Professional Documents

Culture Documents

Profitability: Comparison of Current Year Performance (Fiscal Year 2011)

Profitability: Comparison of Current Year Performance (Fiscal Year 2011)

Uploaded by

Edward K. QuachOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitability: Comparison of Current Year Performance (Fiscal Year 2011)

Profitability: Comparison of Current Year Performance (Fiscal Year 2011)

Uploaded by

Edward K. QuachCopyright:

Available Formats

Profitability

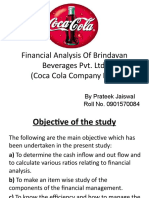

Return on equity 2007 18.99% 18.64% 0.35% ROE 2008 12.53% 9.46% 3.07% 2009 9.08% 6.84% 2.24% 2010 13.19% 10.85% 2.34% 2011 14.13% 12.37% 1.76%

ANZ NAB difference

ROE

20.00% 15.00% ANZ 10.00% 5.00% 0.00% 2007 2008 2009 2010 2011 NAB difference

Comparison of Current Year Performance (fiscal year 2011) In the latest fiscal year of 2011, comparing the two banks performance based on profitability ratios, it appears ANZ is performing better than NAB. Looking at the return on equity (ROE) table, in 2011, ANZ had a higher ROE of 14.13% compared to NABs 12.37%. This means that ANZ was capable in providing a 1.76% higher return to its investors that year for each unit of equity they contribute.

From the financial statements of the latest fiscal year of 2011 ROE= Net income/Total equity capital It can tell us that how much return investor receives for each unit of equity they contribute. From the graph below, we can see that ANZ and NAB have similar ROE in 2007. Both firms have a sharply decrease in return on equity and start to recovery after 2009. In general, ANZ have a higher return on equity comparing to NAB. The different showings by the green line tell us that different between two firms return on equity is quiet constant.

ROA= Net income/Total assets It can tell us that the net income generate per unit of asset. From the graph below, we can see that ANZ always have a higher return on asset than NAB. Both banks have the highest return on asset in 2007 and start to decrease after 2007 and reach a trough before their recovery period in 2009.

Moreover, we can find that the different between two banks return on asset is quite constant from 2007 to 2011.

Equity Multiplier

25.00 20.00 15.00 10.00 5.00 0.00 2007 2008 2009 2010 2011 ANZ NAB

EM = Total assets/Total equity capital It can tell us that how much assets are funded by equity capital. The higher the ratio, the more debt the bank is using to fund the assets. From the graph below, we can see that NAB always has a higher equity multiplier than ANZ from 2007 to 2011. Both banks have the highest equity multiplier in 2008 and then start to decline until 2009 and have a slightly increase from 2009 to 2011.

Asset Utilization

0.15 0.1 0.05 0 2007 2008 2009 2010 2011 ANZ NAB difference

AU= Total operation income/Total assets It can tell us the amount of interest and nom interest income generated per unit of asset. The more income returns per unit of asset, the higher the profitability of the bank. From the graph below, we can see that ANZ always have higher asset utilization than NAB. ANZ asset utilization is the highest in 2007 and decline gradually until 2011. For NAB, its asset utilization decrease sharply from 2007 to 2008 and increase a little bit from 2008 to 2009 and remain constant form 2009 to 2011.

0.70% 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00% 2007

Net charge off to net loan

ANZ NAB

2008

2009

2010

2011

Net charge off to net loan= net charge off/ average loan It can tell us the amount of loans that we are not except to receive per unit of average loans. The higher the net charge off ratio, the more the loan we expect we cannot collect. From the graph below, we can see that NAB always have a higher net charge off to net loan then ANZ. Both banks net charge off to net loan increase from 2007 to 2009. ANZ net charge off to net loan started to decrease from 2009 onwards, while NAB still increasing. There are no big different of net charge off to net loan between 2007 and 2009. However, the gap started to widen since 2009 while ANZ decreasing at a faster rate than NAB. Overall NAB has more loans that cannot be collected than ANZ. To conclude, it is more profitable to invest in ANZ then NAB as ANZ has higher ROA, ROE, EM, AU and net charge off to loan then NAB, which indicate that ANZ have better management control of their business.

You might also like

- Dissertation Report Aadriti Mba (Finance)Document75 pagesDissertation Report Aadriti Mba (Finance)Aadriti Upadhyay100% (7)

- Sainsbury Report Final - MergedDocument38 pagesSainsbury Report Final - MergedTosin Yusuf100% (1)

- Compare Their Profitability Ratios. Why Is There A Difference?Document24 pagesCompare Their Profitability Ratios. Why Is There A Difference?Shruti MalpaniNo ratings yet

- Ratio Analysis Advance To Deposit RatioDocument9 pagesRatio Analysis Advance To Deposit RatioJamal GillNo ratings yet

- Financial Analysis of NestleDocument5 pagesFinancial Analysis of NestleArun AhlawatNo ratings yet

- Prime Bank LTD Ratio AnalysisDocument30 pagesPrime Bank LTD Ratio Analysisrafey201No ratings yet

- Series 1: 1. Profit Margin RatioDocument10 pagesSeries 1: 1. Profit Margin RatioPooja WadhwaniNo ratings yet

- AXIS Bank AnalysisDocument44 pagesAXIS Bank AnalysisArup SarkarNo ratings yet

- Chapter # 4: Findings, Recommendation and SuggestionDocument5 pagesChapter # 4: Findings, Recommendation and Suggestionm0424mNo ratings yet

- SampleDocument5 pagesSampleDyuty FirozNo ratings yet

- United Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Document0 pagesUnited Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Elegant EmeraldNo ratings yet

- Course Title: Fundamentals of Banking Subject Code: BNK-201Document23 pagesCourse Title: Fundamentals of Banking Subject Code: BNK-201Shaon Chandra Saha 181-11-5802No ratings yet

- Ratio Analysis: Liquidity RatiosDocument7 pagesRatio Analysis: Liquidity RatiosAneeka NiazNo ratings yet

- Financial Ratios NestleDocument23 pagesFinancial Ratios NestleSehrash SashaNo ratings yet

- Bank of Baroda RoshniDocument2 pagesBank of Baroda RoshniroshcrazyNo ratings yet

- Camel Analysis of BOMDocument11 pagesCamel Analysis of BOMashuboy006No ratings yet

- Chapter 5 - ThesisDocument5 pagesChapter 5 - ThesisPradipta KafleNo ratings yet

- Ratio Analysis of Pepsi Co.Document88 pagesRatio Analysis of Pepsi Co.ZAS100% (2)

- Ratio AnalysisDocument36 pagesRatio AnalysisAditya SawantNo ratings yet

- CAMELS ReportDocument8 pagesCAMELS ReportAnonymous SF7rP3TwNo ratings yet

- Data Analysis & InterpretationDocument47 pagesData Analysis & InterpretationsangfroidashNo ratings yet

- Abbott Laboratories (ABT)Document8 pagesAbbott Laboratories (ABT)Riffat Al ImamNo ratings yet

- Ratio Analyses:: Current Ratio Current Assets/ Current Liabilities InterpretationDocument4 pagesRatio Analyses:: Current Ratio Current Assets/ Current Liabilities InterpretationSharanya RamasamyNo ratings yet

- Profitability Ratios: Return On Asset (ROA)Document11 pagesProfitability Ratios: Return On Asset (ROA)Saddam Hossain EmonNo ratings yet

- Du Pont Analysis: South Indian BankDocument7 pagesDu Pont Analysis: South Indian BankKashish AroraNo ratings yet

- Return On Equity (ROE) & Return On Asset (ROA) : Net Income Total Equity CapitalDocument7 pagesReturn On Equity (ROE) & Return On Asset (ROA) : Net Income Total Equity CapitalLinh ChiNo ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisIrin HaNo ratings yet

- 1) Ratio Calculations: (1) CurrentDocument13 pages1) Ratio Calculations: (1) CurrentRahul KumarNo ratings yet

- Financial Performance Analysis of First Security Islami Bank LimitedDocument21 pagesFinancial Performance Analysis of First Security Islami Bank LimitedSabrinaIra50% (2)

- Days Sales Outstanding: Introduction To Business Finance Assignment No 1Document10 pagesDays Sales Outstanding: Introduction To Business Finance Assignment No 1Varisha AlamNo ratings yet

- Interpretation of The CAMEL RatioDocument3 pagesInterpretation of The CAMEL RatioAnuja AgrawalNo ratings yet

- Current Assets (Rs in Lakh)Document35 pagesCurrent Assets (Rs in Lakh)Jagadeesh MuthikiNo ratings yet

- Interepretation-7,8 Fin InfoDocument2 pagesInterepretation-7,8 Fin InfoRaisa UronchondiNo ratings yet

- Current Ratio Year LiabilitiesDocument14 pagesCurrent Ratio Year LiabilitiesVaibhavSonawaneNo ratings yet

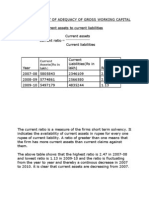

- Financial Analysis of Brindavan Beverages Pvt. LTD (Coca Cola Company LTD.)Document16 pagesFinancial Analysis of Brindavan Beverages Pvt. LTD (Coca Cola Company LTD.)Prateek JaiswalNo ratings yet

- Asyad Financial AnalysisDocument9 pagesAsyad Financial AnalysisshawktNo ratings yet

- SsssssDocument5 pagesSsssssShishir AhmedNo ratings yet

- Current Ratio Year 2018Document5 pagesCurrent Ratio Year 2018Shishir AhmedNo ratings yet

- Analysis For Reeby Sports CompressDocument4 pagesAnalysis For Reeby Sports CompressBolla Avanindraa100% (1)

- Aet Jefferson BuyDocument11 pagesAet Jefferson BuysinnlosNo ratings yet

- Project 1Document9 pagesProject 1Umesh GadeNo ratings yet

- Ratio Analysis of NCC & UCB Bank (2010-2014)Document17 pagesRatio Analysis of NCC & UCB Bank (2010-2014)سرابوني رحمانNo ratings yet

- Bank Management ProjectDocument20 pagesBank Management ProjectK M Tanveer AhmedNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosDorcas YanoNo ratings yet

- Liquidity Ratio AnalysisDocument5 pagesLiquidity Ratio AnalysisbezeeNo ratings yet

- Swap - Worked Out Examples V02Document32 pagesSwap - Worked Out Examples V02Harshit DwivediNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisShankar PrakashNo ratings yet

- Analysis of The Financial Position and Performance of Shell Co LTDDocument12 pagesAnalysis of The Financial Position and Performance of Shell Co LTDBoodhun VishalNo ratings yet

- Next PLC BriefDocument11 pagesNext PLC Briefshariqanis1500No ratings yet

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Document40 pagesStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamNo ratings yet

- Case 3: BNL StoresDocument16 pagesCase 3: BNL StoresAMBWANI NAREN MAHESHNo ratings yet

- Bond Prices and YieldsDocument1 pageBond Prices and YieldsvancouvertownNo ratings yet

- Phân Tích Lưu Chuyển Dòng Tiền Fpt 2009-2011 1 Current status of short-term cash flow management of FPT Telecom Joint Stock CompanyDocument11 pagesPhân Tích Lưu Chuyển Dòng Tiền Fpt 2009-2011 1 Current status of short-term cash flow management of FPT Telecom Joint Stock CompanyTrần Trọng BìnhNo ratings yet

- CH 8 TabDocument5 pagesCH 8 TabNasser MoslamNo ratings yet

- Tata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & InterpretationDocument31 pagesTata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & Interpretationaditya_sanghviNo ratings yet

- Nhom 7 L02 VIBDocument4 pagesNhom 7 L02 VIBĐỗ Hoàng Thu ThuỷNo ratings yet

- Case Study 1 Fin745Document11 pagesCase Study 1 Fin745nieyoot0% (1)

- Analysis Gemini & NTCDocument2 pagesAnalysis Gemini & NTCAnand RahmanNo ratings yet

- Banking Sector Update - 230611Document25 pagesBanking Sector Update - 230611chaltrikNo ratings yet

- Introduction of The Ratio AnalysisDocument11 pagesIntroduction of The Ratio AnalysisAlisha SharmaNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- 5 Corpo Number 5Document32 pages5 Corpo Number 5Miko TabandaNo ratings yet

- Cash ManagementDocument34 pagesCash Managementankitha singhNo ratings yet

- Regulators Said Sterling's CRA Data Unreliable, Under FOIA Fed Blacks-Out Most of 400 PagesDocument5 pagesRegulators Said Sterling's CRA Data Unreliable, Under FOIA Fed Blacks-Out Most of 400 PagesMatthew Russell LeeNo ratings yet

- 2024 Term 1 Gr. 8 Training Manual Final - 120233Document31 pages2024 Term 1 Gr. 8 Training Manual Final - 120233vanillablossom7No ratings yet

- Anti Money Laundering NotesDocument5 pagesAnti Money Laundering Notesmuneebmateen01No ratings yet

- The Spiritual Monetary Instrument Banking Hierarchy Energy Harvesting Limiting Controlling Food Chain Set Up. Your Birth Certificate Became Hijacked & Turned To A Bond the Corporate Fraudlent Strawman Subcontract That Some Call It The Name Fraud, Which Was Traded Over & Over & Over Again, and it was all tied into the CHINA US TRADE ACT of 1922 which became LAW in 1922Document10 pagesThe Spiritual Monetary Instrument Banking Hierarchy Energy Harvesting Limiting Controlling Food Chain Set Up. Your Birth Certificate Became Hijacked & Turned To A Bond the Corporate Fraudlent Strawman Subcontract That Some Call It The Name Fraud, Which Was Traded Over & Over & Over Again, and it was all tied into the CHINA US TRADE ACT of 1922 which became LAW in 1922indigo1967100% (9)

- Sealdah Division-Electrical - Eleg-Ot-989-2022-23 - 21-06-2023Document5 pagesSealdah Division-Electrical - Eleg-Ot-989-2022-23 - 21-06-2023ADEE G GRCNo ratings yet

- 1 MainDocument26 pages1 MainKRCG 13No ratings yet

- Deposit Slip For Affiliated Institutions-StudentsDocument1 pageDeposit Slip For Affiliated Institutions-StudentsNAI DUNYANo ratings yet

- Higher Education Loans BoardDocument8 pagesHigher Education Loans Boardobed jumaNo ratings yet

- TYBAF - GROUP 15 - SAPM-compressedDocument19 pagesTYBAF - GROUP 15 - SAPM-compressedDhruviNo ratings yet

- Edgetech 1Document35 pagesEdgetech 1abhaytalentcornerNo ratings yet

- Van de Brug v. Philippine National Bank20210619-12-S95m38Document20 pagesVan de Brug v. Philippine National Bank20210619-12-S95m38Lance LagmanNo ratings yet

- Contracts Case DigestsDocument29 pagesContracts Case DigestsMarife Tubilag ManejaNo ratings yet

- Proposal FormDocument9 pagesProposal FormAmbuj ChaturvediNo ratings yet

- Bhushan Patil Bank Management SystemDocument56 pagesBhushan Patil Bank Management SystemPimpri39Abhishek GaikwadNo ratings yet

- Irfan Habib NotesDocument13 pagesIrfan Habib NotesShyam ChonatNo ratings yet

- Leap of Faith: Using The Internet Despite The DangersDocument42 pagesLeap of Faith: Using The Internet Despite The DangersDr-Mirza Abdur RazzaqNo ratings yet

- Modern Slavery Statement 20190328Document4 pagesModern Slavery Statement 20190328Cypher TechNo ratings yet

- 01 Tan Vs CADocument1 page01 Tan Vs CAJimenez Lorenz100% (1)

- APA Style Hawa DharanDocument6 pagesAPA Style Hawa DharanDandapani GautamNo ratings yet

- Balance of Payments With A Focus On NigeriaDocument33 pagesBalance of Payments With A Focus On NigeriaJohn KargboNo ratings yet

- Mutual Fund Project ReportDocument53 pagesMutual Fund Project ReportAzraNo ratings yet

- BIBM Program Summary - 05082018Document4 pagesBIBM Program Summary - 05082018mitemkt9683No ratings yet

- Bharat Petroleum Corporation LTDDocument15 pagesBharat Petroleum Corporation LTDsagunkumarNo ratings yet

- Application Form Account Opening UBIDocument4 pagesApplication Form Account Opening UBIDba ApsuNo ratings yet

- BRAND BUILDING FOR BANKING INSTITUTIONS - Advantages, Challenges Functions & Constituent ComponentsDocument6 pagesBRAND BUILDING FOR BANKING INSTITUTIONS - Advantages, Challenges Functions & Constituent Componentsvivekananda RoyNo ratings yet

- Comparative Analysis of State Bank of India With Other Credit SchemesDocument97 pagesComparative Analysis of State Bank of India With Other Credit SchemesVKM2013No ratings yet