Professional Documents

Culture Documents

Capital Capital Funds

Capital Capital Funds

Uploaded by

Abhishek KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Capital Funds

Capital Capital Funds

Uploaded by

Abhishek KumarCopyright:

Available Formats

Capital Capital Funds Equity contribution of owners.

The basic approach of capital adequacy framework is that a bank should have sufficient capital to provide a stable resource to absorb any losses arising from the risks in its business. Capital is divided into different tiers according to the characteristics / qualities of each qualifying instrument. For supervisory purposes capital is split into two categories: Tier I and Tier II. Tier I Capital A term used to refer to one of the components of regulatory capital. It consists mainly of share capital and disclosed reserves (minus goodwill, if any). Tier I items are deemed to be of the highest quality because they are fully available to cover losses Hence it is also termed as core capital. Tier II Capital Refers to one of the components of regulatory capital. Also known as supplementary capital, it consists of certain reserves and certain types of subordinated debt. Tier II items qualify as regulatory capital to the extent that they can be used to absorb losses arising from a bank's activities. Tier II's capital loss absorption capacity is lower than that of Tier I capital. Revaluation reserves Revaluation reserves are a part of Tier-II capital. These reserves arise from revaluation of assets that are undervalued on the bank's books, typically bank premises and marketable securities. The extent to which the revaluation reserves can be relied upon as a cushion for unexpected losses depends mainly upon the level of certainty that can be placed on estimates of the market values of the relevant assets and the subsequent deterioration in values under difficult market conditions or in a forced sale. Leverage Ratio of assets to capital. Capital reserves That portion of a company's profits not paid out as dividends to shareholders. They are also known as undistributable reserves and are ploughed back into the business. Deferred Tax Assets Unabsorbed depreciation and carry forward of losses which can be set-off against future taxable income which is considered as timing differences result in deferred tax assets. The deferred Tax Assets are accounted as per the Accounting Standard 22. Deferred Tax Liabilities Deferred tax liabilities have an effect of increasing future year's income tax payments, which indicates that they are accrued income taxes and meet definition of liabilities. Subordinated debt Refers to the status of the debt. In the event of the bankruptcy or liquidation of the debtor, subordinated debt only has a secondary claim on repayments, after other debt has been repaid. Hybrid debt capital instruments In this category, fall a number of capital instruments, which combine certain characteristics

of equity and certain characteristics of debt. Each has a particular feature, which can be considered to affect its quality as capital. Where these instruments have close similarities to equity, in particular when they are able to support losses on an ongoing basis without triggering liquidation, they may be included in Tier II capital. BASEL Committee on Banking Supervision The BASEL Committee is a committee of bank supervisors consisting of members from each of the G10 countries. The Committee is a forum for discussion on the handling of specific supervisory problems. It coordinates the sharing of supervisory responsibilities among national authorities in respect of banks' foreign establishments with the aim of ensuring effective supervision of banks' activities worldwide.

You might also like

- Moodys - Sample Questions 1Document12 pagesMoodys - Sample Questions 1iva100% (2)

- Accounts Receivable NarrativeDocument3 pagesAccounts Receivable NarrativeCaterina De LucaNo ratings yet

- Essentials of Financial Management 3rd Edition Brigham Test BankDocument26 pagesEssentials of Financial Management 3rd Edition Brigham Test BankKevinRobertsbfak100% (52)

- Chapter 9 The Cost of CapitalDocument54 pagesChapter 9 The Cost of CapitalCindy Canlas100% (3)

- IMChap 020Document29 pagesIMChap 020Roger TanNo ratings yet

- Capital Adequacy (Chapter 20)Document10 pagesCapital Adequacy (Chapter 20)Farzana AkhterNo ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Bfs Foreclosed Properties Listing As of 2017-04-12 PublicDocument14 pagesBfs Foreclosed Properties Listing As of 2017-04-12 PublicCianPanganibanNo ratings yet

- Glossory of RBIDocument3 pagesGlossory of RBIgargmba910No ratings yet

- Definition of 'Qip': Basel Capital AccordDocument7 pagesDefinition of 'Qip': Basel Capital AccordRISHABH GUPTANo ratings yet

- Capital Adequacy Ratio - ReportDocument11 pagesCapital Adequacy Ratio - ReportAllex JackNo ratings yet

- Glossary: Capital Earnings Funds and Investment Asset Securitisation Nds-Om Web HomeDocument16 pagesGlossary: Capital Earnings Funds and Investment Asset Securitisation Nds-Om Web HomeSanjeet MohantyNo ratings yet

- Capital Capital FundsDocument12 pagesCapital Capital FundsDrKhalid A ChishtyNo ratings yet

- Capital Capital FundsDocument11 pagesCapital Capital FundsSantosh Kumar BarikNo ratings yet

- Glossary PDFDocument8 pagesGlossary PDFkumarsanjeev.net9511No ratings yet

- Capital Earnings Funds and Investment Asset Securitisation HomeDocument7 pagesCapital Earnings Funds and Investment Asset Securitisation HomeKumar PsnNo ratings yet

- Capital Capital FundsDocument10 pagesCapital Capital Fundsbhau_20No ratings yet

- Economics Glossary PDFDocument9 pagesEconomics Glossary PDFSK PNo ratings yet

- Basel III Capital Adequacy Ratio Minimum RequirementDocument4 pagesBasel III Capital Adequacy Ratio Minimum RequirementMD Abdur RahmanNo ratings yet

- Capital Adequacy NormsDocument21 pagesCapital Adequacy NormsAayush ChimankarNo ratings yet

- General Banking MGTDocument16 pagesGeneral Banking MGTJibon JainNo ratings yet

- Capital Adequacy RatioDocument2 pagesCapital Adequacy RatiomanoramanNo ratings yet

- BaselDocument27 pagesBaselSimran MehrotraNo ratings yet

- U 3: C A N: NIT Apital Dequacy OrmsDocument12 pagesU 3: C A N: NIT Apital Dequacy OrmsJaldeep MangawaNo ratings yet

- Basel Norms in Banking SectorsDocument36 pagesBasel Norms in Banking SectorsSaikat ChatterjeeNo ratings yet

- B&I Unit 3Document14 pagesB&I Unit 3saisri nagamallaNo ratings yet

- Reserve Bank of IndiaDocument33 pagesReserve Bank of IndiaxytiseNo ratings yet

- An Overview On Financial Statements and Ratio AnalysisDocument10 pagesAn Overview On Financial Statements and Ratio AnalysissachinoilNo ratings yet

- Capital Adequacy RatioDocument3 pagesCapital Adequacy Ratioawadesh44rai9983No ratings yet

- Sources Applications of FundsDocument234 pagesSources Applications of Fundsjananidhanasekaran26No ratings yet

- Tier 1 Capital RatioDocument23 pagesTier 1 Capital RatiokapilchandanNo ratings yet

- Session 12 - 13 - Basel I PDFDocument18 pagesSession 12 - 13 - Basel I PDFrizzzNo ratings yet

- The First Pillar Minimum Capital RequirementsDocument24 pagesThe First Pillar Minimum Capital RequirementsPradeep RajendranNo ratings yet

- Guidance Notes - Risk Weighted Capital Adequacy RatioDocument55 pagesGuidance Notes - Risk Weighted Capital Adequacy Ratiokusharani601No ratings yet

- International Regulation of Banking SystemDocument24 pagesInternational Regulation of Banking SystemShivam GuptaNo ratings yet

- Basel Norms Npa Financial Inclusion 28Document7 pagesBasel Norms Npa Financial Inclusion 28AKSHAY SANTHOSH SANTHOSH SACHARIASNo ratings yet

- Commercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Document8 pagesCommercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dhruti BhatiaNo ratings yet

- Commerce Glossary June 2022Document2 pagesCommerce Glossary June 2022Shaktisinh GohilNo ratings yet

- Capital Adequacy Ratios For BanksDocument36 pagesCapital Adequacy Ratios For BanksRezaDennyzaSatriawanNo ratings yet

- Nalysis Of: Third Time's The CharmDocument47 pagesNalysis Of: Third Time's The CharmUmair ChishtiNo ratings yet

- Capital Adequacy & Capital PlanningDocument21 pagesCapital Adequacy & Capital PlanningAdityaNo ratings yet

- The Reforms TargetDocument8 pagesThe Reforms TargetPrachi PawarNo ratings yet

- Capital Adequacy CalculationDocument9 pagesCapital Adequacy CalculationSyed Ameer HayderNo ratings yet

- Master Circular-Prudential Norms On Capital Adequacy - UcbsDocument32 pagesMaster Circular-Prudential Norms On Capital Adequacy - UcbsVijay KumarNo ratings yet

- The New Basel Capital Accord: Glossary of TermsDocument6 pagesThe New Basel Capital Accord: Glossary of TermsNevena BebićNo ratings yet

- Capital Adequacy Ratio For Banks - 1Document9 pagesCapital Adequacy Ratio For Banks - 1Jignesh NayakNo ratings yet

- Basel 3 and Liquidity GapDocument3 pagesBasel 3 and Liquidity GapParas MittalNo ratings yet

- What Is Capital Adequacy of Banks and Financial Institutions?Document5 pagesWhat Is Capital Adequacy of Banks and Financial Institutions?Raymond mmuNo ratings yet

- Overview of Philippine Financial Reporting Standards 9 (PFRS 9)Document4 pagesOverview of Philippine Financial Reporting Standards 9 (PFRS 9)Earl John ROSALESNo ratings yet

- Principles of BankingDocument33 pagesPrinciples of BankingMANAN MEHTANo ratings yet

- What Is Leverage in Financial Management?Document13 pagesWhat Is Leverage in Financial Management?majidNo ratings yet

- What Is Leverage in Financial Management?Document13 pagesWhat Is Leverage in Financial Management?majidNo ratings yet

- Basel II Accord1Document7 pagesBasel II Accord1Alfaz AnsariNo ratings yet

- Chapter 2-Commercial Banks: Bank Put NameDocument3 pagesChapter 2-Commercial Banks: Bank Put NameYeane FeliciaNo ratings yet

- Components of Assets & Liabilities in Bank'S Balance SheetDocument7 pagesComponents of Assets & Liabilities in Bank'S Balance SheetAnonymous nx6TUjNP4No ratings yet

- Sales Receivables Loans and Advances Investments in Leased Assets Investment in Real Estates Equity/Profit Sharing Financing InventoriesDocument4 pagesSales Receivables Loans and Advances Investments in Leased Assets Investment in Real Estates Equity/Profit Sharing Financing InventoriesnadeemuzairNo ratings yet

- Prudential Norms and FDI in Banking Sector and Banks As IntermediateriesDocument7 pagesPrudential Norms and FDI in Banking Sector and Banks As Intermediateriesmba departmentNo ratings yet

- MBM Slides Set 4 - August 26 2022Document61 pagesMBM Slides Set 4 - August 26 2022Mukul BaviskarNo ratings yet

- Interpreting The IRB Capital Requirements in Basel IIDocument31 pagesInterpreting The IRB Capital Requirements in Basel IIcriscinca100% (1)

- Capital Adequacy RatioDocument7 pagesCapital Adequacy Ratiokumar_rajeshNo ratings yet

- Tier 1 CapitalDocument5 pagesTier 1 CapitalsmaarNo ratings yet

- Banking Ch5Document14 pagesBanking Ch5karimhishamNo ratings yet

- R29 Sources of CapitalDocument12 pagesR29 Sources of CapitalSumair ChughtaiNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- The psychology of investment: Educating the Financial Mind to Invest ConsciouslyFrom EverandThe psychology of investment: Educating the Financial Mind to Invest ConsciouslyNo ratings yet

- Organization and Management Quarter 2.1Document38 pagesOrganization and Management Quarter 2.1Ehlvie PreciosoNo ratings yet

- F3CB PreviewDocument21 pagesF3CB PreviewTaranpreet KaurNo ratings yet

- Additional Exercise Ch3Document2 pagesAdditional Exercise Ch3Tam DoNo ratings yet

- Credit Management SAPDocument14 pagesCredit Management SAPVijay KumarNo ratings yet

- Karnataka Bank AR 2020-21 10.08.2021Document255 pagesKarnataka Bank AR 2020-21 10.08.2021Karthik KarthikNo ratings yet

- Notes 3 Accounts Exam AnsDocument11 pagesNotes 3 Accounts Exam AnsAYUSH MAURYANo ratings yet

- PrefaceDocument98 pagesPrefaceviralNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument9 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelMichael RajaNo ratings yet

- Raya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuDocument15 pagesRaya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuFantayNo ratings yet

- w-9 FormDocument4 pagesw-9 Formapi-350005045No ratings yet

- Terms and Conditions 27 06 PDFDocument4 pagesTerms and Conditions 27 06 PDFShreyash NaikwadiNo ratings yet

- Finacle MenusDocument50 pagesFinacle MenusKuldeep YadavNo ratings yet

- As 19 - Leases: Practical QuestionsDocument2 pagesAs 19 - Leases: Practical QuestionsHimanshu YadavNo ratings yet

- Auditing Quiz BeeDocument9 pagesAuditing Quiz BeeWilsonNo ratings yet

- Astrotech Vs AC 04-09Document3 pagesAstrotech Vs AC 04-09Usama malikNo ratings yet

- Spark Capital TAJ GVK Initiating Coverage May 2008Document10 pagesSpark Capital TAJ GVK Initiating Coverage May 2008rchawdhry123No ratings yet

- Allan and Donna Butler Bankruptcy PetitionDocument10 pagesAllan and Donna Butler Bankruptcy PetitionCamdenCanaryNo ratings yet

- Federal Funds RateDocument2 pagesFederal Funds RateNicolas JaramilloNo ratings yet

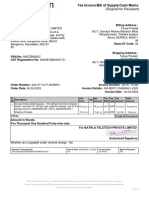

- InvoiceDocument1 pageInvoicetanya.prasadNo ratings yet

- Project Report OF: Capital Market in India With Respect To Mumbai. Submitted byDocument74 pagesProject Report OF: Capital Market in India With Respect To Mumbai. Submitted byAli Ahmed KhanNo ratings yet

- Jpmorgan Chase & CoDocument3 pagesJpmorgan Chase & CoSargamNo ratings yet

- Angel Broking Limited: Contract NoteDocument2 pagesAngel Broking Limited: Contract NoteMUTHYALA NEERAJANo ratings yet

- Boston BeerDocument23 pagesBoston BeerarnabpramanikNo ratings yet

- Risk Assessment Contract FormDocument5 pagesRisk Assessment Contract FormSafarudin RamliNo ratings yet