Professional Documents

Culture Documents

Tnews 5

Tnews 5

Uploaded by

Nathan MartinCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Armstrong On GoldDocument5 pagesArmstrong On GoldNathan MartinNo ratings yet

- Tire LogbookDocument37 pagesTire LogbookNathan MartinNo ratings yet

- July Operating NotesDocument2 pagesJuly Operating NotesNathan MartinNo ratings yet

- Employment December 2011Document41 pagesEmployment December 2011Nathan MartinNo ratings yet

- Employment September 2011Document38 pagesEmployment September 2011Nathan MartinNo ratings yet

- Case Shiller Home Prices November 2011Document5 pagesCase Shiller Home Prices November 2011Hart Van DenburgNo ratings yet

- Case-Shiller October 2011Document5 pagesCase-Shiller October 2011Nathan MartinNo ratings yet

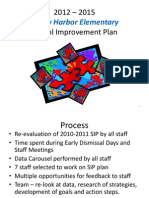

- FHES SIP Presentation 2012-2015Document12 pagesFHES SIP Presentation 2012-2015Nathan MartinNo ratings yet

- TIC December 2011Document2 pagesTIC December 2011Nathan MartinNo ratings yet

- Employment Situation November 2011Document39 pagesEmployment Situation November 2011Nathan MartinNo ratings yet

- Employment August 2011Document38 pagesEmployment August 2011Nathan MartinNo ratings yet

- Case-Shiller August 2011Document5 pagesCase-Shiller August 2011Nathan MartinNo ratings yet

- Helter Skelter - "Gentlemen Start Your Engines": "Helter Skelter - Are You Ready For The Ride?" in Contrast ToDocument20 pagesHelter Skelter - "Gentlemen Start Your Engines": "Helter Skelter - Are You Ready For The Ride?" in Contrast ToNathan MartinNo ratings yet

- Presidential Press Release-10 11 2011Document2 pagesPresidential Press Release-10 11 2011Nathan MartinNo ratings yet

- TIC Data For May 2011Document2 pagesTIC Data For May 2011Nathan MartinNo ratings yet

- ExterredrawnDocument1 pageExterredrawnNathan MartinNo ratings yet

- Greece: It's Time To Default Before Civil War Breaks OutDocument8 pagesGreece: It's Time To Default Before Civil War Breaks OutNathan MartinNo ratings yet

- Employment June 2011Document38 pagesEmployment June 2011Nathan MartinNo ratings yet

- TRReport 23Document30 pagesTRReport 23Nathan MartinNo ratings yet

- TIC Press Release APRILDocument3 pagesTIC Press Release APRILNathan MartinNo ratings yet

- Rome's Inflation Versus USDocument1 pageRome's Inflation Versus USNathan MartinNo ratings yet

- CDIS CV PL.1 EcosystemDocument39 pagesCDIS CV PL.1 EcosystemIvanildo CostaNo ratings yet

- Style Only: 42 Scientific American, October 2014Document6 pagesStyle Only: 42 Scientific American, October 2014Gabriel MirandaNo ratings yet

- (Exclusive) The Shocking Plan of The 6900 Series of ProtocolsDocument29 pages(Exclusive) The Shocking Plan of The 6900 Series of ProtocolsWilliam TrentiniNo ratings yet

- People v. SantocildesDocument3 pagesPeople v. SantocildesJonimar Coloma QueroNo ratings yet

- Basics of Accounting in Small Business NewDocument50 pagesBasics of Accounting in Small Business NewMohammed Awwal NdayakoNo ratings yet

- Warning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionDocument9 pagesWarning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionOmar Rodriguez OrtizNo ratings yet

- Book CoreConcernsinIndianDefence PDFDocument408 pagesBook CoreConcernsinIndianDefence PDFVishal TiwariNo ratings yet

- Motor Claim FormDocument5 pagesMotor Claim Formபிரகாஷ் குமார்No ratings yet

- Soft Power With Chinese Characteristics: The Ongoing DebateDocument17 pagesSoft Power With Chinese Characteristics: The Ongoing DebateKanka kNo ratings yet

- Self Organization Case AssignmentDocument2 pagesSelf Organization Case AssignmentCj NightsirkNo ratings yet

- Form - T: Combined Muster Roll Cum Register of WagesDocument2 pagesForm - T: Combined Muster Roll Cum Register of WageskapilvarshaNo ratings yet

- Financial Accounting - Reporting November 2021 Question PaperDocument9 pagesFinancial Accounting - Reporting November 2021 Question PaperMunodawafa ChimhamhiwaNo ratings yet

- Envizi L4 POX - API OverviewDocument2 pagesEnvizi L4 POX - API OverviewzvranicNo ratings yet

- The Deficienies of Women in The Eyes of Imam Ali in Nahjul BalaghaDocument33 pagesThe Deficienies of Women in The Eyes of Imam Ali in Nahjul BalaghaSaleem BhimjiNo ratings yet

- Francais The Crochet Puffin PDF Amigurumi Free PatternDocument5 pagesFrancais The Crochet Puffin PDF Amigurumi Free PatternІрина Бердей100% (2)

- Bock, de L.L.M. 4179781, BA Thesis 2017Document29 pagesBock, de L.L.M. 4179781, BA Thesis 2017DutraNo ratings yet

- Blue Star Land Services v. Coleman - Ex Parte Seizure Order (WD Okl)Document5 pagesBlue Star Land Services v. Coleman - Ex Parte Seizure Order (WD Okl)Ken VankoNo ratings yet

- MAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDocument9 pagesMAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDawoodHameedNo ratings yet

- XFPIP02674220A: A B A BDocument3 pagesXFPIP02674220A: A B A BmnmusorNo ratings yet

- ASA University Term Paper GuidelinesDocument16 pagesASA University Term Paper Guidelineskuashask2No ratings yet

- Types of Criminal OffensesDocument4 pagesTypes of Criminal OffensesPAOLO ABUYONo ratings yet

- Introduction To Organizational BehaviorDocument6 pagesIntroduction To Organizational BehaviorRajeev SubediNo ratings yet

- Red Flags Checklist For PractitionersDocument29 pagesRed Flags Checklist For PractitionersBernadette Martínez HernándezNo ratings yet

- 09.1 Carey - Cultural ApproachDocument16 pages09.1 Carey - Cultural ApproachOneness EnglishNo ratings yet

- Manifestation of Gender BiasDocument18 pagesManifestation of Gender BiasJoemar TisadoNo ratings yet

- Measuring The Readiness of Navotas Polytechnic College For SLO AdoptionDocument5 pagesMeasuring The Readiness of Navotas Polytechnic College For SLO AdoptionMarco MedurandaNo ratings yet

- Agenda SLW ES 2022 - Bootcamp #2 - PesertaDocument6 pagesAgenda SLW ES 2022 - Bootcamp #2 - PesertaJonathan AndrewNo ratings yet

- Shame and GuiltDocument19 pagesShame and GuiltCissa CostamilanNo ratings yet

- Communicate With Customer Using Technologies PDF Teaching MaterialDocument25 pagesCommunicate With Customer Using Technologies PDF Teaching MaterialAzarya DamtewNo ratings yet

Tnews 5

Tnews 5

Uploaded by

Nathan MartinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tnews 5

Tnews 5

Uploaded by

Nathan MartinCopyright:

Available Formats

news

1st June 2009

This issue: This Thunder Road News was a bit more hurried than normal as

I took a few days holiday at the Center Parcs resort in Sherwood

Forest. In the neighbouring chalet was a lovely couple who had

Demographics, stock market both trained as doctors and now work as psychiatrists in the north

earnings and food/energy

west of England. One evening we got chatting and they were

investments (here)

telling us about their concerns for the future and how most of

Gold - suspicious exports their savings are in UK government bonds and they weren’t sure

from US (here) if this was the right place for them going forward. That was like a

red rag to a bull and it was hard not to unleash a verbal tsunami

about the need for everyone to protect themselves from reckless

politicians and central bankers and to buy gold/silver, as well as

energy, food/agriculture (they were already thinking about land)

and internet infrastructure related investments – the “global end

of normal”, etc, etc. I hope I didn’t bore them too much.

The first three investment classes had a stellar week last week as

the global inflation trade (or should we call it an emerging dollar

crisis) took centre stage while I was away: The 22.6% rise in the

silver price was its biggest weekly rise since April 1987. I’m told

that a high profile fund manager in London has personally bought

a cubic metre of silver - the investment case is becoming better

understood! I stick to my view that before this gold and silver

bull market is over, people will be discussing ownership of gold

and silver exploration companies over dinner in London and New

York.

Many people are getting optimistic about maturing green shoots

in the global economy, but I still have grave doubts regarding

the UK and US. These quotes from the Cara Trading Advisory

(Bahamas) team after the close on Friday summed up my feelings

perfectly:

“What is going on today is atrocious. Where is the SEC these

days? Do you feel like a frog dropped in the lukewarm water

as the heat is slowly turned up, oblivious to one’s impending

demise? We do. Seriously, could Friday get any duller? Are the

masters lulling us to sleep, trotting out their minions on Tout TV,

imploring us to invest on “hope”, buying time as financial firms

desperately raise much-needed capital? Then suddenly jerking

our chain, as they did in the final moments of Friday’s trading, to

be sure they have our full attention. Points of interest for Friday:

Paul Mylchreest

paul@thunderroadreport.com

BB Gold (GLD + 2.04%) and silver (SLV + 3.62%) continued their ascent, particularly strong since Thursday

morning, the fundamentals too compelling to ignore;

BB A rare combination of major bond strength (TLT + 2.23%) and extreme dollar weakness (Euro ETF FXE

+ 1.36%);

BB An unbelievable buy-on-close program, which drove the S&P futures +2% in five minutes, which left us

shaking our heads at the co-ordination with Tout TV’s usual talking heads; and

BB The Financials (XLF +1.42%) are coiling, getting ready for a large move – one way or the other.

But think, now that Government leaders have taken center stage, with promises everywhere; has

government ever come up with the most efficient, most cost-effective solution? Wasn’t government in

league with bankers to blame for this mess?

Most people lost nearly -50% of their net worth over the past 18 months. A week ago I remarked that

promoters were coming out in flocks. This appears to be the start of Silly Season – a bit like the summer of

1987. Please don’t start swinging for the fence, attempting to get back what is “rightfully” yours. Instead,

think singles and doubles, minimizing risk while ringing the register.”

Demographics, stock market earnings and food/energy

A blog I’ve started to follow is “Nathan’s Economic Edge” at economicedge.blogspot.com. Recently he wrote

a piece (here) on demographics and the work of Harry S. Dent in particular. At the beginning he considers

the extent that demographics impacts economics, highlighting the quote from David Foot in his book,

“Boom, Bust & Echo”:

“Demographics explain about two-thirds of everything: which products will be in demand, where job

opportunities will occur, what school enrolments will be, when house values will rise or drop, what kinds of

food people will buy and what kinds of cars they will drive.”

Nathan argues (correctly I think) that the impact of demographics is far less than two-thirds as there are so

many other factors that “comprise the economic brew that add up to prosperity of lack thereof”. One factor

he mentions is the rule of law (i.e. contracts with integrity), and I want to go off briefly on a tangent here.

Regarding countries without the rule of law, Nathan argues that they:

“are far more likely to be poor because their rule-shifting drives capital away.”

I thought it was very interesting how Obama bulldozed through bankruptcy law in respect of the demotion

of Chrysler’s secured creditors vis-a-vis their unsecured counterparts with stronger political connections. It

augurs badly for confidence in the US, just at the moment when it needs more finance than ever before.

Back to demographics and the subject of world population, the growth of which is firmly in its exponential

phase. The planet is currently adding one billion people every 13-14 years and the population could double

again by 2040. On a daily basis, the world population is increasing by 211,000 people daily. This is shown

in chart for below:

© Thunder Road Report - 1 June 2009 2

Growth in the world population

Nathan then ties this in with the work of economist and writer, Harry S. Dent. I wasn’t familiar with his

work, although I probably should have been. Wikipedia describes Dent’s work as follows:

“The basis of Dent’s research is the highly predictable nature of consumer spending based on a family

formation pattern - minimal spending as young adults, spending more as raising children, peaking in that

spending as children are leaving home, and then slowing spending during the last 15 years of working life

(48-63) while saving more and preparing for retirement.

In the late 1980s, Dent forecast that the Japanese economy, then the darling of the world, would soon enter

a slowdown that would last more than a decade. In the early 1990s, he predicted that the Dow would reach

10k. Both of these predictions were met with much skepticism, and yet both eventually came to pass. In

Japan, Dent was using their peak of 45-50 year olds (1990-1994) as the beginning of a long slowdown.”

While these were stunning successes, he did not anticipate the recession of 2002-03 in the wake of the dot.

com bust and predicted the Dow would reach 40,000 by the end of this decade. Despite this, I think much

of his analysis is not only thought-provoking, but also has a great deal of validity.

Nathan uses some of the charts on Dent’s website, www.hsdent.com, to make a bearish case for the stock

market focusing on US data. The first key chart is the birth rate index adjusted for immigration. This shows

the first peak associated with height of the “baby boom” generation in 1961:

Trend in US birth rate

Source: H.S. Dent Foundation

© Thunder Road Report - 1 June 2009 3

As an aside, the UK birth rate peaked at almost the same time. The next phase of the analysis focuses on

the age of peak earnings power, and therefore peak spending power, of the statistically average person.

Dent worked out that the average age for peak earnings power is 48.5 years old:

Typical lifecycle spending cycle

Source: H.S. Dent Foundation

Obviously, for a person born at the peak of the baby boom generation in 1961 would reach their peak

earnings power in late 2009 or early 2010. The most interesting part of Dent’s work is when he compares

the birth rate adjusted for peak spending (i.e. by 48.5 years) versus the inflation-adjusted chart of the Dow

Jones. For much of the last fifty years, the trends in the two charts have followed each other quite closely:

Spending (birth rate adjusted) vs. inflation-adjusted Dow Jones

Source: H.S. Dent Foundation

The message is that the inflation-adjusted Dow should be peaking in the next 12 months. Now as we know,

Dent hasn’t been infallible and the Dow Jones actually peaked in October 2007 at 14,164. This is where

Nathan makes an interesting point when he asks why was Dent late in his estimate?

© Thunder Road Report - 1 June 2009 4

“The reason is DEBT!...central bankers were able to force more and more debt into the system. This pulled

the baby boomer’s FUTURE INCOMES into the NOW. The effect of this was to over accentuate the growth

phase and now to over accentuate the decline as well as to make the decline lengthier in time as future

incomes will be servicing the interest on all that debt.”

I couldn’t agree with him more as one of my mantras is “Debt brings forward consumption”. The decline in

peak spending power feeds through to corporate earnings!

US corporate profits after tax

Source: St Louis Federal Reserve

Nathan then makes another interesting point:

“The baby boomer’s kids (echo boomers) are now moving through or past college and people who represent

the leading edge of this wave are already moving into their first homes. What impact will this have? If you

are going to invest in real estate, you should know. Thus, it is fair to say that for the near-term, luxury

home prices will languish and starter home prices will hold up better.”

Leaving aside differential moves within the residential property market, it seems to me that there is

another strong and obvious investment message. The exponential rise in world population combined with

Dent’s work regarding the lull in spending power in developed economies like the US (accentuated by the

heavy ongoing debt burden) is a powerful driver for basic commodities and food/agriculture and energy

related investments in particular. To the extent that the supply side of these commodities is constrained

only adds to their attraction.

In my view, if you want confirmation about the demographic justification for food and energy related

investments you got it with the secret meeting of billionaires on 5 May 2009 at the home of Sir Paul Nurse,

president of the Rockefeller University, in Manhattan. Despite their best efforts to keep it secret, it leaked

into the mainstream media with an article on page 26 of the Sunday Times on 24 May 2009.

“Some of America’s leading billionaires have met secretly to consider how their wealth could be used to

slow the growth of the world’s population…The informal afternoon session was so discreet that some of the

billionaires’ aides were told they were at security briefings.”

Those present included David Rockefeller, George Soros, Bill Gates, Michael Bloomberg, Warren Buffet, Ted

Turner and Oprah Winfrey. The Sunday Times reported one guest saying that “population growth would be

tackled as a potentially disastrous environmental, social and industrial threat.”

© Thunder Road Report - 1 June 2009 5

The reason given for all the secrecy, which is laughable in respect of the agenda of at least one of the

guests:

“They wanted to speak rich to rich without worrying anything they said would end up in the newspapers,

painting them as an alternative world government.”

Gold – suspicious exports from the US

In the last few weeks, I’ve been highlighting the massive buying of gold call options in the June and

December contracts on the COMEX exchange in New York. The June contract expired on 26 May 2009, i.e.

last Tuesday. Trading that day was very illustrative of how the character of the gold market had changed

recently. As the chart below shows, the interventionists moved in to suppress gold prices during the

morning session in London, but the buyers were waiting. The usual “Plan A” of the interventionists to push

down the price on the opening in New York was run, but once again, the buyers were waiting.

Gold price on 26 May 2009 (US$/oz)

Source: Kitco

Now we have to see to what extent the holders of “in the money” call options for the June contract take

delivery of their futures contracts and stand for delivery of physical gold.

For those who haven’t heard about him, Rob Kirby of Kirby Analytics (www.kirbyanalytics.com) is an

excellent forensic analyst with an uncanny ability to uncover data that everyone else has missed. His latest

piece, “US Gold, Going or Completely Gone?” (here) shows how the US has exported a massive amount

of gold during the last two years and how the US authorities have done their best to hide this fact in the

official statistics.

Kirby set out to prove that the US trade statistics were inaccurate and was analysing Mineral Industry

Surveys published by the United States Geological Survey (USGS) This shows import and export data for

commodities and, in the latest survey for gold in January 2009, he found the following:

© Thunder Road Report - 1 June 2009 6

US imports and exports of gold

Source: USGS, Rob Kirby

In 2008, under the terminology of “Gold compounds”, the US reported exports with a gross weight of 2,920

tonnes. Rob Kirby contact the USGS to query the number and was told that the data was provided by US

Census Bureau and gold compounds were “typified by industrial type products containing low percentages/

amounts of actual gold content – like gold paint.”

Kirby had already checked the 2007 data, which showed that the export level was significantly lower at

2,150 tonnes. With a much weaker global economy in 2008, he asked the USGS representative, why would

exports surge in 2008? The USGS representative acknowledged that this didn’t make sense and admitted

that the US Census Bureau was questioned on this line item. Kirby asked whether it was the gross weight

of these exports or the gross value which was questioned? The USGS confirmed that it questioned the gross

value of these export goods. And here is the key - Kirby asked:

“Being an issue of gross value – then let me guess that the US Census Bureau is assigning an astronomically

high value to these goods. Such a high value would be completely inconsistent with what the US Census

Bureau claims these items are – namely industrial goods. The values being reported would be more in line

with these goods being gold bullion or equivalents?”

The USGS representative replied:

“That would be correct.”

Rob Kirby concludes:

“the forgoing data and discussion with the US is proof that the US has surreptitiously exported physical

gold – and continues to do so.”

© Thunder Road Report - 1 June 2009 7

If these “Gold compounds” are gold bullion, or predominantly gold bullion (like melted down gold coins

– see below), the tonnage is massive. Aggregate exports of 5,070 tonnes in 2007-08 compares with the

official (alleged) figure for US gold reserves of 8,133.5 tonnes and annual US mine production of just over

200 tonnes.

Having established the existence of these gold exports, the next question is what they represent? Kirby

speculates:

“The exports are likely coin melt (or gold compound, if you prefer) from the great gold confiscation back in

1933; or alternatively, this terminology is being used to disguise the physical repatriation of foreign gold

bullion formerly on deposit with the N.Y. Federal Reserve.”

For readers who are less familiar with the gold market, some explanation might be useful here. President

Roosevelt confiscated gold from US citizens in 1933 to stem a run on the US’s gold reserves during the

Great Depression. In many cases, the confiscated gold coins were not pure gold (often about 90%), but

nonetheless, were melted down into bars. Such bars might fit with could be described as “Gold compounds”

in the USGS trade data. If this is the case, it would represent the US covertly exporting part of its gold

reserves to sell on foreign exchanges to suppress the gold price and protect the value of the US dollar.

Alternatively, as Kirby speculates, it could represent foreign central banks repatriating gold reserves stored

at the vaults of the New York Federal Reserve. Describing such bullion exports as “Gold compounds” could

just be a convenient way of trying to hide their true nature. Coincidentally, in last week’s TRoad News, I

reported that according to Jim Willie’s (of the Hat-Trick letter) source, Germany is demanding that its gold

stored in the US be returned. From other sources, I also noted that the US and Germany may have engaged

in a gold swap that allowed the US to “mobilise” Bundesbank gold in Europe to hold down the price on the

major physical markets in Europe, i.e. London and Zurich.

What’s also interesting is that the USGS trade data also shows which nations the gold compounds was

exported to or imported from. Rob Kirby doesn’t mention this, but it’s worth taking a look. The table below

shows imports and exports for 2008:

US imports and exports of “Gold compounds” in 2008 (tonnes)

2008

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

Imports 4 11 1 17 0 27 24 0 16 3 0 0 102

Exports 220 281 293 232 257 359 187 197 265 226 228 174 2,920

Canada 41 68 36 54 43 65 44 37 42 47 35 38 550

China 66 23 100 69 46 43 0 1 19 52 30 0 449

Dominican Rep. 13 13 10 10 10 12 29 22 5 18 15 18 174

Germany 0 1 1 1 1 6 2 0 1 3 3 2 21

Netherlands 0 33 11 5 7 7 2 30 17 6 38 19 173

Singapore 55 108 94 63 87 204 86 72 120 68 92 78 1,127

Switzerland 0 0 0 0 0 0 0 0 0 0 0 0 0

Taiwan 15 12 10 11 15 13 4 21 10 10 2 8 130

UK 3 0 1 0 2 0 2 0 0 1 0 0 10

Other 26 23 30 17 48 10 19 13 51 22 14 11 284

Source: USGS

I’ve included the UK and Switzerland even though the exports are negligible. If physical gold from these

“Gold compounds” was being used to suppress the gold price in Europe it would most likely be exported to

either or both of these nations, or ones nearby. This is not the case, although there are modest exports to

the Netherlands and Germany.

© Thunder Road Report - 1 June 2009 8

By far the biggest destination is Singapore (exports of 1,126.5 tonnes in 2008 alone) but, according to the

World Gold Council, Singapore’s official gold reserves are only 127.4 tonnes. It is possible that Singapore

has covertly increased its gold reserves without making a public announcement, just as China did between

2003 and April 2009. Alternatively, it could represent the US selling gold reserves into Asia to satisfy the

strong demand in the region where holding savings in gold is far more common than in the west.

The movement of these gold compounds to China could represent the repatriation of some of the 454

tonnes of bullion purchased (and now acknowledged) during the last six years. Another very suspicious

figure is the 174 tonnes of gold compounds exported to the Dominican Republic, that well known hub of

world gold trade! Maybe these gold compounds really are used in gold paint and that artist who normally

puts colourful tarpaulins around islands and buildings has painted the whole of the Dominican Republic

gold. I’ll go and check Google Earth. If not, maybe this quote from Reuters last year is closer to the mark:

“Drug smugglers are flying with impunity into the Dominican Republic and have turned it into a far more

important transshipment point for South American cocaine than its largely lawless and impoverished

neighbor, Haiti, U.S. officials said on Thursday.”

Wouldn’t it be interesting if drug smugglers have seen the writing on the wall for the paper dollar and will

now only accept payment in gold bullion?

© Thunder Road Report - 1 June 2009 9

Author: I started work the month before the stock market crash in 1987. I’ve worked mainly as an analyst

covering the Metals & Mining, Oil & Gas and Chemicals industries for a number of brokers and banks

including S.G. Warburg (now UBS), Credit Lyonnais, JP Morgan Chase, Schroders (became Citibank) and,

latterly, at the soon to be mighty Redburn Partners.

Disclaimer: The views expressed in this report are my own and are for information only. It is not intended

as an offer, invitation, or solicitation to buy or sell any of the securities or assets described herein. I do not

accept any liability whatsoever for any direct or consequential loss arising from the use of this document or

its contents. Please consult a qualified financial advisor before making investments. The information in this

report is believed to be reliable , but I do not make any representations as to its accuracy or completeness.

I may have long or short positions in companies mentioned in this report.

© Thunder Road Report - 1 June 2009 10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Armstrong On GoldDocument5 pagesArmstrong On GoldNathan MartinNo ratings yet

- Tire LogbookDocument37 pagesTire LogbookNathan MartinNo ratings yet

- July Operating NotesDocument2 pagesJuly Operating NotesNathan MartinNo ratings yet

- Employment December 2011Document41 pagesEmployment December 2011Nathan MartinNo ratings yet

- Employment September 2011Document38 pagesEmployment September 2011Nathan MartinNo ratings yet

- Case Shiller Home Prices November 2011Document5 pagesCase Shiller Home Prices November 2011Hart Van DenburgNo ratings yet

- Case-Shiller October 2011Document5 pagesCase-Shiller October 2011Nathan MartinNo ratings yet

- FHES SIP Presentation 2012-2015Document12 pagesFHES SIP Presentation 2012-2015Nathan MartinNo ratings yet

- TIC December 2011Document2 pagesTIC December 2011Nathan MartinNo ratings yet

- Employment Situation November 2011Document39 pagesEmployment Situation November 2011Nathan MartinNo ratings yet

- Employment August 2011Document38 pagesEmployment August 2011Nathan MartinNo ratings yet

- Case-Shiller August 2011Document5 pagesCase-Shiller August 2011Nathan MartinNo ratings yet

- Helter Skelter - "Gentlemen Start Your Engines": "Helter Skelter - Are You Ready For The Ride?" in Contrast ToDocument20 pagesHelter Skelter - "Gentlemen Start Your Engines": "Helter Skelter - Are You Ready For The Ride?" in Contrast ToNathan MartinNo ratings yet

- Presidential Press Release-10 11 2011Document2 pagesPresidential Press Release-10 11 2011Nathan MartinNo ratings yet

- TIC Data For May 2011Document2 pagesTIC Data For May 2011Nathan MartinNo ratings yet

- ExterredrawnDocument1 pageExterredrawnNathan MartinNo ratings yet

- Greece: It's Time To Default Before Civil War Breaks OutDocument8 pagesGreece: It's Time To Default Before Civil War Breaks OutNathan MartinNo ratings yet

- Employment June 2011Document38 pagesEmployment June 2011Nathan MartinNo ratings yet

- TRReport 23Document30 pagesTRReport 23Nathan MartinNo ratings yet

- TIC Press Release APRILDocument3 pagesTIC Press Release APRILNathan MartinNo ratings yet

- Rome's Inflation Versus USDocument1 pageRome's Inflation Versus USNathan MartinNo ratings yet

- CDIS CV PL.1 EcosystemDocument39 pagesCDIS CV PL.1 EcosystemIvanildo CostaNo ratings yet

- Style Only: 42 Scientific American, October 2014Document6 pagesStyle Only: 42 Scientific American, October 2014Gabriel MirandaNo ratings yet

- (Exclusive) The Shocking Plan of The 6900 Series of ProtocolsDocument29 pages(Exclusive) The Shocking Plan of The 6900 Series of ProtocolsWilliam TrentiniNo ratings yet

- People v. SantocildesDocument3 pagesPeople v. SantocildesJonimar Coloma QueroNo ratings yet

- Basics of Accounting in Small Business NewDocument50 pagesBasics of Accounting in Small Business NewMohammed Awwal NdayakoNo ratings yet

- Warning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionDocument9 pagesWarning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionOmar Rodriguez OrtizNo ratings yet

- Book CoreConcernsinIndianDefence PDFDocument408 pagesBook CoreConcernsinIndianDefence PDFVishal TiwariNo ratings yet

- Motor Claim FormDocument5 pagesMotor Claim Formபிரகாஷ் குமார்No ratings yet

- Soft Power With Chinese Characteristics: The Ongoing DebateDocument17 pagesSoft Power With Chinese Characteristics: The Ongoing DebateKanka kNo ratings yet

- Self Organization Case AssignmentDocument2 pagesSelf Organization Case AssignmentCj NightsirkNo ratings yet

- Form - T: Combined Muster Roll Cum Register of WagesDocument2 pagesForm - T: Combined Muster Roll Cum Register of WageskapilvarshaNo ratings yet

- Financial Accounting - Reporting November 2021 Question PaperDocument9 pagesFinancial Accounting - Reporting November 2021 Question PaperMunodawafa ChimhamhiwaNo ratings yet

- Envizi L4 POX - API OverviewDocument2 pagesEnvizi L4 POX - API OverviewzvranicNo ratings yet

- The Deficienies of Women in The Eyes of Imam Ali in Nahjul BalaghaDocument33 pagesThe Deficienies of Women in The Eyes of Imam Ali in Nahjul BalaghaSaleem BhimjiNo ratings yet

- Francais The Crochet Puffin PDF Amigurumi Free PatternDocument5 pagesFrancais The Crochet Puffin PDF Amigurumi Free PatternІрина Бердей100% (2)

- Bock, de L.L.M. 4179781, BA Thesis 2017Document29 pagesBock, de L.L.M. 4179781, BA Thesis 2017DutraNo ratings yet

- Blue Star Land Services v. Coleman - Ex Parte Seizure Order (WD Okl)Document5 pagesBlue Star Land Services v. Coleman - Ex Parte Seizure Order (WD Okl)Ken VankoNo ratings yet

- MAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDocument9 pagesMAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDawoodHameedNo ratings yet

- XFPIP02674220A: A B A BDocument3 pagesXFPIP02674220A: A B A BmnmusorNo ratings yet

- ASA University Term Paper GuidelinesDocument16 pagesASA University Term Paper Guidelineskuashask2No ratings yet

- Types of Criminal OffensesDocument4 pagesTypes of Criminal OffensesPAOLO ABUYONo ratings yet

- Introduction To Organizational BehaviorDocument6 pagesIntroduction To Organizational BehaviorRajeev SubediNo ratings yet

- Red Flags Checklist For PractitionersDocument29 pagesRed Flags Checklist For PractitionersBernadette Martínez HernándezNo ratings yet

- 09.1 Carey - Cultural ApproachDocument16 pages09.1 Carey - Cultural ApproachOneness EnglishNo ratings yet

- Manifestation of Gender BiasDocument18 pagesManifestation of Gender BiasJoemar TisadoNo ratings yet

- Measuring The Readiness of Navotas Polytechnic College For SLO AdoptionDocument5 pagesMeasuring The Readiness of Navotas Polytechnic College For SLO AdoptionMarco MedurandaNo ratings yet

- Agenda SLW ES 2022 - Bootcamp #2 - PesertaDocument6 pagesAgenda SLW ES 2022 - Bootcamp #2 - PesertaJonathan AndrewNo ratings yet

- Shame and GuiltDocument19 pagesShame and GuiltCissa CostamilanNo ratings yet

- Communicate With Customer Using Technologies PDF Teaching MaterialDocument25 pagesCommunicate With Customer Using Technologies PDF Teaching MaterialAzarya DamtewNo ratings yet