Professional Documents

Culture Documents

Currency Daily Report, August 7 2013

Currency Daily Report, August 7 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Full Carding Course by SudhanshuDocument7 pagesFull Carding Course by SudhanshuMiguel OrihuelaNo ratings yet

- Strategic Planning & Budget Essentials Part - 2 by GartnerDocument26 pagesStrategic Planning & Budget Essentials Part - 2 by GartnerRavi Teja ChillaraNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 24 2013Document4 pagesCurrency Daily Report, July 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, March 19Document4 pagesCurrency Daily Report, March 19Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report August 13Document4 pagesCurrency Daily Report August 13Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, February 12Document4 pagesCurrency Daily Report, February 12Angel BrokingNo ratings yet

- Currency Daily Report, July 22 2013Document4 pagesCurrency Daily Report, July 22 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report October 10Document4 pagesCurrency Daily Report October 10Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report August 17Document4 pagesCurrency Daily Report August 17Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Our Haus V Parian G.R. No. 204651Document4 pagesOur Haus V Parian G.R. No. 204651AP Cruz100% (1)

- Hand Grinder IncidentDocument1 pageHand Grinder IncidentMohammedNo ratings yet

- IAP GuidebookDocument21 pagesIAP Guidebooksuheena.CNo ratings yet

- Hindu Marriage ActDocument13 pagesHindu Marriage ActAshok GautamNo ratings yet

- Name: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistDocument6 pagesName: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistNadila OktarinaNo ratings yet

- Apl Apollo Annual Report 2017-18Document216 pagesApl Apollo Annual Report 2017-18Nitin PatidarNo ratings yet

- Full Download PDF of (Ebook PDF) Forensic Accounting and Fraud Examination 2nd Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Forensic Accounting and Fraud Examination 2nd Edition All Chapterguurhawk9100% (7)

- CA-10 PPP For DFA (Aug. 2012)Document21 pagesCA-10 PPP For DFA (Aug. 2012)Daily Kos ElectionsNo ratings yet

- Case 3-1 Prudent Provisions For PensionsDocument2 pagesCase 3-1 Prudent Provisions For PensionspamelaNo ratings yet

- TermProj assignMutFund 2019 SpringDocument1 pageTermProj assignMutFund 2019 Springjl123123No ratings yet

- Pilot Testing - 21st Century LiteratureDocument6 pagesPilot Testing - 21st Century LiteratureTanjiro KamadoNo ratings yet

- FS Q2 Module 2Document10 pagesFS Q2 Module 2Ahrcelie FranciscoNo ratings yet

- JLL - Shelley Street 15Document23 pagesJLL - Shelley Street 15Red Da KopNo ratings yet

- ORF IssueBrief 228 BuddhismDocument12 pagesORF IssueBrief 228 BuddhismAnkur RaiNo ratings yet

- A Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntDocument377 pagesA Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntLe Po100% (3)

- Business Intelligence (BI) Frequently Asked Questions (FAQ)Document9 pagesBusiness Intelligence (BI) Frequently Asked Questions (FAQ)Milind ChavareNo ratings yet

- PH Map-Regions-Province-FestivesDocument10 pagesPH Map-Regions-Province-FestivesishavlncrnaNo ratings yet

- Thermae RomaeDocument11 pagesThermae RomaeBerenice RamírezNo ratings yet

- Nova Scotia Home Finder January 2014Document104 pagesNova Scotia Home Finder January 2014Nancy BainNo ratings yet

- 13mar2020 Week11Document16 pages13mar2020 Week11cerejagroselhaNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Report-MKT 623-Promotional MarketingDocument22 pagesReport-MKT 623-Promotional MarketingMd. Faisal ImamNo ratings yet

- Gilgit BaltistanDocument4 pagesGilgit BaltistanJunaid HassanNo ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Rain Water Harvesting: The PotentialDocument25 pagesRain Water Harvesting: The PotentialMohamed NaveenNo ratings yet

- Lisacenter WolfempowermentDocument4 pagesLisacenter WolfempowermentVedvyas100% (2)

- Communication QuestionsDocument4 pagesCommunication QuestionsAmit Kumar JhaNo ratings yet

- Member Ethical StandardsDocument9 pagesMember Ethical StandardsEDWIN YEBRAIL BERNAL SANCHEZNo ratings yet

Currency Daily Report, August 7 2013

Currency Daily Report, August 7 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, August 7 2013

Currency Daily Report, August 7 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

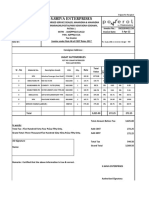

Currencies Daily Report

Wednesday| August 7, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Reena Rohit Chief Manager Non-Agri Commodities and Currencies Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company d does oes not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer er to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Wednesday| August 7, 2013

Highlights

Indian Rupee touched all time low of 61.87-mark mark in yesterdays trade. US Trade Balance was at a deficit of $34.2 billion in month of June June. German Factory Orders gained by 3.8 percent in the prior month. UKs Manufacturing Production grew by 1.9 percent in month of June.

Market Highlights (% change)

Last Prev. day

as on August 6, 2013 WoW MoM YoY

NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (Aug13) - $/bbl Comex Gold (Aug13) - $/oz Comex Silver(Sept13) $/oz LME Copper (3 month) -$/tonne G-Sec -10 yr @7.8% - Yield

5542.3 18733.0 15518.74 1697.4 16683.2 1959.2 58497.8 14506.3 105.30 1283.20 19.71

-2.5 -2.3 -0.6 -0.6 -0.4 -1.5 0.2 0.2 -1.2 -1.5 -1.0

-3.7 -3.2 0.0 4.0 0.8 2.2 20.5 -0.1 2.2 -2.2 0.2

-5.5 -3.9 1.5 4.0 6.4 7.4 25.5 0.0 -1.1 0.2 2.9

4.9 2.4 18.3 21.7 13.8 2.0 1.3 66.3 14.2 -20.4 -29.2

Asian markets are trading lower today on the back of statement from Federal Reserve member Charles Evans that it is quite likely the central bank will pullback its stimulus measures in current year. US Trade Balance was at a deficit of $34.2 billion in June as against a earlier deficit of $44.1 billion a month ago. Job Openings and Labor Turnover Summary (JOLTS) Job Openings was at 3.94 million in June from 3.83 million a month earlier. Investor's Business Daily (IBD) / TechnoMetrica Institute of Policy and Politics (TIPP) Economic Optimism fell by 2 points to 45.1-mark mark in August with respect to 47.1 47.1-level in July.

US Dollar Index

The US Dollar Index (DX) declined around 0.3 percent in yesterdays trade on the back of favorable economic data which showed signs of economic growth. However, positive economic data led to expectations that the Fed will pullback its stimulus measures coupled with rise in risk aversion in global market sentiments in later part of the trade cushioned sharp fall in the currency. Additionally, statement from Federal Reserve member Evans that there is probability of central bank cutting its stimulus measures in current year. The DX touched an intra intra-day low of 81.56 and closed at 81.66 on Tuesday.

6997.00 102.09

0.1 0.0

4.0 10.1

-10.8 4.6

-7.8 2.8

Source: Reuters

US Dollar (% change)

Last Prev. day WoW

as on August 6, 2013 MoM YoY

Dollar/INR

The Indian Rupee depreciated around 0.1 percent in yesterdays trading session. The currency depreciated preciated on the back of weak global and domestic markets coupled with strength in the DX in early part of the trade. Further, heavy dollar demand from importers also exerted downside pressure on the currency. However, sharp downside in the currency was cushioned as a result of appointment of Raghuram Rajan as new governor of Reserve Bank of India (RBI) raising hopes of new approach towards currency management. Additionally, , expectations that RBI will announce measures to attract foreign inflows by way of raising debt through state run banks and companies prevented evented fall in the currency. The Rupee touched an all time low of 61.866 and closed at 60.78 on Tuesday. For the month of August 2013, FII inflows totaled at Rs.440.30 crores th ($72.42 million) as on 5 August 2013. Year to date basis, net capital th inflows stood at Rs.66,990.90 crores ($12,633.50 million) till 5 August 2013. Outlook From the intra-day day perspective, we expect Indian Rupee to depreciate on the back of weak global market sentiments couple coupled with strength in the DX. . Additionally, dollar demand from importers and oil firms will exert downside pressure on the currency.

Dollar Index US $ / INR (Spot) US $ / INR Aug13 Futures (NSE) US $ / INR Aug13 Futures (MCX-SX)

81.66 60.78 61.46 61.47

-0.3 0.1 0.32 0.32

-0.3 0.0 1.44 1.47

-3.7 -0.9 1.44 1.47

2.8 -9.4 10.36 10.38

Technical Chart USD/INR

Source: Telequote

Technical Outlook

Trend US Dollar/INR Aug13 (NSE/MCX-SX) Up

valid for August 7, 2013 Support 61.30/61.10 Resistance 61.90/62.20

www.angelbroking.com

Currencies Daily Report

Wednesday| August 7, 2013

Euro/INR

The Euro appreciated around 0.4 percent in the yesterdays trading session on the back of weakness in the DX coupled with favorable economic data from the region. However, sharp upside in the currency was capped as result of weak global markets in later part of the trade. The Euro touched an intra-day high of 1.3323 and closed at 1.3 1.33305 against the dollar on Tuesday. Italian Industrial Production rose by 0.3 percent nt in June as against a rise of 0.1 percent a month ago. Italian Prelim Gross Domestic Product (GDP) fell by 0.2 percent in Q2 of 2013 from earlier decline of 0.6 percent in Q1 of 2013. German Factory Orders gained by 3.8 percent in June with respect to decline of 0.5 percent a month earlier. Outlook In todays session, Euro is expected to trade lower on the back of rise in risk aversion in the global market sentiments coupled with strength in the DX. . However, sharp downside in the currency would be cushioned as a result of expectations of favorable German industrial production data from the region. Technical Outlook

Trend Euro/INR Aug13 (NSE/MCX-SX) Sideways 81.40/81.10 81.90/82.20 valid for August 7, 2013 Support Resistance

Euro (% change)

Last Prev. day

as on August 6, 2013 WoW MoM YoY

Euro /$ (Spot) Euro / INR (Spot) Euro / INR July 13 Futures (NSE) Euro / INR July13 Futures (MCX-SX)

1.3305 80.87 81.6 81.6

0.4 -0.2 0.41 0.40

0.3 -0.3 4.65 4.72

3.7 -4.7 4.65 4.72

7.3 -15.6 18.50 18.51

Source: Reuters

Technical Chart Euro

Source: Telequote

GBP (% change)

as on August 6, 2013

GBP/INR

The Sterling Pound depreciated around 0.1 percent yesterday taking cues from weak global markets in later part of the trade trade. However, weakness in the DX along with upbeat global markets cushioned sharp fall in the currency. The Sterling Pound touched an intra intra-day low of 1.533 and closed at 1.5347 against dollar on Tuesday. day. UKs Halifax House Price Index (HPI) increased by 0.9 percent in July as against a rise of 0.7 percent in June. Manufacturing Production grew by 1.9 percent in June from decline of 0.7 percent a month ago. Industrial Production increased by 1.1 percent in the month of June. Outlook We expect Sterling Pound to trade lower on the back of weak global markets coupled with stronger DX. . However, sharp downside will be prevented or reversal can be seen on account of any major announcement from Governor of the country or inflation report report. Technical Outlook

Trend GBP/INR Aug 13 (NSE/MCX-SX) Sideways valid for August 7, 2013 Support 94.20/93.90 Resistance 94.80/95.10

Last

Prev. day

WoW

MoM

YoY

$ / GBP (Spot) GBP / INR (Spot) GBP / INR July13 Futures (NSE) GBP / INR July 13 Futures (MCX-SX)

1.5347 94.35

-0.07 0.07 0.37 -

0.7 -

3.1

-1.7 9.11

3.99

3.99

94.39

0.37

4.06

4.06

9.18

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

www.angelbroking.com

Currencies Daily Report

Wednesday| August 7, 2013

JPY/INR

The Japanese Yen appreciated around 0.6 percent in the yesterdays trade on account rise in risk aversion in the global market sentiments which led to rise in demand for the currency. The Yen touched an intraday high of 97.51 and closed at 97.74 against dollar on Tuesday. Outlook Fall in Japanese equities will lead to increase ease in demand for the Yen. On the back of this, we expect the Yen to appreciate in todays trading session. Technical Outlook

Trend JPY/INR Aug 13 (NSE/MCX-SX) Sideways valid for August 7, 2013 Support 62.50/62.20 Resistance 63.0/63.30

JPY (% change)

Last Prev day

as on August 6, 2013 WoW MoM YoY

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR July13 Futures (NSE) JPY 100 / INR July13 Futures (MCX-SX)

97.74

62.62 62.63 -

-0.6

-0.3

-

-3.4

3.38 3.41

24.4

-10.12 -10.14

0.69 0.65

3.38 3.41

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on August 7 7, 2013

Indicator Country Time (IST) Actual Forecast Previous Impact

BOE Gov Carney Speaks BOE Inflation Report German Industrial Production m/m Crude Oil Inventories 10-y Bond Auction

UK UK Euro US US

3:00pm 3:00pm 3:30pm 8:00pm 10:30pm

0.3% -

-1.0% 0.4M 2.67/2.6

High High Medium Medium Medium

www.angelbroking.com

You might also like

- The Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketFrom EverandThe Art of Currency Trading: A Professional's Guide to the Foreign Exchange MarketRating: 4.5 out of 5 stars4.5/5 (4)

- Full Carding Course by SudhanshuDocument7 pagesFull Carding Course by SudhanshuMiguel OrihuelaNo ratings yet

- Strategic Planning & Budget Essentials Part - 2 by GartnerDocument26 pagesStrategic Planning & Budget Essentials Part - 2 by GartnerRavi Teja ChillaraNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 5 2013Document4 pagesCurrency Daily Report, August 5 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Currency Daily Report 07 March 2013Document4 pagesCurrency Daily Report 07 March 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 24 2013Document4 pagesCurrency Daily Report, July 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 27 2013Document4 pagesCurrency Daily Report, May 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 14Document4 pagesCurrency Daily Report, March 14Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 20Document4 pagesCurrency Daily Report, February 20Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, March 19Document4 pagesCurrency Daily Report, March 19Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Currency Daily Report August 13Document4 pagesCurrency Daily Report August 13Angel BrokingNo ratings yet

- Currency Daily Report, April 23Document4 pagesCurrency Daily Report, April 23Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, February 12Document4 pagesCurrency Daily Report, February 12Angel BrokingNo ratings yet

- Currency Daily Report, July 22 2013Document4 pagesCurrency Daily Report, July 22 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report October 10Document4 pagesCurrency Daily Report October 10Angel BrokingNo ratings yet

- Currency Daily Report, June 20 2013Document4 pagesCurrency Daily Report, June 20 2013Angel BrokingNo ratings yet

- Currency Daily Report August 17Document4 pagesCurrency Daily Report August 17Angel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Our Haus V Parian G.R. No. 204651Document4 pagesOur Haus V Parian G.R. No. 204651AP Cruz100% (1)

- Hand Grinder IncidentDocument1 pageHand Grinder IncidentMohammedNo ratings yet

- IAP GuidebookDocument21 pagesIAP Guidebooksuheena.CNo ratings yet

- Hindu Marriage ActDocument13 pagesHindu Marriage ActAshok GautamNo ratings yet

- Name: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistDocument6 pagesName: Nadila Oktarina NIM:12203173033 Class: Tbi 4B: Westland Row Ophthalmologist and ENT SpecialistNadila OktarinaNo ratings yet

- Apl Apollo Annual Report 2017-18Document216 pagesApl Apollo Annual Report 2017-18Nitin PatidarNo ratings yet

- Full Download PDF of (Ebook PDF) Forensic Accounting and Fraud Examination 2nd Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Forensic Accounting and Fraud Examination 2nd Edition All Chapterguurhawk9100% (7)

- CA-10 PPP For DFA (Aug. 2012)Document21 pagesCA-10 PPP For DFA (Aug. 2012)Daily Kos ElectionsNo ratings yet

- Case 3-1 Prudent Provisions For PensionsDocument2 pagesCase 3-1 Prudent Provisions For PensionspamelaNo ratings yet

- TermProj assignMutFund 2019 SpringDocument1 pageTermProj assignMutFund 2019 Springjl123123No ratings yet

- Pilot Testing - 21st Century LiteratureDocument6 pagesPilot Testing - 21st Century LiteratureTanjiro KamadoNo ratings yet

- FS Q2 Module 2Document10 pagesFS Q2 Module 2Ahrcelie FranciscoNo ratings yet

- JLL - Shelley Street 15Document23 pagesJLL - Shelley Street 15Red Da KopNo ratings yet

- ORF IssueBrief 228 BuddhismDocument12 pagesORF IssueBrief 228 BuddhismAnkur RaiNo ratings yet

- A Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntDocument377 pagesA Cup of Trembling (Jerusalem and Bible Prophecy) - Dave HuntLe Po100% (3)

- Business Intelligence (BI) Frequently Asked Questions (FAQ)Document9 pagesBusiness Intelligence (BI) Frequently Asked Questions (FAQ)Milind ChavareNo ratings yet

- PH Map-Regions-Province-FestivesDocument10 pagesPH Map-Regions-Province-FestivesishavlncrnaNo ratings yet

- Thermae RomaeDocument11 pagesThermae RomaeBerenice RamírezNo ratings yet

- Nova Scotia Home Finder January 2014Document104 pagesNova Scotia Home Finder January 2014Nancy BainNo ratings yet

- 13mar2020 Week11Document16 pages13mar2020 Week11cerejagroselhaNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Report-MKT 623-Promotional MarketingDocument22 pagesReport-MKT 623-Promotional MarketingMd. Faisal ImamNo ratings yet

- Gilgit BaltistanDocument4 pagesGilgit BaltistanJunaid HassanNo ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Rain Water Harvesting: The PotentialDocument25 pagesRain Water Harvesting: The PotentialMohamed NaveenNo ratings yet

- Lisacenter WolfempowermentDocument4 pagesLisacenter WolfempowermentVedvyas100% (2)

- Communication QuestionsDocument4 pagesCommunication QuestionsAmit Kumar JhaNo ratings yet

- Member Ethical StandardsDocument9 pagesMember Ethical StandardsEDWIN YEBRAIL BERNAL SANCHEZNo ratings yet