Professional Documents

Culture Documents

Self Leasing

Self Leasing

Uploaded by

Tekumani Naveen KumarCopyright:

Available Formats

You might also like

- Permanent Audit Files & CurrentDocument3 pagesPermanent Audit Files & CurrentTekumani Naveen KumarNo ratings yet

- Chapter 3 Traditional Bases For PayDocument25 pagesChapter 3 Traditional Bases For PayKhalid Javaid Anwer100% (1)

- Ebook Simple Strategy PDFDocument70 pagesEbook Simple Strategy PDFA100% (1)

- TDS & TCSDocument107 pagesTDS & TCSSANDEEP CHAURENo ratings yet

- ITR GuideDocument8 pagesITR Guiderajesh kumar muhal jaatNo ratings yet

- IT Assignment - MDocument8 pagesIT Assignment - Mrushabh pareetNo ratings yet

- IFRS-Deferred Tax Balance Sheet ApproachDocument8 pagesIFRS-Deferred Tax Balance Sheet ApproachJitendra JawalekarNo ratings yet

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocument14 pagesBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- Section 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09Document32 pagesSection 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09api-19795300No ratings yet

- CBDT Circular How To Calculate Tds On Salary For FY 1213Document64 pagesCBDT Circular How To Calculate Tds On Salary For FY 1213skybluehemaNo ratings yet

- Upload 2Document27 pagesUpload 2NAGESH PORWALNo ratings yet

- Advance TaxDocument9 pagesAdvance TaxManvi JainNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Deferred Tax AnalysisDocument12 pagesDeferred Tax AnalysisBHAT SHARMA AND ASSOCIATESNo ratings yet

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- Practice Questions: Advanced Tax LawsDocument68 pagesPractice Questions: Advanced Tax LawsMehul Roy ChowdhuryNo ratings yet

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiNo ratings yet

- Income Tax All Particulars 2013-14Document72 pagesIncome Tax All Particulars 2013-14kvsgssNo ratings yet

- Week 1 - Module Notes - Lump SumsDocument3 pagesWeek 1 - Module Notes - Lump SumslondekaamazibukoNo ratings yet

- Deduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009Document70 pagesDeduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009rhldxmNo ratings yet

- Tds SALARY FOR A.Y. 2011-12Document59 pagesTds SALARY FOR A.Y. 2011-12Pragnesh ShahNo ratings yet

- Income Tax CircularDocument67 pagesIncome Tax CirculartaxscribdNo ratings yet

- DAY2Document3 pagesDAY2Sameer XalkhoNo ratings yet

- Circular On Serction 192 of The Income Tax Act 1961Document74 pagesCircular On Serction 192 of The Income Tax Act 1961Ayush ChatterjeeNo ratings yet

- Taxguru - In-All About DEFERRED TAX and Its Entry in BooksDocument8 pagesTaxguru - In-All About DEFERRED TAX and Its Entry in Bookskumar45caNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- ALEKYA - Tax Saving SchemsDocument14 pagesALEKYA - Tax Saving SchemsMOHAMMED KHAYYUMNo ratings yet

- DeferredDocument11 pagesDeferredShubham MaheshwariNo ratings yet

- Question and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofDocument6 pagesQuestion and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofAnamika VatsaNo ratings yet

- Atlp Practice Questions Direct Tax & International TaxationDocument82 pagesAtlp Practice Questions Direct Tax & International Taxationharsh bangNo ratings yet

- Employment Income TaxDocument10 pagesEmployment Income TaxHarsh Nahar100% (1)

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- TaxationDocument9 pagesTaxationRohit SoniNo ratings yet

- Taxation-Direct-and-Indirect - AssignmentDocument8 pagesTaxation-Direct-and-Indirect - AssignmentAkshatNo ratings yet

- IT Circular 2011-12Document56 pagesIT Circular 2011-12Narasimha SastryNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Unit 5 TaxDocument15 pagesUnit 5 TaxVijay GiriNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof Submissiongopikiran6No ratings yet

- Taxation Direct and Indirect Yly11mDocument10 pagesTaxation Direct and Indirect Yly11mAyush SoodNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Corporate Tax Planning)Document368 pagesCorporate Tax Planning)Théotime Habineza100% (1)

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- It's Time To Estimate Advance TaxDocument4 pagesIt's Time To Estimate Advance TaxRavi KtNo ratings yet

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDocument35 pagesTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNo ratings yet

- Income Tax Circular No. 17/2014 Dated 10.12.14Document70 pagesIncome Tax Circular No. 17/2014 Dated 10.12.14Elisabeth MuellerNo ratings yet

- TPM - Unit 1 (SB)Document6 pagesTPM - Unit 1 (SB)mondalsomen75No ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Hussainkhawaja 1177 3641 2 LECTURE-10Document51 pagesHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- White Paper: Ministry of Finance, Trade and Economic PlanningDocument16 pagesWhite Paper: Ministry of Finance, Trade and Economic PlanningBonar StepanusNo ratings yet

- Income Tax Group AssignmentDocument8 pagesIncome Tax Group AssignmentFozle Rabby 182-11-5893No ratings yet

- Worksheet 5 Q2 TaxationDocument15 pagesWorksheet 5 Q2 TaxationJennifer FabiaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Audit Programe For Statutory AuditDocument20 pagesAudit Programe For Statutory AuditTekumani Naveen KumarNo ratings yet

- Audit Programe For Statutory AuditDocument20 pagesAudit Programe For Statutory AuditTekumani Naveen KumarNo ratings yet

- Guidance Note On Audit of Banks by IcaiDocument955 pagesGuidance Note On Audit of Banks by IcaiTekumani Naveen Kumar100% (1)

- NRI TaxationDocument9 pagesNRI TaxationTekumani Naveen KumarNo ratings yet

- Final PlannerDocument27 pagesFinal PlannerTekumani Naveen KumarNo ratings yet

- Accounting HeadsDocument6 pagesAccounting HeadsTekumani Naveen Kumar100% (11)

- Revised Audit ReportDocument16 pagesRevised Audit ReportTekumani Naveen KumarNo ratings yet

- Value Added Tax (IPCC) 2013-14: Complete Information Relating VATDocument24 pagesValue Added Tax (IPCC) 2013-14: Complete Information Relating VATTekumani Naveen KumarNo ratings yet

- SH0622Document12 pagesSH0622Anonymous 9eadjPSJNgNo ratings yet

- KLDocument2,094 pagesKLVirender Rawat0% (1)

- Consumer Behaviour in Services: Key FactorDocument15 pagesConsumer Behaviour in Services: Key Factor9986212378No ratings yet

- Power of Promotional ProductsDocument50 pagesPower of Promotional ProductsspiraniNo ratings yet

- Inventory Record AccuracyDocument7 pagesInventory Record AccuracyWawang SukmoroNo ratings yet

- The First Perspective Is "Customer Perspective"Document6 pagesThe First Perspective Is "Customer Perspective"teoysNo ratings yet

- Course Specs - CTRL 606Document7 pagesCourse Specs - CTRL 606musicslave96No ratings yet

- Export CostingDocument6 pagesExport CostingVasant KothariNo ratings yet

- Diversification of RMGDocument8 pagesDiversification of RMGফাহমিদা আহমদNo ratings yet

- Micro Lesson 1Document26 pagesMicro Lesson 1Micaela Cariño50% (4)

- Common SealDocument3 pagesCommon SealPrav SrivastavaNo ratings yet

- Bus Ethics M1Document19 pagesBus Ethics M1Jennery Sortegosa PototNo ratings yet

- Catalog - 1 - Mezzanine-Floors - en - AUDocument20 pagesCatalog - 1 - Mezzanine-Floors - en - AURanjit MarimuthuNo ratings yet

- Supply Chain Performance of Sugar Industry Using Regression AnalysisDocument8 pagesSupply Chain Performance of Sugar Industry Using Regression AnalysisVittal SBNo ratings yet

- Profile On The Production of Woven PP Bags MulugetaDocument29 pagesProfile On The Production of Woven PP Bags MulugetaEndayenewMolla50% (2)

- Economic Impacts of The Padma BridgeDocument2 pagesEconomic Impacts of The Padma Bridgezahirrayhan80% (10)

- Bajaj Finserv Ltd. Investor Presentation - Q3 FY2017-18Document32 pagesBajaj Finserv Ltd. Investor Presentation - Q3 FY2017-18Mayank SharmaNo ratings yet

- Talent Acquisition Group at HCL Technologies - Improving The Quality of Hire Through Focused MetricsDocument22 pagesTalent Acquisition Group at HCL Technologies - Improving The Quality of Hire Through Focused MetricsAbdul sattar33% (3)

- BHARAT ENTERPRISES (Machine Project)Document4 pagesBHARAT ENTERPRISES (Machine Project)Sandip GumtyaNo ratings yet

- 6021-P3-Lembar Kerja Kirim Ke SiswaDocument38 pages6021-P3-Lembar Kerja Kirim Ke SiswaMuhamad ZikiNo ratings yet

- Bounce ScootorDocument9 pagesBounce ScootorSamar Ghorpade0% (1)

- Spare Part Supply Chain: The Case of Airlines: Utdallas - Edu/ MetinDocument16 pagesSpare Part Supply Chain: The Case of Airlines: Utdallas - Edu/ MetinYuvraj KumarNo ratings yet

- NEPAL BUILDCON International ExpoDocument4 pagesNEPAL BUILDCON International ExpoShouruvh RajouriaNo ratings yet

- Group Assignment Question BBL3614Document3 pagesGroup Assignment Question BBL3614Mohd Shafik100% (1)

- Administrative Office ProceduresDocument125 pagesAdministrative Office ProceduresRobert Kikah100% (3)

- A Presentation On Micromax Mobile: Roll No. Name of StudentsDocument74 pagesA Presentation On Micromax Mobile: Roll No. Name of StudentsRamesh Maheshwari0% (1)

- Accounting Professional: Corporate - Insolvency - CharteredDocument2 pagesAccounting Professional: Corporate - Insolvency - Charteredsamwilson0501No ratings yet

- Strategic Staffing Guidebook Table of Contents: Executive SummaryDocument51 pagesStrategic Staffing Guidebook Table of Contents: Executive SummaryAik MusafirNo ratings yet

Self Leasing

Self Leasing

Uploaded by

Tekumani Naveen KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Self Leasing

Self Leasing

Uploaded by

Tekumani Naveen KumarCopyright:

Available Formats

uct # 1 d ro P l ia c n a in F g in T ax S av

Self Leasing

By G Sekar, B.Com, FCA Chennai

SHREE GURU KRIPAS INSTITUTE OF MANAGEMENT

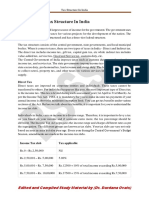

Two executives approached a Chartered Accountant for their Tax and Financial Planning for the Financial Year 20122013 with the following details Details of Income Salary and Taxable Allowances other than HRA HRA Housing Loan Availed Interest on Loan Position of the House Chapter VI Deduction Section 80C Executive 1(Rs.) 50,000 15,000 30,00,000 11% p.a Self-Occupied 1,00,000 Executive 2(Rs.) 1,00,000 30,000 75,00,000 12% p.a Self-Occupied 1,00,000

On the basis of above his tax liability computed as follows Details of Income Salary and Taxable Allowances other than HRA HRA (Being Self Occupied and no rental expenditure incurred Fully Taxable) Income under the Head Salary Income under House Property Loss Maximum Allowable Interest being Self Occupied restricted to Rs.1,50,000 Gross Total Income Less: Chapter VI Deduction Total Income Tax Payable Education Cess 2% & Secondary and Higher Education Cess 1% Total Tax Payable Executive 1(Rs.) 6,00,000 1,80,000 7,80,000 (1,50,000) 6,30,000 (1,00,000) 5,30,000 36,000 1,080 37,080 Executive 2(Rs.) 12,00,000 3,60,000 15,60,000 (1,50,000) 14,10,000 (1,00,000) 13,10,000 2,23,000 6,690 2,29,690

They approached you that their employers agree for any internal adjustments without any additional cash flow from him. In the above circumstances advice them how to reduce the tax liability. Tax Advice: For the above said client we can advice them to go for self-leasing. SelfLeasing: Self-Leasing means an employee who owns a Residential House Property can let-out the property to his employer by entering into a rental agreement with the Employer. The Employer shall pay rent to the employee for that house equivalent to the amount of HRA received.

Page 2

Tax Saving Financial Product # 1

In that case, his house property will be treated as letout property and the house property income will be calculated separately. The employer gives back the same house to the employee as Rent-Free Accommodation in-lieu of HRA. This will be taxable as perquisite Under Rule 3(1) of the Income Tax Rules, 1962. The taxable value of Rent Free Leased accommodation is the actual cost incurred by the employer or 15% of Salary whichever is lower. If the above concept is applied in-lieu of HRA, then the Taxable Total Income shall be worked out as follows Revised Total Income Calculation Details of Income Salary and Taxable Allowances other than HRA Taxable Value of Rent Free Accommodation Least of the Following 15% of Salary Actual Expenditure Therefore, Income under the Head Salary Income from House Property: Rent Received (instead of HRA) Less: Municipal Taxes Paid Net Annual Value Less: Deduction u/s 24 (a) 30% of NAV (b) Interest on Loans Full Interest being letout property Income / (Loss) from House Property Gross Total Income Less: Chapter VI Deduction Total Income Tax Payable on above Education Cess 2% and Secondary and Higher Education Cess 1% Total Tax Payable (Rounded Off) Tax Saving /Additional Cash Flow Executive 1(Rs.) 6,00,000 Executive 2(Rs.) 12,00,000

90,000 1,80,000 90,000 6,90,000 Therefore,

1,80,000 3,60,000 1,80,000 13,80,000

1,80,000 5,000 1,75,000 (52,500) (3,30,000) (2,07,500) 4,82,500 (1,00,000) 3,82,500 18,250 547.50 18,800 37,080 - 18,800 = 18,280

3,60,000 10,000 3,50,000 (1,05,000) (9,00,000) (6,55,000) 7,25,000 (1,00,000) 6,25,000 55,000 1,650 56,650 2,29,690 - 56,650 = 1,73,040

The above benefits can be achieved only in case of employer agree for Self-Leasing instead of HRA. The above scheme will be beneficial to an employee who has taxable HRA as well as Huge commitment of Interest on House Property Loan i.e Housing Loan Interest exceeds Rs.1,50,000. Before advising any client on self-leasing the tax consultant shall workout both the option and has to take decision. Where you can apply? Existing employee in Corporate Sector who are in high tax bracket as well as higher commitment to housing loan interest. In case of designing a Salary Structure of Directors of closely held Private Limited Companies. The above consultancy may be provided to your client by charging a reasonable fee. Dont forget we are Chartered Accountants for the institute and a Charging Accountant to our client and nobody shall think our service as Charitable Accountant.

Gurukripas Classes

Gurukripas CA IPCC FULL TIME CLASSES For May 2013 / Nov 2013 Starts from 24th August, 2012 Registration in progress Visit: www.shrigurukripa.com

Padhukas Books

Shri Guru Padhuka, No. 27, Akbarabad II Street, Kodambakkam,Chennai 24. Mobile: 99400 12301 / 03 / 06 Ph: 0442483 7667 / 2484 7667 Email: padhuka@shrigurukripa.com, Website: www.shrigurukripa.com

Were on the Web! www.shrigurukripa.com

Shree Guru Kripas Institute of Management

Launch of Handbook on Direct Taxes & TDS and TCS Guide

Some Highlights of Direct Taxes Book Amendments made by Finance Bill, 2012 incorporated at appropriate places in respective Chapters. All recent and relevant Circulars, Notifications, Press Releases & Court Decisions updated. Tax Referencer Tables for Individuals, HUF, AOP, BOI, Firms, Companies, Co operative Societies for 10 AYs. Highlights and Summaries of Important Provisions / contents of Direct Tax Laws under Fast Track Referencer. Quick Guide to Allied Laws like Service Tax, Company Law, Accounting Standards Only Book having relevant Case Laws, Circulars and Notifications. Some Highlights of TDS & TCS Book Concise presentation of the law relating to TDS and TCS Ready Referencer for TDS and TCS rates clearly demarcating rates for various Assessees under different situations. Simplified, yet detailed and comprehensive procedures on how to compute: Income under the head Salaries and Income from House Property for determining TDS on Salaries Incorporates all amendments up to date and Circulars and Notifications up to April 2012 including Finance Bill 2012 Formalities and Procedure for eTDS Return and eTCS Return

You might also like

- Permanent Audit Files & CurrentDocument3 pagesPermanent Audit Files & CurrentTekumani Naveen KumarNo ratings yet

- Chapter 3 Traditional Bases For PayDocument25 pagesChapter 3 Traditional Bases For PayKhalid Javaid Anwer100% (1)

- Ebook Simple Strategy PDFDocument70 pagesEbook Simple Strategy PDFA100% (1)

- TDS & TCSDocument107 pagesTDS & TCSSANDEEP CHAURENo ratings yet

- ITR GuideDocument8 pagesITR Guiderajesh kumar muhal jaatNo ratings yet

- IT Assignment - MDocument8 pagesIT Assignment - Mrushabh pareetNo ratings yet

- IFRS-Deferred Tax Balance Sheet ApproachDocument8 pagesIFRS-Deferred Tax Balance Sheet ApproachJitendra JawalekarNo ratings yet

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocument14 pagesBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- Section 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09Document32 pagesSection 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09api-19795300No ratings yet

- CBDT Circular How To Calculate Tds On Salary For FY 1213Document64 pagesCBDT Circular How To Calculate Tds On Salary For FY 1213skybluehemaNo ratings yet

- Upload 2Document27 pagesUpload 2NAGESH PORWALNo ratings yet

- Advance TaxDocument9 pagesAdvance TaxManvi JainNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Deferred Tax AnalysisDocument12 pagesDeferred Tax AnalysisBHAT SHARMA AND ASSOCIATESNo ratings yet

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- Practice Questions: Advanced Tax LawsDocument68 pagesPractice Questions: Advanced Tax LawsMehul Roy ChowdhuryNo ratings yet

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiNo ratings yet

- Income Tax All Particulars 2013-14Document72 pagesIncome Tax All Particulars 2013-14kvsgssNo ratings yet

- Week 1 - Module Notes - Lump SumsDocument3 pagesWeek 1 - Module Notes - Lump SumslondekaamazibukoNo ratings yet

- Deduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009Document70 pagesDeduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009rhldxmNo ratings yet

- Tds SALARY FOR A.Y. 2011-12Document59 pagesTds SALARY FOR A.Y. 2011-12Pragnesh ShahNo ratings yet

- Income Tax CircularDocument67 pagesIncome Tax CirculartaxscribdNo ratings yet

- DAY2Document3 pagesDAY2Sameer XalkhoNo ratings yet

- Circular On Serction 192 of The Income Tax Act 1961Document74 pagesCircular On Serction 192 of The Income Tax Act 1961Ayush ChatterjeeNo ratings yet

- Taxguru - In-All About DEFERRED TAX and Its Entry in BooksDocument8 pagesTaxguru - In-All About DEFERRED TAX and Its Entry in Bookskumar45caNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- ALEKYA - Tax Saving SchemsDocument14 pagesALEKYA - Tax Saving SchemsMOHAMMED KHAYYUMNo ratings yet

- DeferredDocument11 pagesDeferredShubham MaheshwariNo ratings yet

- Question and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofDocument6 pagesQuestion and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofAnamika VatsaNo ratings yet

- Atlp Practice Questions Direct Tax & International TaxationDocument82 pagesAtlp Practice Questions Direct Tax & International Taxationharsh bangNo ratings yet

- Employment Income TaxDocument10 pagesEmployment Income TaxHarsh Nahar100% (1)

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- TaxationDocument9 pagesTaxationRohit SoniNo ratings yet

- Taxation-Direct-and-Indirect - AssignmentDocument8 pagesTaxation-Direct-and-Indirect - AssignmentAkshatNo ratings yet

- IT Circular 2011-12Document56 pagesIT Circular 2011-12Narasimha SastryNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Unit 5 TaxDocument15 pagesUnit 5 TaxVijay GiriNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof Submissiongopikiran6No ratings yet

- Taxation Direct and Indirect Yly11mDocument10 pagesTaxation Direct and Indirect Yly11mAyush SoodNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Corporate Tax Planning)Document368 pagesCorporate Tax Planning)Théotime Habineza100% (1)

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- It's Time To Estimate Advance TaxDocument4 pagesIt's Time To Estimate Advance TaxRavi KtNo ratings yet

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDocument35 pagesTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNo ratings yet

- Income Tax Circular No. 17/2014 Dated 10.12.14Document70 pagesIncome Tax Circular No. 17/2014 Dated 10.12.14Elisabeth MuellerNo ratings yet

- TPM - Unit 1 (SB)Document6 pagesTPM - Unit 1 (SB)mondalsomen75No ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Hussainkhawaja 1177 3641 2 LECTURE-10Document51 pagesHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- White Paper: Ministry of Finance, Trade and Economic PlanningDocument16 pagesWhite Paper: Ministry of Finance, Trade and Economic PlanningBonar StepanusNo ratings yet

- Income Tax Group AssignmentDocument8 pagesIncome Tax Group AssignmentFozle Rabby 182-11-5893No ratings yet

- Worksheet 5 Q2 TaxationDocument15 pagesWorksheet 5 Q2 TaxationJennifer FabiaNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Audit Programe For Statutory AuditDocument20 pagesAudit Programe For Statutory AuditTekumani Naveen KumarNo ratings yet

- Audit Programe For Statutory AuditDocument20 pagesAudit Programe For Statutory AuditTekumani Naveen KumarNo ratings yet

- Guidance Note On Audit of Banks by IcaiDocument955 pagesGuidance Note On Audit of Banks by IcaiTekumani Naveen Kumar100% (1)

- NRI TaxationDocument9 pagesNRI TaxationTekumani Naveen KumarNo ratings yet

- Final PlannerDocument27 pagesFinal PlannerTekumani Naveen KumarNo ratings yet

- Accounting HeadsDocument6 pagesAccounting HeadsTekumani Naveen Kumar100% (11)

- Revised Audit ReportDocument16 pagesRevised Audit ReportTekumani Naveen KumarNo ratings yet

- Value Added Tax (IPCC) 2013-14: Complete Information Relating VATDocument24 pagesValue Added Tax (IPCC) 2013-14: Complete Information Relating VATTekumani Naveen KumarNo ratings yet

- SH0622Document12 pagesSH0622Anonymous 9eadjPSJNgNo ratings yet

- KLDocument2,094 pagesKLVirender Rawat0% (1)

- Consumer Behaviour in Services: Key FactorDocument15 pagesConsumer Behaviour in Services: Key Factor9986212378No ratings yet

- Power of Promotional ProductsDocument50 pagesPower of Promotional ProductsspiraniNo ratings yet

- Inventory Record AccuracyDocument7 pagesInventory Record AccuracyWawang SukmoroNo ratings yet

- The First Perspective Is "Customer Perspective"Document6 pagesThe First Perspective Is "Customer Perspective"teoysNo ratings yet

- Course Specs - CTRL 606Document7 pagesCourse Specs - CTRL 606musicslave96No ratings yet

- Export CostingDocument6 pagesExport CostingVasant KothariNo ratings yet

- Diversification of RMGDocument8 pagesDiversification of RMGফাহমিদা আহমদNo ratings yet

- Micro Lesson 1Document26 pagesMicro Lesson 1Micaela Cariño50% (4)

- Common SealDocument3 pagesCommon SealPrav SrivastavaNo ratings yet

- Bus Ethics M1Document19 pagesBus Ethics M1Jennery Sortegosa PototNo ratings yet

- Catalog - 1 - Mezzanine-Floors - en - AUDocument20 pagesCatalog - 1 - Mezzanine-Floors - en - AURanjit MarimuthuNo ratings yet

- Supply Chain Performance of Sugar Industry Using Regression AnalysisDocument8 pagesSupply Chain Performance of Sugar Industry Using Regression AnalysisVittal SBNo ratings yet

- Profile On The Production of Woven PP Bags MulugetaDocument29 pagesProfile On The Production of Woven PP Bags MulugetaEndayenewMolla50% (2)

- Economic Impacts of The Padma BridgeDocument2 pagesEconomic Impacts of The Padma Bridgezahirrayhan80% (10)

- Bajaj Finserv Ltd. Investor Presentation - Q3 FY2017-18Document32 pagesBajaj Finserv Ltd. Investor Presentation - Q3 FY2017-18Mayank SharmaNo ratings yet

- Talent Acquisition Group at HCL Technologies - Improving The Quality of Hire Through Focused MetricsDocument22 pagesTalent Acquisition Group at HCL Technologies - Improving The Quality of Hire Through Focused MetricsAbdul sattar33% (3)

- BHARAT ENTERPRISES (Machine Project)Document4 pagesBHARAT ENTERPRISES (Machine Project)Sandip GumtyaNo ratings yet

- 6021-P3-Lembar Kerja Kirim Ke SiswaDocument38 pages6021-P3-Lembar Kerja Kirim Ke SiswaMuhamad ZikiNo ratings yet

- Bounce ScootorDocument9 pagesBounce ScootorSamar Ghorpade0% (1)

- Spare Part Supply Chain: The Case of Airlines: Utdallas - Edu/ MetinDocument16 pagesSpare Part Supply Chain: The Case of Airlines: Utdallas - Edu/ MetinYuvraj KumarNo ratings yet

- NEPAL BUILDCON International ExpoDocument4 pagesNEPAL BUILDCON International ExpoShouruvh RajouriaNo ratings yet

- Group Assignment Question BBL3614Document3 pagesGroup Assignment Question BBL3614Mohd Shafik100% (1)

- Administrative Office ProceduresDocument125 pagesAdministrative Office ProceduresRobert Kikah100% (3)

- A Presentation On Micromax Mobile: Roll No. Name of StudentsDocument74 pagesA Presentation On Micromax Mobile: Roll No. Name of StudentsRamesh Maheshwari0% (1)

- Accounting Professional: Corporate - Insolvency - CharteredDocument2 pagesAccounting Professional: Corporate - Insolvency - Charteredsamwilson0501No ratings yet

- Strategic Staffing Guidebook Table of Contents: Executive SummaryDocument51 pagesStrategic Staffing Guidebook Table of Contents: Executive SummaryAik MusafirNo ratings yet