Professional Documents

Culture Documents

Monthly Report: November 2012 Daily Pse Index and Value Turnover

Monthly Report: November 2012 Daily Pse Index and Value Turnover

Uploaded by

srichardequipCopyright:

Available Formats

You might also like

- Philip Kotler Questions On ManagementDocument29 pagesPhilip Kotler Questions On Managementjagadishprasad88% (32)

- GTP Ew230203 4Document1 pageGTP Ew230203 4pcm-indo techNo ratings yet

- Sample - Europe Pet Food Market (2020-2025) - Mordor IntelligenceDocument24 pagesSample - Europe Pet Food Market (2020-2025) - Mordor IntelligenceKallum Poyurs100% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Towngas: Achieving Competitive Advantage Through CRM.: Presented byDocument19 pagesTowngas: Achieving Competitive Advantage Through CRM.: Presented bypriyankshekhar100% (1)

- Chapter 02 - Rosenbloom 8edDocument28 pagesChapter 02 - Rosenbloom 8edheize resenteNo ratings yet

- Monthly Report: September 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: September 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: JANUARY 2013 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: JANUARY 2013 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: AUGUST 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: AUGUST 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- 10 For WebsiteDocument2 pages10 For WebsitesrichardequipNo ratings yet

- Monthly Report: JUNE 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: JUNE 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: MARCH 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: MARCH 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: MAY 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: MAY 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: JANUARY 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: JANUARY 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- August 5, 2011: Market OverviewDocument14 pagesAugust 5, 2011: Market OverviewValuEngine.comNo ratings yet

- Msil 4Q Fy 2013Document15 pagesMsil 4Q Fy 2013Angel BrokingNo ratings yet

- Rs 490 Hold: Key Take AwayDocument5 pagesRs 490 Hold: Key Take AwayAnkush SaraffNo ratings yet

- Nestle India: Performance HighlightsDocument9 pagesNestle India: Performance HighlightsAngel BrokingNo ratings yet

- Opening Bell: Key Points Index Movement (Past 5 Days)Document14 pagesOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandNo ratings yet

- Rupee Karvy 130911Document3 pagesRupee Karvy 130911jitmNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- ValuEngine Weekly Newsletter September 30, 2011Document12 pagesValuEngine Weekly Newsletter September 30, 2011ValuEngine.comNo ratings yet

- DNH Sri Lanka Weekly 10-14 Dec 2012Document9 pagesDNH Sri Lanka Weekly 10-14 Dec 2012Randora LkNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- JPM Guide To The Markets - Q1 2014Document71 pagesJPM Guide To The Markets - Q1 2014adamsro9No ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Bajaj Hindusthan (BAJHIN) : Underperformance To ContinueDocument6 pagesBajaj Hindusthan (BAJHIN) : Underperformance To Continuedrsivaprasad7No ratings yet

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Document12 pagesKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatareNo ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- Performance Highlights: NeutralDocument12 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Daily Trade Journal - 21.02.2014Document6 pagesDaily Trade Journal - 21.02.2014Randora LkNo ratings yet

- Wyeth - Q4FY12 Result Update - Centrum 22052012Document4 pagesWyeth - Q4FY12 Result Update - Centrum 22052012SwamiNo ratings yet

- Renata LimitedDocument20 pagesRenata LimitedJakaria KhanNo ratings yet

- DWSAlphaEquityFund 2014jul07Document4 pagesDWSAlphaEquityFund 2014jul07Yogi173No ratings yet

- Blue Star Q1FY14 Result UpdateDocument5 pagesBlue Star Q1FY14 Result UpdateaparmarinNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - Weeklyapi-182070220No ratings yet

- Max KotakDocument26 pagesMax KotakMary GonsalvesNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Nestle India Result UpdatedDocument11 pagesNestle India Result UpdatedAngel BrokingNo ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Union Bank, 1Q FY 2014Document11 pagesUnion Bank, 1Q FY 2014Angel BrokingNo ratings yet

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Document4 pagesValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsNo ratings yet

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Andhra Bank, 1Q FY 2014Document11 pagesAndhra Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Weekly Mutual Fund and Debt Report: Retail ResearchDocument14 pagesWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAngel BrokingNo ratings yet

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingNo ratings yet

- HSL PCG "Currency Daily": Private Client Group (PCG)Document6 pagesHSL PCG "Currency Daily": Private Client Group (PCG)umaganNo ratings yet

- Market Outlook 30th April 2012Document16 pagesMarket Outlook 30th April 2012Angel BrokingNo ratings yet

- BRS Market Report: Week II: 11Document7 pagesBRS Market Report: Week II: 11Sudheera IndrajithNo ratings yet

- Market Research Jan 20 - Jan 24Document2 pagesMarket Research Jan 20 - Jan 24FEPFinanceClubNo ratings yet

- Daily Trade Journal - 10.02.2014Document6 pagesDaily Trade Journal - 10.02.2014Randora LkNo ratings yet

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingNo ratings yet

- Mind TreeDocument16 pagesMind TreeAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument10 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Hex AwareDocument14 pagesHex AwareAngel BrokingNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- Capital Mall TrustDocument7 pagesCapital Mall TrustChan Weng HongNo ratings yet

- Misc (Hold, Eps ) : HLIB ResearchDocument3 pagesMisc (Hold, Eps ) : HLIB ResearchJames WarrenNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- Daily Trade Journal - 06.05.2013Document6 pagesDaily Trade Journal - 06.05.2013ishara-gamage-1523No ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- Global High-End Fashion Companies: Haute-Couture - Luxury - PremiumDocument1 pageGlobal High-End Fashion Companies: Haute-Couture - Luxury - PremiumsrichardequipNo ratings yet

- TABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- TABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- Restaurant Operations ManualDocument4 pagesRestaurant Operations ManualsrichardequipNo ratings yet

- TABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011Document2 pagesTABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011srichardequipNo ratings yet

- RAHULDocument10 pagesRAHULprabhakar76No ratings yet

- Online Trading at Networth CapitalDocument62 pagesOnline Trading at Networth CapitalnaveenNo ratings yet

- Chapter 18 - BVPSDocument2 pagesChapter 18 - BVPSLorence IbañezNo ratings yet

- Traditional Vs Digital MarketingDocument17 pagesTraditional Vs Digital MarketingVarshaNo ratings yet

- STDM Class Partipation QandADocument6 pagesSTDM Class Partipation QandAZhaira Kim CantosNo ratings yet

- Ceramic IndustriesDocument16 pagesCeramic IndustriesIubianNo ratings yet

- Inb 372 Sla CaseDocument5 pagesInb 372 Sla CaseJannatul Ferdousi Prity 1911654630No ratings yet

- Top Reasons Forex Traders FailDocument16 pagesTop Reasons Forex Traders Failkapoor_mukesh4u100% (1)

- Starting A Business 101Document44 pagesStarting A Business 101Robiul HasanNo ratings yet

- DM 2020 - Pertemuan 8 - Ch6 Relationship Marketing Using Digital PlatformsDocument20 pagesDM 2020 - Pertemuan 8 - Ch6 Relationship Marketing Using Digital PlatformsgaldinojsfoodNo ratings yet

- Marketing Management of Financial MCDocument44 pagesMarketing Management of Financial MCtsrajanNo ratings yet

- Sandy Lai HKU PaperDocument49 pagesSandy Lai HKU PaperAnish S.MenonNo ratings yet

- Chapter 10 Transaction Exposure: Multinational Business Finance, 14e (Eiteman)Document17 pagesChapter 10 Transaction Exposure: Multinational Business Finance, 14e (Eiteman)EnciciNo ratings yet

- CEED Marketing - Biscolata MOOD Digital Marketing Blueprint For 2018Document12 pagesCEED Marketing - Biscolata MOOD Digital Marketing Blueprint For 2018Namron GnobmyNo ratings yet

- Advanced Price Action Analysis - Trading With Smart MoneyDocument12 pagesAdvanced Price Action Analysis - Trading With Smart MoneyVIGNESH RK100% (2)

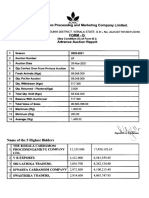

- Ero"" "Iltjtia: Kerala Cardamom Marketing Company LimitedDocument25 pagesEro"" "Iltjtia: Kerala Cardamom Marketing Company LimitedRoshniNo ratings yet

- Nature and Kind of Partnership BusinessDocument26 pagesNature and Kind of Partnership BusinessMd Anik HasanNo ratings yet

- A) Head and Shoulder PatternDocument3 pagesA) Head and Shoulder PatternDevraj BhandariNo ratings yet

- Crown Plaza Hotel Market Entry StrategyDocument16 pagesCrown Plaza Hotel Market Entry StrategyIhtisham Sohail100% (1)

- Kotler CH04Document55 pagesKotler CH04adam halimNo ratings yet

- Mutual Fund - Project ReportDocument73 pagesMutual Fund - Project ReportAmrit Kar0% (1)

- Key Business CorrespondenceDocument11 pagesKey Business CorrespondenceLe Quỳnh Như NguyễnNo ratings yet

- Factors Influencing Demand For HotelsDocument8 pagesFactors Influencing Demand For HotelsAnusha NursingNo ratings yet

- Need For International TradeDocument3 pagesNeed For International Tradeyasasrii45No ratings yet

- Guide To Marketing and Business DevelopmentDocument86 pagesGuide To Marketing and Business DevelopmentGáborTengerdi50% (2)

Monthly Report: November 2012 Daily Pse Index and Value Turnover

Monthly Report: November 2012 Daily Pse Index and Value Turnover

Uploaded by

srichardequipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Report: November 2012 Daily Pse Index and Value Turnover

Monthly Report: November 2012 Daily Pse Index and Value Turnover

Uploaded by

srichardequipCopyright:

Available Formats

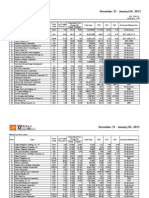

ISSN 0118-1769 VOL. XI NO.

11

Monthly Report

DAILY PSE INDEX and VALUE TURNOVER

NOVEMBER 2012

Mil Php (truncated) 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 10-Nov

PSEi

5,600 5,400 5,200 5,000

4,800

4,600 4,400 4,200 4,000 3,800 3,600

3,400

3,200 9-Dec 9-Jan 7-Feb 6-Mar 3-Apr 7-May 4-Jun 3-Jul 31-Jul 3-Sep 1-Oct 30-Oct 3,000 29-Nov

INDEX PERFORMANCE

High PSE Index (PSEi) All Shares Index Financials Index Industrial Index Holding Firms Index Property Index Services Index Mining & Oil Index 5,640.45 3,641.89 1,507.76 8,851.22 4,956.22 2,153.37 1,754.61 19,919.39 Nov-12 Low 5,414.82 3,568.67 1,404.47 8,584.10 4,648.13 2,059.19 1,678.02 18,043.13 Close 5,640.45 3,639.42 1,488.30 8,803.31 4,956.22 2,153.37 1,734.58 18,043.13 1-month 3.98 1.64 8.26 3.12 7.16 2.18 (1.12) (9.39) Comparative Change (in percent) 3-month 6-month 12-month 8.55 5.54 15.37 11.37 14.37 8.26 (1.53) (13.92) 10.79 7.77 18.59 12.30 10.85 18.14 5.74 (23.83) 33.94 23.28 59.96 26.68 50.48 46.04 12.45 (23.92) Year-to-date 29.01 19.52 53.61 24.43 41.46 45.38 7.32 (23.24)

AVERAGE DAILY VALUE TRADED (in Million Php)

Oct-12 (22 days) Total Market Regular Market Non-regular Market Domestic Issues Foreign Issues Common Preferred Warrants & PDR Total Market Financials Sector Industrial Sector Holding Firms Sector Property Sector Services Sector Mining & Oil Sector SME Board 7,527.21 5,899.93 1,627.28 7,526.96 0.25 7,362.67 105.82 58.72 7,527.21 1,852.52 1,205.08 1,715.01 868.77 1,596.75 289.07 0.01 Nov-12 (19 days) 7,606.73 6,787.67 819.06 7,606.01 0.72 7,437.04 89.59 80.10 7,606.73 1,576.23 1,938.72 1,800.71 1,024.27 1,060.86 205.93 0.01 Year-to-date (226 days) 7,158.28 5,930.56 1,227.72 7,157.84 0.44 7,071.76 28.42 58.11 7,158.28 1,139.43 1,685.65 1,643.14 954.84 1,153.02 582.19 0.009 1-month 1.06 15.05 (49.67) 1.05 186.70 1.01 (15.34) 36.40 1.06 (14.91) 60.88 5.00 17.90 (33.56) (28.76) (14.15) Comparative Change (in percent) 3-month 6-month 12-month 44.72 47.77 23.56 44.72 66.61 43.97 501.98 5.75 44.72 76.88 92.29 27.14 29.12 16.01 (11.56) 2,223.14 3.88 3.93 3.49 3.87 115.30 2.85 143.74 46.47 3.88 29.56 7.42 (3.43) 20.51 18.32 (70.16) 12.77 29.62 (45.70) 12.76 194.42 10.62 491.39 1,074.54 12.77 96.43 48.09 114.93 73.87 (56.45) (73.29) (92.75) Year-to-date 27.13 25.89 33.51 27.14 (22.63) 26.03 128.97 735.81 27.13 83.58 8.88 48.37 61.35 21.96 (28.75) (60.91)

2010, The Philippine Stock Exchange, Inc. All rights reserved. No part of this report may be reproduced in any form by any means without the consent of the Exchange.

November 2012

Monthly Report MONTHLY REVIEW

Value (Mil Php)

Table of Contents

1 4 6 Monthly Review Monthly Features Business Cost Indicators Foreign Quotations Exchange Rates Market Statistics Daily PSEi Daily Foreign Transactions Daily Trading Monthly Sector Summary Monthly Market Activity PSE Sector Indices Sector Index Performance & Trading Value Market Capitalization PSEi Constituents Active Companies By Volume Turnover Ratio By Trading Frequency By Trading Value By Foreign Activity Active Issues Gainers and Losers By Price Change By Change in Volume Traded By Net Foreign Buying By Net Foreign Selling Active Trading Participants By Trading Value By Frequency Trading Statistics Fundamental Data & Financial Ratios Corporate Disclosures Dividend Declaration Initial Public Offering Additional Listings Changes in Corporate Information Trading Suspension Block Sales Schedule of Stockholders Meeting Directory of Trading Participants PSE Board of Directors & Officers

PSEi 5,800

16,000

5,600 12,000 5,400

8,000

5,200

4,000

5,000

13

0 November 1

4,800 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

17

STOCK MARKET REPORT

The PSEi reached unprecedented highs nine times in November. On 29 November, the benchmark index soared to its highest level of 5,640.45 points, up by 4.0% or 215.94 points from the previous months close of 5,424.51 points, following the better-than-expected third quarter GDP growth figure. Year-to-date, the PSEi posted an increase of 29.0% as of endNovember. Four sector indices likewise registered gains during the month, led by the Financials sector which surged by 8.3% month-on-month. The Holding Firms, Industrial, and Property sectors followed, increasing by 7.2%, 3.1%, and 2.2%, respectively. The Mining & Oil and Services sectors, on the other hand declined by 9.4% and 1.1%, respectively. Meanwhile, the broader All Shares index rose by 1.6% or 58.83 points to end the month at 3,639.42 points from 3,580.59 points a month ago. Value turnover in November decreased by 12.7% to P144.53 billion from P165.60 billion in the previous month. Average daily turnover in November however, inched up by 1.1% to P7.61 billion from the October average of P7.53 billion. Value turnover for the first eleven months of the year was posted at P1.62 trillion, 26.0% higher than the market value turnover for the same period last year. Foreign investors in November were net buyers in the amount of P7.91 billion, a turnaround from the previous months net foreign selling figure of P8.85 billion. Foreign investors were net buyers at P94.27 billion during the January-November period. Foreign trades cornered 44.3% of the total market trades during the eleven-month period. STI Education Systems Holdings, Inc. (STI) conducted a follow on offering for 2.90 billion primary shares at P0.90 per share on 07 November 2012. Total capital raised amounted to P2.61 billion. STI closed the month at P1.07, 18.9% more than its offer price. The Philippine Stock Exchange (PSE) adjusted the float levels of one PSEimember company and six sector-index member companies on 26 November, following the conduct of its quarterly rebalancing of float levels based on its Policy on Index Management.

18

19 33

36

The data contained in the PSE Monthly Report were collated by the Corporate Planning and Research Section of the Philippine Stock Exchange. The views and comments presented by the writers in this report do not necessarily represent the views and comments of the PSE. The PSE does not make any representations or warranties on matters such as, but not limited to, the accuracy, timeliness, completeness, currentness, non-infringement, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in the report, or any decision made or action taken in reliance upon information contained herein. The information contained herein is for information purposes only, does not constitute investment advice, and is not intended to influence investment decisions. Advice from a securities professional is strongly recommended. For inquiries, suggestions or subscriptions to the Monthly Report, please call (632) 819-4100, or send a message by fax to (632) 6378818, or email to pirs@pse.com.ph.

You might also like

- Philip Kotler Questions On ManagementDocument29 pagesPhilip Kotler Questions On Managementjagadishprasad88% (32)

- GTP Ew230203 4Document1 pageGTP Ew230203 4pcm-indo techNo ratings yet

- Sample - Europe Pet Food Market (2020-2025) - Mordor IntelligenceDocument24 pagesSample - Europe Pet Food Market (2020-2025) - Mordor IntelligenceKallum Poyurs100% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Towngas: Achieving Competitive Advantage Through CRM.: Presented byDocument19 pagesTowngas: Achieving Competitive Advantage Through CRM.: Presented bypriyankshekhar100% (1)

- Chapter 02 - Rosenbloom 8edDocument28 pagesChapter 02 - Rosenbloom 8edheize resenteNo ratings yet

- Monthly Report: September 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: September 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: JANUARY 2013 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: JANUARY 2013 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: AUGUST 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: AUGUST 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- 10 For WebsiteDocument2 pages10 For WebsitesrichardequipNo ratings yet

- Monthly Report: JUNE 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: JUNE 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: MARCH 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: MARCH 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: MAY 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: MAY 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Monthly Report: JANUARY 2012 Daily Pse Index and Value TurnoverDocument2 pagesMonthly Report: JANUARY 2012 Daily Pse Index and Value TurnoversrichardequipNo ratings yet

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- August 5, 2011: Market OverviewDocument14 pagesAugust 5, 2011: Market OverviewValuEngine.comNo ratings yet

- Msil 4Q Fy 2013Document15 pagesMsil 4Q Fy 2013Angel BrokingNo ratings yet

- Rs 490 Hold: Key Take AwayDocument5 pagesRs 490 Hold: Key Take AwayAnkush SaraffNo ratings yet

- Nestle India: Performance HighlightsDocument9 pagesNestle India: Performance HighlightsAngel BrokingNo ratings yet

- Opening Bell: Key Points Index Movement (Past 5 Days)Document14 pagesOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandNo ratings yet

- Rupee Karvy 130911Document3 pagesRupee Karvy 130911jitmNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- ValuEngine Weekly Newsletter September 30, 2011Document12 pagesValuEngine Weekly Newsletter September 30, 2011ValuEngine.comNo ratings yet

- DNH Sri Lanka Weekly 10-14 Dec 2012Document9 pagesDNH Sri Lanka Weekly 10-14 Dec 2012Randora LkNo ratings yet

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- JPM Guide To The Markets - Q1 2014Document71 pagesJPM Guide To The Markets - Q1 2014adamsro9No ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Bajaj Hindusthan (BAJHIN) : Underperformance To ContinueDocument6 pagesBajaj Hindusthan (BAJHIN) : Underperformance To Continuedrsivaprasad7No ratings yet

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Document12 pagesKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatareNo ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- Performance Highlights: NeutralDocument12 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Daily Trade Journal - 21.02.2014Document6 pagesDaily Trade Journal - 21.02.2014Randora LkNo ratings yet

- Wyeth - Q4FY12 Result Update - Centrum 22052012Document4 pagesWyeth - Q4FY12 Result Update - Centrum 22052012SwamiNo ratings yet

- Renata LimitedDocument20 pagesRenata LimitedJakaria KhanNo ratings yet

- DWSAlphaEquityFund 2014jul07Document4 pagesDWSAlphaEquityFund 2014jul07Yogi173No ratings yet

- Blue Star Q1FY14 Result UpdateDocument5 pagesBlue Star Q1FY14 Result UpdateaparmarinNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - Weeklyapi-182070220No ratings yet

- Max KotakDocument26 pagesMax KotakMary GonsalvesNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Nestle India Result UpdatedDocument11 pagesNestle India Result UpdatedAngel BrokingNo ratings yet

- AnandRathi Relaxo 05oct2012Document13 pagesAnandRathi Relaxo 05oct2012equityanalystinvestorNo ratings yet

- Union Bank, 1Q FY 2014Document11 pagesUnion Bank, 1Q FY 2014Angel BrokingNo ratings yet

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Document4 pagesValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsNo ratings yet

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Andhra Bank, 1Q FY 2014Document11 pagesAndhra Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Weekly Mutual Fund and Debt Report: Retail ResearchDocument14 pagesWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAngel BrokingNo ratings yet

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingNo ratings yet

- HSL PCG "Currency Daily": Private Client Group (PCG)Document6 pagesHSL PCG "Currency Daily": Private Client Group (PCG)umaganNo ratings yet

- Market Outlook 30th April 2012Document16 pagesMarket Outlook 30th April 2012Angel BrokingNo ratings yet

- BRS Market Report: Week II: 11Document7 pagesBRS Market Report: Week II: 11Sudheera IndrajithNo ratings yet

- Market Research Jan 20 - Jan 24Document2 pagesMarket Research Jan 20 - Jan 24FEPFinanceClubNo ratings yet

- Daily Trade Journal - 10.02.2014Document6 pagesDaily Trade Journal - 10.02.2014Randora LkNo ratings yet

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingNo ratings yet

- Mind TreeDocument16 pagesMind TreeAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument10 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Hex AwareDocument14 pagesHex AwareAngel BrokingNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- Capital Mall TrustDocument7 pagesCapital Mall TrustChan Weng HongNo ratings yet

- Misc (Hold, Eps ) : HLIB ResearchDocument3 pagesMisc (Hold, Eps ) : HLIB ResearchJames WarrenNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- Daily Trade Journal - 06.05.2013Document6 pagesDaily Trade Journal - 06.05.2013ishara-gamage-1523No ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- Global High-End Fashion Companies: Haute-Couture - Luxury - PremiumDocument1 pageGlobal High-End Fashion Companies: Haute-Couture - Luxury - PremiumsrichardequipNo ratings yet

- TABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4 - Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- TABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040Document1 pageTABLE 1.4b - Women Population Projection by Age Group, Philippines: 2015 - 2040srichardequipNo ratings yet

- Restaurant Operations ManualDocument4 pagesRestaurant Operations ManualsrichardequipNo ratings yet

- TABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011Document2 pagesTABLE 2.1 - Household Population 15 Years Old and Over by Sex, Philippines: 1998 - 2011srichardequipNo ratings yet

- RAHULDocument10 pagesRAHULprabhakar76No ratings yet

- Online Trading at Networth CapitalDocument62 pagesOnline Trading at Networth CapitalnaveenNo ratings yet

- Chapter 18 - BVPSDocument2 pagesChapter 18 - BVPSLorence IbañezNo ratings yet

- Traditional Vs Digital MarketingDocument17 pagesTraditional Vs Digital MarketingVarshaNo ratings yet

- STDM Class Partipation QandADocument6 pagesSTDM Class Partipation QandAZhaira Kim CantosNo ratings yet

- Ceramic IndustriesDocument16 pagesCeramic IndustriesIubianNo ratings yet

- Inb 372 Sla CaseDocument5 pagesInb 372 Sla CaseJannatul Ferdousi Prity 1911654630No ratings yet

- Top Reasons Forex Traders FailDocument16 pagesTop Reasons Forex Traders Failkapoor_mukesh4u100% (1)

- Starting A Business 101Document44 pagesStarting A Business 101Robiul HasanNo ratings yet

- DM 2020 - Pertemuan 8 - Ch6 Relationship Marketing Using Digital PlatformsDocument20 pagesDM 2020 - Pertemuan 8 - Ch6 Relationship Marketing Using Digital PlatformsgaldinojsfoodNo ratings yet

- Marketing Management of Financial MCDocument44 pagesMarketing Management of Financial MCtsrajanNo ratings yet

- Sandy Lai HKU PaperDocument49 pagesSandy Lai HKU PaperAnish S.MenonNo ratings yet

- Chapter 10 Transaction Exposure: Multinational Business Finance, 14e (Eiteman)Document17 pagesChapter 10 Transaction Exposure: Multinational Business Finance, 14e (Eiteman)EnciciNo ratings yet

- CEED Marketing - Biscolata MOOD Digital Marketing Blueprint For 2018Document12 pagesCEED Marketing - Biscolata MOOD Digital Marketing Blueprint For 2018Namron GnobmyNo ratings yet

- Advanced Price Action Analysis - Trading With Smart MoneyDocument12 pagesAdvanced Price Action Analysis - Trading With Smart MoneyVIGNESH RK100% (2)

- Ero"" "Iltjtia: Kerala Cardamom Marketing Company LimitedDocument25 pagesEro"" "Iltjtia: Kerala Cardamom Marketing Company LimitedRoshniNo ratings yet

- Nature and Kind of Partnership BusinessDocument26 pagesNature and Kind of Partnership BusinessMd Anik HasanNo ratings yet

- A) Head and Shoulder PatternDocument3 pagesA) Head and Shoulder PatternDevraj BhandariNo ratings yet

- Crown Plaza Hotel Market Entry StrategyDocument16 pagesCrown Plaza Hotel Market Entry StrategyIhtisham Sohail100% (1)

- Kotler CH04Document55 pagesKotler CH04adam halimNo ratings yet

- Mutual Fund - Project ReportDocument73 pagesMutual Fund - Project ReportAmrit Kar0% (1)

- Key Business CorrespondenceDocument11 pagesKey Business CorrespondenceLe Quỳnh Như NguyễnNo ratings yet

- Factors Influencing Demand For HotelsDocument8 pagesFactors Influencing Demand For HotelsAnusha NursingNo ratings yet

- Need For International TradeDocument3 pagesNeed For International Tradeyasasrii45No ratings yet

- Guide To Marketing and Business DevelopmentDocument86 pagesGuide To Marketing and Business DevelopmentGáborTengerdi50% (2)