Professional Documents

Culture Documents

Social Security Is Both A Concept As Well As A System

Social Security Is Both A Concept As Well As A System

Uploaded by

DA NAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Social Security Is Both A Concept As Well As A System

Social Security Is Both A Concept As Well As A System

Uploaded by

DA NACopyright:

Available Formats

SOCIAL SECURITY

Social Security is both a concept as well as a system. It represents basically a system of protection of individuals who are in need of such protectionby the State as an agent of the society. Such protection is relevant incontingencies such as retirement, resignation, retrenchment, death, disablementwhich are beyond the control of the individual members of the Society. Men are born differently, they think differently and act differently. State as an agent of the society has an important mandate to harmonise such differences through a protective cover to the poor, the weak, the deprived and the disadvantaged. The concept of social security is now generally understood as meaning protection provided by the society to its members through a series of public measures against the economic and social distress that otherwise is caused by the stoppage or substantial reduction of earnings resulting from sickness, maternity , employment injury, occupational diseases, unemployment, invalidity, old age and death. According to ILO Convention on the Social Security ( minimum standards) adopted in 1952,following are the eight components of Social Security: 1.Medical care 2.Sickness benefits 3.Old age benefits 4.Employment injury benefits 5.Family benefits 6.Maternity benefits. 7.Invalidity benefits 8.Survivors benefits A strategy to promote economic growth must therefore be accompanied by efforts to protect the most disadvantaged groups in the population by effective, efficiently targeted and financially sound cash transfer schemes. An efficient targeting of existing programs can also promote economic growth by containing fiscal costs and promoting macroeconomic stability. The link between poverty, low levels of education and low health outcomes implies that investment to improve the health status and education levels of the poorest groups will also be critical for reducing poverty. Investment in human capital is a long-term poverty alleviation strategy that would eliminate on of he main causes of poverty in Romania and have a positive impact on economic growth. The returns to investments in education and health would be made all the more significant by labor market policies that are conducive to economic growth.

SOCIAL SECURITY

Most unemployed are secondary school graduates and that having asecondary and lower level of education (relative to college education) reduces the likelihood of a worker's being employed. These findings indicate that the current secondary school system may not be adequately preparing individuals for the labor market, perhaps because of its narrow focus and specialized programs. Thus, improvements in the quality of education should also focus on increasing the general focus education in basic education and in secondary school in order to make the curriculum responsive to emerging labor market conditions. Develop a more progressive tax system. A progressive transfer and investment system should be accompanied by a progressive tax structure. The tax structure in Romania appears very progressive, but the Government could still raise revenues without worsening the distribution of income by taxing rent, petrol, tobacco, and public transport. The Government could also raise revenue from taxing pensions without altering the distribution of income. However, taxing pension income should be phased in the longterm when income sources can be better audited and monitored.

You might also like

- Assignment 1 - 2020 - Bridge Design ProjectDocument4 pagesAssignment 1 - 2020 - Bridge Design ProjectMCNo ratings yet

- Metacognitive Reflection Essay - Tereza MojzisovaDocument5 pagesMetacognitive Reflection Essay - Tereza Mojzisovaapi-302385985No ratings yet

- Social SecurityDocument10 pagesSocial SecurityParth DevNo ratings yet

- Labour Law II - 1582Document22 pagesLabour Law II - 1582Maneesh ReddyNo ratings yet

- Social Security in India - 2Document24 pagesSocial Security in India - 2Amitav TalukdarNo ratings yet

- TST Issues Brief: Social ProtectionDocument7 pagesTST Issues Brief: Social Protectionashu548836No ratings yet

- Effects of Public ExpenditureDocument4 pagesEffects of Public ExpenditureRafiuddin BiplabNo ratings yet

- Ocial Security IN Alaysia: Present by Teh Pei ShanDocument19 pagesOcial Security IN Alaysia: Present by Teh Pei ShanPei ShanNo ratings yet

- Self Reliance and Social SecurityDocument12 pagesSelf Reliance and Social Securitytlotlo mmualefeNo ratings yet

- Labor Law Moduleb 4. Social SecurityDocument6 pagesLabor Law Moduleb 4. Social SecurityradhiaalfonceNo ratings yet

- My ProposalDocument27 pagesMy ProposalAmani ZakariaNo ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryPachamuthu SchoolNo ratings yet

- 08 Rajasekhar Social Security in IndiaDocument24 pages08 Rajasekhar Social Security in IndiaLokesh ParasharNo ratings yet

- Social Security in MalaysiaDocument6 pagesSocial Security in MalaysiaGraceYeeNo ratings yet

- Social SecurityDocument11 pagesSocial SecurityChedu SetumeNo ratings yet

- Social Protection, As Defined by TheDocument3 pagesSocial Protection, As Defined by TheMIRCEANo ratings yet

- Social Insurance ProgramsDocument12 pagesSocial Insurance Programsermirakastrati2004No ratings yet

- Effects of Public Expenditure On Economy Production DistributionDocument2 pagesEffects of Public Expenditure On Economy Production DistributionPeter NdiranguNo ratings yet

- Non-Convectional Forms of Social ProtectionDocument7 pagesNon-Convectional Forms of Social ProtectionJoe KimNo ratings yet

- Critical Analysis of The Unemployment Schemes in IndiaDocument35 pagesCritical Analysis of The Unemployment Schemes in IndiaArtika AshdhirNo ratings yet

- Labour Law 2Document124 pagesLabour Law 2sridharcmoftn1841No ratings yet

- Social Assistance Is Typically Cash or In-Kind Social Transfers, Subsidies or FeeDocument5 pagesSocial Assistance Is Typically Cash or In-Kind Social Transfers, Subsidies or FeeAzər ƏmiraslanNo ratings yet

- Social Security - Concept, Objective and Other Details PDFDocument4 pagesSocial Security - Concept, Objective and Other Details PDFAdityaMishraNo ratings yet

- Social SecurityDocument2 pagesSocial SecuritySuresh MuruganNo ratings yet

- Economies 06 00012 PDFDocument17 pagesEconomies 06 00012 PDFsociologingNo ratings yet

- Demography-WPS OfficeDocument2 pagesDemography-WPS Officewarrenville24No ratings yet

- Social Security Term Paper ThesisDocument6 pagesSocial Security Term Paper Thesisgingerschifflifortwayne100% (2)

- School of Law. Dehradun Labour Law Assignment Social Security: Concept, Objective and Other DetailsDocument5 pagesSchool of Law. Dehradun Labour Law Assignment Social Security: Concept, Objective and Other DetailsDivyansh BhargavaNo ratings yet

- Non-Convectional Forms of Social ProtectionDocument6 pagesNon-Convectional Forms of Social ProtectionJoe KimNo ratings yet

- Key Areas of Social Security in India - The ContextDocument2 pagesKey Areas of Social Security in India - The ContextJitendra KhatriNo ratings yet

- WHO 2005 Towards A National Health Insurance System in Yemen Part 1 - Background and AssessmentDocument6 pagesWHO 2005 Towards A National Health Insurance System in Yemen Part 1 - Background and AssessmentYemen ExposedNo ratings yet

- Keuskupan Agung JakartaDocument15 pagesKeuskupan Agung JakartaFransiskus Juan Pablo Montoya GuluNo ratings yet

- Lecture 5Document56 pagesLecture 5Castro Osei WusuNo ratings yet

- Concept and Evolution of Social Security PDFDocument10 pagesConcept and Evolution of Social Security PDFparas diwanNo ratings yet

- Chapter 4 - Health Insurance Schemes - GovernmentDocument0 pagesChapter 4 - Health Insurance Schemes - GovernmentJonathon CabreraNo ratings yet

- Social Expenditure Plays A Positive Role Towards Economic GrowthDocument1 pageSocial Expenditure Plays A Positive Role Towards Economic Growthasaad ibrahimNo ratings yet

- Social Security and Labour Welfare in IndiaDocument8 pagesSocial Security and Labour Welfare in IndiaAvinash KumarNo ratings yet

- Essay About Social SecurityDocument3 pagesEssay About Social SecurityScribdTranslationsNo ratings yet

- Academy of Economic Studies of Moldova: Performed by Artur CatanoiDocument3 pagesAcademy of Economic Studies of Moldova: Performed by Artur CatanoiArtur CatanoiNo ratings yet

- Social PolicyDocument2 pagesSocial PolicyV Lenin KumarNo ratings yet

- Who 2010Document18 pagesWho 2010ananya Dan (anya)No ratings yet

- Module10 Posarac PDFDocument79 pagesModule10 Posarac PDFÁlvaro DíazNo ratings yet

- What Is Employee Employer Insurance? Life InsuranceDocument39 pagesWhat Is Employee Employer Insurance? Life InsuranceImdad KhanNo ratings yet

- Social Security - NotesDocument17 pagesSocial Security - NotesAkshat YadavNo ratings yet

- Social Securities and RewardsDocument18 pagesSocial Securities and RewardskragniveshNo ratings yet

- NEP Social ProtectionDocument3 pagesNEP Social ProtectionSaba HussainNo ratings yet

- Awareness and Effective Utilization of Esi BenefitsDocument86 pagesAwareness and Effective Utilization of Esi BenefitsRajesh BathulaNo ratings yet

- Universal Health Coverage - OxfamDocument36 pagesUniversal Health Coverage - OxfammarindawennyNo ratings yet

- "Social Investments - Meeting Social and Economic Goals in New Ways" by Jon KvistDocument2 pages"Social Investments - Meeting Social and Economic Goals in New Ways" by Jon KvisteulacfoundationNo ratings yet

- 31 Okt - General 3 - Daily Express PDFDocument3 pages31 Okt - General 3 - Daily Express PDFNor Iskandar Md NorNo ratings yet

- Education Health Government Role On EconomyDocument3 pagesEducation Health Government Role On Economywattooawais065No ratings yet

- The Current Infant Mortality Rate For South Korea in 2020 Is 1.982 Deaths Per 1000 Live Births, A 3.03% Decline From 2019Document1 pageThe Current Infant Mortality Rate For South Korea in 2020 Is 1.982 Deaths Per 1000 Live Births, A 3.03% Decline From 2019Divyesh Varun D VNo ratings yet

- Child Sensitivity Social Protection Cambodia 2022Document20 pagesChild Sensitivity Social Protection Cambodia 2022kithchetrashchNo ratings yet

- Labour Law 2 Class ReportDocument5 pagesLabour Law 2 Class ReportCharran saNo ratings yet

- ConventionDocument12 pagesConventionKnowledge PlanetNo ratings yet

- Human CapitalDocument14 pagesHuman CapitalTeddy AdaneNo ratings yet

- Income InequalityDocument5 pagesIncome Inequalityxhxmpx4pc5No ratings yet

- Governments Needs To Act Before Employees Get Short End of StickDocument2 pagesGovernments Needs To Act Before Employees Get Short End of Stickbrook kebedeNo ratings yet

- Older Persons' Rights to Social Protection, Safety and ParticipationFrom EverandOlder Persons' Rights to Social Protection, Safety and ParticipationNo ratings yet

- Economics and Sociability in new tools for Integrated WelfareFrom EverandEconomics and Sociability in new tools for Integrated WelfareNo ratings yet

- LhfdsaqwertyDocument1 pageLhfdsaqwertyDA NANo ratings yet

- Sdfghjkloiuytredghjk DFGHJKDocument1 pageSdfghjkloiuytredghjk DFGHJKDA NANo ratings yet

- 17 Iulian PinisoaraDocument8 pages17 Iulian PinisoaraDA NANo ratings yet

- Tema EnglDocument7 pagesTema EnglDA NANo ratings yet

- SpyDocument15 pagesSpyDA NANo ratings yet

- Causes of Unemployment in RomaniaDocument9 pagesCauses of Unemployment in RomaniaDA NANo ratings yet

- Observation: First Rule of SpyingDocument35 pagesObservation: First Rule of SpyingDA NANo ratings yet

- Medium Power Transistor (Motor, Relay Drive) (60 10V, 2A) : 2SD2212 / 2SD2143 / 2SD1866 / 2SD2397Document2 pagesMedium Power Transistor (Motor, Relay Drive) (60 10V, 2A) : 2SD2212 / 2SD2143 / 2SD1866 / 2SD2397DA NANo ratings yet

- Technical Data Sheet: Wi/Wiv Prim 4/3 6/5Document1 pageTechnical Data Sheet: Wi/Wiv Prim 4/3 6/5DA NANo ratings yet

- Modul PPG 2 PKB 3105topic6Document7 pagesModul PPG 2 PKB 3105topic6masitahNo ratings yet

- Performance Appraisal Nigerias in Civil Service Management EssayDocument29 pagesPerformance Appraisal Nigerias in Civil Service Management EssayHND Assignment HelpNo ratings yet

- Buddhism Day by DayDocument6 pagesBuddhism Day by DayArina CatalinaNo ratings yet

- Department of Education: TEST I - Basic Facts (1 Point Each) Addition Subtraction Multiplication DivisionDocument2 pagesDepartment of Education: TEST I - Basic Facts (1 Point Each) Addition Subtraction Multiplication DivisionMaestro VarixNo ratings yet

- Ryden International Technological Institute, (R.I.T.I) Inc.: Zone 6, Pawili, Pili, Camarines SurDocument18 pagesRyden International Technological Institute, (R.I.T.I) Inc.: Zone 6, Pawili, Pili, Camarines SurRose Ann AbarientosNo ratings yet

- BINUS University: Learning OutcomesDocument3 pagesBINUS University: Learning Outcomeslaura oktavianiNo ratings yet

- 2016-Application-Form La TrobeDocument4 pages2016-Application-Form La TrobeYenny Sandoval KoppNo ratings yet

- Parmila DeviDocument1 pageParmila DeviSantoshKumarNo ratings yet

- Practice-Profession TeachingDocument3 pagesPractice-Profession TeachingAllen AllenpogiNo ratings yet

- Anna K., Marketing, AdminDocument1 pageAnna K., Marketing, AdmindonaalmosniNo ratings yet

- Motivation As A Skill: Strategies For Managers and EmployeesDocument41 pagesMotivation As A Skill: Strategies For Managers and EmployeesCane CirpoNo ratings yet

- Unit-1 Introduction To HRMDocument70 pagesUnit-1 Introduction To HRMAlisha Delta100% (1)

- Lesson Plan in Grade 7 - ApproachesDocument2 pagesLesson Plan in Grade 7 - ApproachesCheiryl DandoyNo ratings yet

- Bielskis, A - Power, History and Genealogy: Nietzsche and FoucaultDocument12 pagesBielskis, A - Power, History and Genealogy: Nietzsche and FoucaultjodrixNo ratings yet

- Discussion A. What Is Promotion?Document11 pagesDiscussion A. What Is Promotion?Chika Rizky AmaliaNo ratings yet

- Body-Page-Pcc-Teams (Final)Document41 pagesBody-Page-Pcc-Teams (Final)Reymart DablioNo ratings yet

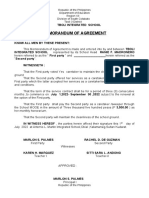

- Memorandum of AgreementDocument7 pagesMemorandum of AgreementYsabella AndresNo ratings yet

- Educational TechnologyDocument11 pagesEducational TechnologyGilbert Mores Esparrago100% (1)

- Learning Continuity PlanbppDocument4 pagesLearning Continuity PlanbppPaul AnapiNo ratings yet

- Effectiveness of Using Celebrity Endorsers in The Advertisements of Philippine-Branded Mobile DevicesDocument25 pagesEffectiveness of Using Celebrity Endorsers in The Advertisements of Philippine-Branded Mobile DevicesNammy Gil0% (1)

- Industrial Liaison: Student Industrial Attachment For 2019-2020Document5 pagesIndustrial Liaison: Student Industrial Attachment For 2019-2020Faith MakazhuNo ratings yet

- Rehabilitation PsychologyDocument69 pagesRehabilitation Psychologyiiimb0% (1)

- Coa M2013-007 PDFDocument8 pagesCoa M2013-007 PDFGie Bernal CamachoNo ratings yet

- 8th Grade Lesson Plan Feb 13 - Feb 17 MathDocument8 pages8th Grade Lesson Plan Feb 13 - Feb 17 MathArosman AguilarNo ratings yet

- New Perspectives On Marketing in The Service Economy UNIT-1: Services Marketing, Canadian Edition Chapter 1-1Document28 pagesNew Perspectives On Marketing in The Service Economy UNIT-1: Services Marketing, Canadian Edition Chapter 1-1SANCHIT KALRA CBSA202605No ratings yet

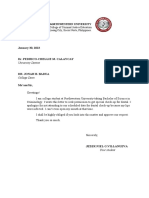

- January 30, 2023: University DentistDocument4 pagesJanuary 30, 2023: University DentistDeneene VillarinNo ratings yet

- RequiredDocuments For SLBDocument2 pagesRequiredDocuments For SLBRenesha AtkinsonNo ratings yet

- Language Leader Coursebook - Lebeau, Gareth Rees, Pearson Education Limited, 2008Document4 pagesLanguage Leader Coursebook - Lebeau, Gareth Rees, Pearson Education Limited, 2008N.U. HamedNo ratings yet