Professional Documents

Culture Documents

Letter of Credit About Documentary Payments

Letter of Credit About Documentary Payments

Uploaded by

raju_srinu06Copyright:

Available Formats

You might also like

- Payment Guarantee Process in SAP (Letter of Credit)Document31 pagesPayment Guarantee Process in SAP (Letter of Credit)Anupa Wijesinghe91% (77)

- STAND BY Letter of CreditDocument16 pagesSTAND BY Letter of CreditRuchitha PrakashNo ratings yet

- Business Process LC and BGDocument26 pagesBusiness Process LC and BGfinal_destination280No ratings yet

- R12 SEPA Core Direct Debit WhitepaperDocument12 pagesR12 SEPA Core Direct Debit WhitepaperAliNo ratings yet

- The MT100 Is An Interbank Message Which Basically The Sending Bank Advises The Receiving Bank To Expect Funds From The Sending BankDocument2 pagesThe MT100 Is An Interbank Message Which Basically The Sending Bank Advises The Receiving Bank To Expect Funds From The Sending Bankkarthickmsit83% (6)

- Import Export: A Guide To Letters of CreditDocument48 pagesImport Export: A Guide To Letters of CreditAmit RaiNo ratings yet

- Amity Global Business School: Letter of Credit Sachin RohatgiDocument32 pagesAmity Global Business School: Letter of Credit Sachin RohatgisachinremaNo ratings yet

- BankGuarantee AnalysisDocument3 pagesBankGuarantee Analysisanshulkumar007No ratings yet

- Usance LC (Deferred LC) : Definition, How Does Usance LC Work, Charges & CommissionDocument5 pagesUsance LC (Deferred LC) : Definition, How Does Usance LC Work, Charges & CommissionShuvro PaulNo ratings yet

- LC Process Mapping and SolutionDocument14 pagesLC Process Mapping and SolutionEjaz Hussain100% (1)

- Letter of Credit-VVTi Sales ProcessDocument11 pagesLetter of Credit-VVTi Sales ProcesssampathNo ratings yet

- Stand by Letter of CreditsDocument14 pagesStand by Letter of CreditsSudershan ThaibaNo ratings yet

- Combined Heat and Power Request For Offers: Issuing Bank Letterhead and AddressDocument4 pagesCombined Heat and Power Request For Offers: Issuing Bank Letterhead and AddresszacybernautNo ratings yet

- Bank GuaranteeDocument2 pagesBank GuaranteeAdnan AminNo ratings yet

- LC Docs ChecklistDocument1 pageLC Docs ChecklistkevindsizaNo ratings yet

- Contract ADocument21 pagesContract ACharles Deneen100% (1)

- Irrevocable Documentary Credit - Appl (EN) v1.1Document2 pagesIrrevocable Documentary Credit - Appl (EN) v1.1Firaol BelayNo ratings yet

- (IBT) - G8 - Documentary CreditDocument45 pages(IBT) - G8 - Documentary Credittram_ngoc_19No ratings yet

- Letter of CreditDocument32 pagesLetter of CreditPeter DjkmNo ratings yet

- List of All SWIFT Messages Types - PaiementorDocument22 pagesList of All SWIFT Messages Types - PaiementoralfarojekltdNo ratings yet

- Merchant Integration GuideDocument28 pagesMerchant Integration GuideMuhammad AtharNo ratings yet

- FC BG-SBLC ServicesDocument6 pagesFC BG-SBLC ServicesDubai InvestmentsNo ratings yet

- BANK'S RWA-Lease-1Document1 pageBANK'S RWA-Lease-1Nohosso DOSSONo ratings yet

- IcpoDocument4 pagesIcpoRonnie AdnalcamaNo ratings yet

- Hong Kong Branch Dear Sir, I/We Request You To Establish With Your Correspondents in - (Country) Documentary Credit As Per Details BelowDocument5 pagesHong Kong Branch Dear Sir, I/We Request You To Establish With Your Correspondents in - (Country) Documentary Credit As Per Details BelowLalith11986No ratings yet

- BDC For FI Posting (F-02 - F-43 - F-65) - SAP BlogsDocument3 pagesBDC For FI Posting (F-02 - F-43 - F-65) - SAP BlogsArun Varshney (MULAYAM)No ratings yet

- Blocked Fund VerbiageDocument2 pagesBlocked Fund VerbiageTony MichaelNo ratings yet

- Invoice: Description Value Excluding Sales Tax (PKR) Sales Tax (PKR) Advance Tax (PKR) Value Including Taxes (PKR)Document1 pageInvoice: Description Value Excluding Sales Tax (PKR) Sales Tax (PKR) Advance Tax (PKR) Value Including Taxes (PKR)M Naveed Sultan0% (1)

- Application For Export Bills For CollectionDocument2 pagesApplication For Export Bills For CollectionsrinivasNo ratings yet

- Letter of Credit ExercisesDocument7 pagesLetter of Credit ExercisesHabdana Clariza Aliaga SamaniegoNo ratings yet

- Letter of CreditDocument5 pagesLetter of CreditSujith PSNo ratings yet

- 03-Mechanism in Letter of CreditDocument5 pages03-Mechanism in Letter of CreditNazish SohailNo ratings yet

- BG Purchase and Procedures AgreementDocument17 pagesBG Purchase and Procedures AgreementthienvupleikuNo ratings yet

- Apple Euro Bond DisclosureDocument69 pagesApple Euro Bond DisclosureMikey CampbellNo ratings yet

- Process For Letter of CreditDocument2 pagesProcess For Letter of Creditraju_srinu06No ratings yet

- HDFC BankDocument82 pagesHDFC BankNishant ParmarNo ratings yet

- BG SBLC With Zero DepositDocument2 pagesBG SBLC With Zero DepositchristianNo ratings yet

- ALL ABOUT FTNX Australia Dec 8 2018Document73 pagesALL ABOUT FTNX Australia Dec 8 2018Dr M R aggarwaalNo ratings yet

- Advance Payment GuaranteeDocument2 pagesAdvance Payment GuaranteeAnonymous odOTMykNo ratings yet

- Letter of Credit in Payables ModuleDocument10 pagesLetter of Credit in Payables ModuleChandan BhangaleNo ratings yet

- EC Monetization of Bank Guarantees2Document3 pagesEC Monetization of Bank Guarantees2ChrisallenmNo ratings yet

- LC Availability 1 0Document5 pagesLC Availability 1 0riothouse1221100% (1)

- E851dmodule 2 - PPT On Ucp 600Document35 pagesE851dmodule 2 - PPT On Ucp 600PriancaSurana100% (1)

- Sample Letter of CreditDocument1 pageSample Letter of CreditMohammad A YousefNo ratings yet

- Applications of SukukDocument14 pagesApplications of SukukUsama AnsariiNo ratings yet

- Letter of CreditDocument7 pagesLetter of CreditCh WaqasNo ratings yet

- Imports With Letter of Credit in SAP ERPDocument8 pagesImports With Letter of Credit in SAP ERPMohamed QamarNo ratings yet

- Bank Guarantee ProcedureDocument1 pageBank Guarantee ProcedureLatiff IbrahimNo ratings yet

- Company Letter Head: Letter of Request (Lor)Document28 pagesCompany Letter Head: Letter of Request (Lor)Thomas HiggsNo ratings yet

- LC RemittanceDocument3 pagesLC Remittancemuhammad shahid ullahNo ratings yet

- mt101 ManualDocument53 pagesmt101 ManualNestor Julio Arias MonáNo ratings yet

- Treasury ManagementDocument47 pagesTreasury Managementsinghsudhir261No ratings yet

- Letter of Credit & Bank GuaranteeDocument3 pagesLetter of Credit & Bank GuaranteeAditya SharmaNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingRahul FouzdarNo ratings yet

- Roll No-D018, SAP ID - 80101190221Document9 pagesRoll No-D018, SAP ID - 80101190221Harsh GandhiNo ratings yet

- The Benefits of DocumentationDocument21 pagesThe Benefits of DocumentationFaisal HanifNo ratings yet

- A Guide ToDocument27 pagesA Guide Toneelamd456No ratings yet

- Letter of Credit - Assigment Banking 7th Semester 2Document7 pagesLetter of Credit - Assigment Banking 7th Semester 2khanzadaali717No ratings yet

- Letter of Credit Case StudyDocument9 pagesLetter of Credit Case StudyLiz KallistaNo ratings yet

- Letter of Credit HardDocument35 pagesLetter of Credit HardReHopNo ratings yet

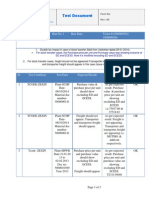

- Test Document: Server/Client: QA / 070 Run No: 1 Run Date: Ticket #:1000000361/ 1000000284Document3 pagesTest Document: Server/Client: QA / 070 Run No: 1 Run Date: Ticket #:1000000361/ 1000000284raju_srinu06No ratings yet

- Activate Letter of Credit in SD DocumentsDocument4 pagesActivate Letter of Credit in SD Documentsraju_srinu06No ratings yet

- Letter of Credit ErrorDocument3 pagesLetter of Credit Errorraju_srinu06No ratings yet

- SAP CustomizingDocument341 pagesSAP Customizingapi-27246999100% (15)

- Process For Letter of CreditDocument2 pagesProcess For Letter of Creditraju_srinu06No ratings yet

- LED Monitor E2243FWKDocument64 pagesLED Monitor E2243FWKDipi SlowNo ratings yet

- Amazon SuitDocument15 pagesAmazon Suitfreddymartinez9No ratings yet

- Developing Living Cities From Analysis To Action PDFDocument314 pagesDeveloping Living Cities From Analysis To Action PDFKien VuNo ratings yet

- Rear Suspension: Group 34Document6 pagesRear Suspension: Group 34Davit OmegaNo ratings yet

- Aegle Marmelos: Aegle Marmelos L., Commonly Known As Bael (Or BiliDocument6 pagesAegle Marmelos: Aegle Marmelos L., Commonly Known As Bael (Or BiliBaldev ChaudharyNo ratings yet

- 9.igtr Aurangabad MCCM QualfileDocument23 pages9.igtr Aurangabad MCCM QualfilewarekarNo ratings yet

- Data Privacy Candidate Consent FormDocument2 pagesData Privacy Candidate Consent FormENG 1B - Tabing - Melanie AngelNo ratings yet

- Mtap Reviewer GR 6 2ND QDocument3 pagesMtap Reviewer GR 6 2ND QMaria Clariza CastilloNo ratings yet

- Application Form For Certificate For English Proficiency Migration Bonafide StudentsDocument1 pageApplication Form For Certificate For English Proficiency Migration Bonafide StudentsE-University OnlineNo ratings yet

- Master Assessor - Trainer GuideDocument338 pagesMaster Assessor - Trainer GuideBME50% (2)

- Aviat WTM3100 User ManualDocument66 pagesAviat WTM3100 User ManualFarooqhimedNo ratings yet

- TLE - AFA - FISH - PROCESSING 7 - 8 - w3Document4 pagesTLE - AFA - FISH - PROCESSING 7 - 8 - w3Marilyn Lamigo Bristol100% (1)

- London Itinerary: SUNDAY, 1.8Document24 pagesLondon Itinerary: SUNDAY, 1.8BlackMegNo ratings yet

- Craft: CopywritingDocument216 pagesCraft: CopywritingZaborra100% (1)

- iNUKE NU6000DSP: Service ManualDocument45 pagesiNUKE NU6000DSP: Service ManualHerberth BarriosNo ratings yet

- 587 enDocument2 pages587 enabhayundaleNo ratings yet

- Notes in Fluid MachineryDocument36 pagesNotes in Fluid MachineryIvanNo ratings yet

- Flow LinesDocument5 pagesFlow LinesShashwat OmarNo ratings yet

- Ladaga vs. MapaguDocument5 pagesLadaga vs. MapaguGenerosa GenosaNo ratings yet

- GPOADmin Quick Start Guide 58Document25 pagesGPOADmin Quick Start Guide 58Harikrishnan DhanapalNo ratings yet

- Identify Risk and Apply Risk Management ProcessesDocument14 pagesIdentify Risk and Apply Risk Management ProcessesS Qambar A Shah0% (1)

- District Memo District Nat Sts Kto12 FormsDocument2 pagesDistrict Memo District Nat Sts Kto12 FormsNica SalentesNo ratings yet

- Bootable USB Pen Drive Has Many Advantages Over Other Boot DrivesDocument3 pagesBootable USB Pen Drive Has Many Advantages Over Other Boot DrivesDebaditya ChakrabortyNo ratings yet

- Synchronverters: Inverters That Mimic Synchronous GeneratorsDocument9 pagesSynchronverters: Inverters That Mimic Synchronous GeneratorsNoita EnolaNo ratings yet

- GM 1927-16 - PcpaDocument12 pagesGM 1927-16 - PcpaNeumar NeumannNo ratings yet

- Sap Table RefDocument18 pagesSap Table RefArjun GhattamneniNo ratings yet

- Saddam CVDocument4 pagesSaddam CVmd saddamNo ratings yet

- Referencia M PDFDocument1,008 pagesReferencia M PDFrobertocarlosricciNo ratings yet

- Indian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDocument5 pagesIndian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDharamNo ratings yet

- Performance Analysis Between RunC and Kata Container RuntimeDocument4 pagesPerformance Analysis Between RunC and Kata Container RuntimeClyde MarNo ratings yet

Letter of Credit About Documentary Payments

Letter of Credit About Documentary Payments

Uploaded by

raju_srinu06Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter of Credit About Documentary Payments

Letter of Credit About Documentary Payments

Uploaded by

raju_srinu06Copyright:

Available Formats

About Documentary Payments

Documentary payments significantly reduce the risk involved in foreign trade transactions. For exporters, they help ensure payment on time and in full. For importers, they help ensure that the exporter has actually shipped the goods for which they are paying. Documentary payments reduce risk by requiring shipping documents as proof of the transaction. Documentary payments reduce the risk for exporters because importers cannot collect the documents they need to retrieve the goods (documents like bills of lading) until they pay for the goods. They reduce the risk for importers because they do not pay for the goods unless the exporter has provided all of the documents proving that the agreed-upon goods were shipped under the agreed-upon conditions. One of the most common types of documentary payments is the letter of credit.

Letters of Credit

A letter of credit is a legally negotiable document issued by a bank at the request of an importer. The letter of credit ensures the financial ability of the importer to pay for the goods by substituting the credit of a bank for the credit of the importer. There are several types of letters of credit differing according to their use and the number of banks involved. Outlined below are the business flow and the goods and value flow for a common foreign trade procedure using a letter of credit.

Business Flow in a Letter of Credit Transaction

1. The importer sends a purchase order to the exporter. The purchase order is a promise to contract purchase of the specified goods under certain conditions. 2. After receiving the purchase order, the exporter issues an order confirmation. The order confirmation is a promise to sell and deliver the goods according to the agreedupon conditions including payment conditions. 3. The importer, in compliance with the payment conditions the exporter requested, opens a letter of credit at the bank of its choice. This bank is called the opening or issuing bank. The order confirmation and the purchase order are the basis of the letter of credit. The terms and conditions between the bank and the importer are based on the importers credit standing. 4. After approving the request for the letter of credit, the opening bank can contact its branch or affiliate (called the advising bank) in the exporters country t o establish and confirm the letter of credit on behalf of the exporter. The letter of credit itself is usually sent through a telex with a set of identification codes that confirm its authenticity. 5. The advising bank authenticates the letter of credit and sends it to the exporter by registered mail.

The letter of credit has been formally established, confirming the ability of the importer to pay for the goods. The exporter now ships the goods.

Goods and Value Flow in a Letter of Credit Transaction

1. The exporter ships the goods to the importer as the letter of credits terms require. Usually the letter of credit specifies shipping details including the mode of transportation, loading and unloading ports, merchandise packaging, and insurance. 2. After shipping the goods, the exporter gives the negotiating bank the valid letter of credit and the required shipping documents. The exporter can select a negotiating bank or use the advising bank as the negotiating bank. 3. The negotiating bank examines the validity of the shipping documents for any discrepancies. If the documents contain discrepancies, the negotiating bank may refuse to accept the documents for negotiation. The exporter may then either apply for an amendment to the letter of credit to allow the discrepancies or submit a letter of guarantee to the negotiating bank. The letter of guarantee states that the exporter is liable if the importer refuses to accept the documents due to the discrepancies. If documents do not contain discrepancies, the negotiating bank accepts the documents and pays the exporter the contracted amount for the goods. Banking charges may be deducted from this payment depending on the letter of credits terms. 4. The opening bank reimburses the negotiating bank for the amount it paid the exporter. In exchange, it receives the shipping documents from the negotiating bank. The negotiating bank may be entitled to collect bank changes from the opening bank depending on the letter of credits terms. 5. The opening bank negotiates with the importer for payment in exchange for the shipping documents. The payment between the importer and the opening bank depends on the terms of their agreement. Some banks require 75% of the order value in advance and the remaining 25% when the shipping documents arrive. 6. After receiving the valid shipping documents from the opening bank, the importer presents the bill of lading to the shipping company and claims the goods. The importer uses other shipping documents like commercial invoices, packing lists, and certificates of origin during customs clearing.

Activate Letter of Credit in SD documents

Link to this Page Link Tiny Link OK Know n Location You must make a Activate Letter of Wiki Markup Cancel Close Click to select the Move Page Act Search Error reading the

Set Page Location Move Recently View ed There w ere no re

The specified pag Brow se Failed to retrieve SD Foreign Trade

You could try relo HTTP Status Move failed. Ther You cannot move

There w ere no pa Show ing <b>{0}< SD

ERP SD Unknow n user or 257756126

You cannot move Page Restrictions

Page Ordering Editing restricted

Back Cancel

Reorder Close

Move Save

Page restrictions apply Attachments:2 Added by Milca Martins, last edited by Zsuzsanna Hartyani on Feb 27, 2013 (view change)

view

Purpose

The purpose of this wiki page is to clarify how to activate Letter of Credit in the SD documents.

Overview

A letter of credit is required for example if a customer is selling expensive goods to a poor country and needs a guarantee of payment. It works as follows: The customer in the poor country contacts his bank who issues a letter of credit supporting the payment of the goods. They contact the sellers bank and the process is fulfilled through the banks. Local bank = opening bank foreign bank = notifying bank. The material is delivered to the bank in the foreign country. When they receive payment it is passed to the customer. The money is then passed to the local bank and then on to the customer.

Customizing:

Path: sales & dist > Foreign trade > documentary payments > basic settings > risk management for FI

some prerequisites necessary in the customizing of the Credit Management area (SD-BF-CM) -> see note 18613 activate credit check for sales document types -> OVA7 assign document determination schema to order type -> OVFI assign customer determination schema to customer master record (payer) > XD02 -> sales area -> billing document -> field payment guarantee procedure customer determination schema + document determination schema -> payment guarantee procedure ( OVFJ ) payment guarantee procedure defines which forms of payment guarantee can be used ( more than one allowed ) the form of payment guarantee determines financial document category and financial document type ( VI52 ) financial document category and financial document define financial document indicator and bank indicator ( VX53 ) bank indicator defines which bank functions can be used in the FD ( VX54 ) financial document indicator defines: ( VX52 ) which documents must be used for the FD how does the FD look like: attributes, required fields, which fields must be checked when the FD is used in the order

VX52 you set the criteria for the LOC, open/hidden/optional fields etc. If you set a flag by the field it will create an incompletion entry when you create the letter of credit in VX11n

Creating a Financial Document

either transaction VX11N

or during order processing: billing -> extras -> financial document -> create (internal call of VX11N / the financial document category and financial document type defined by the FIRST form of payment guarantee in the payment guarantee procedure will be taken as default proposal for creating the FD)

Assigning an FD number to an sales order

must be done manually in the order on header or item level

if the FD no. is assigned in the header it is valid for all order items (provided that credit check is set to active in the item category customizing) system checks if the assigned FD no. fulfils the necessary requirements (values, dates, payer data etc.) 1. if the check is okay a. b. c. 2. a. b. credit status set to okay, open value is reduced in the FD record (VX13N) table S131 is updated (SE16) credit status is set to not okay order is blocked for delivery

if the check is not okay

In VA01 the log is only visible once, you can make a change to the payment terms and it is available again. Also you must call the customer address manually or you get an incompletion entry

Remarks

if no FD no. is assigned but required the credit status i s set to not okay (header -> status) status of the FD must be set to D so it can be used either the whole value of an order item can be covered by the SD or nothing! FD no. is split criteria for delivery creation! FD. no. is part of the delivery header. FD is also checked during delivery note creation. FD. no. is also part of the invoice header. Used just as a information field. theres no FD check in the invoice

Important transactions:

VKM3 Release of a blocked SD documents VX11N Create a financial document VXA1 Assigned sales documents (display all assigned)

VXA2 Available FDs VXA3 Blocked SD documents VXA7 To simulate the assignment of an FD doc

Relevant coding

Order check: function unit RV_LOC_CHECK_ORDER_LINE_ITEM Delivery check: RV_LOC_CHECK_DELIV_LINE_ITEM Tables: VBKD-LCNUM FD no. order (header and items) LIKP- LCNUM FD no. delivery header VBRK-LCNUM FD no. invoice header

Related Content

Related Notes

SAP Note: 1739363 LIPS-ABGES : Outbound Delivery Guaranteed with Zero % SAP Note: 1744831 Letter of credit for import SAP Note: 409393 Dokumentengeschft: Wertfortschreibung Auftrag, Lieferung

You might also like

- Payment Guarantee Process in SAP (Letter of Credit)Document31 pagesPayment Guarantee Process in SAP (Letter of Credit)Anupa Wijesinghe91% (77)

- STAND BY Letter of CreditDocument16 pagesSTAND BY Letter of CreditRuchitha PrakashNo ratings yet

- Business Process LC and BGDocument26 pagesBusiness Process LC and BGfinal_destination280No ratings yet

- R12 SEPA Core Direct Debit WhitepaperDocument12 pagesR12 SEPA Core Direct Debit WhitepaperAliNo ratings yet

- The MT100 Is An Interbank Message Which Basically The Sending Bank Advises The Receiving Bank To Expect Funds From The Sending BankDocument2 pagesThe MT100 Is An Interbank Message Which Basically The Sending Bank Advises The Receiving Bank To Expect Funds From The Sending Bankkarthickmsit83% (6)

- Import Export: A Guide To Letters of CreditDocument48 pagesImport Export: A Guide To Letters of CreditAmit RaiNo ratings yet

- Amity Global Business School: Letter of Credit Sachin RohatgiDocument32 pagesAmity Global Business School: Letter of Credit Sachin RohatgisachinremaNo ratings yet

- BankGuarantee AnalysisDocument3 pagesBankGuarantee Analysisanshulkumar007No ratings yet

- Usance LC (Deferred LC) : Definition, How Does Usance LC Work, Charges & CommissionDocument5 pagesUsance LC (Deferred LC) : Definition, How Does Usance LC Work, Charges & CommissionShuvro PaulNo ratings yet

- LC Process Mapping and SolutionDocument14 pagesLC Process Mapping and SolutionEjaz Hussain100% (1)

- Letter of Credit-VVTi Sales ProcessDocument11 pagesLetter of Credit-VVTi Sales ProcesssampathNo ratings yet

- Stand by Letter of CreditsDocument14 pagesStand by Letter of CreditsSudershan ThaibaNo ratings yet

- Combined Heat and Power Request For Offers: Issuing Bank Letterhead and AddressDocument4 pagesCombined Heat and Power Request For Offers: Issuing Bank Letterhead and AddresszacybernautNo ratings yet

- Bank GuaranteeDocument2 pagesBank GuaranteeAdnan AminNo ratings yet

- LC Docs ChecklistDocument1 pageLC Docs ChecklistkevindsizaNo ratings yet

- Contract ADocument21 pagesContract ACharles Deneen100% (1)

- Irrevocable Documentary Credit - Appl (EN) v1.1Document2 pagesIrrevocable Documentary Credit - Appl (EN) v1.1Firaol BelayNo ratings yet

- (IBT) - G8 - Documentary CreditDocument45 pages(IBT) - G8 - Documentary Credittram_ngoc_19No ratings yet

- Letter of CreditDocument32 pagesLetter of CreditPeter DjkmNo ratings yet

- List of All SWIFT Messages Types - PaiementorDocument22 pagesList of All SWIFT Messages Types - PaiementoralfarojekltdNo ratings yet

- Merchant Integration GuideDocument28 pagesMerchant Integration GuideMuhammad AtharNo ratings yet

- FC BG-SBLC ServicesDocument6 pagesFC BG-SBLC ServicesDubai InvestmentsNo ratings yet

- BANK'S RWA-Lease-1Document1 pageBANK'S RWA-Lease-1Nohosso DOSSONo ratings yet

- IcpoDocument4 pagesIcpoRonnie AdnalcamaNo ratings yet

- Hong Kong Branch Dear Sir, I/We Request You To Establish With Your Correspondents in - (Country) Documentary Credit As Per Details BelowDocument5 pagesHong Kong Branch Dear Sir, I/We Request You To Establish With Your Correspondents in - (Country) Documentary Credit As Per Details BelowLalith11986No ratings yet

- BDC For FI Posting (F-02 - F-43 - F-65) - SAP BlogsDocument3 pagesBDC For FI Posting (F-02 - F-43 - F-65) - SAP BlogsArun Varshney (MULAYAM)No ratings yet

- Blocked Fund VerbiageDocument2 pagesBlocked Fund VerbiageTony MichaelNo ratings yet

- Invoice: Description Value Excluding Sales Tax (PKR) Sales Tax (PKR) Advance Tax (PKR) Value Including Taxes (PKR)Document1 pageInvoice: Description Value Excluding Sales Tax (PKR) Sales Tax (PKR) Advance Tax (PKR) Value Including Taxes (PKR)M Naveed Sultan0% (1)

- Application For Export Bills For CollectionDocument2 pagesApplication For Export Bills For CollectionsrinivasNo ratings yet

- Letter of Credit ExercisesDocument7 pagesLetter of Credit ExercisesHabdana Clariza Aliaga SamaniegoNo ratings yet

- Letter of CreditDocument5 pagesLetter of CreditSujith PSNo ratings yet

- 03-Mechanism in Letter of CreditDocument5 pages03-Mechanism in Letter of CreditNazish SohailNo ratings yet

- BG Purchase and Procedures AgreementDocument17 pagesBG Purchase and Procedures AgreementthienvupleikuNo ratings yet

- Apple Euro Bond DisclosureDocument69 pagesApple Euro Bond DisclosureMikey CampbellNo ratings yet

- Process For Letter of CreditDocument2 pagesProcess For Letter of Creditraju_srinu06No ratings yet

- HDFC BankDocument82 pagesHDFC BankNishant ParmarNo ratings yet

- BG SBLC With Zero DepositDocument2 pagesBG SBLC With Zero DepositchristianNo ratings yet

- ALL ABOUT FTNX Australia Dec 8 2018Document73 pagesALL ABOUT FTNX Australia Dec 8 2018Dr M R aggarwaalNo ratings yet

- Advance Payment GuaranteeDocument2 pagesAdvance Payment GuaranteeAnonymous odOTMykNo ratings yet

- Letter of Credit in Payables ModuleDocument10 pagesLetter of Credit in Payables ModuleChandan BhangaleNo ratings yet

- EC Monetization of Bank Guarantees2Document3 pagesEC Monetization of Bank Guarantees2ChrisallenmNo ratings yet

- LC Availability 1 0Document5 pagesLC Availability 1 0riothouse1221100% (1)

- E851dmodule 2 - PPT On Ucp 600Document35 pagesE851dmodule 2 - PPT On Ucp 600PriancaSurana100% (1)

- Sample Letter of CreditDocument1 pageSample Letter of CreditMohammad A YousefNo ratings yet

- Applications of SukukDocument14 pagesApplications of SukukUsama AnsariiNo ratings yet

- Letter of CreditDocument7 pagesLetter of CreditCh WaqasNo ratings yet

- Imports With Letter of Credit in SAP ERPDocument8 pagesImports With Letter of Credit in SAP ERPMohamed QamarNo ratings yet

- Bank Guarantee ProcedureDocument1 pageBank Guarantee ProcedureLatiff IbrahimNo ratings yet

- Company Letter Head: Letter of Request (Lor)Document28 pagesCompany Letter Head: Letter of Request (Lor)Thomas HiggsNo ratings yet

- LC RemittanceDocument3 pagesLC Remittancemuhammad shahid ullahNo ratings yet

- mt101 ManualDocument53 pagesmt101 ManualNestor Julio Arias MonáNo ratings yet

- Treasury ManagementDocument47 pagesTreasury Managementsinghsudhir261No ratings yet

- Letter of Credit & Bank GuaranteeDocument3 pagesLetter of Credit & Bank GuaranteeAditya SharmaNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingRahul FouzdarNo ratings yet

- Roll No-D018, SAP ID - 80101190221Document9 pagesRoll No-D018, SAP ID - 80101190221Harsh GandhiNo ratings yet

- The Benefits of DocumentationDocument21 pagesThe Benefits of DocumentationFaisal HanifNo ratings yet

- A Guide ToDocument27 pagesA Guide Toneelamd456No ratings yet

- Letter of Credit - Assigment Banking 7th Semester 2Document7 pagesLetter of Credit - Assigment Banking 7th Semester 2khanzadaali717No ratings yet

- Letter of Credit Case StudyDocument9 pagesLetter of Credit Case StudyLiz KallistaNo ratings yet

- Letter of Credit HardDocument35 pagesLetter of Credit HardReHopNo ratings yet

- Test Document: Server/Client: QA / 070 Run No: 1 Run Date: Ticket #:1000000361/ 1000000284Document3 pagesTest Document: Server/Client: QA / 070 Run No: 1 Run Date: Ticket #:1000000361/ 1000000284raju_srinu06No ratings yet

- Activate Letter of Credit in SD DocumentsDocument4 pagesActivate Letter of Credit in SD Documentsraju_srinu06No ratings yet

- Letter of Credit ErrorDocument3 pagesLetter of Credit Errorraju_srinu06No ratings yet

- SAP CustomizingDocument341 pagesSAP Customizingapi-27246999100% (15)

- Process For Letter of CreditDocument2 pagesProcess For Letter of Creditraju_srinu06No ratings yet

- LED Monitor E2243FWKDocument64 pagesLED Monitor E2243FWKDipi SlowNo ratings yet

- Amazon SuitDocument15 pagesAmazon Suitfreddymartinez9No ratings yet

- Developing Living Cities From Analysis To Action PDFDocument314 pagesDeveloping Living Cities From Analysis To Action PDFKien VuNo ratings yet

- Rear Suspension: Group 34Document6 pagesRear Suspension: Group 34Davit OmegaNo ratings yet

- Aegle Marmelos: Aegle Marmelos L., Commonly Known As Bael (Or BiliDocument6 pagesAegle Marmelos: Aegle Marmelos L., Commonly Known As Bael (Or BiliBaldev ChaudharyNo ratings yet

- 9.igtr Aurangabad MCCM QualfileDocument23 pages9.igtr Aurangabad MCCM QualfilewarekarNo ratings yet

- Data Privacy Candidate Consent FormDocument2 pagesData Privacy Candidate Consent FormENG 1B - Tabing - Melanie AngelNo ratings yet

- Mtap Reviewer GR 6 2ND QDocument3 pagesMtap Reviewer GR 6 2ND QMaria Clariza CastilloNo ratings yet

- Application Form For Certificate For English Proficiency Migration Bonafide StudentsDocument1 pageApplication Form For Certificate For English Proficiency Migration Bonafide StudentsE-University OnlineNo ratings yet

- Master Assessor - Trainer GuideDocument338 pagesMaster Assessor - Trainer GuideBME50% (2)

- Aviat WTM3100 User ManualDocument66 pagesAviat WTM3100 User ManualFarooqhimedNo ratings yet

- TLE - AFA - FISH - PROCESSING 7 - 8 - w3Document4 pagesTLE - AFA - FISH - PROCESSING 7 - 8 - w3Marilyn Lamigo Bristol100% (1)

- London Itinerary: SUNDAY, 1.8Document24 pagesLondon Itinerary: SUNDAY, 1.8BlackMegNo ratings yet

- Craft: CopywritingDocument216 pagesCraft: CopywritingZaborra100% (1)

- iNUKE NU6000DSP: Service ManualDocument45 pagesiNUKE NU6000DSP: Service ManualHerberth BarriosNo ratings yet

- 587 enDocument2 pages587 enabhayundaleNo ratings yet

- Notes in Fluid MachineryDocument36 pagesNotes in Fluid MachineryIvanNo ratings yet

- Flow LinesDocument5 pagesFlow LinesShashwat OmarNo ratings yet

- Ladaga vs. MapaguDocument5 pagesLadaga vs. MapaguGenerosa GenosaNo ratings yet

- GPOADmin Quick Start Guide 58Document25 pagesGPOADmin Quick Start Guide 58Harikrishnan DhanapalNo ratings yet

- Identify Risk and Apply Risk Management ProcessesDocument14 pagesIdentify Risk and Apply Risk Management ProcessesS Qambar A Shah0% (1)

- District Memo District Nat Sts Kto12 FormsDocument2 pagesDistrict Memo District Nat Sts Kto12 FormsNica SalentesNo ratings yet

- Bootable USB Pen Drive Has Many Advantages Over Other Boot DrivesDocument3 pagesBootable USB Pen Drive Has Many Advantages Over Other Boot DrivesDebaditya ChakrabortyNo ratings yet

- Synchronverters: Inverters That Mimic Synchronous GeneratorsDocument9 pagesSynchronverters: Inverters That Mimic Synchronous GeneratorsNoita EnolaNo ratings yet

- GM 1927-16 - PcpaDocument12 pagesGM 1927-16 - PcpaNeumar NeumannNo ratings yet

- Sap Table RefDocument18 pagesSap Table RefArjun GhattamneniNo ratings yet

- Saddam CVDocument4 pagesSaddam CVmd saddamNo ratings yet

- Referencia M PDFDocument1,008 pagesReferencia M PDFrobertocarlosricciNo ratings yet

- Indian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDocument5 pagesIndian-Constitution GTU Study Material E-Notes Unit-5 25102019114854AMDharamNo ratings yet

- Performance Analysis Between RunC and Kata Container RuntimeDocument4 pagesPerformance Analysis Between RunC and Kata Container RuntimeClyde MarNo ratings yet