Professional Documents

Culture Documents

Potential Applications of Real Option Analysis in The Construction Industry in Developing Countries

Potential Applications of Real Option Analysis in The Construction Industry in Developing Countries

Uploaded by

Ujjal Regmi0 ratings0% found this document useful (0 votes)

18 views11 pagesThis document introduces real option analysis and its potential applications in the construction industry of developing countries. Real option analysis values flexibility and the ability to respond to uncertainty, which can provide benefits in risky investment environments like construction. The document outlines some limitations of traditional capital budgeting methods and discusses how real option analysis incorporates factors like flexibility and uncertainty that other methods ignore. It concludes that real option analysis could be a useful investment evaluation tool for construction firms and clients in developing countries by better accounting for risk and maximizing investment value.

Original Description:

abc

Original Title

9fcfd50631c21712d1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document introduces real option analysis and its potential applications in the construction industry of developing countries. Real option analysis values flexibility and the ability to respond to uncertainty, which can provide benefits in risky investment environments like construction. The document outlines some limitations of traditional capital budgeting methods and discusses how real option analysis incorporates factors like flexibility and uncertainty that other methods ignore. It concludes that real option analysis could be a useful investment evaluation tool for construction firms and clients in developing countries by better accounting for risk and maximizing investment value.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views11 pagesPotential Applications of Real Option Analysis in The Construction Industry in Developing Countries

Potential Applications of Real Option Analysis in The Construction Industry in Developing Countries

Uploaded by

Ujjal RegmiThis document introduces real option analysis and its potential applications in the construction industry of developing countries. Real option analysis values flexibility and the ability to respond to uncertainty, which can provide benefits in risky investment environments like construction. The document outlines some limitations of traditional capital budgeting methods and discusses how real option analysis incorporates factors like flexibility and uncertainty that other methods ignore. It concludes that real option analysis could be a useful investment evaluation tool for construction firms and clients in developing countries by better accounting for risk and maximizing investment value.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 11

Potential Applications of Real Option Analysis in the

Construction Industry in Developing Countries

G MBUTHIA

University of Cape Town

Private Bag, Rondebosch 7700

Cape Town, South Africa

mbtgeo001@mail.uct.ac.za

Abstract

This paper introduces the real options method of investment appraisal and its evolution. It discusses the

advantages and disadvantages of real options with regard to other commonly used investment methods and

with emphasis on the construction industry in developing countries. Investment analysis is not an

entrenched practice in construction industries, and needs to be undertaken more often, which is discussed

together with possible areas of application of real options for participants in the construction industry. The

process of implementing real options and problems encountered in implementation are then considered.

The paper concludes with reasons for the likely success of real options as an investment analysis method

and notes the potential positive effects implementing the approach will have in the construction industry in

developing countries.

Keywords: Real options, real options analysis, investment, investment analysis, developing countries.

INTRODUCTION

There has been a growing use of real options analysis as a tool for valuation and strategic decision-making

in the recent past. This has potentially significant implications for the construction industry in developing

countries. Faced with limited resources, clients and construction firms see the decision to invest or tender

as fraught with danger. There is a great need for methods of analysing such investments that identify

uncertainty, reduce risk and maximise value to the parties in the construction industry, be they contractors,

the professionals or clients. Real option analysis is touted as containing the insight and flexibility needed in

valuing opportunities and uncertain investments. It offers a novel way of valuing changes to ongoing

projects and assessing the implications of changes to programme decisions.

Traditionally, the construction industry in a typical developing country has not delved deep into the fields of

formal risk analysis and valuation. Participants operate primarily on intuition, historical data or cursory

financial analysis and judging the value of and risk involved in any project is rarely the subject of an

exhaustive scrutiny of the options involved. The advent of globalisation, the resulting need to operate at

international standards, the increasing cost of construction and the many competing uses for scarce capital

have made it imperative for construction industries in developing countries to adopt new strategies and

tools.

This paper will look at the potential of real options in developing country construction industries. It will

analyse the workings of the method, its strengths and weaknesses and make recommendations as to its

implementation in the construction industry.

Real options An introduction

In 1997, Robert Merton and Myron Scholes were awarded the Nobel Prize in Economic Sciences for their

work in devising a new method to determine the value of derivatives. Derivatives are financial instruments

such as futures and options; futures are trades where the price of a commodity is set against future delivery

at a specific date, while options are the rights (but not the obligations) to sell or buy a commodity at a

predetermined price on or before a predetermined date.

Along with Fisher Black, Merton and Scholes solved what had up to then been an intractable problem.

While the first attempt at valuing options had been made by Louis Bachelier in 1900, until 1973 no one had

solved the problem of valuing the risk element of derivatives. Investors are by nature risk-averse and

demand a premium on top of the interest rates to cater for risk, and the determination of this premium was,

and is, a subjective exercise. (Mason and Merton, 1985; Amram and Kulatilaka, 1999; The Royal Swedish

Academy Of Sciences, 1997).

In 1973, Black and Scholes with input from Merton derived a formula which eliminated the need to

determine the risk element by incorporating it into the option price. By recognising that any attempt to

value an option must eliminate arbitrage (the existence at the same time of a different buying and selling

price for a commodity), the three introduced a tracking portfolio of traded securities similar in nature to the

option, which would in essence provide a hedge for it (Bernstein, 1992). Changes in the value of the

options underlying asset would be matched by introducing changes in the hedging portfolio in a process

referred to as dynamic tracking. The hedging position creates a situation of no uncertainty, which eliminates

the effect of risk (in effect, a risk-free rate of return) and the value of the option would then be determined

by the value of the portfolio. If they differed, as Smith (1999) describes, there would be a chance to earn a

risk-free profit by buying the more expensive and selling the cheaper.

The development of the Black-Scholes formula was important because, as Altman and Subrahmanyam

(1985) note, the development of a way to price options provided a framework for the valuation of traded

options on stocks and related financial instruments. This could then be extended to a wide range of

corporate assets and liabilities. The formulas attractiveness derives from its reliance on observable

variables, giving it practical appeal. Courtadon and Merrick (1986) observe that of the five variables

required in the equation developed by Black and Scholes; the stocks current value, the options exercise

price, the options time to expiration, the prevailing interest rate and the volatility of the underlying stock,

only the last is not directly observable.

Amram and Kulatilaka (1999)

further note the relevance of the formula when applied to real options (as

opposed to stock market options). First coined by Stuart Myers, real options are simply the extension of

financial options theory to options on real (non-financial) assets. For example, owning a power plant gives

a utility the opportunity, but not the obligation, to produce electricity at a later date and having the

development rights to an oil field gives a company the option, but not the obligation, to produce oil later.

Production of electricity or drilling for the oil would then be a case of exercising the option.

Copeland and Keenan (1998) point out that it is difficult sometimes to identify real options in real life

managerial settings. They give the example of insurance contracts in the 1960s that gave holders the right

to borrow against the policy at a fixed rate of interest when interest rates were low and that option, when

exercised at a time of prevailing high interest rates, caused near insolvency in the insurance companies as

they had to borrow at higher rates in order to honour their contracts; they had no idea of the value of the

options they gave away.

The problems with standard methods of valuation

Capital budgeting is the process of determining whether the value of investment projects exceeds the cost of

implementation. The discounted cash flow method is the most commonly used method for capital

budgeting and involves the comparison of the cost of the project and the present value of future cash flows

the project will generate. As Brennan and Schwartz (1986) point out, that this assumes that future cash

flows will be constant, certain and unaffected by future management decisions. It also assumes a known

and constant discount rate. By ignoring the effect of future managerial decisions, for example the decision

to expand, contract or close down operations, the discounted cash flow method ignores decisions that can

significantly affect the value of a project.

The difficulty in assuming a known discount rate arises from two problems; one, the selected rate, in

addition to being determinable, should account for the individual nature of project risk and two, that it

remain constant over the life of the entire project. Both conditions are unlikely to be true for a project of

any complexity and significant errors in valuation can result over the wrong choice of discount rate.

Further to the previously mentioned problems, discounted cash flow analysis also suffers from the fact that

there is no way of incorporating uncertainty or choosing between scenarios.

Other tools and methods for decision-making and the valuation of investments also exhibit limitations in

their approach to valuing projects. Classic decision tree analysis builds a tree of possible situations and the

decisions management can make in response to those situations. Cash flows are then determined based on

their objective probability and then discounted at a chosen rate. Discount rates are adjusted to reflect risk,

however, and the risk changes depending on the node in the tree. Thus, we would need to calculate a

different discount rate for each node. Decision tree analysis gives us no indication of how to choose the rate

or adjust it for risk. The rate usually used is the weighted average cost of capital, which when used can give

false results of up to a factor of two. (Copeland and Keenan 1998)

Comparing real options and the decision analysis approach, Smith (1999)

states that while both are about

modelling decisions and uncertainties related to investments, real options analyses usually focus on the

evolution of a few stochastic factors (factors that change over time in an uncertain manner) that determine

the value of the investment over time. The cash flows are then defined as functions of these factors, and

thus the models are said to focus on dynamic complexity at the expense of detail complexity.

Decision analysis models, on the other hand, tend to consider in detail cash flows and other uncertainties,

emphasizing detail rather than dynamic decision-making or downstream decisions. Amram and Kulatilaka

(1999) point out that decision analysis relies on the subjective assessment of discount rates and probabilities

that are not considered in the real options method.

Traditional capital budgeting methods further have difficulty in valuing project abandonment, deferral or

alteration in any way. This means that such methods cannot adequately recognise managerial operating

flexibility and strategic interactions. The end result is an inability to properly recognise the value of active

management in adapting to changing market conditions (Trigeorgis, 1997:9). Traditional techniques are

also prone to managerial bias, especially in the selection of interest rates to be used.

The reason for real options superiority in factoring in managerial flexibility is its consideration of more

variables. It factors in the time to expiry, uncertainty of expected cash flows, risk free interest rate, value

lost over duration of an option, present value of fixed costs and the present value of expected cash flows

(note the slight difference with the five variables Black and Scholes consider for stock option valuation).

Discounted cash flow methods factor in only two; the present value of fixed costs and the present value of

expected cash flows. Real options can be seen as encompassing discounted cash flow plus a premium, so to

speak, in the form of flexibility value, the change in discounted cash flow over a projects life. (Net present

values for our purpose are a form of discounted cash flow valuation.)

The advantages of real options

Perhaps the greatest value of option pricing theory to the construction industry lies in implementing it more

as a way of thinking than a method of valuation. Leslie and Michaels (1997) and Amram and Kulatilaka

(1999) both stress this aspect, with the former stating that while option-pricing models are indeed a

superior valuation tool - the purpose to which the theory is generally put - we believe real options can

provide a systematic framework that will also serve as a strategic tool, and that it is in this strategic

application that the real power of real options lies. They recognise that proper use can provide the tools to

help turn strategy concepts into strategic plans.

A significant advantage of option valuation over the other approaches lies in its treatment of uncertainty and

flexibility.

Uncertainty

The historical use of discounted cash flow valuation emphasised the importance of selecting the right

discount rate, which accentuated the negative aspects of uncertainty for managers. With the use of real

options, however, uncertainty can be seen as an opportunity. Factoring in volatility in valuing options

shows that the more volatile an asset, the more valuable the option on the asset. Coy (1999) gives the

example of an option to buy a share at a set price by a certain date when the current price is lower. The

lower the volatility, the lower the chance the shares will rise, so the option to buy them at the lower price is

not very valuable. If the volatility is high, the chance the shares will rise increases, which makes the option

to buy them at the lower price more valuable. Should the shares price fall the option can simply be allowed

to expire.

In addition, the real options approach brings a new perspective on capital investment decision-making to

managers and investors. Viewing investment opportunities as options on real assets provides valuable

insights and may challenge popular beliefs, one of which is the perception that uncertainty is bad. As a

hypothetical example, take a company with a licence to exploit a stone quarry. Traditional analysis may

show that there is a marginal profit to be expected from exploitation of the mine, but the high risk caused by

uncertainty over future prices in the construction industry makes the investment undesirable. A real options

approach would recognise, however, that the company has the option to develop the quarry at any point in

the future, including those times when prices are favourable. Also, should prices drop to unprofitable

levels, the option exists to shut down temporarily. These two decisions would be missed by a traditional

analysis. Financial market information about prices and trends in the construction industry is used to

predict aggregate price volatility, avoiding subjectivity.

Flexibility

Mason and Merton (1985:32) define project flexibility as a description of options made available to

management as part of a project. Flexibility arises through managements ability to make contingent

business decisions (i.e., those decisions made because an event has happened and if the event changes, the

decision changes). The payoff to an option will be non-linear; it will change with the decision taken. In

contrast, fixed or non-contingent decisions have linear payoffs; whatever happens the decision made is the

same (Amram and Kulatilaka, 1999). Non-linear decision-making is actually the norm in business. Leslie

and Michaels (1997) postulate two types of flexibilities as identified by option theory, proactive and

reactive flexibility. Reactive flexibility refers to the flexibility exercised by an option holder in response to

changes in the environment. Proactive flexibility is the maximization of the value of an option after

acquiring it, making it worth more than its purchase price. The six levers they identified; i.e. the

uncertainty of expected cash flows

time to expiry

present value of fixed costs

present value of expected cash flows

risk free interest rate

value lost over duration of option

could be used to increase option value. For example, increasing the marketing budget and hence sales will

by extension increase the present value of expected cash flows.

Utilisation of option valuation helps expand the identifiable menu of available resources and alternative

markets for investment. It establishes the risk of strategic alternatives, asks questions to create value from

uncertainty and aligns internal project valuations with financial markets. Used in conjunction with

traditional, resource-based perspectives, it can identify new capabilities. Instead of focusing on increasing

pricing power as suggested by competitive strategies, real options create value through the recognition and

management of risk (Copeland and Keenan 1998).

In addition to investments involving uncertainty and flexibility, non-cash generating investment

opportunities like the following can be best valued using real options:

Platform investment like research and development - In platform investments, the choice of an option

will modify the possible future investment strategies.

Contingent contracts, and non-linear payoffs - In contingent contracts, for example partnering or joint

ventures, each milestone represent a series of options where the payoff is proceeding to the next stage.

The judicious use of contractual options will change the risk profile faced by asset owners. (Amram

and Kulatilaka, 1999).

Granted, these are rarely found in the realm of the construction industry, but the industrys dynamism

should see them as part of the landscape sooner rather than later. To value these investments, instead of

asking what that investment is worth, real options ask; what does it take in the form of outcomes and

payoffs from future investments to justify the present investment.

Real options allow a firm to identify operating alternatives and the flexibility to use an asset in all ways.

For example, machinery can be valued with regard to the option to switch to different use or even to shut

down. The value of a real option can thus include the value of optimal utilisation of all its operating

options. The identifying of investment and disinvestment options - asset configuration, type and scale,

timing of investment are some examples - is a further benefit of option analysis. Also, since modules can

be treated as a portfolio of options with one contingent on the previous one, modular development - where

one stage or module is completed and a decision on whether to proceed to the next stage taken - can now be

valued at inception. An interesting application of this in the construction industry would be in the type of

serial construction common on large-scale projects like housing estates. Completion of the first stage

determines whether and in what form the project will advance to subsequent stages.

Construction in developing countries and the need for a method of investment analysis

The importance of the construction industry in developing countries can be seen from recent estimates

putting the share of the industry in developing country economies at between 5 and 10 %. Wells (1986)

indicates that about half of this may be in civil engineering projects, and these are usually large projects

involving substantial amounts of capital. Construction also plays a major role in providing capital,

accounting for over 50% of gross capital formation in the economy. The industry in developing countries

has inherited the fragmented structure described by Ball (1988) as hierarchical, with professions heading the

production team comprising of contractors and suppliers who have further links down the chain to sub-

contractors.

Construction industries in developing countries have similar characteristics to those in other parts of the

world but have their own unique characteristics. Amongst the universal characteristics of the industry are:

unique products

long production process

fragmented industry

fluctuations in workload

immobile end product.

(Hindle 1997, Ball 1988, Hillebrandt, 1984)

Specific characteristics of the construction industry in developing countries include:

A dual structure of indigenous and exogenous contractors (Uwakweh, 1999).

A large informal sector.

Underdeveloped human resources capacity characterised by little training and manpower development.

Reliance on external funding for major infrastructural developments.

Fluctuating workloads in the industry.

The predominance of the public sector as a client.

We can look at the application of real options valuations in developing countries from the perspectives of

the three broad interest groups in construction identified by Chow (1990), developers, contractors and the

industry professions. However, it is important to keep in mind that developing countries are a disparate lot

in terms of their socio-economic development, resource endowment and the nature and problems of their

construction industries (Ofori 1991).

Developers

The government as a construction client deals in public projects, which usually form the largest single

infrastructural investments made in developing countries. Low gross domestic product and competing

needs for scarce funds require that optimal use of these resources be ensured. One way of doing so is

through the accurate valuation of development projects the real options approach can offer. Further,

stricter conditions on the disbursement of development assistance by donors and multi-national bodies

emphasizing transparency and accountability render accurate valuations essential for such large projects.

These conditions also apply equally for private sector developers. Limited funds for investment and

shareholder scrutiny, intensified by the present trend of increasing economic awareness, drive the need for

accurate project valuation.

The growing use of non-traditional methods of procurement provides another potential avenue for the

increased use of real option valuations. De Valence (1999) has noted the growing trend toward the private

sector provision of infrastructure in developing countries through variations of build-own-operate, design

and build and turnkey procurement methods. These have been fuelled by capital limitations for

infrastructure development, increasing client awareness and dissatisfaction with traditional methods,

globalisation and the effect of imported business practices, and greater project complexity.

From real options identified by Trigeorgis (1997) we can find parallels for developers in the construction

industry, such as:

Flexibility options: the option to switch creates value out of uncertain events.

It may make the

construction of a building previously thought of as too expensive profitable. For example, if a building

has only one use as a warehouse, valuation of the potential income to a developer may show its lack of

viability. Recognizing that the use of the building can be changed to production in times of demand

incorporates the dimension of flexibility, which creates added value.

Learning options: where uncertainty can be resolved by a learning process, these processes can be

broken down into stages, and the real options approach used to value the contingent decisions and

structure each stage for a higher value.

In the planning for a housing estate, the question may arise as

to which architectural design or type of houses will be more marketable. If in the first phase of

construction one type proves to be more in demand and attracts better prices, the subsequent make-up

of the estate can be changed to reflect that discovery.

Exit options: the exit option introduces the option to abandon a project. In the development of a new

project, the size of the market may worry the company. Real options analysis can be used to value the

option to walk away from the project should it not show promise. This is applicable both to contractors

(as investors) and for developers.

Evaluating market strategies: real options way of thinking expands the vision and alternatives used in

creating strategies, and real options tools translate strategic thinking into an investment plan.

Options to defer: for example, management may defer the investment while awaiting better market

conditions.

Options to default during staged construction: this refers to instances where a project is being

implemented in stages. Each stage can be seen as an option on previous stages. The initial outlay

creates the asset and the developer has the option to default should conditions prove negative.

Contractors

The primary focus of a real options approach to contractors would be in the evaluation of investment

choices. The nature of construction is such that at the end of a project the contractor has a large liquidity

position. Given the unpredictable nature of workloads in the industry and the predominance of the

traditional procurement method in developing countries (which forces contractors to compete afresh for

each new project thus adding uncertainty to individual contractor workloads), it becomes even more

imperative to put available funds to the most efficient use possible. Should a contractor invest in treasury

bills or property? Should they add to the firms resources by purchasing plant? If plant, which would be a

better option, a crane or an excavator? The choice of where and what to invest in is a crucial part of a

contractors strategy, and the use of a tool that helps master that strategy has positive implications for a

construction firm.

Given the trend towards new procurement systems and increasing usage of private sector in infrastructure

provision there may also be a need for contractors to adopt better ways of valuation of the choice of project

to tender for or implement and anticipated returns to the firm. Some construction procurement methods

involve outlays in capital and long payback periods that essentially transform the process into an

investment. This is particularly so in the build-own-operate procurement method where the contractor

undertakes the design, construction, financing, operation and maintenance of a facility of an agreed period.

Examples of real options in the construction industry for contractors are:

Growth and expansion options: a sector of the construction industry is booming. Should a construction

company invest in equipment and plant in order to take advantage of any upcoming projects? As

Trigeorgis (1997) says, when a firm buys plant and equipment, land for development or sets up in a

new location it takes out an option for future growth. Investment in plant and equipment is expensive

but it could lead to increased capacity and the ability to undertake previously undoable projects.

Conversely, the scaling down of operations creates the option to contract.

Takeover and merger options: should a construction company desire to take over or merge with

another, what would be an accurate valuation of the target company? The primary reason for the surge

in attention paid to the real options approach has been in its role in valuation of Internet start-ups. Its

recognition of the value of the technology companies as a function of their greater number of real

options, exemplified by their ability to move easily into new markets, niches and segments, gave a

method for the valuation of these companies that reflected their quoted values. Real options capture

the value of managerial flexibility and so the consideration the value of management quality and

intellectual capital in a firm is easier. Companies with little in the way of physical assets, like

construction companies, can now be valued more realistically by weighing their options as compared to

their liabilities.

Competition and strategy: strategy development requires a long-term cause and effect mode of thinking

that is best visualised by the application of real options. An investment can now be pursued on the

basis of the options it opens up. The value of a diversification strategy (into, say, materials supply) can

be incorporated into the present investment decision by a construction company to purchase a quarry.

Professions

The role of professions in the construction industry is to provide design advice and supporting services to

the industry on both the producing and consuming sides. This role is rapidly and constantly evolving to

encompass new fields, which results in the professions having to acquire new skills to keep up. These skills

will span traditional industry boundaries, and will be subject to perpetual change (Hindle, 1998). The

services that they provide will affect the viability and outcome of a project. As a result, for all categories of

consultants knowledge of the options applications listed above may well prove useful as they consult for

developers and contractors, in contracting, investment decision-making, acquisitions, research and

development.

The process of implementing real options

Once a real options approach has been decided upon, the next important step is framing the application.

This involves identifying the decisions to be made, the risks and uncertainties, and stating them in a logical

expression. For example, continuing with the quarry example, deciding whether to exploit it or purchase

aggregate for a major roads project can be summarised by:

Exploit it when the value of the extracted product is greater than the value of purchased product plus costs

of extraction.

Real options analysis is about expanding the investment horizon, so all options should be considered with

the emphasis on broad thinking. As a general rule, financial options are usually easier to configure than

physical options.

The next step is to identify the inputs, which are: (1) present value of expected cash flows; (2) leakages in

the value of the option over time due to, for example, dividends, convenience yields, rental payments; (3)

the time to expiry or the life of the option; (4) the uncertainty of expected cash flows (sometimes referred to

the volatility of the underlying asset which is estimated form similar assets or historical data; (5) the present

value of fixed costs and (6) the risk free interest rate, which can be ascertained from short-term treasury

bills yield.

Not needed are probability estimates of future asset prices, the expected rate of return of the option and an

adjustment to the discount rate for risk. Future asset prices are captured by the current value of the

underlying estimate and the volatility estimate, while the value of the asset and the tracking portfolio

capture its risk-return trade-off eliminating the need for the expected rate of return.

There are a number of option calculators, or mathematical expressions, available that the inputs can be

slotted into to produce an accurate value. The choice of these calculators will depend on the inputs, the

particular application and the users preference, though properly applied all will give the same answer. The

types of calculator are:

Partial differential equations, an example of which is the Black-Scholes equation, express the option

value through the equation and boundary conditions. While providing an easily available solution for

the valuation, they cannot deal with more than two variables. Software solutions are available for

partial differential equations, which enhances their usability.

Dynamic programming methods like the binomial model, which chart out possible paths for the option,

determine the ideal one and then track it back to the present, handle complex decisions, leakage

conditions and asset-option relationships well.

Simulation models, which roll out possible future scenarios, average the payoffs and then discount to

the present. The commonest example of a simulation model is the Monte Carlo simulation.

The need is to establish a mathematical representation or frame for the stochastic processes, the payoff

function and the decision rules in mathematical terms. Select a solution method between partial differential

equations, dynamic programming or simulation models and the specific option calculator: e.g. Black-

Scholes equation, binomial model, and Monte Carlo simulation. The general rule is use an analytical

solution if one is available as analytical solutions and the binomial model are easier to use and can be even

be used on spreadsheets. Also, choose an option calculator based on ease of use, transparency and ability to

re-use code. Simulations are best for path-dependent options (where the current value of an option depends

on its past) use. Whatever the case, the focus should be on the application frame and not the calculator

details (Amram and Kulatilaka, 1999).

Reviewing the results of the calculation is important as it determines the outcome of the proposed

investment and possible company strategies. Deducting the value of assets under discounted cash flow

from value of assets under real options will give the value of embedded options. Another way of looking at

it is that if all volatility inputs were eliminated, the value of the asset should be equal to the discounted cash

flow outcome. This is because without uncertainty there are no contingent decisions so discounted cash

flow gives the right answer.

If necessary, a redesign of the investment can be undertaken. The proactive approach to flexibility options

advocated by Leslie (1997) can be used in this regard.

Anticipated problems in using real options

The difficulty in getting contractors in developing countries to accurately develop mathematical models and

frame inputs will undoubtedly prove the biggest obstacle in the use of real options valuations. Apart from

the size of the projects having to be substantial to warrant the time and trouble involved, there is the

trepidation brought about by the arcane mathematical skills needed, and the corresponding further

difficulties of actually getting people with the necessary skills to follow through these methods. As Ofori

(1991) has stated, construction companies in developing countries tend to be transient and are unable and

unwilling to employ qualified personnel. This will be even truer for a field that traditionally does not form

part of the mainstream construction disciplines. It is also difficult to determine exactly what portion of

success of the valuation would be attributable to the model, so serendipity may cause rejoicing at the

selection of an inappropriate method or, conversely, the rejection of a valuable tool due to formulation

errors.

Undeveloped financial markets in the developing countries may also result in a lack of tracking portfolios

and little grounds for establishing risk-free rates. This is doubtful, however, as the vast majority of

developing countries either have or are setting up securities trading mechanisms. A more serious problem

is that few of the problems requiring valuation allow the direct application of no-arbitrage arguments. For

example, technical risks and market shares for research and development cannot be perfectly hedged by

trading existing securities. Though perfect hedges are not necessary to determine option values using the

tracking portfolio- finding similar assets is still a (conceptual) difficulty. The idea is to consider those

hedging opportunities that do exist and recognise them and use market information to risk-adjust the

probabilities associated with these risks. The possibility exists that the above will cause real options to be

viewed as a foreign tool inappropriate to developing country settings.

Perhaps an even greater obstacle towards the use of real options in developing country construction

industries is the fact that it is not at present being used in the developed world in the same capacity. Real

options find applications in diverse industries like energy, electronics, mining and exploration and airlines,

but have yet to make an impact in construction. The industry in developing countries is often modelled

along the lines of the former colonial powers (Wells, 1986) and looks to them for new developments given

that work on the theory of the construction firm is confined to the industrialised countries (Ofori, 1991). If

a method or approach has not been tried and tested in industrialised countries there is little chance that the

third world will pioneer it.

Reasons why real options are likely to make a big impact in developing countries construction

industry

In conclusion, real options analysis shows enough promise to spur investigation into its viability in the

construction industry. There is pressure on the construction industry professions to expand the quality and

range of services offered. Potential developers face the pressure from shareholders, stakeholders or simply

tighter budgets to be more accountable and to use resources in the most efficient manner. Construction

companies desire a better way to allocate limited financial resources and invest under uncertainty. In all

these cases there is incentive to study and, if applicable, implement as a system of valuation the touted

method.

Just as new production methods such as supply chain management, total quality management and

knowledge management have found their way into the construction industry, the adoption of real options as

a valuation method by other industries and sectors may well result in its adoption. Furthermore, the use of

tools such as computers and pre-programmed calculators will also aid in the usage and development of real

options models.

SUMMARY AND RECOMMENDATIONS

This paper has tried to investigate the applicability of real options theory to developing country construction

industries. While still in its infancy, the approach holds much promise once its esoteric aura has been

stripped away. It encourages thinking far (into the future) and wide (across the firm). As long as financial

markets exist to give a measure of relevant information, and the demands of accuracy and precision

consider the rapidly changing environment of the construction industry, the results should be satisfactory.

The framework and approach is more important than the details of numerical methods. For options to be

optimally identified and exercised the organization must have good information management and the

organization must be capable of acting on rational information, i.e. it must be a functional rather than

dysfunctional organisation. Management should be prepared to act immediately the conditions favouring

exercising the options come into play, and the real options team which includes the introducer, the

measurers and the manager with an eye on the overall picture should be put in place. Academics are vital in

the adoption of new strategies and theories in construction. They should scrutinize this approach for its

merits and if found with value, urge for its inclusion in syllabi and courses.

More research on this topic, and indeed of valuation in construction, as it applies to developing countries is

necessary, with special regard to efficacy of results and cost effectiveness. Finally, the construction

industry in those countries needs to be sensitised on the evolution of the method as it applies to the industry.

As a planning tool real options is still in its infancy, but the new approach it brings to decision-making in

developing countries may well prove valuable.

REFERENCES

1. Altman E I, and Subrahmanyam, M G, ed. (1985) Recent Advances in Corporate Finance Homewood,

Illinois, Richard D. Irwin.

2. Amram, M, and Kulatilaka, N. (1999) Real Options: Managing Strategic Investment in an Uncertain

World, Boston, Harvard Business School.

3. Ball, M (1988) Rebuilding Construction: Economic Change and the British Construction Industry,

London, Routledge.

4. Bernstein, P L (1992) Capital Ideas: The Improbable Origins of Modern Wall Street, New York,

Macmillan.

5. Brealey R. A. and Myers, S C (1996) Principles of Corporate Finance, New York, McGraw-Hill.

6. Brennan, M J and Schwartz, E S (1986) The Revolution in Corporate Finance p 80, ed, Stern J. M and

Chew D H, Oxford, Basil Blackwell

7. Chow K F, (1990) The Construction Agenda: The Development of the Construction Industry in

Singapore, Singapore, Construction Industry Development Board.

8. Copeland T E and Keenan P. T. (1998) How Much is Flexibility Worth? The McKinsey Quarterly,

1998, No. 2, p 38 - 49.

9. Courtadon, G R and Merrick J. J. (1986) The Revolution in Corporate Finance, ed, Stern J. M and

Chew D. H., Oxford, Basil Blackwell

10. Coy, P (1999) Exploiting Uncertainty: The Real-Options Revolution in Decision-Making,

Businessweek, June 7, 1999

11. De Valence, G, (1999) Trends in Procurement of Urban Infrastructure: Implications for Developing

Countries, CIB W55 and 65 Joint Triennial Symposium, Cape Town

12. Hillebrandt, P M (1984) Analysis of the British Construction Industry, London, Macmillan

13. Hindle, R. D. (1997) Two Construction Industry Characteristics That Are Hindering Its Development,

1st International Conference on Construction Industry Development: Building the Future Together,

National University of Singapore, 9 11 December, 1997

14. Hindle, R. D. (1998) A Role For The Built Environment Professions In The Development of The

Construction Process?, 1st Meeting of the CIB Task Group, 29: Construction in Developing Countries,

Arusha International Conference Centre, 21 23 September 1997

15. Leslie, K. J. and Michaels, M. P. (1997) The Real Power of Real Options, McKinsey Quarterly, 1997,

No 3, p 4 - 23

16. Mason, S. P. and Merton, R. C. (1985) The Role of Contingent Claims Analysis in Corporate

Finance. In Recent Advances in Corporate Finance Homewood, ed. Altman E. I., and Subrahmanyam,

M. G., Illinois, Richard D. Irwin.

17. Ofori, G. (1991) Programmes for Improving the Performance of Contracting Firms in Developing

Countries: A Review of the Approaches and Appropriate Options, Construction Management and

Economics, No 9, p 19 - 38

18. Smith J, (1999) Much Ado About Options? [Online], Available: www.reaI-

optIons.com]smIth.htm, August 1999

19. The Royal Swedish Academy Of Sciences, (1997) Press Release - The Sveriges Riksbank (Bank of

Sweden) Prize in Economic Sciences in Memory of Alfred Nobel, [Online]. Available:

http:]]www.nobeI.se]economIcs]Iaureates]1997]press.htmI, [June 18, 2000]

20. Trigeorgis, L. (1997) Real Option: Managerial Flexibility and Strategy in Resource Allocation, 2nd

Edition, Cambridge, Massachusetts, MIT Press.

21. Uwakweh, B. O., (1999) Framework for Analysing Construction Human Resource Needs in

Developing Countries, CIB W55 and 65 Joint Triennial Symposium, Cape Town

22. Wells, J (1986) The Construction Industry in Developing Countries: Alternative Strategies for

Development, Kent, Billing and Sons

You might also like

- Test For Certificate - Coursera - PassedDocument1 pageTest For Certificate - Coursera - Passedmitochondri100% (2)

- Real Options in Capital Investment PDFDocument249 pagesReal Options in Capital Investment PDFmr.tyagi5383100% (1)

- Entrepreneurial FinanceDocument10 pagesEntrepreneurial FinanceAjathaNo ratings yet

- Project Quality Plan: Put Your Organization Name HereDocument3 pagesProject Quality Plan: Put Your Organization Name HereUjjal RegmiNo ratings yet

- CH 10.risk and Refinements in Capital BudgetingDocument27 pagesCH 10.risk and Refinements in Capital BudgetingTria_Octaviant_8507100% (1)

- FBE 432 / Korteweg: Corporate Financial StrategyDocument24 pagesFBE 432 / Korteweg: Corporate Financial StrategyDragan PetkanovNo ratings yet

- Quiz 4 SolutionDocument5 pagesQuiz 4 SolutionSam LindersonNo ratings yet

- The Real Option Model - Evolution and ApplicationsDocument35 pagesThe Real Option Model - Evolution and ApplicationsIQ3 Solutions GroupNo ratings yet

- Caso AntaminaDocument3 pagesCaso Antaminaimperdible0No ratings yet

- TBChap 010Document42 pagesTBChap 010varun cyw100% (3)

- Comparison of Real Asset Valuation Models: A Literature ReviewDocument11 pagesComparison of Real Asset Valuation Models: A Literature ReviewDany SetiawanNo ratings yet

- BSM Model - Nobel PrizeDocument4 pagesBSM Model - Nobel Prize21-Nguyễn Châu Ngọc LộcNo ratings yet

- Real Estate Development, Highest and Best Use and Real OptionsDocument20 pagesReal Estate Development, Highest and Best Use and Real OptionsgarycwkNo ratings yet

- Utility Multiname Credit WWWDocument23 pagesUtility Multiname Credit WWWeeeeeeeeNo ratings yet

- Right and Wrong Model For Callable Muni BondsDocument22 pagesRight and Wrong Model For Callable Muni BondssoumensahilNo ratings yet

- Uncertainty, Time-Varying Fear, and Asset PricesDocument48 pagesUncertainty, Time-Varying Fear, and Asset PricesDessy ParamitaNo ratings yet

- ConvertibleBondStudy (TF and AFV Model)Document32 pagesConvertibleBondStudy (TF and AFV Model)Zheng GaoNo ratings yet

- Real Options in Capital Budgeting. Pricing The Option To Delay and The Option To Abandon A ProjectDocument12 pagesReal Options in Capital Budgeting. Pricing The Option To Delay and The Option To Abandon A ProjectKhiev ThidaNo ratings yet

- Altman, Onorato (2005) (An Integrated Pricing Model For Defaultable Loans and Bonds)Document21 pagesAltman, Onorato (2005) (An Integrated Pricing Model For Defaultable Loans and Bonds)as111320034667No ratings yet

- Unioersiry of Pennsylvania, Philadelphia, PA 19104. USADocument21 pagesUnioersiry of Pennsylvania, Philadelphia, PA 19104. USAEdzwan RedzaNo ratings yet

- A. RISK - Optimal Capital Structure and Financial Risk of Project InvestmentDocument18 pagesA. RISK - Optimal Capital Structure and Financial Risk of Project Investmentwidya firdansyahNo ratings yet

- Tarekegn LiteratureDocument25 pagesTarekegn LiteraturetewodrosbayisaNo ratings yet

- Evaluating Growth Options As Sourcesof Value For Pharmaceutical ResearchprojectsDocument18 pagesEvaluating Growth Options As Sourcesof Value For Pharmaceutical ResearchprojectsmaleticjNo ratings yet

- Real OptionsDocument14 pagesReal OptionsRayCharlesCloud100% (1)

- Devt Vs EquityDocument51 pagesDevt Vs EquityRania RebaiNo ratings yet

- Operations Research Techniques Applied To The FinancialMarketsDocument10 pagesOperations Research Techniques Applied To The FinancialMarketsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Valuing Real Options Projects With Correlated UncertaintiesDocument15 pagesValuing Real Options Projects With Correlated UncertaintiesmikaelcollanNo ratings yet

- 2 Real Options in Theory and PracticeDocument50 pages2 Real Options in Theory and Practicedxc12670No ratings yet

- Analysis of The Dulles GreenwayDocument21 pagesAnalysis of The Dulles GreenwayRakesh JainNo ratings yet

- CAPMDocument56 pagesCAPMraghavan swaminathanNo ratings yet

- Valuing Oil PropertiesDocument20 pagesValuing Oil Properties10manbearpig01No ratings yet

- Agency Problems, Screening and Increasing Credit LinesDocument41 pagesAgency Problems, Screening and Increasing Credit LinesBen ShionNo ratings yet

- Expansion Planning Using Options Analysis: of TransmissionDocument6 pagesExpansion Planning Using Options Analysis: of Transmissionapi-3697505No ratings yet

- Evaluating Risk in Put-Or-Pay Contracts: An Application in Waste Management Using Fuzzy Delphi MethodDocument9 pagesEvaluating Risk in Put-Or-Pay Contracts: An Application in Waste Management Using Fuzzy Delphi MethodScore1234No ratings yet

- Korajczyk1992 (Chap2)Document22 pagesKorajczyk1992 (Chap2)Tuấn KiệtNo ratings yet

- Hornung 2016 Heuristic Reasoning in The Setting of Hurdle Rates and in The Projection of Cash Flows in Investment Appraisal - 2016-09-30 - Appendix 2Document19 pagesHornung 2016 Heuristic Reasoning in The Setting of Hurdle Rates and in The Projection of Cash Flows in Investment Appraisal - 2016-09-30 - Appendix 2Sebastián SantiagoNo ratings yet

- B 41 Devanshi Vora Corporate FinanceDocument16 pagesB 41 Devanshi Vora Corporate FinanceDhrumil ShahNo ratings yet

- Valuation of RD Compound Option Using Markov ChainDocument27 pagesValuation of RD Compound Option Using Markov Chainbdvd1007092No ratings yet

- Azevedo and Gottlieb - Competition With Adverse SelectionDocument36 pagesAzevedo and Gottlieb - Competition With Adverse SelectionsouzajoseNo ratings yet

- YarosDocument3 pagesYarossfsdhg,kNo ratings yet

- Viability of Building Rehabilitation With Real Option Approaches: An Empirical Study in Hong KongDocument22 pagesViability of Building Rehabilitation With Real Option Approaches: An Empirical Study in Hong KongFeung Rabil. SatyasaiNo ratings yet

- The Arbitrage-Free Valuation and Hedging of Demand Deposits and Credit Card LoansDocument24 pagesThe Arbitrage-Free Valuation and Hedging of Demand Deposits and Credit Card LoansmahaNo ratings yet

- Syllabus Real Options AnalysisDocument4 pagesSyllabus Real Options AnalysisShayne LimNo ratings yet

- OTT StevenDocument61 pagesOTT StevengarycwkNo ratings yet

- Challenges Facing The Capital Asset Pricing Model (CAPM)Document1 pageChallenges Facing The Capital Asset Pricing Model (CAPM)faraazxbox1100% (1)

- UnifiedDocument33 pagesUnifiedmrtandonNo ratings yet

- Creditworthiness and Thresholds in A Credit Market Model With Multiple EquilibriaDocument35 pagesCreditworthiness and Thresholds in A Credit Market Model With Multiple EquilibriarrrrrrrrNo ratings yet

- Machine Learning For Fixed IncomeDocument17 pagesMachine Learning For Fixed IncomeVichara PoolsNo ratings yet

- How Proþtable Is Capital Structure Arbitrage?: Fan Yu University of California, IrvineDocument45 pagesHow Proþtable Is Capital Structure Arbitrage?: Fan Yu University of California, IrvineAVNo ratings yet

- A Stock Market ModelDocument33 pagesA Stock Market Modelc0nch1No ratings yet

- The Cost of Capital, The Regulatory Asset Base and Risk - 26.9.23Document14 pagesThe Cost of Capital, The Regulatory Asset Base and Risk - 26.9.23brilliantyakovNo ratings yet

- Perfect Competition in Markets With Adverse SelectionDocument40 pagesPerfect Competition in Markets With Adverse SelectionRAHMADANY HANINDA AKMAL 1No ratings yet

- Grenadier WangDocument45 pagesGrenadier WangMarysol AyalaNo ratings yet

- Dissertation On Determinants of Capital StructureDocument8 pagesDissertation On Determinants of Capital StructureCollegePaperServiceUK100% (1)

- Jafarizadeh 2009Document8 pagesJafarizadeh 2009Daniel Gallegos RamírezNo ratings yet

- RV YTM Model PDFDocument47 pagesRV YTM Model PDFAllen LiNo ratings yet

- Academy of Management Academy of Management PerspectivesDocument15 pagesAcademy of Management Academy of Management PerspectivesMario Claudio Amaro CarreñoNo ratings yet

- Credit Risk Models Par Robert A. JarrowDocument33 pagesCredit Risk Models Par Robert A. JarrowCJNo ratings yet

- 9 Real Options Valuation 2016 ValuationDocument10 pages9 Real Options Valuation 2016 ValuationPhuoc DangNo ratings yet

- Building A Credit Risk Valuation Framework For Loan InstrumentsDocument26 pagesBuilding A Credit Risk Valuation Framework For Loan InstrumentshyperionnNo ratings yet

- Modigliani MillerDocument12 pagesModigliani MillerAlvaro CamañoNo ratings yet

- CAPMDocument4 pagesCAPMhamza hamzaNo ratings yet

- Investment Decision in Oil and Gas Projects Using Real Option and Risk Tolerance ModelsDocument22 pagesInvestment Decision in Oil and Gas Projects Using Real Option and Risk Tolerance ModelsEdzwan RedzaNo ratings yet

- An Examination of Capital Budgeting PracticesDocument43 pagesAn Examination of Capital Budgeting PracticesAnkur ShuklaNo ratings yet

- WP 78 RiddioDocument47 pagesWP 78 RiddioIrenataNo ratings yet

- Soa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives AssignmentDocument10 pagesSoa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives Assignment87 gunjandasNo ratings yet

- Microscopic Simulation of Financial Markets: From Investor Behavior to Market PhenomenaFrom EverandMicroscopic Simulation of Financial Markets: From Investor Behavior to Market PhenomenaNo ratings yet

- List For EquipmentDocument1 pageList For EquipmentUjjal RegmiNo ratings yet

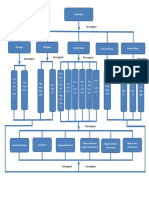

- Organization ChartDocument1 pageOrganization ChartUjjal RegmiNo ratings yet

- Steps To Developing A Project ScheduleDocument3 pagesSteps To Developing A Project ScheduleUjjal RegmiNo ratings yet

- Resource Utilization Sheet - 1Document17 pagesResource Utilization Sheet - 1Ujjal RegmiNo ratings yet

- Migration From Sybase Installation InstructionsDocument5 pagesMigration From Sybase Installation InstructionsUjjal RegmiNo ratings yet

- GFS722 PD 1 2015 3 - 1Document177 pagesGFS722 PD 1 2015 3 - 1Ujjal RegmiNo ratings yet

- A Guide To Project Finance - 2013 PDFDocument92 pagesA Guide To Project Finance - 2013 PDFPuneet MittalNo ratings yet

- FGH) G HNLJB'T SDKGL Lnld6) 8: SDKGLDF Nufglsf) Aoa:YfmDocument5 pagesFGH) G HNLJB'T SDKGL Lnld6) 8: SDKGLDF Nufglsf) Aoa:YfmUjjal RegmiNo ratings yet

- 6 - Review of DBSTDocument34 pages6 - Review of DBSTUjjal RegmiNo ratings yet

- Project Implementation and ControllingDocument41 pagesProject Implementation and ControllingUjjal Regmi100% (1)

- Manual of Rebar Test Data Processing SoftwareDocument47 pagesManual of Rebar Test Data Processing SoftwareUjjal RegmiNo ratings yet

- Feasibility Study Report BN PDFDocument120 pagesFeasibility Study Report BN PDFUjjal Regmi100% (3)

- Valoracion y Negociacion de TecnologíaDocument9 pagesValoracion y Negociacion de Tecnologíaliliana martinezNo ratings yet

- J Applied Corp Finance - 2022 - Myers - Real Options and Hidden LeverageDocument16 pagesJ Applied Corp Finance - 2022 - Myers - Real Options and Hidden LeverageVaconselos ChacuivaNo ratings yet

- Real Options and Other Topics in Capital BudgetingDocument24 pagesReal Options and Other Topics in Capital BudgetingAJ100% (1)

- Edited-Valuing Multistage Investment Projects in The Pharmaceutical IndustryDocument13 pagesEdited-Valuing Multistage Investment Projects in The Pharmaceutical IndustryUCDIE ConsultingNo ratings yet

- Lee 2018Document12 pagesLee 2018Yusuf Fidi UcupNo ratings yet

- Sustainability 10 03143Document21 pagesSustainability 10 03143Yinsheng XuNo ratings yet

- AFM Vs SFMDocument5 pagesAFM Vs SFMdartopapseNo ratings yet

- ECONOMIC JUSTIFICATION OF A FLEXIBLE MANUFACTURING SYSTEM PDF Report PDFDocument26 pagesECONOMIC JUSTIFICATION OF A FLEXIBLE MANUFACTURING SYSTEM PDF Report PDFvatsalparikh191991No ratings yet

- Business Valuation ManagementDocument304 pagesBusiness Valuation Managementcorredornicolas100% (2)

- The Theoretical and Methodological Basis of Startups ValuationDocument6 pagesThe Theoretical and Methodological Basis of Startups ValuationClaudio JuniorNo ratings yet

- 10 - Financial ManagementDocument133 pages10 - Financial ManagementMaha FarooqNo ratings yet

- Course Outline - Real Estate FinanceDocument2 pagesCourse Outline - Real Estate FinanceBabu RaoNo ratings yet

- Valuation ModelsDocument47 pagesValuation ModelsAshwin Kumar100% (1)

- Answers To Problem Sets: Real OptionsDocument13 pagesAnswers To Problem Sets: Real Optionsmandy YiuNo ratings yet

- Project Appraisal Using DCF MethodDocument26 pagesProject Appraisal Using DCF MethodardhanarentaNo ratings yet

- Advanced Corporate Finance (Mesznik) SP2016Document7 pagesAdvanced Corporate Finance (Mesznik) SP2016darwin12No ratings yet

- RovbrohureDocument94 pagesRovbrohurevicotheNo ratings yet

- FFM12, CH 13, IM, 01-08-09Document20 pagesFFM12, CH 13, IM, 01-08-09seventeenlopez100% (1)

- Real Options TheoryDocument24 pagesReal Options TheoryKumar PrashantNo ratings yet

- Evaluation Mining Project (Topal, 2008)Document15 pagesEvaluation Mining Project (Topal, 2008)LFNo ratings yet

- Vol03 02 DeterminingTheRealValueOfJnrMiningCompanies 08 10Document3 pagesVol03 02 DeterminingTheRealValueOfJnrMiningCompanies 08 10DanySuperfishNo ratings yet

- Capital Budgeting Practices in Developing CountriesDocument19 pagesCapital Budgeting Practices in Developing CountriescomaixanhNo ratings yet