Professional Documents

Culture Documents

Daily Metals and Energy Report, August 8 2013

Daily Metals and Energy Report, August 8 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- Being The Principal Powerpoint Ead 501Document15 pagesBeing The Principal Powerpoint Ead 501api-337555351100% (9)

- Living Under The Crescent MoonDocument20 pagesLiving Under The Crescent MoonhelenaladeiroNo ratings yet

- Daily Metals and Energy Report, August 6 2013Document6 pagesDaily Metals and Energy Report, August 6 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 18 2013Document6 pagesDaily Metals and Energy Report, July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 26 2013Document6 pagesDaily Metals and Energy Report, July 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 21 2013Document6 pagesDaily Metals and Energy Report, August 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 15 2013Document6 pagesDaily Metals and Energy Report, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 14 2013Document6 pagesDaily Metals and Energy Report, August 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 5 2013Document6 pagesDaily Metals and Energy Report, July 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 12 2013Document6 pagesDaily Metals and Energy Report, August 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 13 2013Document6 pagesDaily Metals and Energy Report, June 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 19 2013Document6 pagesDaily Metals and Energy Report, June 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 10 2013Document6 pagesDaily Metals and Energy Report, June 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 19 2013Document6 pagesDaily Metals and Energy Report, July 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 27 2013Document6 pagesDaily Metals and Energy Report, June 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 9 2013Document6 pagesDaily Metals and Energy Report, July 9 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 23 2013Document6 pagesDaily Metals and Energy Report, July 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 13 2013Document6 pagesDaily Metals and Energy Report, August 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28 2013Document6 pagesDaily Metals and Energy Report August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 5 2013Document6 pagesDaily Metals and Energy Report, June 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 29 2013Document6 pagesDaily Metals and Energy Report August 29 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 22 2013Document6 pagesDaily Metals and Energy Report, August 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 5 2013Document6 pagesDaily Metals and Energy Report September 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 7 2013Document6 pagesDaily Metals and Energy Report, August 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 5 2013Document6 pagesDaily Metals and Energy Report, August 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 12 2013Document6 pagesDaily Metals and Energy Report, June 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 20 2013Document6 pagesDaily Metals and Energy Report, August 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 11 2013Document6 pagesDaily Metals and Energy Report, July 11 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 9Document6 pagesDaily Metals and Energy Report August 9Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 25Document6 pagesDaily Metals and Energy Report, March 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 10 2013Document6 pagesDaily Metals and Energy Report September 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 26 2013Document6 pagesDaily Metals and Energy Report August 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 23 2013Document6 pagesDaily Metals and Energy Report, August 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 27 2013Document6 pagesDaily Metals and Energy Report August 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 22 2013Document6 pagesDaily Metals and Energy Report, July 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 22 2013Document6 pagesDaily Metals and Energy Report, May 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 23 2013Document6 pagesDaily Metals and Energy Report, May 23 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 2 2013Document6 pagesDaily Metals and Energy Report September 2 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report 07 March 2013Document6 pagesDaily Metals and Energy Report 07 March 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 24 2013Document6 pagesDaily Metals and Energy Report, June 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 14 2013Document6 pagesDaily Metals and Energy Report, June 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 14 2013Document6 pagesDaily Metals and Energy Report, May 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 16 2013Document6 pagesDaily Metals and Energy Report, July 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 13Document6 pagesDaily Metals and Energy Report, February 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 20 2013Document6 pagesDaily Metals and Energy Report, May 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 15Document6 pagesDaily Metals and Energy Report, March 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report Jan 04Document6 pagesDaily Metals and Energy Report Jan 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 26Document6 pagesDaily Metals and Energy Report September 26Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 7 2013Document6 pagesDaily Metals and Energy Report, June 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 19 2013Document6 pagesDaily Metals and Energy Report, August 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 17 2013Document6 pagesDaily Metals and Energy Report, June 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 10Document6 pagesDaily Metals and Energy Report, April 10Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 13Document6 pagesDaily Metals and Energy Report, March 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 18Document6 pagesDaily Metals and Energy Report, March 18Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 20 2013Document6 pagesDaily Metals and Energy Report, June 20 2013Angel BrokingNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Arts 10 4th QuarterDocument37 pagesArts 10 4th QuarterSamantha DelaraNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- SYLLABUS-English 101-Borg D-16236-FA2020Document7 pagesSYLLABUS-English 101-Borg D-16236-FA2020L MNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument82 pagesStock Screener, Technical Analysis Scannerravi kumarNo ratings yet

- Hand Grinder IncidentDocument1 pageHand Grinder IncidentMohammedNo ratings yet

- IntroductionDocument59 pagesIntroductionCIRI CORPORATENo ratings yet

- The+Gambia+Law+Reports+1997+ +2001Document115 pagesThe+Gambia+Law+Reports+1997+ +2001Zeynab Gazal - ZaizalNo ratings yet

- Hello Teacher and EverybodyDocument2 pagesHello Teacher and EverybodyThanh HuyennNo ratings yet

- Church Is Citizen of The Year: EventsDocument8 pagesChurch Is Citizen of The Year: EventsDaveNo ratings yet

- Upload Documents For Free AccessDocument3 pagesUpload Documents For Free AccessNitish RajNo ratings yet

- Dear John Book AnalysisDocument2 pagesDear John Book AnalysisQuincy Mae MontereyNo ratings yet

- PH Map-Regions-Province-FestivesDocument10 pagesPH Map-Regions-Province-FestivesishavlncrnaNo ratings yet

- Geography P2 Nov 2021 MG EngDocument13 pagesGeography P2 Nov 2021 MG EngAlfa VutiviNo ratings yet

- College Accounting A Practical Approach Canadian 12th Edition Slater Test BankDocument30 pagesCollege Accounting A Practical Approach Canadian 12th Edition Slater Test Bankthomasgillespiesbenrgxcow100% (27)

- Strategic and Operational PlanningDocument7 pagesStrategic and Operational PlanninggwapdoseNo ratings yet

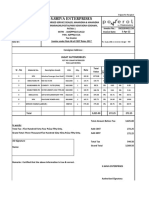

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNo ratings yet

- Lesson Plan in Teaching Mapeh 8Document9 pagesLesson Plan in Teaching Mapeh 8Kimverly zhaira DomaganNo ratings yet

- CHN ReviewerDocument10 pagesCHN ReviewerAyessa Yvonne PanganibanNo ratings yet

- Customer Value ManagementDocument31 pagesCustomer Value ManagementP RAGHU VAMSYNo ratings yet

- Get Set Case - WeRock - IIM KozhikodeDocument7 pagesGet Set Case - WeRock - IIM KozhikodeKESHAV RATHI 01No ratings yet

- Lessee's Per Procedure AnalysisDocument4 pagesLessee's Per Procedure AnalysisShafiq0% (1)

- How To Grow Your Business Using BaZi PDFDocument18 pagesHow To Grow Your Business Using BaZi PDFanudora100% (1)

- Business Office Manager Administrator in NYC Resume M Crawford GardnerDocument3 pagesBusiness Office Manager Administrator in NYC Resume M Crawford GardnerMCrawfordGardnerNo ratings yet

- Intelsat 21 at 58Document4 pagesIntelsat 21 at 58Antonio ÁlcarezNo ratings yet

- Jeanne G. Quimata: Mitchell F. Thompson, EsqDocument3 pagesJeanne G. Quimata: Mitchell F. Thompson, EsqEquality Case FilesNo ratings yet

- English 4Document7 pagesEnglish 4Jane Balneg-Jumalon TomarongNo ratings yet

Daily Metals and Energy Report, August 8 2013

Daily Metals and Energy Report, August 8 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Metals and Energy Report, August 8 2013

Daily Metals and Energy Report, August 8 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Thursday| August 8, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Reena Rohit Chief Manager Non-Agri Currencies and Commodities Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn gn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company d does oes not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, dist distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| August 8, 2013

International Commodities

Overview

Chinas Trade Balance was at a surplus of $17.8 billion in July. German Industrial Production increased by 2.4 percent in June June. Japans Current Account was at a surplus of 0.65 trillion Yen in June. French Trade Balance was at deficit of 4.4 billion Euros in prior month.

Market Highlights (% change)

Last INR/$ (Spot) 61.2 Prev day -0.7 0.7

as on 7 August, 2013 w-o-w -0.6 m-o-m -0.9 y-o-y -9.7

Asian markets are trading higher today ahead of the Bank of Japan (BOJ) policy meeting and Chinese Trade Balance data. It is expected that BOJ will keep its policy unchanged in todays meeting and more stimulus can be estimated over next ten months from Governor Haruhiko Kuroda as their main target is to achieve inflation of 2 percent. Chinas Trade Balance was at a surplus of $17.8 billion in July from earlier surplus of $27.1 billion in June. The US Dollar Index (DX) declined around 0.4 percent in yesterdays trade on the back of favorable economic data from previous sessions showing signs of economic growth. wth. However, positive economic data has led to expectations that the Fed will pullback its stimulus measures coupled with rise in risk aversion in global market sentiments cushioned sharp fall in the currency. The DX touched an intra-day low of 81.27 and closed at 81.32 on Wednesday. The Indian Rupee depreciated around 0.7 percent in yesterdays trading session. The currency depreciated on the back of weak global and domestic markets coupled with strength in the DX in early part of the trade. Further, heavy avy dollar demand from importers also exerted downside pressure on the currency. However, sharp downside in the currency was cushioned as a result of expectations that Reserve Bank of India (RBI) will ease its norms for External Commercial Borrowing (ECB). ). Additionally, selling of dollars from central banks along with expectations that RBI will come up with some measures prevented sharp fall in the currency. The Rupee touched an intra-day day low of 61.461 and closed at 61.20 on Wednesday. f August 2013, FII inflows totaled at Rs.1406 crores For the month of th ($230.44 million) as on 7 August 2013. Year to date basis, net capital th inflows stood at Rs.67498.40 crores ($12,716.20 million) till 7 August 2013. Japans Current Account was at a surplus of 0.65 trillion Yen in June as against a earlier surplus of 0.62 trillion Yen a month ago. Bank Lending was at 2 percent in July from 1.9 percent in June.

$/Euro (Spot)

1.3336

0.2

0.3

3.6

7.9

Dollar Index NIFTY

81.32

-0.4 0.4

-0.3

-3.5

2.3

5519.1

-0.4 0.4

-3.9

-5.0

4.5

SENSEX

18664.9

-0.4 0.4

-3.5

-3.4

2.1

DJIA

15470.7

-0.3 0.3

-0.2

0.1

17.5

S&P

1690.9

-0.4 0.4

3.6

3.6

20.7

Source: Reuters

The Euro appreciated around 0.2 percent in the yesterdays trading session on the back of weakness in the DX coupled with favorable economic data from the region. However, sharp upside in the currency was capped as result of weak global markets sentiments. The Euro o touched an intra-day intra high of 1.3345 and closed at 1.3336 against the dollar on Wednesday. Wednesday French Trade Balance was at a deficit of 4.4 billion Euros in June as against a previous deficit of 5.7 billion Euros a month ago. German Industrial Production increased inc by 2.4 percent in June from earlier decline of 0.8 percent in earlier month.

www.angelcommodities.com

Commodities Daily Report

Thursday| August 8, 2013

International Commodities

Bullion Gold

Spot gold prices declined around 0.5 percent in the yesterdays trade on the back of weakness in the DX. However, sharp upside in prices was capped as a result of fall in SPDR gold holdings by 0.5 percent in yesterdays trade and stood at 910.53 tonnes which is at lowest level since February 2009. Further, weak global market sentiments prevented sharp fall in prices. The yellow metal touched an intra-day low of $1272. .64/oz and closed at $1287.1/oz in the yesterdays trading session. In the Indian markets, prices traded on a positive note and gained around 0.2 percent on account of depreciation in the Rupee and closed at Rs.27,677/10 gms after touching a high of Rs.27 7,718/10 gms on Wednesday. Market Highlights - Gold (% change)

Gold Gold (Spot) Unit $/oz Last 1287.1 Prev. day 0.5 as on 7 August, 2013 WoW -2.7 MoM 4.1 YoY -20.1

Gold (Spot Mumbai) Gold (LBMA-PM Fix) Comex Gold (Oct13) MCX Gold (Oct13)

Rs/10 gms $/oz

27800.0

-0.9

0.1

6.9

-6.7

1282.5

0.2

-2.4

3.8

-20.5

$/oz

1286.1

0.2

-1.9

0.6

-20.1

Rs /10 gms

27677.0

0.2

-1.9

6.0

-7.4

Source: Reuters

Silver

Taking cues from fall in gold prices, Spot silver prices declined around 0.4 percent in yesterdays trade. However, sharp p downside in prices was cushioned on account of weakness in the DX coupled with positive movement in base metals complex. . The white metal touched an intra intraday low of $19.13/oz and closed at $19.56 in yesterdays trading session. On the domestic front, prices traded on a flat note on account of depreciation in the Rupee and closed at Rs.41,517/kg /kg after touching a high of Rs.41,580/kg on Wednesday.

Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (Sept13) MCX Silver (Sept13) Unit $/oz Rs/1 kg Last 19.6 41670.0 Prev day 0.4 -1.5

as on 7 August, 2013 WoW -1.2 -1.8 MoM 2.7 1.0 YoY -30.1 -22.6

$/oz $/ oz

1927.0 19.5

-2.6 -1.0

-3.4 -0.5

0.6 -2.1

-30.8 -30.5

Rs / kg

41517.0

0.0

0.0

2.8

-22.3

Outlook

In todays session, we expect precious metals to trade higher on the back of recovery in global market sentiments. However However, sharp upside in prices will be capped on account of declining trend in SPDR gold holdings. Further, strength in the DX will also prevent positive movement in prices. . In the Indian markets, depreciation in the Rupee will support an upside in prices on the MCX. Technical Outlook

Unit Spot Gold MCX Gold Oct13 Spot Silver MCX Silver Sept13 $/oz Rs/10 gms $/oz Rs/kg valid for August 8, 2013 Support 1283/1278 27500/27400 19.45/19.26 41100/40700 Resistance 1297/1304 27800/27950 19.83/20.02 41900/42300

Source: Reuters

Technical Chart Spot Gold

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Thursday| August 8, 2013

International Commodities

Energy Crude Oil

Nymex crude oil prices declined around 0.9 percent in yesterdays trade taking cues from expectations that US Federal Reserve will reduce its bond buying program anytime in current year. However, decline in US crude oil inventories along with weakness in the DX cushioned sharp fall in prices. Crude oil prices touched an intra intra-day low of $104.10/bbl and closed at $104.40/oz /oz in yesterdays trading session. On the domestic bourses, MCX crude August contract fell around 0.8 percent and crude oil prices touched an intra-day low of Rs.6,396/bbl and closed at Rs.6,409/bbl on Wednesday. EIA Inventories Data As per the US Energy Department (EIA) report, US crude oil inventories decline more than expected by 1.32 million barrels to 363.30 million barrels for the week ending on 2nd August 2013. Gasoline stocks gained by 135,000 barrels to 223.60 million barrels and whereas distillate stockpiles shoot up by 469,000 barrels to 126.50 million barrels for the last week. Market Highlights - Crude Oil (% change)

Crude Oil Brent (Spot) Nymex Crude (Sep 13) ICE Brent Crude (Sep13) MCX Crude (Aug 13) Unit $/bbl $/bbl Last 109.4 104.4 Prev. day -0.3 -0.9 WoW 0.5 -0.6 as on 7 August, 2013 MoM 1.1 -0.5 YoY -4.2 11.4

$/bbl

107.4

-0.7

-0.2

0.0

-4.2

Rs/bbl

6409.0

-0.8

0.0

2.5

24.0

Source: Reuters

Market Highlights - Natural Gas (% change)

Natural Gas (NG) Nymex NG MCX NG (Aug 13) Unit $/mmbtu Rs/ mmbtu Last 3.231 200.8 Prev. day -2.2 -2.3

as on 7 August, 2013 MoM -10.67 -8.81 YoY 9.23 22.74

Source: Reuters

WoW -10.67 -8.81

Technical Chart NYMEX Crude Oil

Natural Gas

EIA Inventories Forecast US Energy Information Administration (EIA) IA) is scheduled to release its weekly inventories and US natural gas inventory are expected to increase by 74 billion cubic feet (bcf) for the week ending on 2nd August 2013. Outlook From the intra-day day perspective, we expect crude oil prices to trade o on a higher note on the back of declining trend in API and US crude oil inventories coupled with recovery in global market sentiments sentiments. Further, increase in Chinese exports and expectations of more stimulus measures from Bank of Japan to achieve inflation ta target of 2 percent will support an upside in prices. However, sharp upside side in prices will be capped on account of strength in the DX. . In the Indian markets, depreciation in the Rupee will support an upside in prices on the MCX. Technical Outlook

Unit NYMEX Crude Oil MCX Crude Aug13 $/bbl Rs/bbl valid for August 8, 2013 Support 103.60/102.80 6350/6300 Resistance 105.30/105.90 6450/6490

Source: Telequote Source: Telequote

Technical Chart NYMEX Natural Gas

www.angelcommodities.com

Commodities Daily Report

Thursday| August 8, 2013

International Commodities

Base Metals

The base metals complex traded on a positive note in the yesterdays trading session as a result of weakness in the DX. . Further, rise in German industrial production data supported an upside in prices prices. Additionally, decline in LME inventories scenario acted as a positive factor. However, sharp upside in prices was capped on the back of weak global market sentiments. In the Indian markets, depreciation in the Rupee supported an upside in prices on the MCX. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (Aug13) LME Aluminum (3 month) MCX Aluminum (Aug13) LME Nickel $/tonne Rs /kg $/tonne Rs/kg $/tonne Last as on 7 August, 2013 WoW MoM YoY

Prev. day

7020.0 431.7 1801.0 108.6 14012.0 859.5 2107.5 129.3 1853.0

0.3 0.2 0.8 0.3 1.7 1.5 0.1 0.0 0.0

1.9 2.4 -0.2 2.7 1.2 3.9 1.9 4.1 0.4

-10.5 3.2 -0.1 0.6 4.2 5.2 1.6 2.9 -1.1

-6.7 3.5 -5.5 3.9 -10.6 -1.3 10.6 22.7 -0.3

Copper

Copper the leader of the base metals group gained around 0.3 percent yesterday on the back of decline in LME Copper inventories by 0.6 percent which stood at 601,600 tonnes. Further, weakness in the DX coupled with favourable German industrial production data supported an upside in prices. However, sharp upside in prices was capped on account of weak global market sentiments. Further, expectations of cut in stimulus measures by Federal Reserve also prevented fall in prices. The red metal touched an intra-day high of $7028.75/oz /oz and closed at $7020/oz in yesterdays trade. In the Indian markets, prices rose around 0.2 percent on account of depreciation in the Rupee and closed at Rs.431.70/kg 0/kg after touching an intra-day high of Rs.431.10/kg on Wednesday. Outlook For todays session, we expect base metals group to trade higher on the back of recovery in global market sentiments. Further, increase in Chinese exports and expectations of more stimulus measures from Bank of Japan to achieve inflation target of 2 percent will support an upside in prices. Additionally, increase in German industrial production data in yesterdays trade e will act as a positive factor. However, sharp upside in prices will be capped on account of strength in the DX. . In the Indian markets, depreciation in the Rupee will support an upside in prices on the MCX. Technical Outlook

Unit MCX Copper Aug13 MCX Zinc Aug 13 MCX Lead Aug 13 MCX Aluminum Aug13 MCX Nickel Aug 13 Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for August 8, 201 2013 Support 428/424 111.50/110.50 128.50/127.50 107.80/107.00 853/846 Resistance 433/436 113.00/113.80 130.00/130.80 109.20/111.00 865/872

(3 month) MCX Nickel (Aug13) LME Lead (3 month) MCX Lead (Aug13) LME Zinc (3 month) MCX Zinc (Aug13)

Source: Reuters

Rs /kg

$/tonne

Rs /kg

$/tonne

Rs /kg

112.4

-0.4

2.5

-0.4

9.3

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 7th August 6th August Actual Change (%) Change

601,600 5,473,275 203,988 1,052,075 199,625

605,125 5,480,625 204,906 1,055,300 200,200

-3,525 -7,350 -918 -3,225 -575

-0.6 -0.1 -0.4 -0.3 -0.3

Source: Reuters

Technical Chart LME Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Thursday| August 8, 2013

International Commodities

Important Events for Today

Indicator Country Time (IST) Actual Forecast Previous Impact

Current Account Monetary Policy Statement Monetary Policy Statement German Trade Balance BOJ Press Conference ECB Monthly Bulletin Unemployment Claims

Japan Japan China Euro Japan Euro US

5:20am Tentative Tentative 11:30am Tentative 1:30pm 6:00pm

0.65T -

0.73T 26.2B 15.2B 336K

0.62T 27.1B 14.1B 326K

High High High Medium High Medium High

www.angelcommodities.com

You might also like

- Being The Principal Powerpoint Ead 501Document15 pagesBeing The Principal Powerpoint Ead 501api-337555351100% (9)

- Living Under The Crescent MoonDocument20 pagesLiving Under The Crescent MoonhelenaladeiroNo ratings yet

- Daily Metals and Energy Report, August 6 2013Document6 pagesDaily Metals and Energy Report, August 6 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 18 2013Document6 pagesDaily Metals and Energy Report, July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 26 2013Document6 pagesDaily Metals and Energy Report, July 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 21 2013Document6 pagesDaily Metals and Energy Report, August 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 15 2013Document6 pagesDaily Metals and Energy Report, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 14 2013Document6 pagesDaily Metals and Energy Report, August 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 5 2013Document6 pagesDaily Metals and Energy Report, July 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 12 2013Document6 pagesDaily Metals and Energy Report, August 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 13 2013Document6 pagesDaily Metals and Energy Report, June 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 19 2013Document6 pagesDaily Metals and Energy Report, June 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 10 2013Document6 pagesDaily Metals and Energy Report, June 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 19 2013Document6 pagesDaily Metals and Energy Report, July 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 27 2013Document6 pagesDaily Metals and Energy Report, June 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 9 2013Document6 pagesDaily Metals and Energy Report, July 9 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 23 2013Document6 pagesDaily Metals and Energy Report, July 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 13 2013Document6 pagesDaily Metals and Energy Report, August 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28 2013Document6 pagesDaily Metals and Energy Report August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 5 2013Document6 pagesDaily Metals and Energy Report, June 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 29 2013Document6 pagesDaily Metals and Energy Report August 29 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 22 2013Document6 pagesDaily Metals and Energy Report, August 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 5 2013Document6 pagesDaily Metals and Energy Report September 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 7 2013Document6 pagesDaily Metals and Energy Report, August 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 5 2013Document6 pagesDaily Metals and Energy Report, August 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 12 2013Document6 pagesDaily Metals and Energy Report, June 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 20 2013Document6 pagesDaily Metals and Energy Report, August 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 11 2013Document6 pagesDaily Metals and Energy Report, July 11 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 9Document6 pagesDaily Metals and Energy Report August 9Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 25Document6 pagesDaily Metals and Energy Report, March 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 10 2013Document6 pagesDaily Metals and Energy Report September 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 26 2013Document6 pagesDaily Metals and Energy Report August 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 23 2013Document6 pagesDaily Metals and Energy Report, August 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 27 2013Document6 pagesDaily Metals and Energy Report August 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 22 2013Document6 pagesDaily Metals and Energy Report, July 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 22 2013Document6 pagesDaily Metals and Energy Report, May 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 23 2013Document6 pagesDaily Metals and Energy Report, May 23 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 2 2013Document6 pagesDaily Metals and Energy Report September 2 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report 07 March 2013Document6 pagesDaily Metals and Energy Report 07 March 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 24 2013Document6 pagesDaily Metals and Energy Report, June 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 14 2013Document6 pagesDaily Metals and Energy Report, June 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 14 2013Document6 pagesDaily Metals and Energy Report, May 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 16 2013Document6 pagesDaily Metals and Energy Report, July 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 13Document6 pagesDaily Metals and Energy Report, February 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 20 2013Document6 pagesDaily Metals and Energy Report, May 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 15Document6 pagesDaily Metals and Energy Report, March 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report Jan 04Document6 pagesDaily Metals and Energy Report Jan 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 26Document6 pagesDaily Metals and Energy Report September 26Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 7 2013Document6 pagesDaily Metals and Energy Report, June 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 19 2013Document6 pagesDaily Metals and Energy Report, August 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 17 2013Document6 pagesDaily Metals and Energy Report, June 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 10Document6 pagesDaily Metals and Energy Report, April 10Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 13Document6 pagesDaily Metals and Energy Report, March 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 18Document6 pagesDaily Metals and Energy Report, March 18Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 20 2013Document6 pagesDaily Metals and Energy Report, June 20 2013Angel BrokingNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Arts 10 4th QuarterDocument37 pagesArts 10 4th QuarterSamantha DelaraNo ratings yet

- I. Product Design II. Planning and Scheduling III. Production Operations IV. Cost AccountingDocument15 pagesI. Product Design II. Planning and Scheduling III. Production Operations IV. Cost Accountingوائل مصطفىNo ratings yet

- SYLLABUS-English 101-Borg D-16236-FA2020Document7 pagesSYLLABUS-English 101-Borg D-16236-FA2020L MNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument82 pagesStock Screener, Technical Analysis Scannerravi kumarNo ratings yet

- Hand Grinder IncidentDocument1 pageHand Grinder IncidentMohammedNo ratings yet

- IntroductionDocument59 pagesIntroductionCIRI CORPORATENo ratings yet

- The+Gambia+Law+Reports+1997+ +2001Document115 pagesThe+Gambia+Law+Reports+1997+ +2001Zeynab Gazal - ZaizalNo ratings yet

- Hello Teacher and EverybodyDocument2 pagesHello Teacher and EverybodyThanh HuyennNo ratings yet

- Church Is Citizen of The Year: EventsDocument8 pagesChurch Is Citizen of The Year: EventsDaveNo ratings yet

- Upload Documents For Free AccessDocument3 pagesUpload Documents For Free AccessNitish RajNo ratings yet

- Dear John Book AnalysisDocument2 pagesDear John Book AnalysisQuincy Mae MontereyNo ratings yet

- PH Map-Regions-Province-FestivesDocument10 pagesPH Map-Regions-Province-FestivesishavlncrnaNo ratings yet

- Geography P2 Nov 2021 MG EngDocument13 pagesGeography P2 Nov 2021 MG EngAlfa VutiviNo ratings yet

- College Accounting A Practical Approach Canadian 12th Edition Slater Test BankDocument30 pagesCollege Accounting A Practical Approach Canadian 12th Edition Slater Test Bankthomasgillespiesbenrgxcow100% (27)

- Strategic and Operational PlanningDocument7 pagesStrategic and Operational PlanninggwapdoseNo ratings yet

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Zensar Standalone Clause 33 Results Mar2023Document3 pagesZensar Standalone Clause 33 Results Mar2023Pradeep KshatriyaNo ratings yet

- Lesson Plan in Teaching Mapeh 8Document9 pagesLesson Plan in Teaching Mapeh 8Kimverly zhaira DomaganNo ratings yet

- CHN ReviewerDocument10 pagesCHN ReviewerAyessa Yvonne PanganibanNo ratings yet

- Customer Value ManagementDocument31 pagesCustomer Value ManagementP RAGHU VAMSYNo ratings yet

- Get Set Case - WeRock - IIM KozhikodeDocument7 pagesGet Set Case - WeRock - IIM KozhikodeKESHAV RATHI 01No ratings yet

- Lessee's Per Procedure AnalysisDocument4 pagesLessee's Per Procedure AnalysisShafiq0% (1)

- How To Grow Your Business Using BaZi PDFDocument18 pagesHow To Grow Your Business Using BaZi PDFanudora100% (1)

- Business Office Manager Administrator in NYC Resume M Crawford GardnerDocument3 pagesBusiness Office Manager Administrator in NYC Resume M Crawford GardnerMCrawfordGardnerNo ratings yet

- Intelsat 21 at 58Document4 pagesIntelsat 21 at 58Antonio ÁlcarezNo ratings yet

- Jeanne G. Quimata: Mitchell F. Thompson, EsqDocument3 pagesJeanne G. Quimata: Mitchell F. Thompson, EsqEquality Case FilesNo ratings yet

- English 4Document7 pagesEnglish 4Jane Balneg-Jumalon TomarongNo ratings yet