Professional Documents

Culture Documents

Daily Metals and Energy Report September 5 2013

Daily Metals and Energy Report September 5 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

You might also like

- TicketDocument5 pagesTicketponmaga100% (1)

- Egg Layer ProposalDocument3 pagesEgg Layer ProposalCoronwokers Homebase94% (16)

- Kauda Game - A Case StudyDocument4 pagesKauda Game - A Case Studynavin9849No ratings yet

- Coca Cola HistoryDocument12 pagesCoca Cola HistorylaquemecuelgaNo ratings yet

- Daily Metals and Energy Report, August 5 2013Document6 pagesDaily Metals and Energy Report, August 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 23 2013Document6 pagesDaily Metals and Energy Report, August 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 7 2013Document6 pagesDaily Metals and Energy Report, August 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 21 2013Document6 pagesDaily Metals and Energy Report, August 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 13 2013Document6 pagesDaily Metals and Energy Report, August 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 6 2013Document6 pagesDaily Metals and Energy Report, August 6 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 10 2013Document6 pagesDaily Metals and Energy Report, July 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 23 2013Document6 pagesDaily Metals and Energy Report, July 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 9 2013Document6 pagesDaily Metals and Energy Report, July 9 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 29 2013Document6 pagesDaily Metals and Energy Report August 29 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 04 2013Document6 pagesDaily Metals and Energy Report, June 04 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 5 2013Document6 pagesDaily Metals and Energy Report, July 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 5 2013Document6 pagesDaily Metals and Energy Report, June 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 2 2013Document6 pagesDaily Metals and Energy Report September 2 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28 2013Document6 pagesDaily Metals and Energy Report August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 15 2013Document6 pagesDaily Metals and Energy Report, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 30 2013Document6 pagesDaily Metals and Energy Report August 30 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 12 2013Document6 pagesDaily Metals and Energy Report, June 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 18 2013Document6 pagesDaily Metals and Energy Report, June 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 30 2013Document6 pagesDaily Metals and Energy Report, July 30 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 20Document6 pagesDaily Metals and Energy Report, March 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 19 2013Document6 pagesDaily Metals and Energy Report, June 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 17 2013Document6 pagesDaily Metals and Energy Report, June 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 4 2013Document6 pagesDaily Metals and Energy Report, July 4 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 18 2013Document6 pagesDaily Metals and Energy Report, July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 10Document6 pagesDaily Metals and Energy Report, April 10Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 3 2013Document6 pagesDaily Metals and Energy Report, July 3 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 27 2013Document6 pagesDaily Metals and Energy Report August 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 20Document6 pagesDaily Metals and Energy Report, February 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report Jan 04Document6 pagesDaily Metals and Energy Report Jan 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 20 2013Document6 pagesDaily Metals and Energy Report, June 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 8 2013Document6 pagesDaily Metals and Energy Report, August 8 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 9Document6 pagesDaily Metals and Energy Report August 9Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 14Document6 pagesDaily Metals and Energy Report, February 14Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 17 2013Document6 pagesDaily Metals and Energy Report, July 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 26 2013Document6 pagesDaily Metals and Energy Report, June 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 24 2013Document6 pagesDaily Metals and Energy Report, May 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 11 2013Document6 pagesDaily Metals and Energy Report, July 11 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 26 2013Document6 pagesDaily Metals and Energy Report August 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 28 2013Document6 pagesDaily Metals and Energy Report, June 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 14 2013Document6 pagesDaily Metals and Energy Report, June 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 23 2013Document6 pagesDaily Metals and Energy Report, May 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 16Document6 pagesDaily Metals and Energy Report, April 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 14 2013Document6 pagesDaily Metals and Energy Report, August 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 26 2013Document6 pagesDaily Metals and Energy Report, July 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report January 16Document6 pagesDaily Metals and Energy Report January 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 20 2013Document6 pagesDaily Metals and Energy Report, August 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 13Document6 pagesDaily Metals and Energy Report, February 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 10 2013Document6 pagesDaily Metals and Energy Report, June 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 27 2013Document6 pagesDaily Metals and Energy Report, June 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 16 2013Document6 pagesDaily Metals and Energy Report, May 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 2 2013Document6 pagesDaily Metals and Energy Report, July 2 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report 07 March 2013Document6 pagesDaily Metals and Energy Report 07 March 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 22 2013Document6 pagesDaily Metals and Energy Report, May 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 25Document6 pagesDaily Metals and Energy Report, February 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 22Document6 pagesDaily Metals and Energy Report, March 22Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Ctreat Rep InstallDocument16 pagesCtreat Rep Installgchaoul87No ratings yet

- IUMI Tutorial Cargo 180813 DigitalDocument4 pagesIUMI Tutorial Cargo 180813 DigitalZoran DimitrijevicNo ratings yet

- Summary Cement CaseDocument4 pagesSummary Cement CaseChinmay PantNo ratings yet

- Waste Management in The Ivory Coast: An Overview (Presentation)Document12 pagesWaste Management in The Ivory Coast: An Overview (Presentation)Ballack-Hyper's HoldingNo ratings yet

- MSME Finance Gap 2018-19 Update (Public)Document88 pagesMSME Finance Gap 2018-19 Update (Public)Abdo CasaNo ratings yet

- Calico ActsDocument2 pagesCalico Actsalejo30y6-1No ratings yet

- Humanizing GlobalizationDocument3 pagesHumanizing GlobalizationEmad Adel Abu SafiahNo ratings yet

- Rice Global Networks and New HistoriesDocument448 pagesRice Global Networks and New Historiescarabrina100% (1)

- Sourcing Strategies and OptionsDocument6 pagesSourcing Strategies and Optionsvij2053No ratings yet

- Sample Research Paper On A CountryDocument8 pagesSample Research Paper On A Countryc9r5wdf5100% (1)

- 57th Campus Placement Brochure 2023 NewDocument12 pages57th Campus Placement Brochure 2023 NewGarima JainNo ratings yet

- Update 13Document89 pagesUpdate 13suvromallickNo ratings yet

- Turbinas Bulb VoithDocument12 pagesTurbinas Bulb VoithGuilherme RosaNo ratings yet

- GO Ms No-171Document5 pagesGO Ms No-171Arunachalam NagarajanNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument2 pagesNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Introduction To Economic DevelopmentDocument59 pagesIntroduction To Economic DevelopmentKarl Yñigo CuballesNo ratings yet

- Chandler Vargo 2011 MTDocument25 pagesChandler Vargo 2011 MTTariq Waheed QureshiNo ratings yet

- Organization and Management: Learning CompetencyDocument13 pagesOrganization and Management: Learning CompetencyEustass Kidd100% (4)

- Time Value - Future ValueDocument4 pagesTime Value - Future ValueSCRBDusernmNo ratings yet

- Law On Taxation Review.-Chapter 1Document17 pagesLaw On Taxation Review.-Chapter 1GeeanNo ratings yet

- En Position Paper Cultural TourismDocument20 pagesEn Position Paper Cultural TourismSlovenian Webclassroom Topic ResourcesNo ratings yet

- Ancient China WebquestDocument2 pagesAncient China Webquestapi-234908816100% (1)

- Net Smelter ReturnDocument7 pagesNet Smelter ReturnlindaNo ratings yet

- International Wire Transfer Quick Tips and FAQDocument4 pagesInternational Wire Transfer Quick Tips and FAQEmanuelNo ratings yet

- Development Is A Universally Cherished Goal of IndividualsDocument52 pagesDevelopment Is A Universally Cherished Goal of Individualsmicboat3No ratings yet

Daily Metals and Energy Report September 5 2013

Daily Metals and Energy Report September 5 2013

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Metals and Energy Report September 5 2013

Daily Metals and Energy Report September 5 2013

Uploaded by

Angel BrokingCopyright:

Available Formats

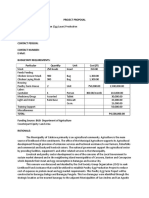

Commodities Daily Report

Thursday| September 5, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Reena Rohit Chief Manager Non-Agri Currencies and Commodities Reena.rohit@angelbroking.com (022) 2921 2000 Extn :6134 Anish Vyas Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn :6104

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn gn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company d does oes not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, dist distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| September 5, 2013

International Commodities

Overview

US Trade Balance was at a deficit of $39.1 billion in month of July. Indian HSBC Services PMI declined to 47.6-mark mark in the last month. European Retail Sales gained 0.1 percent in the month of July. UKs Services PMI rose by 0.3 points to 60.5-mark mark in month of August. Sharp Rupee appreciation led to fall in MCX prices in yesterdays trade trade.

Market Highlights (% change)

Last INR/$ (Spot) Prev day

as on September 4, 2013 w-o-w m-o-m y-o-y

67.065

0.8

2.5

-10.2

-17.1

Asian markets are trading on a mixed note today ahead of the monetary policy meeting from Japan to Euro Zone. Further, downside in markets was seen as a result of favorable economic data from US increased concerns of QE tapering from Federal Reserve in current month. US Trade Balance was at a deficit of $39.1 billion in Jul July as against a deficit of $34.5 billion a month ago. Investor's Business Daily (IBD) / TechnoMetrica Institute of Policy and Politics (TIPP) Economic Optimism increased by 0.9 points to 46-mark mark in September from 45.1 45.1-level in August. Indian HSBC Services PMI declined to 47.6-mark mark in August from 47.9 47.9-level in July.

$/Euro (Spot)

1.3207

0.3

-1.0

-0.4

5.1

Dollar Index NIFTY

82.21

-0.2 0.2

0.9

1.1

3.5

5448.1

2.0

-4.2

-4.2

3.7

SENSEX

18567.6

1.8

-3.2

-3.2

1.5

DJIA

The US Dollar Index (DX) declined around 0.2 percent in the yesterdays trading session on the back of rise in risk appetite in the global market sentiments which led to fall in demand for the low yielding currency. However, sharp downside in the currency was cushioned as a result of favorable economic data from US increased concerns regarding QE tapering from the Federal Reserve in this month. The currency touched an intra-day low of 82.11 and d closed at 82.21 on Wednesday. The Indian Rupee appreciated around 0.8 percent in yesterdays trading session. The currency appreciated on the back of aggressive selling of dollars from the Reserve Bank of India (RBI). Further, appointment of new RBI governor ernor Raghuram Rajan said that central banks primary role will be stable monetary policy which means low and stable inflation rates. It also raised hopes of new measures to be taken by the governor which supported an upside in the currency. Also, easing of norms by RBI for External Commercial Borrowing (ECB) to allow companies to use overseas loans acted as a positive factor. The currency touched an intra-day day high of 66.81 and closed at 67.07 on Wednesday. For the month of September 2013, FII outflows totaled at Rs.324.6 crores th ($47.44 million) as on 4 September 2013. Year to date basis, net capital th inflows stood at Rs.59845.20 crores ($11535.80 million) till 4 September 2013. UKs Services Purchasing Managers' Index (PMI) rose by 0.3 points to 60.5-mark in August as against a rise of 60.2-level level in July.

14930.9

0.7

1.0

-3.5

14.5

S&P

1653.1

0.8

-3.3

-3.3

17.7

Source: Reuters

The Euro gained around 0.3 percent in the yesterdays trading session taking cues from weakness in the DX. Further, favorable economic data from the region along with upbeat global market sentiments supported an upside in the currency. The Euro touched an intra-day day high of 1.3218 and closed at 1.3207 on Wednesday. Spanish Services PMI jumped into expansion in August to 50.450.4 mark from 48.5 level in July. Italian Services PMI rose marginally to 48.8 level in August from 48.7-mark 48.7 in July. Euro Zone Final Services rvices PMI declined to 50.7-mark 50.7 in August from 51 level in July. European Retail Sales gained 0.1 percent in July as against a decline of 0.7 percent in June. European Revised GDP for the quarter ended June remained unchanged at 0.3 percent.

www.angelcommodities.com

Commodities Daily Report

Thursday| September 5, 2013

International Commodities

Bullion Gold

Spot gold prices declined around 1.5 percent in yesterdays trade on the back of decline in SPDR gold holdings at 919.23 tonnes tonnes. However, sharp downside in prices was cushioned as result of upbeat global market sentiments coupled with strength in the DX. The yellow metal touched an intra-day low of $1384.24/oz /oz and closed at $1390.80/oz in yesterdays trading session. In the Indian markets, prices traded on a negative note by 5.3 percent as a result of sharp appreciation in n the Rupee and closed at Rs.32,604/10 gms after touching an intra-day low of Rs.34,4 Rs.34,410/10 gms on Wednesday. Market Highlights - Gold (% change)

Gold Gold (Spot) Unit $/oz Last 1390.8 Prev. day -1.5 as on September 4, 2013 WoW -1.9 MoM 6.7 YoY -17.9

Gold (Spot Mumbai) Gold (LBMA-PM Fix) Comex Gold (Oct13) MCX Gold (Oct13)

Rs/10 gms $/oz

32400.0

-2.3

17.0

17.0

8.7

1390.0

-0.7

-2.1

6.5

-18.1

$/oz

1389.9

-1.6

-2.1

6.0

-17.9

Rs /10 gms

32604.0

-5.3

-2.4

14.2

3.7

Silver

Taking cues from fall in gold prices along with downside in base metals complex, Spot silver prices declined around 3 percent in the yesterdays trade. However, weakness in the DX capped sharp fall in $23.31/oz and prices. The white metal touched an intra-day low of $2 closed at $23.40 in yesterdays trading session. On the domestic front, prices fell around 7.3 .3 percent o on account of sharp appreciation preciation in the Rupee and closed at Rs.5 Rs.53,141/kg after touching a low of Rs.52,800/kg on Wednesday. Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (Dec13) MCX Silver (Sept13) Unit $/oz Rs/1 kg Last 23.4 56300.0 Prev day -3.0 -3.4

Source: Reuters

as on September 4, 2013 WoW -3.7 33.1 MoM 19.0 33.1 YoY -27.5 2.9

$/oz $/ oz

2371.0 23.4

-2.1 -4.2

-4.2 -4.2

20.0 15.8

-26.1 -27.6

Outlook

In the Indian markets, Rupee appreciation preciation is expected to exert downside pressure in gold and silver prices both. In the international markets, gold prices are expected to trade on a negative note on the back of weak global market sentiments. Additionally, decline in SPDR gold holdings will act as a negative factor. Further, strength in the DX will add downside pressure in p prices. Technical Outlook

Unit Spot Gold MCX Gold Oct13 Spot Silver MCX Silver Sept13 $/oz Rs/10 gms $/oz Rs/kg valid for September 5 5, 2013 Support 1384/1376 32400/32200 23.20/22.90 54400/53900 Resistance 1406/1418 32900/33200 23.60/23.90

Rs / kg

53141.0

-7.3

-4.7

27.3

-12.3

Source: Reuters

Technical Chart Spot Gold

Source: Telequote

55400/55900

www.angelcommodities.com

Commodities Daily Report

Thursday| September 5, 2013

International Commodities

Energy Crude Oil

Nymex crude oil prices declined around 1.2 percent in the yesterdays trading session taking cues from estimates of limited military action by US on Syria. Further, favorable economic data from US has increased concerns of QE tapering from Federal Reserve in this month which exerted downside pressure on prices. However, sharp downside in prices was cushioned as result of weakness in the DX along with upbeat global market sentiments sentiments. Crude oil prices touched an intra-day low of $106.77/bbl /bbl and closed at $10 $107.20/oz in yesterdays trading session. On the domestic bourses, MCX crude September contract slipped around 5.1 percent as a result of Rupee appreciation preciation and prices touched an intra-day low of Rs.7,104/bbl /bbl and closed at Rs.7, Rs.7,127/bbl on Wednesday. API Inventories Data As per the American Petroleum Institute (API) report last night, US crude oil inventories declined by 4.2 million barrels to 362.0 million barrels for the week ending on 30th August 2013. Gasoline inventories dropped by 387,000 barrels to 218.72 million barrels and whereas distillate inventories slipped by 109,000 barrels to 129.08 million barrels for the same week. EIA Inventories Forecast The US Energy Department (EIA) is scheduled to release its weekly inventories report today at 8:00pm IST and US crude ude oil inventories is expected to fall by 1.3 million barrels for the week ending on 30th August 2013. Gasoline stocks are expected to drop by 0.3 million barrels whereas distillate inventories are expected to shoot up by 0.6 million barrels for the same period. Outlook From the intra-day day perspective, we expect crude oil prices to trade lower on the back of weak global markets sentiments coupled with strength in the DX. Further, expectations of limited military actions against Syria will exert downside ide pressure on prices prices. However, sharp upside in the prices will be prevented as a result of decline in API crude oil inventories in yesterdays trade and forecast for fall in US crude oil inventories in todays trade. In the Indian markets, ap appreciation in the Rupee will add downside pressure in prices on the MCX. Technical Outlook

Unit NYMEX Crude Oil MCX Crude Sep13 $/bbl Rs/bbl valid for September 5 5, 2013 Support 106.40/105.50 7060/7000 Resistance 108.50/109.75 7200/7280

Source: Telequote Source: Telequote

Market Highlights - Crude Oil (% change)

Crude Oil Brent (Spot) Nymex Crude (Oct 13) ICE Brent Crude (Sep13) MCX Crude (Sep 13) Unit $/bbl $/bbl Last 117.6 107.2 Prev. day 0.1 -1.2

as on September 4, 2013 WoW -0.5 -1.6 MoM 6.1 2.7 YoY 1.9 12.5

$/bbl

114.9

-0.7

-1.5

5.7

0.6

Rs/bbl

7127.0

-5.1

-3.0

8.9

34.1

Source: Reuters

Market Highlights - Natural Gas (% change)

Natural Gas (NG) Nymex NG MCX NG (Sep 13) Unit $/mmbtu Rs/ mmbtu Last 3.674 244.1 Prev. day 0.2 -3.8

as on September 4, 2013 MoM 10.16 19.31 YoY 31.21 56.07

Source: Reuters

WoW 2.74 2.39

Technical Chart NYMEX Crude Oil

Technical Chart NYMEX Natural Gas

www.angelcommodities.com

Commodities Daily Report

Thursday| September 5, 2013

International Commodities

Base Metals

Base metals pack declined in the yesterdays trade taking cues from favorable economic data from US had increased concerns of QE tapering from the Federal Reserve. Further, mixed LME inventories exerted downside pressure on the prices. However, sharp downside in prices was cushioned as a result of weakness in the DX, , favorable economic data from Euro Zone and UK along with upbeat global market sentiments. In the Indian markets, appreciation preciation in the Rupee acted as a negative factor for prices. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (Nov13) LME Aluminum (3 month) MCX Aluminum (Sep13) LME Nickel (3 month) MCX Nickel (Sep13) LME Lead (3 month) MCX Lead (Sep13) LME Zinc (3 month) MCX Zinc (Sep13)

Source: Reuters

as on September 4, 2013 WoW -1.7 MoM -9.1 YoY -6.5

Last 7135.8

Prev. day -1.6

$/tonne

Rs/kg

483.7

-5.1

-0.1

13.0

12.6

$/tonne

1791.0

-1.8

-3.9

-0.7

-7.5

Rs /kg

117.3

-5.3

-2.8

7.7

9.0

Copper

LME Copper declined 1.6 percent yesterday on account of favourable economic data from the US increased concerns of pullback in stimulus measures from the Federal Reserve. Further, rise in LME copper inventories by 0.2 percent which stood at 603,900 tonnes acted as negative factor. However, sharp downside in prices was cushioned on account of upbeat global market sentiments coupled with weakness in the DX DX. The red metal touched an intraday low of $7087 087/tonne before closing at $7135.80/tonne on Wednesday. The near month copper contract on the MCX dropped 5.1 percent on account of appreciation preciation in the Rupee and closed at Rs. Rs.483.70/kg in the last trading session. Outlook In todays session, we expect base metals prices to trade on a negative note on the back of weak global market sentiments along with strength in the DX. Further, expectations of un unfavorable economic data from Euro Zone will exert downside pressure on prices. Additionally, non-manufacturing manufacturing data and other economic data from US in evening session will add downside pressure in prices. In the Indian markets, appreciation preciation in the Rupee will add downside pressure in prices on the MCX. Technical Outlook

Unit MCX Copper Nov13 MCX Zinc Sep13 MCX Lead Sep 13 MCX Aluminum Sep13 MCX Nickel Sep 13 Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for September 5 5, 2013 Support 478/474 122.0/121.0 140.0/139.0 116.0/115.0 902/894 Resistance 487/492 124.50/125.50 142.50/144.0 118.50/119.80 917/925

$/tonne

13670.0

-0.7

-3.9

-1.4

-14.6

Rs /kg

910.2

-4.0

-3.3

7.2

1.5

$/tonne

2136.5

-0.9

-3.5

0.3

7.4

Rs /kg

141.7

-4.5

-3.4

8.8

28.0

$/tonne

1873.0

-1.7

-4.2

0.2

0.0

Rs /kg

123.4

-5.2

-3.5

8.9

18.7

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 4th September 603,900 5,386,625 213,804 992,600 185,350 3rd September 602,850 5,389,175 213,270 997,600 184,725 Actual Change 1,050 -2,550 534 -5,000 625 (%) Change 0.2 0.0 0.3 -0.5 0.3

Source: Reuters

Technical Chart LME Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Thursday| September 5, 2013

International Commodities

Important Events for Today

Indicator Country Time (IST) Actual Forecast Previous Impact

Monetary Policy Statement BOJ Press Conference Halifax HPI m/m French 10-y Bond Auction Spanish 10-y Bond Auction German Factory Orders m/m Asset Purchase Facility Official Bank Rate MPC Rate Statement Minimum Bid Rate ADP Non-Farm Employment Change ECB Press Conference Unemployment Claims Revised Nonfarm Productivity q/q ISM Non-Manufacturing PMI Factory Orders m/m Crude Oil Inventories G20 Meetings

Japan Japan UK Euro Euro Euro UK UK UK Euro US Euro US US US US US All

Tentative Tentative 5 -7

th th

-0.7% 375B 0.5% 0.5% 175K 332K 1.6% 55.2 -3.4% -1.3M -

0.9% 2.32/1.7 4.72/2.3 3.6% 375B 0.5% 0.5% 200K 331K 0.9% 56.0 1.5% 3.0M -

High High Medium Medium Medium Medium High High High High High High High Medium High Medium Medium Medium

Tentative Tentative 3:30pm 4:30pm 4:30pm Tentative 5:15pm 5:45pm 6:00pm 6:00pm 6:00pm 7:30pm 7:30pm 8:30pm Day 1

www.angelcommodities.com

You might also like

- TicketDocument5 pagesTicketponmaga100% (1)

- Egg Layer ProposalDocument3 pagesEgg Layer ProposalCoronwokers Homebase94% (16)

- Kauda Game - A Case StudyDocument4 pagesKauda Game - A Case Studynavin9849No ratings yet

- Coca Cola HistoryDocument12 pagesCoca Cola HistorylaquemecuelgaNo ratings yet

- Daily Metals and Energy Report, August 5 2013Document6 pagesDaily Metals and Energy Report, August 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 23 2013Document6 pagesDaily Metals and Energy Report, August 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 7 2013Document6 pagesDaily Metals and Energy Report, August 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 21 2013Document6 pagesDaily Metals and Energy Report, August 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 13 2013Document6 pagesDaily Metals and Energy Report, August 13 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 6 2013Document6 pagesDaily Metals and Energy Report, August 6 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 10 2013Document6 pagesDaily Metals and Energy Report, July 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 23 2013Document6 pagesDaily Metals and Energy Report, July 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 9 2013Document6 pagesDaily Metals and Energy Report, July 9 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 29 2013Document6 pagesDaily Metals and Energy Report August 29 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 04 2013Document6 pagesDaily Metals and Energy Report, June 04 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 5 2013Document6 pagesDaily Metals and Energy Report, July 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 5 2013Document6 pagesDaily Metals and Energy Report, June 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 2 2013Document6 pagesDaily Metals and Energy Report September 2 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 28 2013Document6 pagesDaily Metals and Energy Report August 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 15 2013Document6 pagesDaily Metals and Energy Report, July 15 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 30 2013Document6 pagesDaily Metals and Energy Report August 30 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 12 2013Document6 pagesDaily Metals and Energy Report, June 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 18 2013Document6 pagesDaily Metals and Energy Report, June 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 30 2013Document6 pagesDaily Metals and Energy Report, July 30 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 20Document6 pagesDaily Metals and Energy Report, March 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 19 2013Document6 pagesDaily Metals and Energy Report, June 19 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 17 2013Document6 pagesDaily Metals and Energy Report, June 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 4 2013Document6 pagesDaily Metals and Energy Report, July 4 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 18 2013Document6 pagesDaily Metals and Energy Report, July 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 10Document6 pagesDaily Metals and Energy Report, April 10Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 3 2013Document6 pagesDaily Metals and Energy Report, July 3 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 27 2013Document6 pagesDaily Metals and Energy Report August 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 20Document6 pagesDaily Metals and Energy Report, February 20Angel BrokingNo ratings yet

- Daily Metals and Energy Report Jan 04Document6 pagesDaily Metals and Energy Report Jan 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 20 2013Document6 pagesDaily Metals and Energy Report, June 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 8 2013Document6 pagesDaily Metals and Energy Report, August 8 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 9Document6 pagesDaily Metals and Energy Report August 9Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 14Document6 pagesDaily Metals and Energy Report, February 14Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 17 2013Document6 pagesDaily Metals and Energy Report, July 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 26 2013Document6 pagesDaily Metals and Energy Report, June 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 24 2013Document6 pagesDaily Metals and Energy Report, May 24 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 11 2013Document6 pagesDaily Metals and Energy Report, July 11 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report August 26 2013Document6 pagesDaily Metals and Energy Report August 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 28 2013Document6 pagesDaily Metals and Energy Report, June 28 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 14 2013Document6 pagesDaily Metals and Energy Report, June 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 23 2013Document6 pagesDaily Metals and Energy Report, May 23 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 16Document6 pagesDaily Metals and Energy Report, April 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 14 2013Document6 pagesDaily Metals and Energy Report, August 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 26 2013Document6 pagesDaily Metals and Energy Report, July 26 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report January 16Document6 pagesDaily Metals and Energy Report January 16Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 20 2013Document6 pagesDaily Metals and Energy Report, August 20 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 13Document6 pagesDaily Metals and Energy Report, February 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 10 2013Document6 pagesDaily Metals and Energy Report, June 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 27 2013Document6 pagesDaily Metals and Energy Report, June 27 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 16 2013Document6 pagesDaily Metals and Energy Report, May 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 2 2013Document6 pagesDaily Metals and Energy Report, July 2 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report 07 March 2013Document6 pagesDaily Metals and Energy Report 07 March 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 22 2013Document6 pagesDaily Metals and Energy Report, May 22 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 25Document6 pagesDaily Metals and Energy Report, February 25Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 22Document6 pagesDaily Metals and Energy Report, March 22Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Ctreat Rep InstallDocument16 pagesCtreat Rep Installgchaoul87No ratings yet

- IUMI Tutorial Cargo 180813 DigitalDocument4 pagesIUMI Tutorial Cargo 180813 DigitalZoran DimitrijevicNo ratings yet

- Summary Cement CaseDocument4 pagesSummary Cement CaseChinmay PantNo ratings yet

- Waste Management in The Ivory Coast: An Overview (Presentation)Document12 pagesWaste Management in The Ivory Coast: An Overview (Presentation)Ballack-Hyper's HoldingNo ratings yet

- MSME Finance Gap 2018-19 Update (Public)Document88 pagesMSME Finance Gap 2018-19 Update (Public)Abdo CasaNo ratings yet

- Calico ActsDocument2 pagesCalico Actsalejo30y6-1No ratings yet

- Humanizing GlobalizationDocument3 pagesHumanizing GlobalizationEmad Adel Abu SafiahNo ratings yet

- Rice Global Networks and New HistoriesDocument448 pagesRice Global Networks and New Historiescarabrina100% (1)

- Sourcing Strategies and OptionsDocument6 pagesSourcing Strategies and Optionsvij2053No ratings yet

- Sample Research Paper On A CountryDocument8 pagesSample Research Paper On A Countryc9r5wdf5100% (1)

- 57th Campus Placement Brochure 2023 NewDocument12 pages57th Campus Placement Brochure 2023 NewGarima JainNo ratings yet

- Update 13Document89 pagesUpdate 13suvromallickNo ratings yet

- Turbinas Bulb VoithDocument12 pagesTurbinas Bulb VoithGuilherme RosaNo ratings yet

- GO Ms No-171Document5 pagesGO Ms No-171Arunachalam NagarajanNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument2 pagesNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- Introduction To Economic DevelopmentDocument59 pagesIntroduction To Economic DevelopmentKarl Yñigo CuballesNo ratings yet

- Chandler Vargo 2011 MTDocument25 pagesChandler Vargo 2011 MTTariq Waheed QureshiNo ratings yet

- Organization and Management: Learning CompetencyDocument13 pagesOrganization and Management: Learning CompetencyEustass Kidd100% (4)

- Time Value - Future ValueDocument4 pagesTime Value - Future ValueSCRBDusernmNo ratings yet

- Law On Taxation Review.-Chapter 1Document17 pagesLaw On Taxation Review.-Chapter 1GeeanNo ratings yet

- En Position Paper Cultural TourismDocument20 pagesEn Position Paper Cultural TourismSlovenian Webclassroom Topic ResourcesNo ratings yet

- Ancient China WebquestDocument2 pagesAncient China Webquestapi-234908816100% (1)

- Net Smelter ReturnDocument7 pagesNet Smelter ReturnlindaNo ratings yet

- International Wire Transfer Quick Tips and FAQDocument4 pagesInternational Wire Transfer Quick Tips and FAQEmanuelNo ratings yet

- Development Is A Universally Cherished Goal of IndividualsDocument52 pagesDevelopment Is A Universally Cherished Goal of Individualsmicboat3No ratings yet