,164

$1,215,000

$1,628,650

$1,757,500

$2,289,987

$2,561,236

$2,896,617

$3,231,998

$3,567,379

$3,902,760

$4,238,141

$4,573,522

$4,908,903

2003

$190,000

$50,000

$30,000

$5,000

$3,000

$1,000

$3,906

$2,133

$1,000

$4,000

$6,000

$1,000

$3,000

$8,750

$1,000

$1,000

$1,000

$6,230

$11,974

$0

$329,993

2004

$191,000

$51,500

$30,900

$5,150

$3,090

$1,030

$3,754

$2,197

$1,330

$4,120

$6,180

$1,030

$3,090

$9,110

$1,030

$1,030

$1,030

$6,120

$12,374

$0

$335,065

2005

$195,000

$53,045

$31,827

$45,305

$3,183

$1,061

$4,010

$2,263

$1,670

$4,244

$6,365

$1,061

$3,183

$9,544

$1,061

$1,061

$1,061

$6,010

$14,186

$0

$385,138

2006

$195,000

$54,636

$32,782

$50,464

$3,278

$1,093

$3,994

$2,331

$2,020

$4,371

$6,556

$1,093

$3,278

$9,929

$1,093

$1,093

$1,093

$5,900

$16,974

$0

$396,977

2007

$197,500

$56,159

$33,695

$70,616

$3,370

$1,123

$4,046

$2,396

$2,355

$4,493

$6,739

$1,123

$3,370

$10,326

$1,123

$1,123

$1,123

$5,790

$18,080

$0

$424,549

2008

$199,400

$57,704

$34,623

$88,270

$3,462

$1,154

$4,098

$2,462

$2,695

$4,616

$6,925

$1,154

$3,462

$10,723

$1,154

$1,154

$1,154

$5,680

$19,761

$0

$449,651

2009

$201,300

$59,250

$35,550

$105,925

$3,555

$1,185

$4,150

$2,528

$3,035

$4,740

$7,110

$1,185

$3,555

$11,120

$1,185

$1,185

$1,185

$5,570

$21,442

$0

$474,754

2010

$203,200

$60,795

$36,477

$123,580

$3,648

$1,216

$4,202

$2,594

$3,375

$4,864

$7,295

$1,216

$3,648

$11,517

$1,216

$1,216

$1,216

$5,460

$23,124

$0

$499,856

2011

$205,100

$62,340

$37,404

$141,234

$3,740

$1,247

$4,254

$2,659

$3,715

$4,987

$7,481

$1,247

$3,740

$11,914

$1,247

$1,247

$1,247

$5,350

$24,805

$0

$524,959

2012

$207,000

$63,886

$38,332

$158,889

$3,833

$1,278

$4,306

$2,725

$4,055

$5,111

$7,666

$1,278

$3,833

$12,311

$1,278

$1,278

$1,278

$5,240

$26,486

$0

$550,061

2013

$208,900

$65,431

$39,259

$176,543

$3,926

$1,309

$4,358

$2,791

$4,395

$5,235

$7,852

$1,309

$3,926

$12,708

$1,309

$1,309

$1,309

$5,130

$28,167

$0

$575,163

2014

$210,800

$66,977

$40,186

$194,198

$4,019

$1,340

$4,410

$2,857

$4,735

$5,358

$8,037

$1,340

$4,019

$13,105

$1,340

$1,340

$1,340

$5,020

$29,848

$0

$600,266

Expenses

Fixed Expenses

Executive Salaries

Advertising

Auto & Truck Expenses

Depreciation

Employee Benefits

Home Office Business Expenses

Insurance

Bank Charges

Legal & Professional Services

Meals & Entertainment

Office Expense

Retirement Plans

Rent - Equipment

Rent - Office & Business Property

Repairs

Supplies

Taxes - Business & Payroll

Travel

Utilities

Other Expenses

Total Fixed Expenses

Copyright, 2006, JaxWorks, All Rights Reserved.

Forecast Analysis- 12 Fiscal Periods

Variable Expenses

Office salaries

Employee benefits

Payroll taxes

Sales and Marketing

Telephone and telegraph

Stationary and office supplies

Bad debts

Postage

Contributions

Add Item

Add Item

Add Item

Add Item

Add Item

Miscellaneous

Total Variable Expenses

2003

$90,000

$43,000

$18,000

$14,000

$6,000

$2,110

$100

$5,557

$0

$0

$0

$0

$0

$0

$0

$178,767

2004

$102,700

$46,875

$18,540

$14,420

$6,180

$2,680

$103

$5,724

$0

$0

$0

$0

$0

$0

$0

$197,222

2005

$112,368

$47,970

$19,096

$14,853

$6,365

$3,005

$106

$5,895

$0

$0

$0

$0

$0

$0

$0

$209,659

2006

$118,647

$51,249

$19,669

$15,298

$6,556

$3,493

$109

$6,072

$0

$0

$0

$0

$0

$0

$0

$221,095

2007

$129,831

$53,734

$20,217

$15,724

$6,739

$3,941

$112

$6,241

$0

$0

$0

$0

$0

$0

$0

$236,540

2008

$139,392

$56,318

$20,774

$16,157

$6,925

$4,388

$115

$6,413

$0

$0

$0

$0

$0

$0

$0

$250,482

2009

$148,953

$58,902

$21,330

$16,590

$7,110

$4,836

$118

$6,585

$0

$0

$0

$0

$0

$0

$0

$264,424

2010

$158,514

$61,487

$21,886

$17,023

$7,295

$5,283

$122

$6,757

$0

$0

$0

$0

$0

$0

$0

$278,366

2011

$168,075

$64,071

$22,443

$17,455

$7,481

$5,731

$125

$6,929

$0

$0

$0

$0

$0

$0

$0

$292,308

2012

$177,636

$66,655

$22,999

$17,888

$7,666

$6,178

$128

$7,100

$0

$0

$0

$0

$0

$0

$0

$306,250

2013

$187,196

$69,239

$23,555

$18,321

$7,852

$6,626

$131

$7,272

$0

$0

$0

$0

$0

$0

$0

$320,192

2014

$196,757

$71,823

$24,112

$18,753

$8,037

$7,073

$134

$7,444

$0

$0

$0

$0

$0

$0

$0

$334,134

Operating expenses

Interest

Depreciation

Amortization

Other

Total expenses

2003

$508,760

$16,250

$32,500

$1,250

$0

$558,760

2004

$532,287

$16,738

$33,475

$1,288

$0

$583,787

2005

$594,797

$17,240

$34,479

$1,326

$0

$647,842

2006

$618,071

$17,757

$35,514

$1,366

$0

$672,707

2007

$661,089

$18,252

$36,503

$1,404

$0

$717,248

2008

$700,134

$18,754

$37,508

$1,443

$0

$757,838

2009

$739,178

$19,256

$38,512

$1,481

$0

$798,428

2010

$778,222

$19,758

$39,517

$1,520

$0

$839,018

2011

$817,267

$20,261

$40,521

$1,559

$0

$879,607

2012

$856,311

$20,763

$41,526

$1,597

$0

$920,197

2013

$895,355

$21,265

$42,530

$1,636

$0

$960,787

2014

$934,400

$21,767

$43,535

$1,674

$0

$1,001,376

Operating income

$656,240

$1,044,863

$1,109,658

$1,617,279

$1,843,988

$2,138,779

$2,433,570

$2,728,362

$3,023,153

$3,317,944

$3,612,735

$3,907,526

Subtotal

2003

$10,000

$20,000

$30,000

2004

$10,300

$20,600

$30,900

2005

$10,609

$21,218

$31,827

2006

$10,927

$31,855

$42,782

2007

$11,232

$32,464

$43,695

2008

$11,541

$36,082

$47,623

2009

$11,850

$39,700

$51,550

2010

$12,159

$43,318

$55,477

2011

$12,468

$46,936

$59,404

2012

$12,777

$50,554

$63,332

2013

$13,086

$54,173

$67,259

2014

$13,395

$57,791

$71,186

Income before tax

2003

$686,240

2004

$1,075,763

2005

$1,141,485

2006

$1,660,061

2007

$1,887,683

2008

$2,186,402

2009

$2,485,120

2010

$2,783,839

2011

$3,082,557

2012

$3,381,276

2013

$3,679,994

2014

$3,978,712

Income taxes

$205,872

$322,729

$342,445

$498,018

$566,305

$655,921

$745,536

$835,152

$924,767

$1,014,383

$1,103,998

$1,193,614

Net income

$480,368

$753,034

$799,039

$1,162,043

$1,321,378

$1,530,481

$1,739,584

$1,948,687

$2,157,790

$2,366,893

$2,575,996

$2,785,099

$670,368

$944,034

$994,039

$1,357,043

$1,518,878

$1,729,881

$1,940,884

$2,151,887

$2,362,890

$2,573,893

$2,784,896

$2,995,899

Other income and expenses

Gain (loss) on sale of assets

Other (net)

Return On Ownership

Copyright, 2006, JaxWorks, All Rights Reserved.

Forecast Analysis- 12 Fiscal Periods

Balance Sheet

ASSETS

Current Assets

Cash and cash equivalents

Accounts receivable

Notes receivable

Inventory

Other current assets

Total Current Assets

Year

2003

$451,000

$350,000

$1,200

$400,000

$10,000

$1,212,200

Year

2004

$464,530

$460,500

$3,200

$612,000

$10,300

$1,550,530

Year

2005

$478,466

$871,315

$3,000

$824,360

$10,609

$2,187,750

Year

2006

$492,820

$1,382,454

$3,400

$937,091

$10,927

$2,826,692

Year

2007

$506,553

$1,643,112

$4,300

$1,149,271

$11,232

$3,314,467

Year

2008

$520,492

$1,993,930

$4,940

$1,331,634

$11,541

$3,862,537

Year

2009

$534,432

$2,344,748

$5,580

$1,513,997

$11,850

$4,410,607

Year

2010

$548,371

$2,695,565

$6,220

$1,696,361

$12,159

$4,958,676

Year

2011

$562,311

$3,046,383

$6,860

$1,878,724

$12,468

$5,506,746

Year

2012

$576,251

$3,397,201

$7,500

$2,061,087

$12,777

$6,054,816

Year

2013

$590,190

$3,748,019

$8,140

$2,243,450

$13,086

$6,602,886

Year

2014

$604,130

$4,098,837

$8,780

$2,425,813

$13,395

$7,150,955

Fixed Assets

Land

Buildings

Equipment

Subtotal

Less-accumulated depreciation

Total Fixed Assets

2003

$1,000,000

$1,500,000

$800,000

$3,300,000

$400,000

$2,900,000

2004

$1,030,000

$1,045,000

$824,000

$2,899,000

$412,000

$2,487,000

2005

$1,106,090

$1,591,350

$948,720

$3,646,160

$424,360

$3,221,800

2006

$1,109,273

$1,739,091

$874,182

$3,722,545

$437,091

$3,285,454

2007

$1,162,318

$1,784,766

$948,542

$3,895,625

$449,271

$3,446,354

2008

$1,202,709

$1,911,128

$983,268

$4,097,104

$461,634

$3,635,470

2009

$1,243,099

$2,037,490

$1,017,995

$4,298,584

$473,997

$3,824,586

2010

$1,283,490

$2,163,852

$1,052,721

$4,500,063

$486,361

$4,013,703

2011

$1,323,881

$2,290,214

$1,087,448

$4,701,543

$498,724

$4,202,819

2012

$1,364,272

$2,416,576

$1,122,174

$4,903,022

$511,087

$4,391,935

2013

$1,404,663

$2,542,938

$1,156,900

$5,104,501

$523,450

$4,581,051

2014

$1,445,053

$2,669,301

$1,191,627

$5,305,981

$535,813

$4,770,167

Intangible Assets

Cost

Less-accumulated amortization

Total Intangible Assets

2003

$50,000

$20,000

$30,000

2004

$51,500

$20,600

$30,900

2005

$53,045

$21,218

$31,827

2006

$54,636

$21,855

$32,782

2007

$56,159

$22,464

$33,695

2008

$57,704

$23,082

$34,623

2009

$59,250

$23,700

$35,550

2010

$60,795

$24,318

$36,477

2011

$62,340

$24,936

$37,404

2012

$63,886

$25,554

$38,332

2013

$65,431

$26,173

$39,259

2014

$66,977

$26,791

$40,186

$25,000

$4,167,200

$25,750

$4,094,180

$26,523

$5,467,899

$27,318

$6,172,246

$28,079

$6,822,596

$28,852

$7,561,481

$29,625

$8,300,367

$30,398

$9,039,253

$31,170

$9,778,138

$31,943

$10,517,024

$32,716

$11,255,910

$33,488

$11,994,795

Other assets

Total Assets

Copyright, 2006, JaxWorks, All Rights Reserved.

Forecast Analysis- 12 Fiscal Periods

Balance Sheet

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities

Accounts payable

Notes payable

Current portion of long-term debt

Income taxes

Accrued expenses

Other current liabilities

Total Current Liabilities

2003

$600,000

$100,000

$100,000

$30,000

$90,000

$16,000

$936,000

2004

$618,000

$103,000

$103,000

$30,900

$92,700

$16,480

$964,080

2005

$636,540

$106,090

$106,090

$31,827

$95,481

$16,974

$993,002

2006

$640,563

$109,273

$109,273

$32,782

$98,345

$17,484

$1,007,719

2007

$658,833

$112,318

$112,318

$33,695

$101,086

$17,971

$1,036,220

2008

$672,856

$115,409

$115,454

$34,636

$103,868

$18,465

$1,060,628

2009

$686,879

$118,499

$118,568

$35,570

$106,649

$18,960

$1,085,037

2010

$700,902

$121,590

$121,659

$36,498

$109,431

$19,454

$1,109,445

2011

$714,925

$124,681

$124,784

$37,435

$112,213

$19,949

$1,133,853

2012

$728,948

$127,772

$127,886

$38,366

$114,995

$20,443

$1,158,261

2013

$742,970

$130,863

$130,994

$39,298

$117,776

$20,938

$1,182,669

2014

$756,993

$133,953

$134,090

$40,227

$120,558

$21,433

$1,207,077

Non-Current Liabilities

Long-term debt

Deferred income

Deferred income taxes

Other long-term liabilities

Sub-total

Total Liabilities

2003

$601,200

$100,000

$30,000

$50,000

$781,200

$1,717,200

2004

$624,200

$103,000

$30,900

$51,500

$809,600

$1,773,680

2005

$645,630

$106,090

$31,827

$53,045

$836,592

$1,829,594

2006

$668,308

$109,273

$32,782

$54,636

$864,999

$1,872,718

2007

$690,523

$112,318

$33,695

$56,159

$892,695

$1,928,916

2008

$712,799

$115,409

$34,623

$57,704

$920,534

$1,981,162

2009

$735,074

$118,499

$35,550

$59,250

$948,373

$2,033,409

2010

$757,350

$121,590

$36,477

$60,795

$976,212

$2,085,656

2011

$779,625

$124,681

$37,404

$62,340

$1,004,051

$2,137,903

2012

$801,901

$127,772

$38,332

$63,886

$1,031,890

$2,190,150

2013

$824,176

$130,863

$39,259

$65,431

$1,059,729

$2,242,397

2014

$846,451

$133,953

$40,186

$66,977

$1,087,567

$2,294,644

Stockholders' Equity

Capital stock issued

Additional paid in capital

Retained earnings

Total Stockholders' Equity

2003

$100,000

$950,000

$1,400,000

$2,450,000

2004

$100,000

$678,500

$1,542,000

$2,320,500

2005

$100,000

$1,853,045

$1,685,260

$3,638,305

2006

$100,000

$2,469,710

$1,729,818

$4,299,528

2007

$100,000

$2,921,233

$1,872,448

$4,893,680

2008

$100,000

$3,494,600

$1,985,719

$5,580,319

2009

$100,000

$4,067,968

$2,098,990

$6,266,958

2010

$100,000

$4,641,335

$2,212,262

$6,953,597

2011

$100,000

$5,214,703

$2,325,533

$7,640,236

2012

$100,000

$5,788,070

$2,438,805

$8,326,874

2013

$100,000

$6,361,438

$2,552,076

$9,013,513

2014

$100,000

$6,934,805

$2,665,347

$9,700,152

$4,167,200

$4,094,180

$5,467,899

$6,172,246

$6,822,596

$7,561,481

$8,300,367

$9,039,253

$9,778,138

$10,517,024

$11,255,910

$11,994,795

2004

2.94

1.88

5.26

2005

3.04

1.62

5.89

2006

3.51

1.88

7.02

2007

3.83

2.01

7.92

2008

4.17

2.14

8.86

2009

4.52

2.27

9.81

2010

4.86

2.41

10.75

2011

5.21

2.54

11.69

2012

5.55

2.67

12.64

2013

5.89

2.80

13.58

2014

6.24

2.93

14.52

Total Liabilities and Equity

Altman Z-Score Analysis

Publicly Held Firm

Privately Held Firm

Service, Retail, Wholesale

2003

2.40

1.35

4.09

Prepared by JaxWorks Consultancy, Inc.

Copyright, 2006, JaxWorks, All Rights Reserved.

Financial Summary Analysis

*EBIT is Earnings Before Interest and Taxes

**Ownership is the Total Reward for being the owner=Owner Salary + Bonus + Net Income + Other

Income Statement

Net Sales

Cost of Goods Sold

Gross Profit (Margin)

G&A

Total Operating Expenses

EBIT*

Net Income After

Ownership**

Balance Sheet

Current Assets

Inventory

Other Assets

Total Assets

Current Liabilities

Non-current Liabilities

Total Liabilities

Equity

Cash Flow

Net Cash Flow

Breakeven

Break-Even

B/E %

DAY OF B/E

DATE OF B/E

Key Ratios

Current Ratio

Quick Ratio

Debt Ratio

Asset Turnover

Net Income/Sales

Debt/Equity

Return on Assets

Working Capital

Sales/Working Capital

Market Value

Book Market Value

Plus Ownership**

Altman Z-Score Analysis

Publicly Held Firm

Privately Held Firm

Non-Manufacturing

Year

Year

Year

Year

Year

Year

Year

Year

Trend

2003

2004

2005

2006

2007

2008

2009

2010

ASSESSMENT

$1,960,000

$745,000

$1,215,000

$178,767

$558,760

$686,240

$480,368

$670,368

$2,500,000

$871,350

$1,628,650

$197,222

$583,787

$1,075,763

$753,034

$944,034

$2,651,800

$894,301

$1,757,500

$209,659

$647,842

$1,141,485

$799,039

$994,039

$3,205,454

$915,467

$2,289,987

$221,095

$672,707

$1,660,061

$1,162,043

$1,357,043

$3,641,354

$990,118

$2,651,236

$236,540

$717,248

$1,887,683

$1,321,378

$1,518,878

$1,212,200

$400,000

$10,000

$4,167,200

$936,000

$781,200

$1,717,200

$2,450,000

$1,550,530

$612,000

$10,300

$4,094,180

$964,080

$809,600

$1,773,680

$2,320,500

$2,187,750

$824,360

$10,609

$5,467,899

$993,002

$836,592

$1,829,594

$3,638,305

$2,826,692

$937,091

$10,927

$6,172,246

$1,007,719

$864,999

$1,872,718

$4,299,528

$3,314,467

$1,149,271

$11,232

$6,822,596

$1,036,220

$892,695

$1,928,916

$4,893,680

$90,360

$289,233

$614,196

$1,267,364

$1,529,282

$636,455

32.47%

119

Apr 27

$593,738

23.75%

87

Mar 26

$668,999

25.23%

92

Apr 01

1.30

0.87

0.41

0.47

0.25

0.70

0.15

$276,200

7.10

1.61

0.97

0.43

0.61

0.30

0.76

0.24

$586,450

4.26

2.20

1.37

0.33

0.48

0.30

0.50

0.18

$1,194,748

2.22

2.81

1.88

0.30

0.52

0.36

0.44

0.23

$1,818,973

1.76

3.20

2.09

0.28

0.53

0.36

0.39

0.23

$2,278,247

1.60

$2,450,000

$3,120,368

$2,320,500

$3,264,534

$3,638,305

$4,632,344

$4,299,528

$5,656,570

$4,893,680

$6,412,558

2.40

1.35

4.09

2.94

1.88

5.26

3.04

1.62

5.89

3.51

1.88

7.02

3.83

2.01

7.92

$618,603

19.30%

70

Mar 10

Forecast

$4,040,170

$4,438,986

$1,043,553

$1,096,988

$2,996,617

$3,341,998

$250,482

$264,424

$757,838

$798,428

$2,186,402

$2,485,120

$1,530,481

$1,739,584

$1,729,881

$1,940,884

Forecast

$3,862,537

$4,410,607

$1,331,634

$1,513,997

$11,541

$11,850

$7,561,481

$8,300,367

$1,060,628

$1,085,037

$920,534

$948,373

$1,981,162

$2,033,409

$5,580,319

$6,266,958

Forecast

$1,914,880

$2,300,477

Forecast

$637,046

$639,217

11.87%

8.07%

43

29

Feb 12

Jan 29

Forecast

3.64

4.06

2.39

2.67

0.26

0.24

0.53

0.53

0.38

0.39

0.36

0.32

0.24

0.24

$2,801,909

$3,325,570

1.44

1.33

Forecast

$5,580,319

$6,266,957

$7,310,200

$8,207,842

Forecast

4.17

4.52

2.14

2.27

8.86

9.81

$634,875

15.68%

57

Feb 26

$4,837,803

$1,150,423

$3,687,379

$278,366

$839,018

$2,783,839

$1,948,687

$2,151,887

Upward

Upward

Upward

Upward

Upward

Upward

Upward

Upward

$4,958,676

$1,696,361

$12,159

$9,039,253

$1,109,445

$976,212

$2,085,656

$6,953,597

Upward

Upward

Upward

Upward

Upward

Upward

Upward

Upward

$2,686,075

Upward

$641,387

4.26%

16

Jan 15

Upward

Downward

Downward

Downward

4.47

2.94

0.23

0.54

0.40

0.30

0.25

$3,849,232

1.26

Upward

Upward

Downward

Upward

Upward

Downward

Upward

Upward

Downward

$6,953,596

$9,105,483

Upward

Upward

4.86

2.41

10.75

Upward

Upward

Upward

*EBIT is Earnings Before Interest and Taxes

**Ownership is the Total Reward for being the owner=Owner Salary + Bonus + Net Income + Other

Income Statement

Smoothing Forecast - 8 Periods

2003

2004

2005

2006

2007

Balance Sheet

Smoothing Forcast - 8 Periods

2008

2009

2010

2003

Net Sales

Cost of Goods Sold

Gross Profit (Margin)

G&A

Total Operating Expenses

EBIT*

Net Income After

Ownership**

2004

Current Assets

Total Assets

Total Liabilities

Prepared by JaxWorks Consultancy, Inc.

Copyright, 2006, JaxWorks, All Rights Reserved.

2005

2006

2007

Inventory

Current Liabilities

Equity

2008

2009

2010

Other Assets

Non-current Liabilities

The Executive Summary

For

The XYZ Company

August 01, 2013

The Executive Summary of your business yields an overall picture of its financial health. We have extracted, compiled, and entered into our

analysis system all of the vital information that pertains to this specific business and yielded this summary. The primary objective is to zero

in on all of the areas that might be detracting from the bottom line.

Knowledge is power, and knowledge of your company's value is the ultimate power tool. Item 9 is the summary results of your Market

Value Analysis. The Market Value Analysis uses the 6 standard methods endorsed by The American Society of Appraisers.

Category

Your

Current

Your

Forecasted

Year

Year

2003

2007

1. Net Revenue

2. Cost of Revenue

3. Gross Profit

4. Total Operating Expenses

5. Operating Profit

6. Return on Ownership

7. Current Ratio

8. Z-Score - Publicly Held

9. Z-Score - Privately Held

10. Z-Score - Non-manufacturing

$1,960,000

$745,000

$1,215,000

$558,760

$656,240

$670,368

1.30

2.40

1.35

4.09

$3,641,354

$990,118

$2,561,236

$717,248

$1,843,988

$1,518,878

3.20

3.83

2.01

7.92

Overall Rating:

Comments

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

The trend in this category is positive.

You meet or exceed all industry standards.

NUMBER OF EVALUATION CATEGORIES CONSIDERED=

NUMBER OF EVALUATION CATEGORIES THAT MAY NEED ASSISTANCE =

PERCENTAGE OF EVALUATION CATEGORIES THAT MAY NEED ASSISTANCE =

0%

Executive Summary

Current vs. Projected

$4,000,000

$3,500,000

$3,000,000

1. Net Revenue

$2,500,000

2. Cost of Revenue

$2,000,000

3. Gross Profit

4. Total Operating Expenses

$1,500,000

5. Operating Profit

$1,000,000

6. Return on Ownership

$500,000

$0

2003

2007

Prepared by JaxWorks Consultancy, Inc.

Copyright, 2006, JaxWorks, All Rights Reserved.

0% to 20% is Best

The XYZ Company

6200 XYZ Drive

ABC, California 00000-0000

Phone: (000) 000-0000

FAX: (000) 000-0000

E-mail: someone@xyz.com

August 01, 2013

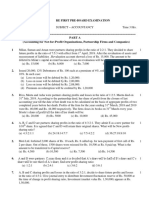

Comparative Income Statement - 4 Periods

Sales Revenue

Cost of Sales

Income Details

Gross Sales

Discounts/Allowances

Net Sales

Gross Profit

Fixed Expenses

Other Expenses

Income Before Tax

Year

Year

Year

2003

2004

2005

$2,010,000

($50,000)

102.55%

-2.55%

$2,560,000

($60,000)

102.40%

($70,000)

Net Income (Loss)

Year

2006

%

$2,721,800

-2.40%

Income Taxes

102.64%

-2.64%

$3,285,454

($80,000)

100.00%

-2.43%

$1,960,000

100.00%

$2,500,000

100.00%

$2,651,800

100.00%

$3,205,454

97.57%

Direct Material Cost

$320,000

16.33%

$427,600

17.10%

$431,238

16.26%

$432,513

13.49%

Direct Labor Cost

$300,000

15.31%

$315,000

12.60%

$330,450

12.46%

$346,364

10.81%

Other Direct Costs

$125,000

6.38%

$128,750

5.15%

$132,613

5.00%

$136,591

4.26%

$745,000

38.01%

$871,350

34.85%

$894,301

33.72%

$915,467

28.56%

$1,215,000

61.99%

$1,628,650

65.15%

$1,757,500

66.28%

$2,289,987

71.44%

Total Cost of Sales

Gross Profit

Expenses

Fixed Expenses

Executive Salaries

$190,000

9.69%

$191,000

7.64%

$195,000

7.35%

$195,000

6.08%

Advertising

$50,000

2.55%

$51,500

2.06%

$53,045

2.00%

$54,636

1.70%

Auto & Truck Expenses

$30,000

1.53%

$30,900

1.24%

$31,827

1.20%

$32,782

1.02%

Depreciation

$5,000

0.26%

$5,150

0.21%

$45,305

1.71%

$50,464

1.57%

Employee Benefits

$3,000

0.15%

$3,090

0.12%

$3,183

0.12%

$3,278

0.10%

Home Office Business Expenses

$1,000

0.05%

$1,030

0.04%

$1,061

0.04%

$1,093

0.03%

Insurance

$3,906

0.20%

$3,754

0.15%

$4,010

0.15%

$3,994

0.12%

Bank Charges

$2,133

0.11%

$2,197

0.09%

$2,263

0.09%

$2,331

0.07%

Legal & Professional Services

$1,000

0.05%

$1,330

0.05%

$1,670

0.06%

$2,020

0.06%

Meals & Entertainment

$4,000

0.20%

$4,120

0.16%

$4,244

0.16%

$4,371

0.14%

Office Expense

$6,000

0.31%

$6,180

0.25%

$6,365

0.24%

$6,556

0.20%

Retirement Plans

$1,000

0.05%

$1,030

0.04%

$1,061

0.04%

$1,093

0.03%

Rent - Equipment

$3,000

0.15%

$3,090

0.12%

$3,183

0.12%

$3,278

0.10%

Rent - Office & Business Property

$8,750

0.45%

$9,110

0.36%

$9,544

0.36%

$9,929

0.31%

Repairs

$1,000

0.05%

$1,030

0.04%

$1,061

0.04%

$1,093

0.03%

Supplies

$1,000

0.05%

$1,030

0.04%

$1,061

0.04%

$1,093

0.03%

Taxes - Business & Payroll

$1,000

0.05%

$1,030

0.04%

$1,061

0.04%

$1,093

0.03%

Travel

$6,230

0.32%

$6,120

0.24%

$6,010

0.23%

$5,900

0.18%

$11,974

0.61%

$12,374

0.49%

$14,186

0.53%

$16,974

0.53%

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

$329,993

16.84%

$335,065

13.40%

$385,138

14.52%

$396,977

12.38%

Utilities

Other Expenses

Total Fixed Expenses

Copyright, 2006, JaxWorks, All Rights Reserved.

Comparative Income Statement - 4 Periods

Sales Revenue

Cost of Sales

Gross Profit

Fixed Expenses

Other Expenses

Income Before Tax

Income Taxes

Net Income (Loss)

Year

Year

Year

Year

2003

2004

2005

2006

Variable Expenses

Office salaries

$90,000

4.59%

$102,700

4.11%

$112,368

4.24%

$118,647

3.70%

Employee benefits

$43,000

2.19%

$46,875

1.88%

$47,970

1.81%

$51,249

1.60%

Payroll taxes

$18,000

0.92%

$18,540

0.74%

$19,096

0.72%

$19,669

0.61%

Sales and Marketing

$14,000

0.71%

$14,420

0.58%

$14,853

0.56%

$15,298

0.48%

Telephone and telegraph

$6,000

0.31%

$6,180

0.25%

$6,365

0.24%

$6,556

0.20%

Stationary and office supplies

$2,110

0.11%

$2,680

0.11%

$3,005

0.11%

$3,493

0.11%

$100

0.01%

$103

0.00%

$106

0.00%

$109

0.00%

$5,557

0.28%

$5,724

0.23%

$5,895

0.22%

$6,072

0.19%

Contributions

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Add Item

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Add Item

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Add Item

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Add Item

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Add Item

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Total Variable Expenses

$178,767

9.12%

$197,222

7.89%

$209,659

7.91%

$221,095

6.90%

Operating expenses

$508,760

25.96%

$532,287

21.29%

$594,797

22.43%

$618,071

19.28%

Interest

$16,250

0.83%

$16,738

0.67%

$17,240

0.65%

$17,757

0.55%

Depreciation

$32,500

1.66%

$33,475

1.34%

$34,479

1.30%

$35,514

1.11%

Amortization

$1,250

0.06%

$1,288

0.05%

$1,326

0.05%

$1,366

0.04%

$0

0.00%

$0

0.00%

$0

0.00%

$0

0.00%

Total expenses

$558,760

28.51%

$583,787

23.35%

$647,842

24.43%

$672,707

20.99%

Operating income

$656,240

33.48%

$1,044,863

41.79%

$1,109,658

41.85%

$1,617,279

50.45%

Gain (loss) on sale of assets

$10,000

0.51%

$10,300

0.41%

$10,609

0.40%

$10,927

0.34%

Other (net)

$20,000

1.02%

$20,600

0.82%

$21,218

0.80%

$31,855

0.99%

$30,000

1.53%

$30,900

1.24%

$31,827

1.20%

$42,782

1.33%

Income before tax

$686,240

35.01%

$1,075,763

43.03%

$1,141,485

43.05%

$1,660,061

51.79%

Income taxes

$205,872

10.50%

$322,729

12.91%

$342,445

12.91%

$498,018

15.54%

Net income

$480,368

24.51%

$753,034

30.12%

$799,039

30.13%

$1,162,043

36.25%

Return On Ownership

$670,368

34.20%

$944,034

37.76%

$994,039

37.49%

$1,357,043

42.34%

Bad debts

Postage

Other

Other income and expenses

Subtotal

Prepared by JaxWorks Consultancy, Inc.

Copyright, 2006, JaxWorks, All Rights Reserved.

The XYZ Company

6200 XYZ Drive

ABC, California 00000-0000

Phone: (000) 000-0000

FAX: (000) 000-0000

E-mail: someone@xyz.com

August 01, 2013

Comparative Balance Sheet - 4 Periods

Total Current Assets

Total Fixed Assets

ASSETS

Total Assets

Total Current Liabilities

Total Liabilities

Total Stockholders' Equity

Year

Year

Year

2003

2004

2005

Total Liabilities and Equity

Year

2006

%

Current Assets

Cash and cash equivalents

$451,000

10.82%

$464,530

11.35%

$478,466

8.75%

$492,820

7.98%

Accounts receivable

$350,000

8.40%

$460,500

11.25%

$871,315

15.94%

$1,382,454

22.40%

$1,200

0.03%

$3,200

0.08%

$3,000

0.05%

$3,400

0.06%

$400,000

9.60%

$612,000

14.95%

$824,360

15.08%

$937,091

15.18%

Notes receivable

Inventory

Other current assets

$10,000

0.24%

$10,300

0.25%

$10,609

0.19%

$10,927

0.18%

$1,212,200

29.09%

$1,550,530

37.87%

$2,187,750

40.01%

$2,826,692

45.80%

Land

$1,000,000

24.00%

$1,030,000

25.16%

$1,106,090

20.23%

$1,109,273

17.97%

Buildings

$1,500,000

36.00%

$1,045,000

25.52%

$1,591,350

29.10%

$1,739,091

28.18%

$800,000

19.20%

$824,000

20.13%

$948,720

17.35%

$874,182

14.16%

$3,300,000

79.19%

$2,899,000

70.81%

$3,646,160

66.68%

$3,722,545

60.31%

$400,000

9.60%

$412,000

10.06%

$424,360

7.76%

$437,091

7.08%

$2,900,000

69.59%

$2,487,000

60.74%

$3,221,800

58.92%

$3,285,454

53.23%

Cost

$50,000

1.20%

$51,500

1.26%

$53,045

0.97%

$54,636

0.89%

Less-accumulated amortization

$20,000

0.48%

$20,600

0.50%

$21,218

0.39%

$21,855

0.35%

Total Intangible Assets

$30,000

0.72%

$30,900

0.75%

$31,827

0.58%

$32,782

0.53%

Other assets

$25,000

0.60%

$25,750

0.63%

$26,523

0.49%

$27,318

0.44%

Total All Other Assets

$55,000

1.32%

$56,650

1.36%

$58,350

1.40%

$60,100

1.44%

$4,167,200

100.00%

$4,094,180

100.00%

$5,467,899

100.00%

$6,172,246

100.00%

Total Current Assets

Fixed Assets

Equipment

Subtotal

Less-accumulated depreciation

Total Fixed Assets

Intangible Assets

Total Assets

Copyright, 2006, JaxWorks, All Rights Reserved.

Comparative Balance Sheet - 4 Periods

Total Current Assets

Total Fixed Assets

Total Assets

Total Current Liabilities

Total Liabilities

Total Stockholders' Equity

Total Liabilities and Equity

Year

Year

Year

Year

2003

2004

2005

2006

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities

Accounts payable

$600,000

14.40%

$618,000

15.09%

$636,540

11.64%

$640,563

10.38%

Notes payable

$100,000

2.40%

$103,000

2.52%

$106,090

1.94%

$109,273

1.77%

$100,000

2.40%

$103,000

2.52%

$106,090

1.94%

$109,273

1.77%

Income taxes

$30,000

0.72%

$30,900

0.75%

$31,827

0.58%

$32,782

0.53%

Accrued expenses

$90,000

2.16%

$92,700

2.26%

$95,481

1.75%

$98,345

1.59%

Other current liabilities

$16,000

0.38%

$16,480

0.40%

$16,974

0.31%

$17,484

0.28%

$936,000

22.46%

$964,080

23.55%

$993,002

18.16%

$1,007,719

16.33%

Long-term debt

$601,200

14.43%

$624,200

15.25%

$645,630

11.81%

$668,308

10.83%

Deferred income

$100,000

2.40%

$103,000

2.52%

$106,090

1.94%

$109,273

1.77%

Deferred income taxes

$30,000

0.72%

$30,900

0.75%

$31,827

0.58%

$32,782

0.53%

Other long-term liabilities

$50,000

1.20%

$51,500

1.26%

$53,045

0.97%

$54,636

0.89%

$1,717,200

41.21%

$1,773,680

43.32%

$1,829,594

33.46%

$1,872,718

30.34%

Capital stock issued

$100,000

2.40%

$100,000

2.44%

$100,000

1.83%

$100,000

1.62%

Number of shares issued

$100,000

2.40%

$100,000

2.44%

$100,000

1.83%

$100,000

1.62%

Additional paid in capital

$950,000

22.80%

$678,500

16.57%

$1,853,045

33.89%

$2,469,710

40.01%

Current portion of long-term debt

Total Current Liabilities

Non-Current Liabilities

Total Liabilities

Stockholders' Equity

$1,400,000

33.60%

$1,542,000

37.66%

$1,685,260

30.82%

$1,729,818

28.03%

Total Stockholders' Equity

Retained earnings

$2,450,000

58.79%

$2,320,500

56.68%

$3,638,305

66.54%

$4,299,528

69.66%

Total Liabilities and Equity

$4,167,200

100.00%

$4,094,180

100.00%

$5,467,899

100.00%

$6,172,246

100.00%

Prepared by JaxWorks Consultancy, Inc.

Copyright, 2006, JaxWorks, All Rights Reserved.

CASH FLOW DATA ENTRY

Year of Projection

Corporation Type (C or S)?

Operating Data

Days sales in accounts receivable

Days materials cost in inventory

Days finished goods in inventory

Days materials cost in payables

Days payroll expense accrued

Days operating expense accrued

Expense Data

Direct labor as % of sales

Other payroll as % of sales

Payroll taxes as % of payroll

Insurance as % of payroll

Legal/accounting as % of sales

Office overhead as % of sales

Financing Data (0 on)

Long term debt

Short-term debt

Capital stock issued

Additional paid-in capital

Accumulated depreciation (as of 1999)

2000

C

16.00%

12.00%

10.00%

5.00%

2.00%

3.00%

'C' Corporation format selected; income taxes WILL be computed

1st Qtr

2nd Qtr

3rd Qtr

30

30

30

30

30

30

45

45

45

60

60

60

7

7

7

20

20

20

of sales

of sales

of payroll

of payroll

of sales

of sales

$320,000

$240,000

$56,000

$28,000

$40,000

$60,000

Depreciation

Capital

$100,000

$50,000

$400,000

Copyright, 2003, JaxWorks, All Rights Reserved.

$240,000

$180,000

$42,000

$21,000

$30,000

$45,000

$208,000

$156,000

$36,400

$18,200

$26,000

$39,000

Current Portion

$100,000

$50,000

LT Portion

$500,000

4th Qtr

30

30

45

60

7

20

$321,616

$241,212

$56,283

$28,141

$40,202

$60,303

Rate

10.00%

10.00%

CASH FLOW STATEMENT

1st Qtr

Forecasted

2nd Qtr

3rd Qtr

4th Qtr

Total

4 Quarters

$490,700

$33,750

$227,879

$35,208

$170,059

$35,208

$746,609

$35,208

$1,635,247

$139,374

$524,450

$263,087

$205,267

$781,817

$1,774,621

($307,534)

($230,411)

($50,000)

($8,000)

($271,233)

$0

$153,300

($6,712)

($4,000)

$0

$164,383

$39,452

$14,910

($87,000)

$0

$0

($112,637)

($20,822)

$0

$0

$65,754

$15,781

($31,230)

$115,000

$0

$0

($24,780)

($8,329)

$0

$0

($233,458)

($117,674)

$26,320

($18,000)

$0

$0

$247,092

$29,571

$0

($50,000)

($310,855)

($292,852)

($40,000)

$2,000

($271,233)

$0

$262,975

($6,292)

($4,000)

($50,000)

($724,590)

($1,714)

$132,196

($116,149)

($710,257)

$12,500

($50,000)

$75,000

$0

$12,500

$0

$0

$0

$12,500

$0

$0

$0

$12,500

$0

$0

$0

$50,000

($50,000)

$75,000

$0

$37,500

$12,500

$12,500

$12,500

$75,000

($50,000)

($100,000)

($10,000)

($3,000)

$40,000

$0

$0

$0

$0

$0

($50,000)

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

($50,000)

($100,000)

($10,000)

($3,000)

($10,000)

$0

Net cash from financing

($123,000)

($50,000)

$0

$0

($173,000)

Net increase (decrease) in cash

($360,640)

$198,873

$324,963

$653,168

$816,364

Cash at beginning of period

$451,000

$90,360

$289,233

$614,196

$451,000

Cash at the end of period

$90,360

$289,233

$614,196

$1,267,364

$1,267,364

Cash from operations

Net earnings (loss)

Add-depreciation and amortization

Net cash from operations

Cash provided (used) by

operating activities

Accounts Receivable

Inventory

Other current assets

Other non-current assets

Accounts payable

Current portion of long-term debt

Income taxes

Accrued expenses

Other current liabilities

Dividends paid

Net cash from operations

Investment transactions

Increases (decreases)

Land

Buildings and improvements

Equipment

Intangible assets

Net cash from investments

Financing transactions

Increases (decreases)

Short term notes payable

Long term debt

Deferred income

Deferred income taxes

Other long-term liabilities

Capital stock and paid in capital

Copyright, 2003, JaxWorks, All Rights Reserved.

CASH FLOW PROJECTIONS - 8 YEARS

1st Qtr

1

$490,700

$33,750

Current

2nd Qtr

3rd Qtr

2

3

$227,879

$170,059

$35,208

$35,208

4th Qtr

4

$746,609

$35,208

Forecasted-Linear Regression Analysis

5th Qtr

6th Qtr

7th Qtr

8th Qtr

5

6

7

8

$586,289

$657,279

$728,270

$799,261

$35,937

$36,374

$36,812

$37,249

$524,450

$263,087

$205,267

$781,817

$622,226

$693,654

$765,082

$836,510

($307,534)

($230,411)

($50,000)

($8,000)

($271,233)

$0

$153,300

($6,712)

($4,000)

$0

$164,383

$39,452

$14,910

($87,000)

$0

$0

($112,637)

($20,822)

$0

$0

$65,754

$15,781

($31,230)

$115,000

$0

$0

($24,780)

($8,329)

$0

$0

($233,458)

($117,674)

$26,320

($18,000)

$0

$0

$247,092

$29,571

$0

($50,000)

($46,814)

$5,422

$35,705

$43,500

$135,617

$0

$158,052

$28,763

$2,000

($50,000)

($34,454)

$36,876

$53,987

$60,700

$216,986

$0

$194,975

$40,897

$3,200

($65,000)

($22,094)

$68,330

$72,269

$77,900

$298,356

$0

$231,899

$53,031

$4,400

($80,000)

($9,734)

$99,784

$90,551

$95,100

$379,726

$0

$268,822

$65,165

$5,600

($95,000)

($724,590)

($1,714)

$132,196

($116,149)

$312,244

$508,167

$704,091

$900,014

$12,500

($50,000)

$75,000

$0

$12,500

$0

$0

$0

$12,500

$0

$0

$0

$12,500

$0

$0

$0

$12,500

$25,000

($37,500)

$0

$12,500

$40,000

($60,000)

$0

$12,500

$55,000

($82,500)

$0

$12,500

$70,000

($105,000)

$0

$37,500

$12,500

$12,500

$12,500

($7,500)

($15,000)

($22,500)

($50,000)

($100,000)

($10,000)

($3,000)

$40,000

$0

$0

$0

$0

$0

($50,000)

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$25,000

$50,000

$5,000

$1,500

($20,000)

$0

$40,000

$80,000

$8,000

$2,400

($27,000)

$0

$55,000

$110,000

$11,000

$3,300

($34,000)

$0

$70,000

$140,000

$14,000

$4,200

($41,000)

$0

Net cash from financing

($123,000)

($50,000)

$0

$0

$61,500

$103,400

$145,300

$187,200

Net increase (decrease) in cash

($360,640)

$198,873

$324,963

$653,168

$995,970

$1,312,721

$1,629,472

$1,946,224

Cash at beginning of period

$451,000

$90,360

$289,233

$614,196

$533,313

$602,159

$671,005

$739,851

Cash at the end of period

$90,360

$289,233

$614,196

$1,267,364

$1,529,282

$1,914,880

$2,300,477

$2,686,075

Cash from operations

Net earnings (loss)

Add-depreciation and amortization

Net cash from operations

Cash provided (used) by

operating activities

Accounts Receivable

Inventory

Other current assets

Other non-current assets

Accounts payable

Current portion of long-term debt

Income taxes

Accrued expenses

Other current liabilities

Dividends paid

Net cash from operations

Investment transactions

Increases (decreases)

Land

Buildings and improvements

Equipment

Intangible assets

Net cash from investments

Financing transactions

Increases (decreases)

Short term notes payable

Long term debt

Deferred income

Deferred income taxes

Other long-term liabilities

Capital stock and paid in capital

Copyright, 2003, JaxWorks, All Rights Reserved.

$0

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Certification Exam: Review: Wall Street PrepDocument21 pagesCertification Exam: Review: Wall Street Prepduc anh100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Dispensers of California Case AnalysisDocument10 pagesDispensers of California Case AnalysisAvinash Singh100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FM Assignment 17-M-518 MMM - Eicher MotorDocument33 pagesFM Assignment 17-M-518 MMM - Eicher MotorTrilokNo ratings yet

- Assert Yourself - 03 - How To Think More AssertivelyDocument15 pagesAssert Yourself - 03 - How To Think More Assertivelyunderwood@eject.co.za100% (1)

- Assert Yourself - 01 - What Is AssertivenessDocument9 pagesAssert Yourself - 01 - What Is Assertivenessunderwood@eject.co.zaNo ratings yet

- TheBusinessofthe21stCenturyBook 1 PDFDocument1 pageTheBusinessofthe21stCenturyBook 1 PDFunderwood@eject.co.zaNo ratings yet

- STR CT Monfri June 2013Document7 pagesSTR CT Monfri June 2013underwood@eject.co.zaNo ratings yet

- 03 Personality ProfilesDocument7 pages03 Personality Profilesunderwood@eject.co.zaNo ratings yet

- A. S. A. P.: Ever Wonder About The Abbreviation ofDocument10 pagesA. S. A. P.: Ever Wonder About The Abbreviation ofunderwood@eject.co.zaNo ratings yet

- PE Illustrative-Financial-Statements-2022 PEDocument40 pagesPE Illustrative-Financial-Statements-2022 PECalebNo ratings yet

- Strategic Management Journal - 2013 - Cheng - Corporate Social Responsibility and Access To FinanceDocument23 pagesStrategic Management Journal - 2013 - Cheng - Corporate Social Responsibility and Access To FinancetnborgesNo ratings yet

- BPI Capital Audited Financial StatementsDocument66 pagesBPI Capital Audited Financial StatementsGes Glai-em BayabordaNo ratings yet

- History of Bank of PunjabDocument32 pagesHistory of Bank of PunjabMahrukh AlTafNo ratings yet

- ExamDocument18 pagesExamJanine SantiagoNo ratings yet

- Exm 2018Document8 pagesExm 2018SubNathan PlayzNo ratings yet

- Solution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesDocument11 pagesSolution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesLayNo ratings yet

- Financial Institutions Management - Chapter 5 Solutions PDFDocument6 pagesFinancial Institutions Management - Chapter 5 Solutions PDFJarrod RodriguesNo ratings yet

- Assignment On JP Morgan ChaseDocument13 pagesAssignment On JP Morgan ChaseAldrich Theo Martin100% (1)

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document11 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)CasimirPampoNo ratings yet

- RemovalDocument6 pagesRemovalJessa Mae BanseNo ratings yet

- Hhtfa8e ch01 WP 1Document87 pagesHhtfa8e ch01 WP 1rishirawr0% (1)

- ENTREP2112 Second Quarter ExamDocument19 pagesENTREP2112 Second Quarter ExamPallas AthenaNo ratings yet

- XII Accts Re First Board Exam 20-21Document9 pagesXII Accts Re First Board Exam 20-21Sagar SharmaNo ratings yet

- Accounting Changes and ErrorsDocument3 pagesAccounting Changes and ErrorsJohn Emerson PatricioNo ratings yet

- GRP 2Document44 pagesGRP 2rikitagujralNo ratings yet

- The Accounting EquationDocument8 pagesThe Accounting EquationYasotha RajendranNo ratings yet

- Postmoney Safe - Valuation Cap Only v1.1 (Canada)Document8 pagesPostmoney Safe - Valuation Cap Only v1.1 (Canada)Shubham WaghmareNo ratings yet

- Dokumen - Tips - Project Report of Kalyani GroupDocument55 pagesDokumen - Tips - Project Report of Kalyani GroupVicky KumarNo ratings yet

- 5418 Assignment # 01Document24 pages5418 Assignment # 01noorislamkhanNo ratings yet

- The Leveraged Buy Out Deal of TataDocument7 pagesThe Leveraged Buy Out Deal of TataNeha ChouhanNo ratings yet

- CFAS Testbank Answer KeyDocument14 pagesCFAS Testbank Answer KeyPrince Jeffrey FernandoNo ratings yet

- Financial Management: Cocoa PowderDocument13 pagesFinancial Management: Cocoa PowderGautam AryaNo ratings yet

- PG Question Paper 2017Document11 pagesPG Question Paper 2017Everything in 1⃣No ratings yet

- Holdings - Us - Emerging Markets Small Cap Portfolio IDocument136 pagesHoldings - Us - Emerging Markets Small Cap Portfolio IRajanThree WaliaNo ratings yet

- POFA Practice QuestionDocument36 pagesPOFA Practice QuestionAli Zain ParharNo ratings yet

- 12 07 2021 Session 5 Reformuation BASICSDocument72 pages12 07 2021 Session 5 Reformuation BASICSAkshayNo ratings yet