Professional Documents

Culture Documents

Taxes and Fees Flyer

Taxes and Fees Flyer

Uploaded by

Heath W. FahleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxes and Fees Flyer

Taxes and Fees Flyer

Uploaded by

Heath W. FahleCopyright:

Available Formats

Yankee Institute

PO Box 260660 Hartford, CT 06126 www.yankeeinstitute.org

The bureaucrats in Hartford dont want you to open this!

2013 Report

E H T T A T U C CONNECTI ! P A E H E H T F BOTTOM O

Improving lives through freedom and opportunity.

Yankee Institute for Public Policy

CONNECTICUTS LIST OF LASTS

An Open Letter to the Connecticut General Assembly On the First Day of the 2013 Legislative Session

Multiple independent reports conrm the truth: Connecticut isnt just struggling, its fallen to the bottom in several key comparisons with other states. Over the last few years, Connecticut has compiled a disgraceful list of lasts.

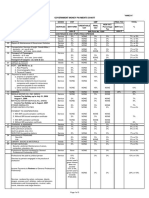

Connecticut raised $19.5 billion from 371 sources of revenue in 2012 but the bottom 200 sources produce only $21.4 million and state officials have no idea how much it costs to collect them.

Motor

Vehicle

Licenses

1%

Mashantucket

Gaming

Payments

1%

Mohegan

Sun

Gaming

Payments

1%

All

other

revenue

sources

20%

Barrons Magazine rated Connecticuts debt situation as the worst in the country in 2012 TopRetirements.com ranked Connecticut as the 2012 worst state for retirement The Institute for Truth in Accounting ranked Connecticuts nancial status as the worst in the nation with a debt burden of $49,000 per taxpayer Connecticuts credit quality was ranked 50th in the nation by Conning Inc.s State of the States Municipal Credit Research Report in 2012 Connecticuts Tax Freedom Day of May 5, 2012 was the latest in the nation according to the Tax Foundation Connecticuts Achievement Gap is the worst in the nation according to the Connecticut Council for Education Reform The Fiscal Policy Report Card on Americas Governors by the Cato Institute gave Gov. Dan Malloy an F

Years of irresponsible spending and tax increases have caused the states scal health to plummet. State spending has risen twice as fast as median household income over the last twenty years. The states job growth has been one of the nations slowest. Connecticut can do better than that. On behalf of the Yankee Institutes nearly 2,000 members, we congratulate you on your swearing in. As you take ofce today, it is your responsibility to take action. Now is the time to lower spending and adopt pro-growth tax policies that can move Connecticut Yankee Institute from last to rst. for Public Policy

Personal Income Tax General Sales and Use Tax Medical Assistance - Title XIX CorporaAon Tax Gasoline Tax - General CigareDe Distributor Tax - General Dependent Children LoDery Tickets Payments Mohegan Sun Gaming Payments Mashantucket Gaming Payments Motor Vehicle Licenses All other revenue sources

Immediate action is needed in Hartford to reform taxes and spending and restore our economy.

LoDery Tickets Payments 1% Dependent Children 2% CigareDe Distributor Tax - General 2% Gasoline Tax - General 2% CorporaAon Tax 3% Medical Assistance - Title XIX 14%

Personal Income Tax 36%

General Sales and Use Tax 17%

The Yankee Institute for Public Policy is Connecticuts think tank focused on improving lives through freedom and opportunity. Visit us on the web at www.yankeeinstitute.org

Improving lives through freedom and opportunity.

Connecticuts Revenue Sources

300%

PAID FOR BY THE YANKEE INSTITUTE FOR PUBLIC POLICY. 800 CONNECTICUT BLVD, SUITE 302, EAST HARTFORD, CT 06108. ALL CONTRIBUTIONS ARE TAX DEDUCTIBLE TO THE EXTENT ALLOWED BY LAW.

Steep Rise in CT Spending Growth 1970-2011

250%

200%

150% Net Appropria7ons Gross State Product State Popula7on Per Capita Personal Income 100%

50%

Sources: Oce of Policy and Management, Bureau of Economic Analysis, and US Census Bureau. Graph represents total percentage change since 1970. Adjusted for ina7on 2005=100 SL IPD

0%

1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

-50%

Connecticuts 371 Sources of Revenue

Category Tax Tax Federal Transfer Tax Tax Tax Tax Tax Tax Fee Revenue Tax Tax Fee Revenue Tax Tax Tax Tax Tax Tax Tax Tax Tax Tax Revenue Tax Tax Fee Tax Tax Tax Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund Transportation Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Name FY 2012 Personal Income Tax - Withhold 5,259,999,445.12 General Sales and Use Tax 3,670,544,853.14 Medical Assistance - Title XIX 2,912,184,198.22 Personal Income Tax - Final Payments 1,621,166,629.63 Personal Income Tax - Estimated Payments 1,419,654,032.66 Corporation Tax 672,340,236.71 Cigarette Distributor Tax - General 408,269,616.67 Gasoline Tax - General 364,221,552.40 Hospital Net Revenue Tax 349,277,587.00 Lottery Tickets Payments 310,000,000.00 Dependent Children 289,995,235.12 Taxes on Petroleum Companies 226,900,000.00 Unified Gift and Estate Tax 191,699,580.56 Motor Vehicle Licenses 185,535,767.54 Administration - Social Services 184,135,945.56 Mohegan Sun Gaming Payments 179,783,312.02 Mashantucket Gaming Payments 165,862,107.41 Foreign Insurance Company Tax 163,260,732.23 Electric and Power Company Tax 153,968,884.09 Nursing Home Provider Tax 151,701,571.92 Taxes on Petroleum Companies 146,066,634.38 Special Motor Fuel Tax - General 112,744,152.73 Real Estate Conveyance Tax 96,552,275.29 Sales/Use Tax - Room Occupancy 95,809,383.92 Sales/Use Tax - DMV 76,617,579.16 Recoveries - Public Assistance 69,529,272.63 Electric Generation 69,515,345.00 Alcoholic Beverage Tax - General 59,150,546.51 Court Fees 56,048,336.51 Business Use Tax 51,661,385.35 Gas and Electric Company Tax 51,181,942.38 Domestic Insurance Company Tax 49,596,514.56 Husky Program Business Entity Tax IV-E Foster Care - DCF Insurance Agent Licenses Motor Veh Operator Licenses IV-E Adoption Assistance - DCF Administration - Child Support Refunds of Expend - Prior Year Taxes on Admission, Dues & Cabaret Workforce Investment Act - DOL Community Antenna TV System Tax ARRA-Fed BABS Interest Subsidy Escheats - Corporations Escheats - CT Bottle Bill Fees - Commercial Recording Commercial Info - Motor Vehicles Hospitals Court Fees Professional Services Licensure - Lockbox Indirect Overhead - Fed Project Title Certificate Fees Escheats - Banking Orgs Hospital and Medical Service Corporation Tax Srvcs - Resident State Police Escheats - Security Sales Cert Competitive Video Service Intermediate Care Facility Fee Economic Transition Charge Escheats - Insurance Companies Motor Carrier Tax - Ifta Recoveries - Emp Fringe Benefits Fines and Costs - Departments Individual Use Tax Controlling Interest Transfer Tax Tobacco Products Tax - General Producer Licenses Other Fees - App/Exam/Qual Occupational Tax Recoveries - WC - Fringe Benefit Fees - Federal Clean Air Act Liquor Fees Permits Soldiers Homes Recoveries - Negotiated Settlements Professional Services Licensure Other Motor Vehicles License Auto Emissions Exemption Fee Fees - Federal Clean Air Act Fees - Inspection/Motor Vehicles Premiums - Unauthorized Insurers Tax Farms, Land, and Buildings Camps and Parking Fines and Costs - Departments Fees - Exam - Motor Vehicle Operator Water Compliance Permits Fish/Game Rcpt License - State Vessel Reg Licenses-Alternate Tourism Tax Recoveries - Inmates - Cost of Incarceration Real Estate Sale Agent Licenses Licenses - Home Imp Contr/Sale IV-E and Non IV-E Programs Teachers Certificate Licenses Taxes on Horse Racing Sale of Property Solid Waste Assessments Tax Auto Emissions Inspection - Late Fee Refunds of Expend - Prior Year Prof Srvcs Lic - App Fees Regist of Brands Fee - Liquor Fees - Insurance Application Other Interest MV Safety Marker Fee License Prof Srvc Ren License/ Class G Escheats - Mutual Fund Sales Cigarette Distributor Tax - Floor Recoveries - General Civil Penalty - Imposed - Agency Real Estate Brokers Licenses Expenses Recovered - Hospitals Fees - Background Checks Fees - Inspect Elev/Pass Trams Special Vehicle Permits Federal Aid - Miscellaneous Prof Srvc Ren License/ Class I Permits to Carry Pistols Electrician Licenses Investment Interest Fee - Birth/Marriage/Death Certificate Unemployment Compensation Unrelated Business Income Tax Additional Fee - Police Training Repealed Taxes Registration - Pesticides Fees Fees - Majority Cards - Liquor Escheats - Govt Agency/Pub Aut Air Compliance Permits Steamfitter Licenses MV Registration Late Fee Licenses Insurance Licenses 44,602,064.00 42,182,073.99 39,127,281.00 38,589,660.00 37,762,092.84 35,334,652.00 35,062,359.00 34,945,272.48 34,395,917.68 29,382,975.70 27,985,326.72 27,548,481.96 27,501,011.54 27,126,033.28 25,922,043.75 23,645,908.42 22,416,509.54 21,372,144.29 19,892,207.00 19,819,962.67 18,575,525.00 18,259,935.87 18,068,574.00 17,838,583.96 17,619,716.24 17,171,313.00 15,966,763.79 14,994,587.85 12,382,427.65 12,089,205.44 11,809,155.30 11,791,602.25 11,503,740.81 10,978,545.29 9,908,967.16 9,902,125.11 9,493,825.04 9,127,225.96 8,991,751.13 8,788,207.31 8,417,021.02 8,031,123.37 7,776,691.78 7,765,061.00 7,670,380.52 7,596,640.00 7,316,429.94 6,730,960.00 6,682,827.48 6,245,059.90 6,014,041.75 5,928,818.02 5,759,450.00 5,523,250.54 5,201,641.00 5,014,337.49 4,914,319.10 4,601,732.29 4,362,940.18 4,109,603.15 3,919,855.44 3,776,471.00 3,756,642.91 3,704,671.33 3,470,185.89 3,460,145.58 3,374,879.13 3,232,050.00 3,119,531.51 3,114,390.00 3,014,549.39 2,897,898.00 2,867,079.00 2,864,543.08 2,826,240.21 2,786,599.28 2,775,480.40 2,770,729.03 2,770,542.27 2,607,567.75 2,492,500.00 2,470,149.30 2,376,529.05 2,263,995.00 2,211,990.00 2,185,933.50 2,172,484.67 2,152,587.85 2,062,794.55 1,993,037.10 1,948,725.00 1,893,661.32 1,887,035.80 1,757,098.50 1,739,526.36 1,737,193.47 1,625,640.50 1,580,080.00 1,532,801.09 Purpose Tax on withheld income of CT residents Tax on gross receipts of retailers Unrestricted federal aid Tax on final income of CT residents Tax on estimated income of CT residents Tax imposed on a corporation doing business in CT Excise tax imposed on all cigarette sales Tax on the sale of gasoline Tax on hospital revenues Profits from CT lottery Childcare and family services assistance to families with dependent children Tax on gross earnings of companies distributing petroleum products Tax on gifts given and/or estates inherited by a descendent Motor vehicle licenses State sponsored social services Tax on Mohegan Sun gaming revenue Tax on Mashantucket gaming revenues Tax on foreign insurance companies Tax on the gross earnings of electric and power companies Chronic and convalescent licensed nursing homes Tax on gross earnings of companies distributing petroleum products Diesel fuel tax Tax on seller when conveying real estate to a buyer Tax on the receipt paid for room occupancy Sales tax on vehicle registrations Recovered public assistance Tax on power plants Tax on the distribution and sale of all alcoholic beverages CT courts fees Tax paid on goods and services when sales tax is not applied Tax on revenue earned from sales Total net direct premiums insurance companies received from policies written on property or risks in CT Reimbursement from the federal government for the Childrens Health Insurance Program Tax on qualifying business entities formed under Connecticut law Federal transfer to reimburse state for subsidized foster care Fee paid for license to be an insurance agent Fee paid to obtain motor vehicle operator license Federal transfer to reimburse state for subsidized adoption assistance Child support administrative work done by state Refunds of prior year expenditures 6% tax on all motion picture shows, 10% tax on places of entertainment, amusement, or recreation and membership or initiation dues Workforce investment act revenue for Department of Labor Tax on utility, railroad and TV Companies American recovery and reinvestment act Bonds. Intended to reduce municipal borrowing costs Escheats from corporations Escheats from bottle deposits Fee paid for reporting a commercial real estate purchase to the state Sale of commercial info related to motor vehicles State-owned hospitals Fee paid for services of the CT courts Fee for licenses for business sales registration Reimbursement from the federal government for indirect overhead costs incurred on federal projects Fee paid for title certificate Escheats from banking organizations Annual state charge applicable to hospital and medical service corporations Funds collected from small towns without an organized police force by the Department of Public Safety for services provided by state troopers Escheats from security sales Fee to be a certified competitive video service Fee for care at facilities for mentally retarded Tax added to utility bills to balance the state budget Escheats from insurance companies Tax on fuel for motor vehicles designed to transport persons or property Recovered employee fringe benefits Fines and costs associated with various state government departments Tax paid when CT sales tax is not paid to retailer Tax on transfering more that 50% of the equity in an entity based on the true and actual value of the real property Tax on distribution of non-cigarette tobacco products Fee for license to act in the capacity of an insurance producer Fee paid for other applications, exams, or qualifications Tax on Attorney practicing law in CT Recovered fringe benefits Fee on renewal or new registration of gasoline or diesel powered vehicles Fee for liquor permit Unrestricted federal aid Recovered negotiated settlements Fee for professional services license Fee paid for other motor vehicle transactions licenses Fee paid for exemption from an auto emissions inspection Fee for renewal or new registration of gasoline or diesel powered vehicles Fee for motor vehicle inspections Tax on premium receipt from unauthorized insurer State ownership of farms, land, and buildings due to rent, fines, or escheats Fee paid for state camp and parking access Fines and costs associated with various state government departments Fee paid for motor vehicle operator exam Fee for permit required for water pollution sources Fee paid for license to hunt and fish Tax on rental and leasing of passenger motor vehicles Money recovered by the state from people who have been sentenced to prison by a Connecticut court Fee paid for license to be a real estate agent Fee for license to conduct home improvement construction Other revenue from Social Security Act Title IV programs Fee paid for license to be a teacher Total money wagered on horse races Sale of state property Tax on per ton processing at commercial resource recovery facilitie orf municipal waste landfills to reclaim energy fee for late auto emissions inspection Refunds of prior year expenditures Fee to apply for a professional services license Fee for registering brands of alcohol to be sold Fee for insurance application Other interest accumulated fee for license for a motor vehicle safety marker fee for license for business sales registration Escheats from mutual fund sales Excise tax imposed on all cigarette sales General recoveries Monetary penalties as imposed by state agencies Fee for license to be a real estate broker Recovered hospital expenses Fee for conducting background checks Fee for State inspection of elevators and pass trams Fee to apply for a special operators permit for limited driving with suspended license Other revenue gained through federal aid Fee for license for business sales registration Fee to obtain a permit to carry a pistol Fee for license to be an electrician Interest accumulated on state investments Fee to obtain a birth, marriage or death certificate Unemployment compensation Tax on trade or business done by a tax-exempt organization that does not substantially relate to its tax exempt purpose Additional fee to undergo police training Receipts from taxes that have been repealed which at times can occur from an audit payment Fee to registrater to use pesticides Fee to obtain a liquor majority card Escheats from a state government agency or public authority Fee for permit required for air pollution sources Fee to obtain a license to be a steamfitter Fee assessed when registering a vehicle 5 or more days after the expiration date Fee to license Category Fee Fee Fee Fee Tax Fund Transportation Fund General Fund General Fund General Fund General Fund Name Other Licenses - Motor Vehicle/Boat Dog Licenses Other Fees - Certificate/Copies Other Rents - Miscellaneous Sales and Use Tax Licenses Alcoholic Beverage Tax-Floor Licenses - MV Dealers/Repairer Fees - Land Use Application Permits - Hazardous Waste Transportation Fees - Inspections of Boilers Child Nutrition Program Penalties - Corporations Permits to Kill Deer Inter/Intrastate Carrier License Fee - Reg - Weighing/Measuring Plumber Licenses Bond Forfeitures Service or Process Fees Pharmacy/Pharmacist Licenses Fees - Filing Annual Reports Fee - Certified Copies - MV Form Fees - Analysis of Feed Laboratory Fees Notary Public Register Licenses Recoveries - Attorney Fees Licenses - Private Det/Bondsmen Penalties-Consumer Credit Oyster Grounds Utility Subsidy Int Income Sundry Services - Miscellaneous Licenses - Ground/Pesticides OSHA - On-Site Consultation Fees - Waste Management Other Fees - Tech and Skilled Vessel Registration Licenses Prof Srvc Ren License/ Class A Other Fees - Miscellaneous General Contractor Licenses Fees - Asbestos Abatement - Large Sales/Use Tax - State Agencies Sheet Metal/Glazier Licenses Civil Penalties - Court Judgments Retail Gasoline Dealer License Cottages or Residences Real Estate Appraiser Licenses Sundry Airport Activites Sealed Tickets Payments Escheats - Reciprocal States Penalty-Broker/Invest/Adv Drug Licenses Licenses - Engineers/Land Surveyers Other Fees - Insp Srvcs - General Certificate-Authority Licenses Royalties - Gasoline Stations OSHA - State of Connecticut Reports, Statutes, Registers Junk and Salvaged Materials Fees - Air Management Junk and Salvaged Materials Prof Srvc Ren License/ Class F Other Fees - Legal and Court Service Food Licenses Apprenticeship Fees Facilities Licensure Wood Licenses - Manu Bed/Furniture Fees - Analysis of Fertilizers Fees - Examination - Accountants Sale of Property New Home Construction Licenses Youth Camp Licenses Rental Surcharge Tax Fees - Bingo Games Other Licenses - Skilled Trade Fire Protection Sprinkler Licenses Other Licenses - Hunt/Fish/Trap Docks and Wharves Ref Salary/Workr Comp - Prior Cigarette Dealer - Retail Licenses Building Demolition Licenses Health Club Licenses Licenses - Milk Dealers Permits to Hold Bingo Games Fees - Cont Education - Real Estate Mobile Home Park Licenses Fees - Certificate of Need Filing Brokered Transactions Fees - GF Environmental Prof Licenses State Park Concessions Permits Motor Carrier Reg Licenses - IFTA Aircraft Parking Fee - Exam - Real Estate Agents Homemaker Companion Certificate TV Repair Licenses Fees - Exam - Insurance License Casual Sales - All Agencies Tolls - Highways/Bridges/Ferry Pheasant Tags Other Permits - Game Animals Reg - Interstate Land Sales Laboratory Licensure Recording Fees Fee - Child Support Enforce Sr Photocopying Fees - Asbestos Abatement - Small Broker/Salesmen Fees - General Motor Carrier Reg Licenses - General Cigarette Distributor Licenses Insurance Reimb - Other Losses Non-Ref Filing Permit - New Ap Jury Fees Fees - Exam - Architects Permits - Other Steam Railroad Company Tax Other Licenses - Professional Services Prof Srvc Ren License/ Class D Adv Signs/Billboard Licenses Prof Srvc Ren License/ Class E Elevator Repair Licenses Principal on Loans Comm License - Lobster Pots/Trawls Fee - Asbestos Alt Work Review Oyster Grounds Tax Pilotage Commission - CT Water Unemployment Compensation OSHA Statistical Grant Program Training Certificate Fees FY 2012 1,516,578.25 1,512,075.73 1,507,015.18 1,498,334.74 1,448,954.22 1,444,800.23 1,432,012.00 1,390,150.00 1,359,664.61 1,319,668.00 1,317,302.15 1,297,046.85 1,256,174.00 1,172,861.00 1,155,874.00 1,112,334.00 1,087,530.00 1,031,300.81 945,488.99 876,357.00 850,903.75 828,400.29 808,279.29 769,531.00 756,280.00 750,964.00 724,418.00 719,522.42 691,645.95 677,446.48 664,630.00 646,844.79 645,843.96 645,233.79 639,610.00 636,350.00 632,506.24 631,375.00 608,728.06 597,440.89 592,838.00 550,110.17 540,729.00 475,303.31 473,676.00 459,056.23 458,927.00 452,914.85 446,633.04 440,549.00 423,429.80 391,330.00 389,167.50 388,954.14 385,336.27 385,005.26 376,180.96 360,400.00 355,582.23 347,315.00 339,796.50 335,231.83 319,795.00 311,977.50 306,098.31 285,640.00 283,332.73 281,515.00 271,091.90 251,489.00 234,015.00 230,314.80 223,856.62 221,153.00 219,655.00 219,483.42 218,540.75 206,866.04 204,773.73 200,895.00 199,849.46 194,400.00 187,333.58 168,102.70 161,678.10 158,805.00 157,570.00 156,132.50 152,730.91 148,180.00 146,859.88 146,327.00 146,100.00 143,990.00 142,706.00 139,146.44 138,503.50 136,973.60 134,988.00 134,234.50 132,200.00 125,870.01 123,420.00 118,675.20 118,500.90 118,279.43 117,720.00 111,872.46 105,250.00 101,815.00 99,991.00 96,420.00 94,464.66 89,113.63 83,144.00 77,365.00 77,291.32 76,410.00 75,118.00 75,000.00 74,705.00 74,350.00 73,647.91 72,777.27 72,485.30 69,928.42 69,427.00 Tax General Fund Transportation Fund Fee Fee General Fund General Fund Fee General Fund Fee Revenue General Fund Fines & Penalties General Fund Fee General Fund Fee Transportation Fund Fee Transportation Fund General Fund Fee Revenue General Fund General Fund Fee Fee General Fund General Fund Fee Fee Transportation Fund General Fund Fee Fee General Fund Fee General Fund Revenue General Fund Fee General Fund Fines & Penalties General Fund Revenue General Fund Revenue General Fund Revenue General Fund Tax General Fund General Fund Revenue Fee Fee Fee Fee Fee Fee Fee Tax Fee General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Purpose Fee for other motor vehicle or boat licenses Fee to obtain license to own a dog Fee to obtain copies of other certificates Fee to renting of other state property Fee to obtain permit to sell goods and taxable services; lease and/or rent tangible personal property Tax on the distribution and sale of alcoholic beverages Fee for license to deal or repair motor vehicle Fee to apply for land use Permit to transport hazardous waste Fee for State inspection of registered boilers Department of Education revenue for child nutrition program Penalty for a corporations failure to make reports to the state Fee to obtain permit to hunt and kill deer Fee to obtain an intrastate or interstate carrier licenses Fee for registering commercial weighing and measuring devices Fee for license to be a plumber Forfeiture of bonds due to criminal convictions Fee for services or processes completed by DMV, Secetary of States Office, or Department of Justice Fee for license to be a pharmacist or operate a pharmacy Fee for filing annual reports Fee for certified copies of motor vehicle forms Fee for states analysis of animal feed Fee to register an environmental or clinical laboratory Fee for license to be a registered public notary Recovered attorney fees Fee for license to be a bondsman Penalty for failure to register State lease of oyster grounds Interest accumulated on utility subsidies Miscellaneous sundry assets of the state Fee associated with acquiring a license to commercially use pesticides On-Site Consultation for the CT Department of Labors Division of Occupational Safety and Health Fee for waste management Fee for States review of other technical and skilled work Fee to obtain a license to own a vessel Fee to obtain license for business sales registration Other miscellaneous fees Fee for license to be a general contractor Fee for States approval of large asbestos abatement Tax on gross receipts of retailers Fee for license to install, maintain or repair glass and sheet metal in residential or commercial structures Monetary penalties as ordered by CT courts Fee to obtain license to be a retail gasoline dealer State ownership of cottages or residences due to rent, fines or escheats Fee for license to be a real estate appraiser Sundry assets of airport activities Fee for sale of sealed tickets Escheats from reciprocal states Penalty for failure to register Fee for license to sell pharmaceutical drugs Fee to obtain license to be a joint practice engineer and surveyor Fees for other general state inspection services Fee to obtain license to collect sales and use tax items sold through catalog or mail-order sales Royalties from state ownership of gasoline stations CT Department of Labors Division of Occupational Safety and Health Fee for various state reports, statutes, and registers Sale of junk and salvaged material owned by state Air management fee Sale of junk and salvaged materials owned by state Fee for license for business sales registration Fee for other legal and court services Fee to obtain food distributors license Apprenticeship fees Fee to obtain health care facilities license Sale of wood from government property Fee for license to make beds and furniture Fee for states analysis of fertilizer use Fee for accounting examination Sale of state property Fee for license to build a new home, inclusive of speculative homes Fee to license to operate a youth camp Surcharge on motor vehicle or truck rental Fee for 5% of gross bingo receipts payable to state Fee for other skilled trades licenses Fee to obtain license to do fire sprinkler system installation, repair, and maintenance Fee for other licenses to hunt, fish, or trap State ownership of docks and wharves Refunds of prior year salary/workers compensation benefits Fee to obtain a cigarette retailer license fee to obtain license to demolish a building Fee to obtain a license to operate a health club Fee to obtain milk dealers license Fee to obtain a permit to hold a bingo game Fee for continued real estate education qualification Fee to obtain a license to operate a mobile home park Fee to apply for certificate of Need collected by Office of Health Care Access Fee on a transaction of a sale by a real estate broker Fee to obtain an environmental professional license Fee for permit to operate a concession stan in state parks Fee to obtain motor carrier registration license as per the International Fuel Tax Agreement Personal aircraft parking at state-owned airports (tie-down fees) Fee for real estate agent license exam Fee to obtain a certificate to be a registered homemaker or companion agency Fee to obtain a license to install, perform maintenance on, repair, replace, inspect, and modify a television or radio-receiving apparatus Fee for insurance license exam Sale of sundry commodities of the state Tolls on highways, bridges, and ferries Fee for a tag to kill a pheasant in CT Fee for other permits to hunt and kill game animals Fee for registering interstate land sales Fee for license to operate a laboratory for medical or research purposes Fee to report a real estate purchase or sale into the public record Fee to obtain child support enforcement services Revenue from the sale of government printer matter Fee for States approval of small asbestos abatement fee for being a broker or a salesman Fee for motor carrier registration license Fee to obtain cigarette distributor license Insurance reimbursement New liquor control permit Fee for request of trial by jury Fee for a architect license exam Fee for other permits to hunt and kill game animals Tax on gross earnings of railroad and steam companies Fee to obtain other licenses for professional services Fee for license for business sales registration Fee for license to display advertising signs or billboards Fee for license for business sales registration Fee for license to install, erect, maintain and repair elevators Fee for repayment of principal Fee for license to take lobsters and crabs other than blue crabs from lobster pots Fee for states review of alternative asbestos work practices Fee for State lease of oyster grounds Pilotage commission of CT waters Unemployment compensation Statistical Grant Program of the Connecticut Department of Labors Division of Occupational Safety and Health Fee for Initial Educator Certificate, Provisional Educator Certificate, Professional Educator Certificate, Certificate for Teaching Adult Education programs, and a duplicate copy of a certificate or endorsement Fee for license to be a commercial asset manager Fee for motor vehicle quality certificate from the state Unrestricted federal aid Fee for licenses to be a joint practice engineer, surveyor and architect Category Fee Fee Fee Fee Fee Fee Fee Tax Revenue Fee Revenue Revenue Revenue Tax Revenue Fee Fee Fee Fee Revenue Tax Fee Fee Fee Fee Revenue Fee Fee Revenue Revenue Fee Fee Revenue Fee Fee

www.yankeeinstitute.org

Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund Transportation Fund General Fund General Fund Transportation Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Name Child Day Care Center Licenses Inmate Fees for Service Well Drill Contractor Licenses Licenses - Weighing Devices Amusement Park/Carnival Licenses Interior Designer Reg Licenses Racing/Jai Alai Reg - Licenses Gasoline Tax-Floor New Haven Parking Authority Fees - Trade/Service Marks Escheats - Corporate Dividends Landing Charges Cottages or Residences Char Games-Dealer/Mfg Reg Fees Escheats - Corporate Actions Permit - Deal/Handle Explosives Fees - Deposit - Domestic Ins Co Licenses to sell Tobacco Grievance Fees Other Interest Taxes on Controlled Substances Personal Use Lobster Licenses Permits to Deal in Fireworks Private Employ Agency Reg Fees Home Inspector Licenses Loan Agreement Interest Motion Picture/Theatre Manager Licenses Permits to Hold Games of Chance Out-Patient & Day Care Clinic Farms, Land, and Buildings Commemorative Plate Licenses Fees - Demolition Notification Subscriptions-Maps/Bulletins Pool Plan Review Fees Permits - Sell Sealed Tickets FY 2012 63,305.00 62,846.95 59,833.00 56,520.00 55,300.00 52,839.00 52,430.00 51,361.78 50,040.00 48,410.00 47,953.16 47,229.08 47,179.86 46,375.00 46,123.12 44,920.00 40,635.00 39,850.00 37,925.00 35,788.21 35,294.45 35,160.00 30,270.00 29,550.00 27,690.00 27,562.50 26,050.00 25,720.00 24,747.71 23,252.25 20,919.00 17,560.00 16,910.00 16,500.00 16,025.00 Purpose Fee to obtain a license to operate a child day care center Fee for programs and services for inmates Fee for license to construct a well, including but not limited to, the installation, repair and maintenance of pumps Fee for license to perform the public weighing of property, produce, commodities or articles other than those which the weigher or his employer either buys or sells Fee to for license to operate an amusement park or carnival Fee for licenses to perform interior design work Fee for license to operate a jai alai or racing business Tax on the sale of gasoline State ownership of land on which the New Haven Parking Authority operates Fee for trade or service mark Escheats from corporate dividends Aircraft landing fees collected at state airports (excluding Bradley Field) State ownership of cottages or residences due to rent, fines or escheats Tax on registration fee for Charitable Games Escheats from corporate actions Fee for permit to deal and handle explosives Fee generated from domestic company appointments and domestic insurance company registrations collected by the Department of Insurance Fee for license to sell tobacco products Fee for filing of grievances or disputes with Department of Labor Other interest accumulated Tax on the acquisition or posession of marijuana and controlled substances Fee for license to take lobsters for personal use with the use of not more than 10 lobster pots or traps, by hand, by skin diving, or by SCUBA diving Fee to obtain permit to deal fireworks Fee for registering of a private employment agency Fee for license to be a home inspector Interest accumulated on loan agreements Fee for license to exhibit moving pictures Fee for permit to hold a game of chance State-owned outpatient and day-care clinics State ownership of farms, land, and buildings due to rent, fines, or escheats fee for issuing commemorative license plates Fee for submitting demolition notification to the state Sale of subscriptions for maps and bulletins Fee for States review of pool construction plans Fee to obtain permit to allow a person to sell sealed ticket games for a permitted organization Fee for application or the annual fee to have an informational sign Late filing of election financial disclosure reports Fee for pathology services performed by the Chief Medical Examiner of CT Sale of maps and state government bulletins Fee to become a registered hypnotist Fee to take the landscape architect license exam Refunds of current year expenditures Renting of state-owned halls and rooms Fee for States review of large subsurface sewer plan Fee for other licenses for professional services Fee for other commodities licenses Sundry assets of airport services Fee for license to hold an exhibition or op show Federal reimbursement for state subsidized adoption assistance Fee for permit to drill a well Fee for a license to register a business that offers services of its employees to the public in plumbing, heating, and cooling work Fee for receiving academic qualification Fee for filing a lemon law complaint Sale of advertising space 1% of gross receipts at retail used to provide grants to dry cleaning establishments Fines and costs associated with courts CT Armories Tax on the franchise of a business Federal reimbursement for state subsidized foster care Revenue from the sale of government printer matter Dining room services in state institutions Fee for license to trap game animals Fee for private donations to the state in the category of licenses, permits, and fees Penalty for failure to register Funds generated from the Groton-New London airport Fee for license to own other animals Penalty for bad checks given to the state Fee for other motor vehicle or boat licenses Receipts from a license for terminals loading oil, chemicals, solids, liquid, or gaseous products Fee for State inspection of public swimming pools Fee for milk production license 6% tax on all motion picture shows, 10% tax on places of entertainment, amusement, or recreation and membership or initiation dues Fee for bringing a witness into court Fee for license to breed, sell or possess specific species of wild birds or wild quadrupeds Fee for licenses to rent out rooms for fewer than 30 days Fee for pharmacy benefits manager license Fees for services provided by state government employees Fee for States review of pool construction plans Fee for States review of small subsurface sewer plan Fee for camps and parking Penalty for failure to register Fee for State review of the plan for construction of a vault or crypt Penalty for failure to register General forfeitures associated with the commission of a crime Fee fo request of trial by jury Miscellaneous sundry assets of the state Court ordered donations A tax on capital gains and interest income Escheats from collections Fee for certificate for wholesale of alcoholic beverages Penalty for failure to register Recovered electronic recycling State correctional facilities Tax on fuel for motor vehicles designed to transport persons or property Fee for cigarette vending license Fee for other CT corporation organization services Fee for Copies of banking certificates Fee for other clerical services performed by the state State-owned vending machines Fee for bringing a witness into court Federal reimbursement for TANF program Federal reimbursement for state subsidized child support enforcement Penalty for filing for an exam late Escheats from decedents with no heirs Public utility contractor exam Fee for permit to sell sheet tickets for teacup raffles Late filing of election registration forms by campaign committees Escheats from mutual fund dividends Revenue from petty cash returned to the state Account used by the State Treasurer for reconciliation. Strictly an accounting mechanism and not a source of new revenue American Recovery and Reinvestment Act revenue Federal matching for state Medicaid Interest accumulated on state investments

Federal Transfer General Fund Tax Federal Transfer Fee Fee Federal Transfer Revenue Revenue Tax General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund

Revenue General Fund General Fund Tax Federal Transfer General Fund Revenue Tax Fee Revenue Revenue Fee Fee Federal Transfer Fee Revenue Tax Revenue Revenue Tax Fee Tax Revenue Tax Revenue Fines & Penalties Tax Tax Tax Fee Fee Tax Revenue Fee Fee Revenue Revenue Fee Fee Fee Fee Fee Tax Revenue Fee Fines & Penalties Fee Fee Fee Fee Tax Revenue Fee Fee Revenue Fee Tax Revenue Tax Fee Revenue Fee Fee Fee Revenue Fee Fee Revenue Tax Revenue Fines & Penalties Fee Revenue Fee Fee Fee Federal Transfer Fee Fee Fee Revenue Fee Revenue Tax Fee Tax Fee Fee Revenue Fee Fee Fee Fee General Fund General Fund General Fund Transportation Fund General Fund Transportation Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund Transportation Fund Transportation Fund General Fund Transportation Fund General Fund Transportation Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund Transportation Fund Transportation Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund Transportation Fund General Fund

Fines & Penalties General Fund Transportation Fund Fee Revenue General Fund Fee General Fund Revenue Transportation Fund Fee General Fund General Fund Revenue Fines & Penalties General Fund Fee General Fund Fee General Fund General Fund Fee Fee General Fund Revenue Revenue Fee Revenue Fee Revenue Fee Fee Fee Fee Fee Revenue Fee Fee Fee Revenue Fee Fee Tax Fee Fee Fee Fee Revenue Revenue Fee Fee Fee Fee Fee Fee Fee Fee Fee Fee Fee Fee Revenue Fee Fee Fee Fee Revenue Revenue Fee Fee Fee Fee Fee Fee Revenue Fee Fee Fee Fee Revenue Fee Fee Fee Fee Tax Fee Fee Fee Fee Fee Fee Fee Fee Tax Revenue Revenue Revenue Fee Fee Fee Federal Transfer Fee Transportation Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund General Fund Transportation Fund General Fund Transportation Fund General Fund General Fund General Fund General Fund General Fund General Fund Transportation Fund Transportation Fund General Fund General Fund General Fund Transportation Fund General Fund General Fund

Fee Transportation Fund Fines & Penalties General Fund General Fund Fee Revenue Transportation Fund General Fund Fee Fee General Fund General Fund Revenue Revenue General Fund General Fund Fee Fee General Fund Fee General Fund Revenue Transportation Fund Fee General Fund General Fund Revenue Fee General Fund Fee General Fund Fee Fee Revenue Tax General Fund General Fund General Fund General Fund

App/Annual Fees - Info Signs 15,470.00 Late Fee - Election/Financial Disclosures 15,450.00 Fees - Stats Info - Legal 15,028.86 Maps and Bulletins 14,474.95 Hypnotist Registration Fees 14,000.00 Fees - Exam - Landscape Architects 13,940.00 Refunds of Expend - Current 13,324.95 Other Rents - Halls/Rooms 12,380.00 Fee - Subsurface Sewer Plan - L 11,500.00 Other Licenses - Professional Services 11,340.00 Other Licenses - Commodities 10,999.70 Sundry Airport Services 10,863.21 Other Licenses - Exhbt/Op Show 10,770.00 ARRA IV-E Adoption Assistance - DCF 10,499.00 Well Drilling Permits 10,445.00 Mechanical Contractor Licenses 10,131.00 Fees - Academic Qualifications Reg Fee - Lemon Law Arbitration Market Bulletin - Advertising Dry Cleaning Tax Fines and Costs - Courts Armories Franchise Tax ARRA IV-E Foster Care - DCF Photocopying State Inst - Dining Room Srvc Trapping Rights Licenses Private Donations Penalties-Bank Examination Passenger Terminal Buildings Other Licenses - Animals Fines and Penalties - Bad Checks Other Licenses - Motor Vehicle/Boat Oil Pollution Licenses 9,699.00 8,850.00 8,492.65 8,326.20 7,618.14 7,017.50 6,542.90 6,531.00 6,441.71 5,725.01 5,520.00 5,312.50 5,000.00 4,810.00 4,715.00 3,873.50 3,650.00 3,625.00

Fines & Penalties General Fund Revenue General Fund General Fund Tax Revenue General Fund Revenue Transportation Fund Revenue General Fund Fee General Fund Transportation Fund Fee Fines & Penalties General Fund Revenue Transportation Fund Fee General Fund Fines & Penalties General Fund Fee General Fund Tax General Fund Fee Fee Tax Fee Fee General Fund General Fund General Fund General Fund General Fund

Fees - Pool Inspections 3,200.00 Milk Production License 3,065.00 Taxes on Admission - Boxing or Wrestling 2,613.20 Witness Fees License - Game Birds/Quadruped Room Occupancy Licenses Pharmacy Benefits Manager Re Fees - Srvcs by Government Employees Pool Plan Review Fees - Resumbit Fee - Subsurface Sewer Plan - S Camps and Parking Penalties-Registration Fees - Vault/Crypt Plan Review Penalties-Commissioner Office General Forfeitures Jury Fees Sundry Services - Miscellaneous Court Ordered Donations Capital Gains-Dividend-Inttax Escheats - Collections Fees - Wholesale Cert - Alcoholic Beverages Penalties-Credit Union Recycled Electronic Equipment Board of Inmates in Jails Motor Carrier Tax - General Cigarette Dealer - Vending Licenses Other Fees - Srvcs - CT Corp Org Fees - Copies/Banking Cert - General Other Fees - Clerical Services Commission - Vending Machines Witness Fees TANF ARRA Basic Assistance ARRA - Child Support Enforcement Penalties - Exam - Late Filing Escheats - Estates of Decedent Exam Fees - Public Util - General Sheet Tickets - Teacup Raffles Late Fee - Election Registration Escheats - Mutual Fund Dividends Petty Cash Returned Treasurer Deposit Adjustment ARRA Revenue ARRA - Increased Medicaid FMAP Investment Interest 2,425.99 2,065.00 1,850.00 1,700.00 1,535.42 1,500.00 1,400.00 1,400.00 1,300.00 1,250.00 1,000.00 771.00 760.00 550.00 410.00 343.00 300.00 200.00 200.00 168.98 161.72 160.00 100.00 100.00 35.00 25.00 16.20 3.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -4.00 -94,205.58 -2,731,990.00 -2,844,623.13

General Fund Fee Fee General Fund General Fund Fee Fee General Fund Fee General Fund Fee Transportation Fund Fines & Penalties General Fund General Fund Fee Fines & Penalties General Fund Revenue General Fund Fee Transportation Fund Transportation Fund Revenue Revenue General Fund Tax General Fund Tax General Fund Fee General Fund Fines & Penalties General Fund Revenue General Fund Revenue General Fund Tax Transportation Fund Fee General Fund Fee General Fund Fee General Fund Fee General Fund Revenue General Fund Fee Transportation Fund Federal Transfer General Fund Federal Transfer General Fund Fines & Penalties General Fund General Fund Revenue Revenue Transportation Fund Fee General Fund Fines & Penalties General Fund Revenue General Fund Revenue General Fund Revenue General Fund Federal Transfer General Fund Federal Transfer General Fund Revenue General Fund

Improving lives through freedom and opportunity.

Yankee Institute for Public Policy

Comm Assc Mngr - Real Estate Licenses 69,360.00 Fees - Motor Fuel Quality Certificate 68,600.00 Medicare 67,688.69 Licenses - Engineers/Land Surveyers/Architects 65,050.00

You might also like

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- English For Speci Fic Purposes: Holly VassDocument15 pagesEnglish For Speci Fic Purposes: Holly VassThahp ThahpNo ratings yet

- D-Insurance Feasibility StudyDocument27 pagesD-Insurance Feasibility StudyDetroit Free PressNo ratings yet

- Auditor FormsDocument10 pagesAuditor FormsRobin OdaNo ratings yet

- Americans For Prosperity FY 2017 Taxpayers' BudgetDocument112 pagesAmericans For Prosperity FY 2017 Taxpayers' BudgetAFPHQ_NewJerseyNo ratings yet

- Multistate Tax Commission ArticleDocument7 pagesMultistate Tax Commission Articleyfeng1018No ratings yet

- Sales and Use Tax in Maryland Presentation To Legislature 20110726Document29 pagesSales and Use Tax in Maryland Presentation To Legislature 20110726Paul MastersNo ratings yet

- Ist of Abbreviations: Budget 2008Document4 pagesIst of Abbreviations: Budget 2008Farshad NiaNo ratings yet

- Fines and Fees in The New York City BudgetDocument7 pagesFines and Fees in The New York City BudgetcrainsnewyorkNo ratings yet

- PESTEL Analysis of PakistanDocument2 pagesPESTEL Analysis of Pakistanchill itNo ratings yet

- Ey Grasping The Thistle - Adding Energy To The Debate November 2013Document12 pagesEy Grasping The Thistle - Adding Energy To The Debate November 2013Russell AllisonNo ratings yet

- Irs Enforcement of The Reporting of Tip Income: HearingDocument67 pagesIrs Enforcement of The Reporting of Tip Income: HearingScribd Government DocsNo ratings yet

- Additional Information About TAXATIONDocument4 pagesAdditional Information About TAXATIONjudeNo ratings yet

- Income Tax Comparison Bangladesh Vs MalaysiaDocument30 pagesIncome Tax Comparison Bangladesh Vs MalaysiaMehmet RaKsNo ratings yet

- Off Budget OperationsDocument151 pagesOff Budget Operationsrefi_sugiantoNo ratings yet

- L1 p2 Budget Without SchemesDocument90 pagesL1 p2 Budget Without Schemesatul.vivNo ratings yet

- May 2014 Rev-E NewsDocument4 pagesMay 2014 Rev-E NewsRob PortNo ratings yet

- Corporate Tax Dodgers Report FinalDocument26 pagesCorporate Tax Dodgers Report FinalSan PaoloNo ratings yet

- Transfer and Business Taxation by Ballada Solution ManualDocument5 pagesTransfer and Business Taxation by Ballada Solution ManualAnonymous aU6BvWTIV20% (1)

- Town of Woodstock: Financial Activities and Information TechnologyDocument26 pagesTown of Woodstock: Financial Activities and Information TechnologyTony AdamisNo ratings yet

- 5yr Report VillageDocument7 pages5yr Report VillageNaplesNYNo ratings yet

- Maryland Energy Administration Revenue ReportDocument11 pagesMaryland Energy Administration Revenue ReportAnonymous sKgTCo2No ratings yet

- Not For UseDocument352 pagesNot For UseElizabeth CaseyNo ratings yet

- AP StyleDocument3 pagesAP StyleJoemar FurigayNo ratings yet

- The Tax Reform For Acceleration and InclusionDocument3 pagesThe Tax Reform For Acceleration and InclusionbeckNo ratings yet

- Module 7 LectureDocument8 pagesModule 7 LectureClarence AblazaNo ratings yet

- CMS ReportDocument30 pagesCMS ReportRecordTrac - City of OaklandNo ratings yet

- Pa Taxation ManualDocument113 pagesPa Taxation ManualVikram rajputNo ratings yet

- Sin Tax in The Philippines ThesisDocument4 pagesSin Tax in The Philippines Thesisafjrpomoe100% (2)

- Pembagian Jenis Pajak Berdasarkan Lembaga Pemungut PajakDocument13 pagesPembagian Jenis Pajak Berdasarkan Lembaga Pemungut PajakIkhsan Gayo GrandNo ratings yet

- Mainstreet Alberta January 18 - Part 1Document4 pagesMainstreet Alberta January 18 - Part 1MichaelFranklinNo ratings yet

- Micro IleriDocument5 pagesMicro IleriIleri PromiseNo ratings yet

- Annual Fraud Indicator 2011Document41 pagesAnnual Fraud Indicator 2011alexstukovNo ratings yet

- Bds News Advice Sai EngDocument2 pagesBds News Advice Sai EngCalimeroNo ratings yet

- Income Tax at A Glance 2013 14 For BangladeshDocument14 pagesIncome Tax at A Glance 2013 14 For BangladeshVidelSatanNo ratings yet

- Ezekiel John Roque 2015707041Document3 pagesEzekiel John Roque 2015707041Keizer DelacruzNo ratings yet

- WSP Operating Budget Request 2013Document353 pagesWSP Operating Budget Request 2013Andrew Charles HendricksNo ratings yet

- Digital Service Tax Debate FinalDocument9 pagesDigital Service Tax Debate FinalShivi CholaNo ratings yet

- Taxation of Electronic Commerce: A Developing Problem: International Review of Law Computers & Technology March 2002Document18 pagesTaxation of Electronic Commerce: A Developing Problem: International Review of Law Computers & Technology March 2002Mehdi MansourianNo ratings yet

- Business License HandbookDocument102 pagesBusiness License HandbookCublktigressNo ratings yet

- Harmonized Sales Tax in Canada British Columbia Edition: Prepared by British Columbia's Certified General AccountantsDocument22 pagesHarmonized Sales Tax in Canada British Columbia Edition: Prepared by British Columbia's Certified General AccountantsMike InfanteNo ratings yet

- Chapter 12 PresentationDocument28 pagesChapter 12 PresentationFin ShinNo ratings yet

- State Government Tax Collections Summary Report: 2014: Economy-Wide Statistics Brief: Public SectorDocument8 pagesState Government Tax Collections Summary Report: 2014: Economy-Wide Statistics Brief: Public SectorAdminAliNo ratings yet

- Tolls: Road Testing Free Market Ideas To Drive Better Roads With Less TrafficDocument14 pagesTolls: Road Testing Free Market Ideas To Drive Better Roads With Less TrafficHeath W. FahleNo ratings yet

- Thesis Statement About Sin Tax BillDocument7 pagesThesis Statement About Sin Tax Billafloziubadtypc100% (2)

- MEMA Rept FinalDocument12 pagesMEMA Rept FinalDavid HarryNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleRating: 3 out of 5 stars3/5 (1)

- TransTalk DecDocument14 pagesTransTalk Dechassaniqbal84No ratings yet

- 2010 Parking in America ReportDocument34 pages2010 Parking in America ReportparkingeconomicsNo ratings yet

- USD 13 BN Consumption Stimulus - Jan 2013Document30 pagesUSD 13 BN Consumption Stimulus - Jan 2013ashishkrishNo ratings yet

- 2013 Consumer Survey ReportDocument51 pages2013 Consumer Survey ReportAldoSolsaNo ratings yet

- NMHD Template4Document80 pagesNMHD Template4sur_ruhNo ratings yet

- Public Accounts 2011-2012 Saskatchewan Government Details of Revenue & ExpensesDocument291 pagesPublic Accounts 2011-2012 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- Family Budget PlannerDocument4 pagesFamily Budget PlannerPriya GoyalNo ratings yet

- What Is Income TaxDocument3 pagesWhat Is Income TaxFaisal AhmedNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- Statement of Facts: PolicyholderDocument4 pagesStatement of Facts: Policyholderramadh111No ratings yet

- NetChoice Request To Amend UT SJR6Document2 pagesNetChoice Request To Amend UT SJR6Bryan SchottNo ratings yet

- Affirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesDocument10 pagesAffirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesTherese Janine HetutuaNo ratings yet

- Nonprofit Law for Colleges and Universities: Essential Questions and Answers for Officers, Directors, and AdvisorsFrom EverandNonprofit Law for Colleges and Universities: Essential Questions and Answers for Officers, Directors, and AdvisorsNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Application For Refund: Section 1 - Applicant InformationDocument3 pagesApplication For Refund: Section 1 - Applicant InformationDaniel Christian-Grafton HutchinsonNo ratings yet

- 1310475807binder1Document39 pages1310475807binder1CoolerAdsNo ratings yet

- States 2 - PacketDocument17 pagesStates 2 - PacketAlay PerezNo ratings yet

- Notice and Affidavit Regional Killer Boyden Gray Use of NYS Government Funded Agencies For Treason and Assassination ProgrammingDocument72 pagesNotice and Affidavit Regional Killer Boyden Gray Use of NYS Government Funded Agencies For Treason and Assassination ProgrammingMiriam SnyderNo ratings yet

- DMV Arrests The Victim of Loan-Sharks For Failing To Pay 500% InterestDocument4 pagesDMV Arrests The Victim of Loan-Sharks For Failing To Pay 500% Interestzacallford100% (1)

- California Reference BookletDocument118 pagesCalifornia Reference BookletVan KochkarianNo ratings yet

- REG 195, Application For Disabled Person Placard or PlatesDocument3 pagesREG 195, Application For Disabled Person Placard or Platestech20000No ratings yet

- 2022 - H 7939 SUBSTITUTE A: in General Assembly January Session, A.D. 2022Document14 pages2022 - H 7939 SUBSTITUTE A: in General Assembly January Session, A.D. 2022Frank MaradiagaNo ratings yet

- 2014 Infrastructure PlanDocument96 pages2014 Infrastructure Planstavros7No ratings yet

- DMV Name Change InformationDocument2 pagesDMV Name Change InformationchairmancorpNo ratings yet

- MV 215Document1 pageMV 215Demogorgón AbigorNo ratings yet

- North Carolina: Driver's License Format, Issuance, and RenewalDocument10 pagesNorth Carolina: Driver's License Format, Issuance, and Renewalannaliese faverNo ratings yet

- Assignment IIDocument5 pagesAssignment IIsoham agarwalNo ratings yet

- Gabayan Final PDFDocument56 pagesGabayan Final PDFthebcmsolutionNo ratings yet

- Srs RtoDocument14 pagesSrs Rtorhlverma2003No ratings yet

- Title Paper PDFDocument2 pagesTitle Paper PDFJason KennedyNo ratings yet

- DMV Teen Parent Training GuideDocument36 pagesDMV Teen Parent Training GuideKathy RamirezNo ratings yet

- Non-Commercial: Application For Restricted Driver License For Financial Responsibility ActionsDocument2 pagesNon-Commercial: Application For Restricted Driver License For Financial Responsibility ActionsC.j. GildnerNo ratings yet

- Vsa 10 ADocument1 pageVsa 10 ADewy WildonNo ratings yet

- Report of Traffic Accident Occurring in California: Read Important Information On BackDocument3 pagesReport of Traffic Accident Occurring in California: Read Important Information On BackThebomb3No ratings yet

- 452Document1 page452Davah Emiel OzNo ratings yet

- 02-15-2013 EditionDocument28 pages02-15-2013 EditionSan Mateo Daily JournalNo ratings yet

- Violation ListDocument2 pagesViolation ListSandyNo ratings yet

- Police Log February 12, 2016Document14 pagesPolice Log February 12, 2016MansfieldMAPoliceNo ratings yet

- Michael Robertson at Driver License Examiner GraduationDocument5 pagesMichael Robertson at Driver License Examiner GraduationJohn DanielsNo ratings yet

- Tesla DMV CommsDocument8 pagesTesla DMV CommsFred LamertNo ratings yet

- MV Dealer Manual CompletemanualDocument163 pagesMV Dealer Manual CompletemanualKonan Snowden100% (1)

- New York State Insurance Identification Card: FS-20 Form 1390 NY (02/15)Document2 pagesNew York State Insurance Identification Card: FS-20 Form 1390 NY (02/15)Jeremy WareNo ratings yet

- Parking FinesDocument11 pagesParking FinesSouthern California Public RadioNo ratings yet