Professional Documents

Culture Documents

IndiaEarningsGuide 1-8-13 PL

IndiaEarningsGuide 1-8-13 PL

Uploaded by

Jenneey D RajaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IndiaEarningsGuide 1-8-13 PL

IndiaEarningsGuide 1-8-13 PL

Uploaded by

Jenneey D RajaniCopyright:

Available Formats

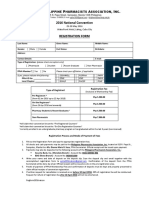

India Earnings Guide |

Sector

Automobiles

Automobiles

Automobiles

Automobiles

Automobiles

Automobiles

Auto Ancillary

Auto Ancillary

Auto Ancillary

Auto Ancillary

Auto Ancillary

Auto Ancillary

Agri Products & Chemicals

Agri Products & Chemicals

Agri Products & Chemicals

Agri Products & Chemicals

Agri Products & Chemicals

Agri Products & Chemicals

Agri Products & Chemicals

Agri Products & Chemicals

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Banks

Bloomberg Company

Code

AL IN

BJAUT IN

HMCL IN

MM IN

MSIL IN

TTMT IN

AMRJ IN

APTY IN

BHFC IN

CEAT IN

EXID IN

MSS IN

CHMB IN

CRIN IN

DFPC IN

DAGRI IN

GSFC IN

RALI IN

TTCH IN

UNTP IN

AXSB IN

BOB IN

BOI IN

FB IN

HDFCB IN

ICICIBC IN

IIB IN

VYSB IN

JKBK IN

KMB IN

PNB IN

SIB IN

SBIN IN

UNBK IN

YES IN

Ashok Leyland

Bajaj Auto

Hero Motocorp

Mahindra & Mahindra

Maruti Suzuki

Tata Motors

Amara Raja Batteries

Apollo Tyres

Bharat Forge

CEAT

Exide Industries

Motherson Sumi Systems

Chambal Fertilizers & Chemicals

Coromandel International

Deepak Fertilisers & Petrochemicals Corporation

Dhanuka Agritech

Gujarat State Fertilisers & Chemicals

Rallis India

Tata Chemicals

United Phosphorus

Axis Bank

Bank of Baroda

Bank of India

Federal Bank

HDFC Bank

ICICI Bank

IndusInd Bank

ING Vysya Bank

Jammu & Kashmir Bank

Kotak Mahindra Bank

Punjab National Bank

South Indian Bank

State Bank of India

Union Bank of India

YES Bank

Rating

Reduce

Reduce

Reduce

Accumulate

BUY

BUY

Reduce

Under Review

Accumulate

Accumulate

Accumulate

Accumulate

BUY

Accumulate

Accumulate

BUY

Accumulate

Accumulate

Accumulate

BUY

BUY

Accumulate

Accumulate

BUY

Accumulate

BUY

BUY

Accumulate

BUY

Reduce

BUY

BUY

Accumulate

BUY

BUY

Page 1

Price SharesO/s

(Rs)

(m)

14

1,935

1,819

911

1,326

291

240

67

204

127

123

206

35

169

85

135

55

138

258

127

1,035

562

185

350

610

909

387

512

1,122

652

570

23

1,708

133

324

2,661

289

200

655

302

3,335

171

507

246

34

850

587

416

283

88

50

399

194

255

443

481

423

597

171

2,379

1,158

523

185

48

767

353

134

684

597

359

FY12

128,420

198,041

235,790

318,472

355,871

1,659,382

23,711

121,531

62,791

44,721

51,111

149,076

75,382

97,900

23,428

5,292

53,018

12,781

137,998

76,936

80,177

103,170

83,134

19,534

128,846

107,342

17,042

12,084

18,384

34,341

134,144

10,217

578,778

69,089

16,156

Revenues(Rsm)

FY13E

FY14E

124,812

202,880

237,681

404,412

435,879

1,888,176

29,811

127,945

57,022

48,815

60,767

256,170

82,020

89,249

26,101

5,869

61,967

14,582

148,061

91,866

96,663

113,153

90,240

19,747

158,111

138,664

22,329

15,386

23,160

41,689

148,565

12,808

611,602

75,428

22,188

128,203

221,179

256,878

437,195

458,266

2,193,688

34,380

140,371

63,529

52,390

69,684

294,514

75,020

100,523

28,063

6,979

58,031

16,396

153,446

103,357

116,321

128,958

103,504

22,102

191,277

162,393

29,637

19,202

25,551

50,244

156,920

14,280

631,164

85,919

27,466

FY15E

153,320

248,475

288,212

493,407

537,521

2,521,868

39,020

153,142

73,881

56,621

79,664

335,323

80,155

110,009

30,141

8,100

61,509

18,447

163,305

115,324

138,998

147,537

116,838

25,976

227,185

183,742

36,088

22,439

28,959

61,208

175,202

16,720

739,517

98,430

33,037

08 01 2013

India Earnings Guide |

Company

FY12

Ashok Leyland

Bajaj Auto

Hero Motocorp

Mahindra & Mahindra

Maruti Suzuki

Tata Motors

Amara Raja Batteries

Apollo Tyres

Bharat Forge

CEAT

Exide Industries

Motherson Sumi Systems

Chambal Fertilizers & Chemicals

Coromandel International

Deepak Fertilisers & Petrochemicals Corporation

Dhanuka Agritech

Gujarat State Fertilisers & Chemicals

Rallis India

Tata Chemicals

United Phosphorus

Axis Bank

Bank of Baroda

Bank of India

Federal Bank

HDFC Bank

ICICI Bank

IndusInd Bank

ING Vysya Bank

Jammu & Kashmir Bank

Kotak Mahindra Bank

Punjab National Bank

South Indian Bank

State Bank of India

Union Bank of India

YES Bank

5,945

31,375

23,783

27,706

16,352

128,668

2,152

4,392

4,205

106

4,613

3,915

2,996

6,229

2,350

571

7,664

1,156

9,144

6,735

42,422

50,070

26,775

7,768

51,671

64,653

8,026

4,563

8,032

17,211

48,846

4,017

152,734

17,871

9,784

PAT(Rsm)

FY13E

FY14E

1,442

29,116

21,101

32,622

23,921

105,517

2,943

5,956

2,319

1,202

5,228

6,074

2,266

3,469

1,519

644

5,187

1,157

7,735

8,469

51,794

44,807

27,493

8,382

64,749

83,255

10,612

6,131

10,551

19,995

47,477

5,023

177,008

21,579

13,012

395

34,750

21,801

35,766

27,637

119,220

3,200

6,537

3,652

1,434

6,651

8,388

3,114

3,904

1,921

758

5,526

1,443

8,404

9,451

59,250

48,736

29,595

8,061

80,740

92,736

13,733

7,648

10,101

24,043

46,453

4,758

152,792

24,598

14,456

FY15E

FY12

3,341

39,324

28,232

41,752

34,875

139,562

3,675

7,351

4,988

1,893

7,852

10,823

3,599

5,161

2,257

874

6,250

1,787

9,457

10,742

70,944

55,586

35,682

9,569

98,391

105,214

16,502

9,562

11,336

29,363

53,688

5,798

194,859

28,030

16,928

12,862

39,951

36,047

37,645

25,130

236,791

3,578

11,660

10,039

2,556

6,880

10,745

8,216

9,971

4,240

794

11,291

2,086

22,974

14,054

74,309

85,806

66,939

15,065

93,906

103,865

13,730

7,679

13,703

26,345

106,143

6,515

401,574

52,538

15,417

Page 2

EBITDA(Rsm)

FY13E

FY14E

8,765

39,260

32,846

47,093

42,297

265,890

4,712

14,566

7,902

4,244

7,896

19,441

6,842

6,591

3,221

865

7,813

2,131

21,180

16,539

93,031

89,992

74,585

14,596

114,276

131,992

18,395

9,927

18,108

31,651

109,074

8,486

403,000

55,827

21,422

8,036

45,990

37,368

51,965

50,857

323,030

5,514

15,529

9,813

4,744

10,801

26,332

8,009

7,865

3,876

1,054

8,474

2,488

23,109

19,121

110,743

101,339

82,767

15,680

141,754

152,977

24,781

13,231

18,404

39,796

111,546

9,219

366,806

60,863

24,929

FY15E

FY12

11,630

52,425

42,864

60,745

62,425

378,707

6,363

17,059

11,945

5,350

12,694

32,698

8,683

9,489

4,379

1,239

9,498

2,912

25,003

21,681

128,422

116,449

88,712

18,516

172,487

173,703

28,735

16,375

20,202

47,340

123,134

10,644

440,932

69,006

28,984

2.2

108.4

119.1

42.3

56.6

40.5

12.6

8.7

17.1

3.1

5.4

6.7

7.2

22.0

26.6

11.4

19.2

5.9

35.9

14.6

102.7

121.4

46.6

45.4

22.0

56.0

17.2

30.4

165.6

23.2

144.0

3.5

227.6

32.5

27.7

EPS(Rs)

FY13E

FY14E

FY15E

0.5

100.6

105.7

49.8

79.2

31.6

17.2

11.8

9.4

35.1

6.2

10.3

5.4

12.3

17.2

12.9

13.0

6.0

30.4

19.1

110.7

106.0

46.1

49.0

27.2

71.9

20.3

39.6

217.6

26.8

134.3

3.8

258.8

36.2

36.3

1.3

135.9

141.4

63.8

115.4

41.8

21.5

14.5

20.3

55.3

9.2

18.4

8.6

18.2

25.6

17.5

15.7

9.2

37.1

24.3

147.6

131.6

59.8

55.9

41.4

90.8

31.6

51.7

233.8

38.3

151.9

4.3

284.9

47.0

47.2

0.1

120.1

109.2

54.6

91.5

35.7

18.7

12.9

14.8

41.9

7.8

14.3

7.5

13.8

21.8

15.2

13.9

7.4

33.0

21.4

123.3

115.3

49.6

47.1

33.9

80.1

26.3

41.4

208.3

31.4

131.4

3.6

223.4

41.2

40.3

08 01 2013

India Earnings Guide |

Company

FY12

Ashok Leyland

Bajaj Auto

Hero Motocorp

Mahindra & Mahindra

Maruti Suzuki

Tata Motors

Amara Raja Batteries

Apollo Tyres

Bharat Forge

CEAT

Exide Industries

Motherson Sumi Systems

Chambal Fertilizers & Chemicals

Coromandel International

Deepak Fertilisers & Petrochemicals Corporation

Dhanuka Agritech

Gujarat State Fertilisers & Chemicals

Rallis India

Tata Chemicals

United Phosphorus

Axis Bank

Bank of Baroda

Bank of India

Federal Bank

HDFC Bank

ICICI Bank

IndusInd Bank

ING Vysya Bank

Jammu & Kashmir Bank

Kotak Mahindra Bank

Punjab National Bank

South Indian Bank

State Bank of India

Union Bank of India

YES Bank

14.6

57.3

65.6

24.6

11.3

49.2

29.3

16.7

20.1

1.6

15.9

22.5

18.3

28.6

20.5

29.7

24.2

21.9

15.4

17.1

20.3

21.7

15.0

14.4

18.7

11.2

19.3

14.3

21.2

14.4

21.1

21.6

16.1

14.9

23.1

RoE(%)

FY13E

FY14E

3.3

41.8

45.4

24.3

14.2

28.2

31.3

19.1

10.0

17.1

16.1

29.2

12.8

15.1

12.0

27.0

13.9

19.7

12.1

19.2

18.5

15.7

12.9

13.9

19.6

13.1

17.8

14.6

23.6

14.5

16.5

20.5

15.3

15.0

24.8

0.9

39.9

39.1

22.4

13.8

25.6

26.8

17.7

14.1

17.7

18.1

32.0

15.9

17.1

13.9

26.0

13.2

21.7

12.6

18.8

16.7

14.9

12.4

12.1

20.3

13.3

17.2

13.3

19.3

14.6

14.1

15.6

11.7

14.8

22.6

FY15E

FY12

7.7

37.2

41.9

22.3

15.2

24.9

24.7

17.2

16.4

19.8

18.5

31.9

16.4

20.6

14.7

24.6

13.4

23.2

13.0

18.2

17.4

15.1

13.6

13.0

20.8

13.8

17.9

13.0

18.8

15.1

14.6

16.8

13.6

15.1

22.2

11.1

55.4

48.4

19.9

10.9

21.8

26.4

11.9

12.5

7.8

16.0

8.7

7.6

15.9

14.3

24.0

21.1

18.5

10.6

13.5

1.6

1.2

0.7

1.4

1.7

1.5

1.6

1.1

1.5

2.3

1.2

1.1

0.9

0.7

1.5

Page 3

RoCE(%)

FY13E

FY14E

5.0

41.3

39.8

20.0

13.7

14.4

28.7

13.6

6.8

12.7

16.2

10.7

4.8

9.3

9.3

23.2

11.3

17.8

8.7

12.8

1.7

0.9

0.7

1.3

1.8

1.6

1.6

1.2

1.6

2.1

1.0

1.1

0.9

0.8

1.5

3.6

39.6

38.2

19.4

13.4

13.9

25.0

13.2

10.0

13.5

18.2

14.2

5.9

10.8

10.1

23.2

10.4

20.7

8.6

12.8

1.6

0.9

0.6

1.1

1.9

1.6

1.7

1.3

1.3

2.1

0.9

0.9

0.7

0.7

1.4

FY15E

FY12

6.8

37.0

42.0

19.8

14.7

14.5

23.3

14.0

12.0

14.9

18.6

16.0

7.1

13.0

10.7

22.4

11.4

22.2

9.2

13.1

1.7

0.9

0.7

1.1

1.9

1.6

1.7

1.4

1.3

2.2

1.0

0.9

0.7

0.7

1.4

6.1

17.8

15.3

21.5

23.4

7.2

19.0

7.7

11.9

41.1

22.7

30.8

4.9

7.6

3.2

11.9

2.8

23.2

7.2

8.7

10.1

4.6

4.0

7.7

27.7

16.2

22.6

16.8

6.8

28.1

4.0

6.4

7.5

4.1

11.7

PER(x)

FY13E

FY14E

25.0

19.2

17.2

18.3

16.7

9.2

13.9

5.7

21.6

3.6

20.0

19.9

6.4

13.7

4.9

10.5

4.2

23.2

8.5

6.7

9.3

5.3

4.0

7.1

22.4

12.6

19.1

12.9

5.2

24.4

4.2

6.0

6.6

3.7

8.9

91.2

16.1

16.7

16.7

14.5

8.1

12.8

5.2

13.7

3.0

15.7

14.4

4.7

12.2

3.9

8.9

3.9

18.6

7.8

6.0

8.4

4.9

3.7

7.4

18.0

11.4

14.8

12.4

5.4

20.8

4.3

6.3

7.6

3.2

8.0

FY15E

10.8

14.2

12.9

14.3

11.5

6.9

11.1

4.6

10.1

2.3

13.3

11.2

4.1

9.2

3.3

7.8

3.5

15.0

7.0

5.2

7.0

4.3

3.1

6.3

14.7

10.0

12.3

9.9

4.8

17.0

3.8

5.2

6.0

2.8

6.9

08 01 2013

India Earnings Guide |

Company

FY12

Ashok Leyland

Bajaj Auto

Hero Motocorp

Mahindra & Mahindra

Maruti Suzuki

Tata Motors

Amara Raja Batteries

Apollo Tyres

Bharat Forge

CEAT

Exide Industries

Motherson Sumi Systems

Chambal Fertilizers & Chemicals

Coromandel International

Deepak Fertilisers & Petrochemicals Corporation

Dhanuka Agritech

Gujarat State Fertilisers & Chemicals

Rallis India

Tata Chemicals

United Phosphorus

Axis Bank

Bank of Baroda

Bank of India

Federal Bank

HDFC Bank

ICICI Bank

IndusInd Bank

ING Vysya Bank

Jammu & Kashmir Bank

Kotak Mahindra Bank

Punjab National Bank

South Indian Bank

State Bank of India

Union Bank of India

YES Bank

5.2

13.6

10.1

16.4

15.4

5.3

11.0

5.2

6.8

6.5

15.1

15.1

5.4

6.7

3.3

8.9

1.7

13.5

4.7

5.8

EV/EBITDA(x)

FY13E

FY14E

8.9

14.1

11.0

13.0

9.6

4.8

8.0

4.0

8.6

3.8

13.2

8.4

8.9

10.9

5.2

8.1

4.5

12.7

5.5

4.8

10.3

12.0

9.3

11.6

7.8

4.0

7.4

3.5

6.4

3.3

9.5

6.1

6.1

8.8

4.2

6.7

3.0

10.8

4.8

4.2

FY15E

7.0

10.4

8.1

9.7

6.2

3.4

6.2

2.9

4.9

2.7

7.8

4.7

5.3

7.0

3.6

5.7

2.4

9.2

4.3

3.5

Page 4

P/B(x)

FY14E

P/S(x)

FY14E

0.8

7.1

7.3

4.1

2.2

2.3

3.9

1.0

2.1

0.6

3.1

5.3

0.8

2.2

0.6

2.6

0.6

4.3

1.0

1.2

1.5

0.8

0.5

0.9

4.0

1.6

2.7

1.8

1.1

3.3

0.6

1.1

0.9

0.5

2.0

0.2

2.3

1.3

1.2

0.7

0.4

1.0

0.2

0.7

0.1

1.3

0.4

0.2

0.4

0.2

0.8

0.4

1.5

0.4

0.5

3.6

1.6

0.9

2.3

6.4

5.7

5.6

4.2

1.9

8.2

1.2

0.2

1.6

0.8

3.5

08 01 2013

India Earnings Guide |

Sector

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Capital Goods

Cement

Cement

Cement

Cement

Construction

Construction

Construction

Construction

Construction

Construction

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Consumer Staples

Bloomberg Company

Code

ABB IN

BHE IN

BHEL IN

CRG IN

KKC IN

KPP IN

KECI IN

KSB IN

PWGR IN

SIEM IN

TMX IN

VOLT IN

ACC IN

ACEM IN

SRCM IN

UTCEM IN

ENGR IN

GMRI IN

JPA IN

LT IN

NJCC IN

PUNJ IN

APNT IN

BRIT IN

CLGT IN

FRL In

SKB IN

HUVR IN

ITC IN

JUBI IN

MRCO IN

PIDI IN

TTAN IN

ABB

Bharat Electronics

BHEL

Crompton Greaves

Cummins India

Kalpataru Power Transmission

KEC International

KSB Pumps

Power Grid Corporation

Siemens

Thermax

Voltas

ACC

Ambuja Cement

Shree Cement

Ultratech Cement

Engineers India

GMR Infrastructure

Jaiprakash Associates

Larsen & Toubro

NCC

Punj Lloyd

Asian Paints

Britannia Industries

Colgate Palmolive

Future Retail

GlaxoSmithKline Consumer Healthcare

Hindustan Unilever

ITC

Jubilant FoodWorks

Marico

Pidilite Industries

Titan Industries

Rating

SELL

BUY

Reduce

Accumulate

Accumulate

Accumulate

Accumulate

Buy

BUY

Reduce

Accumulate

Accumulate

Reduce

Sell

BUY

Reduce

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Reduce

BUY

Reduce

BUY

Reduce

Reduce

BUY

Reduce

Accumulate

Accumulate

Accumulate

Page 5

Price SharesO/s

(Rs)

(m)

500

1,103

158

84

428

61

28

208

101

512

582

78

1,174

168

4,355

1,837

137

13

36

847

23

26

508

699

1,376

82

4,672

613

342

1,126

210

268

263

212

80

2,448

642

277

154

257

35

5,084

341

119

331

188

1,382

35

274

337

3,892

2,219

925

257

332

959

119

136

232

42

2,163

7,972

65

645

513

888

FY12

74,518

56,500

479,789

112,486

41,172

30,327

58,147

7,495

100,353

129,199

60,912

51,857

100,021

85,043

58,981

181,603

36,988

83,201

127,429

531,705

52,485

103,129

96,322

49,742

26,932

41,015

27,800

221,164

251,475

10,175

39,797

28,164

88,384

Revenues(Rsm)

FY13E

FY14E

76,105

61,038

484,123

120,944

45,894

33,354

69,795

7,224

127,579

116,282

54,917

55,310

111,306

96,749

56,494

200,181

25,059

98,719

132,087

608,738

56,594

114,082

109,707

56,155

31,738

4,346

32,024

258,102

299,013

14,076

45,962

33,317

101,127

88,086

66,605

477,230

132,782

50,877

39,224

80,971

7,646

156,931

122,096

56,202

53,489

114,133

101,899

64,863

216,033

24,057

131,618

145,856

689,490

62,595

133,533

126,511

65,006

36,325

95,230

36,826

284,976

351,125

19,122

50,687

39,762

118,762

FY15E

103,882

73,265

460,527

147,973

57,719

45,108

89,750

8,399

180,559

135,970

62,658

59,452

123,796

112,074

75,428

245,341

25,981

154,525

156,751

794,394

68,854

152,227

148,510

75,849

42,442

107,065

42,805

329,563

402,568

25,713

58,920

47,364

142,584

08 01 2013

India Earnings Guide |

Company

FY12

ABB

Bharat Electronics

BHEL

Crompton Greaves

Cummins India

Kalpataru Power Transmission

KEC International

KSB Pumps

Power Grid Corporation

Siemens

Thermax

Voltas

ACC

Ambuja Cement

Shree Cement

Ultratech Cement

Engineers India

GMR Infrastructure

Jaiprakash Associates

Larsen & Toubro

NCC

Punj Lloyd

Asian Paints

Britannia Industries

Colgate Palmolive

Future Retail

GlaxoSmithKline Consumer Healthcare

Hindustan Unilever

ITC

Jubilant FoodWorks

Marico

Pidilite Industries

Titan Industries

1,847

8,299

70,592

3,616

5,398

1,649

1,863

430

32,549

5,211

4,035

1,620

10,209

11,780

6,308

23,066

6,365

(7,336)

10,263

44,196

360

(752)

9,887

2,020

4,465

603

3,552

25,725

61,624

1,098

3,171

3,472

6,048

PAT(Rsm)

FY13E

FY14E

1,409

8,882

66,126

2,686

6,846

1,421

654

580

42,343

3,682

3,201

1,327

13,305

15,053

10,170

26,554

6,181

(5,697)

5,013

45,499

503

(1,141)

11,139

2,339

4,968

95

4,367

33,144

74,184

1,351

3,959

4,548

7,252

2,960

9,309

61,094

4,212

7,012

1,986

1,674

689

47,892

4,802

3,319

2,287

11,502

15,000

9,528

28,701

5,518

(2,627)

4,250

47,551

747

633

12,476

2,950

5,335

626

5,281

34,504

87,997

1,654

5,117

5,511

8,233

FY15E

FY12

4,169

10,146

56,976

6,555

8,181

2,326

2,372

804

52,844

7,324

4,232

2,928

14,604

17,330

11,466

32,433

5,241

1,117

5,806

55,384

1,071

1,248

15,302

3,846

6,051

1,527

6,161

40,445

107,618

2,234

6,289

6,811

10,205

3,371

5,007

99,072

8,036

6,972

3,292

4,713

712

83,824

8,913

5,919

3,365

16,861

19,271

16,239

39,988

7,032

16,645

33,294

62,826

3,974

6,532

15,088

2,944

5,786

4,190

5,195

32,913

88,486

1,905

4,844

4,950

8,330

Page 6

EBITDA(Rsm)

FY13E

FY14E

3,416

6,361

94,009

3,832

8,349

3,265

3,814

911

109,999

6,977

4,902

1,497

19,690

24,495

15,498

45,206

6,138

23,952

31,755

64,200

4,055

8,410

17,319

3,716

6,668

349

5,883

40,038

106,275

2,444

6,258

6,136

10,106

4,845

7,441

87,760

8,039

8,903

4,079

5,305

1,064

136,832

8,913

5,390

2,841

17,678

23,501

17,690

47,550

5,647

32,137

34,266

73,520

4,881

9,844

20,314

4,770

7,305

7,386

7,072

45,417

127,975

3,156

7,846

7,498

12,242

FY15E

FY12

6,752

8,481

80,595

11,166

10,389

4,691

6,662

1,232

161,012

12,917

6,604

3,673

21,821

26,826

20,398

55,350

5,821

35,892

36,280

88,497

5,357

11,392

23,752

5,976

8,460

8,558

8,388

54,461

151,204

4,177

9,262

9,034

15,509

8.7

103.7

28.8

5.6

19.5

10.7

7.2

12.3

7.0

15.3

33.9

4.9

54.3

7.7

181.1

84.2

18.9

(1.9)

4.8

47.8

1.4

(2.3)

10.3

16.9

32.8

2.8

84.5

11.9

7.9

16.9

5.2

6.8

6.8

EPS(Rs)

FY13E

FY14E

FY15E

6.6

111.0

27.0

4.2

24.7

9.3

2.5

16.7

9.1

10.8

26.9

4.0

70.8

10.9

291.9

96.9

18.3

(1.5)

2.3

49.2

2.0

(3.4)

11.6

19.6

36.5

(0.2)

103.8

15.3

9.4

20.8

6.1

8.9

8.2

19.7

126.8

23.3

10.2

29.5

15.2

9.2

23.1

10.4

21.5

35.5

8.9

77.7

12.5

329.1

118.3

15.6

0.3

2.6

59.9

4.2

3.8

16.0

32.2

44.5

6.6

146.5

18.7

13.4

34.3

9.8

13.3

11.5

14.0

116.4

25.0

6.6

25.3

12.9

6.5

19.8

9.4

14.1

27.9

6.9

61.2

10.9

273.5

104.7

16.4

(0.7)

1.9

51.4

2.9

1.9

13.0

24.7

39.2

2.7

125.6

16.0

11.0

25.4

7.9

10.8

9.3

08 01 2013

India Earnings Guide |

FY12

RoE(%)

FY13E

FY14E

FY15E

FY12

RoCE(%)

FY13E

FY14E

FY15E

FY12

PER(x)

FY13E

FY14E

7.6

15.6

31.0

10.5

27.7

9.9

18.1

11.4

13.0

13.4

27.4

11.4

15.4

15.3

26.7

19.6

38.7

(9.6)

9.5

18.8

1.5

(2.4)

40.1

41.6

109.0

2.2

33.8

83.4

35.5

44.7

30.8

27.6

48.9

5.7

14.9

23.7

7.3

30.5

7.9

5.7

14.2

15.1

8.9

18.3

8.5

18.5

17.8

31.6

18.8

30.3

(6.8)

3.9

16.7

2.1

(3.8)

36.3

40.2

107.4

(0.1)

34.9

107.1

36.1

36.8

25.3

29.2

42.6

13.4

13.2

15.0

15.1

28.9

10.9

15.8

15.8

13.6

14.3

18.1

15.3

17.3

16.6

21.5

16.8

19.5

1.6

4.2

16.3

4.1

3.9

35.1

43.7

103.8

4.4

34.8

102.9

38.6

32.1

24.0

29.3

35.9

8.5

15.7

31.0

9.5

27.6

11.0

13.0

10.8

6.4

13.8

22.7

11.3

15.2

15.5

17.1

15.4

38.7

(0.2)

6.7

15.2

6.0

4.5

36.4

24.4

109.2

3.8

33.8

63.9

35.6

42.7

19.0

23.7

49.6

6.4

14.9

23.2

6.2

30.5

9.6

8.0

13.7

7.0

9.1

14.3

8.7

18.7

18.2

22.0

14.8

30.2

1.9

5.2

14.2

6.7

4.0

33.8

29.0

107.4

5.0

34.7

79.6

36.3

35.5

18.6

26.7

44.3

13.1

13.2

15.1

11.3

28.7

11.2

12.3

15.6

6.7

14.4

15.1

14.5

17.8

17.0

18.1

14.8

19.5

3.3

5.1

14.4

6.7

5.3

33.0

38.9

103.8

6.1

34.6

78.0

38.7

31.5

20.8

28.3

30.0

57.3

10.6

5.5

14.9

22.0

5.7

3.8

16.8

14.4

33.4

17.2

15.9

21.6

21.8

24.1

21.8

7.3

(6.8)

7.5

17.7

16.4

(11.4)

49.2

41.4

41.9

29.4

55.3

51.5

43.4

66.7

40.6

39.2

38.7

75.2

9.9

5.9

20.1

17.3

6.6

11.0

12.5

11.1

47.3

21.6

19.4

16.6

15.4

14.9

19.0

7.5

(8.8)

16.0

17.2

11.7

(7.5)

43.7

35.7

37.7

(534.5)

45.0

40.0

36.4

54.2

34.1

30.2

32.2

Company

ABB

Bharat Electronics

BHEL

Crompton Greaves

Cummins India

Kalpataru Power Transmission

KEC International

KSB Pumps

Power Grid Corporation

Siemens

Thermax

Voltas

ACC

Ambuja Cement

Shree Cement

Ultratech Cement

Engineers India

GMR Infrastructure

Jaiprakash Associates

Larsen & Toubro

NCC

Punj Lloyd

Asian Paints

Britannia Industries

Colgate Palmolive

Future Retail

GlaxoSmithKline Consumer Healthcare

Hindustan Unilever

ITC

Jubilant FoodWorks

Marico

Pidilite Industries

Titan Industries

11.1

13.7

18.5

10.8

27.8

10.2

13.0

15.2

14.3

10.5

16.4

13.2

14.9

16.1

22.5

17.3

23.1

(3.3)

3.1

15.6

3.0

2.1

33.8

41.4

103.2

1.9

35.4

111.9

36.5

32.2

23.6

28.7

36.9

Page 7

10.8

13.8

18.2

8.1

27.6

11.1

11.0

15.0

6.9

10.6

13.4

12.6

15.3

16.4

17.8

14.1

23.1

2.4

5.1

13.6

6.7

5.0

32.1

35.0

103.2

5.3

35.2

80.9

36.7

31.4

19.2

27.8

33.3

35.8

9.5

6.3

12.8

16.9

4.7

4.3

10.5

10.7

36.3

20.9

11.3

19.2

15.4

15.9

17.5

8.4

(19.0)

18.9

16.5

7.9

13.6

39.0

28.3

35.1

30.2

37.2

38.4

31.0

44.3

26.4

25.0

28.4

FY15E

25.4

8.7

6.8

8.2

14.5

4.1

3.0

9.0

9.7

23.9

16.4

8.8

15.1

13.4

13.2

15.5

8.8

44.8

13.8

14.1

5.5

6.9

31.8

21.7

30.9

12.4

31.9

32.8

25.5

32.8

21.5

20.2

22.9

08 01 2013

India Earnings Guide |

Company

ABB

Bharat Electronics

BHEL

Crompton Greaves

Cummins India

Kalpataru Power Transmission

KEC International

KSB Pumps

Power Grid Corporation

Siemens

Thermax

Voltas

ACC

Ambuja Cement

Shree Cement

Ultratech Cement

Engineers India

GMR Infrastructure

Jaiprakash Associates

Larsen & Toubro

NCC

Punj Lloyd

Asian Paints

Britannia Industries

Colgate Palmolive

Future Retail

GlaxoSmithKline Consumer Healthcare

Hindustan Unilever

ITC

Jubilant FoodWorks

Marico

Pidilite Industries

Titan Industries

FY12

EV/EBITDA(x)

FY13E

FY14E

30.7

4.1

3.2

7.4

16.7

4.0

3.5

9.9

12.1

18.5

10.6

7.5

11.7

10.6

8.5

12.7

4.2

21.4

8.9

13.7

7.7

8.4

31.9

28.7

31.7

9.5

37.8

39.0

30.0

38.0

29.4

27.6

26.9

31.7

5.5

3.4

17.4

13.8

4.3

5.3

7.0

10.4

22.8

13.4

16.6

9.7

7.9

8.9

11.1

4.5

16.4

9.4

13.4

6.8

9.0

27.7

22.6

27.3

157.4

33.4

32.1

24.8

29.5

22.4

21.9

21.9

21.0

4.4

3.1

8.0

13.0

3.9

3.8

5.8

8.9

17.3

11.5

8.7

11.0

8.0

7.4

10.7

4.0

12.8

9.5

11.7

5.5

7.9

23.4

17.2

24.9

7.1

27.7

28.1

20.3

22.8

17.8

17.6

19.4

FY15E

P/B(x)

FY14E

P/S(x)

FY14E

14.8

2.9

2.6

5.5

11.0

3.3

3.1

4.7

8.2

11.6

8.6

6.0

9.0

6.8

5.8

8.9

3.6

10.7

8.6

9.8

4.7

6.2

19.7

13.4

21.3

6.3

23.3

23.1

16.9

16.8

14.9

14.3

15.2

4.2

1.4

1.3

1.5

5.0

0.5

0.6

1.7

1.6

4.0

3.7

1.5

3.0

2.6

4.1

3.3

2.1

0.5

0.6

2.7

0.2

0.3

14.4

13.0

38.2

0.6

14.4

49.5

12.1

16.9

6.8

7.9

11.9

1.0

1.2

0.8

0.4

2.1

0.2

0.1

0.9

2.8

1.3

1.1

0.4

1.8

2.1

2.0

2.1

1.8

0.3

0.5

1.0

0.1

0.1

3.3

1.1

4.4

0.2

4.6

4.0

6.8

2.8

2.3

2.9

1.6

Page 8

08 01 2013

India Earnings Guide |

Sector

Financial Services

Financial Services

Financial Services

Financial Services

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Technology

Metals

Metals

Metals

Metals

Metals

Metals

Metals

Offshore, Ports & Shipbuilding

Offshore, Ports & Shipbuilding

Offshore, Ports & Shipbuilding

Offshore, Ports & Shipbuilding

Bloomberg Company

Code

IDFC IN

MMFS IN

LICHF IN

SHTF IN

CMC IN

ECLX IN

GEO IN

HCLT IN

HEXW IN

INFO IN

KPIT IN

MPHL IN

MTCL IN

NITEC IN

POL IN

PSYS IN

TCS IN

TECHM IN

WPRO IN

COAL IN

HZ IN

JSP IN

JSTL IN

SAIL IN

STLT IN

TATA IN

ABAN IN

ADSEZ IN

GDPL IN

GPPV IN

Infrastructure Development Finance Corporation

Mahindra & Mahindra Financial Services

LIC Housing Finance

Shriram Transport Finance

CMC

eClerx Services

Geometric

HCL Technologies

Hexaware Technologies

Infosys

KPIT Cummins Infosystems

Mphasis

MindTree

NIIT Technologies

Polaris Financial Technology

Persistent Systems

Tata Consultancy Services

Tech Mahindra

Wipro

Coal India

Hindustan Zinc

Jindal Steel & Power

JSW Steel

Steel Authority of India

Sterlite industries

Tata Steel

Aban Offshore

Adani Port & SEZ

Gateway Distriparks

Gujarat Pipavav Port

Rating

BUY

BUY

BUY

Accumulate

Accumulate

Reduce

Reduce

Accumulate

Reduce

BUY

Accumulate

Accumulate

Accumulate

BUY

Accumulate

Accumulate

Accumulate

Accumulate

BUY

Accumulate

BUY

Accumulate

Reduce

Reduce

Reduce

Reduce

Accumulate

BUY

Accumulate

BUY

Page 9

Price SharesO/s

(Rs)

(m)

110

234

166

632

1,202

727

69

938

116

2,970

126

401

960

240

100

520

1,816

1,246

438

282

102

200

566

42

75

216

255

125

101

48

1,515

563

505

227

30

29

63

698

297

572

193

210

42

60

99

40

1,957

128

2,463

6,316

4,225

935

223

4,131

3,361

971

44

2,070

109

483

FY12

20,730

15,549

13,916

9,890

10,844

4,729

8,079

160,342

14,505

337,340

15,000

50,678

19,152

15,764

20,527

10,003

488,938

54,897

318,747

624,154

112,551

180,910

341,237

456,540

409,668

1,328,997

31,629

26,973

8,235

3,968

Revenues(Rsm)

FY13E

FY14E

25,420

20,234

15,345

14,837

14,693

6,605

10,204

210,312

19,482

403,520

22,386

54,906

23,618

20,213

23,083

12,945

629,895

68,731

374,256

683,027

125,257

195,540

380,949

439,611

449,219

1,347,115

36,727

35,766

9,541

4,160

28,195

25,941

19,653

21,314

19,279

8,120

11,191

257,336

22,196

478,279

27,027

55,939

28,765

23,069

24,030

15,701

780,378

78,353

422,060

733,090

131,332

227,432

395,892

455,942

410,373

1,452,638

37,478

45,867

11,022

4,644

FY15E

31,846

31,941

24,203

26,265

21,885

8,464

12,203

314,104

24,841

535,754

30,607

61,937

31,970

26,097

25,905

18,148

882,029

85,405

467,170

796,031

136,404

286,738

426,960

529,765

508,397

1,498,191

39,961

55,910

12,918

5,443

08 01 2013

India Earnings Guide |

Company

FY12

Infrastructure Development Finance Corporation

Mahindra & Mahindra Financial Services

LIC Housing Finance

Shriram Transport Finance

CMC

eClerx Services

Geometric

HCL Technologies

Hexaware Technologies

Infosys

KPIT Cummins Infosystems

Mphasis

MindTree

NIIT Technologies

Polaris Financial Technology

Persistent Systems

Tata Consultancy Services

Tech Mahindra

Wipro

Coal India

Hindustan Zinc

Jindal Steel & Power

JSW Steel

Steel Authority of India

Sterlite industries

Tata Steel

Aban Offshore

Adani Port & SEZ

Gateway Distriparks

Gujarat Pipavav Port

15,521

6,201

9,142

12,575

1,794

1,598

592

17,099

2,669

83,160

1,454

7,927

2,156

1,972

2,204

1,418

107,476

10,952

52,568

147,263

54,610

40,585

10,950

37,268

56,058

20,279

3,215

11,018

1,320

572

PAT(Rsm)

FY13E

FY14E

18,368

8,541

10,231

13,606

1,518

1,716

687

25,260

3,276

94,210

1,990

7,922

3,395

2,133

1,941

1,876

139,414

12,877

61,684

179,742

68,448

34,842

12,126

23,999

61,610

3,323

1,939

16,232

1,267

740

20,819

9,748

13,019

14,105

2,302

2,335

777

40,984

3,750

105,040

2,817

8,091

3,960

2,315

2,232

2,264

167,516

14,887

71,643

181,030

64,580

28,561

17,221

21,592

52,754

19,004

2,248

19,309

1,565

1,079

FY15E

FY12

23,087

11,638

16,066

16,636

2,837

2,333

833

48,426

4,244

114,332

3,140

9,083

4,358

2,622

2,503

2,537

187,089

16,312

81,408

196,991

68,098

28,845

20,637

25,667

61,838

22,549

2,987

23,868

1,839

1,293

24,355

10,823

13,870

26,431

2,107

1,897

1,116

27,488

2,647

107,160

2,181

9,252

2,930

2,683

3,177

2,324

144,203

9,194

66,713

156,678

59,193

67,692

58,575

53,574

99,564

124,168

18,404

17,908

2,504

1,829

Page 10

EBITDA(Rsm)

FY13E

FY14E

29,176

15,340

14,524

28,613

2,243

2,568

1,951

40,251

4,074

115,580

3,356

11,843

4,864

3,296

4,242

3,352

180,872

14,243

78,181

187,061

63,075

63,157

63,892

40,397

102,285

123,212

19,859

23,835

2,441

1,819

31,887

19,427

18,511

31,659

3,168

3,211

2,010

58,356

5,002

129,493

4,434

11,600

5,582

3,595

4,386

3,899

217,795

14,887

89,476

186,172

65,190

64,787

69,170

50,764

110,046

145,100

20,065

31,999

2,981

2,229

FY15E

FY12

35,517

24,210

22,824

36,990

3,646

3,168

2,041

69,482

5,166

141,873

4,748

11,417

6,045

3,894

4,656

4,454

241,241

15,800

103,002

203,768

66,431

84,445

75,190

67,458

125,945

150,548

20,708

38,228

3,488

2,939

10.3

12.1

18.1

55.6

118.4

55.0

9.4

24.8

9.1

145.4

8.2

37.7

53.2

33.1

22.2

35.4

54.9

85.9

21.4

23.3

12.9

43.4

49.1

9.0

16.7

20.9

73.9

5.5

12.2

1.3

EPS(Rs)

FY13E

FY14E

FY15E

12.1

15.2

20.3

60.0

50.1

59.1

10.9

36.4

11.0

164.7

10.3

37.7

81.8

35.4

19.5

46.9

71.2

101.0

25.0

28.5

16.2

37.3

54.3

5.8

18.3

3.4

44.5

8.1

11.7

1.5

15.2

20.7

31.8

73.3

93.6

80.3

13.2

69.4

14.3

199.9

16.3

43.2

105.0

43.5

25.2

63.4

95.6

127.9

33.1

31.2

16.1

30.9

92.6

6.2

18.4

23.2

68.6

11.5

17.0

2.7

13.7

17.3

25.8

62.2

76.0

80.4

12.3

58.7

12.6

183.6

14.6

38.5

95.4

38.4

22.4

56.6

85.6

116.7

29.1

28.7

15.3

30.6

77.2

5.2

15.7

19.6

51.7

9.3

14.4

2.2

08 01 2013

India Earnings Guide |

Company

FY12

Infrastructure Development Finance Corporation

Mahindra & Mahindra Financial Services

LIC Housing Finance

Shriram Transport Finance

CMC

eClerx Services

Geometric

HCL Technologies

Hexaware Technologies

Infosys

KPIT Cummins Infosystems

Mphasis

MindTree

NIIT Technologies

Polaris Financial Technology

Persistent Systems

Tata Consultancy Services

Tech Mahindra

Wipro

Coal India

Hindustan Zinc

Jindal Steel & Power

JSW Steel

Steel Authority of India

Sterlite industries

Tata Steel

Aban Offshore

Adani Port & SEZ

Gateway Distriparks

Gujarat Pipavav Port

13.7

22.8

18.6

23.1

30.8

54.9

29.3

22.1

26.9

27.4

22.1

22.0

24.9

23.6

19.6

17.8

37.1

29.6

20.0

39.9

22.1

25.2

6.7

9.7

12.8

5.2

14.7

24.4

18.2

7.5

RoE(%)

FY13E

FY14E

14.1

23.1

16.8

20.6

21.3

44.5

30.6

26.4

29.5

25.7

22.8

19.1

29.9

21.2

15.2

20.2

37.9

29.2

21.7

40.9

23.1

17.7

7.1

5.9

12.7

0.9

8.0

28.9

16.5

7.4

14.4

20.3

18.6

18.1

26.8

47.4

26.1

32.8

28.5

24.2

24.3

17.5

26.4

19.8

15.6

20.4

36.2

28.7

23.2

36.4

18.6

12.6

9.5

5.2

9.9

5.6

9.4

25.4

18.9

8.6

FY15E

FY12

14.4

20.8

19.7

18.2

26.7

37.9

20.7

29.9

27.4

22.5

22.2

18.0

23.1

19.6

15.5

19.5

32.5

26.8

22.4

36.0

17.3

11.4

10.5

6.0

10.7

6.4

11.3

24.6

19.9

9.6

2.8

4.3

1.6

4.7

28.0

51.7

27.2

15.8

26.8

27.2

19.5

21.5

24.7

23.1

19.5

17.7

35.5

25.6

18.2

36.2

22.1

13.3

5.1

7.4

12.1

4.6

6.3

8.4

12.1

7.6

Page 11

RoCE(%)

FY13E

FY14E

2.8

4.2

1.5

4.0

18.7

44.8

28.5

20.0

29.4

25.6

20.8

18.8

29.7

21.0

14.5

19.4

35.9

24.1

20.5

37.3

23.2

9.6

5.7

4.9

11.7

2.6

6.2

9.8

11.4

8.0

2.8

3.7

1.5

3.3

24.5

47.4

26.3

26.9

28.4

24.2

21.5

17.5

26.3

18.5

15.4

19.3

36.1

24.2

22.9

33.4

18.7

7.2

6.6

4.4

9.4

4.2

6.3

11.8

11.7

8.6

FY15E

FY12

2.7

3.5

1.6

3.2

23.6

37.9

21.7

26.5

27.2

22.5

20.1

17.9

23.0

18.8

15.3

18.6

31.3

23.2

22.1

33.2

17.3

7.5

7.3

4.9

10.0

4.4

6.7

12.6

12.6

8.5

10.7

19.3

9.2

11.4

10.2

13.2

7.4

37.8

12.8

20.4

15.4

10.6

18.0

7.3

4.5

14.7

33.1

14.5

20.5

12.1

7.9

4.6

11.5

4.6

4.5

10.3

3.5

22.8

8.3

35.5

PER(x)

FY13E

FY14E

9.0

15.4

8.2

10.5

24.0

12.3

6.4

25.7

10.5

18.0

12.2

10.6

11.7

6.8

5.1

11.1

25.5

12.3

17.5

9.9

6.3

5.4

10.4

7.2

4.1

63.1

5.7

15.5

8.7

31.3

8.0

13.5

6.4

10.2

15.8

9.0

5.6

16.0

9.2

16.2

8.6

10.4

10.1

6.2

4.4

9.2

21.2

10.7

15.1

9.8

6.7

6.5

7.3

8.0

4.8

11.0

4.9

13.4

7.0

21.4

FY15E

7.2

11.3

5.2

8.6

12.8

9.1

5.3

13.5

8.1

14.9

7.7

9.3

9.1

5.5

4.0

8.2

19.0

9.7

13.3

9.0

6.3

6.5

6.1

6.7

4.1

9.3

3.7

10.9

6.0

17.9

08 01 2013

India Earnings Guide |

Company

FY12

Infrastructure Development Finance Corporation

Mahindra & Mahindra Financial Services

LIC Housing Finance

Shriram Transport Finance

CMC

eClerx Services

Geometric

HCL Technologies

Hexaware Technologies

Infosys

KPIT Cummins Infosystems

Mphasis

MindTree

NIIT Technologies

Polaris Financial Technology

Persistent Systems

Tata Consultancy Services

Tech Mahindra

Wipro

Coal India

Hindustan Zinc

Jindal Steel & Power

JSW Steel

Steel Authority of India

Sterlite industries

Tata Steel

Aban Offshore

Adani Port & SEZ

Gateway Distriparks

Gujarat Pipavav Port

17.2

10.2

3.8

24.4

11.4

13.9

11.0

8.9

13.4

4.6

2.5

8.4

24.2

18.1

15.3

7.7

6.4

5.3

6.0

5.1

2.0

5.7

7.9

23.7

5.3

15.6

EV/EBITDA(x)

FY13E

FY14E

16.2

7.3

2.1

16.6

8.0

12.8

7.2

6.8

8.0

3.8

1.7

6.2

19.3

11.4

12.7

5.9

5.7

6.8

6.0

8.9

1.2

6.4

7.2

15.2

6.2

14.2

11.2

5.5

2.1

11.2

6.3

11.1

5.5

7.0

6.5

3.5

1.4

5.2

15.8

10.6

10.8

5.7

4.9

7.5

5.4

8.3

0.7

5.8

6.8

11.7

5.2

11.7

FY15E

P/B(x)

FY14E

P/S(x)

FY14E

9.8

5.2

1.8

9.1

5.7

9.7

4.7

6.6

5.5

3.0

1.0

4.4

14.0

9.6

8.8

4.8

4.2

5.8

4.7

7.3

0.5

6.0

6.2

8.7

4.2

9.2

1.2

3.0

1.3

2.0

4.7

4.9

1.7

4.6

2.4

4.3

2.3

1.9

3.0

1.3

0.7

2.0

8.7

3.3

3.8

3.7

1.3

0.9

0.7

0.4

0.5

0.6

0.5

3.9

1.4

1.9

5.2

4.1

3.5

5.5

1.7

2.5

0.4

2.1

1.4

3.2

0.8

1.4

1.2

0.6

0.4

1.1

4.0

1.9

2.3

2.2

3.1

0.7

0.3

0.3

0.5

0.1

0.3

4.6

0.8

4.2

Page 12

08 01 2013

India Earnings Guide |

Sector

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Pharmaceuticals

Power

Power

Power

Power

Power

Power

Power

Power

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Others

Others

Others

Bloomberg Company

Code

ARBP IN

CDH IN

CIPLA IN

DRRD IN

GNP IN

JOL IN

LPC IN

RBXY IN

SUNP IN

LANCI IN

NHPC IN

NTPC IN

PTCIN IN

RELI IN

RPWR IN

SJVN IN

TPWR IN

ARCP IN

DLFU IN

HDIL IN

OBER IN

PENL IN

PEPL IN

SOBHA IN

UT IN

RW IN

MHRL IN

MTEL IN

Aurobindo Pharma

Cadila Healthcare

Cipla

Dr.Reddy's Laboratories

Glenmark Pharmaceuticals

Jubilant Life Sciences

Lupin

Ranbaxy Laboratories

Sun Pharmaceutical Industries

Lanco Infratech

NHPC

NTPC

PTC India

Reliance Infrastructure

Reliance Power

SJVN

Tata Power

Anant Raj Industries

DLF

Housing Development & Infrastructure

Oberoi Realty

Peninsula Land

Prestige Estates Projects

Sobha Developers

Unitech

Raymond

Mahindra Holidays & Resorts India

MT Educare

Rating

Buy

Reduce

Accumulate

Accumulate

Reduce

Accumulate

Accumulate

BUY

Sell

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Accumulate

Reduce

Accumulate

Accumulate

Accumulate

Accumulate

Reduce

Accumulate

BUY

BUY

Page 13

Price SharesO/s

(Rs)

(m)

169

736

400

2,281

577

90

871

287

565

5

17

131

45

342

73

19

88

49

150

33

199

33

128

289

16

185

250

90

291

205

803

170

271

159

448

423

1,036

2,392

12,301

8,246

296

263

2,805

4,137

2,373

295

1,775

419

328

279

350

98

2,616

61

88

40

FY12

46,274

50,900

70,207

98,145

40,206

42,540

69,597

101,612

80,195

101,194

56,547

611,963

76,503

236,407

20,192

19,098

260,014

3,115

96,294

20,064

8,247

5,323

10,523

14,079

24,219

36,424

5,781

1,306

Revenues(Rsm)

FY13E

FY14E

57,831

61,554

82,793

116,266

50,123

51,610

94,616

124,597

112,999

137,388

52,052

662,980

88,562

222,276

49,266

16,821

330,254

5,586

77,728

10,252

10,476

7,412

19,476

18,645

24,405

40,692

6,944

1,573

69,256

69,048

91,296

127,070

57,286

61,880

98,552

135,760

138,514

165,162

59,116

747,123

101,615

224,199

52,096

19,300

392,370

6,123

101,761

14,322

11,557

6,549

26,862

26,369

26,830

45,073

8,471

2,145

FY15E

79,147

76,059

102,039

139,970

67,653

69,762

131,351

153,311

150,875

185,004

65,480

826,058

125,200

253,215

74,641

23,821

425,175

7,699

107,609

17,288

16,778

7,310

34,823

27,528

29,231

50,757

10,745

2,617

08 01 2013

India Earnings Guide |

Company

FY12

Aurobindo Pharma

Cadila Healthcare

Cipla

Dr.Reddy's Laboratories

Glenmark Pharmaceuticals

Jubilant Life Sciences

Lupin

Ranbaxy Laboratories

Sun Pharmaceutical Industries

Lanco Infratech

NHPC

NTPC

PTC India

Reliance Infrastructure

Reliance Power

SJVN

Tata Power

Anant Raj Industries

DLF

Housing Development & Infrastructure

Oberoi Realty

Peninsula Land

Prestige Estates Projects

Sobha Developers

Unitech

Raymond

Mahindra Holidays & Resorts India

MT Educare

(1,235)

6,526

11,442

13,009

4,604

146

8,677

(28,997)

25,872

(1,120)

21,381

82,608

753

14,460

8,668

10,814

11,007

1,191

12,263

8,174

4,633

1,515

826

2,060

2,374

1,558

1,023

132

PAT(Rsm)

FY13E

FY14E

2,939

6,553

15,449

16,771

6,147

1,528

13,142

9,228

30,081

(11,187)

19,402

91,858

1,144

17,199

10,114

10,523

8,548

1,051

7,623

5,156

5,049

1,953

2,860

2,172

3,130

577

908

180

6,388

7,707

15,136

18,427

6,833

4,055

13,714

23,110

11,669

(6,998)

22,843

106,650

1,252

15,268

10,513

11,167

10,710

2,037

8,487

2,805

5,215

1,667

3,892

3,803

3,116

963

1,291

245

FY15E

FY12

8,128

8,677

16,575

20,370

8,524

4,781

19,123

30,887

41,490

1,137

23,471

113,416

1,488

17,691

10,881

12,148

12,512

2,547

11,024

4,307

7,308

2,133

5,569

4,125

2,669

1,615

1,675

319

6,138

9,192

17,958

24,986

8,461

8,242

13,214

24,261

34,298

17,899

36,806

131,938

1,454

21,515

6,239

16,613

53,253

1,699

39,043

9,562

4,835

1,779

2,966

4,666

3,281

4,536

954

231

Page 14

EBITDA(Rsm)

FY13E

FY14E

8,169

9,230

21,979

25,558

10,100

10,373

20,903

19,379

49,673

25,820

32,270

177,381

1,694

28,117

17,129

14,508

66,323

1,605

26,262

6,723

6,121

1,966

5,791

5,483

3,270

3,714

1,228

293

11,150

12,014

22,940

28,464

11,744

11,774

20,893

30,242

56,165

31,822

37,983

185,561

1,865

28,998

19,705

16,717

78,845

3,123

37,143

5,623

6,685

2,217

7,877

7,719

5,060

4,620

1,821

418

FY15E

FY12

13,534

13,539

25,264

31,353

14,342

13,413

28,897

39,882

59,386

35,518

44,373

196,846

2,286

36,302

34,124

21,130

85,436

3,927

39,923

7,605

9,803

2,561

10,416

8,305

4,432

5,776

2,471

542

(4.2)

31.9

14.3

76.7

17.0

0.9

19.4

(68.7)

25.0

(0.5)

1.7

10.0

2.6

55.0

3.1

2.6

4.6

4.0

7.2

19.5

14.1

5.4

2.5

21.0

0.9

25.4

12.2

3.8

EPS(Rs)

FY13E

FY14E

10.1

32.0

19.2

98.7

22.7

9.6

29.4

21.8

29.0

(4.7)

1.6

11.1

3.9

65.4

3.6

2.5

3.6

3.6

4.5

12.3

15.4

7.0

8.2

22.1

1.2

9.4

10.8

4.6

21.9

37.6

18.9

108.5

25.2

25.5

30.6

54.6

11.3

(2.9)

1.9

12.9

4.2

58.1

3.7

2.7

4.5

6.9

4.8

6.7

15.9

6.0

11.1

38.8

1.2

15.7

14.7

6.2

FY15E

27.9

42.4

20.6

119.9

31.5

30.0

42.7

73.0

40.1

0.5

1.9

13.8

5.0

67.3

3.9

2.9

5.3

8.6

6.2

10.3

22.3

7.6

15.9

42.1

1.0

26.3

19.0

8.1

08 01 2013

India Earnings Guide |

Company

FY12

Aurobindo Pharma

Cadila Healthcare

Cipla

Dr.Reddy's Laboratories

Glenmark Pharmaceuticals

Jubilant Life Sciences

Lupin

Ranbaxy Laboratories

Sun Pharmaceutical Industries

Lanco Infratech

NHPC

NTPC

PTC India

Reliance Infrastructure

Reliance Power

SJVN

Tata Power

Anant Raj Industries

DLF

Housing Development & Infrastructure

Oberoi Realty

Peninsula Land

Prestige Estates Projects

Sobha Developers

Unitech

Raymond

Mahindra Holidays & Resorts India

MT Educare

(5.2)

27.5

16.0

28.8

20.7

0.6

23.8

(68.3)

23.9

(2.4)

8.4

11.7

3.4

6.1

5.0

14.4

8.2

3.2

4.9

8.3

13.2

10.4

3.9

10.7

2.0

12.1

19.2

25.1

RoE(%)

FY13E

FY14E

11.9

23.3

18.5

27.3

23.8

6.3

28.5

26.5

22.1

(26.7)

7.2

12.0

5.0

6.8

5.6

13.0

6.5

2.7

3.0

5.0

12.8

12.3

11.7

10.5

2.7

4.2

15.4

22.7

22.8

23.3

15.7

24.4

19.8

16.0

23.9

44.1

7.8

(20.9)

8.0

12.5

5.3

5.7

5.5

12.8

8.3

5.1

3.2

2.7

12.0

9.8

13.5

16.5

2.7

6.8

18.2

22.8

FY15E

FY12

24.2

22.2

15.0

23.4

18.8

17.1

26.9

38.9

24.7

3.7

7.8

12.2

6.1

6.2

5.4

12.8

9.5

6.0

3.9

4.0

15.3

11.7

17.2

15.7

2.3

10.6

19.3

26.0

(1.4)

18.7

15.7

18.6

12.3

2.9

18.0

(32.5)

24.8

2.7

5.5

8.0

3.8

4.8

3.6

11.2

5.0

2.8

5.2

6.2

13.1

11.0

4.0

9.1

1.7

8.9

17.8

23.4

Page 15

RoCE(%)

FY13E

FY14E

8.1

14.6

17.8

17.1

13.4

5.5

22.9

14.1

22.6

1.4

4.8

8.1

4.6

5.2

3.3

10.0

5.6

2.3

4.4

4.0

12.8

11.8

8.1

9.9

2.0

5.8

14.5

22.4

11.7

14.1

14.4

16.8

12.2

10.0

20.7

28.1

9.6

2.3

5.5

8.6

5.2

4.6

2.8

9.7

5.6

4.0

4.1

2.6

12.0

10.8

9.4

13.3

2.7

7.0

17.1

22.7

FY15E

FY12

13.2

14.2

13.9

17.0

12.8

11.2

24.2

28.1

23.3

3.8

5.5

8.1

6.0

4.7

3.4

10.1

5.5

4.7

4.5

3.4

15.3

12.5

11.8

13.1

2.4

8.5

18.3

26.1

(39.9)

23.1

28.1

29.7

33.9

98.1

44.8

(4.2)

22.6

(11.1)

9.6

13.0

17.5

6.2

23.6

7.3

19.0

12.2

20.7

1.7

14.1

6.1

51.0

13.7

18.1

7.3

20.5

23.9

PER(x)

FY13E

FY14E

16.8

23.0

20.8

23.1

25.4

9.4

29.7

13.1

19.5

(1.1)

10.5

11.7

11.6

5.2

20.2

7.5

24.4

13.8

33.4

2.7

13.0

4.8

15.7

13.0

13.7

19.7

23.1

19.7

7.7

19.6

21.2

21.0

22.9

3.5

28.4

5.2

50.2

(1.8)

8.9

10.1

10.6

5.9

19.5

7.1

19.5

7.1

31.3

5.0

12.5

5.6

11.5

7.4

13.8

11.8

17.0

14.5

FY15E

6.1

17.4

19.4

19.0

18.3

3.0

20.4

3.9

14.1

10.9

8.7

9.5

8.9

5.1

18.8

6.5

16.7

5.7

24.1

3.2

9.0

4.4

8.1

6.9

16.1

7.0

13.1

11.1

08 01 2013

India Earnings Guide |

Company

FY12

Aurobindo Pharma

Cadila Healthcare

Cipla

Dr.Reddy's Laboratories

Glenmark Pharmaceuticals

Jubilant Life Sciences

Lupin

Ranbaxy Laboratories

Sun Pharmaceutical Industries

Lanco Infratech

NHPC

NTPC

PTC India

Reliance Infrastructure

Reliance Power

SJVN

Tata Power

Anant Raj Industries

DLF

Housing Development & Infrastructure

Oberoi Realty

Peninsula Land

Prestige Estates Projects

Sobha Developers

Unitech

Raymond

Mahindra Holidays & Resorts India

MT Educare

9.5

18.1

17.9

16.2

21.0

6.4

30.4

5.6

16.1

17.2

8.9

10.6

10.2

14.6

60.3

4.5

9.4

13.5

12.8

5.5

10.9

7.4

20.7

8.5

25.0

6.3

23.0

14.2

EV/EBITDA(x)

FY13E

FY14E

9.9

18.7

15.0

15.8

17.9

4.3

18.9

4.9

11.0

13.8

10.5

8.2

5.7

11.6

26.5

5.7

8.3

15.4

18.9

7.8

8.9

7.8

11.1

7.4

25.6

7.8

17.6

10.8

7.3

14.6

14.1

14.0

14.5

4.0

18.6

2.4

9.8

12.4

8.8

8.7

5.6

12.4

27.2

4.6

7.8

9.0

13.0

10.2

8.5

6.6

8.2

5.2

18.0

6.3

11.0

7.5

FY15E

P/B(x)

FY14E

P/S(x)

FY14E

5.8

12.8

12.6

12.3

11.8

3.3

13.5

1.2

8.8

9.4

7.9

8.4

4.2

10.2

18.3

3.8

7.3

6.8

12.1

7.6

6.0

5.8

6.1

4.7

20.9

4.8

7.8

5.2

1.9

5.0

3.6

5.3

5.7

0.6

7.5

3.0

3.9

0.3

0.7

1.3

0.6

0.3

1.1

0.9

1.6

0.4

1.0

0.1

1.6

0.6

1.6

1.3

0.4

0.8

3.4

3.5

0.6

2.0

3.1

2.8

2.3

0.2

3.0

0.8

3.9

0.1

3.1

1.3

0.1

0.4

2.7

3.3

0.5

1.9

2.5

0.8

3.9

1.3

1.3

1.0

1.5

0.2

2.0

1.4

Page 16

08 01 2013

You might also like

- Common Law TrustDocument17 pagesCommon Law TrustTrey Sells97% (71)

- India Fortune 500 CompaniesDocument11 pagesIndia Fortune 500 CompaniesAnonymous HIv2HyFZ33% (6)

- FX GOAT SessionsDocument6 pagesFX GOAT Sessionsjames johnNo ratings yet

- Danone CaseDocument4 pagesDanone CaseThomas AtkinsNo ratings yet

- Top 500 Indian CompaniesDocument9 pagesTop 500 Indian Companiesapi-247127730100% (1)

- FCA Brand Mark GuidelinesDocument10 pagesFCA Brand Mark GuidelinesWilliam MartinezNo ratings yet

- PC Express Quotation For Office ComputersDocument2 pagesPC Express Quotation For Office ComputersDustin NitroNo ratings yet

- Equity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Document28 pagesEquity Funds Hybrid Funds Fund-of-Funds: 30 December 2011Ahmed HusainNo ratings yet

- 2008 Rank 2007 Rank COMPANY CityDocument50 pages2008 Rank 2007 Rank COMPANY Cityram4937No ratings yet

- Stock PricesDocument4 pagesStock PricesJagadish Kumar BobbiliNo ratings yet

- Test SheetDocument53 pagesTest SheetVishal SharmaNo ratings yet

- Stock Holding Disclosure 15th March 2012Document4 pagesStock Holding Disclosure 15th March 2012Angel BrokingNo ratings yet

- Stock Holding Disclosure List As On July 30, 2011Document4 pagesStock Holding Disclosure List As On July 30, 2011Angel BrokingNo ratings yet

- Sr. No. Name of The Company Standalone / ConsolidatedDocument4 pagesSr. No. Name of The Company Standalone / ConsolidatedJyotiNo ratings yet

- Fidelity Fund Management Private LimitedDocument28 pagesFidelity Fund Management Private LimitedsubudaniNo ratings yet

- AnnexureDocument1,162 pagesAnnexuremkeshthanaNo ratings yet

- Monthly Scheme 1 PDFDocument14 pagesMonthly Scheme 1 PDFRitesh BaranwalNo ratings yet

- Market RatesDocument219 pagesMarket RatesSundar VadivelanNo ratings yet

- Stock Holding Disclosure List As On January 16, 2012Document4 pagesStock Holding Disclosure List As On January 16, 2012Angel BrokingNo ratings yet

- Stock Holding Disclosure List As On September 30, 2011Document4 pagesStock Holding Disclosure List As On September 30, 2011Angel BrokingNo ratings yet

- RANK 2015 Rank2014 Company Name: Economic Times Top 500 Companies in India 2015Document24 pagesRANK 2015 Rank2014 Company Name: Economic Times Top 500 Companies in India 2015SathishKumarNo ratings yet

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulNo ratings yet

- Chapter 5 AnnexureDocument46 pagesChapter 5 AnnexureVenkata RamanaNo ratings yet

- Stock Holding Disclosure List As On October 15, 2011Document4 pagesStock Holding Disclosure List As On October 15, 2011Angel BrokingNo ratings yet

- List of American Companies in India: Agro Tech American Express AmwayDocument33 pagesList of American Companies in India: Agro Tech American Express AmwayVikram GuptaNo ratings yet

- For Student Circulation 27.7.13Document25 pagesFor Student Circulation 27.7.13indu296No ratings yet

- Fortune India 500Document12 pagesFortune India 500Naman VarshneyNo ratings yet