Professional Documents

Culture Documents

Currency Daily Report, August 5 2013

Currency Daily Report, August 5 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- RBI Act 1934 NDocument42 pagesRBI Act 1934 NRohit SinghNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 7 2013Document4 pagesCurrency Daily Report, August 7 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 22 2013Document4 pagesCurrency Daily Report, July 22 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 30 2013Document4 pagesCurrency Daily Report, July 30 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 17 2013Document4 pagesCurrency Daily Report, July 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 18Document4 pagesCurrency Daily Report, March 18Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, July 24 2013Document4 pagesCurrency Daily Report, July 24 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- 1) Introduction: Currency ConvertibilityDocument34 pages1) Introduction: Currency ConvertibilityZeenat AnsariNo ratings yet

- Intro KunalDocument30 pagesIntro KunalRaghunath AgarwallaNo ratings yet

- Act BillDocument2 pagesAct Billv sundeep ReddyNo ratings yet

- Transaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMDocument32 pagesTransaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMNishant RaghuwanshiNo ratings yet

- SharesDocument23 pagesSharesTûshar ThakúrNo ratings yet

- 395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30Document6 pages395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30blazeweaverNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Pic Activity 1Document7 pagesPic Activity 1ParameshNo ratings yet

- Chandigarh AtaGlanceDocument12 pagesChandigarh AtaGlanceRakesh dahiyaNo ratings yet

- Tax Invoice: Treebo Trip Aasma Luxury VillaDocument2 pagesTax Invoice: Treebo Trip Aasma Luxury VillaManish ChouhanNo ratings yet

- RS.4 Crore 99 LakhsDocument2 pagesRS.4 Crore 99 LakhsManpreet SinghNo ratings yet

- NRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationDocument7 pagesNRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationSherinWorinNo ratings yet

- FINMET MarketWatch - GOLD Sees Losses As NY Manufacturing Activity Improves !!Document2 pagesFINMET MarketWatch - GOLD Sees Losses As NY Manufacturing Activity Improves !!P DNo ratings yet

- Regular Commemorative Coins of Each MintDocument4 pagesRegular Commemorative Coins of Each MintLikhithNo ratings yet

- MTP 4 (Additional MCQ) - Q&ADocument19 pagesMTP 4 (Additional MCQ) - Q&ADeepsikha maitiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sachin ChadhaNo ratings yet

- Unit 4 INTERNATIONAL BUSINESS MANAGEMENTDocument11 pagesUnit 4 INTERNATIONAL BUSINESS MANAGEMENTnoroNo ratings yet

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeDocument1 pageI. Convertible Currencies With Bangko Sentral:: Run Date/timeJENNY LALUNo ratings yet

- Rahul 123456789Document2 pagesRahul 123456789Rahul KumarNo ratings yet

- BOB Outward Remittance Application Form A2 CUM LRS DECLARATION 15-12-202... 2Document8 pagesBOB Outward Remittance Application Form A2 CUM LRS DECLARATION 15-12-202... 2smtynnxskzNo ratings yet

- Pair of Linear EQn Revision Tracker BasicDocument16 pagesPair of Linear EQn Revision Tracker BasicOfficial WorkNo ratings yet

- The Great Indian Bank RobberyDocument29 pagesThe Great Indian Bank Robberyhindu.nation100% (1)

- MergedDocument14 pagesMergedUrvashi RNo ratings yet

- UV Plastic Manufacturing: Estimate/QuotationDocument1 pageUV Plastic Manufacturing: Estimate/QuotationManoj EmmidesettyNo ratings yet

- How Is Coin An Important Source of StudyDocument4 pagesHow Is Coin An Important Source of Study12d Gautam Maheshwary 25No ratings yet

- NGC PriceListDocument2 pagesNGC PriceListvims JoshiNo ratings yet

- Money and Banking System MBADocument29 pagesMoney and Banking System MBABabasab Patil (Karrisatte)100% (1)

- Article No.25intersol & FinacleDocument31 pagesArticle No.25intersol & FinacleMahendra VanzaraNo ratings yet

- Icssr Major 16Document29 pagesIcssr Major 16Hemanth RatalaNo ratings yet

Currency Daily Report, August 5 2013

Currency Daily Report, August 5 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Daily Report, August 5 2013

Currency Daily Report, August 5 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

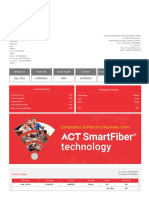

Currencies Daily Report

Monday| August 5, 2013

Content

Overview US Dollar Euro GBP JPY Economic Indicators

Overview:

Research Team

Reena Rohit Chief Manager Non-Agri Commodities and Currencies Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Broking Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company d does oes not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer er to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Broking Ltd. Your feedback is appreciated on currencies@angelbroking.com

www.angelbroking.com

Currencies Daily Report

Monday| August 5, 2013

Highlights

US Unemployment Rate fell to 7.4 percent in the month of July13. Spanish Unemployment Change declined by 64,900 in the last month. UK Construction PMI rose to 57-mark mark in the previous month. Asian equities are trading on a mixed note today but over the trade we expect sentiments to improve as major economic indicators today are likely to come on the positive side. While US jobs data missed market expectations, the fall in unemployment rate to 7.4 percent in July13 is a positive indicator and is also a point which could draw the Federal Reserve closer to the winding of its stimulus program. US Non-Farm Farm Employment Change grew at slow pace of 162,000 in July as against a rise of 188,000 in June. . Unemployment Rate fell to 7.4 percent in July from rise of 7.6 percent in June. Personal Income was at 0.3 percent in June when compared to 0.4 percent a month earlier. Personal Spending rose by 0.5 percent in June from 0.2 percent in prior month. Factory ory Orders grew at slow pace of 1.5 percent in June with respect to rise of 3 percent in previous month. Chinas Non-Manufacturing Manufacturing Purchasing Managers' Index (PMI) rose by 0.2 points to 54.1-mark mark in July as against a rise of 53.9 53.9-level a month ago.

Market Highlights (% change)

Last Prev. day

as on August 2, 2013 WoW MoM YoY

NIFTY SENSEX DJIA S&P FTSE KOSPI BOVESPA NIKKEI Nymex Crude (Aug13) - $/bbl Comex Gold (Aug13) - $/oz Comex Silver(Sept13) $/oz LME Copper (3 month) -$/tonne G-Sec -10 yr @7.8% - Yield

5677.9 19164.0 15658.36 1709.7 16779.2 1959.2 58497.8 14506.3 106.94 1310.60 19.62

-0.9 -0.8 0.2 0.2 -0.2 -1.5 0.2 0.2 -0.9 0.0 0.0

-3.5 -3.0 0.6 5.9 2.2 2.5 18.4 -0.1 2.1 -1.3 -0.8

-1.6 -0.1 2.8 5.9 6.3 7.8 29.8 0.6 3.7 5.2 3.1

8.6 4.8 21.6 25.3 18.8 2.0 2.2 66.3 22.7 -17.4 -27.3

7007.00 102.09

0.2 0.0

2.2 9.4

-10.7 4.6

-5.6 2.7

US Dollar Index

The US Dollar Index (DX) increased around 0.3 percent last week on the back of favorable economic data which showed signs of economic growth, thereby leading to expectations that the Fed will pullback its stimulus measures. However, rise in risk k appetite in global market sentiments capped sharp gains in the currency. The DX touched a weekly high of 82.61 and closed at 81.978 on Friday.

Source: Reuters

US Dollar (% change)

Last Prev. day WoW

as on August 2, 2013 MoM YoY

Dollar Index US $ / INR (Spot) US $ / INR Aug13 Futures (NSE) US $ / INR Aug13 Futures (MCX-SX)

81.98 61.09 61.45 61.45

-0.5 -0.9 1.17 1.19

0.3 -3.5 2.58 2.61

-3.2 -1.5 2.58 2.61

3.2 -8.7 9.51 9.50

Dollar/INR

On a weekly basis, the Indian Rupee depreciated around 3.5 percent. The currency depreciated on the back of worries that central bank measures may not be sufficient to control volatility in the currency. Further, DX strength and weak domestic markets exerted pressure. The Reserve Bank of India (RBI) tightened rules to defend weakness in the Rupee by announcing that foreign institutional investors will require a mandate from promissory note holders to hedge on their behalf. The Rupee touched a weekly low of 61.185 and closed at 61.09 on Fri Friday. For the month of August 2013, FII inflows totaled at Rs.458.20 crores nd ($78.26 million) as on 2 August 2013. Year to date basis, net capital 2nd inflows stood at Rs.66,550.60 crores ($12,561million) till August 2013. Outlook Trend in the Rupee is expected to be largely bearish as domestic fundamentals remain weak and point towards depreciation in the currency. However, sharp losses in the Rupee could be prevented due to Dollar Weakness.

Technical Chart USD/INR

Source: Telequote

Technical Outlook

Trend US Dollar/INR Aug13 (NSE/MCX-SX) Up

valid for August 5, 2013 Support 61.10/60.90 Resistance 61.60/61.80

www.angelbroking.com

Currencies Daily Report

Monday| August 5, 2013

Euro/INR

The Euro traded on a flat note and gained marginally in the last week on the back of upbeat global markets coupled with favorable economic data from the region. However, sharp upside in the currency was capped on account of strength in the DX. The Euro touched a w weekly high of 1.3344 and closed at 1.3281 against the dollar on Friday Friday. Spanish Unemployment Change declined by 64,900 in July from earlier fall of 127,200 a month ago. Outlook The Euro is expected to trade on a positive note to expected upbeat economic c data from the Euro Zone today. While retail sales in the Euro Zone are expected to show a fall, the services PMI of Spain and Italy is expected to show a rise. Euro Zone investor confidence is also expected to improve and this factor will support gains in n the currency. Technical Outlook

Trend Euro/INR Aug13 (NSE/MCX-SX) Sideways 80.60/80.80 81.30/81.60 valid for August 5, 2013 Support Resistance

Euro (% change)

Last Prev. day

as on August 2, 2013 WoW MoM YoY

Euro /$ (Spot) Euro / INR (Spot) Euro / INR July 13 Futures (NSE) Euro / INR July13 Futures (MCX-SX)

1.3281 81.13 81.2 81.2

0.6 -1.5 0.96 0.97

0.0 -3.5 4.06 4.06

2.1 -3.6 4.06 4.06

7.2 -14.9 18.13 18.15

Source: Reuters

Technical Chart Euro

GBP/INR

Source: Telequote

On a weekly basis, The Sterling Pound depreciated around 0.6 percent taking cues from stronger DX. However, upbeat global market sentiments along with favorable economic data from the country cushioned sharp fall in the currency. The Sterling Pound touched a weekly low of 1.5101 and closed at t 1.5287 against dollar on Friday. UKs Nationwide House Price Index (HPI) rose by 0.8 percent in July as against a rise of 0.3 percent in June. Construction Purchasing Managers' Index (PMI) rose by 6 points to 57-mark mark in July from earlier rise of 51 51level a month ago. Outlook Expected rise in the UK Services PMI will support gains in the currency and weakness in the Dollar Index will additionally support upside. Technical Outlook

Trend GBP/INR Aug 13 (NSE/MCX-SX) Sideways valid for August 5, 2013 Support 92.60/92.80 Resistance 93.30/93.60

GBP (% change)

as on August 2, 2013

Last

Prev. day

WoW

MoM

YoY

$ / GBP (Spot) GBP / INR (Spot) GBP / INR July13 Futures (NSE) GBP / INR July 13 Futures (MCX-SX)

1.5287 93.416 93.17

1.12 2.23 0.64

-0.6 2.83 2.47

0.1 3.53 2.47

-2.3 7.79 6.77

93.18

0.63

2.55

2.55

6.79

Source: Reuters

Technical Chart Sterling Pound

Source: Telequote

www.angelbroking.com

Currencies Daily Report

Monday| August 5, 2013

JPY/INR

The Japanese Yen depreciated around 0.7 percent in the last week on account rise in risk appetite in the global market sentiments which led to fall in demand for the currency. The Yen touched a weekly low of 99.94 and closed at 98.93 against dollar on Friday. Outlook Fall in Japanese equities will lead to increase in demand for the Yen. On the back of this, we expect the Yen to appreciate in todays trading session. Technical Outlook

Trend JPY/INR Aug 13 (NSE/MCX-SX) Sideways valid for August 5, 2013 Support 61.10/61.30 Resistance 61.70/61.90

JPY (% change)

Last 98.93 0.617 61.57 61.55 Prev day -0.6 0.6079 0.10 0.06

as on August 2, 2013 WoW 0.7 0.6008 2.58 2.62 MoM -1.0 0.590 2.58 2.62 YoY 26.1 0.7139 -14.16 -14.16

JPY / $ (Spot) JPY / INR (Spot) JPY 100 / INR July13 Futures (NSE) JPY 100 / INR July13 Futures (MCX-SX)

Source: Reuters

Technical Chart JPY

Source: Telequote

Economic Indicators to be released on August 5, 2013

Indicator Country Time (IST) Actual Forecast Previous Impact

th th

Halifax HPI m/m Spanish Services PMI Italian Services PMI Services PMI Retail Sales m/m ISM Non-Manufacturing PMI

UK Euro Euro UK Euro US

5 -7

0.3% 48.4 46.6 57.4 -0.6% 53.2

0.6% 47.8 45.8 56.9 1% 52.2

Medium Medium Medium High Medium High

12:45pm 1:15pm 2:00pm 2:30pm 7:30pm

www.angelbroking.com

You might also like

- RBI Act 1934 NDocument42 pagesRBI Act 1934 NRohit SinghNo ratings yet

- Currency Daily Report, August 6 2013Document4 pagesCurrency Daily Report, August 6 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 01 2013Document4 pagesCurrency Daily Report, July 01 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 18 2013Document4 pagesCurrency Daily Report, July 18 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report, August 8 2013Document4 pagesCurrency Daily Report, August 8 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 15 2013Document4 pagesCurrency Daily Report, July 15 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 29 2013Document4 pagesCurrency Daily Report, July 29 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 17 2013Document4 pagesCurrency Daily Report, June 17 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, August 7 2013Document4 pagesCurrency Daily Report, August 7 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, July 16 2013Document4 pagesCurrency Daily Report, July 16 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 14 2013Document4 pagesCurrency Daily Report, June 14 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 03 2013Document4 pagesCurrency Daily Report, June 03 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 10 2013Document4 pagesCurrency Daily Report, July 10 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, May 20 2013Document4 pagesCurrency Daily Report, May 20 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 13 2013Document4 pagesCurrency Daily Report, June 13 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 27 2013Document4 pagesCurrency Daily Report, June 27 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, June 28 2013Document4 pagesCurrency Daily Report, June 28 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 22 2013Document4 pagesCurrency Daily Report, July 22 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 30 2013Document4 pagesCurrency Daily Report, July 30 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 11Document4 pagesCurrency Daily Report, March 11Angel BrokingNo ratings yet

- Currency Daily Report, June 10 2013Document4 pagesCurrency Daily Report, June 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 13Document4 pagesCurrency Daily Report, February 13Angel BrokingNo ratings yet

- Currency Daily Report, June 07 2013Document4 pagesCurrency Daily Report, June 07 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 16 2013Document4 pagesCurrency Daily Report, May 16 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 17 2013Document4 pagesCurrency Daily Report, July 17 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, June 18 2013Document4 pagesCurrency Daily Report, June 18 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 31 2013Document4 pagesCurrency Daily Report, May 31 2013Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- Currency Daily Report, July 26 2013Document4 pagesCurrency Daily Report, July 26 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 11 2013Document4 pagesCurrency Daily Report, July 11 2013Angel BrokingNo ratings yet

- Currency Daily Report, April 18Document4 pagesCurrency Daily Report, April 18Angel BrokingNo ratings yet

- Currency Daily Report, February 11Document4 pagesCurrency Daily Report, February 11Angel BrokingNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Currency Daily Report, July 23 2013Document4 pagesCurrency Daily Report, July 23 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 18Document4 pagesCurrency Daily Report, March 18Angel BrokingNo ratings yet

- Currency Daily Report, June 25 2013Document4 pagesCurrency Daily Report, June 25 2013Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report, May 10 2013Document4 pagesCurrency Daily Report, May 10 2013Angel BrokingNo ratings yet

- Currency Daily Report, May 13 2013Document4 pagesCurrency Daily Report, May 13 2013Angel BrokingNo ratings yet

- Currency Daily Report July 25 2013Document4 pagesCurrency Daily Report July 25 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 12Document4 pagesCurrency Daily Report, March 12Angel BrokingNo ratings yet

- Currency Daily ReportDocument4 pagesCurrency Daily ReportAngel BrokingNo ratings yet

- Currency Daily Report, June 24 2013Document4 pagesCurrency Daily Report, June 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, February 15Document4 pagesCurrency Daily Report, February 15Angel BrokingNo ratings yet

- Currency Daily Report, July 24 2013Document4 pagesCurrency Daily Report, July 24 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- 1) Introduction: Currency ConvertibilityDocument34 pages1) Introduction: Currency ConvertibilityZeenat AnsariNo ratings yet

- Intro KunalDocument30 pagesIntro KunalRaghunath AgarwallaNo ratings yet

- Act BillDocument2 pagesAct Billv sundeep ReddyNo ratings yet

- Transaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMDocument32 pagesTransaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMNishant RaghuwanshiNo ratings yet

- SharesDocument23 pagesSharesTûshar ThakúrNo ratings yet

- 395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30Document6 pages395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30blazeweaverNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Pic Activity 1Document7 pagesPic Activity 1ParameshNo ratings yet

- Chandigarh AtaGlanceDocument12 pagesChandigarh AtaGlanceRakesh dahiyaNo ratings yet

- Tax Invoice: Treebo Trip Aasma Luxury VillaDocument2 pagesTax Invoice: Treebo Trip Aasma Luxury VillaManish ChouhanNo ratings yet

- RS.4 Crore 99 LakhsDocument2 pagesRS.4 Crore 99 LakhsManpreet SinghNo ratings yet

- NRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationDocument7 pagesNRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationSherinWorinNo ratings yet

- FINMET MarketWatch - GOLD Sees Losses As NY Manufacturing Activity Improves !!Document2 pagesFINMET MarketWatch - GOLD Sees Losses As NY Manufacturing Activity Improves !!P DNo ratings yet

- Regular Commemorative Coins of Each MintDocument4 pagesRegular Commemorative Coins of Each MintLikhithNo ratings yet

- MTP 4 (Additional MCQ) - Q&ADocument19 pagesMTP 4 (Additional MCQ) - Q&ADeepsikha maitiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sachin ChadhaNo ratings yet

- Unit 4 INTERNATIONAL BUSINESS MANAGEMENTDocument11 pagesUnit 4 INTERNATIONAL BUSINESS MANAGEMENTnoroNo ratings yet

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeDocument1 pageI. Convertible Currencies With Bangko Sentral:: Run Date/timeJENNY LALUNo ratings yet

- Rahul 123456789Document2 pagesRahul 123456789Rahul KumarNo ratings yet

- BOB Outward Remittance Application Form A2 CUM LRS DECLARATION 15-12-202... 2Document8 pagesBOB Outward Remittance Application Form A2 CUM LRS DECLARATION 15-12-202... 2smtynnxskzNo ratings yet

- Pair of Linear EQn Revision Tracker BasicDocument16 pagesPair of Linear EQn Revision Tracker BasicOfficial WorkNo ratings yet

- The Great Indian Bank RobberyDocument29 pagesThe Great Indian Bank Robberyhindu.nation100% (1)

- MergedDocument14 pagesMergedUrvashi RNo ratings yet

- UV Plastic Manufacturing: Estimate/QuotationDocument1 pageUV Plastic Manufacturing: Estimate/QuotationManoj EmmidesettyNo ratings yet

- How Is Coin An Important Source of StudyDocument4 pagesHow Is Coin An Important Source of Study12d Gautam Maheshwary 25No ratings yet

- NGC PriceListDocument2 pagesNGC PriceListvims JoshiNo ratings yet

- Money and Banking System MBADocument29 pagesMoney and Banking System MBABabasab Patil (Karrisatte)100% (1)

- Article No.25intersol & FinacleDocument31 pagesArticle No.25intersol & FinacleMahendra VanzaraNo ratings yet

- Icssr Major 16Document29 pagesIcssr Major 16Hemanth RatalaNo ratings yet