Professional Documents

Culture Documents

Sanjay Bakshi: Dear Students

Sanjay Bakshi: Dear Students

Uploaded by

Bharat SahniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sanjay Bakshi: Dear Students

Sanjay Bakshi: Dear Students

Uploaded by

Bharat SahniCopyright:

Available Formats

Sanjay Bakshi

www.sanjaybakshi.net

Management Development Institute Behavioral Finance & Business Valuation (BFBV) V. 8

Dear Students, I will be teaching you BFBV over the next 1 terms. BFBV is an excuse to teach worldly wisdom through multidisciplinary thinking. While the course is being offered by Finance Area of MDI, it draws heavily upon some of the best ideas from economics, psychology, mathematics and probability, engineering, accounting, history, neurology, and evolutionary biology. My aim is to train you to think in a multi-disciplinary manner, not just about nance and investments, but also about life. I hope to accomplish this over our next 30 contact sessions. Your Teachers for this Course While formally I would be your professor for this course, I would like you to think of me as a funnel through which you will learn what I learnt from my own teachers. These include some of the most successful and original thinkers in their elds and include Warren Buffett, Charlie Munger, Benjamin Graham, Walter Schloss, Robert Rubin, Philip Fisher, Robert Cialdini, John Templeton, Martin Whitman, Nassim Taleb, the partners of Tweedy Brown, John Kenneth Galbraith, Seth Klarman, and Benjamin Franklin. Apart from vicarious learnings from these teachers, I also hope to pass on you, important learnings from my own direct experience acquired over the last 17 years as a practitioner of deep value investing. Live cases with real-time learnings will be very much an integral part of BFBV. Reference Material There is no prescribed book for this course. I will be handing out almost all the reading material to you. These would include the letters written by the worlds most successful investors to their clients and shareholders, the annual reports of numerous companies to be studied in this course, and important extracts from what I consider to the best books in my library. This course require you to read a lot. There will be surprise quizzes so its in your interest to read the assigned materials diligently. Session Plan

TERM V

Sessions 1 to 6: Mental Models & Mental Tricks, Sense and Nonsense in Modern Corporate Finance, The Psychology of Human Misjudgment. Session 7 to 20: Investment philosophies of Benjamin Graham, Warren Buffett, Charlie Munger, Philip Fisher, Martin Whitman, and the evolution of my own investment philosophy.

TERM VI

Session 1 to 10: Cases in a variety of corporate actions including M&A, share buybacks, leveraged buyouts, leveraged recapitalizations, spinoffs, valuation of a variety of businesses, bankruptcy investing, investing in uU (unknown and unknowable) situations, sidecar investments, activist investments, valuation of unique assets, special situations, statistical themes, and turnarounds.

Page 1

Evaluation Component Quizzes Group Project Mid Term (2 hours, open book) End Term (3 hours, open book) End Term (2 hours, open book) Class Participation Total Weight Term V 20 marks 15 marks 25 marks 40 marks 100 marks Weight Term VI 20 marks 20 marks 10 marks 50 marks

I look forward to meeting you tomorrow and interacting with you over the next few months. I am also available for guidance outside classroom hours with prior appointment. If you need an appointment, please email me or call me at +919810068324. Yours truly,

Page 2

You might also like

- Book Summary What They Teach You at Harvard Business SchoolDocument2 pagesBook Summary What They Teach You at Harvard Business SchoolShwetabh Jaiswal100% (2)

- Hedge Fund Investing: Understanding Investor Motivation, Manager Profits and Fund Performance, Third EditionFrom EverandHedge Fund Investing: Understanding Investor Motivation, Manager Profits and Fund Performance, Third EditionRating: 5 out of 5 stars5/5 (1)

- Private Equity The Top of The Financial Food ChainDocument46 pagesPrivate Equity The Top of The Financial Food ChainAbhy SinghNo ratings yet

- Wannabe Financial Analyst | Useful Tips and Resources to get you started with financial analysisFrom EverandWannabe Financial Analyst | Useful Tips and Resources to get you started with financial analysisRating: 1 out of 5 stars1/5 (2)

- Common Big 4 Accounting Firm Interview QuestionsDocument7 pagesCommon Big 4 Accounting Firm Interview Questionsxepholion0% (1)

- MGMT E-5805 - Syllabus - 16.08.22Document15 pagesMGMT E-5805 - Syllabus - 16.08.22Shesharam ChouhanNo ratings yet

- Module 1 - Introduction To Business PlanningDocument11 pagesModule 1 - Introduction To Business Planningagnou7No ratings yet

- Why-Most Investors Are Mostly Wrong Most of The TimeDocument3 pagesWhy-Most Investors Are Mostly Wrong Most of The TimeBharat SahniNo ratings yet

- All Multibaggers Started With Small Market CapsDocument138 pagesAll Multibaggers Started With Small Market CapsBharat Sahni0% (2)

- Interviews With 9 Ace PersonalitiesDocument36 pagesInterviews With 9 Ace Personalitiessaikat_nit11No ratings yet

- Tano Santos Value Investing MBA Spring 2023 1stversion Term ADocument11 pagesTano Santos Value Investing MBA Spring 2023 1stversion Term AUddeshya GoelNo ratings yet

- Investment Banking PrepDocument68 pagesInvestment Banking PrepAkbaraly Kevin100% (1)

- Corporate and Investment Banking: Preparing for a Career in Sales, Trading, and Research in Global MarketsFrom EverandCorporate and Investment Banking: Preparing for a Career in Sales, Trading, and Research in Global MarketsNo ratings yet

- Q&A - 300+ Finance Interview Questions Leverage Academy ForumDocument21 pagesQ&A - 300+ Finance Interview Questions Leverage Academy Forumsaw4321No ratings yet

- Honest Conversations: Important Questions Americans Should Ask Their Financial Advisor to Have More Productive ConversationsFrom EverandHonest Conversations: Important Questions Americans Should Ask Their Financial Advisor to Have More Productive ConversationsNo ratings yet

- Project and Flipped ClassesDocument9 pagesProject and Flipped ClassesOmar ArroyoNo ratings yet

- StreetOfWalls - Question Set PDFDocument21 pagesStreetOfWalls - Question Set PDFEric LukasNo ratings yet

- Northeastern University Admission EssayDocument1 pageNortheastern University Admission EssayTejas HendreNo ratings yet

- The Investment Committee Guide to Prudence: Increasing the Odds of Success When Fulfilling Your Fiduciary Responsibilities in the Administration of Pension/Investment Assets.From EverandThe Investment Committee Guide to Prudence: Increasing the Odds of Success When Fulfilling Your Fiduciary Responsibilities in the Administration of Pension/Investment Assets.No ratings yet

- 3326!12!1954 - 72 - Session 1 Understanding The Marketing FunctionDocument15 pages3326!12!1954 - 72 - Session 1 Understanding The Marketing FunctionAbhinav SachdevaNo ratings yet

- Institute of Management Sciences Bahauddin Zakariya University (Multan) Course Outline: Strategic Financial ManagementDocument4 pagesInstitute of Management Sciences Bahauddin Zakariya University (Multan) Course Outline: Strategic Financial ManagementJarhan AzeemNo ratings yet

- Flame Essays FeedbackDocument3 pagesFlame Essays FeedbackJaiNo ratings yet

- Investing AdviceDocument9 pagesInvesting AdviceAltrosas100% (1)

- Competency QuestionsDocument11 pagesCompetency QuestionsTodd CollinsNo ratings yet

- ENT 105 Marketing Fall 2023-Rev 5 081723Document15 pagesENT 105 Marketing Fall 2023-Rev 5 081723Mesay BarekewNo ratings yet

- Ogl 482 Module Career Plan TemplateDocument8 pagesOgl 482 Module Career Plan Templateapi-619377883No ratings yet

- Start-Up Guide for the Technopreneur: Financial Planning, Decision Making, and Negotiating from Incubation to ExitFrom EverandStart-Up Guide for the Technopreneur: Financial Planning, Decision Making, and Negotiating from Incubation to ExitNo ratings yet

- Value Investing - A Value Investor's Journey Through The UnknownDocument422 pagesValue Investing - A Value Investor's Journey Through The UnknownGonzaloNo ratings yet

- Graham & Doddsville - Issue 20 - Winter 2014 - FinalDocument68 pagesGraham & Doddsville - Issue 20 - Winter 2014 - Finalbpd3kNo ratings yet

- Yashish SopDocument6 pagesYashish SopAnam SayyedNo ratings yet

- What Do You Know About ROSHNDocument5 pagesWhat Do You Know About ROSHNSARAHNo ratings yet

- Running & Growing a Business QuickStart Guide: The Simplified Beginner’s Guide to Becoming an Effective Leader, Developing Scalable Systems and Growing Your Business ProfitablyFrom EverandRunning & Growing a Business QuickStart Guide: The Simplified Beginner’s Guide to Becoming an Effective Leader, Developing Scalable Systems and Growing Your Business ProfitablyNo ratings yet

- 006-Module Plan Investor 16-18Document8 pages006-Module Plan Investor 16-18Ajay BhattNo ratings yet

- Unit 4 Test 2023Document6 pagesUnit 4 Test 2023rovshanmirzakhanliNo ratings yet

- Reflective Report: Name: Hamza Iqbal SahiDocument15 pagesReflective Report: Name: Hamza Iqbal SahiSalman ZafarNo ratings yet

- SOP For FinanceDocument2 pagesSOP For Financekhareshweta1428No ratings yet

- Personal StatementDocument6 pagesPersonal StatementomondistepNo ratings yet

- Unit 3 Module Career Plan SDocument8 pagesUnit 3 Module Career Plan Sapi-689129681No ratings yet

- JB Capstone Draft Proposal - May 22 1Document6 pagesJB Capstone Draft Proposal - May 22 1api-642676232No ratings yet

- BPE - Ngoc TienDocument5 pagesBPE - Ngoc Tien12E-33-Le Ho Ngoc TienNo ratings yet

- Fina1310 CF - C1Document63 pagesFina1310 CF - C1admin AdminNo ratings yet

- Finance Interview QDocument8 pagesFinance Interview QckrishnaNo ratings yet

- Personal Wealth ManagementDocument30 pagesPersonal Wealth ManagementSourabh100% (3)

- 20 Must Have Investment Banking SkillsDocument11 pages20 Must Have Investment Banking SkillsMangesh BansodeNo ratings yet

- Global Strategic Management 1 PDFDocument12 pagesGlobal Strategic Management 1 PDFMonaNo ratings yet

- To Understand The Anatomy of An EntrepreneurDocument7 pagesTo Understand The Anatomy of An EntrepreneurSaloni SanghaviNo ratings yet

- GIC Global ScholarshipDocument3 pagesGIC Global ScholarshipChristel YeoNo ratings yet

- Writingsample 3Document2 pagesWritingsample 3api-308902875No ratings yet

- Business Strategy Understand What It Takes To Be Successful In BusinessFrom EverandBusiness Strategy Understand What It Takes To Be Successful In BusinessNo ratings yet

- The Subtle Influence: Conflicts of Interest in Financial PlanningFrom EverandThe Subtle Influence: Conflicts of Interest in Financial PlanningNo ratings yet

- Cns220finalproject PersonalactionplanDocument10 pagesCns220finalproject Personalactionplanapi-328816550No ratings yet

- Invest Your Way to Financial Freedom: A Step-By-Step Guide to Investing and Building Wealth in the Stock MarketFrom EverandInvest Your Way to Financial Freedom: A Step-By-Step Guide to Investing and Building Wealth in the Stock MarketNo ratings yet

- MAN 385 - Opportunity Identification and Analysis - Doggett - 04695Document7 pagesMAN 385 - Opportunity Identification and Analysis - Doggett - 04695ceojiNo ratings yet

- Rohul Set 16 PPDDocument22 pagesRohul Set 16 PPDTaukir AhmedNo ratings yet

- Graham & Doddsville Fall 2014Document39 pagesGraham & Doddsville Fall 2014Wall Street WanderlustNo ratings yet

- Indian School of Business Corporate Control, Mergers and AcquisitionsDocument8 pagesIndian School of Business Corporate Control, Mergers and AcquisitionsAranab RayNo ratings yet

- Making More Money for You! Mutual Fund Investing on a Budget for BeginnersFrom EverandMaking More Money for You! Mutual Fund Investing on a Budget for BeginnersNo ratings yet

- Data Bank For Interview Questions 06apr2011Document18 pagesData Bank For Interview Questions 06apr2011cotogo0% (1)

- Portfolio CheckupDocument84 pagesPortfolio CheckupBharat SahniNo ratings yet

- Markets Move FirstDocument385 pagesMarkets Move FirstBharat Sahni100% (1)

- Haldiram PPT 110113235127 Phpapp01Document17 pagesHaldiram PPT 110113235127 Phpapp01Bharat SahniNo ratings yet

- Overcoming The Fear of The UnknownDocument5 pagesOvercoming The Fear of The UnknownBharat SahniNo ratings yet

- Understanding Dilution: Earnings Per Share DilutionDocument4 pagesUnderstanding Dilution: Earnings Per Share DilutionBharat SahniNo ratings yet

- Sap FicoDocument6 pagesSap FicoBharat SahniNo ratings yet

- The Business Plan and Executive Summary513Document22 pagesThe Business Plan and Executive Summary513Bharat SahniNo ratings yet

- E ShopaidDocument2 pagesE ShopaidBharat SahniNo ratings yet

- The Small Print in ICICI BondsDocument3 pagesThe Small Print in ICICI BondsBharat SahniNo ratings yet

- Count On The Margin of SafetyDocument9 pagesCount On The Margin of SafetyBharat SahniNo ratings yet

- Can The Small Investor WinDocument3 pagesCan The Small Investor WinBharat SahniNo ratings yet

- The Pizza Theory of Business ValuationDocument3 pagesThe Pizza Theory of Business ValuationBharat SahniNo ratings yet

- Confusions About Stock PricesDocument5 pagesConfusions About Stock PricesBharat SahniNo ratings yet

- Financial Status and Academic AchievementDocument20 pagesFinancial Status and Academic AchievementkalbokalapatoNo ratings yet

- Asphalt Material Presentation Group 4Document27 pagesAsphalt Material Presentation Group 4El Barack MaulanaNo ratings yet

- World History 2147, Shayaan.Document15 pagesWorld History 2147, Shayaan.Ifrah DarNo ratings yet

- Fiber Optic Connectors PDFDocument3 pagesFiber Optic Connectors PDFPaBenavidesNo ratings yet

- Operating System Question Bank FinalDocument22 pagesOperating System Question Bank FinalRoushan GiriNo ratings yet

- Tobacco IndustryDocument9 pagesTobacco IndustryjoséNo ratings yet

- Backbone JSDocument4 pagesBackbone JSShantha Moorthy0% (1)

- Configurando Google Sheet y Pushing BoxDocument23 pagesConfigurando Google Sheet y Pushing BoxRuben RaygosaNo ratings yet

- Huawei V1 R3 Upgrade GuideDocument67 pagesHuawei V1 R3 Upgrade GuideMahmoud RiadNo ratings yet

- Us Deloitte For Development BrochureDocument4 pagesUs Deloitte For Development BrochuremichekaNo ratings yet

- The High Cost of College Textbooks: Mem PresentationDocument12 pagesThe High Cost of College Textbooks: Mem Presentationchinmayaa reddyNo ratings yet

- Modern Architecture of India: New Architectural StyleDocument4 pagesModern Architecture of India: New Architectural StyledhruvNo ratings yet

- AAPG Memoir 71.reservoir Characterization-Recent Advances PDFDocument388 pagesAAPG Memoir 71.reservoir Characterization-Recent Advances PDFCarolina Castaño Uribe100% (1)

- Glossary of Pharmaceutical TermsDocument140 pagesGlossary of Pharmaceutical Termsmohammed goudaNo ratings yet

- Swot AnalysisDocument7 pagesSwot AnalysisAlyssa Harriet MartinezNo ratings yet

- Eco Tourism - Jafari Four PlatformsDocument4 pagesEco Tourism - Jafari Four PlatformsErnie Cinco Soria TestonNo ratings yet

- Computer Science IADocument51 pagesComputer Science IAMarshall CampbellNo ratings yet

- Hijra Bank Installation Guide For Kaspersky Security CenterDocument54 pagesHijra Bank Installation Guide For Kaspersky Security Centermohammed JundiNo ratings yet

- Common Effluent Treatment Plants: Technical Eia Guidance ManualDocument183 pagesCommon Effluent Treatment Plants: Technical Eia Guidance ManualGOWTHAM GUPTHANo ratings yet

- Demand ForecastingDocument20 pagesDemand ForecastingShahbaz Ahmed AfsarNo ratings yet

- 3 Ways To View Your Shared Folders in Windows (All Versions) - Digital CitizenDocument7 pages3 Ways To View Your Shared Folders in Windows (All Versions) - Digital CitizenSelvakumar RNo ratings yet

- Presentation 4th Global Tea Forum Dubai (World Tea News)Document10 pagesPresentation 4th Global Tea Forum Dubai (World Tea News)Dan BoltonNo ratings yet

- ALMM For Solar PV ModuleDocument53 pagesALMM For Solar PV Modulemandar kattiNo ratings yet

- Queueing Problems Solutions 2021 SztrikDocument403 pagesQueueing Problems Solutions 2021 Sztrikjasleensaggu9417No ratings yet

- Binary CodingDocument3 pagesBinary CodingSivaranjan GoswamiNo ratings yet

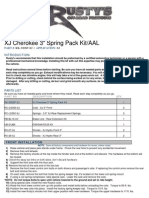

- Rustys 3inch Lift Kit Installation RK-300SP-XJDocument2 pagesRustys 3inch Lift Kit Installation RK-300SP-XJnorthernscribdNo ratings yet

- 02 - Property Tables and ChartsDocument2 pages02 - Property Tables and ChartsjhamilcarNo ratings yet

- Formal & Informal OrganizationDocument2 pagesFormal & Informal OrganizationHasanMahade100% (1)

- Salesforce Industries Communications Cloud DatasheetDocument2 pagesSalesforce Industries Communications Cloud DatasheetCharLy HuynhNo ratings yet

- So Ping Bun Vs CADocument2 pagesSo Ping Bun Vs CAAsh Manguera67% (3)