Professional Documents

Culture Documents

Globalization in Financial Environment

Globalization in Financial Environment

Uploaded by

abdakbarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Globalization in Financial Environment

Globalization in Financial Environment

Uploaded by

abdakbarCopyright:

Available Formats

“Globalization in financial environment”

• Financial globalization has increased pressure and impact on the national

industries of developing countries. For historical reasons, the developing

countries' economic structure is fragile, their capital is scarce, technology

backward and market growth immature. They are vulnerable to impact in the

process of being merged into economic globalization, so they not only need

private investment and technological aid from the developed nations, but all the

more need the assistance of official capital.

• In fact, the developed nations' official capital flowing into developing countries in

the past 10 years has notably decreased. Many developed countries have failed

to earnestly undertake their responsibilities, falling far short of fulfilling the

internationally acknowledged target for aiding the developing countries.

• The World Bank report "1999 Global Development Fund" shows that the amount

of developed nations' official capital flowing into developing countries has fallen

from approximately US$60 billion in 1990 to less than US$45 billion at present.

• Financial globalization under the condition of economic globalization has, without

doubt, accelerated the flow of international capital, it, however, has also

increased the financial risk of the developing countries. Under the circumstance

wherein the financial system is not perfect and financial control capability is not

strong, if the developing countries blindly open their domestic financial market,

the negative influence of financial globalization will stand out. The best illustration

of this is the eruption of the Asian financial crisis in 1997.

• The negative influences brought about by the tide of economic globalization

obviously is not the development target of humanity. The developed nations

should bear certain responsibility for the emergence of these consequences. In

the world economic arena, the fact that the developed nations are both the

participants in the play and the makers of regulations on the play determines that

in the solutions of many international trade problems and the formulation of trade

regulations, the voice of the poor developing countries is weak.

• One measure of the extent of globalization is the volume of

international financial transactions, with over $1.2 trillion

flowing

through New York currency markets each day, and with the

volume

of daily international stock market transactions exceeding

this enormous amount.

“Six main forces with four main aspects of globalization

in Financial environment"

Forces:

Innovation and technological progress

Integration of economies

Information revolution

Advances in Communication

Advances in Transportation

Aspects:

Trade,

Capital movements,

Movement of people and finally

Spread of knowledge (and technology)

“Reasons of Globalization in world’s financial

Envirnoment”

increases in worldwide trade and exchanges in an increasingly

open,

integrated, and borderless.

people moving through international travel and migration

integration of markets on a worldwide basis, and a movement

toward a borderless world, all of which have led to increases in

global flows.

significantly lowered the costs of transportation and

communication and dramatically lowered the costs of data

processing and information storage and retrieval.

A significance source of globalization has been trade

liberalization and other forms of economic liberalization that

have led to reductions in trade protection and to a more liberal

world trading system.

Formation of multi National companies and businesses and

where these companies go their financial trades and works can

be seen easily through the head quarters of these companies.

Return on investment (ROI) is High so businesses are globalizing not

only in financial area but also in operations ,marketing and other areas

--------------------------------

You might also like

- PerpetuityDocument22 pagesPerpetuityarif nugrahaNo ratings yet

- The Importance of International Trade All Over The WorldDocument18 pagesThe Importance of International Trade All Over The WorldEhesanulHaqueSaifNo ratings yet

- TOWS Matrix To VolkswagenDocument2 pagesTOWS Matrix To Volkswagenabdakbar100% (2)

- Grapes Raisin (Kishmish)Document8 pagesGrapes Raisin (Kishmish)Paneendra KumarNo ratings yet

- What Is GlobalizationDocument22 pagesWhat Is GlobalizationPrashant SharmaNo ratings yet

- Globalisation - A-Level EconomicsDocument15 pagesGlobalisation - A-Level EconomicsjannerickNo ratings yet

- Chapter IDocument22 pagesChapter IAshantiliduNo ratings yet

- Globalization: Historical DevelopmentDocument9 pagesGlobalization: Historical DevelopmentManisha TomarNo ratings yet

- Globalization Processes and Geoeconomic StrategiesDocument56 pagesGlobalization Processes and Geoeconomic StrategiesОксана ЛипееваNo ratings yet

- Answer: The Term "Globalization" Has Acquired Considerable Emotive Force. Some View It As Process That IsDocument2 pagesAnswer: The Term "Globalization" Has Acquired Considerable Emotive Force. Some View It As Process That IsMD RezaNo ratings yet

- 305-Int Fin-NotesDocument6 pages305-Int Fin-NotesRutik PatilNo ratings yet

- International BusinessDocument27 pagesInternational BusinessRizsNo ratings yet

- Economic Risk of GlobalizationDocument4 pagesEconomic Risk of Globalizationfarhad5685390535No ratings yet

- Introduction To International BusinessDocument34 pagesIntroduction To International Businessmanasi sadavarteNo ratings yet

- Q1. Write A Note On Globalization.: 1. Trade: Developing Countries As A Whole Have Increased Their Share of World TradeDocument6 pagesQ1. Write A Note On Globalization.: 1. Trade: Developing Countries As A Whole Have Increased Their Share of World TradeYogesh MishraNo ratings yet

- Intl FinanceDocument10 pagesIntl FinanceMAYNo ratings yet

- Glob Il IzationDocument22 pagesGlob Il IzationEyosyas WoldekidanNo ratings yet

- Financial Management in A Global PerspectiveDocument6 pagesFinancial Management in A Global PerspectiveRaj AnwarNo ratings yet

- Unit 4Document9 pagesUnit 4rmewan30No ratings yet

- Global Economy - Economics - NotesDocument19 pagesGlobal Economy - Economics - NotesSeth kumiNo ratings yet

- Economic Globalization Is One of The Three Main Dimensions of Globalization Commonly FoundDocument3 pagesEconomic Globalization Is One of The Three Main Dimensions of Globalization Commonly FoundAngeline De ChavezNo ratings yet

- APRIL 2019 International Finance Question PaperDocument9 pagesAPRIL 2019 International Finance Question PaperApruva BelapurkarNo ratings yet

- GE 5 Contempo (Prelim Reviewer)Document4 pagesGE 5 Contempo (Prelim Reviewer)RothNo ratings yet

- Analysing The Role of Foreign Trade On Economic Development of NationDocument6 pagesAnalysing The Role of Foreign Trade On Economic Development of NationAhmad AbdullahNo ratings yet

- IBT - Chapter 1Document35 pagesIBT - Chapter 1Grace DNo ratings yet

- Responding To Globalization: India's AnswerDocument14 pagesResponding To Globalization: India's Answerneelesh_361497No ratings yet

- Lesson 2.1 The Global EconomyDocument9 pagesLesson 2.1 The Global EconomyRenelyn LimNo ratings yet

- Ge 3 Chapter IiDocument27 pagesGe 3 Chapter IiRyan SalipsipNo ratings yet

- Economic Structure of GlobalizationDocument47 pagesEconomic Structure of GlobalizationFilipinas YabesNo ratings yet

- Types of Globalisation, Merits and DemeritsDocument25 pagesTypes of Globalisation, Merits and DemeritsLokeCheeYanNo ratings yet

- Financial Resources For Economic DevelopmentDocument27 pagesFinancial Resources For Economic DevelopmentaizentaijoNo ratings yet

- IBF ch1Document36 pagesIBF ch1meka mehdeNo ratings yet

- Global Business TodayDocument37 pagesGlobal Business TodayLINH NGUYỄN KHÁNHNo ratings yet

- CHAPTER 2: The Structures of GlobalizationDocument14 pagesCHAPTER 2: The Structures of GlobalizationRanz Denzel Isaac SolatorioNo ratings yet

- Business GlobalizationDocument2 pagesBusiness GlobalizationShreejan PandeyNo ratings yet

- CONWORLDDocument3 pagesCONWORLDCollege DumpfilesNo ratings yet

- Topic 2-Globalization and Tourism DevelopmentDocument57 pagesTopic 2-Globalization and Tourism DevelopmentLidyaRNo ratings yet

- Assignment GlobalisationDocument15 pagesAssignment GlobalisationramlogunsandhyaNo ratings yet

- Y V Reddy Towards Globalization in The Financial Sector in IndiaDocument8 pagesY V Reddy Towards Globalization in The Financial Sector in Indiaashoku_s01No ratings yet

- Chap 001Document18 pagesChap 001Uzair FeerozeNo ratings yet

- Devt Econ II PPT 5.1Document19 pagesDevt Econ II PPT 5.1mesobewerkeNo ratings yet

- MB0037 International Business ManagementDocument23 pagesMB0037 International Business ManagementsasyamNo ratings yet

- International FinanceDocument207 pagesInternational FinanceAnitha Girigoudru50% (2)

- Afu 08504 - International Finance - Introduction and The ImsDocument18 pagesAfu 08504 - International Finance - Introduction and The ImsAbdulkarim Hamisi KufakunogaNo ratings yet

- Globalization and Impact On BusinessDocument2 pagesGlobalization and Impact On BusinessSaad BenzaidaNo ratings yet

- Master of Business Administration-MBA Semester 4cDocument15 pagesMaster of Business Administration-MBA Semester 4cChitra KotihNo ratings yet

- New Microsoft Word DocumentDocument22 pagesNew Microsoft Word DocumentAjay PandayNo ratings yet

- Chap 001Document18 pagesChap 001m khubaibNo ratings yet

- Issues Brief - Globalization - A Brief OverviewDocument12 pagesIssues Brief - Globalization - A Brief OverviewVon Rother Celoso DiazNo ratings yet

- IB PPT Ch1iDocument33 pagesIB PPT Ch1iMỹ Duyên LêNo ratings yet

- Exchange Rate and Capital Account Management For Developing CountriesDocument10 pagesExchange Rate and Capital Account Management For Developing CountriesJace BezzitNo ratings yet

- Globalization - A Brief OverviewDocument8 pagesGlobalization - A Brief OverviewfbonciuNo ratings yet

- Foreign Aid For DevelopmentDocument24 pagesForeign Aid For DevelopmentMukund GuptaNo ratings yet

- Chap 002Document17 pagesChap 002Dino DizonNo ratings yet

- BBA603 SLM Unit 01 PDFDocument14 pagesBBA603 SLM Unit 01 PDFAditya NairNo ratings yet

- Business Environment Presentation: Master of Commerce, Honours (Mcom-Hons)Document95 pagesBusiness Environment Presentation: Master of Commerce, Honours (Mcom-Hons)Shivika kaushikNo ratings yet

- Importance of International FinanceDocument4 pagesImportance of International FinanceNandini Jagan29% (7)

- IFM Notes 1Document108 pagesIFM Notes 1Suresh Varma SNo ratings yet

- Economic Development. CHAPTER 15Document8 pagesEconomic Development. CHAPTER 15Mica Joy GallardoNo ratings yet

- Impact of Globalization in Global Economic and Financial CrisisDocument7 pagesImpact of Globalization in Global Economic and Financial CrisisHasibun ShuhadNo ratings yet

- Economic Globalization 1Document7 pagesEconomic Globalization 1Geneva CaveNo ratings yet

- The Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichFrom EverandThe Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichNo ratings yet

- Summary Of "The Difficult International Insertion Of Latin America" By Enrique Iglesias: UNIVERSITY SUMMARIESFrom EverandSummary Of "The Difficult International Insertion Of Latin America" By Enrique Iglesias: UNIVERSITY SUMMARIESNo ratings yet

- IT 2 Return2010witoutFormulas (Draft)Document7 pagesIT 2 Return2010witoutFormulas (Draft)abdakbarNo ratings yet

- IT 2 Return2010witoutFormulas (Draft)Document7 pagesIT 2 Return2010witoutFormulas (Draft)abdakbarNo ratings yet

- Energy Drinks in PakistanDocument138 pagesEnergy Drinks in Pakistanabdakbar100% (2)

- IT 2 Return2010witoutFormulas (Draft)Document7 pagesIT 2 Return2010witoutFormulas (Draft)abdakbarNo ratings yet

- Jit and Lean ProductionDocument31 pagesJit and Lean ProductionabdakbarNo ratings yet

- MetroDocument16 pagesMetroabdakbar100% (3)

- DWH MiningDocument6 pagesDWH MiningabdakbarNo ratings yet

- Facts About Palestine and Israel: Presented By: World Islamic NetworkDocument8 pagesFacts About Palestine and Israel: Presented By: World Islamic NetworkabdakbarNo ratings yet

- Project Presentation S O N YDocument25 pagesProject Presentation S O N Yabdakbar100% (1)

- Implementation of MIS in OrganizationDocument4 pagesImplementation of MIS in OrganizationabdakbarNo ratings yet

- Pizza Industry of PakistanDocument9 pagesPizza Industry of Pakistanabdakbar100% (1)

- Capital Market and Impact On Economy of PakistanDocument5 pagesCapital Market and Impact On Economy of PakistanabdakbarNo ratings yet

- Cutlery Industry in PakistanDocument22 pagesCutlery Industry in PakistanabdakbarNo ratings yet

- Working Paper 2Document11 pagesWorking Paper 2abdakbarNo ratings yet

- Gourmet BakeryDocument12 pagesGourmet Bakeryabdakbar60% (5)

- PRJDocument13 pagesPRJabdakbarNo ratings yet

- Strindberg (1849-1912), Swedish DramatistDocument9 pagesStrindberg (1849-1912), Swedish DramatistabdakbarNo ratings yet

- MetroDocument16 pagesMetroabdakbar100% (3)

- The Development of Debt Securities Market Country Experience of PakistanDocument12 pagesThe Development of Debt Securities Market Country Experience of PakistanabdakbarNo ratings yet

- CaseDocument2 pagesCaseabdakbarNo ratings yet

- Shopping ManiaDocument15 pagesShopping Maniaabdakbar100% (6)

- Mobile Phone Shop Business Plan Executive SummaryDocument11 pagesMobile Phone Shop Business Plan Executive SummaryGary KiDz50% (2)

- Final Exam ProposedDocument12 pagesFinal Exam ProposedGech DebNo ratings yet

- Problems of Merchant BankersDocument2 pagesProblems of Merchant BankersMohith Sharma75% (12)

- Sunway: Company ReportDocument4 pagesSunway: Company ReportBrian StanleyNo ratings yet

- Analysis of Indian EconomyDocument41 pagesAnalysis of Indian EconomySaurav GhoshNo ratings yet

- Credit Appraisal in Banking Sector PPT at Bec DomsDocument31 pagesCredit Appraisal in Banking Sector PPT at Bec DomsBabasab Patil (Karrisatte)100% (2)

- Midland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoyDocument13 pagesMidland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoymariliamonfardineNo ratings yet

- 2.2 Ukulima Sacco Audited Accounts Year 2014Document27 pages2.2 Ukulima Sacco Audited Accounts Year 2014sebichondoNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set ADocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set AleshamunsayNo ratings yet

- 2010 Annual ReportDocument68 pages2010 Annual ReportMbongeni ShongweNo ratings yet

- Week 2 - Credit Transactions (Mutuum) Full-TextDocument44 pagesWeek 2 - Credit Transactions (Mutuum) Full-TextMaestro LazaroNo ratings yet

- Banking NotesDocument28 pagesBanking NotesnitiNo ratings yet

- Agriculture (Ias 41) : OpentuitionDocument15 pagesAgriculture (Ias 41) : OpentuitionHamza Ali100% (1)

- Instructor: FAISAL SARWAR: Ushair Fareed Zahra Sadiq Abdul MoizDocument42 pagesInstructor: FAISAL SARWAR: Ushair Fareed Zahra Sadiq Abdul MoizushairNo ratings yet

- Akuntansi Perusahaan Dagang Panorama HijauDocument27 pagesAkuntansi Perusahaan Dagang Panorama Hijausintya saputri100% (1)

- Banking Law Unit 2Document17 pagesBanking Law Unit 2D. BharadwajNo ratings yet

- Financial Regulation and Capital Adequacy: Arthur Centonze FIN644 - Slides 6Document45 pagesFinancial Regulation and Capital Adequacy: Arthur Centonze FIN644 - Slides 6Robert LongoNo ratings yet

- Harrod's Sporting GoodsDocument17 pagesHarrod's Sporting GoodsElisabete PadilhaNo ratings yet

- Drills Notes Receivable To Discounting of ReceivableDocument3 pagesDrills Notes Receivable To Discounting of ReceivableVincent AbellaNo ratings yet

- Cfs NumericalsDocument12 pagesCfs NumericalsNeelu AhluwaliaNo ratings yet

- G9's Project Overview Sem 2Document2 pagesG9's Project Overview Sem 2Jenny NguyenNo ratings yet

- Group 2-Transparency & DisclosureDocument12 pagesGroup 2-Transparency & DisclosureSoo CealNo ratings yet

- Account Statement - 2022 10 01 - 2022 10 13Document1 pageAccount Statement - 2022 10 01 - 2022 10 13Gary EcclesNo ratings yet

- On Site Inspection Manual, 2064 (English)Document33 pagesOn Site Inspection Manual, 2064 (English)sujit kcNo ratings yet

- Indian Insurance SectorDocument24 pagesIndian Insurance SectorDivye SharmaNo ratings yet

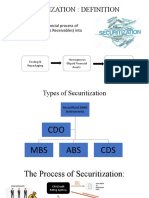

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- Principles ExcerptDocument41 pagesPrinciples ExcerptDarrenJohnsonNo ratings yet

- Click For Merger Letter:: Kotak Indo World Infrastructure FundDocument1 pageClick For Merger Letter:: Kotak Indo World Infrastructure FundPriyanka PatelNo ratings yet